Beazley SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beazley Bundle

Beazley's innovative approach to specialty insurance and strong underwriting capabilities are key strengths, but the company also faces evolving market dynamics and regulatory shifts. Understanding these internal and external factors is crucial for informed decision-making.

Want the full story behind Beazley’s competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Beazley's strength lies in its deep, specialist underwriting expertise, particularly in complex and niche risks like cyber and professional liability. This focus allows for precise risk assessment and the creation of bespoke insurance products, a crucial differentiator in competitive insurance landscapes. For instance, in 2024, Beazley reported a combined ratio of 85% for its cyber and executive risk division, highlighting its underwriting discipline and profitability in these specialized areas.

Beazley's strength lies in its diversified portfolio, spanning cyber, property, marine, and political risks. This broad operational base across various insurance lines significantly reduces reliance on any single market or peril, fostering more stable financial performance.

The company boasts a robust global presence, operating in key regions like Europe, North America, Latin America, and Asia. This international footprint, coupled with its management of multiple Lloyd's syndicates, positions Beazley to capitalize on diverse market opportunities and navigate global economic fluctuations effectively.

Beazley has showcased impressive financial results, notably achieving record profits and significant premium growth in recent reporting periods. For instance, the company reported a profit before tax of $474.4 million for the full year 2023, a substantial increase from $189.6 million in 2022.

The insurer maintains a robust solvency ratio, standing at 175% as of December 31, 2023, which is well above regulatory requirements. This strong capitalization, coupled with healthy investment income, creates a stable platform for strategic expansion and effective management of its underwriting risks.

Leadership in Cyber Insurance Market

Beazley stands out as a prominent leader in the global cyber insurance sector, a market experiencing significant expansion due to escalating cyber threats. The company commands a substantial market share, continually enhancing its cyber services and underwriting expertise. This strategic focus positions Beazley to effectively leverage the anticipated robust growth within this critical insurance segment.

Their commitment to leading the cyber insurance market is further evidenced by substantial investments in cyber risk management and their innovative development of cyber catastrophe bonds. For instance, Beazley's cyber and specialty insurance segment saw gross written premiums reach $2,358.3 million in 2023, reflecting strong performance in this key area. This proactive stance and pioneering spirit solidify their leadership credentials.

- Market Leadership: Recognized as a top player in the rapidly growing global cyber insurance market.

- Market Share: Holds a significant position, indicating strong competitive standing.

- Investment in Capabilities: Continuously invests in cyber services and underwriting to maintain an edge.

- Innovation: Pioneered cyber catastrophe bonds, demonstrating a forward-thinking approach to risk.

Proactive Risk Management and Innovation

Beazley demonstrates a strong commitment to proactive risk management, continuously identifying emerging threats and investing in technology to enhance its underwriting and claims operations. This forward-thinking strategy is evident in their research initiatives focusing on areas like artificial intelligence, climate resilience, and the impact of technological obsolescence, positioning them to navigate evolving risk landscapes effectively.

The company's measured approach to adopting AI, coupled with robust resilience planning, underscores their dedication to mitigating future challenges. For instance, Beazley's investment in technology and innovation is a key component of their strategy to maintain a competitive edge and manage complex, interconnected risks. In 2024, Beazley continued to emphasize digital transformation, with a significant portion of their IT budget allocated to enhancing data analytics and AI capabilities to support underwriting accuracy and claims efficiency.

Their focus on innovation extends to developing new products and services that address emerging risks, such as cyber threats and environmental liabilities. Beazley's proactive stance in anticipating and responding to these shifts, rather than simply reacting, is a core strength that underpins their long-term sustainability and market leadership.

Key aspects of their proactive risk management and innovation include:

- Investment in AI and Data Analytics: Beazley is actively integrating AI into its underwriting processes to improve risk selection and pricing, aiming to reduce adverse selection and enhance profitability.

- Climate Resilience Focus: The company is investing in research and product development to address the growing risks associated with climate change, offering solutions for businesses impacted by extreme weather events.

- Technology Obsolescence Planning: Beazley is developing strategies to manage the risks associated with rapid technological change and the potential obsolescence of critical systems for their clients.

- Proactive Mitigation Strategies: Their approach emphasizes building resilience within their own operations and for their clients, anticipating potential disruptions and developing contingency plans.

Beazley's core strength is its specialized underwriting, particularly in complex areas like cyber and professional liability. This focus allows them to excel in niche markets. Their dedication to leading the cyber insurance sector is further demonstrated by significant investments in cyber risk management and innovative products like cyber catastrophe bonds. In 2024, Beazley reported a combined ratio of 85% for its cyber and executive risk division, showcasing strong underwriting performance in this critical area.

What is included in the product

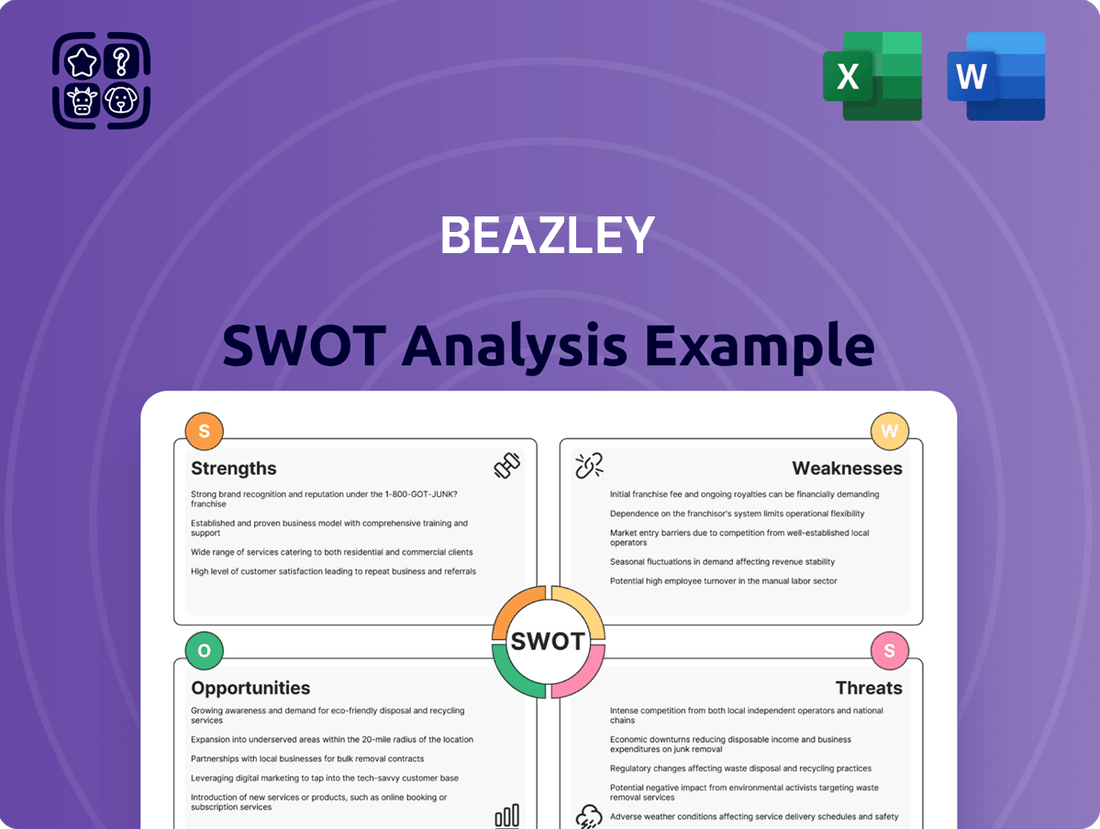

Delivers a strategic overview of Beazley’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable SWOT framework to identify and address critical business challenges.

Weaknesses

Beazley saw premium rates decrease on renewals in Q1 2025 for lines like cyber and property. This trend, while not stopping overall premium growth, signals a more competitive market and could put pressure on profitability.

The softening rate environment necessitates strong underwriting discipline. Beazley must carefully manage risk selection and pricing to maintain healthy margins amidst increased competition.

The cyber insurance market, while expanding, is highly competitive, forcing Beazley to strategically allocate capital to areas with the best risk-reward balance. This crowded landscape, particularly in mature regions like North America, could lead to pricing pressures and a squeeze on market share.

Furthermore, Beazley's digital division is experiencing heightened competition, mirroring the broader trend across the insurance technology sector.

Beazley's property and MAP (Marine, Aviation, Political) risks divisions are particularly vulnerable to substantial losses stemming from catastrophic events like hurricanes and wildfires. While the company actively manages this exposure through reinsurance, the sheer scale of these events can still negatively affect financial performance and combined ratios.

The growing trend of more frequent and severe extreme weather events poses a persistent and significant challenge for Beazley. For instance, in 2023, the insurance industry faced record insured losses from natural catastrophes, estimated to be around $110 billion globally, underscoring the heightened risk environment.

Impact of Capital Markets Activity on Specialty Risks

Subdued capital markets activity has presented a headwind for Beazley's Specialty Risks division, particularly affecting growth in certain product lines that are sensitive to these conditions. This reliance creates a degree of volatility in the segment's performance, as external market sentiment directly influences demand and pricing for these specialized insurance offerings.

The company anticipates flat to moderate growth for the Specialty Risks division in the near term, reflecting the ongoing impact of these capital market dynamics. For instance, Beazley's 2024 interim report indicated that while the overall group saw robust premium growth, certain specialty lines experienced more tempered expansion due to the prevailing economic climate.

- Capital Market Sensitivity: Some Specialty Risks products are directly tied to the health and activity of capital markets, making their growth susceptible to fluctuations.

- Growth Projections: Beazley forecasts flat to moderate growth for this division, acknowledging the constraints imposed by current market conditions.

- Performance Volatility: The inherent link to capital markets can introduce unpredictability into the segment's financial results.

- Product Line Impact: Specific products within Specialty Risks have seen their growth trajectory moderated by subdued capital market engagement.

Challenges with Regulatory Divergence and ESG Complexity

Beazley faces significant hurdles due to the increasing divergence in regulatory frameworks globally, alongside the intricate nature of Environmental, Social, and Governance (ESG) compliance. This complexity demands substantial resources and expertise to navigate effectively across its international operations.

For a global insurer like Beazley, the patchwork of evolving regulations across different countries presents a considerable challenge. This can lead to higher compliance costs and an increased risk of legal and reputational damage if not managed meticulously.

- Regulatory Divergence: Navigating varying insurance and data privacy laws across key markets like the US, UK, and EU requires constant adaptation and specialized legal counsel.

- ESG Complexity: Keeping pace with evolving ESG disclosure requirements and standards, such as those from the International Sustainability Standards Board (ISSB) and various regional bodies, adds layers of operational complexity.

- Compliance Costs: The need for bespoke compliance strategies in each jurisdiction can significantly inflate operational expenses, impacting profitability.

- Resource Strain: Effectively managing these diverse regulatory landscapes strains internal legal, compliance, and risk management teams, potentially diverting resources from core business activities.

Beazley's profitability faces pressure from a softening rate environment, particularly evident in Q1 2025 with decreased premiums in cyber and property lines. This intensified competition necessitates stringent underwriting and careful risk selection to maintain healthy margins.

The cyber insurance market's crowded nature, especially in North America, could lead to pricing pressures and a potential squeeze on Beazley's market share. Furthermore, the company's digital division experiences similar heightened competition, mirroring broader trends in the insurance technology sector.

Beazley's exposure to catastrophic events, such as hurricanes and wildfires, presents a significant weakness. The insurance industry faced substantial insured losses from natural catastrophes, estimated at around $110 billion globally in 2023, highlighting the potential impact on Beazley's financial performance and combined ratios.

Subdued capital markets activity negatively impacts Beazley's Specialty Risks division, leading to tempered growth projections and performance volatility. For instance, the 2024 interim report indicated more moderate expansion in certain specialty lines due to prevailing economic climates.

Preview Before You Purchase

Beazley SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The world is facing increasingly complex and interconnected risks, from escalating cyberattacks to the unpredictable consequences of climate change and shifting geopolitical landscapes. This growing uncertainty directly fuels a greater need for specialized insurance solutions that can effectively cover these niche and often severe exposures.

Beazley is strategically positioned to capitalize on this trend, leveraging its established expertise in underwriting complex and emerging risks. The company's focus on specialist lines of business, such as cyber, political risk, and marine, allows it to offer tailored coverage where generalist insurers may fall short.

For instance, Beazley anticipates robust growth within its MAP Risks division, which specifically addresses political and trade credit risks. This outlook is directly linked to the heightened geopolitical tensions and trade disruptions observed globally, creating a clear market opportunity for their specialized products.

While the U.S. cyber insurance market is quite developed, Europe presents a significant growth opportunity. Beazley is already experiencing robust expansion in its cyber offerings across Europe, and this trend is expected to continue as the market penetration is still relatively low compared to the U.S.

Beazley's strategic focus includes sustained investment in property underwriting, with plans to bolster its capabilities in both European and Asian markets. This geographic expansion is a clear avenue for increasing market share and capitalizing on the developing demand for cyber insurance in these regions.

Beazley can harness AI to refine its underwriting accuracy and speed, potentially reducing loss ratios. For instance, in 2024, the insurtech sector saw significant investment in AI-driven underwriting platforms, with some reporting a 15% improvement in risk assessment accuracy.

The company can also utilize technology to streamline claims processing, aiming for faster payouts and enhanced customer satisfaction. By 2025, AI-powered claims automation is projected to handle over 40% of routine claims in the insurance industry, leading to operational cost savings.

Furthermore, Beazley's focus on cyber insurance aligns with a growing market need; the global cybersecurity market was valued at over $200 billion in 2023 and is expected to grow at a compound annual growth rate of 13% through 2030, presenting a substantial opportunity for Beazley's specialized services.

Strategic Partnerships and Acquisitions

Beazley is actively exploring avenues for both organic expansion and strategic acquisitions that complement its existing business model and expertise. The company's robust performance and the evolving insurance landscape in 2024 and 2025 present a fertile ground for identifying and pursuing promising acquisition targets. These moves are designed to bolster its market position and operational capabilities.

Furthermore, Beazley is keen on forging strategic partnerships that can unlock new markets and enhance its service offerings. Such collaborations are crucial for expanding its reach and deepening its expertise in specialized insurance sectors.

- Growth Strategy: Beazley prioritizes growth that aligns with its strategic objectives and core competencies, whether through internal development or external acquisitions.

- Market Conditions: Favorable market conditions in 2024-2025 are creating more opportunities for Beazley to identify suitable acquisition prospects that fit its criteria.

- Partnership Benefits: Strategic alliances can significantly enhance Beazley's capabilities and extend its market presence, offering mutual benefits to all parties involved.

Increased Focus on Climate Resilience and ESG Solutions

Despite some executives still underestimating climate risk, there's a significant and growing demand for businesses to create strong plans to deal with extreme weather events caused by climate change. This presents a clear opportunity for Beazley.

Beazley is well-positioned to capitalize on this trend. By leveraging its expertise in risk management, the company can develop specialized insurance products and offer consulting services focused on environmental and climate-related risks. This is especially relevant as Environmental, Social, and Governance (ESG) regulations continue to evolve and become more stringent.

- Growing Market for Climate Resilience: The global market for climate risk analytics and adaptation solutions is projected to reach billions of dollars by 2025, driven by increasing frequency and severity of climate-related disasters.

- ESG Integration: As of early 2024, over 90% of S&P 500 companies now report on ESG metrics, highlighting the mainstream adoption of sustainability considerations in business strategy.

- Demand for Tailored Solutions: Businesses are actively seeking insurance and advisory services that specifically address the unique challenges posed by climate change, such as supply chain disruptions and property damage from extreme weather.

- Beazley's Niche: Beazley's existing specialization in specialty lines insurance and its proactive approach to emerging risks align perfectly with the need for sophisticated climate resilience offerings.

The increasing complexity of global risks, from cyber threats to climate change, creates a significant demand for specialized insurance. Beazley's focus on niche markets like cyber, political risk, and marine positions it to meet this growing need. For example, the global cybersecurity market was valued at over $200 billion in 2023 and is projected to grow at a 13% CAGR through 2030, highlighting a substantial opportunity for Beazley's cyber insurance offerings.

Europe represents a key growth area for Beazley's cyber insurance, as market penetration is lower than in the U.S. The company is also expanding its property underwriting capabilities in Europe and Asia. Furthermore, Beazley is leveraging AI to enhance underwriting accuracy and streamline claims processing, with AI-powered claims automation projected to handle over 40% of routine claims by 2025.

The rising demand for climate resilience solutions presents another avenue for growth, with Beazley able to offer specialized insurance and consulting services for environmental and climate-related risks. As of early 2024, over 90% of S&P 500 companies report on ESG metrics, underscoring the importance of sustainability considerations for businesses.

Beazley is actively pursuing both organic expansion and strategic acquisitions to bolster its market position and capabilities. Favorable market conditions in 2024-2025 are creating more opportunities for suitable acquisition prospects. Strategic partnerships are also a key focus to unlock new markets and enhance service offerings.

| Opportunity Area | Market Context (2023-2025) | Beazley's Advantage |

|---|---|---|

| Specialized Insurance Demand | Global cyber market > $200B (2023), 13% CAGR to 2030 | Expertise in niche, high-severity risks |

| European Cyber Market | Lower penetration than US, significant growth potential | Existing expansion and focus on tailored solutions |

| Climate Resilience & ESG | Growing demand for climate risk solutions; 90%+ S&P 500 ESG reporting (early 2024) | Ability to develop specialized products and consulting |

| AI Integration | AI claims automation > 40% of routine claims by 2025 | Potential for improved underwriting accuracy and claims efficiency |

| Strategic Growth | Favorable M&A environment (2024-2025) | Pursuit of acquisitions and partnerships to expand reach |

Threats

The insurance landscape is becoming more competitive, with premium rates softening across several important sectors, including cyber and property insurance. This trend suggests that insurers are increasingly vying for business, which can put pressure on profit margins if underwriting remains disciplined. Beazley's Q1 2025 performance highlighted this, reporting a 4% reduction in premium rates on its renewal book.

The cyber threat landscape is constantly shifting, with cybercrime escalating and systemic IT outages becoming more frequent. Beazley, a key player in cyber insurance, faces the challenge of adapting its underwriting and claims processes to these evolving, unpredictable threats, especially the potential for widespread damage from a single event.

The increasing sophistication of cyberattacks, including ransomware and supply chain compromises, directly impacts Beazley's ability to accurately price risk and manage claims. For instance, in 2023, ransomware attacks continued to be a major concern, with reports indicating a significant increase in the average cost of a data breach due to these incidents.

Furthermore, the threat of technology obsolescence, as highlighted by executives, adds another layer of complexity. Outdated systems can become vulnerabilities, increasing the likelihood and severity of cyber incidents, which in turn affects Beazley's exposure and need for robust risk mitigation strategies for its clients.

Geopolitical instability, while potentially boosting demand for Beazley's political risk insurance, also introduces significant volatility and the risk of unpredictable events. This global uncertainty can disrupt markets and create new, unforeseen claims environments.

While Beazley has indicated no direct claims from trade tariffs, broader geopolitical realignments can indirectly impact the insurance sector. These shifts can affect global trade flows, supply chain resilience, and overall economic stability, influencing demand for various insurance products and altering risk landscapes.

Economic Uncertainty and Inflationary Pressures

Global economic uncertainty is a significant concern for executives, potentially shifting focus away from long-term sustainability initiatives and dampening business investment. This broad economic unease can create a challenging operating environment for companies like Beazley.

Inflationary pressures are an inherent part of Beazley's operations, affecting both underwriting and claims. However, if inflation remains persistently high, it could negatively impact profitability by increasing claims costs and potentially reducing the value of investment income.

The subdued activity in capital markets, a direct consequence of wider economic anxieties, can also present challenges for insurers. This environment might limit opportunities for profitable investment or capital raising, influencing Beazley's financial flexibility and strategic options.

- Economic Uncertainty: In Q1 2024, the World Economic Forum's Chief Economists Survey indicated that 60% of economists expected a recession in their countries within the next 12 months.

- Inflationary Pressures: As of May 2024, inflation rates in major economies like the US and UK remained above central bank targets, impacting the cost of goods and services relevant to insurance claims.

- Capital Markets: Global equity markets experienced volatility throughout 2023 and early 2024, with many indices showing subdued performance compared to historical averages, reflecting investor caution.

Regulatory and Legal Complexity

Beazley, like many global insurers, faces a significant threat from the increasing complexity and divergence of regulatory landscapes worldwide. Navigating these varied rules, especially concerning environmental, social, and governance (ESG) mandates, presents substantial compliance hurdles and the potential for legal repercussions. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) and similar initiatives in other regions require detailed reporting on sustainability risks and impacts, adding layers of operational complexity.

The burgeoning field of artificial intelligence (AI) introduces another layer of regulatory risk, particularly the potential for 'AI-washing' or misrepresenting the capabilities and ethical considerations of AI-driven products and services. Regulators are increasingly focusing on the responsible development and deployment of AI, and companies that fail to meet these evolving standards could face scrutiny. For example, discussions around AI governance frameworks, such as those being explored by the UK government and international bodies, signal a proactive regulatory stance.

Non-compliance with these intricate and often rapidly changing regulations can result in severe financial penalties and significant damage to a company's reputation. In 2024, the financial services sector continued to see substantial fines for regulatory breaches, underscoring the high stakes involved. Beazley must remain vigilant in adapting its operations and reporting mechanisms to mitigate these risks.

- Diverging Global Regulations: Challenges in complying with varied international insurance and ESG regulations.

- AI Governance Scrutiny: Risk of penalties and reputational damage due to 'AI-washing' and misrepresentation.

- Compliance Costs: Increased investment required to stay abreast of and adhere to evolving legal frameworks.

- Reputational Impact: Potential for loss of trust and market share stemming from regulatory missteps.

The insurance market's increasing competitiveness, marked by softening premium rates in sectors like cyber and property, poses a threat to Beazley's profitability. This is evident in Beazley's Q1 2025 results, which showed a 4% decrease in renewal book premium rates, indicating a challenging environment for maintaining margins.

The escalating sophistication of cyber threats, including ransomware and supply chain attacks, directly impacts Beazley's risk assessment and claims management. The continued rise in data breach costs, largely driven by these advanced attacks, necessitates constant adaptation of underwriting strategies.

Geopolitical instability and global economic uncertainty create a volatile operating environment, potentially impacting demand for insurance products and introducing unforeseen claims. Persistent inflation also remains a concern, as it can elevate claims costs and diminish investment income, thereby affecting overall profitability.

| Threat Category | Specific Threat | Impact on Beazley | Supporting Data/Context |

|---|---|---|---|

| Market Competition | Softening Premium Rates | Pressure on profit margins | Q1 2025: 4% reduction in renewal book premium rates |

| Cyber Risk | Increasingly Sophisticated Attacks | Challenges in risk pricing and claims management | Continued rise in average data breach costs due to ransomware (2023 data) |

| Economic Environment | Global Economic Uncertainty & Inflation | Potential dampening of business investment, increased claims costs | Q1 2024: 60% of economists expected recession; May 2024 inflation above targets |

SWOT Analysis Data Sources

This Beazley SWOT analysis is informed by a comprehensive review of the company's financial statements, industry-specific market research, and expert commentary from insurance sector analysts to provide a robust strategic overview.