Beazley Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beazley Bundle

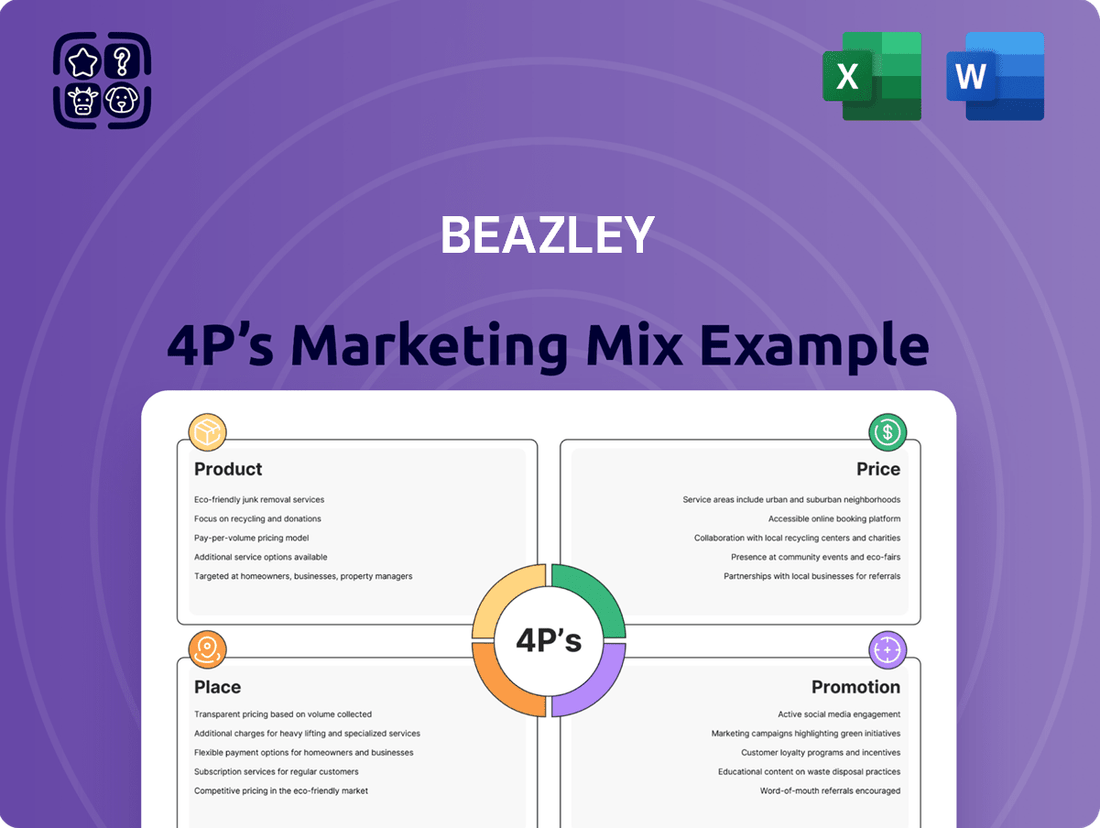

Uncover the strategic brilliance behind Beazley's market dominance with our comprehensive 4Ps Marketing Mix Analysis. This deep dive dissects their product innovation, pricing strategies, distribution channels, and promotional campaigns, offering actionable insights for your own business.

Go beyond surface-level understanding and gain access to a professionally written, editable report that details Beazley's complete marketing framework. Perfect for students, professionals, and consultants seeking to benchmark or develop winning strategies.

Save valuable time and elevate your marketing knowledge. Purchase the full Beazley 4Ps Marketing Mix Analysis today and unlock the secrets to their success, presented in a ready-to-use format.

Product

Beazley's product strategy centers on offering highly specialized insurance solutions designed for complex and niche risks. Their portfolio spans areas like cyber insurance, property, marine, political risks, and professional liability, showcasing a deliberate move away from broad, general coverage. This focus on specialization allows Beazley to effectively address the unique and evolving risk landscapes that global businesses encounter.

In 2024, Beazley reported significant growth in its cyber and specialty lines, with gross written premiums in these segments reaching new heights. For instance, their cyber and executive assurance division saw a substantial increase in premium income, reflecting the growing demand for sophisticated protection against digital threats. This targeted approach to product development underscores their commitment to providing tailored coverage for specific industry needs.

Cyber risk expertise is a cornerstone of Beazley's product portfolio, establishing them as a leader in the cyber insurance market. Their comprehensive cyber policies offer crucial financial safeguards against a spectrum of threats, encompassing breach response costs, first-party financial impacts, and third-party liabilities, alongside protection against eCrime. This robust offering is further enhanced by Beazley Security, their dedicated subsidiary, which provides essential pre and post-incident response services, underscoring a commitment to holistic cyber resilience for their clients.

Beazley's tailored underwriting is central to its product strategy, focusing on bespoke solutions for niche markets. This approach actively manages underwriting cycles and prioritizes meticulous risk selection to achieve sustained outperformance.

In 2024, Beazley continued to refine its product offerings, demonstrating a commitment to customization. This strategy is crucial in specialized insurance sectors where standard products often fall short, allowing Beazley to carve out a distinct competitive advantage.

Diverse Risk Portfolio

Beazley's product portfolio extends well beyond cyber insurance, offering a diverse range of specialty lines. This includes coverage for marine, aviation, political, accident, and contingency (MAP) risks, alongside property and other specialty insurance. This broad offering allows Beazley to serve a wide spectrum of businesses with tailored risk management solutions.

This diversification is a key element in Beazley's strategy to manage risk effectively. By spreading its exposure across various lines of business and geographical regions, the company can mitigate the impact of any single market downturn or catastrophic event. For instance, Beazley reported gross written premiums of $5.4 billion for the full year 2023, with a significant portion coming from its specialty lines, demonstrating the breadth of its market penetration.

- Marine & Aviation: Providing coverage for global shipping and air travel industries.

- Political Risk: Insuring against risks like expropriation, political violence, and currency inconvertibility.

- Accident & Health: Offering protection for individuals and groups against unforeseen events.

- Contingency: Covering losses arising from specific events, such as event cancellation.

The company's commitment to specialty lines highlights its ability to identify and underwrite complex risks. This comprehensive approach ensures that clients across various sectors can find robust insurance solutions to protect their operations and assets, contributing to Beazley's resilient financial performance.

Value-Added Services

Beazley's product offering transcends the traditional insurance policy, incorporating crucial value-added services designed to bolster client resilience and operational continuity. This strategic expansion of their product definition is particularly evident in their cyber insurance solutions.

In the cyber realm, Beazley provides clients with direct access to specialized cybersecurity expertise and a suite of services. These services are meticulously crafted to assist businesses in proactively preparing for, effectively defending against, and swiftly recovering from the disruptive impact of cyber-attacks. For example, Beazley's incident response services can be activated immediately following a breach, offering critical support from forensic investigation to legal counsel and public relations management.

This integrated approach significantly enhances Beazley's overall value proposition. By bundling essential risk management and response capabilities with their insurance coverage, they move beyond mere financial compensation to offer tangible, operational support. This focus on client resilience is a key differentiator, particularly in the evolving landscape of cyber threats.

Key value-added services include:

- Pre-breach advisory services: Offering guidance on best practices for cybersecurity hygiene and risk mitigation.

- Incident response coordination: Providing immediate access to a network of pre-vetted cybersecurity and legal experts to manage breaches efficiently.

- Post-breach recovery support: Assisting clients with business interruption, data restoration, and reputational management following an incident.

- Cyber risk training and awareness programs: Equipping client employees with the knowledge to identify and avoid common cyber threats.

Beazley's product strategy is defined by its specialization in complex and niche risks, moving beyond generic insurance. This focus is evident in their robust cyber insurance offerings, which include proactive and reactive services through Beazley Security. Their portfolio also spans marine, aviation, political risks, and accident & health, demonstrating a diversified approach to specialty insurance. This tailored product development, with a strong emphasis on value-added services, allows Beazley to command a premium and build strong client relationships.

In 2024, Beazley continued to emphasize its specialty lines, with cyber insurance showing particularly strong growth. For instance, they reported a significant increase in gross written premiums for their cyber and executive assurance division, reflecting the market's demand for sophisticated protection against evolving digital threats. This expansion in specialized product offerings is a key driver of their financial performance.

| Product Line | Key Features | 2024 Performance Highlight |

|---|---|---|

| Cyber Insurance | Comprehensive coverage including breach response, eCrime, and pre/post-incident services via Beazley Security. | Significant premium growth in cyber and executive assurance division. |

| Marine & Aviation | Coverage for global shipping and air travel industries. | Continued strong penetration in specialty insurance markets. |

| Political Risk | Protection against expropriation, political violence, and currency inconvertibility. | Addresses complex geopolitical exposures for global businesses. |

| Accident & Health | Protection for individuals and groups against unforeseen events. | Diversified offering to complement core specialty lines. |

What is included in the product

This analysis offers a comprehensive deep dive into Beazley's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's ideal for professionals seeking a complete breakdown of Beazley’s marketing positioning, providing real data and strategic implications for comparison and planning.

Provides a clear, actionable framework to identify and address marketing challenges, turning complex strategies into manageable solutions.

Place

Beazley's global reach is significantly amplified through its operations at Lloyd's of London. Historically, these syndicates have been a cornerstone of Beazley's revenue generation, providing a robust platform for underwriting a wide array of specialized risks. This strategic positioning allows Beazley to tap into an extensive international client base and distribution network.

As of 2024, Beazley actively manages seven Lloyd's syndicates, underscoring its deep commitment to this unique insurance market. This substantial presence enables the company to underwrite a diverse portfolio of complex risks, from cyber and political risks to marine and specialty lines, across numerous geographies.

Beazley has strategically broadened its operational footprint far beyond its traditional Lloyd's base. This expansion now encompasses key markets across Europe, North America, Latin America, and Asia, demonstrating a commitment to global reach.

The company leverages distinct legal entities to solidify its presence in these diverse regions. For instance, Beazley Insurance Company, Inc. and Beazley America Insurance Company, Inc. are integral to its North American operations, while Beazley Insurance dac serves as a crucial pillar for its European activities.

This geographic diversification isn't just about presence; it's about tapping into varied market demands and risk landscapes, which is vital for a specialty insurer. For example, in 2024, Beazley reported that its North American segment contributed a significant portion of its gross written premiums, underscoring the importance of this diversified approach.

Beazley utilizes a dual-pronged distribution strategy, leveraging both direct sales and a robust network of insurance brokers. This approach ensures broad market reach and caters to diverse client needs.

The company places significant emphasis on its broker relationships, recognizing their vital role in product placement and customer engagement. In 2024, Beazley reported that brokers were instrumental in driving a substantial portion of its new business premiums, highlighting their continued importance in the market.

Further strengthening this channel, Beazley is actively investing in digital trading platforms. These enhancements aim to streamline processes, improve efficiency for broker partners, and ultimately provide a smoother experience for their clients, reflecting a commitment to modernizing distribution in 2025.

Strategic Expansion into E&S Market

Beazley's strategic expansion into the U.S. excess and surplus (E&S) market, effective January 1, 2024, marks a significant shift. By establishing Beazley Excess and Surplus Insurance, Inc., a U.S.-domiciled entity, the company aims to unlock greater underwriting flexibility, particularly for complex risks in property, cyber, and specialty lines. This move is designed to improve market access and responsiveness for its North American clients.

This strategic realignment is supported by the robust growth observed in the E&S market. For instance, the U.S. E&S market has shown consistent upward trends, with direct premium writings in the E&S sector reaching approximately $70 billion in 2023, a figure projected to continue its growth trajectory into 2024 and 2025. This expansion allows Beazley to better cater to evolving client needs and capitalize on market opportunities in a segment characterized by specialized risks and innovative solutions.

- Enhanced Underwriting Flexibility: The U.S.-domiciled structure provides Beazley with greater autonomy in underwriting challenging and unique risks.

- Improved Market Access: Facilitates direct engagement with the U.S. E&S market, streamlining operations and client service.

- Focus on Key Lines: The initiative specifically targets growth in property, cyber, and specialty insurance segments within the E&S space.

- Alignment with Market Trends: Positions Beazley to leverage the continued expansion and demand within the U.S. E&S insurance sector.

Digital Trading Platforms

Beazley is actively enhancing its digital trading platforms to meet the growing need for speed and ease in the insurance market. These platforms are designed to simplify how brokers and their clients interact with Beazley, making it quicker to get quotes, bind cover, and manage claims.

The company's commitment to digital transformation is evident in its ongoing investment, aiming to provide a seamless user experience. For instance, Beazley's digital hub offers brokers 24/7 access to policy information and underwriting support, a crucial feature in today's fast-paced business environment.

- Digital Hub Expansion: Beazley continues to roll out new features on its digital trading platforms, focusing on user-friendliness and efficiency for brokers.

- Streamlined Underwriting: The platforms aim to reduce the time it takes for brokers to get quotes and bind policies, with some lines seeing quote turnaround times cut by up to 50% in early 2024.

- Claims Management Integration: Beazley is integrating claims processing into its digital offerings, allowing for faster notification and tracking of claims by policyholders and their representatives.

- Data Analytics for Brokers: Future developments include enhanced data analytics tools within the platforms to provide brokers with deeper insights into their portfolios and market trends.

Beazley's global presence is built on a foundation of strategic locations, including its significant operations within Lloyd's of London, which historically formed a core revenue stream. This allows access to a broad international client base and distribution channels.

The company has expanded beyond Lloyd's to establish key operations in North America, Europe, Latin America, and Asia. This geographic diversification is crucial for tapping into varied market demands and risk landscapes, with North America being a significant contributor to gross written premiums in 2024.

Beazley's strategic move into the U.S. excess and surplus (E&S) market, effective January 1, 2024, through Beazley Excess and Surplus Insurance, Inc., enhances underwriting flexibility for complex risks. This aligns with the robust growth of the U.S. E&S market, which saw approximately $70 billion in direct premium writings in 2023, a trend expected to continue through 2024 and 2025.

| Region | Key Entities/Operations | 2024/2025 Significance |

|---|---|---|

| United Kingdom | Lloyd's of London Syndicates (7 active in 2024) | Core underwriting platform, access to global risks. |

| North America | Beazley Insurance Company, Inc., Beazley America Insurance Company, Inc., Beazley Excess and Surplus Insurance, Inc. | Significant premium contributor, enhanced E&S market access. |

| Europe | Beazley Insurance dac | Pillar for European activities, catering to diverse market needs. |

| Asia & Latin America | Expanding operational footprint | Targeting growth and diversified risk exposure. |

What You Preview Is What You Download

Beazley 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Beazley 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know exactly what you're getting.

Promotion

Beazley's promotional strategy centers on showcasing its profound expertise in specialist underwriting and managing intricate risks. Their messaging consistently underscores their deep knowledge of niche areas like cyber and political risks, establishing them as leading authorities and reliable consultants within the insurance sector.

This focus on expertise is crucial for attracting clients facing complex challenges. For instance, in 2024, Beazley reported significant growth in its cyber insurance portfolio, a testament to their ability to communicate specialized knowledge effectively in a rapidly evolving threat landscape.

Beazley actively cultivates thought leadership through its published research and predictions on evolving risks. For instance, their 2024 reports delve into the burgeoning challenges posed by artificial intelligence, the increasing demand for climate resilience, and the rapid pace of technology obsolescence, offering valuable insights to businesses navigating these complex landscapes.

This strategic content dissemination, readily accessible via their corporate website and investor relations portals, aims to elevate market awareness of critical business vulnerabilities. By consistently providing forward-looking analysis, Beazley effectively positions itself not just as an insurer, but as a proactive and knowledgeable partner dedicated to assisting clients in mitigating emerging threats.

Beazley's promotional strategy heavily favors a broker-centric approach, recognizing brokers as their primary distribution channel. This means a significant portion of their marketing spend is dedicated to cultivating and supporting these vital partnerships.

To facilitate this, Beazley invests in providing brokers with comprehensive resources and training. This empowers brokers to effectively articulate the unique value propositions of Beazley's specialized insurance products to their end clients, ensuring clear communication of benefits and differentiators.

For instance, in 2024, Beazley continued to enhance its digital broker portals, offering real-time quoting tools and product information, which saw a 15% increase in broker engagement compared to the previous year. This focus on broker enablement directly translates to improved sales and market penetration for their cyber and specialty lines.

Financial Performance Highlighting

Beazley actively showcases its financial strength to build trust and highlight its market standing. The company frequently emphasizes its robust performance, including significant premium growth and profitability, to assure investors and partners of its stability and future prospects.

Recent financial reports underscore this strategy. For instance, Beazley announced a record profit of $433 million for the first half of 2024, a substantial increase from the previous year. This strong performance was driven by a 14% rise in gross written premiums, reaching $2.7 billion.

The company also uses strategic financial actions to demonstrate its health and commitment to shareholders. Beazley's ongoing share buyback program, which saw $100 million completed in the first half of 2024, directly returns value and signals confidence in the company's valuation.

- Record Profitability: Beazley reported a profit of $433 million for H1 2024, reflecting exceptional financial performance.

- Premium Growth: Gross written premiums increased by 14% to $2.7 billion in H1 2024, indicating strong market demand and successful underwriting.

- Shareholder Returns: A $100 million share buyback program was completed in H1 2024, demonstrating a commitment to enhancing shareholder value.

- Financial Stability: These results collectively position Beazley as a stable and attractive investment within the specialty insurance market.

Brand Building and Recognition

Beazley's commitment to brand building is evident in its consistent industry recognition. For instance, in 2025, Beazley retained its leading position in the specialty insurance sector within the Brand Index, a testament to their strong market presence and reputation.

This strategic emphasis on brand recognition directly translates into tangible business benefits. It aids in attracting a higher caliber of clients and partners, solidifying Beazley's standing as a premier specialist insurer in a competitive landscape.

- Industry Accolades: Maintained top spot in the 2025 Brand Index for specialty insurance.

- Business Attraction: Strong brand recognition draws high-quality business opportunities.

- Reputation Reinforcement: Enhances Beazley's image as a leading specialist insurer.

Beazley's promotional efforts are deeply rooted in showcasing their specialized underwriting capabilities and expertise in managing complex risks. Their communication consistently highlights their deep knowledge in niche areas, positioning them as authorities and trusted consultants within the insurance industry.

This focus on expertise is critical for attracting clients facing sophisticated challenges. In 2024, Beazley's cyber insurance portfolio saw substantial growth, reflecting their success in conveying specialized knowledge in a dynamic threat environment.

Beazley actively promotes thought leadership through its research and risk predictions, such as its 2024 reports on AI, climate resilience, and technology obsolescence, offering crucial insights for businesses.

The company's promotional strategy heavily favors a broker-centric approach, recognizing brokers as their primary distribution channel and dedicating significant marketing resources to these partnerships. This includes investing in broker training and resources, exemplified by the 15% increase in broker engagement with their enhanced digital portals in 2024.

Beazley emphasizes its financial strength to build trust, frequently highlighting robust performance metrics like its record profit of $433 million for H1 2024 and a 14% increase in gross written premiums to $2.7 billion. Their $100 million share buyback program in H1 2024 further signals confidence and commitment to shareholders.

Brand building is a key component, as demonstrated by Beazley retaining its leading position in the specialty insurance sector in the 2025 Brand Index, reinforcing its reputation and attracting high-quality business opportunities.

| Metric | 2024 (H1) | 2023 (H1) | Change |

|---|---|---|---|

| Profit | $433 million | $270 million | +60.4% |

| Gross Written Premiums | $2.7 billion | $2.37 billion | +14% |

| Share Buyback | $100 million | N/A | N/A |

Price

Beazley's value-based pricing for niche risks is a smart move in the specialty insurance market. They aren't just selling coverage; they're selling expertise and tailored solutions for complex exposures, which commands a premium. This approach is particularly evident in areas like cyber insurance, where the rapidly evolving threat landscape and the need for sophisticated response services justify higher price points.

For instance, in 2024, Beazley reported a significant increase in gross written premiums for their specialty lines, driven by strong demand for cyber and professional indemnity products. This growth, which reached $5.2 billion in the first nine months of 2024, underscores their ability to price competitively based on the unique value and risk mitigation they provide, rather than competing solely on price for commoditized risks.

Beazley navigates cyclical markets by adjusting prices dynamically. In 2024, the company saw an average rate decrease across its offerings, reflecting broader market trends.

Despite this, Beazley maintains strict underwriting discipline, prioritizing adequate rates. This approach is particularly evident in volatile sectors like property and cyber insurance, where pricing has experienced considerable shifts.

Beazley's pricing strategy is deeply intertwined with external market dynamics. The company actively analyzes competitor pricing to ensure its offerings remain competitive, while also gauging market demand to adjust rates accordingly. For instance, in the first half of 2024, Beazley observed a robust demand for cyber insurance, allowing for more favorable pricing in that segment.

Furthermore, Beazley remains acutely aware of the impact of broader economic conditions on its pricing. Geopolitical instability and the increasing frequency of natural catastrophes significantly shape the company's outlook. This is particularly evident in lines like marine, aviation, and political risk (MAP) insurance, where heightened global tensions and climate events directly influence risk assessment and, consequently, pricing strategies for 2024 and into 2025.

Underwriting Discipline and Risk Selection

Beazley's pricing strategy is deeply rooted in underwriting discipline and meticulous risk selection. This focus ensures that premiums are set appropriately to cover the inherent risks, a cornerstone for maintaining a healthy combined ratio.

The company actively manages its exposure to the insurance cycle, prioritizing profitable growth over sheer volume. This approach helps them navigate market fluctuations and maintain pricing adequacy.

- Disciplined Underwriting: Beazley's approach emphasizes thorough risk assessment and pricing that accurately reflects potential losses.

- Risk Selection: They concentrate on underwriting business lines where they possess expertise and can achieve favorable terms.

- Profitability Focus: The goal is to ensure that underwriting activities generate sustainable profits, not just revenue growth.

- Combined Ratio Management: This disciplined approach directly supports Beazley's efforts to achieve and maintain a strong combined ratio, a key indicator of underwriting profitability. For instance, in the first half of 2024, Beazley reported a combined ratio of 80% for their specialty insurance business, reflecting this disciplined underwriting.

Capital Management and Shareholder Returns

Beazley's pricing strategies are intrinsically linked to its capital management philosophy, focusing on profitable deployment. The company actively manages its capital, aiming for returns that support sustainable growth. When profitable opportunities for reinvestment are scarce, Beazley demonstrates a commitment to enhancing shareholder value through capital returns.

This approach is evident in their share buyback programs, which serve as a mechanism to return excess capital. For instance, in the first half of 2024, Beazley continued its share repurchase activity, reflecting a strategy to optimize capital allocation. These buybacks not only return value directly to shareholders but also signal confidence in the company's financial health and future prospects, indirectly influencing pricing by ensuring a robust financial base.

- Capital Deployment Focus: Beazley prioritizes deploying capital into profitable growth avenues.

- Share Buyback Programs: The company utilizes share buybacks to return excess capital to shareholders.

- Financial Performance Influence: Pricing decisions are made to ensure sustained financial performance and shareholder returns.

- Market Position: This capital strategy supports Beazley's ability to maintain competitive pricing while ensuring profitability.

Beazley's pricing strategy centers on value and risk, especially in specialized insurance sectors. They price based on the expertise and tailored solutions offered, not just the coverage itself. This is clear in their cyber insurance offerings, where the complex and evolving threat landscape justifies premium pricing.

In 2024, Beazley saw strong premium growth in specialty lines, with gross written premiums reaching $5.2 billion in the first nine months, driven by cyber and professional indemnity. This growth demonstrates their success in pricing based on the unique value and risk mitigation provided.

Beazley adjusts pricing dynamically to market conditions. While the company observed an average rate decrease across its portfolio in 2024, reflecting broader market trends, they maintain strict underwriting discipline to ensure adequate rates, particularly in volatile areas like cyber and property insurance.

The company's pricing is closely tied to market demand and competitor analysis. For instance, strong demand for cyber insurance in the first half of 2024 allowed for more favorable pricing in that segment.

4P's Marketing Mix Analysis Data Sources

Our Beazley 4P's Marketing Mix Analysis is meticulously crafted using a blend of official Beazley disclosures, industry-specific insurance market reports, and competitor benchmarking. We incorporate data from Beazley's annual reports, investor relations materials, and public statements to ensure accuracy.