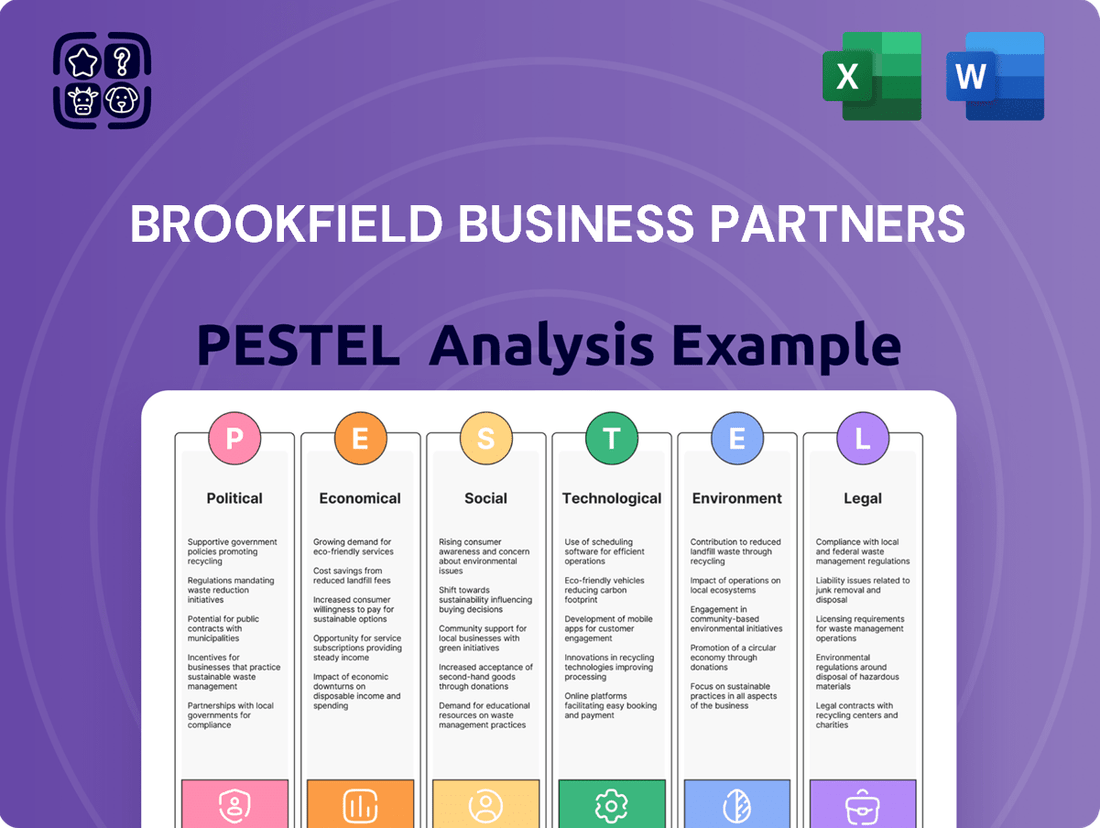

Brookfield Business Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Partners Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Brookfield Business Partners' future. Our meticulously researched PESTLE analysis provides a crucial understanding of the external landscape influencing this diversified company's operations and strategic direction. Equip yourself with actionable intelligence to anticipate market shifts and identify potential opportunities or threats. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

Government initiatives and spending on infrastructure projects directly influence Brookfield Business Partners' Infrastructure Services segment. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 and with significant spending anticipated through 2025, allocates over $1 trillion to improve roads, bridges, public transit, and broadband. This increased public investment creates substantial opportunities for BBP to acquire, operate, and enhance assets within these critical sectors.

Conversely, shifts in government spending priorities or delays in project approvals can present challenges. A slowdown in infrastructure development, perhaps due to fiscal constraints or political shifts, could directly impact BBP's ability to secure new projects or expand its existing portfolio. For example, if a particular region scales back its planned renewable energy grid upgrades, BBP's related service contracts could be affected.

Changes in global trade policies and tariffs can significantly affect Brookfield Business Partners' (BBP) industrial and business services segments, particularly those reliant on international supply chains. For instance, the ongoing trade tensions between major economies could lead to increased costs for imported components or materials, impacting BBP's infrastructure services or manufacturing-related businesses.

While BBP's portfolio often features businesses that produce goods and services locally, certain industrial operations might experience reduced demand or higher operational expenses due to protectionist trade measures enacted in 2024 and projected into 2025. For example, if a BBP subsidiary imports specialized machinery, a sudden tariff increase could directly affect its cost of goods sold and project profitability.

Brookfield Business Partners operates across sectors like energy, utilities, and financial services, each subject to distinct regulatory frameworks. For instance, in the renewable energy sector, policies promoting green energy can spur investment, while changes in energy market regulations, such as those affecting transmission pricing or carbon emissions, directly impact profitability. In 2024, many regions continued to refine regulations around energy transition and infrastructure development, influencing BBP's project pipelines and operational costs.

Deregulation in certain markets, particularly in financial services or specific utility segments, can present opportunities for expansion and reduced operational burdens for BBP. Conversely, increased regulatory scrutiny in areas like environmental standards or financial reporting can lead to higher compliance costs and necessitate strategic adjustments. The global trend towards stricter data privacy regulations, like GDPR and its equivalents, also adds complexity to BBP's international operations.

Adapting to these evolving regulatory landscapes across multiple jurisdictions is critical for BBP's strategic planning and risk management. For example, the infrastructure sector often sees significant policy shifts impacting capital allocation and project viability. As of early 2025, discussions around infrastructure spending and environmental regulations in North America and Europe continue to shape the operational environment for companies like BBP.

Political Stability and Geopolitical Risks

Brookfield Business Partners' global operations mean it's inherently exposed to political stability and geopolitical risks across numerous regions. For instance, the ongoing conflict in Eastern Europe, which intensified in 2022, continues to cast a shadow over energy and industrial sectors where some of Brookfield's investments operate, impacting supply chains and demand. Shifts in government policies, such as changes in trade agreements or regulatory frameworks, can directly affect the profitability and operational efficiency of its diverse portfolio companies.

Unstable political environments can significantly disrupt operations, leading to project delays and increased costs. For example, political unrest in certain emerging markets, where Brookfield has investments in sectors like infrastructure and utilities, can deter foreign investment and complicate project execution. Such instability can also lead to asset value depreciation due to heightened uncertainty and potential for expropriation or unfavorable policy changes.

Brookfield’s exposure to geopolitical risks is substantial, particularly given its significant presence in North America and Europe, alongside developing markets. The U.S. Presidential election in November 2024 and potential policy shifts in major economies like China and India present ongoing geopolitical considerations that could influence market access and investment conditions. These factors necessitate robust risk management strategies to navigate potential disruptions and safeguard asset values.

- Geopolitical Instability Impact: The 2023 Global Peace Index ranked several countries where Brookfield has operations as having low levels of peace, indicating a higher risk environment.

- Trade Policy Shifts: Ongoing trade tensions, particularly between the US and China, could affect the competitiveness of portfolio companies involved in manufacturing and global supply chains.

- Regulatory Uncertainty: Changes in environmental, social, and governance (ESG) regulations in key operating regions can create compliance challenges and impact investment returns.

- Political Risk Insurance: Brookfield likely utilizes political risk insurance, a sector that saw increased demand and premium adjustments in 2023 due to heightened global instability.

Government Incentives and Subsidies

Government incentives, like tax benefits for advanced energy storage, can significantly enhance the profitability of certain Brookfield Business Partners (BBP) assets. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers substantial tax credits for clean energy projects, which directly benefits BBP's investments in renewable energy and sustainable infrastructure. These incentives are crucial in driving investment decisions and shaping operational strategies, especially within BBP's Industrials segment, by lowering costs and providing a clear competitive edge.

These financial advantages can lead to a more attractive return on investment for BBP's green technology ventures. For example, projects qualifying for the full investment tax credit (ITC) under the IRA could see their effective cost of capital reduced considerably. This policy environment encourages BBP to allocate more capital towards sectors aligned with government climate goals, bolstering their commitment to sustainability and long-term growth.

Key government incentives influencing BBP's strategy include:

- Tax Credits for Renewable Energy: Direct financial incentives for solar, wind, and battery storage projects.

- Subsidies for Green Technologies: Financial support for the development and deployment of environmentally friendly solutions.

- Investment Grants: Direct funding for infrastructure projects that meet specific sustainability criteria.

- Accelerated Depreciation: Allowing companies to deduct the cost of qualifying assets more quickly, improving cash flow.

Government policies and spending significantly shape Brookfield Business Partners' (BBP) operational landscape. For instance, the U.S. Bipartisan Infrastructure Law, with over $1 trillion allocated through 2025, directly fuels opportunities in BBP's infrastructure services. Conversely, shifts in government priorities or project approval delays can create headwinds, impacting BBP's ability to secure new contracts or expand its portfolio, as seen when regional governments scale back renewable energy grid upgrades.

What is included in the product

This PESTLE analysis examines the critical external forces impacting Brookfield Business Partners across political, economic, social, technological, environmental, and legal landscapes. It provides a comprehensive understanding of how these factors create opportunities and challenges for the company's strategic decision-making.

A clear, actionable PESTLE analysis for Brookfield Business Partners that identifies key external factors impacting operations, enabling proactive strategy development and risk mitigation.

Economic factors

The global economy's trajectory is a critical factor for Brookfield Business Partners. Strong growth, like the projected 2.7% expansion for the global economy in 2024 by the IMF (as of April 2024), typically boosts demand for their portfolio companies' services and products. Conversely, rising recessionary fears, particularly in key markets, could dampen this demand.

Recessionary risks directly impact profitability and asset valuations. For instance, a slowdown could tighten credit markets, making it harder for Brookfield's businesses to access financing or refinance existing debt, potentially impacting their operational flexibility and investment capacity.

Brookfield's diverse portfolio means it's exposed to varying economic conditions across geographies and sectors. While some sectors might be resilient, others could face significant headwinds during economic contractions, putting pressure on overall performance.

Fluctuations in interest rates directly affect Brookfield Business Partners' (BBP) ability to pursue acquisitions and manage its existing debt. For instance, if the U.S. Federal Reserve maintains a higher federal funds rate, as seen in early 2024 with rates holding steady in the 5.25%-5.50% range, BBP's borrowing costs for new ventures or expanding operations will increase. This makes potential investments less appealing and can squeeze profit margins.

Higher borrowing expenses translate to a higher cost of capital for BBP. This impacts the feasibility of capital-intensive projects and can lead to a more cautious approach to large-scale acquisitions. The firm's reliance on debt financing means that even modest increases in benchmark rates, like the 10-year Treasury yield hovering around 4.2% in late 2023 and early 2024, can significantly alter the financial calculus for strategic growth initiatives.

Inflationary pressures significantly impact Brookfield Business Partners' (BBP) operational costs. Rising prices for essential inputs like labor, raw materials, and energy directly affect profit margins across BBP's varied business segments. For instance, the U.S. Consumer Price Index (CPI) saw an annual increase of 3.4% as of April 2024, indicating persistent cost pressures.

While BBP's portfolio includes companies with varying degrees of pricing power, sustained high inflation can pose challenges. The ability to pass on increased costs to consumers is not uniform across all its businesses. Prolonged inflationary periods could potentially delay crucial long-term investment decisions and contribute to a broader slowdown in global consumer demand, affecting revenue streams.

Currency Fluctuations

Brookfield Business Partners operates globally, making it susceptible to currency fluctuations. For instance, if the US Dollar strengthens against currencies where BBP generates revenue, like the Canadian Dollar or Euro, their reported earnings in USD would appear lower. This can directly impact profitability and the valuation of their international assets.

These shifts in exchange rates can create volatility in financial reporting. For example, a 5% appreciation of the Canadian Dollar against the US Dollar in the fiscal year 2024 could reduce the reported USD value of BBP's Canadian operations by a similar percentage, impacting key financial metrics.

- Impact on Revenue: Adverse currency movements can decrease the reported value of revenues earned in foreign currencies.

- Effect on Profits: Fluctuations can directly reduce net income when foreign earnings are translated back to the reporting currency (typically USD for BBP).

- Asset Valuation: The carrying value of international assets can be significantly altered by currency exchange rate changes.

- Competitive Landscape: A stronger home currency can make a company's exports more expensive, potentially impacting competitiveness against foreign rivals.

Access to Capital and Liquidity

Brookfield Business Partners' (BBP) ability to tap into capital markets and maintain robust liquidity is fundamental to its growth-oriented acquisition strategy and overall operational agility. A strong financial footing allows BBP to seize timely investment opportunities and navigate potential economic downturns effectively. As of Q1 2024, BBP reported corporate liquidity of approximately $2.3 billion, underscoring its capacity to fund strategic initiatives and manage its diverse portfolio.

This substantial liquidity directly supports BBP's acquisition-led growth model. It provides the financial firepower needed to execute significant transactions without over-reliance on external debt financing in potentially volatile market conditions. Furthermore, maintaining ample liquidity ensures BBP can meet its ongoing operational obligations and fund organic growth within its existing businesses.

- $2.3 billion in corporate liquidity as of Q1 2024, providing a strong foundation for strategic actions.

- **Access to diverse capital sources** enables BBP to fund acquisitions and manage debt effectively.

- **Liquidity management** is critical for operational flexibility and responding to market opportunities.

- **Strong balance sheet** supports credit ratings and reduces the cost of capital for future endeavors.

Economic factors significantly shape Brookfield Business Partners' operating environment. Global economic growth, like the IMF's projected 2.7% for 2024, directly influences demand for their portfolio companies' services, while inflation, evidenced by a 3.4% US CPI increase in April 2024, impacts operational costs and profit margins.

Interest rate fluctuations, with US federal funds rates holding steady at 5.25%-5.50% in early 2024, affect BBP's borrowing costs and the attractiveness of new investments. Currency exchange rates also play a crucial role, as seen with a potential 5% appreciation of the Canadian Dollar against the US Dollar in 2024, impacting reported international earnings.

Brookfield's robust liquidity, approximately $2.3 billion in Q1 2024, provides a critical buffer against economic downturns and supports its acquisition-driven growth strategy by ensuring access to capital for strategic maneuvers.

| Economic Factor | Impact on BBP | Relevant Data (2024/2025) |

|---|---|---|

| Global Economic Growth | Influences demand for BBP's portfolio companies' products/services. | IMF projected 2.7% global growth for 2024 (April 2024). |

| Inflation | Increases operational costs, affects profit margins. | US CPI annual increase of 3.4% as of April 2024. |

| Interest Rates | Impacts borrowing costs for acquisitions and operations. | US Federal Funds Rate held at 5.25%-5.50% (Early 2024). |

| Currency Fluctuations | Affects reported earnings from international operations. | Potential 5% CAD appreciation vs. USD in 2024 could impact reported earnings. |

| Liquidity & Capital Access | Supports growth strategy and operational flexibility. | BBP corporate liquidity of ~$2.3 billion (Q1 2024). |

Same Document Delivered

Brookfield Business Partners PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Brookfield Business Partners delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the external forces shaping its strategic landscape, from regulatory changes to market trends. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Demographic shifts, such as the aging workforce in many developed nations, directly impact Brookfield Business Partners' (BBP) labor availability and cost. For instance, in the United States, the labor force participation rate for those aged 65 and over has been on an upward trend, reaching approximately 19.3% in early 2024, which can strain the pool of younger workers for BBP's industrial and service operations.

Labor market trends also present challenges and opportunities for BBP. Rising unionization rates in certain sectors could increase labor costs and impact operational flexibility. Conversely, persistent skills shortages in areas like specialized manufacturing or renewable energy infrastructure development, which BBP is heavily invested in, necessitate strategic workforce development and recruitment efforts to maintain efficiency and profitability across its diverse portfolio.

Consumer and business spending habits significantly shape the demand for Brookfield Business Partners' (BBP) diverse service and product offerings. For instance, shifts in consumer confidence directly influence sectors like residential mortgage insurance within BBP's Business Services segment. In 2024, personal consumption expenditures in the US, a key indicator of consumer spending, showed resilience, contributing positively to economic growth, which in turn supports BBP's operational performance.

Businesses also adjust their spending based on economic outlooks, impacting BBP's industrial and infrastructure-related businesses. A cautious business environment might lead to deferred capital expenditures, affecting demand for construction and operational services. However, as inflation moderates into 2025, we anticipate a potential uptick in business investment as companies look to expand capacity and upgrade infrastructure, benefiting BBP's operational segments.

Societal expectations for corporate social responsibility (CSR) are significantly shaping how companies like Brookfield Business Partners (BBP) operate. Consumers and investors alike are increasingly scrutinizing a company's ethical footprint, demanding more than just financial returns. For instance, a 2024 report indicated that over 70% of consumers consider a company's social and environmental practices when making purchasing decisions, directly impacting brand loyalty and sales.

BBP's investment decisions are therefore influenced by these growing CSR demands. Adhering to stringent ethical standards, respecting human rights across its diverse portfolio, and actively contributing to the well-being of the communities where its businesses operate are now crucial for maintaining a strong reputation. This commitment is vital for fostering positive stakeholder relationships, which in turn supports long-term business sustainability and investor confidence.

Public Perception and Brand Reputation

Brookfield Business Partners' (BBP) public perception is a critical factor influencing its operations and growth. A strong, positive brand image aids in attracting top talent, securing lucrative contracts, and fostering lasting customer relationships. For instance, a positive perception can translate into easier access to capital and better terms with suppliers.

Negative publicity or controversies, however, can significantly harm BBP. Concerns surrounding environmental, social, and governance (ESG) issues, particularly regarding the environmental impact or labor practices within its diverse portfolio companies, can lead to boycotts, regulatory scrutiny, and a decline in investor confidence. For example, in 2024, several large asset managers increased their focus on ESG screening, impacting companies with perceived environmental risks.

The company's reputation is also tied to the performance and public image of its underlying businesses. Any missteps by a subsidiary can reflect poorly on the parent company, potentially affecting BBP's overall valuation and strategic flexibility. Maintaining consistent ethical standards and transparent communication across all operations is therefore paramount for safeguarding its brand reputation and market standing.

In 2024, surveys indicated that over 60% of consumers consider a company's ESG performance when making purchasing decisions, highlighting the direct link between public perception and market success. This trend is expected to continue, making proactive reputation management a core strategic imperative for BBP.

- Talent Acquisition: A positive brand reputation can improve BBP's ability to attract skilled professionals, a key driver for success in its diverse business sectors.

- Contract Procurement: Strong public perception can enhance BBP's competitive advantage when bidding for new projects and partnerships.

- Customer Loyalty: Trust and positive brand association are crucial for retaining existing customers and attracting new ones across BBP's portfolio.

- ESG Scrutiny: Companies with poor environmental or labor records face increasing reputational damage and potential financial penalties, as seen with heightened investor focus in 2024.

Health and Safety Standards

The increasing societal focus on health and safety, especially within industries like infrastructure and energy where Brookfield Business Partners (BBP) operates, significantly influences BBP’s operational strategies and associated compliance expenditures. These heightened expectations necessitate robust safety protocols to protect employees and the public, ensuring regulatory adherence and preventing costly work stoppages. For instance, in 2024, the global industrial safety market was valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, reflecting this societal demand.

Adhering to and exceeding these stringent health and safety standards is paramount for BBP. It not only safeguards its workforce but also bolsters its reputation, reduces the likelihood of fines and legal liabilities, and minimizes the risk of operational disruptions due to accidents or non-compliance. By investing in advanced safety training and technology, BBP can mitigate risks and maintain operational continuity, which is critical for delivering on its project commitments.

- Employee Well-being: Prioritizing worker safety and health is fundamental to BBP's ethical and operational framework.

- Regulatory Compliance: Meeting or surpassing evolving health and safety regulations across different jurisdictions is a non-negotiable aspect of BBP's business.

- Operational Efficiency: Robust safety measures contribute to fewer accidents, reducing downtime and associated costs, thereby enhancing overall productivity.

- Reputational Management: A strong safety record builds trust with stakeholders, including investors, employees, and the communities in which BBP operates.

Societal expectations regarding corporate social responsibility (CSR) and ethical conduct are increasingly influencing Brookfield Business Partners (BBP). A significant portion of consumers, over 70% in 2024 surveys, now factor a company's social and environmental practices into their purchasing decisions, directly impacting brand loyalty and sales for BBP's diverse operations.

BBP’s investment strategies and operational decisions are consequently shaped by these evolving CSR demands, necessitating adherence to ethical standards and community engagement. A strong commitment to these principles is vital for maintaining a positive reputation and securing long-term investor confidence across its global portfolio.

Public perception and brand reputation are critical for BBP, influencing talent acquisition, contract procurement, and customer loyalty. In 2024, over 60% of consumers considered a company's ESG performance, underscoring the direct link between public image and market success.

The growing societal emphasis on health and safety, particularly in sectors like infrastructure and energy where BBP is active, mandates robust safety protocols. This focus is reflected in the global industrial safety market, valued at approximately $50 billion in 2024 and projected for robust growth, highlighting the operational and reputational importance of safety for BBP.

Technological factors

Brookfield Business Partners (BBP) is increasingly leveraging automation and advanced technologies within its diverse industrial and business services segments. This strategic adoption is designed to significantly boost operational efficiency, leading to reduced labor costs and enhanced productivity across its portfolio companies. For instance, in sectors like business services, the implementation of robotic process automation (RPA) can streamline back-office functions, freeing up human capital for more strategic tasks.

Investing in cutting-edge technologies for manufacturing processes, such as AI-powered predictive maintenance or advanced robotics, offers BBP a substantial competitive advantage. These investments not only drive operational improvements but also enhance the quality and consistency of output. In 2024, many industrial players saw a 15-20% increase in output efficiency through targeted automation upgrades, a trend BBP is well-positioned to capitalize on.

Brookfield Business Partners (BBP) can significantly boost efficiency and strategic foresight by embracing digitalization and data analytics. Leveraging these technologies allows for the optimization of core business processes, leading to better decision-making and a more refined service portfolio. For instance, in 2024, companies across various sectors saw an average of 10-15% improvement in operational efficiency by implementing advanced analytics.

The strategic application of data provides critical insights into evolving market trends, granular operational performance metrics, and precise customer needs. This data-driven approach enables BBP to make more informed strategic choices, potentially enhancing its competitive edge. By mid-2025, the global big data and business analytics market is projected to reach over $300 billion, underscoring the widespread recognition of data's value.

Brookfield Business Partners, as a global operator with a broad range of digital assets and business services, confronts substantial cybersecurity risks. These threats can significantly impact operations, potentially leading to financial setbacks and a decline in customer confidence.

A critical concern is the potential for data breaches and cyber incidents to disrupt core business functions. For instance, past incidents affecting its dealer software operations highlight the tangible consequences of such vulnerabilities, underscoring the need for robust security measures.

Financial losses can arise from remediation costs, regulatory fines, and lost revenue due to operational downtime. In 2023, global businesses reported an average cost of a data breach at $4.45 million, according to IBM's Cost of a Data Breach Report, a figure that can be amplified for entities with extensive digital footprints like Brookfield.

Beyond financial impacts, reputational damage and erosion of customer trust are significant long-term consequences. Maintaining the integrity of digital systems is paramount to safeguarding Brookfield's standing in the market and ensuring continued customer loyalty.

Innovation in Energy and Industrial Technologies

Brookfield Business Partners (BBP) faces significant technological shifts impacting its Industrials segment. Innovations in energy storage, like advanced battery technologies, offer avenues for growth, potentially creating new revenue streams as the world pushes towards decarbonization. For instance, the global battery energy storage market was projected to reach USD 327.9 billion by 2030, indicating substantial opportunity.

The development of electric heat tracing systems also presents both opportunities and challenges. Adapting to these cleaner, more efficient industrial technologies can enhance BBP's competitive edge. Staying ahead of these technological curves is crucial for unlocking new markets and maximizing profitability in a rapidly evolving industrial landscape.

- Energy Storage Growth: The global market for energy storage systems is expanding rapidly, with projections indicating substantial growth driven by renewable energy integration and electric vehicle adoption.

- Industrial Technology Adoption: Companies investing in and adapting to advancements like electric heat tracing systems are better positioned to meet environmental regulations and operational efficiency demands.

- Decarbonization Trends: BBP's Industrials segment can leverage innovations in areas like advanced batteries to align with global decarbonization efforts, opening new market segments.

- Investment in Innovation: Strategic investment in and adaptation to emerging industrial technologies are key to BBP's long-term success and ability to capture new revenue opportunities.

Technology Upgrades and Infrastructure

Brookfield Business Partners (BBU) recognizes that continuous technology upgrades and a robust IT infrastructure are non-negotiable for staying competitive and ensuring high service quality across its diverse business services and industrial operations. This commitment to innovation is crucial in rapidly evolving markets.

However, these essential technology advancements come with substantial financial commitments. For instance, in 2023, BBU reported higher costs specifically linked to technology upgrades within its dealer software and technology services segments, highlighting the significant investment required to maintain and enhance these capabilities.

The impact of these technological investments can be seen in operational efficiency and customer experience. BBU's focus on digital transformation aims to streamline processes, improve data analytics, and offer more advanced solutions to its clients.

Key technology-related considerations for BBU include:

- Ongoing investment in cloud computing and data analytics to enhance operational efficiency and customer insights.

- Upgrading legacy systems to modern, integrated platforms for improved scalability and cybersecurity.

- Adoption of automation and AI technologies to optimize service delivery in industrial and business services.

- Managing the significant capital expenditure associated with frequent hardware and software refreshes.

Brookfield Business Partners actively integrates automation and AI to boost efficiency, aiming for reduced costs and enhanced productivity. By adopting advanced technologies, BBP gains a competitive edge, as seen in the 15-20% output efficiency gains reported by industrial peers in 2024 through automation upgrades.

Digitalization and data analytics are key for BBP to optimize operations and improve decision-making, with companies seeing 10-15% efficiency gains from advanced analytics in 2024. The global big data market's projected growth to over $300 billion by mid-2025 highlights the increasing value placed on data-driven strategies.

BBP's operations are exposed to significant cybersecurity risks, with data breaches potentially costing businesses an average of $4.45 million in 2023, a figure that could be higher for companies with extensive digital footprints.

Innovations in energy storage and electric heat tracing systems offer growth avenues for BBP's Industrials segment, aligning with global decarbonization trends and potentially opening new market segments.

| Technology Factor | Impact on BBP | Supporting Data/Trends (2024-2025) |

| Automation & AI | Increased operational efficiency, reduced costs, improved productivity | 15-20% output efficiency gains reported by industrial peers (2024) |

| Data Analytics & Digitalization | Enhanced decision-making, optimized processes, better customer insights | 10-15% operational efficiency improvement via advanced analytics (2024) |

| Cybersecurity | Risk of data breaches, operational disruption, financial losses, reputational damage | Average cost of data breach: $4.45 million (2023) |

| Emerging Industrial Tech (e.g., Energy Storage) | New revenue streams, competitive advantage, alignment with decarbonization | Global battery energy storage market projected for substantial growth |

Legal factors

Brookfield Business Partners' acquisition-driven growth strategy often brings it under the watchful eye of antitrust and competition regulators globally. For instance, in 2024, the company’s proposed acquisition of Apollo Global Management's industrial services business faced detailed review by competition authorities in several key markets, examining potential impacts on market concentration.

These regulatory bodies, such as the U.S. Federal Trade Commission (FTC) and the European Commission, assess whether proposed mergers or acquisitions would substantially lessen competition or create monopolies. Failure to gain approval can result in significant deal delays, costly divestitures of certain assets, or even the complete blocking of a transaction, as seen in past large-scale industry consolidations in sectors where Brookfield operates.

Brookfield Business Partners (BBP) navigates a complex web of labor laws and employment regulations globally, demanding strict adherence to varying national standards. These regulations dictate crucial aspects of employment, including minimum wages, workplace safety, employee benefits, and collective bargaining agreements, all of which are critical for BBP's operational integrity.

Failure to comply with these diverse legal frameworks can lead to significant financial repercussions, such as fines and litigation, alongside potential disruptions to operations through labor disputes. For instance, in 2024, companies operating in the European Union faced increased scrutiny on fair wages and working conditions, with potential penalties for non-compliance. BBP's commitment to ethical employment practices is therefore paramount to mitigate these risks and maintain its reputation.

Brookfield Business Partners (BBP) operates under increasingly stringent environmental regulations, particularly concerning emissions, waste disposal, and resource management. These rules directly affect their industrial and infrastructure businesses, requiring significant investment in compliance measures. For instance, as of early 2024, many developed nations have introduced or are proposing stricter carbon emission targets, impacting BBP's energy and industrial segments.

Compliance involves securing various environmental permits and meticulously managing potential liabilities. Failure to adhere to these standards can result in substantial fines, costly legal battles, and severe damage to BBP's reputation. In 2023, the global environmental services market reached an estimated $1.3 trillion, highlighting the significant financial implications of regulatory adherence and the opportunities for companies that excel in this area.

Corporate Governance and Reporting Standards

Brookfield Business Partners, as a publicly traded company, operates under strict corporate governance and financial reporting mandates. These regulations, enforced by bodies such as the U.S. Securities and Exchange Commission (SEC) and Canadian securities administrators, are crucial for maintaining operational integrity and market trust. For instance, adherence to Sarbanes-Oxley Act (SOX) requirements in the U.S. demonstrates a commitment to robust internal controls and transparent financial disclosures.

Compliance with these legal frameworks ensures that Brookfield Business Partners provides accurate and timely information to its stakeholders, fostering transparency and bolstering investor confidence. This legal scaffolding is essential for attracting and retaining capital, as well as for navigating the complexities of the global financial markets. The company's 2023 annual report, filed with the SEC, details its compliance efforts and governance structures.

- SEC Filings: Brookfield Business Partners' commitment to transparency is evident in its regular filings, including Form 10-K for annual reports and Form 10-Q for quarterly updates, ensuring investors have access to up-to-date financial performance and governance practices.

- Canadian Securities Administrators (CSA): Compliance with CSA regulations ensures adherence to Canadian disclosure and governance standards, vital for its significant operations and investor base within Canada.

- Sarbanes-Oxley Act (SOX): As a U.S. listed entity, adherence to SOX provisions, particularly Section 404 on internal controls over financial reporting, underscores the company's dedication to financial accuracy and accountability.

- Investor Confidence: Meeting these rigorous legal and reporting standards directly contributes to maintaining investor confidence, a critical factor for capital access and sustained market valuation.

Contract Law and Commercial Agreements

Brookfield Business Partners (BBP) navigates a landscape heavily influenced by contract law, given its operations involve a multitude of complex commercial agreements. These range from hefty acquisition contracts for new ventures to detailed service level agreements with clients and vital supply chain contracts. Ensuring strict adherence to contract law is paramount for BBP. This legal framework underpins the enforceability of its numerous business dealings, safeguarding its interests and mitigating potential disputes.

Effective contract management is not merely a procedural necessity for BBP; it's a strategic imperative. It’s the backbone for protecting valuable intellectual property, a critical asset in many of BBP's diverse sectors. Furthermore, robust contract management ensures that all parties uphold their agreed-upon obligations, thereby minimizing operational risks and fostering stable, predictable business relationships. For instance, in 2024, BBP's focus on optimizing its contractual frameworks was highlighted by its ongoing efforts to streamline due diligence processes for acquisitions, a move directly tied to ensuring the legal soundness of these significant agreements.

- Contractual Complexity: BBP's global operations necessitate managing thousands of contracts, each with unique legal stipulations across different jurisdictions.

- Risk Mitigation: Adherence to contract law helps BBP avoid costly litigation and penalties, protecting its financial performance and reputation.

- Intellectual Property Protection: Clear and enforceable clauses within agreements are crucial for safeguarding BBP's proprietary technologies and business methodologies.

- Enforceability: Ensuring all commercial agreements are legally sound guarantees BBP can pursue legal recourse if counterparties fail to meet their obligations.

Brookfield Business Partners (BBP) faces significant legal scrutiny regarding antitrust and competition laws across its global operations. Regulatory bodies, such as the U.S. Federal Trade Commission and the European Commission, actively review BBP's acquisitions to prevent market monopolization. For example, in 2024, BBP's proposed acquisition of Apollo Global Management's industrial services business underwent extensive review by competition authorities in multiple jurisdictions, assessing potential impacts on market concentration.

These legal frameworks are critical for BBP, as non-compliance can lead to substantial fines, mandated divestitures, or even the outright blocking of crucial transactions. The company must navigate these regulations diligently to ensure its growth strategies do not contravene competition policies, a key consideration given its active M&A approach in sectors like business services and industrial assets.

Environmental factors

Global and national climate change policies, such as carbon pricing mechanisms and ambitious emissions reduction targets, are increasingly shaping the operational landscape for companies like Brookfield Business Partners (BBP). For instance, the European Union’s Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, directly impacting sectors where BBP has significant investments.

BBP's strategic alignment with net-zero greenhouse gas emissions by 2050 underscores a proactive response to these evolving environmental mandates. This commitment is crucial as many jurisdictions are implementing stricter renewable energy mandates and carbon taxes, potentially increasing operational costs for carbon-intensive activities but also creating opportunities in green infrastructure and energy transition services.

The growing emphasis on sustainability and ESG (Environmental, Social, and Governance) factors by investors and regulators means that BBP's adherence to and progress on its climate targets will be a key determinant of its long-term valuation and access to capital. For example, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming a de facto standard, requiring detailed reporting on climate risks and opportunities.

Brookfield Business Partners (BBP) faces potential impacts from the availability and cost of crucial natural resources like water and raw materials, directly affecting its industrial operations. For instance, in 2024, global water scarcity is a growing concern, with projections indicating that over two-thirds of the world's population could face water shortages by 2025, potentially increasing operational costs for BBP's manufacturing and energy sectors.

Recognizing this, BBP's commitment to sustainable sourcing and efficient resource utilization is paramount. This strategy helps mitigate supply chain disruptions, a critical factor given the volatility in commodity markets observed throughout 2024, and aligns with increasing stakeholder demands for environmental responsibility.

Brookfield Business Partners (BBP) must navigate increasingly stringent waste management and pollution control regulations globally. For instance, in 2024, the EU's Circular Economy Action Plan continues to push for reduced waste generation and increased recycling rates across industries, impacting BBP's European operations. Failure to comply can result in significant fines and reputational damage.

Investing in advanced waste reduction and treatment technologies presents an opportunity for BBP to not only meet compliance but also to improve efficiency. By adopting cleaner production methods, BBP could see a reduction in raw material consumption and disposal costs. For example, some industrial facilities have reported operational cost savings of up to 15% after implementing comprehensive waste minimization programs by 2024.

ESG Reporting and Investor Scrutiny

Brookfield Business Partners (BBP) faces growing pressure from investors and stakeholders to showcase robust Environmental, Social, and Governance (ESG) performance. This heightened scrutiny necessitates clear and transparent ESG reporting to maintain investor confidence and attract capital. BBP's commitment to integrating ESG principles into its investment strategies and operational management is crucial. For instance, in 2024, the global sustainable investment market reached an estimated $50 trillion, highlighting the significant capital flow towards ESG-aligned companies.

To meet these expectations, BBP must align its reporting with recognized frameworks such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). This alignment not only enhances credibility but also provides investors with standardized data for evaluation. A 2025 survey indicated that over 70% of institutional investors consider ESG factors material to their investment decisions, underscoring the importance of BBP’s proactive approach.

- Growing ESG Investment: The sustainable investment market is projected to exceed $60 trillion by 2026, indicating a strong demand for ESG-compliant assets.

- Investor Demand for Transparency: Approximately 65% of investors report that clear ESG data influences their capital allocation decisions.

- Regulatory Tailwinds: Many jurisdictions are implementing stricter ESG disclosure requirements, making adherence a necessity rather than an option for companies like BBP.

- Risk Mitigation: Strong ESG performance can mitigate regulatory, reputational, and operational risks, contributing to long-term business resilience.

Physical Climate Risks

Brookfield Business Partners (BBP), like many companies with significant infrastructure and industrial operations, faces increasing physical climate risks. These include the potential for extreme weather events such as hurricanes, floods, and wildfires, which could disrupt operations and damage physical assets. For instance, the increased frequency and intensity of storms in regions where BBP operates could lead to significant repair costs and downtime. Rising sea levels also pose a threat to coastal infrastructure assets, potentially impacting their long-term viability and value.

BBP's commitment to resilience requires rigorous assessment and mitigation of these physical climate risks. This involves understanding the vulnerability of its diverse portfolio, which spans sectors like business services, construction, and energy. Proactive measures, such as investing in climate-resilient infrastructure and developing robust business continuity plans, are essential for safeguarding operations and ensuring long-term asset protection. For example, a 2024 report indicated that global economic losses from natural disasters reached $110 billion in 2023, highlighting the growing financial impact of these events.

- Extreme weather events pose a direct threat to BBP's physical assets and operational continuity.

- Rising sea levels could impact the long-term viability of coastal infrastructure holdings.

- Natural disasters represent a significant source of potential financial and operational disruption for BBP.

- Mitigation strategies are crucial for ensuring the resilience and asset protection of BBP's diverse portfolio.

Global climate policies, like the EU's Fit for 55 package aiming for a 55% emissions reduction by 2030, directly influence BBP's operations. BBP's commitment to net-zero by 2050 is a response to stricter renewable energy mandates and carbon taxes, creating both cost pressures and opportunities in green infrastructure.

Resource scarcity, particularly water, presents a challenge, with over two-thirds of the world's population projected to face shortages by 2025. BBP's focus on sustainable sourcing and efficient resource use mitigates supply chain risks, a critical factor given commodity market volatility in 2024.

Stringent waste management regulations, such as the EU's Circular Economy Action Plan, impact BBP's European operations. Investing in advanced waste reduction technologies can lead to cost savings, with some facilities reporting up to 15% savings by 2024 after implementing such programs.

The physical risks of climate change, including extreme weather and rising sea levels, threaten BBP's infrastructure assets. Global economic losses from natural disasters reached $110 billion in 2023, underscoring the need for BBP to invest in resilience and robust business continuity plans.

PESTLE Analysis Data Sources

Our PESTLE analysis for Brookfield Business Partners is built on a comprehensive review of data from official government publications, leading financial news outlets, and reputable market research firms. This approach ensures a robust understanding of the political, economic, social, technological, environmental, and legal factors influencing the company.