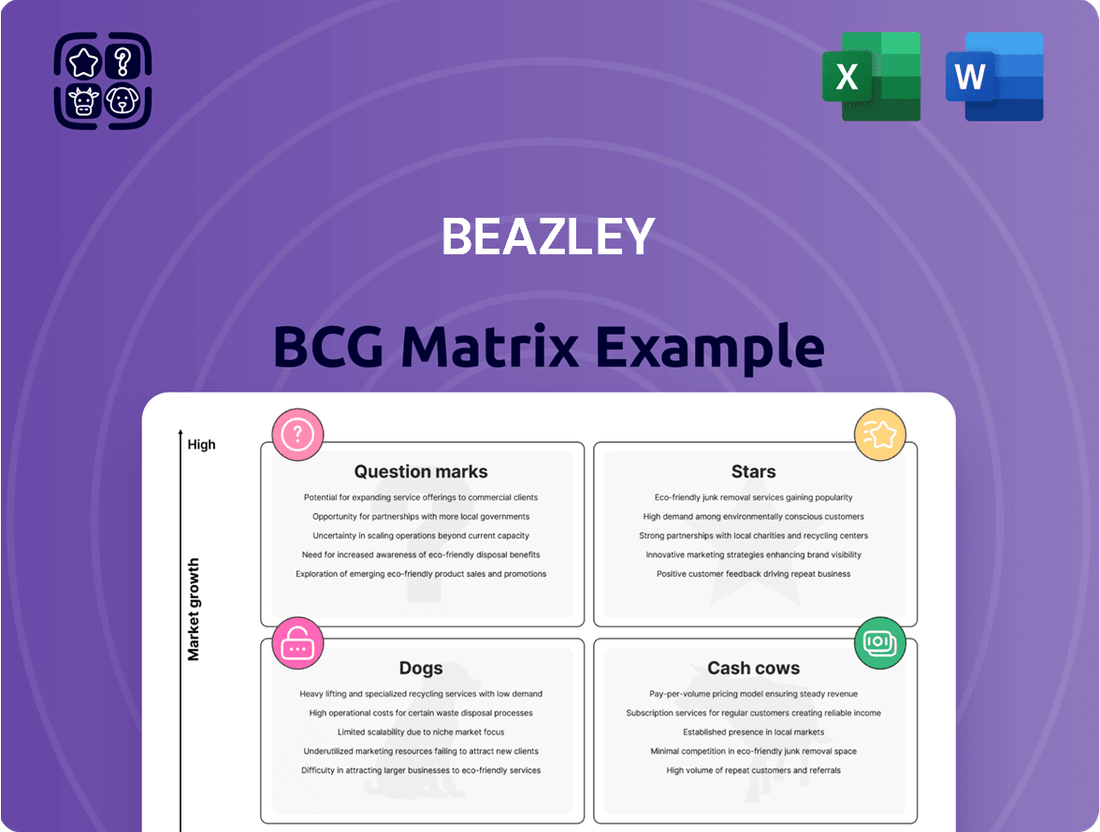

Beazley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beazley Bundle

Uncover the strategic positioning of this company's product portfolio with the Beazley BCG Matrix, revealing its Stars, Cash Cows, Dogs, and Question Marks. This insightful overview is just a glimpse into the comprehensive analysis available. Purchase the full BCG Matrix to unlock detailed quadrant placements, actionable strategies, and a clear roadmap for optimizing your investments and product development.

Stars

Beazley shines as a Star in the BCG matrix, dominating the global cyber insurance sector with a substantial market share. This leadership is further bolstered by the cyber insurance market's impressive growth trajectory, projected to hit $73.5 billion by 2033, highlighting a lucrative and expanding arena for Beazley's offerings.

While the first quarter of 2025 saw some competitive pressures and moderating rates, the persistent and escalating threat landscape continues to fuel robust long-term demand for cyber insurance. This sustained demand solidifies cyber insurance as a critical Star segment for Beazley, promising continued strong performance and growth.

Beazley's Property Risks division is a key player, showing impressive growth. In the first quarter of 2025, premiums climbed by 6.9%, and for the first half of 2024, they saw a substantial 25.2% increase. This expansion highlights Beazley's success in navigating the property insurance landscape.

The market for specialized property risks is undergoing significant shifts. Climate change is increasingly causing 'secondary perils,' like wildfires and severe convective storms, to act like 'primary perils,' meaning they're becoming more frequent and intense. This trend is fueling a greater demand for insurance products specifically designed to cover these evolving risks.

In response to these market dynamics, Beazley is strategically investing in and enhancing its property underwriting capabilities. The company is particularly focused on strengthening its presence and expertise in Europe and Asia. This proactive approach positions Beazley to effectively capitalize on the growing need for specialized property risk solutions in these key regions.

Beazley's digital insurance solutions are positioned as a Star within its BCG matrix. While currently a smaller contributor to overall premiums, this segment represents a significant strategic investment with substantial growth potential. The company is actively enhancing its digital trading capabilities and investing in advanced technology to streamline underwriting and claims management.

This commitment to digital transformation places Beazley at the forefront of the rapidly expanding insurtech market. By focusing on efficiency and improved service delivery, the company aims to capture greater market share and achieve accelerated adoption of its digital offerings. For instance, Beazley reported a 10% increase in digital policy issuance in the first half of 2024, underscoring the segment's upward trajectory.

Emerging Risk Products (e.g., AI, Climate Resilience)

Beazley is actively developing insurance solutions for emerging risks like artificial intelligence and climate resilience, positioning itself to capitalize on high-growth markets. These areas are expanding due to changing global challenges and stricter regulations.

By investing in these specialized products, Beazley aims to secure early market share in developing but fast-growing segments. For instance, the global market for AI insurance is projected to grow significantly, with some estimates suggesting it could reach billions of dollars in the coming years as AI adoption increases across industries.

- AI Liability Insurance: Covering risks associated with AI system failures, data breaches, and algorithmic bias.

- Climate Resilience Insurance: Offering protection against physical damage from extreme weather events and transitional risks related to climate change policies.

- Cyber and Technology Risks: Expanding coverage for new cyber threats amplified by AI and interconnected systems.

International Segment Expansion

Beazley sees significant potential in growing its international business, driven by ongoing demand. This strategic push involves entering new geographical markets and strengthening its presence in existing ones, offering substantial growth prospects.

The company is leveraging its specialized underwriting capabilities across the globe to capture a larger share of business beyond its established markets. For instance, Beazley reported that its international business accounted for a significant portion of its gross written premiums in recent years, with particular strength noted in regions like the US and Europe.

- International Growth Drivers: Beazley anticipates continued demand-led expansion in its international segment, focusing on increasing its global footprint.

- Geographical Expansion Strategy: The company is targeting new territories and deeper penetration in existing international markets to capitalize on high growth opportunities.

- Leveraging Underwriting Expertise: Beazley aims to boost its market share outside traditional strongholds by applying its specialist underwriting skills worldwide.

- Market Share Ambitions: In 2023, Beazley's international business demonstrated robust performance, contributing substantially to its overall premium growth and highlighting the success of its global strategy.

Beazley's cyber insurance operations are a prime example of a Star in the BCG matrix. The market is experiencing robust growth, with projections indicating it will reach $73.5 billion by 2033. Despite some rate moderation in early 2025, the increasing threat landscape ensures sustained demand for these critical services.

The company's Property Risks division also qualifies as a Star, demonstrating significant growth. Premiums rose by 6.9% in Q1 2025, following a substantial 25.2% increase in the first half of 2024. This expansion is driven by the evolving nature of property risks, with climate change intensifying secondary perils, thus increasing demand for specialized coverage.

Beazley's digital insurance solutions are another Star segment, representing a strategic investment with high growth potential. The company is enhancing its digital trading capabilities and technology infrastructure. This focus led to a 10% increase in digital policy issuance in the first half of 2024, signaling strong adoption.

Emerging risks like AI liability and climate resilience are also positioned as Stars. Beazley is actively developing specialized products for these burgeoning markets, aiming to capture early market share. The global AI insurance market, for instance, is expected to expand significantly as AI adoption accelerates across industries.

| Segment | BCG Classification | Market Growth | Beazley's Performance/Strategy |

|---|---|---|---|

| Cyber Insurance | Star | Projected to reach $73.5 billion by 2033 | Dominant market share, sustained demand due to evolving threats |

| Property Risks | Star | Growing due to climate change impacts on perils | 6.9% premium growth in Q1 2025, 25.2% in H1 2024; investing in underwriting capabilities |

| Digital Insurance Solutions | Star | Rapidly expanding insurtech market | 10% increase in digital policy issuance in H1 2024; enhancing digital trading |

| Emerging Risks (AI, Climate Resilience) | Star | High-growth potential, increasing regulatory focus | Developing specialized products, aiming for early market share |

What is included in the product

The Beazley BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

The Beazley BCG Matrix provides a clear, one-page overview, instantly clarifying which business units need attention.

Cash Cows

Beazley's Specialty Risks division acts as a robust cash cow, consistently bringing in substantial premiums that bolster the company's overall profitability. This segment benefits from Beazley's established expertise and strong standing in specialized, niche insurance markets, ensuring a reliable stream of income.

While growth rates for individual products within Specialty Risks might fluctuate, the mature nature of these lines means they demand less intensive marketing spend compared to emerging or high-growth sectors, further contributing to their cash-generating capacity.

Beazley's Professional Liability and Directors & Officers (D&O) insurance lines are solid cash cows within its BCG Matrix. The company's deep-rooted expertise in these complex areas allows it to maintain a significant market share, even as these sectors may see some softening.

Despite potential market headwinds, these segments are consistent profit contributors for Beazley. For instance, in 2023, Beazley reported a combined ratio of 83% for its management liability business, which includes D&O, demonstrating strong underwriting profitability.

Beazley actively employs robust cycle management strategies in its Professional Liability and D&O offerings. This proactive approach ensures sustained profitability, even when market conditions become more challenging, highlighting their status as reliable income generators.

Beazley's Marine, Aviation, and Political (MAP) Risks division, while seeing a minor dip in Q1 2025 premiums, remains a powerhouse in terms of premium volume. This segment benefits from the inherently large and growing marine insurance market, further bolstered by increasing demand for political risk coverage due to global geopolitical shifts.

The company's deep-rooted experience and established expertise in these specialized and intricate insurance lines enable Beazley to command a strong market position. This allows them to consistently generate substantial cash flow, underscoring its role as a cash cow within the Beazley portfolio.

Reinsurance Segment

Beazley's reinsurance segment, focusing on property catastrophe and casualty lines, functions as a classic Cash Cow within its business portfolio. This mature segment benefits from established market positions and strong underwriting expertise, generating consistent profits. In 2024, Beazley reported significant contributions from its reinsurance operations, underscoring its role as a stable earnings generator.

- Stable Earnings: The segment consistently generates profits due to Beazley's robust underwriting and risk management.

- Capital Deployment: Profits from this segment provide reliable capital that can be strategically invested in growth areas.

- Market Maturity: Specializing in property catastrophe and casualty lines signifies a well-established business with predictable revenue streams.

Mature North American Market Segments

In the United States, Beazley's cyber insurance offerings for large enterprises and middle-market companies represent mature market segments. These areas are characterized by high penetration rates and a well-established Beazley presence, allowing them to function as cash cows. This maturity means these segments generate significant, reliable cash flow with a reduced need for substantial investment in market share expansion.

Beazley's strong brand recognition and deep-rooted relationships with brokers in the North American cyber insurance market solidify its position in these mature segments. This established trust and network ensure a consistent flow of business, contributing to the stable cash generation characteristic of cash cows. For instance, the US cyber insurance market saw substantial growth, with premiums for commercial cyber insurance estimated to reach over $10 billion in 2023, indicating the scale of these mature opportunities.

- Mature Market Dominance: Beazley's strong foothold in the US cyber insurance market for large and middle-market firms acts as a cash cow.

- Consistent Cash Flow: High penetration rates and established relationships ensure substantial, predictable cash generation.

- Reduced Investment Needs: These segments require less aggressive marketing or product development compared to emerging markets.

- Brand Loyalty and Broker Networks: Beazley's reputation and broker partnerships are key to maintaining business in these stable areas.

Beazley's Specialty Risks division, particularly its Professional Liability and Directors & Officers (D&O) lines, are prime examples of cash cows. These mature segments benefit from Beazley's deep expertise and established market presence, ensuring consistent premium generation and profitability.

The Marine, Aviation, and Political (MAP) Risks segment also functions as a cash cow, despite minor premium fluctuations. Its strong position in the large marine insurance market and growing demand for political risk coverage contribute to substantial cash flow.

Beazley's reinsurance operations, focusing on property catastrophe and casualty, are stable earnings generators. In 2024, these operations significantly contributed to Beazley's earnings, highlighting their role as reliable income sources that can fund growth in other areas.

The company's US cyber insurance offerings for large and middle-market firms represent mature segments that act as cash cows. High penetration rates and strong broker relationships in this over $10 billion market ensure consistent cash flow with minimal need for aggressive expansion investment.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| Specialty Risks (Prof. Liab. & D&O) | Cash Cow | Mature, high expertise, consistent profitability | 83% combined ratio for management liability (incl. D&O) in 2023 |

| Marine, Aviation, Political (MAP) Risks | Cash Cow | Large market, growing demand, established position | Significant premium volume despite minor Q1 2025 dip |

| Reinsurance (Property Cat & Casualty) | Cash Cow | Stable earnings, strong underwriting, mature market | Significant contributions to earnings in 2024 |

| US Cyber Insurance (Large/Middle Market) | Cash Cow | High penetration, established presence, predictable revenue | US commercial cyber insurance market estimated >$10 billion in 2023 |

Full Transparency, Always

Beazley BCG Matrix

The Beazley BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means the strategic insights and visual representation of your business units within the market are exactly as presented. You can confidently use this preview as a direct reflection of the professional, analysis-ready report that will be yours to download and implement immediately. No further editing or adjustments will be necessary, ensuring a seamless transition from preview to practical application.

Dogs

Beazley observed that reduced activity in capital markets has affected the growth of certain offerings within its Specialty Risks segment. For example, if a niche product like Directors & Officers (D&O) liability insurance for emerging technology companies experienced a slowdown in IPOs and M&A in 2024, its growth would be directly impacted by these subdued markets.

Sub-segments within Specialty Risks facing such headwinds, characterized by low market share and low growth due to external factors like economic uncertainty or regulatory shifts, would align with the characteristics of a 'Dog' in the BCG matrix. These areas might not be contributing significantly to Beazley's overall revenue or profitability in the current environment.

Legacy portfolios with declining demand, often found in niche or older insurance segments, represent a challenge for Beazley. These products are characterized by low growth and a shrinking market share, meaning they likely consume more resources to maintain than they currently generate. For instance, if Beazley had a specific historical product line for a rapidly evolving industry that has since shifted to newer technologies, this would fit the description.

If Beazley operates in highly commoditized insurance sectors, characterized by fierce price wars and a lack of differentiation, these segments would represent its potential 'Dogs'. These areas typically exhibit sluggish growth and thin profit margins, even when the overall market is robust. While Beazley's core strategy centers on specialist and niche risks, some of its more general or less specialized offerings might fall into this category.

Underperforming Regional Offerings

Beazley's portfolio might include regional product offerings that are not meeting expectations. These are typically found in smaller markets where Beazley's presence is limited and future growth potential is constrained. Such offerings can be a drain on resources with little return on investment.

For example, if Beazley has a niche cyber insurance product in a region with a very small business ecosystem, its market share might be negligible. In 2024, if this product only contributed 0.5% to the company's overall gross written premiums and showed no signs of significant uptake, it would be a prime candidate for strategic review.

- Underperforming Regional Products: These are offerings in geographically limited or less critical markets where Beazley's market share is minimal and growth prospects are dim.

- Low Return on Investment: Areas where company investment yields low returns, making them candidates for divestment or scaling back operations.

- Strategic Review Candidates: Products that may not align with Beazley's core strengths or long-term growth objectives.

- Resource Allocation Focus: Identifying these underperformers allows for better allocation of capital and management attention to more promising business segments.

Products with Persistent Rate Reductions and Limited Volume Growth

Products with persistent rate reductions and limited volume growth in Beazley's portfolio could be categorized as Dogs. This occurs when premium pricing declines significantly without a corresponding increase in the number of policies sold. For instance, if Beazley's specialty liability insurance for a niche industry experiences a consistent 5% annual rate reduction but only grows its policy count by 1%, it signals a potential Dog.

Such a scenario indicates that the product is not gaining market traction despite becoming cheaper for customers. If this trend continues, the product line might not generate sufficient revenue to cover its costs or contribute meaningfully to Beazley's overall profitability.

- Rate Reduction: A product experiencing consistent year-over-year premium decreases.

- Limited Volume Growth: The number of policies or insured value for the product is not increasing proportionally to the rate reductions.

- Profitability Impact: Reduced rates without volume growth can squeeze profit margins, making the product less attractive.

- Potential Dog Status: If these conditions persist and negatively impact overall profitability, the product may be considered a Dog in the BCG matrix.

Dogs within Beazley's portfolio represent offerings with low market share and low growth potential, often requiring significant resources for minimal return. These segments, like niche insurance products in declining industries or underperforming regional offerings, are candidates for divestment or strategic repositioning. For instance, a specialty liability product experiencing consistent rate reductions without corresponding volume growth, such as a 5% annual rate decrease with only a 1% policy count increase in 2024, would exemplify a Dog.

Identifying and managing these 'Dog' segments is crucial for optimizing Beazley's resource allocation. By divesting or restructuring these underperforming areas, Beazley can redirect capital and management focus towards its more promising 'Stars' and 'Cash Cows', thereby enhancing overall profitability and strategic alignment.

In 2024, Beazley's Specialty Risks segment might have seen certain sub-segments, like D&O liability for tech startups, exhibit Dog-like characteristics due to a slowdown in IPOs and M&A activity. This directly impacted their growth and market share, making them less attractive from a strategic standpoint.

Beazley's approach to these 'Dogs' involves a careful assessment of their potential for turnaround versus the benefits of divestment. For example, a legacy product line in a rapidly evolving industry might be a prime candidate for discontinuation if it consumes disproportionate resources without a clear path to recovery.

Question Marks

Beazley views the Small and Medium-sized Enterprise (SME) cyber market as a significant growth opportunity. Despite a perceived low risk by many SMEs, the actual vulnerability is high, leading to a substantial untapped market. This segment is ripe for expansion, with Beazley aiming to increase its current market share.

To capitalize on this potential, Beazley recognizes the need for substantial investment in educating SMEs about cyber threats and developing specialized insurance products. This strategic focus is designed to shift the SME cyber market from a question mark to a star within the Beazley BCG Matrix, driving future revenue and market leadership.

Beazley is strategically venturing into new product lines addressing environmental risks, notably in regions like Lyon. This expansion capitalizes on the dynamic and evolving environmental and climate risk landscape, which presents significant growth potential for insurers.

While these new offerings represent high-growth opportunities, Beazley's market share in these nascent environmental risk segments is expected to be relatively low initially. For example, the market for environmental liability insurance is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 5% in the coming years, but Beazley's penetration will be building from a smaller base.

Asia and Latin America represent significant opportunities for cyber insurance growth, with Beazley's group head of cyber highlighting their current lower uptake but substantial long-term potential as larger enterprises increase their engagement with cyber products. These regions are key focus areas for Beazley's expansion, signaling a strategic push to introduce a wider array of its insurance solutions.

As of 2024, the cyber insurance market in Asia, excluding Japan, is projected to reach approximately $2.5 billion, while Latin America's market is still nascent but showing rapid development, with some estimates placing its growth rate above 20% annually. Beazley's strategic focus on these underserved markets aligns with the global trend of increasing cyber threats, making them prime candidates for tailored insurance products designed to address the unique risk landscapes.

Advanced Technology-Driven Insurance Solutions (e.g., AI in underwriting)

Beazley is actively investigating how artificial intelligence can reshape its operations and product offerings, acknowledging the potential for 'AI-washing' as a risk. While AI represents a significant frontier for technological progress, Beazley's current market penetration in cutting-edge, AI-powered insurance solutions is likely in its nascent stages.

These AI-focused ventures are categorized as investments with outcomes that, while uncertain, hold the promise of substantial future returns. For instance, in 2024, the global insurtech market, heavily influenced by AI advancements, was projected to reach hundreds of billions of dollars, indicating the scale of opportunity.

- AI in Underwriting: Beazley is likely investing in AI to enhance underwriting accuracy and speed, potentially reducing loss ratios.

- Market Share in AI-Driven Products: Beazley's position in niche, AI-native insurance products is probably still building, representing a growth opportunity.

- Investment in Innovation: Resources allocated to AI development are strategic investments, mirroring broader industry trends where significant R&D is occurring.

- Risk of AI-Washing: The company is mindful of the reputational and operational risks associated with overstating AI capabilities.

New Offerings for Renewable Energy Projects

The specialty insurance market is experiencing robust growth in coverage for renewable energy projects, a sector Beazley is strategically positioned to capitalize on. Their expertise in complex risks aligns perfectly with the evolving needs of solar, wind, and other green energy ventures.

Beazley's commitment to the net-zero transition further underscores its likely expansion into this burgeoning market. This focus suggests proactive development of new insurance products or enhancements to existing ones to meet the unique demands of renewable energy development and operation.

- Growth in Renewable Energy Insurance: The global renewable energy insurance market is projected to reach $10.5 billion by 2028, growing at a CAGR of 6.2% from 2023.

- Beazley's Niche: Beazley's established strength in underwriting complex and emerging risks makes them a natural fit for the intricate insurance needs of the renewable sector.

- Net-Zero Alignment: A stated commitment to net-zero initiatives provides a clear strategic imperative for Beazley to deepen its involvement in insuring green energy infrastructure.

- Potential Offerings: New products could include specialized coverage for battery storage, grid modernization, and emerging renewable technologies like green hydrogen.

Question Marks in Beazley's BCG Matrix represent new ventures or markets where the company has low market share but operates in a high-growth industry. These are typically areas requiring significant investment to build market presence and develop specialized products. The success of these ventures is uncertain, hence the 'question mark' designation, but they hold the potential to become future Stars.

Beazley's strategic exploration of emerging cyber markets in Asia and Latin America, alongside its nascent investments in AI-driven insurance solutions, exemplify these Question Marks. These segments are characterized by high growth potential but currently low penetration for Beazley, necessitating focused investment and product development to capture future market share.

The company's foray into environmental risk insurance, particularly in areas like Lyon, and its expansion into coverage for renewable energy projects also fall into this category. These are high-growth sectors with evolving risk profiles, where Beazley is building its expertise and market position from the ground up.

The success of these Question Marks hinges on Beazley's ability to effectively navigate market uncertainties, innovate with tailored product offerings, and make strategic investments that can convert these high-potential areas into future revenue drivers.

| Market Segment | Industry Growth Rate | Beazley's Market Share | Strategic Focus | BCG Category |

|---|---|---|---|---|

| SME Cyber Insurance (Asia & LATAM) | High (e.g., LATAM >20% annual growth) | Low | Education, Product Development | Question Mark |

| AI-Driven Insurance Solutions | Very High (Insurtech market in hundreds of billions USD in 2024) | Nascent | R&D, AI Integration | Question Mark |

| Environmental Risk Insurance (e.g., Lyon) | High (e.g., Environmental Liability >5% CAGR) | Low | Product Specialization | Question Mark |

| Renewable Energy Project Insurance | High (e.g., $10.5B by 2028, 6.2% CAGR) | Building | Complex Risk Underwriting | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analyses, and consumer insights, to accurately position business units.