Brookfield Business Partners Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Partners Bundle

Brookfield Business Partners operates in a landscape shaped by significant competitive forces. Understanding the intensity of rivalry among existing competitors, the bargaining power of both suppliers and buyers, and the constant threat of new entrants and substitutes is crucial for strategic success. Each of these forces plays a vital role in defining the industry's profitability and Brookfield's market position.

The complete report reveals the real forces shaping Brookfield Business Partners’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Brookfield Business Partners (BBP) benefits from a fragmented supplier base across its varied operational segments. This means BBP doesn't typically depend heavily on just one or a few suppliers for critical inputs, spreading its risk.

This broad diversification naturally weakens the bargaining power of any single supplier. For instance, in 2024, BBP's diverse portfolio, encompassing everything from industrial services to infrastructure, means it sources components and services from countless vendors globally.

The company's significant global footprint further amplifies this advantage. By having the ability to procure from multiple international markets, BBP can always seek out competitive pricing and ensure continuity of supply, thereby keeping supplier leverage in check.

Brookfield Business Partners' (BBP) strategic acquisitions often target businesses that provide critical industrial inputs, thereby mitigating supplier power. Their acquisition of an electric heat tracing systems manufacturer in January 2025 exemplifies this, aiming to secure specialized manufacturing capabilities.

By integrating such suppliers or securing long-term supply agreements through these acquisitions, BBP effectively reduces its reliance on external vendors. This vertical integration strategy can lead to more stable input costs and greater control over the production process.

Brookfield Business Partners' (BBP) portfolio companies, especially those in infrastructure and industrial services, often secure long-term contracts with suppliers. These contracts frequently feature fixed terms or pre-determined price adjustments, which are crucial for cost stability. For instance, a company like BBP's infrastructure segment might have a 10-year agreement for critical components, shielding it from immediate price hikes. This contractual security significantly curtails suppliers' leverage to unilaterally change terms, ensuring predictable input costs for BBP's operations.

Specialized Inputs and Limited Suppliers

Brookfield Business Partners (BBP) navigates the bargaining power of suppliers, particularly in specialized industrial or infrastructure ventures within its diverse portfolio. In these niche sectors, a scarcity of suppliers offering proprietary technology or unique expertise can amplify their leverage.

For instance, consider a project requiring highly specialized components for renewable energy infrastructure. If only a few manufacturers produce these critical parts, they can command higher prices. BBP’s strategy to counter this involves concentrating on businesses that inherently possess low production costs or robust competitive advantages, enabling them to better absorb any upward pressure on input prices from these powerful suppliers.

- Specialized Niche Dependence: Certain BBP segments, like those in advanced manufacturing or specific infrastructure development, might depend on a small pool of suppliers with unique capabilities.

- Supplier Leverage in Niche Markets: Suppliers holding patents or exclusive production methods for essential components in these specialized areas can exert significant pricing power.

- Mitigation through Cost Leadership: BBP actively seeks and cultivates businesses within its portfolio that benefit from economies of scale or operational efficiencies, allowing them to absorb increased supplier costs without compromising profitability.

- Strategic Sourcing and Partnerships: BBP likely engages in long-term supplier agreements and explores alternative sourcing options to reduce reliance on single suppliers, thereby diminishing their bargaining strength.

Operational Efficiency and Procurement Scale

Brookfield Business Partners (BBP) actively enhances operational efficiency, and this focus directly impacts its bargaining power with suppliers. By consolidating procurement across its diverse portfolio of companies, BBP can leverage significant collective purchasing power. This scale allows BBP to negotiate more favorable pricing and terms, effectively reducing input costs for its various businesses.

For instance, in 2024, BBP's strategy of integrating acquired companies into its operational framework means that a supplier providing a common component to multiple BBP entities would face a larger, more unified buyer. This increased leverage is a key factor in managing supplier relationships and driving cost savings throughout the organization. The ability to negotiate from a position of strength directly contributes to improved profitability at the portfolio company level.

- Leveraged Procurement: BBP's ability to centralize or coordinate procurement across its diverse holdings significantly boosts its bargaining power with suppliers.

- Cost Reduction: This collective scale allows for more favorable negotiations on pricing and terms, leading to direct cost efficiencies.

- Supplier Relationship Management: A stronger negotiating position enhances BBP's ability to manage supplier relationships effectively, ensuring reliable supply chains at competitive costs.

- Profitability Enhancement: Improved procurement terms directly translate to better margins for the individual businesses within the BBP portfolio.

Brookfield Business Partners (BBP) generally faces moderate bargaining power from its suppliers due to its vast and diversified operational base. The sheer scale and global reach of BBP allow it to source from numerous vendors, preventing any single supplier from dictating terms. For example, in 2024, BBP's operations span numerous sectors, meaning it sources a wide array of goods and services from thousands of suppliers worldwide, diluting any individual supplier's leverage.

However, in certain specialized segments, such as those requiring proprietary technology or unique components for infrastructure projects, supplier power can increase. For instance, if a particular renewable energy component is only manufactured by a handful of firms, those suppliers can command higher prices. BBP mitigates this by focusing on cost-efficient businesses and securing long-term agreements, like a 10-year component supply contract reported in its infrastructure division, which locks in pricing and limits supplier flexibility.

BBP's strategy of acquiring businesses that provide critical inputs, such as its January 2025 acquisition of an electric heat tracing systems manufacturer, also serves to reduce supplier reliance and potential power. By integrating these capabilities, BBP gains greater control over its supply chain and input costs, further strengthening its position against external suppliers.

The company's ability to consolidate procurement across its portfolio amplifies its purchasing power. This coordinated approach, evident in 2024, allows BBP to negotiate more favorable terms with suppliers, driving down costs for its various operating companies and enhancing overall profitability.

| Supplier Factor | Impact on BBP | Mitigation Strategy |

|---|---|---|

| Supplier Concentration | Low overall due to BBP's diverse portfolio. | Global sourcing, multiple vendor relationships. |

| Supplier Differentiation | Can be high in specialized niche markets (e.g., advanced manufacturing components). | Long-term contracts, vertical integration through acquisitions, focus on cost leadership in acquired businesses. |

| Switching Costs for BBP | Generally low for common inputs, higher for specialized items. | Strategic sourcing, maintaining supplier relationships, operational efficiency gains. |

| Threat of Forward Integration | Low for most suppliers given BBP's scale and diversification. | Continued focus on core competencies, strategic partnerships. |

What is included in the product

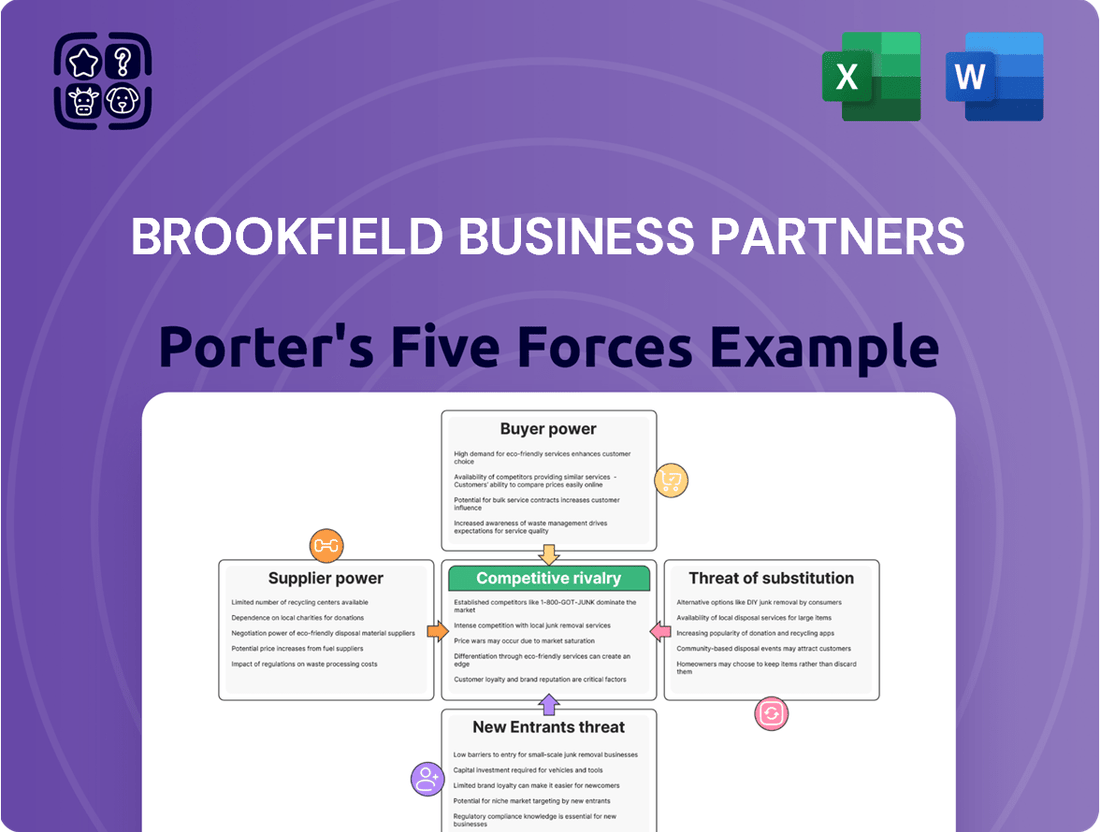

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Brookfield Business Partners' diversified business operations.

Instantly identify and mitigate competitive threats with a dynamic visualization of Brookfield Business Partners' Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Brookfield Business Partners (BBU) operates across diverse sectors, including industrials, business services, and infrastructure. This broad reach means BBU often deals with a fragmented customer base. For instance, in its residential mortgage insurance or dealer software services, the clients are typically numerous and individual.

This widespread customer distribution significantly dilutes the bargaining power of any single buyer. Because no individual customer represents a large percentage of BBU's overall revenue, their ability to negotiate substantial price reductions or dictate custom terms is inherently limited.

Many of Brookfield Business Partners' (BBP) portfolio companies operate in sectors where customers face substantial costs when switching providers. For instance, in specialized business services or critical infrastructure, the integration of BBP's solutions into a client's existing operational framework often creates a deep dependency. This can involve complex IT systems, extensive training, or unique contractual obligations that make a changeover prohibitively expensive and disruptive.

These high switching costs effectively limit the bargaining power of customers. Consider a utility service provider within BBP's portfolio; a municipality or industrial client might have invested millions in specialized equipment and regulatory compliance tied to that provider's technology. The sheer expense and logistical hurdles of migrating to a new system, potentially involving lengthy approval processes and downtime, significantly reduce their leverage to demand lower prices or better terms.

In 2024, the infrastructure services sector, a key area for BBP, continued to see customers locked into long-term agreements. These contracts, often spanning 10-20 years, are designed to recoup significant upfront investments and provide stable revenue streams. For example, a waste management contract for a large city, a typical BBP-type asset, involves substantial capital expenditure on specialized vehicles and processing facilities, making renegotiation difficult for the city without incurring penalties or replacement costs.

The mission-critical nature of many services BBP offers further solidifies customer loyalty and reduces their bargaining power. Businesses that rely on uninterrupted power, specialized logistics, or essential facility management cannot afford the risk associated with switching to an unproven or less integrated provider. This inherent need for reliability and continuity means customers are less likely to exert significant price pressure, as the cost of service failure far outweighs potential savings from switching.

Brookfield Business Partners (BBP) strategically targets businesses that supply indispensable products and services. Think of companies involved in critical infrastructure maintenance or the provision of specialized industrial components. This focus inherently limits customer alternatives.

Because these offerings are so essential, customers often find themselves with few, if any, viable substitutes. This scarcity of alternatives significantly diminishes their power to negotiate lower prices or dictate terms, thereby reducing downward price pressure.

The non-discretionary nature of BBP's acquired businesses' services means customers cannot easily forgo these offerings without significant disruption. For instance, in 2024, sectors like essential utility maintenance services continued to see steady demand, irrespective of broader economic fluctuations, underscoring their critical role.

Long-Term Relationships and Value Proposition

Brookfield Business Partners' portfolio companies frequently foster enduring client connections, especially within business and infrastructure services. These long-standing relationships, anchored in dependability and consistent value delivery, cultivate strong customer loyalty, significantly diminishing the inclination for clients to explore competing options or engage in price-driven negotiations.

- Customer Loyalty: For instance, Brookfield's facility management segment often secures multi-year contracts, minimizing churn.

- Reduced Price Sensitivity: Clients value the integrated service offerings and reliability, making price a secondary consideration.

- Switching Costs: The effort and disruption involved in switching providers for specialized services further solidify these relationships.

- Value Proposition: The comprehensive solutions provided by Brookfield's businesses offer tangible benefits that outweigh minor price differences.

Customer Concentration in Specific Niche Markets

While Brookfield Business Partners (BBP) operates across a diverse range of industries, specific niche markets within its portfolio can lead to heightened customer concentration. For example, in certain industrial or infrastructure projects, BBP might rely on a limited number of large government or corporate contracts. This situation can amplify the bargaining power of these key customers.

In 2024, BBP continued to leverage its operational strengths to manage this dynamic. The company's focus on delivering exceptional value and unwavering reliability in its services, rather than solely competing on price, helps to solidify customer relationships and mitigate the impact of concentrated customer power. This strategic approach ensures that even in niche segments, BBP maintains a strong position.

- Customer Concentration: In select niche markets, BBP may serve a smaller number of significant customers, potentially increasing their bargaining leverage.

- Mitigation Strategy: BBP's emphasis on operational excellence, reliability, and value creation counterbalances the inherent risk of customer concentration.

- Competitive Positioning: Maintaining strong competitive advantages within these niche segments allows BBP to retain pricing power and reduce dependency on individual large contracts.

Brookfield Business Partners' customers generally exhibit low bargaining power. This is primarily due to high switching costs associated with BBP's specialized and integrated services, which make it expensive and disruptive for clients to change providers. Furthermore, the essential nature of many services offered by BBP's portfolio companies, such as infrastructure maintenance, reduces customer price sensitivity and limits their ability to negotiate substantial concessions.

In 2024, many of BBP's infrastructure contracts, like those for waste management with municipalities, were locked into long-term agreements, often 10-20 years, further cementing customer reliance and limiting their leverage. The mission-critical nature of these services means clients prioritize reliability over price, diminishing their bargaining strength.

While some niche segments might experience customer concentration, BBP mitigates this by focusing on operational excellence and value delivery, thereby retaining pricing power and customer loyalty.

| Factor | Impact on Customer Bargaining Power | BBP Specifics |

| Switching Costs | High | Complex integration, long-term contracts, specialized technology |

| Customer Loyalty | High | Reliability, value-added services, enduring relationships |

| Product Differentiation | High | Indispensable products/services, few viable substitutes |

| Price Sensitivity | Low | Mission-critical services, cost of service failure outweighs savings |

What You See Is What You Get

Brookfield Business Partners Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Brookfield Business Partners, detailing the competitive landscape and strategic implications. The document you see here is precisely the same professionally written, fully formatted analysis you will receive instantly after purchase, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

Brookfield Business Partners' (BBU) strength in managing competitive rivalry stems from its highly diversified portfolio. With operations across industrials, business services, and infrastructure services, intense competition in one area doesn't cripple the entire company. This broad spread of businesses significantly dilutes the impact of sector-specific competitive pressures, offering a crucial layer of resilience.

The company actively employs capital recycling as a strategy to navigate competitive landscapes. For instance, in 2024, BBU continued to evaluate and divest non-core assets. A notable example from previous periods, which informs its ongoing strategy, was the sale of its offshore oil services shuttle tanker operation. This allows BBU to redeploy capital into segments offering more favorable competitive dynamics and higher growth potential.

This strategic reallocation of capital is key to mitigating the risks associated with intense rivalry. By identifying and exiting over-saturated or highly competitive markets, BBU can invest in areas where it can establish or maintain a stronger competitive advantage. This proactive approach ensures the company remains agile in a dynamic market environment.

Brookfield Business Partners (BBP) actively targets businesses with substantial entry barriers or cost advantages, a strategy that naturally dampens competitive rivalry. For instance, in 2024, BBP's focus on sectors like business services and utilities, which often feature high capital requirements or regulatory hurdles, means fewer players can easily enter and challenge existing market leaders.

This deliberate selection of high-quality, defensible assets means BBP's portfolio companies typically operate in markets with less intense competition. Their strong competitive positions allow them to maintain pricing power and market share, reducing the pressure from rivals who might otherwise engage in aggressive price wars or disruptive innovation.

By concentrating on businesses that are difficult to replicate or possess inherent cost efficiencies, BBP sidesteps markets characterized by fierce, head-to-head competition. This approach is evident in their acquisition of companies with established reputations and loyal customer bases, making it challenging for new entrants to gain traction.

Brookfield Business Partners (BBP) distinguishes itself through an active management strategy focused on boosting the operational and financial performance of its diverse portfolio. This hands-on approach is a key competitive edge, allowing BBP to drive efficiencies and deliver superior services across its businesses.

For instance, BBP's investments in upgrading dealer software services enhance productivity and customer satisfaction, while its focus on tax benefits in advanced energy storage projects improves profitability and market competitiveness. These targeted initiatives allow BBP's operating companies to stand out on quality, cost-effectiveness, and dependability, moving beyond simple price competition.

Global Scale and Access to Capital

Brookfield Business Partners (BBP) leverages its position as the primary listed entity for Brookfield Asset Management's Private Equity Group, granting it access to immense global resources and significant capital. This substantial financial backing allows its portfolio companies to pursue ambitious, large-scale projects and invest in sustained growth, offering a distinct advantage over smaller competitors. For instance, Brookfield Asset Management managed approximately $850 billion in assets as of December 31, 2023, illustrating the sheer scale of capital available.

This financial muscle enables BBP's businesses to weather economic volatility more effectively than less capitalized rivals, acting as a powerful barrier to entry. The ability to deploy significant capital for acquisitions or organic expansion deters potential new entrants who would struggle to match the financial firepower. This scale also facilitates global reach and the ability to invest in diverse markets simultaneously.

- Global Capital Access: Brookfield Business Partners benefits from the vast capital pools managed by its parent, Brookfield Asset Management.

- Scale Advantage: This allows portfolio companies to undertake large-scale projects and invest in long-term growth initiatives.

- Competitive Deterrent: Significant financial backing deters smaller, less capitalized competitors from entering markets.

- Resilience: The ability to access substantial capital enhances resilience during economic downturns.

Strategic Capital Recycling and Industry Consolidation

Brookfield Business Partners (BBP) actively manages its portfolio through strategic capital recycling. In 2024, this involved selling stakes in companies like DexKo and BrandSafway, while simultaneously reinvesting in growth areas, evidenced by its acquisition of Antylia Scientific.

This approach directly influences competitive rivalry by enabling BBP to acquire market-leading businesses. For example, by integrating Antylia Scientific, BBP strengthens its position in the specialized life sciences sector, potentially consolidating market share.

- Capital Recycling: BBP's strategy of selling mature assets and acquiring new growth opportunities, such as Antylia Scientific, allows for continuous portfolio optimization.

- Industry Consolidation: By acquiring market leaders, BBP actively shapes the competitive landscape, often reducing the number of significant players within specific industries.

- Competitive Positioning: This dynamic approach enhances BBP's competitive standing by allowing it to enter or expand in high-growth sectors while divesting from less strategic assets.

- Market Influence: BBP's strategic acquisitions and divestitures can significantly impact market dynamics, influencing pricing power and the overall competitive intensity within its operating sectors.

Brookfield Business Partners (BBP) actively manages its portfolio, a strategy that directly shapes competitive rivalry. By divesting non-core assets and reinvesting in promising sectors, BBP aims to acquire market leaders, thereby influencing industry consolidation. For example, BBP's 2024 divestitures, including stakes in DexKo and BrandSafway, freed up capital for strategic acquisitions like Antylia Scientific, enhancing its position in specialized markets and potentially reducing competitive intensity through consolidation.

| BBP Action | Impact on Rivalry | Example (2024/Recent) |

|---|---|---|

| Divestiture of Non-Core Assets | Reduces exposure to highly competitive or mature markets. | Sale of stakes in DexKo and BrandSafway. |

| Acquisition of Growth Assets | Strengthens market position and can lead to consolidation. | Acquisition of Antylia Scientific. |

| Portfolio Rebalancing | Allows BBP to enter or expand in high-growth sectors with potentially less rivalry. | Focus on specialized life sciences via Antylia Scientific. |

SSubstitutes Threaten

For many of Brookfield Business Partners' core infrastructure services, like essential utilities and transportation networks, the threat of direct substitutes is quite low. These are services that societies really depend on, and finding something that can do the same job just as well is difficult.

Think about electricity or water supply; there aren't many practical alternatives that can meet the demand on a large scale. This lack of readily available, viable substitutes significantly strengthens the competitive position of these infrastructure assets.

Furthermore, the immense capital required to build and maintain these types of infrastructure, coupled with strict government regulations, creates substantial barriers to entry. These factors make it incredibly challenging for new or alternative services to emerge and compete effectively against established infrastructure providers like those managed by Brookfield.

The threat of substitutes in business services, particularly in areas like dealer software and technology services, is a significant concern. Continuous innovation can quickly bring forth new solutions that bypass traditional offerings. For instance, advancements in AI-powered customer relationship management or cloud-based operational platforms can serve as effective substitutes for existing software and technology services.

Brookfield Business Partners' (BBP) portfolio companies operating in these segments need to be highly adaptable. This means consistently investing in technology upgrades and evolving their service models to remain competitive. For example, a company providing traditional IT support might see its services substituted by clients adopting fully managed cloud services or leveraging internal IT talent augmented by AI tools.

BBP's strategic emphasis on operational improvement is crucial in mitigating this threat. By optimizing efficiency and enhancing service delivery, BBP's businesses can offer greater value compared to potential substitutes. In 2023, BBP reported that its focus on operational excellence contributed to improved margins across its diverse portfolio, demonstrating a tangible benefit in navigating competitive pressures, including those from substitutes.

Customers evaluating Brookfield Business Partners' (BBP) various services, from business services to industrial products, consistently perform a cost-benefit analysis when exploring alternatives. A compelling substitute emerges if it delivers a substantially better value, perhaps through reduced costs or enhanced efficiency for a comparable need.

For instance, in the industrial sector, if a new material technology drastically lowers production costs for a key component BBP supplies, it could significantly impact demand. BBP's focus on boosting operational and financial performance is a direct response, aiming to keep its solutions attractive and resilient against such value-driven substitutions.

Consider the energy services sector where BBP operates; the rise of distributed renewable energy solutions, offering lower long-term operational costs compared to traditional centralized power generation, represents a clear substitution threat. BBP’s strategy to improve its own operational efficiencies and financial structures is designed to mitigate this by ensuring its service bundles provide a compelling value proposition that remains competitive even with these evolving alternatives.

High Barriers to Entry for Substitute Technologies

Many of Brookfield Business Partners' (BBP) core services, especially within industrial and infrastructure domains, face high barriers to substitution due to stringent regulatory oversight and the necessity for specialized technical knowledge. These demanding requirements, coupled with the significant capital outlay needed to establish competing operations, effectively deter the rapid emergence and adoption of novel substitute technologies or business models. This inherent structural advantage offers considerable protection against swift market displacement.

For instance, BBP's involvement in areas like specialized contracting or facilities management often necessitates adherence to complex safety standards and environmental regulations, which can take years and substantial investment to navigate. The need for highly skilled labor, often with specific certifications, further compounds the difficulty for new entrants. As of early 2024, the average lead time for obtaining necessary permits in many infrastructure-related sectors can extend from 18 to 36 months, creating a natural moat.

- Significant Capital Investment: New entrants require substantial upfront capital, often in the hundreds of millions of dollars, to build comparable infrastructure or acquire specialized fleets.

- Regulatory Hurdles: Navigating complex and evolving regulatory landscapes, including environmental and safety compliance, acts as a considerable deterrent.

- Specialized Expertise: A deep pool of highly trained and experienced personnel is essential, creating a talent acquisition challenge for potential substitutes.

- Established Relationships: BBP's long-standing relationships with key clients and suppliers, built on trust and a proven track record, are difficult for substitutes to replicate quickly.

Focus on Essential, High-Quality Offerings

Brookfield Business Partners' (BBP) investment strategy heavily relies on acquiring and operating businesses that offer essential products and services. This focus inherently makes substitution less appealing for customers. By consistently providing superior operational performance and demonstrating critical value, these businesses aim to solidify their position, making it difficult for competitors to offer a comparable alternative.

The threat of substitutes for BBP's portfolio companies is mitigated by their core strategy of focusing on indispensable services. This reduces the customer's incentive to explore or switch to alternative solutions. For instance, in 2024, BBP's Facilities Management segment continued to benefit from the essential nature of maintaining critical infrastructure, with many clients demonstrating low churn rates due to the non-discretionary need for these services.

- Essential Services Focus: BBP targets businesses providing non-discretionary goods and services, inherently limiting the appeal of substitutes.

- Operational Excellence: Superior performance and value creation make it harder for competitors to offer compelling alternatives.

- Customer Stickiness: Indispensable offerings foster customer loyalty and reduce the likelihood of switching.

- Reduced Substitution Incentive: The critical nature of BBP's portfolio businesses minimizes customer inclination to seek alternatives.

In sectors like essential utilities, the threat of substitutes for Brookfield Business Partners (BBP) is minimal due to the fundamental nature of these services and the high barriers to entry. These infrastructure assets benefit from a strong competitive position, as few alternatives can match their scale and reliability. The substantial capital investment and regulatory complexities involved further solidify this advantage, making it difficult for substitutes to emerge.

For business services and technology offerings, however, the threat of substitutes is more pronounced. Rapid innovation, particularly in AI and cloud computing, can quickly render existing solutions obsolete. BBP's portfolio companies in these areas must therefore prioritize continuous technological upgrades and service model evolution to remain competitive against disruptive alternatives, a strategy supported by BBP's 2023 focus on operational excellence driving improved margins.

Customers consistently evaluate substitutes based on a cost-benefit analysis, seeking greater value. For instance, advancements in material technology or the rise of distributed renewable energy solutions present clear substitution threats by offering lower costs or enhanced efficiency. BBP's strategy to boost operational and financial performance aims to ensure its offerings remain attractive and resilient against such value-driven competitive pressures.

The essential nature of BBP's portfolio businesses, particularly in industrial and infrastructure domains, inherently limits the appeal of substitutes. Providing indispensable services and demonstrating superior operational performance fosters customer stickiness, reducing the incentive to explore alternatives. In 2024, BBP's Facilities Management segment, for example, continued to see low churn rates due to the non-discretionary need for its services.

Entrants Threaten

Many of Brookfield Business Partners' core sectors, such as infrastructure and heavy industrials, necessitate enormous capital outlays to get off the ground and function effectively. This high financial threshold serves as a substantial deterrent for any new players looking to enter these markets.

For instance, Brookfield's own strategic moves underscore this reality; their acquisition of Chemelex for $1.7 billion and Antylia Scientific for $1.3 billion demonstrate the sheer financial muscle required to even consider competing in these capital-intensive industries.

Brookfield Business Partners (BBP) operates in sectors like infrastructure services and specialized industrials, which are inherently burdened by substantial regulatory requirements. For instance, many utilities and specialized manufacturing processes demand rigorous licensing and ongoing compliance with environmental and safety standards, creating a high barrier for newcomers. These complex regulations can take years and significant capital to navigate, effectively deterring new entrants who lack established expertise and relationships.

Brookfield Business Partners' (BBP) portfolio companies often possess substantial economies of scale, built over years of operation. This allows them to produce goods or services at a lower per-unit cost than potential new entrants. For instance, in the industrial sector, a BBP company with a large, efficient manufacturing facility can significantly undercut the prices of a smaller, newly established competitor.

These established operations also translate into greater efficiency and optimized supply chains. Newcomers would need considerable time and capital investment to build comparable infrastructure and forge the same supplier relationships. This inherent advantage in cost and operational expertise acts as a significant barrier, making it difficult for new players to enter and compete effectively.

The established customer base and brand loyalty enjoyed by BBP's subsidiaries further compound this challenge. A new entrant would not only need to match price and quality but also overcome existing trust and recognition. This established market position, solidified by scale and experience, effectively deters most potential new competition.

Access to Proprietary Technology and Expertise

Brookfield Business Partners' (BBP) acquired entities often hold proprietary technology and specialized expertise that act as significant deterrents to new entrants. This intellectual capital, honed through years of operation and investment, creates a steep learning curve and substantial cost barriers for any company seeking to enter these markets. For example, BBP’s involvement in advanced energy storage leverages unique operational know-how, further solidifying its competitive advantage. In 2024, the global market for advanced battery technology alone was projected to reach hundreds of billions of dollars, underscoring the value of specialized knowledge in this sector.

The difficulty in replicating BBP’s acquired technical capabilities and operational efficiency means new competitors would face considerable challenges in matching existing quality and cost structures. This inherent advantage, often protected by patents or trade secrets, directly limits the threat of new entrants. Such barriers ensure that even with substantial capital, new players struggle to gain a foothold without comparable innovation and experience.

- Proprietary Technology: Acquired businesses may possess unique technological assets, often protected by patents, making replication difficult and costly for new entrants.

- Specialized Know-How: Deep operational expertise and accumulated experience within BBP’s portfolio companies create a significant knowledge gap that new competitors must bridge.

- Intellectual Capital: The combination of technology and expertise forms a strong intellectual capital base, serving as a formidable barrier to entry in the markets BBP operates within.

- Market Share Protection: These barriers effectively protect the market share of BBP’s businesses by making it economically unviable for new, less experienced companies to compete effectively.

Strong Brand Reputation and Established Networks

Brookfield Business Partners (BBP) benefits from the formidable barrier to entry posed by its strong brand reputation and deeply entrenched networks. In sectors like business services and industrials, where trust and established relationships are paramount, new competitors struggle to replicate the loyalty BBP's acquired companies command. For instance, many of BBP's portfolio companies have decades-long customer partnerships, making it exceptionally difficult for new entrants to gain a foothold.

These pre-existing relationships act as a significant deterrent. Newcomers must invest substantial time and resources to build similar levels of trust and connectivity, a process that can take years. BBP’s strategy of acquiring businesses with these established advantages means they often enter markets with an immediate competitive edge.

- Established Brand Loyalty: Many of BBP's acquired businesses boast brand recognition built over decades, fostering customer loyalty that new entrants cannot easily match.

- Intricate Distribution Networks: The complex and long-standing distribution channels of BBP's portfolio companies present a significant hurdle for new players seeking market access.

- Deep Customer Relationships: Long-term, trusted relationships with clients are a hallmark of BBP's acquired operations, creating a high switching cost for customers and a barrier for new competitors.

- Economies of Scale and Scope: BBP's existing operational scale and the synergies among its diverse holdings further solidify its market position, making it challenging for smaller, new entrants to compete effectively on cost or service breadth.

The threat of new entrants for Brookfield Business Partners (BBP) is considerably low, primarily due to the high capital requirements in its core sectors. For example, BBP's infrastructure services often demand billions in upfront investment. Furthermore, stringent regulatory hurdles, such as obtaining licenses for utility operations or adhering to complex environmental standards, necessitate significant time and capital, deterring potential new competitors.

The established economies of scale and proprietary technology within BBP's portfolio companies create a formidable cost advantage. For instance, in 2024, the global advanced manufacturing sector, where BBP has significant holdings, saw companies leveraging automation and specialized processes to achieve per-unit cost reductions of up to 15% compared to less efficient operations. This makes it economically challenging for new entrants to match BBP's pricing and quality.

Additionally, BBP's acquired businesses often benefit from strong brand loyalty and deep-rooted customer relationships, built over years of reliable service. In 2024, customer retention rates for established players in BBP's serviced sectors frequently exceeded 90%, highlighting the difficulty for new entrants to penetrate these markets and build comparable trust and distribution networks.

Here’s a look at some key barriers:

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment needed for infrastructure and operations. | Significant financial hurdle, limiting the pool of potential entrants. |

| Regulatory Hurdles | Complex licensing, compliance, and safety standards. | Time-consuming and costly to navigate, requiring specialized expertise. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to compete on price without comparable output volume. |

| Proprietary Technology & Know-How | Unique operational processes and intellectual property. | Creates a steep learning curve and high replication costs. |

| Brand Loyalty & Networks | Established customer trust and entrenched distribution channels. | Difficult for new players to gain market access and build credibility. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brookfield Business Partners leverages data from Brookfield's investor relations website, financial filings (e.g., 10-K, 10-Q), and reputable financial news outlets. We also incorporate industry-specific market research reports and analyses from firms specializing in infrastructure and business services.