Banco do Brasil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

Uncover the critical political, economic, and technological forces shaping Banco do Brasil's landscape. Our PESTLE analysis provides a deep dive into these external factors, essential for understanding the bank's strategic positioning and future growth. Gain a competitive edge by downloading the full, actionable report today.

Political factors

As a state-controlled entity, Banco do Brasil's strategic direction is significantly shaped by the prevailing government administration and its associated political ideologies. Policy shifts concerning state-owned enterprises, including potential privatization efforts or changes in public sector lending mandates, directly impact the bank's operational priorities and long-term planning. For instance, the Brazilian government's fiscal policies and economic development plans, often announced annually, dictate the environment in which Banco do Brasil operates, influencing its lending targets and investment strategies.

The Brazilian government's stance on financial sector regulation, encompassing capital adequacy, loan restrictions, and consumer safeguards, profoundly influences Banco do Brasil's operational landscape. For instance, the Central Bank of Brazil's ongoing adjustments to Basel III implementation, impacting risk-weighted assets, directly affects the bank's capital planning.

Unforeseen shifts or ambiguity in these regulatory frameworks often compel substantial modifications to the bank's compliance structures and strategic approaches. This necessitates a constant vigilance and agility in responding to evolving legal directives, ensuring continued adherence and operational efficiency.

Brazil's political landscape, while subject to the ebb and flow of electoral cycles and occasional social unrest, has shown resilience in recent years, impacting investor confidence. The effectiveness of its legislative processes in enacting economic reforms is a key determinant of predictability for institutions like Banco do Brasil.

A stable political climate, marked by predictable policy implementation, generally fosters greater foreign direct investment and lowers the perceived sovereign risk for Brazil, which is crucial for a large financial entity. For instance, the successful passage of fiscal reforms in late 2023 aimed at improving the country's debt trajectory was viewed positively by markets.

International Relations and Trade Policies

Brazil's foreign policy and evolving trade agreements significantly shape its economic landscape, directly influencing Banco do Brasil's international operations and cross-border financial activities. For instance, Brazil's participation in the Mercosur trade bloc aims to foster regional economic integration, potentially creating more opportunities for trade finance and expansion within South America. However, shifts in global trade dynamics, such as the renegotiation of trade deals or increased protectionism by major economies, can introduce volatility and affect the volume of international transactions handled by the bank.

The bank's international presence and cross-border business are also sensitive to geopolitical developments and trade disputes involving key partners. For example, as of early 2025, ongoing trade tensions between major global economic powers could indirectly impact commodity prices and investment flows, areas crucial for Banco do Brasil's international client base. Conversely, strengthening diplomatic ties and new bilateral trade agreements, such as those Brazil might pursue with Asian or European nations, could unlock new avenues for international trade finance and investment banking services.

- Mercosur trade volume: In 2023, intra-Mercosur trade reached approximately $70 billion, highlighting the importance of regional agreements for Brazilian businesses and the financial services supporting them.

- Global trade disruptions: The World Trade Organization (WTO) has forecast a slowdown in global trade growth for 2024 and 2025, citing geopolitical uncertainties and protectionist measures as key contributing factors.

- Brazil's trade partners: China remains Brazil's largest trading partner, underscoring the critical nature of bilateral relations and trade policies with Beijing for Banco do Brasil's international business.

- Emerging trade pacts: Brazil's ongoing discussions regarding potential trade agreements with blocs like the European Free Trade Association (EFTA) could open new markets for Brazilian exports and corresponding financial services.

Fiscal Policies and Public Spending

Government fiscal policies, such as budget deficits and public debt management, directly impact interest rates and the overall liquidity within the financial system. These policies, especially those concerning social spending programs, can significantly influence the economic environment in which Banco do Brasil operates.

Banco do Brasil, given its substantial involvement in financing public sector initiatives and its role in executing social programs, is particularly attuned to shifts in these fiscal stances. For instance, a government decision to increase spending on infrastructure projects in 2024 could open up new avenues for lending and business development for the bank.

Conversely, a policy aimed at fiscal consolidation, perhaps through reduced public spending in 2025, might present challenges. This could lead to tighter liquidity conditions and potentially constrain the bank's ability to expand its credit offerings in certain sectors.

- Fiscal Policy Impact: Government budget deficits and debt management strategies directly affect interest rates and liquidity, influencing Banco do Brasil's operating environment.

- Social Spending Sensitivity: Banco do Brasil's significant role in public sector financing and social programs makes it highly sensitive to changes in government spending priorities.

- Lending Opportunities: Increased public spending, such as infrastructure investments planned for 2024, can create new lending opportunities for the bank.

- Potential Constraints: Fiscal consolidation efforts, potentially seen in 2025, could lead to tighter liquidity and constrain credit expansion.

Political stability and government policy are paramount for Banco do Brasil, given its state-controlled nature. Shifts in administration can lead to changes in strategic direction, particularly concerning privatization or public sector lending mandates. For instance, the Brazilian government's economic development plans for 2024-2025 will significantly influence the bank's operational focus and investment strategies.

Regulatory frameworks set by the government and the Central Bank of Brazil directly shape the bank's operations. Adjustments to capital requirements and consumer protection laws, such as ongoing Basel III implementation, necessitate continuous adaptation in Banco do Brasil's compliance and capital planning.

The effectiveness of Brazil's legislative processes in implementing economic reforms is crucial for market predictability. For example, the successful passage of fiscal reforms in late 2023 aimed at improving the country's debt trajectory positively impacted investor confidence, benefiting institutions like Banco do Brasil.

Brazil's foreign policy and trade agreements influence its international operations. Participation in blocs like Mercosur, which saw intra-bloc trade around $70 billion in 2023, fosters regional opportunities, while global trade disruptions forecast by the WTO for 2024-2025 due to geopolitical uncertainties can introduce volatility.

| Political Factor | Impact on Banco do Brasil | Relevant Data/Context (2023-2025) |

| Government Control & Policy Shifts | Directly influences strategic direction and operational priorities. | Brazilian government's economic plans for 2024-2025 will shape lending targets. |

| Financial Sector Regulation | Dictates operational landscape, capital planning, and compliance. | Ongoing Basel III implementation impacts risk-weighted assets and capital needs. |

| Legislative Effectiveness & Reforms | Affects market predictability and investor confidence. | Successful fiscal reforms in late 2023 boosted market confidence. |

| Foreign Policy & Trade Agreements | Shapes international operations and cross-border activities. | Mercosur intra-trade was ~$70 billion in 2023; WTO forecasts trade slowdown for 2024-2025. |

What is included in the product

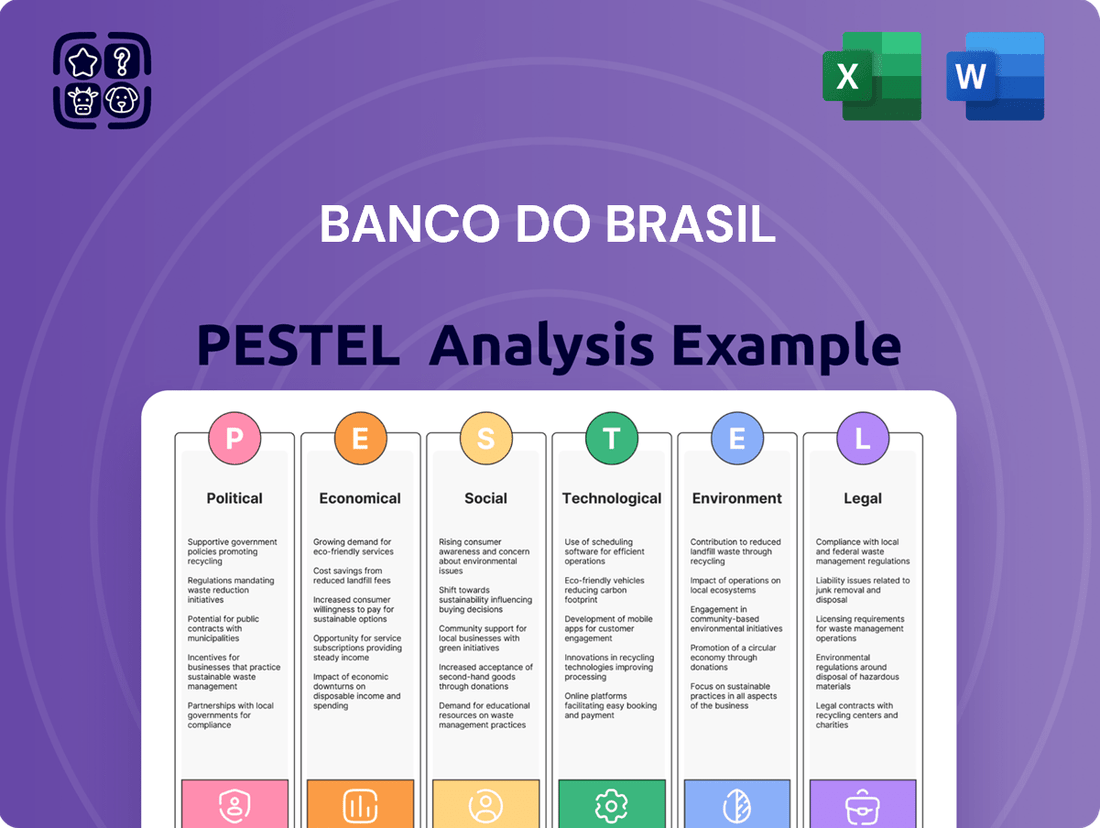

This PESTLE analysis of Banco do Brasil examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive overview of the macro-environmental landscape, highlighting potential challenges and opportunities for the financial institution.

Banco do Brasil's PESTLE analysis offers a clear, summarized version of complex external factors, acting as a pain point reliever by enabling easy referencing during critical meetings and strategic planning.

This analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively relieving the pain point of information overload.

Economic factors

The Central Bank of Brazil's monetary policy, especially its decisions on the SELIC rate, significantly influences Banco do Brasil's profitability. For instance, the SELIC rate stood at 10.50% as of May 2024, a level that affects the bank's lending margins and funding costs. Adjusting to these rates is crucial for the bank's financial health.

Higher interest rates generally increase borrowing costs for both Banco do Brasil and its clients, which can dampen credit demand and slow economic activity. Conversely, lower rates might encourage borrowing but can squeeze the bank's net interest margins. Banco do Brasil must continually refine its strategies and product offerings to align with the prevailing interest rate landscape.

Inflationary pressures in Brazil have remained a key concern. For instance, Brazil's IPCA inflation rate was 4.62% in 2023, a notable decrease from 2022's 5.79%, but still above the central bank's target range. This impacts consumer spending and the real returns on savings, directly affecting demand for credit and investment products offered by Banco do Brasil.

Economic growth prospects for Brazil in 2024 are projected to be moderate, with forecasts suggesting around 2% GDP growth. While this indicates a positive trend, it's a slowdown from the stronger growth observed in previous periods. Such growth levels generally support credit demand and can lead to a healthier loan portfolio for Banco do Brasil, with potentially lower non-performing loan ratios.

However, any significant economic contraction or a scenario of stagflation, characterized by high inflation and low growth, would pose considerable risks. This could translate into increased defaults on loans, negatively impacting Banco do Brasil's profitability and necessitating a more cautious approach to lending and risk management.

Unemployment rates significantly influence Banco do Brasil's financial health. As of early 2024, Brazil's unemployment rate hovered around 7.8%, a notable decrease from previous periods. This trend generally supports increased consumer confidence and spending, which in turn boosts demand for banking services like loans and mortgages. However, even with declining rates, regional disparities and specific sector vulnerabilities can still pose risks to the bank's retail loan portfolio.

Robust consumer spending is a direct driver of Banco do Brasil's revenue. Higher disposable incomes, often correlated with lower unemployment, translate into greater demand for credit products, from personal loans to home financing. For instance, retail credit growth in Brazil saw a healthy expansion in late 2023 and early 2024, reflecting this positive consumer sentiment. The bank's performance is thus intrinsically linked to the spending power and financial stability of Brazilian households.

Exchange Rates and International Trade

Fluctuations in the Brazilian Real (BRL) significantly influence Banco do Brasil's international business. For instance, as of early 2024, the BRL has shown volatility against the US Dollar, impacting the bank's foreign currency-denominated assets and liabilities. A stronger Real generally makes imports more affordable for Brazilian businesses, potentially reducing demand for trade finance services, while a weaker Real can stimulate exports, increasing the need for Banco do Brasil's trade finance solutions.

The bank's corporate clients engaged in international trade are directly exposed to these exchange rate movements. A depreciating Real, for example, can make it more expensive for Brazilian companies to service foreign currency debt, a factor Banco do Brasil must consider in its lending and risk management strategies. Conversely, a stronger Real can improve the purchasing power of Brazilian importers, potentially leading to increased transaction volumes for the bank.

- Impact on International Operations: Banco do Brasil's profitability from overseas branches and subsidiaries is directly affected by the BRL's exchange rate. A stronger BRL can reduce the repatriated value of foreign earnings.

- Trade Finance Dynamics: Exchange rate shifts alter the cost and competitiveness of Brazilian exports and imports, influencing the volume and nature of trade finance products and services Banco do Brasil offers.

- Client Exposure: Corporate clients involved in importing or exporting face direct financial consequences from currency fluctuations, impacting their borrowing needs and financial planning, which in turn affects Banco do Brasil's client relationships and service offerings.

Credit Market Conditions and Competition

The Brazilian credit market in 2024 and early 2025 is characterized by a dynamic interplay of availability, pricing, and competition, directly impacting Banco do Brasil's performance. While credit availability has seen some improvement, particularly for larger corporations, small and medium-sized enterprises (SMEs) may still face tighter conditions. Pricing pressures are evident as both traditional banks and burgeoning fintechs vie for market share, potentially compressing net interest margins.

Competition is fierce, with established players like Itaú Unibanco, Bradesco, and Santander Brazil constantly innovating, while agile fintechs and digital banks are rapidly gaining traction. This necessitates continuous investment in technology and customer experience for Banco do Brasil to maintain its competitive edge. For instance, the digital banking sector has seen substantial growth, with user numbers increasing significantly year-over-year, forcing traditional banks to adapt their service models.

Access to stable and diversified funding remains a critical factor for Banco do Brasil. In a market where interest rates can fluctuate, securing consistent funding at competitive costs is paramount for sustained lending operations and profitability. The bank's ability to tap into various funding sources, including deposits, interbank markets, and capital markets, will be key to navigating the evolving credit landscape.

- Credit Market Health: Brazil's credit market has shown resilience, with overall loan growth projected to be around 8-10% in 2024, though SME lending may lag.

- Competitive Landscape: Fintechs continue to capture market share, particularly in consumer credit and payments, with some digital banks reporting user growth exceeding 20% annually.

- Pricing Pressures: Increased competition has led to a slight compression in average lending rates, especially for prime borrowers, impacting bank profitability.

- Funding Sources: Banco do Brasil relies on a mix of retail deposits, wholesale funding, and securitization to manage its liquidity and funding costs effectively.

Brazil's economic performance in 2024 and early 2025 presents a mixed bag of opportunities and challenges for Banco do Brasil. Moderate GDP growth, projected around 2% for 2024, supports credit demand but signals a slowdown from prior years. Inflation, while easing to 4.62% in 2023, remains a factor influencing consumer spending and the bank's real returns.

The SELIC rate, at 10.50% in May 2024, directly impacts Banco do Brasil's net interest margins and borrowing costs. A declining unemployment rate, around 7.8% in early 2024, bolsters consumer confidence and demand for banking services. However, exchange rate volatility, particularly for the BRL, affects international operations and client exposure to foreign currency debt.

| Economic Factor | Metric | Value/Trend (2023-2025) | Impact on Banco do Brasil |

|---|---|---|---|

| GDP Growth | Annual GDP Growth | ~2% projected for 2024 | Supports credit demand, but slower than previous periods. |

| Inflation | IPCA Inflation Rate | 4.62% in 2023 (down from 5.79% in 2022) | Influences consumer spending and real returns on savings. |

| Interest Rates | SELIC Rate | 10.50% (as of May 2024) | Affects lending margins and funding costs. |

| Unemployment | Unemployment Rate | ~7.8% (early 2024) | Boosts consumer confidence and demand for banking services. |

| Exchange Rate | BRL vs USD | Volatile (early 2024) | Impacts international operations and client FX exposure. |

Same Document Delivered

Banco do Brasil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Banco do Brasil delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain a clear understanding of the external forces shaping the bank's strategic landscape.

Sociological factors

Brazil's population is experiencing significant demographic shifts. The median age has been steadily increasing, with projections indicating a continued trend towards an older population in the coming years. This aging demographic directly impacts financial services, fostering a greater need for retirement planning, pension products, and wealth management solutions. For instance, by 2024, a notable portion of the Brazilian population is expected to be over 60, a segment that typically requires more sophisticated financial advisory services.

Simultaneously, Brazil continues to see strong urbanization, with more people moving to cities. This concentration of population in urban centers fuels demand for accessible and convenient financial services, particularly digital and mobile banking solutions. Younger, urban populations are also more inclined to utilize consumer credit for housing, vehicles, and personal expenses. Banco do Brasil needs to adapt its product offerings to cater to these distinct needs, ensuring its digital platforms are robust and its credit products are competitive for this growing urban demographic.

Consumer preferences are rapidly shifting towards digital banking and personalized experiences. In Brazil, a significant portion of the population, especially younger demographics, now prefers online transactions and mobile banking apps. For instance, by the end of 2024, it's projected that over 75% of banking interactions for major Brazilian banks will occur through digital channels, a trend Banco do Brasil must actively address.

Financial literacy levels play a crucial role in shaping demand for financial products. While a growing segment of Brazilians seeks complex investment options, a substantial portion still requires basic, easily understandable banking services. This duality necessitates a tiered product strategy, offering both sophisticated investment portfolios and accessible savings accounts to cater to diverse financial knowledge bases and drive customer acquisition and retention.

Brazil's persistent income inequality significantly shapes financial behaviors and access to banking. This disparity means Banco do Brasil must cater to a wide spectrum of financial needs, from basic transaction accounts for lower-income individuals to more complex investment products for the affluent.

As a major player in government social programs, Banco do Brasil plays a crucial role in financial inclusion for millions of Brazilians. For instance, the bank has been a key facilitator for Brazil's Bolsa Família program, which aims to alleviate poverty. In 2023, the program reached over 20 million families, highlighting the bank's direct connection to a substantial portion of the population with lower disposable incomes.

Banco do Brasil's strategic planning must therefore prioritize financial literacy initiatives and accessible digital banking solutions to effectively serve its diverse customer base. Understanding the evolving landscape of social welfare, such as potential adjustments to government aid programs, is also vital for maintaining customer loyalty and expanding market share.

Trust in Financial Institutions

Public trust is a cornerstone of financial sector stability, directly impacting customer loyalty and adoption of new services. For instance, a 2024 survey indicated that only 45% of Brazilians expressed high confidence in their primary financial institutions, a slight dip from the previous year, highlighting the ongoing need for reassurance. Events that shake this confidence, like the fallout from the 2023 banking sector turbulence in other global markets, can cause significant customer attrition and invite stricter regulatory oversight.

Banco do Brasil, as a major player, must actively cultivate and preserve public trust through unwavering transparency and ethical conduct. This involves clear communication about its financial health and operational procedures.

- Customer Confidence: A 2024 study showed that 45% of Brazilians have high trust in their main banks.

- Impact of Scandals: Financial scandals or economic downturns can lead to a 10-15% increase in customer churn.

- Regulatory Scrutiny: Low trust can trigger enhanced regulatory reviews and compliance demands.

- Banco do Brasil's Role: Maintaining transparency is key for customer retention and market stability.

Cultural Attitudes towards Debt and Savings

Cultural attitudes toward debt and savings play a crucial role in shaping financial behaviors in Brazil. Historically, there's been a strong emphasis on saving for future security, a trend that continues to influence consumer choices. For instance, a 2024 survey indicated that over 60% of Brazilians prioritize saving a portion of their income, even amidst economic fluctuations.

This inclination towards saving can directly benefit Banco do Brasil by increasing its deposit base, providing more capital for lending activities. Conversely, a growing comfort with credit, particularly among younger demographics, fuels demand for consumer loans and financing products. Understanding these evolving cultural nuances is vital for Banco do Brasil to tailor its marketing strategies and manage the associated credit risks effectively.

Key cultural influences include:

- Emphasis on family and community support: This often translates into a preference for personal savings to assist relatives rather than relying solely on credit for immediate needs.

- Perception of debt: While debt is increasingly accepted for major purchases like housing, a lingering cultural caution exists regarding high-interest consumer debt.

- Influence of social media and peer behavior: Younger generations are more exposed to globalized financial trends, potentially influencing their attitudes towards borrowing and investment.

- Trust in established financial institutions: A long-standing cultural reliance on traditional banks like Banco do Brasil for savings and investment guidance remains significant.

Brazil's demographic shifts, including an aging population and increasing urbanization, present both opportunities and challenges for Banco do Brasil. The growing elderly segment demands more retirement and wealth management services, while urban centers drive demand for digital and accessible banking. These trends necessitate a strategic focus on digital platforms and tailored credit products to meet diverse consumer needs.

Consumer preferences are increasingly leaning towards digital interactions, with a significant portion of banking activities expected to occur online by the end of 2024. This shift underscores the need for robust mobile banking solutions and personalized digital experiences. Financial literacy levels also vary widely, requiring Banco do Brasil to offer a tiered product strategy, catering to both basic banking needs and sophisticated investment options.

Income inequality continues to shape financial behaviors, with Banco do Brasil needing to serve a broad spectrum of clients, from those requiring basic transaction accounts to the affluent seeking complex investments. As a key facilitator of government social programs like Bolsa Família, which supported over 20 million families in 2023, the bank plays a vital role in financial inclusion.

Public trust is paramount, with a 2024 survey indicating only 45% of Brazilians have high confidence in their primary financial institutions. Maintaining transparency and ethical conduct is crucial for customer retention and market stability, especially given the potential impact of global financial events on local confidence. Cultural attitudes towards savings remain strong, with over 60% of Brazilians prioritizing saving, which benefits the bank's deposit base.

| Sociological Factor | Trend/Observation | Implication for Banco do Brasil |

|---|---|---|

| Demographics | Aging population; increasing urbanization | Demand for retirement/wealth management; growth in digital/mobile banking |

| Consumer Behavior | Preference for digital banking; varying financial literacy | Need for robust digital platforms; tiered product offerings |

| Income Inequality | Significant income disparity | Serve diverse needs from basic accounts to complex investments |

| Financial Inclusion | Role in social programs (e.g., Bolsa Família) | Facilitate access for lower-income segments |

| Public Trust | 45% high confidence (2024); need for transparency | Cultivate trust through ethical conduct and clear communication |

| Cultural Attitudes | Strong savings culture; evolving view on debt | Benefit from deposit growth; tailor credit product marketing |

Technological factors

Banco do Brasil is navigating a landscape where digital transformation is paramount. In 2024, the Brazilian financial sector saw continued growth in digital banking adoption, with an estimated 70% of transactions occurring through digital channels. This trend demands ongoing investment in robust IT infrastructure and user-friendly digital platforms.

The bank faces significant competition from nimble fintech companies and challenger banks, many of whom launched innovative digital offerings throughout 2024. For instance, Pix, Brazil's instant payment system, facilitated over 42 billion transactions in 2024, highlighting the demand for seamless digital payment solutions. Banco do Brasil must therefore accelerate its own digital initiatives, focusing on enhancing its mobile banking app, streamlining online account opening processes, and expanding its digital payment capabilities to maintain market share.

As financial transactions increasingly move online, Banco do Brasil faces elevated risks from cyberattacks, data breaches, and fraud. In 2023, Brazil saw a significant increase in cybercrime incidents, with financial institutions being prime targets. For instance, phishing attacks and ransomware attempts continue to be prevalent threats, impacting customer confidence and operational continuity.

Robust cybersecurity measures and strict adherence to data privacy regulations are paramount to protect customer information and maintain trust. Banco do Brasil, like other major financial institutions, must comply with LGPD (Lei Geral de Proteção de Dados), Brazil's comprehensive data privacy law. Failure to comply can result in substantial fines and reputational damage.

Continuous investment in security technologies and employee training is essential to mitigate these evolving threats and comply with regulatory requirements. In 2024, the bank is expected to allocate a significant portion of its IT budget towards advanced threat detection systems, encryption technologies, and ongoing cybersecurity awareness programs for its staff to counter sophisticated cyber threats.

Banco do Brasil is actively integrating AI and automation to streamline its operations. For instance, AI-powered chatbots are handling an increasing volume of customer inquiries, freeing up human agents for more complex issues. This technological shift is crucial for efficiency gains, with the global banking sector expected to save billions through automation by 2025.

The bank is also exploring AI for enhanced fraud detection and more accurate credit risk assessments, which are vital in today's financial landscape. While these advancements promise cost reductions and improved customer service, Banco do Brasil must also address the implications for its workforce, focusing on reskilling and upskilling employees for new roles in an increasingly automated environment.

Mobile Banking Adoption

The increasing prevalence of smartphones and robust internet connectivity in Brazil directly fuels the demand for advanced mobile banking solutions. Banco do Brasil needs to ensure its mobile offerings are not just comprehensive but also intuitive and secure, covering everything from basic transactions to more complex financial activities like investment management and loan processing.

A key technological factor is the continued growth in mobile banking adoption. For instance, by the end of 2023, Brazil saw a significant surge in digital banking users, with many actively utilizing mobile apps for their financial needs. This trend is projected to continue accelerating through 2024 and into 2025.

- Smartphone Penetration: Brazil's smartphone penetration rate reached approximately 75% by late 2023, providing a vast user base for mobile banking services.

- Digital Transactions: In 2024, it's estimated that over 60% of all banking transactions in Brazil are conducted digitally, with a substantial portion via mobile.

- User Experience: A superior mobile banking experience is paramount for attracting and retaining customers, particularly younger, tech-savvy demographics who expect seamless and efficient digital interactions.

Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLT) offer significant potential to transform core banking operations. For Banco do Brasil, this includes streamlining cross-border payments and enhancing the security and transparency of trade finance processes. By 2024, the global blockchain in banking market was projected to reach over $1.5 billion, indicating growing industry adoption.

Exploring DLT for digital identity verification could also bolster security and customer onboarding efficiency. While widespread implementation is ongoing, pilot programs in 2024 and 2025 are crucial for Banco do Brasil to assess benefits like reduced transaction times and costs. These advancements could unlock new product development and strategic partnerships within the financial ecosystem.

- Enhanced Security: DLT's cryptographic nature can significantly improve data integrity and reduce fraud risks in banking transactions.

- Operational Efficiency: Automating processes through smart contracts on blockchain platforms can lead to faster settlement times and lower operational costs.

- New Revenue Streams: Developing innovative financial products leveraging blockchain, such as tokenized assets or improved trade finance solutions, can create new income opportunities.

- Regulatory Compliance: DLT can provide immutable audit trails, potentially simplifying regulatory reporting and compliance efforts.

Banco do Brasil must continually innovate its digital offerings to meet evolving customer expectations and stay ahead of competitors. With over 70% of Brazilian financial transactions occurring digitally in 2024, the bank's investment in user-friendly mobile platforms and robust IT infrastructure is critical. The widespread adoption of Pix, which saw over 42 billion transactions in 2024, underscores the demand for seamless digital payment solutions.

The bank's strategic focus on AI and automation is essential for operational efficiency and enhanced customer service. AI-powered chatbots are already handling a significant volume of customer inquiries, and the bank is exploring AI for improved fraud detection and credit risk assessment. These technological advancements are vital for cost reduction and competitive advantage in the global banking sector, which is projected to save billions through automation by 2025.

Furthermore, the increasing smartphone penetration in Brazil, reaching approximately 75% by late 2023, necessitates a strong mobile banking presence. Banco do Brasil needs to ensure its mobile applications are intuitive, secure, and offer comprehensive services, catering to the growing segment of digitally active consumers who expect efficient and accessible financial management tools.

| Technology Area | 2024/2025 Focus | Impact/Opportunity |

|---|---|---|

| Digital Banking | Enhancing mobile app, streamlining online processes | Increased customer acquisition and retention, improved transaction efficiency |

| AI & Automation | Chatbots, fraud detection, credit risk assessment | Cost savings, improved customer service, better risk management |

| Cybersecurity | Advanced threat detection, data encryption, employee training | Mitigating fraud risks, protecting customer data, maintaining trust |

| Blockchain/DLT | Exploring for payments, trade finance, digital identity | Enhanced security, operational efficiency, potential new revenue streams |

Legal factors

Banco do Brasil navigates a stringent regulatory landscape overseen by the Central Bank of Brazil. Key among these are capital adequacy ratios, with the bank adhering to Basel III standards, which mandate specific levels of capital relative to risk-weighted assets. As of the first quarter of 2024, Banco do Brasil reported a Common Equity Tier 1 (CET1) ratio of 13.5%, comfortably above the regulatory minimums, demonstrating its strong capital position.

Brazilian consumer protection laws, notably the Consumer Defense Code, significantly shape Banco do Brasil's customer interactions. These regulations mandate transparency in product offerings, fair dispute resolution processes, and ethical lending practices, directly impacting the bank's operations and customer trust.

Compliance with these stringent consumer protection measures is paramount for Banco do Brasil to circumvent substantial fines, protect its brand reputation, and prevent costly legal battles. In 2023, Brazil's National Consumer Secretariat (SENACON) reported a notable increase in consumer complaints across various sectors, underscoring the critical importance of robust adherence to these legal frameworks.

Banco do Brasil operates under stringent anti-money laundering (AML) and Know Your Customer (KYC) regulations designed to thwart financial crime. This necessitates the bank's commitment to robust customer due diligence, diligent transaction monitoring, and prompt reporting of any suspicious activities.

Failure to adhere to these regulations can result in substantial penalties, including significant financial fines and considerable damage to the bank's reputation. Consequently, continuous investment in compliance technology and employee training is paramount for Banco do Brasil to maintain regulatory adherence and safeguard its standing in the financial market.

Data Protection Laws (e.g., LGPD in Brazil)

Brazil's Lei Geral de Proteção de Dados (LGPD), enacted in 2020, significantly impacts how Banco do Brasil handles customer information. The bank must adhere to strict rules regarding data collection, processing, storage, and sharing, ensuring robust data security measures are in place. Failure to comply with LGPD, which mirrors aspects of GDPR, can lead to substantial penalties, with fines potentially reaching up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction. This necessitates a strong data governance framework to protect customer privacy and maintain trust.

Banco do Brasil's compliance efforts with LGPD involve respecting data subject rights, such as the right to access, rectify, and delete personal data. The bank must also ensure clear consent mechanisms for data processing and implement timely data breach notification procedures to the National Data Protection Authority (ANPD) and affected individuals. Navigating cross-border data transfer rules is also a critical component, requiring careful consideration of data protection standards in other jurisdictions.

The financial implications of non-compliance are considerable. Beyond direct fines, reputational damage and loss of customer trust can have long-term detrimental effects on Banco do Brasil's operations and market position. For instance, a significant data breach could lead to a substantial drop in customer confidence, impacting deposit levels and loan origination. Therefore, investing in comprehensive data protection strategies and ongoing training for employees is paramount for the bank's continued success and regulatory adherence.

Taxation Policies for Financial Institutions

Changes in Brazil's tax legislation, such as adjustments to corporate income tax rates and the financial transaction tax (IOF), directly influence Banco do Brasil's profitability and strategic financial planning. For instance, the Brazilian government has periodically reviewed tax incentives and rates impacting financial institutions, necessitating ongoing adaptation of the bank's operations to remain competitive and compliant. The bank's ability to manage its tax obligations effectively is crucial for maintaining healthy profit margins.

Banco do Brasil must remain vigilant and adaptable to evolving tax policies. For example, any significant increase in corporate income tax or specific banking levies could directly reduce the bank's net income. Conversely, favorable tax reforms, such as reductions in financial transaction taxes, could boost its earnings. The bank's financial strategy must therefore incorporate robust tax planning to optimize its overall tax burden within the prevailing legal framework.

The bank’s financial performance is intrinsically linked to the tax environment. Key considerations include:

- Corporate Income Tax (IRPJ): Fluctuations in the IRPJ rate directly impact Banco do Brasil's bottom line. For example, a higher rate means less retained earnings.

- Financial Transaction Tax (IOF): Changes to IOF rates on credit operations, foreign exchange, or insurance affect the cost of financial products and services offered by the bank.

- Other Sector-Specific Levies: Additional taxes or contributions targeting the financial sector can increase operational costs.

- Tax Reform Impact: Ongoing discussions and potential implementation of broader tax reforms in Brazil, such as those aimed at simplifying or increasing tax collection from financial institutions, require continuous monitoring and strategic adjustment by Banco do Brasil.

Banco do Brasil operates under a complex web of Brazilian laws, including stringent data protection regulations like the LGPD. Failure to comply with LGPD, which governs how customer data is collected and processed, can lead to significant fines, potentially up to 2% of revenue, capped at R$50 million per infraction. The bank's commitment to data security and privacy is therefore critical for maintaining customer trust and avoiding financial penalties.

Environmental factors

Banco do Brasil faces mounting pressure from investors, regulators, and the public to bolster its Environmental, Social, and Governance (ESG) performance. This push is driving the bank to embed ESG considerations into its core operations, from risk management and lending practices to investment strategies. For instance, in 2023, the bank continued to expand its sustainable finance portfolio, aiming to reach R$150 billion in credit for sustainable activities by 2030, demonstrating a tangible commitment to these evolving expectations.

The bank is also tasked with providing transparent and comprehensive reporting on its sustainability efforts, a crucial step in building trust and attracting capital. This includes detailed disclosures on climate risk, social impact, and corporate governance. A strong ESG track record, evidenced by improved ratings from agencies like Sustainalytics, is increasingly seen as a key differentiator, enhancing Banco do Brasil's reputation and its ability to attract responsible investment flows, which are becoming a significant part of the global financial landscape.

Banco do Brasil faces significant climate change risks, including physical damage to assets from extreme weather and transition risks arising from new environmental regulations impacting borrowers. For instance, the bank must consider how drought conditions in Brazil, which intensified in 2023 and early 2024, could affect agricultural loan portfolios.

Conversely, climate change presents substantial opportunities for Banco do Brasil, particularly in financing the transition to a low-carbon economy. The bank is actively involved in green finance initiatives, aiming to support renewable energy projects and sustainable agriculture.

In 2024, Banco do Brasil committed to increasing its portfolio for sustainable business, with a target of R$100 billion by 2030, reflecting a strategic shift towards environmental, social, and governance (ESG) principles. This includes rigorous assessment of the carbon footprint of financed activities, ensuring alignment with national climate goals and international best practices.

Banco do Brasil is actively expanding its sustainable finance portfolio, responding to a global and national drive for environmentally conscious financial products. This includes a growing emphasis on green loans and sustainable bonds, reflecting a commitment to supporting eco-friendly projects. For instance, in 2023, the bank reported a significant increase in its green financing operations, reaching R$ 20.5 billion, a 35% rise compared to the previous year.

The bank's involvement in initiatives promoting responsible resource management is also a key strategy. This not only bolsters its brand image among environmentally aware customers and investors but also directly supports Brazil's national development goals. By facilitating investments in renewable energy and sustainable agriculture, Banco do Brasil positions itself as a leader in aligning financial growth with environmental stewardship.

Reputational Risks Related to Environmental Impact

Banco do Brasil confronts significant reputational risks if its financing activities are perceived as contributing to environmental damage, particularly through investments in projects associated with deforestation or pollution. Negative public perception can directly impact its market standing, potentially leading to consumer boycotts and a withdrawal of investor capital, as seen in increased scrutiny of financial institutions' environmental, social, and governance (ESG) performance.

In 2023, for instance, global ESG investment funds saw significant inflows, with investors increasingly prioritizing sustainability. A failure to align with these expectations could result in divestment, impacting Banco do Brasil's access to capital and increasing its cost of funding. This scrutiny is amplified by watchdog groups and media attention, which can quickly disseminate negative information.

To mitigate these risks, a robust environmental track record and open communication about sustainability initiatives are paramount. Banco do Brasil's commitment to sustainable finance, including its targets for reducing financed emissions and increasing green financing, directly addresses these concerns. For example, its 2025 sustainability targets aim to further integrate ESG principles into its credit analysis and investment strategies.

- Reputational Damage: Negative association with environmentally harmful projects can erode public trust and brand loyalty.

- Investor Divestment: ESG-focused investors may withdraw capital, impacting share price and access to funding.

- Regulatory Scrutiny: Increased environmental regulations can lead to fines and operational restrictions if compliance is not maintained.

- Social License to Operate: Maintaining a positive public image is crucial for continued business operations and stakeholder acceptance.

Resource Scarcity and Operational Efficiency

Resource scarcity, particularly concerning water and energy, is increasingly influencing operational strategies for institutions like Banco do Brasil. The bank is motivated to enhance its internal operational efficiency through more sustainable practices. This involves actively reducing energy consumption across its extensive branch network and streamlining waste management processes. Furthermore, promoting digital banking services plays a key role in minimizing paper usage, contributing to both environmental stewardship and potential cost reductions.

These sustainability initiatives directly impact Banco do Brasil's operational resilience and financial performance. For instance, a focus on energy efficiency can lead to tangible savings; in 2023, a significant portion of operational expenses for major banks were tied to energy and facility management. By digitizing processes, Banco do Brasil can expect to see a reduction in material costs and improved workflow efficiency, aligning with broader environmental, social, and governance (ESG) objectives that are becoming critical for investor confidence and long-term value creation.

- Energy Consumption Reduction: Efforts to lower electricity usage in branches directly cut operational costs.

- Waste Management Optimization: Improved recycling and disposal practices reduce environmental impact and associated fees.

- Digital Process Adoption: Minimizing paper usage through digital channels lowers material costs and enhances efficiency.

- Operational Resilience: Sustainable practices contribute to a more robust and adaptable business model.

Banco do Brasil is increasingly focused on mitigating climate-related risks, such as extreme weather events impacting its loan portfolios, particularly in agriculture. The bank is also actively pursuing opportunities in green finance, aiming to support renewable energy and sustainable agriculture projects, reflecting a strategic shift towards ESG principles.

The bank's commitment to sustainable finance is evident in its growing green portfolio. For instance, in 2023, Banco do Brasil reported R$20.5 billion in green financing operations, a 35% increase from the prior year. This aligns with national climate goals and international best practices, with a target of R$100 billion for sustainable business by 2030.

| Environmental Factor | Impact on Banco do Brasil | Key Initiatives/Data (2023-2025) |

| Climate Change Risks | Physical damage to assets, increased loan defaults (e.g., drought in agricultural sectors). | Continued monitoring of drought impacts on agricultural loan portfolios; increased focus on climate risk assessment in lending. |

| Climate Change Opportunities | Growth in green finance, renewable energy, and sustainable agriculture sectors. | Expansion of sustainable finance portfolio; R$20.5 billion in green operations in 2023 (35% YoY increase). Target of R$100 billion by 2030. |

| Resource Scarcity | Operational efficiency pressures, potential cost increases. | Enhancing internal operational efficiency through sustainable practices, reducing energy consumption and waste. Promoting digital banking to minimize paper usage. |

| Regulatory & Public Pressure | Need for robust ESG reporting, reputational risks from non-compliance. | Increased transparency in sustainability reporting; strong ESG ratings are crucial for attracting capital. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Banco do Brasil is meticulously crafted using data from official Brazilian government agencies, international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental forces impacting the bank.