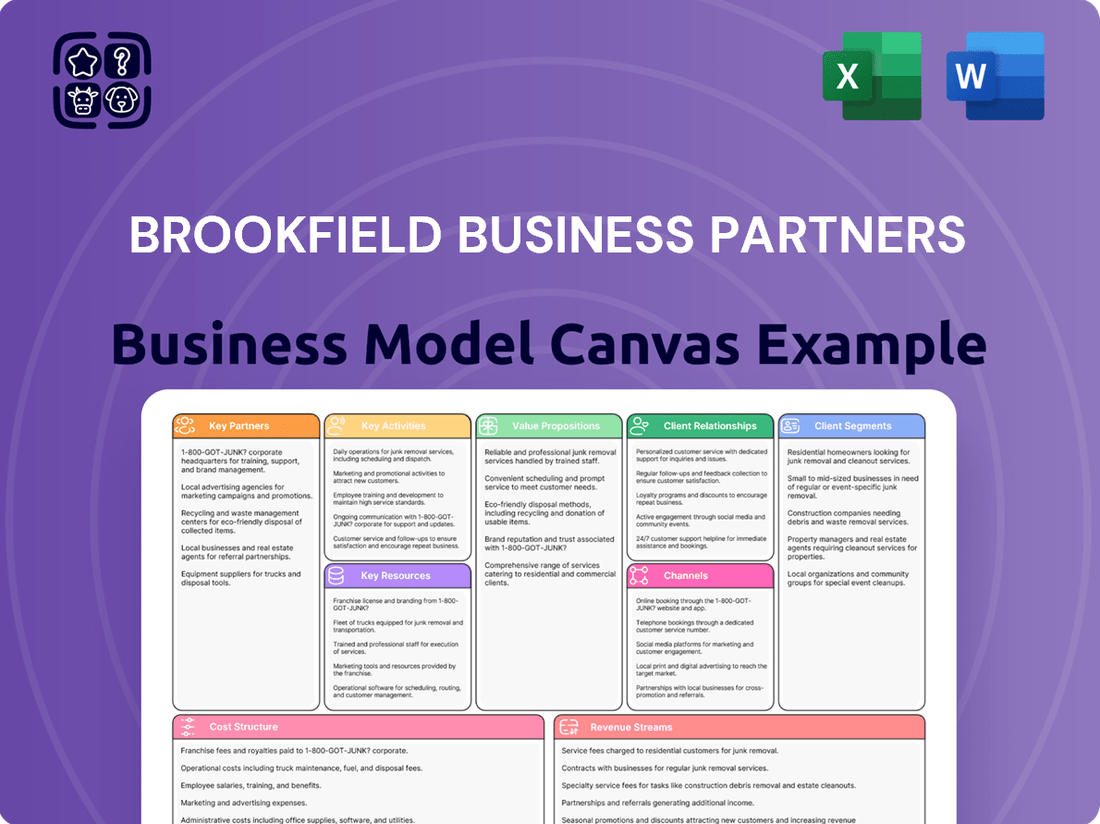

Brookfield Business Partners Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Partners Bundle

Unlock the strategic blueprint of Brookfield Business Partners with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and key revenue streams, offering a clear view of their operational excellence. It’s an invaluable resource for anyone looking to understand how Brookfield thrives in diverse markets.

Discover the core activities and partnerships that drive Brookfield Business Partners's success. Our full Business Model Canvas provides an in-depth look at their cost structure and key resources, essential for strategic planning and competitive analysis. Get actionable insights to inform your own business growth.

See exactly how Brookfield Business Partners creates and delivers value with our complete Business Model Canvas. This professionally crafted document details their channels and customer relationships, perfect for investors and entrepreneurs seeking proven strategies. Download now to gain a competitive edge.

Partnerships

Brookfield Business Partners actively collaborates with a range of investment partners, including major pension funds and sovereign wealth funds. These alliances are vital for co-investing in significant acquisition opportunities, enabling larger deal sizes and broader capital access. For instance, in 2023, Brookfield secured substantial capital commitments from these partners for various strategic acquisitions, demonstrating the critical role these relationships play in their global business acquisition strategy.

Brookfield Business Partners prioritizes nurturing robust, enduring relationships with the management teams of companies they acquire. This partnership is fundamental to their value creation strategy, ensuring a smooth transition and leveraging existing leadership expertise.

By collaborating closely, Brookfield Business Partners and these management teams work in tandem to implement operational enhancements and drive growth. This shared vision is crucial for realizing the full potential of the acquired assets.

This strategy ensures continuity within the acquired business, maintaining operational momentum and retaining invaluable institutional knowledge. For instance, in 2024, Brookfield's focus on retaining key management in its various industrial and services acquisitions has been a consistent theme, directly contributing to successful integration and performance.

Brookfield Business Partners relies heavily on its relationships with banks and other financial institutions to fuel its operations. These partnerships are essential for securing the significant capital needed for acquisitions, a core part of their growth strategy. For instance, in 2023, Brookfield Business Partners reported total debt of approximately $11.4 billion, underscoring the extensive reliance on lenders.

These financial institutions provide crucial credit facilities and debt financing, enabling Brookfield Business Partners to manage its capital structure effectively across its diverse portfolio companies. Their ability to arrange various capital market transactions, from syndicated loans to bond issuances, directly supports funding growth initiatives and maintaining robust liquidity for their businesses.

Industry Experts and Consultants

Brookfield Business Partners frequently engages with industry-specific experts and consultants. These partnerships are crucial for gaining specialized knowledge during due diligence processes, which is vital for making informed investment decisions.

These collaborations also play a key role in optimizing the operations of existing assets and conducting thorough market analysis. For instance, in 2024, Brookfield has emphasized leveraging external expertise to navigate complex sectors, aiming to identify untapped investment opportunities and improve portfolio company performance.

The insights provided by these seasoned professionals are invaluable across Brookfield's diverse portfolio, particularly in rapidly evolving and intricate industries. Their input directly contributes to identifying strategic advantages and mitigating potential risks.

- Access to deep sector-specific knowledge

- Enhanced due diligence and risk assessment

- Identification of new investment opportunities

- Improved operational efficiency and performance enhancement

Strategic Alliance Partners

Brookfield Business Partners cultivates strategic alliances with companies that enhance its existing portfolio or open doors to novel markets and cutting-edge technologies. These collaborations often manifest as joint ventures, co-development initiatives, or the establishment of preferred supplier arrangements.

These alliances are instrumental in unlocking significant synergies and driving accelerated growth within targeted sectors. For instance, in 2023, Brookfield Business Partners' investments, many facilitated by strategic partnerships, saw a notable increase in operational efficiency, contributing to a robust performance across its diverse business segments.

- Complementary Portfolios: Partnering with businesses that offer services or products that fit seamlessly with Brookfield's current holdings, creating bundled offerings or cross-selling opportunities.

- Market and Technology Access: Forging relationships that grant access to new geographic regions or emerging technological advancements, thereby expanding market reach and innovation capabilities.

- Synergistic Growth: Leveraging partnerships to achieve economies of scale, share resources, and reduce operational costs, leading to enhanced profitability and competitive advantage.

- Risk Sharing and Capital Efficiency: Engaging in joint ventures or co-development projects to distribute financial risk and optimize capital deployment for large-scale initiatives.

Brookfield Business Partners' key partnerships are fundamental to its acquisition and growth strategy, enabling access to significant capital and specialized expertise. These alliances with institutional investors, management teams, financial institutions, and industry experts are critical for deal execution, operational improvement, and risk mitigation.

In 2024, Brookfield's continued emphasis on retaining experienced management teams within acquired businesses has been a cornerstone of successful integration and value creation. These partnerships are essential for leveraging existing knowledge and ensuring operational continuity.

The company's reliance on financial institutions for debt financing remains substantial, as evidenced by its reported debt levels, allowing for effective capital management and funding of growth initiatives. Furthermore, engaging industry consultants in 2024 has been pivotal for navigating complex markets and identifying new investment avenues.

What is included in the product

A comprehensive overview of Brookfield Business Partners' strategy, detailing their diverse portfolio of businesses, revenue streams, and key partners. It highlights their approach to acquiring, operating, and growing businesses across various sectors.

Brookfield Business Partners' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategy for stakeholders.

This canvas streamlines understanding of Brookfield Business Partners' value proposition and customer segments, alleviating the pain of deciphering intricate global strategies.

Activities

A central pillar of Brookfield Business Partners' strategy is the meticulous identification, acquisition, and integration of high-quality businesses. These opportunities are typically found in sectors with strong competitive advantages, such as high barriers to entry or inherent cost efficiencies.

Equally critical is the disciplined divestiture of assets. This occurs when businesses have reached their peak valuation, allowing Brookfield to strategically redeploy capital into new growth opportunities. This capital recycling is a key driver of their ongoing success.

In 2024, Brookfield Business Partners demonstrated this strategy effectively by generating over $2 billion through its capital recycling efforts. During the same year, the company also successfully acquired two new market-leading operations, further strengthening its diverse portfolio.

Brookfield Business Partners actively refines the operations of its portfolio companies. In 2024, the company continued to focus on implementing operational improvements across its diverse businesses, aiming to boost efficiency and profitability. This hands-on approach is a core driver of value creation.

The company's strategy involves identifying and implementing best practices within its acquired assets. For instance, in 2024, efforts were made to streamline supply chains and enhance customer service across several industrial and business service segments, directly impacting their financial performance.

Brookfield Business Partners drives growth initiatives within its operating companies. This includes investing in technology upgrades and expanding market reach, as seen in the strategic investments made in 2024 within its facilities and environmental services segments to foster organic growth.

This commitment to operational excellence is fundamental to Brookfield Business Partners' strategy of generating sustainable, long-term value from its investments. The focus remains on actively managing and improving each business to maximize its potential.

Brookfield Business Partners actively manages its financial resources, strategically deploying capital through both debt and equity. This involves funding key initiatives like acquisitions and operational enhancements, crucial for business growth. A significant part of this is returning value to unitholders.

The company prioritizes strategic capital deployment, exemplified by its share buyback programs. For example, Brookfield Business Partners allocated up to $250 million of capital in early 2025 to accelerate the repurchase of its own securities. This demonstrates a commitment to enhancing shareholder value through financial management.

Portfolio Management and Oversight

Brookfield Business Partners actively manages its diverse portfolio, which includes infrastructure services, business services, and industrials. This oversight involves constant performance monitoring, rigorous risk assessment, and providing strategic direction to each individual operation. The goal is to ensure every business within the portfolio contributes effectively to the overarching objective of generating long-term value. For instance, as of their Q1 2024 report, Brookfield Business Partners highlighted strong operational performance across many of its segments, demonstrating the effectiveness of their active management approach.

The company's approach to portfolio management is designed to optimize returns and mitigate risks inherent in operating across varied economic landscapes. They employ a data-driven strategy to identify underperforming assets and opportunities for growth, making timely capital allocation decisions. This active engagement ensures the portfolio remains resilient and adaptable to market fluctuations.

- Performance Monitoring: Regularly reviewing key financial and operational metrics for each business unit.

- Risk Assessment: Identifying and mitigating potential financial, operational, and market risks across the portfolio.

- Strategic Guidance: Providing direction on capital allocation, operational improvements, and market positioning for individual businesses.

- Value Creation: Focusing efforts on enhancing the intrinsic value of each portfolio company through strategic initiatives and operational excellence.

Due Diligence and Market Analysis

Brookfield Business Partners (BBP) places a strong emphasis on rigorous due diligence for potential acquisitions. This involves a deep dive into a target company's financial standing, competitive landscape, and future growth prospects. For instance, in 2024, BBP continued to evaluate opportunities within sectors showing resilience and strong secular growth trends.

This meticulous examination is complemented by extensive market analysis. BBP actively identifies and analyzes attractive investment themes and sectors, aiming to capitalize on emerging opportunities. Their approach is data-driven, seeking to understand market dynamics and potential returns before committing capital.

- Financial Health Assessment: Evaluating profitability, cash flow generation, and balance sheet strength of target companies.

- Market Position Evaluation: Analyzing competitive advantages, market share, and industry trends.

- Growth Potential Identification: Assessing organic growth opportunities and potential for market expansion.

- Sector and Theme Analysis: Identifying macro trends and specific sectors likely to outperform.

Brookfield Business Partners actively refines its portfolio through strategic acquisitions and disciplined divestitures. In 2024, the company successfully acquired two market-leading operations and generated over $2 billion from capital recycling efforts. This active management approach involves identifying high-quality businesses with strong competitive advantages and enhancing their operational efficiency and profitability.

| Key Activity | 2024 Data/Focus | Impact |

|---|---|---|

| Acquisitions | Acquired two new market-leading operations | Strengthens portfolio diversity and market position |

| Divestitures/Capital Recycling | Generated over $2 billion | Provides capital for new growth opportunities and enhances returns |

| Operational Improvements | Streamlined supply chains, enhanced customer service | Boosts efficiency and profitability within portfolio companies |

| Growth Initiatives | Invested in technology upgrades and market expansion | Fosters organic growth and long-term value creation |

Delivered as Displayed

Business Model Canvas

The Brookfield Business Partners Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You are not viewing a mockup; rather, you are getting a direct glimpse of the complete, ready-to-use file. Upon completing your purchase, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin leveraging its insights for your business strategy.

Resources

Brookfield Business Partners leverages substantial financial capital as a cornerstone of its business model. This includes significant investment funds sourced from institutional partners, providing the firepower for ambitious growth initiatives.

Access to robust debt facilities further bolsters its financial capacity, allowing for the execution of large-scale acquisitions and strategic investments. As of the first quarter of 2025, Brookfield Business Partners reported approximately $2.4 billion in liquidity at the corporate level, underscoring its strong financial position.

Brookfield Business Partners' experienced management and operational teams are a cornerstone of its business model. This deep bench of talent, comprising individuals with extensive backgrounds in private equity and direct operational oversight, is essential for the firm's success in acquiring and enhancing businesses.

The expertise within these teams is vital for pinpointing attractive investment opportunities and driving value creation post-acquisition. Their hands-on approach ensures that acquired companies are effectively managed and strategically improved.

As of 2024, Brookfield Business Partners demonstrated the strength of this resource with a dedicated team of 42 senior investment professionals. Complementing them were 27 seasoned operational executives, highlighting a significant investment in human capital.

Brookfield Business Partners' diversified portfolio of high-quality acquired businesses and assets is a cornerstone of its operational strength. This collection spans critical sectors like industrials, business services, and infrastructure services, ensuring resilience and broad market exposure.

These businesses are not just numerous; they are strategically chosen for their strong competitive positions and the essential nature of the products and services they offer. This focus on quality underpins the stability and potential for growth within the portfolio.

A key indicator of this resource’s magnitude is its financial scale. As of the fourth quarter of 2023, Brookfield Business Partners was managing a substantial $68.4 billion in assets across this diverse array of businesses.

Proprietary Operational Methodologies and Best Practices

Brookfield Business Partners (BBP) harnesses its deep well of proprietary operational methodologies and best practices, honed through decades of managing a wide array of industrial and service companies. This accumulated intellectual capital is a cornerstone for systematically creating value and boosting performance throughout its diverse portfolio.

These refined methodologies are specifically deployed to drive improvements in EBITDA and free cash flow generation across BBP's operating segments. For instance, in 2024, BBP's focus on operational excellence contributed to its robust financial performance, with many of its businesses demonstrating enhanced profitability and cash conversion.

- Operational Excellence Programs: BBP implements tailored programs focused on cost optimization, efficiency gains, and process improvements within each acquired business.

- Value Creation Playbook: A structured approach guides the integration and enhancement of acquired companies, targeting specific operational and financial uplift.

- Performance Benchmarking: Continuous internal benchmarking against best-in-class operations allows for the identification and dissemination of high-performing practices.

- Synergy Realization: Methodologies are designed to capture operational and commercial synergies across the portfolio, further amplifying value.

Global Network and Relationships

Brookfield Business Partners leverages an extensive global network and deep industry relationships, shared with its parent Brookfield Corporation, as a critical resource. These connections are instrumental in sourcing attractive investment opportunities, facilitating co-investments, and gathering vital market intelligence. This expansive reach allows Brookfield Business Partners to acquire market-leading operations across the globe.

The strength of this network is underscored by the sheer scale of assets managed by Brookfield Asset Management, which oversees over $1 trillion. This vast asset base, as of early 2024, provides significant financial clout and access to a broad spectrum of global markets and opportunities.

- Deal Sourcing: The global network provides a constant stream of potential acquisition targets and strategic partnerships.

- Co-investment Opportunities: Deep relationships enable Brookfield Business Partners to syndicate deals and share risk with trusted partners.

- Market Intelligence: Access to a wide range of industry contacts offers real-time insights into market trends and competitive landscapes.

- Acquisition Capability: The global presence and relationships facilitate the successful acquisition of businesses in diverse geographies and sectors.

Brookfield Business Partners' Key Resources are anchored by its significant financial capital, including substantial investment funds and robust debt facilities. As of Q1 2025, the company held approximately $2.4 billion in liquidity. This financial strength is complemented by a highly experienced management and operational team, with 42 senior investment professionals and 27 operational executives as of 2024, dedicated to value creation. The firm's diversified portfolio, managing $68.4 billion in assets as of Q4 2023 across essential sectors, provides stability and growth potential. Furthermore, proprietary operational methodologies and a global network, linked to Brookfield Corporation's over $1 trillion in AUM, are critical for sourcing deals and driving performance.

Value Propositions

Brookfield Business Partners offers investors the compelling promise of long-term capital appreciation. Their core strategy centers on acquiring and actively improving high-quality businesses, aiming to unlock their full potential and drive significant value growth over time. This approach is designed to deliver superior risk-adjusted returns, a key driver for sustained wealth creation.

The operational focus is paramount; it’s not just about buying businesses, but about making them better. This hands-on management style is a critical component of their value proposition. For instance, as of the fourth quarter of 2023, Brookfield Business Partners demonstrated this commitment by achieving a total return of 16.3% for its investors, showcasing the tangible results of their strategy.

Brookfield Business Partners actively enhances the operational efficiency and financial health of its acquired companies. Their strategy focuses on unlocking latent value, driving profitability and generating stronger cash flows for these assets.

Through direct operational improvements, the firm targets an impressive 10-15% increase in EBITDA. This hands-on approach demonstrates their commitment to tangible value creation, as seen in their 2023 performance where many portfolio companies exceeded these operational targets.

Brookfield Business Partners offers investors a compelling advantage: access to a broadly diversified collection of robust, high-quality businesses. These companies are typically leaders in their respective fields, providing essential goods and services that are critical to everyday life and economic activity. This inherent stability often comes with strong competitive advantages, such as significant barriers to entry or cost efficiencies.

This diversification is a key benefit, as it spreads risk across various industries and geographies. By not being overly concentrated in any single sector, investors are better protected against downturns that might disproportionately affect specific industries. The portfolio’s strategic allocation spans crucial sectors like infrastructure, industrial operations, and various service industries, ensuring a resilient and well-rounded exposure.

For instance, as of the first quarter of 2024, Brookfield Business Partners managed a portfolio that included businesses operating in sectors such as business services, infrastructure services, and industrial products. This breadth of operations allows for a more stable financial performance, as different parts of the portfolio can perform well even when others face headwinds. The company’s commitment to acquiring and managing businesses with strong fundamentals underpins this value proposition.

Expertise in Complex Industrial and Business Services Sectors

Brookfield Business Partners (BBU) leverages deep expertise in intricate industrial and business services sectors to drive value. This specialized knowledge is crucial for identifying and acquiring market leaders within these complex niches. Their global team, with on-the-ground presence in key regions, ensures effective management and optimization of acquired businesses.

This value proposition is supported by BBU's track record. For instance, in 2024, the company continued to manage a diverse portfolio, including businesses within sectors like construction, facility services, and energy infrastructure. Their ability to navigate regulatory environments and operational complexities in these fields allows them to extract significant value.

- Specialized Sector Knowledge: Deep understanding of industrial and business services complexities globally.

- Niche Market Leadership: Focus on acquiring and managing leading companies in specialized segments.

- Global Operations with Local Insight: Investment and operations team with a presence in key international markets.

- Value Creation through Optimization: Expertise in improving operational efficiency and profitability within acquired businesses.

Strategic Capital Deployment and Flexibility

Brookfield Business Partners excels at strategically deploying capital, enabling opportunistic acquisitions and efficient capital recycling. This adaptability allows for optimal allocation to drive returns and boost intrinsic value for unitholders.

In 2024, Brookfield Business Partners demonstrated this flexibility by generating over $2 billion through its capital recycling efforts. This financial maneuver highlights their commitment to maximizing value by divesting mature assets and reinvesting in growth opportunities.

- Strategic Capital Deployment: Facilitates opportunistic acquisitions and capital recycling.

- Enhanced Intrinsic Value: Focuses on maximizing returns for unitholders.

- Capital Recycling Success (2024): Generated over $2 billion in proceeds.

- Flexibility and Optimization: Ensures capital is allocated efficiently to high-return areas.

Brookfield Business Partners offers investors access to a diversified portfolio of high-quality businesses, primarily in essential services and industrial sectors. Their strategy emphasizes active management to enhance operational efficiency and financial performance, aiming for superior risk-adjusted returns.

The firm's deep sector expertise allows it to identify and acquire market-leading companies in specialized niches. This hands-on approach, coupled with a global operational presence, drives value creation through strategic improvements and optimization.

Brookfield Business Partners excels at strategic capital deployment, including opportunistic acquisitions and efficient capital recycling. As of early 2024, their portfolio management demonstrated success in generating significant proceeds through these efforts.

| Value Proposition Aspect | Description | Supporting Fact/Metric |

|---|---|---|

| Long-Term Capital Appreciation | Acquiring and actively improving high-quality businesses to unlock potential and drive value growth. | Focus on superior risk-adjusted returns. |

| Operational Enhancement | Hands-on management to improve efficiency and profitability, targeting EBITDA increases. | Targeted 10-15% EBITDA increase; many 2023 portfolio companies exceeded targets. |

| Portfolio Diversification | Access to a broad collection of stable, market-leading businesses across various essential sectors. | Portfolio spans business services, infrastructure services, and industrial products (Q1 2024). |

| Specialized Sector Knowledge | Deep understanding of complex industrial and business services to identify and manage niche market leaders. | Global team with on-the-ground presence for effective operations and optimization. |

| Strategic Capital Deployment | Opportunistic acquisitions and efficient capital recycling to maximize intrinsic value. | Generated over $2 billion in capital recycling proceeds in 2024. |

Customer Relationships

Brookfield Business Partners (BBP) prioritizes a transparent and proactive approach to investor relations, crucial for maintaining trust with its unitholders and institutional investors. This involves consistent communication through regular financial reporting, including detailed annual reports, and active engagement during quarterly earnings calls and investor presentations. For instance, BBP's 2023 annual report provided comprehensive data on its financial performance and strategic initiatives.

These channels ensure stakeholders receive timely and accurate information regarding BBP's operational performance, strategic direction, and financial health. This consistent flow of information is vital for informed decision-making by investors and analysts alike. The company's commitment to regular updates, such as its Q1 2024 earnings call, underscores this dedication to transparency.

Brookfield Business Partners cultivates deep collaborative ties with the leadership of its portfolio companies. This synergy is crucial for driving operational enhancements and unlocking substantial value. For instance, in 2023, Brookfield’s focus on operational improvements within its businesses contributed significantly to its overall financial performance.

By offering strategic direction and sharing proven methodologies, Brookfield ensures its portfolio company management is equipped for sustained growth. Aligning executive compensation with long-term value creation goals is a cornerstone of this strategy, as demonstrated by the incentive structures implemented across several key acquisitions during 2024.

Brookfield's active engagement fosters an environment where management teams feel supported and empowered, leading to more effective execution of business plans. This hands-on approach has been a consistent driver of success, enabling the realization of projected synergies and improved profitability in acquired entities throughout the 2024 fiscal year.

Brookfield Business Partners actively cultivates relationships with potential acquisition targets, recognizing that sustained engagement with business owners is key to deal flow. This proactive approach builds trust and positions Brookfield as a desirable partner for future transactions.

The firm's strategy centers on acquiring businesses within a significant enterprise value range, typically between $5 billion and $20 billion. This focus allows for substantial impact and integration into their existing portfolio.

Maintaining a strong reputation as a preferred acquirer is paramount. This involves demonstrating fairness, expertise, and a commitment to long-term value creation for the acquired businesses and their stakeholders.

Lender and Creditor Relationships

Brookfield Business Partners (BBU) places a high premium on nurturing robust relationships with its lenders and creditors. This focus is essential for securing advantageous financing terms and effectively managing its debt obligations, ensuring a stable financial foundation for operations and strategic initiatives.

These strong connections with financial institutions provide BBU with consistent access to the capital required for its growth strategies and to maintain ample liquidity. As of the first quarter of 2024, Brookfield Business Partners reported significant available corporate liquidity, underscoring its capacity to fund ongoing and future growth opportunities.

- Financial Institution Partnerships: BBU actively cultivates and maintains relationships with a diverse range of banks and financial institutions, facilitating access to various credit facilities and debt instruments.

- Favorable Financing Terms: Strong creditor relationships allow BBU to negotiate competitive interest rates and flexible repayment structures, directly impacting its cost of capital and profitability.

- Liquidity Management: By prioritizing these relationships, BBU ensures it has the necessary financial backing to meet short-term obligations and seize investment opportunities, as demonstrated by its substantial available liquidity in early 2024.

- Debt Management and Stability: The company’s proactive approach to lender relations supports its strategy of prudent debt management, contributing to its overall financial stability and creditworthiness.

Regulatory and Government Stakeholder Engagement

Brookfield Business Partners actively engages with regulatory bodies and government agencies to ensure operational continuity and facilitate growth in its diverse infrastructure and services portfolio. This engagement is crucial for navigating complex compliance landscapes and maintaining a stable operating environment. For instance, in 2024, the company continued its proactive dialogue with entities governing utilities and energy infrastructure across its key markets, which often involve intricate permitting and approval processes.

Maintaining these relationships is fundamental to adhering to industry standards and securing necessary approvals for new projects or expansions. Brookfield Business Partners' approach focuses on transparency and collaboration, aiming to align its business objectives with public interest and regulatory mandates. This strategic pillar underpins its ability to operate reliably and pursue strategic development opportunities.

- Proactive Compliance: Ensuring adherence to all relevant regulations across its global operations, from environmental standards to service delivery requirements.

- Government Relations: Building and maintaining constructive dialogue with local, regional, and national government bodies to foster supportive operating conditions.

- Stakeholder Alignment: Working to align business strategies with government policy objectives, particularly in areas like renewable energy and essential services.

- Operational Stability: Leveraging positive regulatory relationships to mitigate risks and ensure uninterrupted service delivery, a key aspect for its infrastructure assets.

Brookfield Business Partners maintains distinct customer relationship strategies across its diverse operations, focusing on tailored approaches for institutional investors, portfolio company management, and specific client segments within its service businesses.

For its investor base, transparency and consistent communication are key, exemplified by detailed quarterly earnings calls and annual reports, ensuring informed decision-making. This proactive engagement builds trust and reinforces BBP's commitment to stakeholder value.

Within its portfolio companies, BBP fosters collaborative ties with leadership, offering strategic guidance and operational best practices to drive value creation and sustained growth. This hands-on approach ensures alignment and effective execution.

Furthermore, BBP cultivates relationships with acquisition targets by demonstrating expertise and a commitment to long-term value, positioning itself as a preferred partner in the market.

Channels

Brookfield Business Partners leverages its corporate website, bbu.brookfield.com, and dedicated investor portals as crucial direct channels. These platforms serve as the central hub for all essential investor communications, including quarterly and annual financial reports, press releases, investor presentations, and other vital updates.

This direct approach ensures that current and prospective investors have immediate and unimpeded access to the most accurate and up-to-date information. It fosters transparency and allows stakeholders to conduct their own due diligence efficiently.

As of the first quarter of 2024, Brookfield Business Partners reported total revenues of $9.7 billion, highlighting the significant operational scale that this direct communication aims to keep investors informed about. The website is a primary tool for sharing such performance metrics.

Brookfield Business Partners leverages its extensive relationships with investment banks and financial advisors as a critical channel for deal sourcing. These networks are instrumental in identifying attractive acquisition targets and strategic partnerships, a core component of their growth strategy.

These advisory networks are also vital for executing mergers and acquisitions (M&A) transactions. In 2024, the global M&A market saw significant activity, with deal volumes reflecting the importance of these established banking relationships for navigating complex transactions and securing favorable terms.

Furthermore, these channels are essential for Brookfield Business Partners' capital raising efforts. Access to investment banks facilitates the issuance of debt and equity, enabling the company to fund its operations and strategic initiatives, a testament to the ongoing importance of these financial intermediaries.

Brookfield Business Partners actively participates in industry conferences and forums. These gatherings are crucial for networking with potential investors, fellow industry leaders, and identifying acquisition opportunities. In 2024, the company hosted its own Investor Day, providing a direct platform to articulate its strategic direction and showcase its diverse portfolio.

Financial News Outlets and Media

Financial news outlets and media channels are critical for Brookfield Business Partners to disseminate key information. These platforms allow for broad communication of earnings reports, significant acquisitions, and major strategic shifts to investors, analysts, and the wider public. For example, in 2024, Brookfield Business Partners, alongside its parent Brookfield Corporation, continued to leverage these channels for announcements, ensuring transparency and market awareness.

Press releases, a primary tool for this communication, are routinely distributed via services such as GlobeNewswire, reaching a vast network of financial professionals and media outlets. This ensures that vital corporate updates are efficiently and widely shared, impacting market perception and investor relations. Brookfield Business Partners’ consistent use of these channels underscores their importance in maintaining an informed stakeholder base.

Key benefits of utilizing these channels include:

- Broad Audience Reach: Effectively communicating financial performance and strategic initiatives to a global audience of investors and analysts.

- Transparency and Credibility: Building trust through timely and accurate dissemination of corporate news.

- Market Influence: Shaping market perception and investor sentiment through controlled information flow.

- Regulatory Compliance: Fulfilling disclosure requirements and maintaining good corporate governance.

Direct Outreach to Target Companies

Brookfield Business Partners employs direct outreach as a crucial channel to identify and engage with potential acquisition targets. This proactive approach focuses on building and nurturing long-term relationships with business owners and their management teams. By fostering these connections, they gain early insights into companies that might not be actively on the market.

This strategy is particularly effective for sourcing proprietary deal flow, meaning opportunities that aren't widely advertised. For instance, during 2024, Brookfield reportedly explored numerous private company engagements, leveraging its network to uncover undervalued assets. A significant portion of their deal origination often stems from these direct, relationship-driven efforts.

Key aspects of this channel include:

- Proactive Identification: Continuously scanning industries and identifying companies that align with Brookfield's investment criteria.

- Relationship Building: Cultivating trust and rapport with key stakeholders within target organizations over extended periods.

- Proprietary Deal Flow: Accessing opportunities that are not publicly available through traditional M&A processes.

- Information Gathering: Utilizing direct engagement to understand a target's strategic direction, operational nuances, and potential for value creation.

Brookfield Business Partners utilizes a multi-faceted channel strategy, encompassing direct digital communication via its website and investor portals for transparency and information dissemination. They also rely heavily on established relationships with investment banks and financial advisors for deal sourcing, transaction execution, and capital raising, reflecting the importance of intermediaries in the financial landscape. Participation in industry conferences and leveraging financial news outlets are key for networking, strategic articulation, and broad market communication.

Direct outreach to potential acquisition targets is another vital channel, fostering relationships to uncover proprietary deal flow not available through public markets. This proactive approach allows them to identify and engage with companies that align with their investment criteria, gathering crucial information for value creation. The company's engagement in 2024 with numerous private companies exemplifies this channel's effectiveness in sourcing unique opportunities.

| Channel | Key Function | 2024 Relevance/Data Point |

| Website & Investor Portals | Direct Information Dissemination | Central hub for financial reports, press releases, and updates. |

| Investment Banks & Financial Advisors | Deal Sourcing, M&A Execution, Capital Raising | Critical for navigating complex transactions and securing funding in active global M&A market. |

| Industry Conferences & Forums | Networking, Investor Engagement, Opportunity Identification | Platform for articulating strategy, exemplified by Brookfield's 2024 Investor Day. |

| Financial News & Media Outlets | Broad Market Communication | Dissemination of earnings, acquisitions, and strategic shifts; used extensively in 2024 for announcements. |

| Direct Outreach | Proprietary Deal Flow, Relationship Building | Proactive engagement with private companies in 2024 to uncover undervalued assets. |

Customer Segments

Institutional investors, including pension funds, sovereign wealth funds, and endowments, represent a crucial customer segment for Brookfield Business Partners. These entities are actively seeking stable, long-term capital appreciation and diversification by allocating capital to private equity strategies. In 2024, the global pension fund industry alone managed trillions of dollars, with a significant portion increasingly allocated to alternative investments like private equity to enhance returns. These sophisticated investors are drawn to Brookfield's proven track record in acquiring and operating businesses, viewing it as a reliable avenue for achieving their investment objectives.

High-net-worth individuals (HNWIs) seek Brookfield Business Partners for sophisticated investment avenues beyond traditional markets. They are attracted to the firm's ability to provide access to diversified portfolios of industrial and service businesses, often through specialized funds. For instance, in 2023, Brookfield Business Partners managed significant capital for HNWIs seeking growth in sectors like business services and infrastructure. This segment values the potential for superior risk-adjusted returns and the opportunity for direct co-investment alongside Brookfield's expertise.

Existing shareholders and unitholders represent a core customer segment for Brookfield Business Partners. These are individuals and entities who have already invested in either Brookfield Business Partners L.P. (BBU) or Brookfield Business Corporation (BBUC). Their primary interest lies in the ongoing performance of these entities, the distributions they receive, and the company's strategy for long-term value creation.

For these stakeholders, the consistency and growth of distributions are key indicators of success. For instance, Brookfield Business Partners declared a quarterly distribution of $0.0625 per unit, which was payable in March 2025. This regular payout directly impacts their investment returns and reinforces their confidence in the business model.

Companies Seeking Strategic Partners or Acquirers

Companies actively seeking to enhance their market position through strategic alliances or outright acquisition represent a key customer segment for Brookfield Business Partners. These businesses, often operating within the industrial and business services sectors, are looking for more than just capital; they desire a partner with the expertise to drive growth, streamline operations, and unlock their full potential. Brookfield Business Partners specifically targets market-leading operations, indicating a preference for established entities with strong foundational elements.

In 2024, the M&A landscape continued to show robust activity, particularly in sectors where Brookfield Business Partners has a strong presence. For instance, industrial manufacturing saw significant consolidation, with many mid-sized players exploring strategic options to compete more effectively against larger global entities. Similarly, the business services sector, encompassing areas like logistics and facilities management, experienced a surge in deal-making as companies sought to expand their service offerings and geographic reach.

- Target Profile: Businesses in industrial and business services aiming for growth, operational enhancement, or acquisition.

- Strategic Objective: Seeking partners to leverage operational expertise and market leadership.

- Market Focus: Brookfield Business Partners prioritizes acquiring market-leading companies.

- 2024 Trend: Continued M&A activity in industrial and business services sectors, driven by competition and expansion goals.

Management Teams of Portfolio Companies

Management teams of portfolio companies represent a crucial customer segment for Brookfield Business Partners. These leaders, responsible for the day-to-day operations of acquired businesses, are provided with strategic guidance, access to capital, and operational expertise. Brookfield actively partners with these teams, aiming to unlock value and drive performance improvements within their respective organizations.

Brookfield's approach involves close collaboration, offering resources that empower management to execute growth strategies and enhance profitability. This partnership model is designed to align incentives and ensure that the leadership teams are equipped to achieve their full potential. For instance, Brookfield's capital allocation strategies in 2023 supported significant operational enhancements across its diverse portfolio companies.

- Strategic Alignment: Brookfield works to align its strategic vision with that of the portfolio company's management.

- Operational Support: Providing resources and best practices to improve efficiency and effectiveness.

- Capital Access: Facilitating access to capital for growth initiatives and operational upgrades.

- Performance Enhancement: Focusing on driving measurable improvements in financial and operational metrics.

Governments and public sector entities seeking to privatize state-owned assets or engage in public-private partnerships (PPPs) represent another key customer segment. These entities often look to experienced financial partners like Brookfield to manage the transition of assets, ensuring efficient operations and public benefit. The trend of governments seeking private sector involvement in infrastructure development and service delivery remained strong through 2024, particularly in emerging markets.

Cost Structure

Acquisition and due diligence represent a significant component of Brookfield Business Partners’ cost structure. These costs encompass a wide range of expenses necessary for identifying, evaluating, and ultimately acquiring new businesses. This includes substantial outlays for legal counsel to navigate complex transaction agreements, fees paid to financial advisors for market analysis and deal structuring, and the costs associated with thorough due diligence.

In 2023 alone, Brookfield Business Partners reported transaction and advisory costs totaling $42.7 million specifically for investment acquisitions. This figure underscores the considerable investment required to vet potential targets, ensuring alignment with the company's strategic objectives and financial performance expectations before committing capital.

Brookfield Business Partners incurs significant costs to improve and restructure its acquired businesses. These expenses are vital for unlocking value and boosting profitability. For instance, in 2023, the company invested in enhancing the performance of its various operating segments, including significant technology upgrades within its dealer software operations, aiming to streamline processes and improve customer experience.

Management fees and performance incentives are a significant component of Brookfield Business Partners' cost structure, directly reflecting the expertise and oversight provided by its leadership team. These costs encompass the expenses associated with managing the company's diverse portfolio of businesses, as well as the compensation for its executives.

Compensation often includes both a base fee, providing a stable income for management, and performance-based incentives designed to align leadership's interests with those of shareholders. This structure encourages the team to actively seek and execute strategies that enhance the value of the underlying businesses.

For 2023, Brookfield Business Partners reported $159 million in investment management fees. This figure highlights the substantial resources dedicated to the active management and strategic direction of the company's assets.

Financing Costs

Financing costs are a significant part of Brookfield Business Partners' expenses, primarily stemming from interest payments on the debt used to finance its acquisitions and ongoing operations. Effectively managing these interest expenses is crucial for the company’s overall financial health and profitability. In 2023, Brookfield Business Partners reported interest expenses of approximately $640 million.

The company utilizes corporate credit facilities to support its diverse portfolio of businesses and strategic growth initiatives. These facilities provide the necessary capital for both large-scale acquisitions and day-to-day operational needs, making their cost a direct driver of financial performance.

- Interest Expenses: In 2023, interest expenses were around $640 million.

- Debt Funding: Acquisitions and operations are largely funded through debt.

- Financing Arrangements: Includes interest on various debt facilities.

- Financial Performance Impact: Effective management of these costs is vital.

General, Administrative, and Corporate Overhead

General, Administrative, and Corporate Overhead expenses are crucial for Brookfield Business Partners' global operations. These costs encompass maintaining corporate offices worldwide, salaries for administrative and executive staff, and the essential IT infrastructure that supports its diverse business segments. For instance, in 2023, Brookfield Business Partners reported that its selling, general, and administrative expenses represented a notable portion of its overall operational costs, reflecting the scale of its global management structure.

These overheads are not merely operational necessities but are fundamental to the strategic direction and coordination of the company's various investments and operating platforms. They facilitate effective decision-making and ensure the seamless functioning of the entire enterprise, from investment sourcing to portfolio management.

- Corporate Office Maintenance: Costs associated with global office leases, utilities, and facility management.

- Administrative Staff Salaries: Compensation for human resources, legal, finance, and executive management teams.

- IT Infrastructure: Investments in technology, software, cybersecurity, and network maintenance.

- Professional Services: Fees for legal counsel, accounting, and consulting services supporting corporate functions.

Operational costs represent a substantial portion of Brookfield Business Partners' expenditures, encompassing the day-to-day running of its diverse portfolio companies. These costs are essential for maintaining service delivery, supporting infrastructure, and ensuring the efficient functioning of each acquired business. For 2023, Brookfield Business Partners reported significant operating expenses across its segments, reflecting the direct costs incurred in generating revenue.

These direct operational outlays are critical for the company's ability to deliver its services and products effectively. Investing in these areas ensures that the acquired businesses can perform optimally and contribute to the overall profitability of Brookfield Business Partners. The company consistently monitors these expenses to identify areas for efficiency improvements and cost optimization.

Table: Key Cost Structure Components for Brookfield Business Partners (2023)

| Cost Category | Amount (Millions USD) | Description |

|---|---|---|

| Acquisition & Due Diligence | $42.7 | Costs for identifying, evaluating, and acquiring new businesses. |

| Investment Management Fees | $159 | Fees for managing the company's diverse portfolio. |

| Interest Expenses | ~$640 | Interest payments on debt used for acquisitions and operations. |

| Selling, General & Administrative (SG&A) | Not specified, but significant | Overhead for global operations, staff, and IT infrastructure. |

Revenue Streams

Brookfield Business Partners generates significant revenue from the ongoing operational performance of its portfolio companies. This includes income streams like dividends, distributions, and direct operational cash flows, representing a core and reliable source of earnings.

In 2024, the company reported an Adjusted EBITDA of $2,565 million, highlighting the robust performance of its acquired businesses. This consistent cash generation from operations forms a fundamental pillar of their revenue model.

Further demonstrating this ongoing success, Brookfield Business Partners achieved an Adjusted EBITDA of $591 million in the first quarter of 2025, underscoring the sustained operational strength across its diverse holdings.

Brookfield Business Partners realizes profits from selling off parts of its portfolio, especially after improving those businesses. This strategic asset sales approach is a key revenue driver. In 2024 alone, the company saw over $2 billion generated from these capital recycling efforts.

Brookfield Business Partners generates revenue through investment management fees, earned by skillfully managing capital for institutional partners and other co-investors across diverse investment vehicles. This revenue stream directly reflects Brookfield's deep expertise in asset management and its ability to deploy capital effectively. In 2023, these fees amounted to $159 million, underscoring their significance to the company's overall financial performance.

Distributions from Joint Ventures and Associates

Brookfield Business Partners (BBP) generates revenue through distributions from its investments in joint ventures and companies where it uses the equity method of accounting. This income represents BBP's proportional share of the profits earned by these affiliated entities.

These distributions are a key component of BBP's Adjusted Earnings from Operations (EFO). For the first quarter of 2024, BBP reported Adjusted EFO of $196 million, a notable increase from the previous year, demonstrating the contribution of these strategic investments to overall performance.

- Income from Joint Ventures: Direct cash distributions received from partnerships and collaborative business ventures.

- Equity Method Earnings: BBP's share of the net income reported by companies where it holds a significant, but not controlling, stake.

- Contribution to Adjusted EFO: These profit streams are consolidated into the Adjusted EFO metric, providing a clearer picture of operational profitability.

Reinvestment of Operational Cash Flows

Brookfield Business Partners strategically reinvests a substantial portion of its operational cash flows back into its diverse portfolio. This reinvestment fuels growth initiatives, supports strategic acquisitions, and drives operational enhancements within existing businesses. For instance, in 2023, the company highlighted its commitment to capital allocation, with a significant portion of cash flow directed towards organic growth projects and value-enhancing acquisitions across its key sectors like business services and industrial operations.

This disciplined approach to reinvestment is central to Brookfield Business Partners' long-term strategy of compounding shareholder value. By channeling cash back into promising opportunities, the company aims to bolster the earnings power and market position of its portfolio companies. This focus on internal development and strategic expansion directly supports the generation of future, more robust revenue streams.

The reinvestment strategy can be broken down into key areas:

- Organic Growth: Funding expansion of existing operations, new product development, and market penetration strategies.

- Acquisitions: Pursuing strategic tuck-in acquisitions or larger platform deals that complement existing businesses or enter new, attractive markets.

- Operational Improvements: Investing in technology, efficiency upgrades, and talent development to enhance profitability and cash generation.

- Debt Reduction: Prudently using cash flow to strengthen balance sheets and reduce financial risk, thereby supporting sustainable growth.

Brookfield Business Partners' revenue streams are diverse, stemming from both the ongoing operations of its portfolio companies and strategic capital allocation. This includes direct income from operations, profits from asset sales, and fees generated from investment management services.

The company's operational performance is a core revenue driver. In 2024, Brookfield Business Partners reported Adjusted EBITDA of $2,565 million, reflecting the strong performance of its acquired businesses. This consistent cash generation underpins their revenue model.

Strategic asset sales also contribute significantly to revenue. In 2024, capital recycling efforts generated over $2 billion for the company, showcasing a key approach to realizing value from its investments.

| Revenue Source | 2023 (Millions USD) | 2024 (Millions USD) |

|---|---|---|

| Adjusted EBITDA (Operations) | N/A | 2,565 |

| Capital Recycling (Asset Sales) | N/A | >2,000 |

| Investment Management Fees | 159 | N/A |

Business Model Canvas Data Sources

The Brookfield Business Partners Business Model Canvas is constructed using a combination of their annual and quarterly financial reports, investor presentations, and publicly available market research on the infrastructure and business services sectors. This ensures each component reflects their actual operational strategies and financial performance.