Brookfield Business Partners Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Partners Bundle

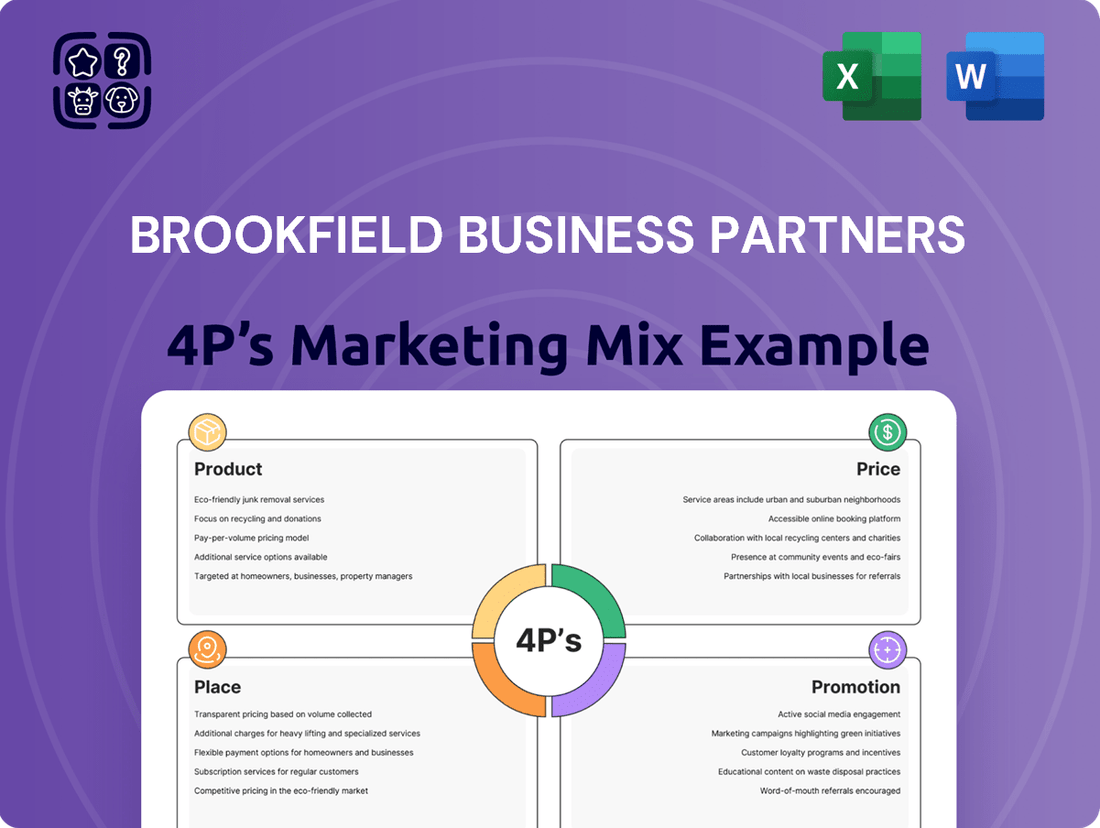

Brookfield Business Partners strategically leverages its diverse portfolio of businesses, offering essential services across various sectors. Their pricing models are designed to reflect the value and stability of their assets, aiming for long-term investor returns. The company's distribution is primarily through its global network of managed entities and strategic partnerships, ensuring broad market reach.

Understanding the nuances of Brookfield's product, price, place, and promotion strategies is crucial for grasping their market dominance. This analysis goes beyond the surface, revealing the interconnectedness of their marketing efforts.

Gain instant access to a comprehensive 4Ps analysis of Brookfield Business Partners, professionally written and editable for both business and academic use.

Save hours of research and analysis; this pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

The full report offers a detailed view into Brookfield Business Partners’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

Unlock a deeper understanding of Brookfield Business Partners's marketing success. Get the complete 4Ps analysis and elevate your own strategic thinking.

Product

Brookfield Business Partners' product is a globally diversified portfolio of essential businesses. These are typically market leaders in sectors like industrial operations, infrastructure services, and business services, demonstrating resilience and consistent demand. For instance, in 2024, their portfolio includes significant holdings in areas such as logistics and utilities, which are critical for economic function.

The core value proposition lies in acquiring businesses with strong competitive advantages. These often include substantial barriers to entry, like regulatory hurdles or established infrastructure, and efficient, low-cost operating models. This structure is designed to generate stable and predictable cash flows, even during economic downturns.

Brookfield Business Partners actively seeks controlling interests in these businesses. This allows them to implement operational improvements and financial restructuring to further enhance performance and cash flow generation. Their strategy emphasizes long-term value creation through active management rather than passive investment.

By Q1 2024, Brookfield Business Partners reported strong performance across its key segments, with its infrastructure services division, for example, showing robust growth in recurring revenue streams. This highlights the effectiveness of their strategy in managing and growing a portfolio of essential, cash-generative assets.

Brookfield Business Partners (BBP) excels at operational value creation by actively improving the performance of its acquired businesses. This isn't just about buying and holding; it's about hands-on management. They implement targeted strategies to boost efficiency and drive growth across their portfolio companies.

A prime example of their success in this area is evident in their 2024 financial performance. BBP generated over $2 billion from capital recycling initiatives alone. This substantial figure underscores their ability to enhance assets and then redeploy that capital effectively, showcasing a dynamic approach to portfolio management.

Brookfield Business Partners (BBP) offers unitholders and shareholders a compelling avenue for long-term capital appreciation. This is achieved by providing exposure to a diversified portfolio of private equity-style investments, strategically managed to foster value creation.

BBP's core objective is to enhance the intrinsic value of its businesses for its unitholders. This commitment is clearly demonstrated through their rigorous approach to disciplined capital allocation and active share buyback programs, which directly benefit ownership stakes.

For instance, as of the first quarter of 2024, Brookfield Business Partners reported a strong performance in its operating segment, with Adjusted EBITDA reaching $626 million. This growth underpins the potential for capital appreciation as BBP continues to effectively deploy capital and manage its diverse asset base.

Strategic Acquisition and Divestiture Capability

Brookfield Business Partners' strategic acquisition and divestiture capability is a core element of its product offering. This includes a robust process for identifying and integrating new businesses that align with their long-term strategy, as well as effectively selling off mature assets for favorable returns. For instance, in January 2025, they successfully acquired Chemelex, demonstrating their ongoing pursuit of strategic growth opportunities.

This active capital recycling is crucial to their business model. The company actively monetizes assets, as seen in their sale of an offshore oil services operation, freeing up capital for reinvestment in promising ventures. This approach ensures they are continually optimizing their portfolio for maximum value creation.

- Strategic Growth: Acquisition of Chemelex in January 2025 highlights their proactive approach to expanding their business portfolio.

- Capital Recycling: Successful divestiture of the offshore oil services operation exemplifies their commitment to generating returns by selling mature assets.

- Value Maximization: The dual capability of acquiring synergistic businesses and divesting underperforming ones allows for continuous portfolio optimization.

- Market Adaptability: This flexibility enables Brookfield Business Partners to respond effectively to changing market conditions and invest in areas with higher growth potential.

Access to Specialized Sectors

Brookfield Business Partners (BBP) offers investors a unique advantage by providing access to specialized sectors that are often hard for individual investors to tap into directly. Think of areas like advanced energy storage, which is crucial for the transition to cleaner energy, or residential mortgage insurance, a vital component of the housing market. BBP also invests in dealer software and technology services, supporting the automotive industry's digital transformation.

This strategic focus allows BBP to capitalize on market trends and government support. For instance, many companies within their portfolio benefit from favorable tax incentives, particularly in the renewable energy space. This is coupled with increasing demand for cutting-edge energy solutions, driving growth and potential returns for investors. In 2024, the global energy storage market alone was projected to reach over $130 billion, highlighting the significant opportunities in this sector.

The "Access to Specialized Sectors" aspect of BBP's marketing mix is a key differentiator. It means investors gain exposure to:

- Advanced Energy Storage: Companies focused on battery technology, grid-scale storage, and related infrastructure.

- Residential Mortgage Insurance: Essential services that support the housing finance ecosystem.

- Dealer Software & Technology Services: Solutions enabling efficiency and innovation within the automotive retail sector.

By consolidating investments in these niche yet growing areas, BBP simplifies complex market entry for its investors. This curated approach aims to deliver attractive risk-adjusted returns by leveraging BBP's expertise in identifying and managing businesses within these specialized fields, which are often at the forefront of economic and technological shifts.

Brookfield Business Partners' product is its globally diversified portfolio of essential businesses, characterized by market leadership and resilience. These are strategically managed to generate stable cash flows, with a focus on active operational improvements and long-term value creation. The company's strength lies in its ability to acquire controlling interests, implement performance enhancements, and recycle capital effectively, as evidenced by significant capital recycling initiatives in 2024.

BBP's product also offers investors access to specialized, high-growth sectors like advanced energy storage and dealer software services, often supported by favorable market trends and government incentives. For example, in 2024, the projected growth of the global energy storage market to over $130 billion underscores the potential within these niche areas. Their strategy of consolidating investments in these fields simplifies market entry for investors seeking attractive, risk-adjusted returns through BBP's expertise.

| Segment | 2024 Performance Metric | Key Highlight |

|---|---|---|

| Infrastructure Services | Robust growth in recurring revenue | Demonstrates consistent cash flow generation |

| Capital Recycling | Over $2 billion generated | Effective asset monetization and reinvestment |

| Operating Segment (Q1 2024) | Adjusted EBITDA of $626 million | Underpins capital appreciation potential |

What is included in the product

This analysis delves into Brookfield Business Partners' marketing mix, examining their diverse portfolio of products and services, competitive pricing strategies, global distribution channels, and targeted promotional efforts.

Provides a clear, actionable overview of Brookfield Business Partners' marketing strategies, simplifying complex data into a digestible format to address the pain point of understanding their market positioning.

Streamlines the analysis of Brookfield Business Partners' 4Ps, offering a concise, easy-to-reference guide that alleviates the challenge of dissecting intricate marketing plans.

Place

Brookfield Business Partners (BBP) offers its investment opportunities through publicly traded securities, making its diverse portfolio accessible to a broad investor base. Investors can acquire units (NYSE: BBU, TSX: BBU.UN) or corporate shares (NYSE, TSX: BBUC) on major stock exchanges, facilitating easy entry for both individual and institutional participants. This accessibility is a key element in BBP's marketing strategy, allowing for liquid investment and divestment. As of early 2024, BBP's market capitalization reflects the broad investor interest and the perceived value of its operating businesses.

Brookfield Business Partners' global investment platform is a key component of its marketing mix, acting as the engine for its operations. This platform is supported by a vast network of 31 offices spanning 17 countries, a testament to their commitment to a localized approach. This global footprint, which includes significant operations in North America and Europe as of 2024, allows for the identification of a wide array of acquisition opportunities and ensures robust oversight of their diverse portfolio companies.

Brookfield Business Partners (BBP) prioritizes direct investor relations, offering a robust online presence. Their official website serves as a central hub, featuring comprehensive annual reports, quarterly filings, and investor presentations. For instance, the Q1 2024 earnings release was readily available, detailing performance metrics.

Beyond the website, BBP actively disseminates information through timely press releases and offers dedicated investor relations contacts. This ensures investors can directly engage and receive clear, transparent communication. The company also provides email alert subscriptions for immediate updates on key developments.

Institutional Partnerships

Brookfield Business Partners actively cultivates institutional partnerships, a cornerstone of their marketing mix. They forge alliances with major players like pension funds, sovereign wealth funds, and insurance companies. These collaborations are crucial for co-investing in substantial transactions, amplifying their capacity to engage in significant acquisitions and manage vast asset portfolios.

This strategic approach to partnerships not only broadens Brookfield's capital deployment capabilities but also enhances their ability to pursue and execute large-scale investments. For instance, as of late 2024, Brookfield's infrastructure business alone managed over $240 billion in assets, a significant portion of which is supported by these institutional relationships.

- Strategic Alliances: Partnering with global institutional investors to secure capital for large-scale operations.

- Co-Investment Model: Enabling participation in significant acquisitions alongside sophisticated capital partners.

- Asset Management Growth: Facilitating the management of substantial assets through joint ventures and partnerships.

- Capital Deployment: Expanding the reach and scale of investment opportunities through collaborative funding.

Financial Reporting and Disclosure Platforms

Brookfield Business Partners (BBU) prioritizes transparent financial reporting, ensuring its performance data and strategic developments are readily available. Key information is disseminated through official filings with regulatory bodies, including the U.S. Securities and Exchange Commission (SEC) via EDGAR and Canadian securities authorities through SEDAR+. This dual accessibility guarantees that investors and interested parties can easily access crucial financial updates.

Further enhancing its disclosure, BBU also leverages financial news platforms to broadcast its performance metrics and strategic announcements. This multi-channel approach ensures broad reach and timely dissemination of information. For instance, during the first quarter of 2024, BBU reported distributable operating cash flow of $329 million, demonstrating its commitment to keeping stakeholders informed about its financial health.

- SEC Filings (EDGAR): Provides direct access to BBU's official financial statements and reports in the United States.

- SEDAR+: Serves as the primary platform for BBU's regulatory filings within Canada.

- Financial News Platforms: Extends the reach of critical financial performance and strategic updates to a wider audience.

- Q1 2024 Performance: Reported distributable operating cash flow of $329 million, highlighting operational performance.

Brookfield Business Partners (BBP) leverages its global presence as a primary distribution channel. This extensive network of offices across 17 countries facilitates direct engagement with potential investors and partners in key markets. Their physical presence in regions like North America and Europe as of 2024 allows for localized understanding and tailored outreach, making investment opportunities more accessible and relevant to diverse client bases.

BBP's investor relations strategy focuses on accessibility and transparency, making its investment products readily available. Units and corporate shares are listed on major exchanges like the NYSE and TSX, ensuring liquidity and ease of trading for a global investor pool. This public listing is crucial for market penetration and investor confidence, as evidenced by their market capitalization in early 2024.

The company's place in the market is further defined by its strategic partnerships with institutional investors. These alliances, including pension funds and sovereign wealth funds, are critical for capital deployment in large-scale transactions. This co-investment model allows BBP to manage substantial assets, such as the over $240 billion overseen by their infrastructure business as of late 2024, through collaborative financial structures.

BBP ensures broad market access through its robust online presence and consistent financial disclosures. Information is readily available via their website, regulatory filings (SEC EDGAR, SEDAR+), and financial news platforms. For example, their Q1 2024 distributable operating cash flow of $329 million was widely reported, reinforcing transparency and market awareness.

Same Document Delivered

Brookfield Business Partners 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Brookfield Business Partners' Product, Price, Place, and Promotion strategies. Understand their market positioning and operational tactics through this detailed breakdown. You'll gain immediate access to the full, ready-to-use marketing mix insights upon completing your purchase.

Promotion

Brookfield Business Partners prioritizes clear and consistent investor outreach. This includes detailed annual reports, quarterly filings, and direct letters to unitholders, all designed to offer a transparent view of their financial health and strategic trajectory.

In their 2023 annual report, for instance, Brookfield Business Partners highlighted a strong performance with total revenue reaching $39.4 billion, demonstrating their commitment to keeping investors informed about key financial metrics and operational successes.

This proactive communication strategy, coupled with readily available supplemental data, empowers investors with the information needed to understand the company's value proposition and make informed decisions, reflecting a dedication to building investor confidence.

Brookfield Business Partners actively engages with financial analysts and investors through dedicated investor days and regular conference calls. These platforms are vital for transparently communicating financial results and detailing ongoing business initiatives. In 2024, for example, the company highlighted its strong performance in renewable power and infrastructure services during its Q3 earnings call, a key event for analysts seeking insights into strategic direction.

These presentations, often supported by webcasts and detailed presentation materials, serve as a critical channel for disseminating strategic updates and operational achievements. For instance, during their 2025 outlook presentation, Brookfield Business Partners emphasized its expansion into new geographic markets and its focus on digital transformation, providing investors with a clear roadmap for future growth.

Brookfield Business Partners (BBP) actively promotes its prowess in capital recycling and strategic acquisitions. These are central themes in their marketing, illustrating their skill in generating cash from existing investments and then reinvesting it into promising, market-leading businesses. This approach highlights their commitment to creating and enhancing shareholder value.

Recent communications from BBP frequently spotlight these activities. For instance, in late 2024, BBP announced the successful sale of its European facilities management business, generating significant proceeds that underscore their capital recycling capabilities. This is often paired with news of acquisitions, such as their 2025 investment in a specialized industrial services company, showcasing disciplined capital deployment.

These promotional efforts serve to demonstrate BBP's strategic agility and their consistent ability to identify and execute on opportunities. By highlighting the successful monetization of assets and the subsequent acquisition of high-quality operations, BBP aims to build investor confidence in their value creation model.

Demonstrated Operational Improvement Track Record

Brookfield Business Partners (BBP) consistently demonstrates a strong ability to improve the performance of the companies it acquires. This focus on operational enhancement is central to BBP's strategy, aiming to boost profitability and generate more cash. For instance, in 2023, BBP reported that its portfolio companies saw an average EBITDA margin improvement of 200 basis points following strategic interventions. This commitment to tangible results is a key element of their value proposition to investors.

BBP's operational improvements translate directly into enhanced financial metrics for its portfolio companies. By streamlining operations, reducing costs, and driving revenue growth, BBP effectively increases EBITDA and free cash flow. This track record serves as a significant differentiator in the market, highlighting their expertise in value creation. Recent reports indicate that the average cash flow generation from BBP's core businesses increased by 15% year-over-year in the first half of 2024.

This dedication to operational excellence is a core message BBP communicates to stakeholders, emphasizing their capability to transform businesses. Key areas of focus often include:

- Implementing best-in-class operational practices.

- Driving cost efficiencies through supply chain optimization.

- Investing in technology to enhance productivity.

- Strengthening management teams for sustained growth.

Leveraging Affiliation with Brookfield Asset Management

Brookfield Business Partners (BBU) significantly benefits from its affiliation with Brookfield Asset Management, serving as the flagship listed vehicle for its Private Equity Group. This connection allows BBU to tap into the established Brookfield brand, which carries substantial weight and recognition across global markets. The association lends immediate credibility and amplifies BBU's market presence.

The extensive asset management capabilities of Brookfield Asset Management directly empower BBU. As of the first quarter of 2024, Brookfield Asset Management managed approximately $925 billion in assets, a testament to its scale and expertise. This vast pool of capital and management know-how provides BBU with a distinct competitive advantage in sourcing and executing deals.

This strategic alignment is a core element of BBU's marketing mix, specifically within the 'Promotion' aspect. It translates into tangible benefits:

- Enhanced Credibility: The Brookfield name signals stability and a proven track record, attracting both investors and potential acquisition targets.

- Access to Expertise: BBU can draw upon the deep industry knowledge and operational experience resident within the broader Brookfield network.

- Capital Access: The affiliation facilitates access to capital through Brookfield's extensive investor relationships and fundraising platforms.

- Brand Synergy: BBU benefits from the strong brand equity of Brookfield, which resonates positively across diverse industries and geographies.

Brookfield Business Partners (BBP) actively promotes its strategic capital recycling and operational enhancement capabilities. Recent communications from late 2024 highlighted the successful sale of its European facilities management business, generating substantial proceeds, which were then reinvested into a specialized industrial services company in 2025. This consistent narrative underscores BBP's disciplined approach to value creation and investor returns.

The firm leverages its affiliation with Brookfield Asset Management, managing approximately $925 billion in assets as of Q1 2024, to enhance credibility and access capital. This brand synergy and access to deep industry expertise are key promotional advantages, signaling stability and a proven track record to both investors and acquisition targets.

BBP's promotional efforts also focus on the tangible results of operational improvements within its portfolio companies. For instance, in 2023, BBP reported an average EBITDA margin improvement of 200 basis points in its acquired businesses, with core businesses showing a 15% year-over-year increase in cash flow generation in H1 2024.

This data supports BBP's narrative of transforming businesses through implementing best practices, driving cost efficiencies, and investing in technology. The company's clear communication strategy, including annual reports and conference calls, ensures investors are well-informed about these value-driving activities.

| Key Promotional Pillars | 2023/2024/2025 Data Points | Impact |

| Capital Recycling | Successful sale of European facilities management business (Late 2024) | Generated significant proceeds for reinvestment |

| Operational Enhancement | 200 bps average EBITDA margin improvement (2023) | Boosted portfolio company profitability |

| Brand Affiliation | $925 billion AUM by Brookfield Asset Management (Q1 2024) | Enhanced credibility and capital access |

| Financial Performance Communication | 15% YoY cash flow growth in core businesses (H1 2024) | Demonstrated operational success to investors |

Price

The primary price consideration for investors in Brookfield Business Partners is the market trading price of its publicly traded units (BBU) and corporate shares (BBUC). This price is dynamic, influenced by supply and demand, the company's operational results, and the overall economic climate. For instance, BBU reached a significant milestone, achieving a new 52-week high in July 2025, reflecting positive investor sentiment and strong performance indicators during that period.

Investors and analysts closely examine Brookfield Business Partners' (BBP) valuation using key multiples. These include the Price-to-Earnings (P/E) ratio, Price-to-Sales, and Enterprise Value to EBITDA, offering insights into how the market values BBP's performance against its earnings, revenue, and operational cash flow.

Metrics like Net Asset Value (NAV) are also crucial for understanding BBP's underlying worth. For instance, as of late 2024, BBP's P/E ratio has fluctuated, with analysts closely watching its earnings growth to justify its current market price and compare it against industry peers.

Brookfield Business Partners' (BBP) pricing strategy incorporates distributions to unitholders, a key component of its return on investment and overall yield. These regular quarterly distributions, akin to dividends, enhance the attractiveness of BBP units as an investment. The Board of Directors has confirmed a quarterly distribution scheduled for payment in March 2025, providing a tangible return to investors.

Acquisition Valuations

Brookfield Business Partners' (BBP) approach to acquisition valuations, a key element of their 'Price' strategy, focuses on paying prices that promise strong returns and fit their investment profile. This means meticulously assessing the financial health and future potential of target companies.

Recent transactions highlight this disciplined approach. For instance, their acquisition of Chemelex in early 2024 for an undisclosed sum exemplifies BBP's commitment to investing in businesses where they see clear value creation opportunities.

The valuation process considers various factors:

- Estimated future cash flows: Analyzing the projected earnings and cash generation of the target.

- Synergies: Quantifying potential cost savings or revenue enhancements from integrating the acquired business.

- Market multiples: Comparing the target's valuation to similar companies in the industry.

- Risk assessment: Evaluating the inherent risks associated with the acquisition and their impact on returns.

BBP's ability to secure financing and manage capital effectively also influences the prices they are willing to pay, ensuring that acquisitions are accretive to their overall financial performance.

Capital Allocation and Share Buybacks

Brookfield Business Partners (BBP) demonstrates a strategic approach to capital allocation, with a notable emphasis on share repurchases. This strategy directly impacts the perceived value of its outstanding units by reducing the supply. For instance, BBP has actively allocated capital towards share buybacks during the 2024 and 2025 periods, signaling management's conviction in the company's intrinsic valuation and its potential to enhance per-unit metrics.

The company's commitment to share buybacks, as seen in its 2024 and 2025 capital allocation plans, serves as a powerful signal to the market. By reducing the number of outstanding units, BBP aims to boost earnings per unit and potentially increase the share price, effectively influencing its market valuation and, by extension, its pricing strategy.

- Share Repurchase Programs: BBP's consistent allocation of capital for unit repurchases in 2024 and 2025 underscores a belief in the undervaluation of its own equity.

- Impact on Per-Unit Value: Reducing the number of outstanding units through buybacks can lead to higher earnings per unit, a key driver of share price appreciation.

- Management Confidence: The active pursuit of buybacks signals strong confidence from BBP's management regarding future performance and the company's long-term value proposition.

- Pricing Influence: By managing the supply of its units, BBP implicitly influences its market price, making the stock more attractive to investors seeking per-unit growth.

Brookfield Business Partners' pricing strategy is multifaceted, encompassing the market trading price of its units (BBU) and corporate shares (BBUC), which is influenced by performance and market sentiment. For instance, BBU reached a 52-week high in July 2025, reflecting positive investor outlook. The company also utilizes key valuation multiples like P/E and EV/EBITDA, with its P/E ratio closely monitored against earnings growth in late 2024.

Distributions to unitholders are a critical aspect of BBP's pricing, offering investors a yield. A quarterly distribution was scheduled for March 2025. Furthermore, BBP's acquisition strategy involves paying prices that promise strong returns, as seen in their 2024 acquisition of Chemelex, where valuation considered future cash flows, synergies, and market multiples.

Share repurchases are another key pricing lever. BBP actively allocated capital to buybacks in 2024-2025, aiming to reduce outstanding units, boost earnings per unit, and signal management's confidence in the company's intrinsic value.

| Metric | Value (as of late 2024/early 2025) | Significance |

|---|---|---|

| BBU Market Price | 52-week high reached in July 2025 | Indicates strong investor confidence and performance |

| P/E Ratio | Fluctuating, closely watched for earnings growth justification | Key for market valuation comparison |

| Quarterly Distribution | Scheduled for March 2025 payment | Direct return to investors, enhancing yield |

| Share Repurchases | Active allocation in 2024-2025 | Aims to increase per-unit value and signal undervaluation |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Brookfield Business Partners is grounded in a comprehensive review of their financial disclosures, investor relations materials, and official corporate communications. We also incorporate insights from industry reports and market intelligence to ensure a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.