Beazley PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beazley Bundle

Navigate the complex external forces shaping Beazley's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and strategy. Gain a critical advantage by downloading the full report, packed with actionable insights for your own strategic planning.

Political factors

Global geopolitical discord, including ongoing conflicts and heightened international tensions, significantly impacts the insurance industry. This volatility can disrupt supply chains, expose regulatory vulnerabilities, and necessitate changes in political risk insurance coverage.

Beazley, as a specialist insurer, is directly exposed to these risks, with political risk being a top concern for global business leaders in 2024 and expected to remain elevated in 2025. For instance, the ongoing conflicts in Eastern Europe and the Middle East have led to increased demand for political risk insurance, with premiums rising in response to the heightened threat landscape. This trend is projected to continue, impacting Beazley's underwriting strategies and product development.

The insurance industry, including Beazley, is under a microscope regarding financial stability and safeguarding consumers. New legislation, like the UK's Financial Services and Markets Act 2023, is reshaping the regulatory environment by adding a competitiveness objective for watchdogs, potentially easing some burdens and freeing up capital.

Beazley must navigate these shifts, particularly with the full rollout of Solvency UK reforms by the end of 2024. These reforms are designed to bolster insurer solvency and ensure robust consumer protection, impacting capital requirements and operational strategies for companies like Beazley.

Shifting global trade patterns and increasing protectionism, marked by new tariffs, can foster economic instability and directly affect the insurance sector. For example, projections indicate that US tariffs could dampen global GDP growth and insurance premium expansion, introducing fresh risks tied to inflation and supply chain disruptions.

Beazley's leadership has voiced concerns that a less free global trade environment in 2025 will present challenges for its international operations, potentially influencing its underwriting strategies and risk appetite across various markets.

Elections and Political Unrest

The upcoming 2024 and 2025 election cycles in major economies, including the United States, are poised to reshape the regulatory landscape and introduce significant political uncertainty. This volatility directly impacts Beazley's political violence insurance offerings, as election outcomes can trigger social unrest, protests, and civil commotion.

Beazley's internal research highlights this concern, with a substantial 70% of global business leaders expressing apprehension about how election results might affect their international operations. This sentiment underscores the growing demand for robust political risk coverage.

- Election Uncertainty: Major elections in 2024-2025 create a fluid regulatory environment.

- Social Upheaval Risk: Potential for protests and civil commotion directly impacts political violence insurance needs.

- Business Leader Concerns: 70% of global business leaders worry about election outcomes impacting international operations.

Cyber Warfare and State-Backed Threats

The escalating sophistication of cyber warfare, including state-backed attacks and advanced persistent threats (APTs), presents a significant national and global security challenge. These threats have the potential to cause widespread disruption, as evidenced by major IT outages reported in 2024, making them a critical factor for cyber insurance providers like Beazley. The company must actively manage the evolving landscape of systemic cyber risk, which includes the possibility of substantial regulatory fines following cyber incidents.

Beazley's exposure to cyber warfare is amplified by the interconnected nature of digital infrastructure. For instance, a successful state-sponsored attack on a critical sector could have cascading effects, impacting multiple industries and increasing the likelihood of large-scale claims. The financial services sector, a key market for Beazley, is particularly vulnerable, with reports indicating a significant rise in cyber-attacks targeting financial institutions throughout 2024. This necessitates robust underwriting and risk mitigation strategies to account for the potential for large, systemic losses.

- State-sponsored cyberattacks are becoming more prevalent, targeting critical infrastructure and supply chains.

- Major IT outages in 2024 highlighted the vulnerability of businesses to sophisticated cyber threats.

- Beazley, as a leading cyber insurer, faces increasing exposure to systemic cyber risk driven by geopolitical tensions.

- The potential for significant regulatory fines for data breaches and cyber incidents adds another layer of financial risk.

The increasing frequency of elections globally in 2024 and 2025 introduces significant political uncertainty, directly impacting Beazley's political violence and specialty lines. A substantial 70% of global business leaders express concern about election outcomes affecting their international operations, driving demand for tailored insurance solutions.

Geopolitical tensions and ongoing conflicts are elevating the need for political risk insurance, with Beazley experiencing increased premiums in this sector. This trend is expected to persist through 2025, influencing underwriting strategies and product development for the company.

Shifting trade policies and rising protectionism, exemplified by new tariffs, contribute to economic instability and pose risks to global GDP growth and insurance premium expansion, as projected for 2025. Beazley's leadership anticipates these changes will challenge international operations and necessitate adjustments in risk appetite.

What is included in the product

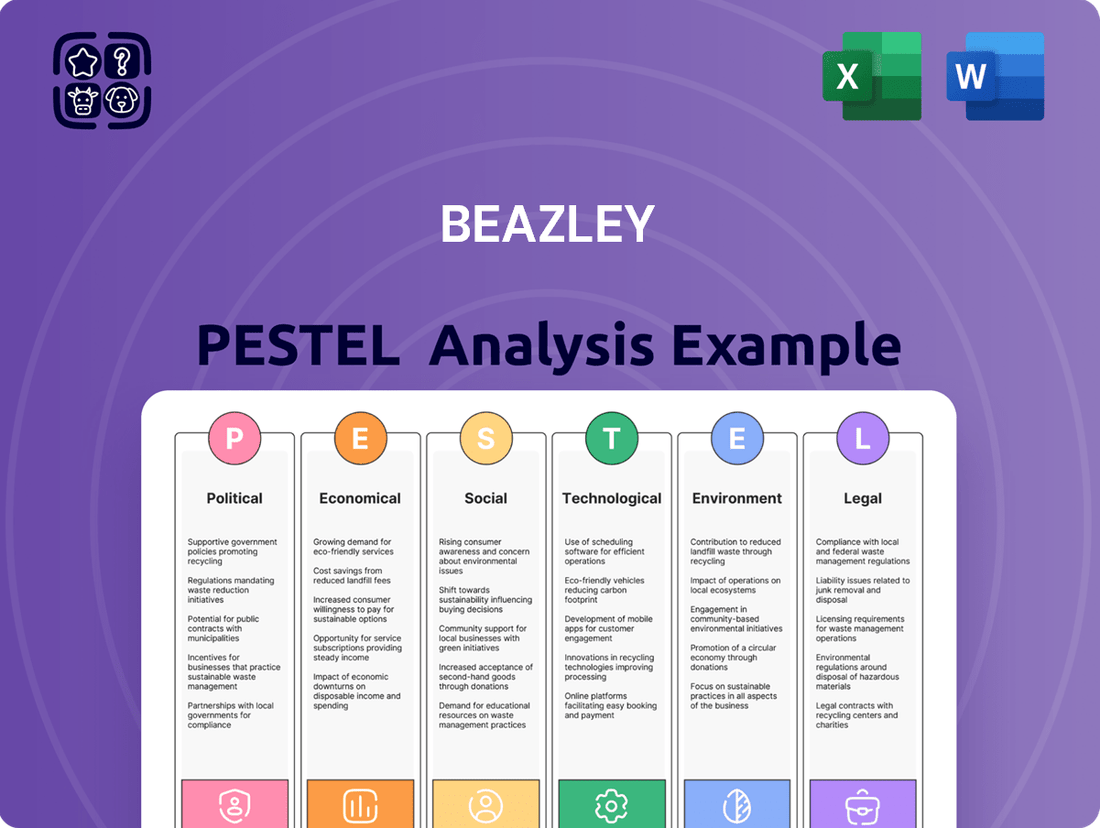

This Beazley PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company, offering a comprehensive view of its external operating environment.

Provides a clear, actionable framework that simplifies complex external factors, enabling faster and more confident strategic decision-making.

Economic factors

The global economic landscape for 2025-2026 projects a slowdown in real premium growth for non-life insurers, a notable shift from the robust performance seen in 2024, which marked a decade high. Despite this moderation, the insurance market benefits from persistent high interest rates, which continue to bolster demand for insurance products.

Beazley demonstrated exceptional profitability in 2024, navigating a challenging environment marked by substantial loss events and a cooling rating cycle. This resilience underscores the company's ability to maintain strong financial performance even amidst economic headwinds and a less favorable pricing environment.

The current elevated long-term interest rate environment is a significant tailwind for insurers like Beazley, directly boosting their investment income and contributing to improved profitability. For instance, Beazley reported substantial growth in its financial assets during 2024, a portion of which was directly attributable to the strong performance of its investment portfolio, bolstered by attractive risk-free yields.

However, this same high-interest-rate landscape presents a dual challenge for underwriting operations. While beneficial for investment returns, it complicates the precise determination of actual property values and, consequently, the accurate calculation of replacement costs, which are critical inputs for setting appropriate insurance premiums.

The insurance industry has been grappling with increased claims severity, a challenge exacerbated by inflation and supply chain disruptions. However, this upward trend in claim costs is showing signs of moderating.

Looking ahead to 2025, a more favorable environment for underwriting profitability is anticipated, supported by decelerating inflation and the impact of higher premium rates. This should lead to improved results, especially within the non-life insurance segments.

Beazley demonstrated robust performance in 2024, posting a strong undiscounted Combined Ratio of 79.0%. This figure underscores the company's success in carefully selecting risks and actively managing its business cycle.

Market Competition and Pricing Trends

The non-life insurance sector is shifting from a hard market to a softer growth outlook, with a noticeable moderation in premium rate increases. Specialist insurers such as Beazley are concentrating on achieving sustained outperformance by offering a range of products and meticulously selecting risks.

The cyber insurance market, a key area for Beazley, demonstrated stability throughout 2024, characterized by ample available capacity. This stability is projected to continue, with forecasts indicating stable rates extending into 2025.

- Premium Rate Moderation: The non-life insurance market is transitioning from a hard market phase to one with more moderate premium growth.

- Specialist Insurer Strategy: Beazley, as a specialist, aims for long-term outperformance via product diversification and stringent risk selection.

- Cyber Insurance Outlook: The cyber insurance market remained stable in 2024, with expectations of continued rate stability into 2025 due to plentiful capacity.

Impact of Climate-Related Disasters

The increasing frequency and intensity of climate-related disasters are placing considerable pressure on the insurance industry. This trend is directly impacting Beazley, a specialist insurer, by necessitating higher premiums and more rigorous underwriting in areas prone to such events. For instance, insured losses from natural catastrophes in 2024 were substantial, affecting insurer profitability across the board.

Beazley is actively managing these climate-related risks by integrating them into its underwriting strategies. Furthermore, the company is developing its Net Zero Transition plan to address its long-term environmental impact.

- Rising Premiums: Climate events are driving up insurance costs, particularly in high-risk zones.

- Underwriting Adjustments: Insurers are implementing stricter criteria for coverage due to escalating climate risks.

- 2024 Losses: Significant insured losses from natural disasters in 2024 impacted the sector's financial performance.

- Beazley's Response: The company is proactively incorporating climate risk into its underwriting and planning its Net Zero Transition.

The economic outlook for 2025-2026 anticipates a slowdown in non-life premium growth compared to the strong 2024 performance. High interest rates, however, continue to support insurance demand and bolster investment income for insurers like Beazley. While Beazley achieved a robust undiscounted Combined Ratio of 79.0% in 2024, demonstrating effective risk management, the high-interest environment complicates accurate premium calculations due to inflation's impact on replacement costs.

| Metric | 2024 Value | Outlook 2025 |

|---|---|---|

| Non-life Premium Growth | Strong (Decade High) | Moderating |

| Interest Rates | High | Persistently High |

| Beazley Combined Ratio (Undiscounted) | 79.0% | Targeting continued efficiency |

What You See Is What You Get

Beazley PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Beazley PESTLE analysis provides a comprehensive overview of the external factors impacting the company. You can trust that the detailed insights and structured format you see will be yours to utilize immediately.

Sociological factors

Societal awareness of complex and emerging risks, like cyber threats and climate change, is on the rise. This heightened awareness directly fuels the demand for specialized insurance products designed to address these evolving challenges.

Businesses are increasingly vocal about their concerns regarding geopolitical instability, often reporting a diminished sense of resilience. This sentiment compels them to actively seek robust insurance coverage to mitigate potential impacts.

Beazley's own research underscores this trend, consistently revealing that businesses perceive an escalation in risks while simultaneously feeling less equipped to handle them. For instance, a 2024 survey indicated that 78% of businesses believe their exposure to cyber risk has increased in the past year.

Customers are increasingly empowered by new technologies, including generative AI, driving a demand for highly personalized and easily accessible insurance. This shift means insurers must rethink customer interactions and deliver more comprehensive solutions that cater to individual needs and behaviors, ultimately boosting satisfaction.

Demographic shifts are significantly reshaping the insurance landscape. Younger generations, particularly those under 50, are increasingly engaging with insurance products, often influenced by social media trends. This trend is notably boosting demand in areas like life insurance, with a growing number of millennials and Gen Z actively seeking financial protection and planning tools.

Insurers must therefore evolve their strategies to cater to these diverse customer segments. This involves adapting product designs, embracing digital distribution channels, and leveraging social media platforms to connect with and educate younger consumers about the value of insurance. For instance, Beazley, like many insurers, is exploring more personalized and digitally-native offerings to capture this evolving market.

Trust and Transparency

In today's world, especially with more data being collected and AI playing a bigger role, keeping customers’ trust and being open about how data is used and how insurance policies are decided is really important for Beazley. This focus on trust influences how they interact with people who buy insurance.

Data privacy rules are changing to give people more say and clarity on their information. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into effect in 2018 and continues to influence global standards, emphasizes strong data protection principles. This directly affects Beazley's operations, requiring them to be transparent about data usage and build stronger relationships with their policyholders.

- Data Privacy Regulations: Evolving laws like GDPR and similar frameworks globally mandate greater transparency in data handling, impacting Beazley's operational procedures.

- Customer Trust: Maintaining and enhancing customer trust is paramount, especially as AI and data analytics become more integrated into underwriting and claims processes.

- AI Transparency: Beazley needs to ensure clarity in how AI-driven decisions are made to avoid alienating customers and to comply with emerging ethical guidelines.

- Reputational Risk: A lack of transparency or a data breach could significantly damage Beazley's reputation, leading to customer attrition and reduced market share.

Workforce Diversity and Inclusion

The insurance sector, including companies like Beazley, is increasingly recognizing diversity and inclusion (D&I) as critical drivers for innovation and sustained growth. This societal shift encourages a broader range of perspectives, which can lead to more creative problem-solving and a better understanding of diverse customer needs.

Beazley has actively embraced this trend, setting tangible goals for its workforce. For instance, the company aims for improved gender balance in leadership positions and increased representation of People of Colour across its operations. These initiatives are not just about compliance but about fostering a culture where varied backgrounds are valued and contribute to the company's overall strength.

The impact of these inclusive practices is significant. By building a workforce that mirrors the diverse societies it serves, Beazley enhances its organizational resilience. This inclusivity can translate into a more robust understanding of market dynamics and a stronger ability to adapt to evolving customer expectations, ultimately contributing to long-term success.

- Gender Diversity: Beazley's commitment includes specific targets for gender representation in leadership roles, aiming to achieve a more balanced executive team.

- Ethnic Representation: The company is focused on increasing the representation of People of Colour within its workforce, reflecting a broader societal push for ethnic inclusion.

- Innovation Driver: A diverse workforce is seen as a catalyst for innovation, bringing varied viewpoints that can lead to new product development and improved service offerings.

- Market Relevance: Inclusive hiring practices help ensure Beazley better understands and serves a diverse customer base, enhancing its market position.

Societal awareness of complex risks like cyber threats and climate change is increasing, driving demand for specialized insurance. Businesses report diminished resilience due to geopolitical instability, seeking robust coverage. Beazley's 2024 data shows 78% of businesses feel their cyber risk exposure has grown.

Customer empowerment through technology, including AI, fuels demand for personalized, accessible insurance, requiring insurers to adapt interaction models. Demographic shifts also play a role, with younger generations actively engaging with insurance, boosting demand for products like life insurance.

Trust and transparency in data usage are crucial, especially with AI integration. Evolving data privacy regulations, like GDPR, mandate greater transparency, impacting Beazley's operations and requiring stronger policyholder relationships. Reputational risk from data breaches or lack of transparency is a significant concern.

Diversity and inclusion (D&I) are recognized as key drivers for innovation and growth in the insurance sector. Beazley has set tangible goals for gender balance in leadership and increased representation of People of Colour, aiming to foster a culture that values varied backgrounds.

Technological factors

Artificial intelligence and machine learning are revolutionizing insurance, improving risk assessment and underwriting. Beazley is using these tools to analyze data more effectively, leading to better fraud detection and customized policies. This digital transformation is key to staying competitive.

The increasing digitalization of the insurance sector, including Beazley's operations, has unfortunately amplified its exposure to sophisticated cyber threats. Ransomware attacks and phishing scams are becoming more prevalent, targeting sensitive data and disrupting business continuity.

This heightened risk environment directly fuels the demand for comprehensive cyber insurance solutions. Beazley, as a significant underwriter in this space, is actively responding to these evolving threats by developing and offering tailored cyber insurance products designed to protect businesses against these digital dangers.

In 2024, the global cyber insurance market is projected to reach over $15 billion, a testament to the growing need for such coverage. Beazley's strategic focus on this segment positions it to capitalize on this expansion while managing the inherent risks of a dynamic threat landscape.

The insurance industry, including Beazley, is significantly benefiting from the explosion of digital consumer data and the rise of data lakehouses. This technological shift empowers insurers to refine predictive analytics and risk modeling with unprecedented accuracy, drawing on real-time customer behavior for continuous model updates. Beazley specifically leverages sophisticated data analysis to sharpen its specialist underwriting capabilities, a key differentiator in its market.

Automation of Processes

Technological advancements are significantly reshaping the insurance sector, with automation now a key driver. This is particularly evident in areas like policy underwriting and claims processing, where repetitive, high-volume tasks are increasingly being handled by sophisticated systems.

This automation directly translates into substantial operational efficiencies and cost savings for companies like Beazley. By reducing the need for manual intervention, businesses can reallocate resources more effectively, leading to improved productivity. For instance, in 2024, the global insurance automation market was valued at approximately USD 3.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 12% through 2030, underscoring the widespread adoption and impact of these technologies.

- Reduced Operational Costs: Automation streamlines workflows, cutting down on labor expenses and processing errors in underwriting and claims.

- Enhanced Productivity: By taking over routine tasks, automation frees up human capital for more complex, value-added activities.

- Improved Accuracy and Speed: Automated systems process information faster and with fewer mistakes than manual methods, leading to quicker policy issuance and claim settlements.

- Data-Driven Decision Making: Automation facilitates the collection and analysis of vast amounts of data, enabling more informed risk assessment and pricing strategies.

Technological Infrastructure and Resilience

The insurance industry's deep reliance on interconnected technology means that even minor IT disruptions can have significant ripple effects. This underscores Beazley's commitment to maintaining a robust technological infrastructure and ensuring operational resilience. A global IT outage in 2024, as highlighted in Beazley's annual report, served as a stark reminder of the vulnerabilities inherent in our increasingly digitized world.

The need for strong operational integrity is paramount. Beazley's focus on this area is crucial for mitigating risks associated with technological failures.

- IT Outage Impact: Non-malicious IT outages can cause widespread business disruption, affecting claims processing, policy management, and customer service.

- Resilience Investment: Beazley continues to invest in infrastructure and disaster recovery capabilities to minimize downtime and maintain service continuity.

- Digital Transformation Risks: As Beazley embraces digital transformation, it must proactively address the associated cybersecurity and operational risks.

Technological advancements, particularly in artificial intelligence and automation, are reshaping insurance operations for companies like Beazley. These tools enhance risk assessment, fraud detection, and claims processing, leading to greater efficiency and accuracy. The global insurance automation market, valued at approximately USD 3.5 billion in 2024, is expected to grow significantly, reflecting this trend.

| Technology Area | Impact on Beazley | Market Data (2024/2025 Projections) |

|---|---|---|

| Artificial Intelligence & Machine Learning | Improved risk assessment, underwriting efficiency, fraud detection, personalized policies. | Global AI in Insurance market projected to exceed $10 billion by 2025. |

| Automation (RPA, AI-driven) | Streamlined claims processing, policy administration, reduced operational costs, faster service delivery. | Global Insurance Automation market valued at ~$3.5 billion in 2024, with a projected CAGR of over 12% through 2030. |

| Cybersecurity Technologies | Essential for protecting sensitive data against increasing cyber threats; drives demand for cyber insurance. | Global Cyber Insurance market projected to reach over $15 billion in 2024. |

| Data Analytics & Big Data | Enhanced predictive modeling, real-time risk analysis, data-driven decision making for specialist underwriting. | Growth in data lakehouse solutions enabling insurers to refine analytics capabilities. |

Legal factors

The UK insurance market operates under a robust and changing regulatory landscape, notably influenced by the Financial Services and Markets Act 2023. This legislation, along with the transition from Solvency II to Solvency UK, signals a push towards simplified compliance and enhanced market stability. Beazley, like its peers, must diligently adapt to these evolving rules to ensure continued operational integrity and a competitive edge.

Global data privacy laws are becoming increasingly stringent, with significant developments like the EU AI Act and various US state-level privacy regulations directly impacting how companies handle sensitive information. For Beazley, this means meticulous attention to how they collect, process, store, and share client data.

Non-compliance with these evolving regulations, such as California's CCPA/CPRA which saw significant enforcement actions in 2023, can lead to substantial financial penalties and severe reputational harm. Beazley's commitment to robust data protection is therefore crucial for maintaining trust and operational integrity.

New consumer duty rules, like those from the UK's Financial Conduct Authority (FCA), are reshaping financial services, including insurance. These regulations mandate that firms deliver good outcomes for retail customers, ensuring fair treatment from product inception through its lifecycle. For instance, the FCA's Consumer Duty, implemented in 2023, requires firms to demonstrate how they are achieving good outcomes for customers across four key areas: products and services, price and value, consumer understanding, and consumer support.

Beazley must therefore adapt its operational strategies and communication protocols to meet these heightened consumer protection standards. This involves a proactive approach to ensuring transparency and fairness in all customer interactions, particularly in the insurance sector where complex products can sometimes lead to consumer confusion. The emphasis is on proactive rather than reactive measures, ensuring that customer well-being is embedded in the firm's core business practices.

Liability and Litigation Risks

Beazley, like all insurers, faces evolving liability and litigation risks due to the increasing complexity of modern threats, especially concerning cyber and climate change. A key area of contention is the extent to which insurance policies cover regulatory fines, a topic frequently debated in legal circles.

Insurers must proactively adapt their policy wordings and risk assessment methodologies to manage these growing legal exposures. For instance, the 2024 legal landscape continues to see challenges regarding the interpretation of cyber insurance coverage for state-sponsored attacks and data breach notification costs.

- Cyber Liability: Litigation surrounding cyber insurance claims, particularly concerning the definition of 'attack' and the scope of coverage for ransomware payments, remains a significant risk.

- Climate Change Litigation: Insurers may face litigation if policyholders seek coverage for damages arising from climate-related events or if the insurer's underwriting practices are deemed to exacerbate climate risks.

- Regulatory Fines: The indemnification of regulatory fines by insurance policies is a persistent legal battleground, with regulators often scrutinizing such clauses to prevent insurers from shielding policyholders from accountability.

International Regulatory Divergence

International regulatory divergence presents a significant hurdle for global insurers like Beazley. Geopolitical volatility and varying national approaches to oversight create a complex, fragmented legal landscape, complicating risk mitigation efforts. For instance, the differing national stances on data privacy, such as GDPR in Europe versus less stringent regulations elsewhere, require Beazley to navigate a patchwork of compliance requirements.

The lack of cross-border coordination, particularly in rapidly evolving fields like artificial intelligence (AI) regulation, further amplifies this complexity. Insurers must ensure compliance with a multitude of potentially conflicting rules across different jurisdictions, impacting product development and operational strategies.

- Data Privacy Laws: Beazley must comply with diverse data privacy regulations globally, including GDPR in Europe and CCPA in California, each with unique data handling and consent requirements.

- Cybersecurity Standards: Varying national cybersecurity mandates, such as those in the US (NIST) and the EU (NIS2 Directive), necessitate tailored security protocols for Beazley's operations.

- AI Regulation: Emerging AI regulations, like the EU AI Act, create new compliance challenges for insurers utilizing AI in underwriting and claims processing, with differing timelines and scopes across countries.

- Financial Services Oversight: Beazley operates under the watchful eyes of multiple financial regulators, including the FCA in the UK and state-based regulators in the US, each with distinct solvency and conduct rules.

Beazley must navigate a complex web of evolving legal frameworks, from the UK's Financial Services and Markets Act 2023 and the transition to Solvency UK, to global data privacy laws like the EU AI Act and US state regulations. These changes demand meticulous adaptation to ensure compliance and maintain operational integrity. The company's proactive approach to consumer duty rules, emphasizing good customer outcomes, is critical in this evolving legal landscape.

Environmental factors

Climate change is significantly reshaping how insurers underwrite risks. More frequent and intense weather events like wildfires, hurricanes, and floods directly affect the insurance sector's ability to assess, price, and create new products. This means historical data alone is insufficient for accurate underwriting.

Beazley, a specialist insurer, is proactively integrating climate risk into its underwriting models. For instance, in 2024, the company continued to enhance its catastrophe modeling capabilities, incorporating forward-looking climate projections. This allows Beazley to provide more informed insights to clients navigating these evolving environmental challenges.

The increasing frequency and severity of natural catastrophes are significantly impacting the insurance industry. Global insured losses from natural disasters have been consistently high, with 2024 seeing an active hurricane season and intense flooding events, as noted in Beazley's annual report. This trend directly affects the profitability of property and casualty insurance lines.

As a consequence, insurers are implementing higher premiums and more stringent underwriting for properties in high-risk zones. In some cases, this leads to the creation of insurance deserts, where coverage becomes scarce or prohibitively expensive, posing a challenge for both policyholders and insurers alike.

Insurers like Beazley face increasing demands to integrate environmental, social, and governance (ESG) factors into their core operations. This means scrutinizing investment portfolios and supply chains for sustainability, with a clear push towards setting ambitious greenhouse gas emission reduction targets.

Beazley actively embraces this shift, committing to responsible business practices and embedding ESG principles across its activities. The company has established a Net Zero Transition plan, demonstrating a strategic focus on aligning its business with long-term sustainability goals.

Energy Transition and Green Opportunities

The global shift towards cleaner energy sources is creating significant new avenues for specialist insurers like Beazley. These areas include insuring nascent technologies like nuclear fusion, which is projected to see substantial investment growth in the coming years, and carbon capture, utilization, and storage (CCUS) projects, a critical component of decarbonization strategies. Beazley's proactive engagement in these sectors demonstrates a strategic alignment with supporting clients navigating the complexities of climate change adaptation and environmental protection.

Emerging markets, such as carbon credit trading, also offer substantial underwriting potential. The voluntary carbon market alone was valued at over $2 billion in 2023 and is expected to grow considerably. Beazley's focus on these innovative areas positions it to capitalize on the increasing demand for specialized insurance solutions supporting the transition to a low-carbon economy.

- Nuclear Fusion: Projected global investment in fusion energy research and development is expected to reach tens of billions of dollars by 2030, presenting unique risk profiles for insurers.

- Carbon Storage (CCUS): The CCUS market is anticipated to grow significantly, with global capacity projected to reach over 6 billion tonnes per annum by 2050, requiring robust insurance for large-scale projects.

- Carbon Credit Markets: The global carbon offset market is forecast to expand, with some estimates suggesting it could reach $50 billion by 2030, creating a need for insurance against project failure and market volatility.

Regulatory Expectations on Climate Risk Management

Regulators like the UK's Prudential Regulation Authority (PRA) are significantly elevating their expectations for insurers regarding climate risk management. This means companies like Beazley must deeply integrate climate considerations into their core risk frameworks, including robust scenario analysis. For instance, the PRA's supervisory statement SS3/19, updated in 2024, emphasizes the need for firms to demonstrate how they are managing both the physical and transition risks associated with climate change.

This heightened regulatory scrutiny directly compels insurers to continuously refine their strategies for addressing physical risks (like extreme weather), transition risks (associated with the shift to a low-carbon economy), and litigation risks (arising from climate-related impacts). By 2025, it's anticipated that a majority of major insurance markets will have implemented or be in the process of implementing enhanced climate risk disclosure requirements, mirroring the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

- PRA's SS3/19 (2024 update) mandates deeper climate risk integration.

- Focus on physical, transition, and litigation climate risks is intensifying.

- Increased regulatory pressure drives continuous improvement in risk management.

- By 2025, most major markets will have enhanced climate risk disclosure requirements.

Climate change is a significant driver for Beazley, impacting underwriting and creating new opportunities in areas like carbon capture and nuclear fusion. The insurer is actively integrating climate risk into its models and developing strategies to support clients through the energy transition.

Beazley's commitment to ESG, including its Net Zero Transition plan, reflects the growing industry-wide focus on sustainability. This proactive stance positions the company to capitalize on emerging markets and the increasing demand for specialized insurance solutions in a low-carbon economy.

Regulatory bodies like the PRA are increasing expectations for climate risk management, pushing insurers like Beazley to enhance their frameworks. This includes robust scenario analysis and a focus on physical, transition, and litigation risks, with enhanced disclosure requirements becoming standard by 2025.

| Environmental Factor | Impact on Beazley | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased underwriting risk, demand for specialized coverage | Global insured losses from natural disasters consistently high; active hurricane seasons and flooding events noted in 2024 reports. |

| Shift to Clean Energy | New insurance markets (nuclear fusion, CCUS) | Fusion energy investment projected to reach tens of billions by 2030; CCUS capacity projected to exceed 6 billion tonnes per annum by 2050. |

| ESG Integration & Net Zero | Strategic alignment, responsible business practices | Beazley has established a Net Zero Transition plan. |

| Regulatory Scrutiny (e.g., PRA) | Enhanced risk management and disclosure requirements | PRA's SS3/19 updated in 2024; by 2025, most major markets to have enhanced climate risk disclosure. |

PESTLE Analysis Data Sources

Our Beazley PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and leading market research firms. This ensures that our insights into political stability, economic trends, and societal shifts are both current and authoritative.