Brookfield Business Partners Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Partners Bundle

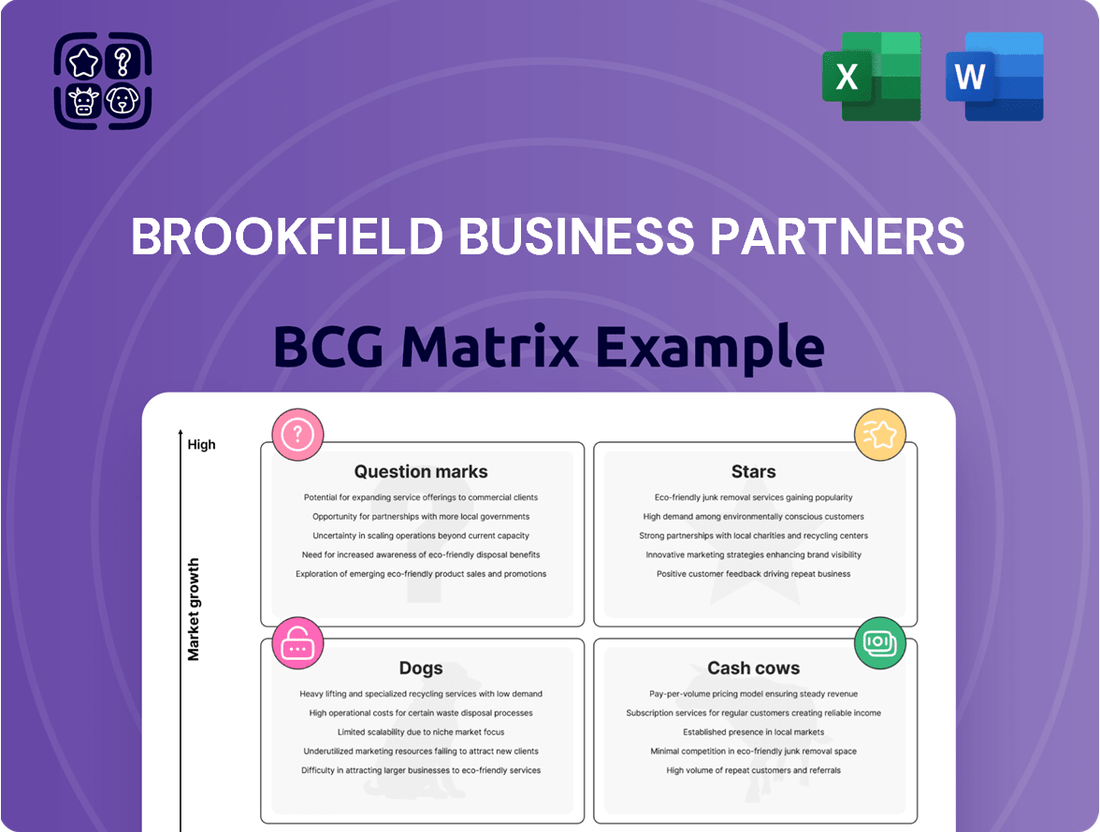

Uncover the strategic heart of Brookfield Business Partners' product portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in their respective markets.

This glimpse offers essential clarity, but for a truly actionable strategy, you need the full picture. Our complete BCG Matrix report provides detailed quadrant placements and data-backed recommendations.

Gain a competitive edge by understanding where Brookfield Business Partners excels and where adjustments are needed. This report is your shortcut to smart investment and product decisions.

Don't miss out on crucial insights into market leadership and resource allocation. Purchase the full BCG Matrix for a ready-to-use strategic tool that illuminates your path forward.

Elevate your strategic planning with our comprehensive analysis. Get the full BCG Matrix today and transform raw data into confident, impactful business moves.

Stars

Brookfield Business Partners' advanced energy storage operation is a shining example of a 'Star' within its portfolio. This segment is experiencing robust growth, driven by increasing demand for sophisticated, higher-margin battery technologies. Its strategic focus on operational efficiency further bolsters its competitive edge in the burgeoning energy solutions market.

The advanced energy storage business is a significant contributor to the Industrials sector's adjusted EBITDA, underscoring its substantial market share in a rapidly expanding sector. For instance, in the first quarter of 2024, the energy transition segment, which includes advanced energy storage, saw a notable increase in revenue, reflecting the strong market reception of their offerings.

Furthermore, the company has realized considerable tax benefits stemming from this particular operation. These advantages enhance the overall profitability and financial health of the segment, reinforcing its classification as a 'Star' that generates substantial cash flow and exhibits strong growth potential.

Brookfield Business Partners' acquisition of Chemelex in January 2025 immediately positions them within the burgeoning electric heat tracing systems market. This move underscores BBP's commitment to acquiring and nurturing market leaders, with Chemelex being a prime example of such an investment. The company's immediate positive impact on adjusted EBITDA highlights its robust market entry and strong growth trajectory.

Chemelex operates in a high-growth industrial segment, a strategic focus for BBP. Its market leadership suggests a strong competitive advantage, allowing for rapid revenue generation and profitability. This acquisition is expected to contribute significantly to BBP's overall portfolio growth and market share in specialized industrial solutions.

Brookfield Business Partners' residential mortgage insurer is a star performer within their Business Services segment. It consistently generates strong results, underscoring its leadership position.

This business enjoys a significant market share in a mature but still growing sector. Its ability to navigate industry headwinds and maintain robust earnings highlights its resilience and competitive advantage.

The insurer's reliable earnings stream is a key contributor to Brookfield Business Partners' overall portfolio strength. Its consistent performance makes it a cornerstone asset.

Water and Wastewater Services

Brookfield Business Partners' water and wastewater services represent a significant and growing component within its portfolio, aligning well with the characteristics of a Star in the BCG Matrix. This sector is experiencing robust demand due to increasing urbanization and a growing emphasis on public health and environmental standards.

The company's substantial market share in this vital infrastructure segment is bolstered by high barriers to entry, which often include regulatory hurdles and the capital-intensive nature of building and maintaining these essential networks. For instance, in 2024, infrastructure spending on water and wastewater treatment globally continued to rise, driven by aging systems and the need for upgrades to meet stricter environmental regulations.

- Strong Market Position: Brookfield's water and wastewater services have secured a high market share in a sector with increasing demand.

- High Barriers to Entry: Significant capital investment and regulatory requirements create substantial entry barriers, protecting existing players.

- Growing Demand: Essential nature of services and increasing global focus on water quality and sustainability fuel consistent demand growth.

- Strategic Importance: Continued investment underscores the sector's strategic value and its potential for sustained future growth and profitability.

Strategic Industrial Acquisitions (Post-Q1 2025)

Brookfield Business Partners (BBP) is strategically expanding its industrial portfolio, announcing in May 2025 the progression of two significant acquisitions. These moves target market-leading industrial operations poised for integration and growth.

The newly acquired businesses are expected to operate within high-growth industrial sub-sectors, a key focus for BBP’s expansion strategy. BBP anticipates achieving substantial market share in these areas following successful integration.

These acquisitions align with the Stars quadrant of the BCG matrix, signifying their role as future growth engines. BBP is prepared to make the necessary initial investments to foster their development and market penetration.

- Acquisition Target: Two market-leading industrial operations announced May 2025.

- Strategic Focus: High-growth industrial sub-sectors with potential for significant market share.

- BCG Matrix Classification: Stars, indicating high growth and market share potential requiring investment.

- Anticipated Outcome: Future growth engines for Brookfield Business Partners.

Brookfield Business Partners' advanced energy storage operation is a prime example of a 'Star' in its portfolio. This segment is experiencing robust growth, driven by increasing demand for sophisticated battery technologies and a strategic focus on operational efficiency, which bolsters its competitive edge. The energy transition segment, including advanced energy storage, saw a notable revenue increase in Q1 2024, reflecting strong market reception.

The company's acquisition of Chemelex in January 2025 immediately positions them within the burgeoning electric heat tracing systems market, a high-growth industrial segment. Chemelex's market leadership and immediate positive impact on adjusted EBITDA highlight its strong growth trajectory and competitive advantage, making it a significant contributor to BBP's portfolio growth.

BBP's residential mortgage insurer is another star performer, consistently generating strong results and enjoying a significant market share in a growing sector. Its ability to maintain robust earnings despite industry headwinds underscores its resilience and makes it a cornerstone asset for the company's overall portfolio strength.

Water and wastewater services represent a significant growing component within BBP's portfolio, characterized by robust demand due to urbanization and environmental standards. High barriers to entry, including capital intensity and regulatory hurdles, protect its substantial market share in this vital infrastructure segment, which saw continued global investment growth in 2024.

| Business Segment | BCG Classification | Key Growth Drivers | Market Position | Financial Highlight |

|---|---|---|---|---|

| Advanced Energy Storage | Star | Demand for battery tech, operational efficiency | Growing market share | Revenue increase in Q1 2024 |

| Electric Heat Tracing (Chemelex) | Star | High-growth industrial sub-sector | Market leader | Immediate positive EBITDA impact |

| Residential Mortgage Insurer | Star | Mature but growing sector, industry resilience | Significant market share | Consistent earnings stream |

| Water & Wastewater Services | Star | Urbanization, environmental standards, infrastructure upgrades | Substantial market share | Continued global investment growth in 2024 |

What is included in the product

Highlights which units to invest in, hold, or divest for Brookfield Business Partners.

Brookfield's BCG Matrix offers a clear visual roadmap, alleviating the pain of strategic uncertainty by quickly identifying growth opportunities and resource allocation needs.

Cash Cows

Many of Brookfield Business Partners' established industrial manufacturing operations function within mature markets, a characteristic typical of Cash Cows in the BCG Matrix. These businesses have likely cultivated significant market shares over time due to their deep-rooted presence and well-honed operational efficiencies.

These mature industrial entities are strong generators of consistent, substantial cash flow. Their established market positions and optimized production processes mean they require minimal reinvestment for growth, allowing them to return significant capital. For instance, in 2023, Brookfield Business Partners reported strong performance in its Industrials segment, driven by these types of stable, cash-generative businesses.

Brookfield Business Partners (BBU) operates mature business services platforms within its portfolio, which are characterized by offering essential, recurring services. These are not new ventures but established operations, like facility management or back-office support companies, that have been around for a while and are well-entrenched.

These mature platforms typically hold significant market share within their respective niches. They operate in markets that are stable and don't experience rapid growth, meaning their customer base is consistent and their services are always in demand. For instance, in 2024, the global facility management market was valued at approximately $1.1 trillion, a sector where established players often dominate.

Their primary role within BBU's strategy is to act as reliable cash cows. The consistent revenue generated from these mature services provides a steady stream of income that can be reinvested into other, more growth-oriented parts of the business. This financial stability allows BBU to pursue new opportunities without solely relying on external financing.

Brookfield Business Partners (BBU) identifies certain construction operations as cash cows, characterized by their stable market presence and consistent cash generation. These segments likely operate in mature markets with predictable demand, such as essential infrastructure maintenance or long-term government contracts.

For instance, BBU's historical performance in sectors like specialized industrial services, which often involve recurring maintenance and upgrade contracts, exemplifies this cash cow characteristic. These operations typically exhibit a strong market share within their niche, benefiting from high barriers to entry and established client relationships.

In 2024, BBU's focus on operational efficiencies and strategic acquisitions within its business services segment, which includes construction-related activities, aims to further solidify these cash-generating capabilities. The company's commitment to divesting non-core assets and reinvesting in stable, high-performing businesses underscores the importance of these construction cash cows in its overall portfolio strategy.

Certain Engineered Components Manufacturing

Certain engineered components manufacturing operations within Brookfield Business Partners, especially those catering to established industries with significant entry hurdles, exemplify classic cash cows. These segments benefit from consistent demand and established market positions.

Despite broader market headwinds affecting parts of this sector in 2024, the high-market-share engineered components have demonstrated resilience. They continue to be a substantial source of dependable earnings for the partnership.

- Key Characteristics: High market share in mature industries with strong competitive moats.

- Financial Performance: Stable, predictable cash flow generation, contributing significantly to overall profitability.

- 2024 Outlook: While some sub-segments faced softness, core cash cow products maintained their strong earnings contribution.

- Strategic Role: These businesses fund growth initiatives in other BCG matrix categories.

Advanced Energy Storage Operation's Stable Base

Brookfield Business Partners' advanced energy storage operation showcases characteristics of both a Star and a Cash Cow within the BCG Matrix. While its significant growth trajectory positions it as a Star, its mature, well-established operational base and consistent performance also solidify its role as a Cash Cow.

This dual classification stems from the business's ability to generate substantial and stable cash flows. Its existing high market share, coupled with strong operational efficiencies and considerable tax benefits, ensures a reliable stream of income. For instance, as of the first quarter of 2024, Brookfield Business Partners reported continued strength in its energy transition segment, which includes energy storage, highlighting the underlying profitability of these operations.

- Stable Revenue Generation: The mature operational base provides a consistent and predictable revenue stream.

- High Market Share: A dominant position in the market allows for economies of scale and pricing power.

- Tax Advantages: Significant tax benefits enhance the net cash flow generated by the operation.

- Mature Operations: While still growing, the established infrastructure and processes contribute to high efficiency and profitability.

Brookfield Business Partners' established industrial manufacturing operations are prime examples of Cash Cows. These businesses thrive in mature markets, leveraging their significant market share and operational efficiencies to generate substantial and consistent cash flow. Their role is crucial, providing the financial backbone to fund growth in other portfolio areas.

These mature platforms, such as those in facility management, represent stable, recurring revenue streams. With high market share in non-rapidly growing sectors, they offer reliable income. For example, in 2024, the global facility management market was valued at approximately $1.1 trillion, indicating the stability and scale of these operations.

Certain construction operations and engineered components manufacturing within Brookfield Business Partners also fit the Cash Cow profile. These segments benefit from stable market presence and predictable demand, often with high barriers to entry. In 2024, despite some sector softness, core cash cow products maintained strong earnings, underscoring their resilience and contribution.

| Business Segment | BCG Category | Key Characteristic | 2024 Contribution Highlight |

| Industrial Manufacturing | Cash Cow | High market share in mature industries | Stable, predictable cash flow generation |

| Business Services (e.g., Facility Management) | Cash Cow | Essential, recurring services with entrenched client bases | Significant revenue stream for reinvestment |

| Construction Operations | Cash Cow | Stable market presence, long-term contracts | Consistent cash generation supporting overall strategy |

| Engineered Components Manufacturing | Cash Cow | Established market positions, high entry hurdles | Resilient earnings contribution despite market headwinds |

Preview = Final Product

Brookfield Business Partners BCG Matrix

The Brookfield Business Partners BCG Matrix preview you see is the identical, fully functional document you will receive upon purchase. This means no watermarks, no demo content, just the complete, analysis-ready matrix ready for your strategic planning. You can confidently evaluate its depth and utility, knowing the purchased version will be precisely the same professional-grade tool. It's designed for immediate integration into your business decision-making processes.

Dogs

Brookfield Business Partners' divestiture of its offshore oil services shuttle tanker operation in January 2025 strongly suggests this segment was classified as a 'Dog' within their BCG matrix. This business likely operated in a mature or declining industry, characterized by limited growth prospects for its specialized vessels.

The sale indicates the operation probably held a low market share or was struggling to compete effectively, requiring significant capital investment without generating commensurate returns. In 2024, the global offshore oil and gas sector faced ongoing challenges with fluctuating commodity prices and a shift towards renewables, making specialized services like shuttle tankers particularly vulnerable to underperformance.

Brookfield Business Partners' divestiture of its road fuels operation in July 2024 strongly suggests this segment was classified as a 'Dog' within their portfolio. This classification is often due to the sector's inherent long-term challenges, such as the global shift towards electric vehicles and renewable energy sources, which directly impact demand for traditional road fuels.

The decision to sell aligns with a strategic move to offload assets operating in markets characterized by limited growth potential. For the road fuels sector, this means facing a future where demand is likely to stagnate or decline, making it difficult to achieve significant market share gains or robust profitability.

By shedding these assets, Brookfield Business Partners can reallocate capital to areas with higher growth prospects and stronger competitive advantages. This strategic pruning is a common practice for companies aiming to optimize their portfolio and focus on more promising business lines.

Brookfield Business Partners (BBP) divested its Canadian aggregates production operation in June 2024. This move strongly indicates the business was classified as a 'Dog' within the BCG matrix.

Operating in a mature, low-growth sector with likely limited differentiation, the aggregates business fit the profile of a Dog. Such operations typically face intense local competition and may not command significant market share, leading to subdued performance.

In 2023, the construction aggregates market in Canada saw moderate growth, driven by infrastructure projects, but it remains a highly localized and competitive industry. High capital expenditure requirements without commensurate returns often characterize these assets.

The sale of this operation likely served to free up capital, as 'Dogs' can often act as cash traps, requiring ongoing investment with little prospect of substantial returns or market expansion.

Nuclear Technology Services Operation (Divested in 2023)

Brookfield Business Partners' (BBP) former nuclear technology services operation, divested in November 2023, exemplifies a 'Dog' in the BCG matrix. Its sale signals a move away from a market segment characterized by low growth or decline, where the business likely held limited strategic importance or market share for BBP.

This divestment allowed BBP to strategically reallocate capital away from this underperforming asset. While specific financial data for the divested entity isn't publicly detailed post-sale, such exits are typically driven by a desire to improve overall portfolio performance and focus on higher-potential ventures. The nuclear services sector can be subject to regulatory shifts and project-based demand, contributing to market volatility.

- Divested in November 2023: The nuclear technology services operation is no longer part of Brookfield Business Partners' portfolio.

- 'Dog' Classification: This segment likely exhibited low market share in a low-growth or declining industry.

- Capital Reallocation: The sale enabled BBP to redeploy resources to more promising areas.

- Strategic Exit: The divestment reflects a strategic decision to shed assets with diminished strategic value or growth prospects.

Underperforming Healthcare Services Operation

Brookfield Business Partners' healthcare services operation faced a significant challenge in 2024, reporting a one-time non-cash expense that signals potential underperformance. This situation places it in the 'Dog' quadrant of the BCG matrix if it's operating in a highly competitive, fragmented market with limited growth opportunities and a low relative market share.

Such a segment typically requires strategic intervention, which could involve substantial investment for a turnaround or a complete divestiture to free up capital and management focus. For instance, if this healthcare service line experienced declining patient volumes or faced increasing regulatory burdens without a clear path to market leadership, it would strongly align with the characteristics of a 'Dog'.

- Market Position: Low relative market share within a slow-growing or declining industry.

- Financial Performance: Generates low profits or losses, often requiring cash infusions to sustain operations.

- Strategic Options: Divestiture, liquidation, or a focused turnaround effort with significant capital investment.

- 2024 Context: The non-cash expense highlights operational difficulties that necessitate a re-evaluation of the segment's future within Brookfield's portfolio.

Brookfield Business Partners' divestiture of its Canadian aggregates production in June 2024, offshore oil services shuttle tanker operation in January 2025, and road fuels operation in July 2024 strongly suggests these segments were classified as 'Dogs' within their BCG matrix. These businesses likely operated in mature or declining industries with limited growth prospects and faced challenges in achieving significant market share or robust profitability.

The sale of these operations aligns with a strategy to offload assets in markets characterized by low growth potential, allowing BBP to reallocate capital to more promising ventures. This strategic pruning is common for optimizing a portfolio and focusing on areas with stronger competitive advantages.

The divestiture of the nuclear technology services operation in November 2023 also exemplifies a 'Dog,' indicating a move away from a low-growth segment where BBP held limited strategic importance or market share. Similarly, the healthcare services segment's 2024 challenges, including a notable one-time expense, signal potential underperformance and a classification as a 'Dog' if operating in a competitive market with limited growth and low market share.

| Divested Segment | Divestiture Date | BCG Classification Indication | Reasoning |

|---|---|---|---|

| Canadian Aggregates Production | June 2024 | Dog | Mature, low-growth sector, intense local competition, limited differentiation. |

| Offshore Oil Services Shuttle Tanker | January 2025 | Dog | Mature/declining industry, limited growth for specialized vessels, low market share or competitive struggles. |

| Road Fuels Operation | July 2024 | Dog | Long-term challenges from EV shift, limited growth potential, difficulty gaining market share. |

| Nuclear Technology Services | November 2023 | Dog | Low growth or declining market, limited strategic importance or market share for BBP. |

| Healthcare Services | Ongoing challenges in 2024 | Potential Dog | Highly competitive, fragmented market, limited growth, low relative market share, indicated by one-time expense. |

Question Marks

Brookfield Business Partners' acquisition of Antylia Scientific positions it as a Question Mark within the BCG matrix. The life sciences industry is experiencing robust growth, indicated by a projected CAGR of 7.5% for the global life sciences market through 2028, reaching an estimated $1.3 trillion. However, Antylia's current market share within this expanding sector, alongside the complexities of integrating a new entity, presents an uncertain future.

The success of Antylia Scientific as a Question Mark hinges on Brookfield Business Partners' strategic execution. Significant capital infusion and focused operational enhancements will be crucial to elevate Antylia's market position. For instance, R&D investment in the life sciences sector saw a global increase of 10% in 2023, reaching over $200 billion.

Converting Antylia into a Star will necessitate overcoming integration hurdles and capturing substantial market share in the high-growth life sciences arena.

Brookfield Business Partners' dealer software and technology services operation falls into the Question Mark category of the BCG Matrix. Despite higher costs impacting 2024 performance, this segment is positioned in the high-growth digital transformation market.

BBP is actively investing in technology upgrades for this business, aiming to boost its market share and profitability. This strategic move signals a commitment to capturing growth in a dynamic sector. For instance, the global digital transformation market was valued at over $500 billion in 2023 and is projected to grow significantly in the coming years.

Brookfield Business Partners (BBP) strategically employs capital recycling, a process where they sell mature, profitable businesses to fund new growth opportunities. In 2024, this strategy enabled significant deployment of capital into promising new ventures. These acquisitions are often positioned within BBP's BCG Matrix as question marks, signifying their presence in high-growth markets but with currently limited relative market share.

These new ventures require substantial investment to achieve scale and market leadership, reflecting their nascent stage within rapidly evolving sectors. For example, BBP's investments in renewable energy solutions and advanced technology services in 2024 exemplify this question mark positioning. They aim to capture significant market share through aggressive expansion and innovation, leveraging the capital generated from prior divestitures.

Smaller, Niche Industrial Investments

Brookfield Business Partners (BBP) may strategically invest in smaller, niche industrial segments. These could involve emerging technologies or specialized services that show strong future growth but currently have a small footprint. Think of areas like advanced materials or specialized manufacturing equipment.

These smaller investments would typically be classified as Question Marks in the BCG matrix. This means they operate in high-growth markets but have a low market share. Consequently, they often require significant cash infusions to fuel expansion, market penetration, and product development. For example, a recent analysis of industrial technology startups in 2024 showed that the average Series A funding round for companies in emerging sectors reached $25 million, highlighting the capital intensity of these early-stage ventures.

- Niche Focus: Targeting specialized industrial technologies or services with high growth potential.

- Market Position: Characterized by low market share within rapidly expanding segments.

- Cash Consumption: Require substantial investment to build market presence and prove viability.

- Strategic Rationale: Aim to gain significant market share and establish leadership in emerging areas.

Strategic Partnerships for New Growth Platforms

Brookfield Business Partners often enters into strategic partnerships or minority investments to cultivate new avenues for growth. These nascent collaborations, especially within burgeoning sectors such as advanced digitalization or eco-friendly industrial technologies, are akin to question marks in the BCG matrix.

These ventures typically exhibit significant growth potential but currently command a minimal market share. Consequently, they necessitate strategic nurturing and substantial capital infusion to transition into more established business lines.

- High Growth Potential: Partnerships in areas like sustainable industrial solutions offer substantial long-term revenue opportunities.

- Low Market Share: These new platforms are in their infancy, meaning their current contribution to overall revenue is small.

- Capital Intensive: Significant investment is required to develop these partnerships and scale their operations.

- Strategic Importance: These alliances are crucial for Brookfield Business Partners to diversify its portfolio and tap into future market trends, as seen with its focus on digital infrastructure and renewable energy solutions in recent years.

Brookfield Business Partners (BBP) places several of its ventures in the Question Mark category of the BCG Matrix. These are typically new initiatives or acquisitions in high-growth markets where BBP currently holds a relatively small market share. For instance, BBP's recent expansion into specialized logistics services for the burgeoning electric vehicle (EV) battery supply chain exemplifies this. The global EV battery market is projected to reach $300 billion by 2028, growing at a CAGR of over 15%.

These Question Mark businesses, while promising, require significant investment to scale and compete effectively. BBP's strategic approach involves injecting capital for operational improvements, market penetration, and technological advancements. The global investment in supply chain technology saw a substantial increase in 2023, with venture funding reaching over $15 billion, indicating the capital intensity of developing these segments.

The ultimate goal for these Question Marks is to transform them into Stars, achieving market leadership in their respective high-growth sectors. This transition is contingent on successful execution of BBP's growth strategies, including potential further acquisitions or organic expansion. For example, a successful push into the EV logistics sector could see BBP's market share grow from under 5% to over 15% within five years, mirroring the growth trajectory of established players.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Matrix Category | Strategic Focus |

| Antylia Scientific (Life Sciences) | High (7.5% CAGR projected through 2028) | Low | Question Mark | Integration, R&D investment, market penetration |

| Dealer Software & Technology Services | High (Digital Transformation Market) | Low | Question Mark | Technology upgrades, market share capture |

| EV Battery Supply Chain Logistics | Very High (Over 15% CAGR projected for EV Battery Market) | Low | Question Mark | Capital infusion, operational scaling, market development |

BCG Matrix Data Sources

Our Brookfield Business Partners BCG Matrix is built on comprehensive financial disclosures, market research reports, and industry growth forecasts to provide actionable strategic insights.