Banco do Brasil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

Banco do Brasil navigates a complex banking landscape, facing moderate bargaining power from buyers and suppliers, while the threat of new entrants and substitutes is significant due to technological advancements and fintech disruption. Intense rivalry among established players further shapes its competitive environment.

The complete report reveals the real forces shaping Banco do Brasil’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Banco do Brasil's reliance on technology, from digital banking platforms to advanced cybersecurity, means technology providers hold significant sway. For highly specialized or proprietary solutions, their bargaining power can lean towards moderate to high, influencing costs and implementation timelines.

However, the sheer scale of Banco do Brasil, a major financial institution in Latin America, coupled with its internal IT development and training initiatives like UniBB, provides a degree of leverage. This internal capacity can reduce dependence on single vendors for certain functionalities and potentially negotiate more favorable terms.

The bargaining power of suppliers in human capital for Banco do Brasil is significantly influenced by the demand for specialized skills. Professionals adept in digital transformation, artificial intelligence, and data analytics are in high demand across the financial sector. This scarcity, coupled with the rapid evolution of technology, grants these skilled employees considerable leverage.

In 2024, the competition for top tech talent in Brazil's financial industry intensified, with reports indicating salary increases of up to 20% for AI and data science roles. This trend directly impacts Banco do Brasil's ability to attract and retain key personnel, as these professionals can command higher compensation and better benefits from competitors.

While individual depositors are numerous, their collective bargaining power is somewhat diluted. However, large institutional investors and international funding markets wield significant influence over Banco do Brasil’s cost of capital. For instance, in 2024, Brazil’s benchmark interest rate, the Selic rate, fluctuated, directly impacting the attractiveness of deposits and other funding instruments, requiring Banco do Brasil to remain competitive.

Infrastructure and Utilities

Banco do Brasil relies heavily on infrastructure and utility providers, such as telecommunications and electricity, for its vast network of branches and digital services. The bargaining power of these suppliers is generally moderate, influenced by the availability of alternative providers and the specific regulatory environment in Brazil.

For instance, while the telecommunications sector in Brazil has seen increased competition, certain essential services might still exhibit concentrated supplier power. In 2023, Brazil's telecommunications market revenue reached approximately R$170 billion, indicating a substantial spend by companies like Banco do Brasil. The banking sector's reliance on stable and high-speed internet connectivity means that disruptions or significant price increases from telecom providers could impact operational efficiency and customer service.

- Telecommunications: Essential for branch operations, ATMs, and online banking platforms. Competition among providers can moderate their power.

- Electricity: Crucial for powering all physical locations and data centers. The reliability and cost of electricity are key considerations.

- Physical Infrastructure: This includes building maintenance and security services, which are necessary for the bank's physical presence.

- Regulatory Impact: Government regulations in Brazil can influence the pricing and service quality of utility providers, thereby affecting their bargaining power.

Regulatory Bodies and Government

Regulatory bodies, such as the Central Bank of Brazil, significantly influence Banco do Brasil's operations. These entities, while not direct suppliers in the traditional sense, impose stringent rules and capital requirements that shape the bank's strategic decisions and operational costs. For instance, the Central Bank's monetary policy decisions directly impact lending rates and the overall financial environment in which Banco do Brasil operates.

The bargaining power of regulatory bodies stems from their ability to levy fines, impose sanctions, or even restrict operations for non-compliance. In 2024, the Central Bank of Brazil continued its focus on financial stability, implementing measures that directly affected banks' risk management frameworks and capital adequacy ratios. Banco do Brasil, like its peers, must allocate resources to ensure adherence to these evolving regulations.

- Regulatory Oversight: Banco do Brasil is subject to the Central Bank of Brazil's comprehensive regulatory framework, impacting its business model.

- Compliance Costs: Adherence to regulations necessitates investment in technology, personnel, and processes, adding to operational expenses.

- Strategic Constraints: Regulatory directives can limit the types of financial products offered or the markets in which the bank can operate.

- Financial Stability Mandate: The Central Bank's role in maintaining economic stability indirectly influences Banco do Brasil's profitability and risk exposure.

Banco do Brasil's bargaining power with suppliers is influenced by its scale and internal capabilities, particularly in technology and human capital. While specialized tech providers and highly sought-after talent can exert moderate to high influence, the bank's investment in its own IT development and training programs, like UniBB, offers a counterbalancing leverage. This internal strength helps mitigate dependence on external sources and supports negotiation for better terms, especially as competition for skilled professionals intensified in 2024, driving salary increases in key areas like AI.

The bank's reliance on infrastructure and utilities, such as telecommunications and electricity, presents a moderate supplier bargaining power scenario. Increased competition within Brazil's telecom sector, which generated approximately R$170 billion in revenue in 2023, helps temper the power of these essential service providers. However, the critical need for stable connectivity means that disruptions or significant price hikes from these suppliers can still impact Banco do Brasil's operational efficiency and customer service delivery.

Regulatory bodies, like the Central Bank of Brazil, exert considerable influence, acting as powerful entities that shape Banco do Brasil's strategic decisions and operational costs. Their ability to impose sanctions or restrict operations for non-compliance means the bank must continually invest in robust risk management and adherence to evolving directives, as seen in 2024's focus on financial stability measures.

| Supplier Category | Influence Level | Key Factors | 2024 Context/Data |

|---|---|---|---|

| Technology Providers | Moderate to High | Specialized/proprietary solutions, bank's internal IT capacity | Intensified competition for AI/data talent, up to 20% salary increases reported. |

| Human Capital (Skilled Talent) | High | Demand for digital transformation, AI, data analytics skills | High demand for specialized skills, impacting recruitment and retention costs. |

| Infrastructure & Utilities | Moderate | Availability of alternatives, regulatory environment, sector competition | Telecom sector revenue ~R$170 billion (2023); reliance on stable connectivity. |

| Regulatory Bodies | High | Enforcement powers, capital requirements, monetary policy | Central Bank's focus on financial stability, impacting risk management frameworks. |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Banco do Brasil, while assessing the threat of substitutes and the bargaining power of buyers and suppliers.

A clear, one-sheet summary of all five forces for Banco do Brasil—perfect for quickly assessing competitive pressures and strategic positioning.

Customers Bargaining Power

The bargaining power of individual retail customers at Banco do Brasil is typically quite low. This is largely because there are so many customers, and most banking services, like checking accounts or basic loans, are pretty similar across different institutions. This makes it hard for any single customer to have much sway.

However, the banking landscape has shifted. The widespread adoption of digital platforms and payment systems like Pix in Brazil has significantly lowered the effort and cost for customers to switch banks. For instance, in 2023, Pix transactions in Brazil reached an astounding 10.7 billion, demonstrating its massive integration into daily financial life, which directly impacts customer loyalty and gives them more leverage.

Large corporate clients and businesses wield considerable bargaining power with Banco do Brasil. Their substantial transaction volumes and need for sophisticated financial products allow them to negotiate favorable terms, potentially impacting Banco do Brasil's profitability.

In 2023, Banco do Brasil reported a net income of R$31.8 billion, with a significant portion attributed to its corporate banking segment. This segment's ability to demand tailored services and competitive pricing underscores the bargaining power of these key clients.

Government entities, as significant clients for Banco do Brasil, wield considerable bargaining power due to the sheer volume of public sector transactions. In 2024, Brazil's federal government, a key client, managed a budget exceeding R$6 trillion, indicating the substantial financial flows Banco do Brasil handles for public services and investments.

The potential for large-scale, long-term contracts with government bodies means these entities can negotiate favorable terms, impacting Banco do Brasil's profitability on these relationships. For instance, contracts related to social programs or infrastructure financing often involve extensive due diligence and competitive bidding processes, allowing governments to secure advantageous pricing and service conditions.

Fintech Users

Fintech users, including those engaging with digital banks and payment platforms, exert significant bargaining power over traditional financial institutions like Banco do Brasil. By offering competitive interest rates, reduced fees, and superior digital experiences, these fintech alternatives provide customers with readily available substitutes, compelling established banks to enhance their own offerings.

This shift in customer behavior is evident in the rapid adoption of digital financial services. For instance, by the end of 2023, Brazil saw over 100 million digital accounts opened, with fintechs playing a substantial role in this growth. This increasing reliance on fintech solutions means customers can easily switch providers if they find better value elsewhere.

- Increased Competition: The proliferation of fintechs and digital banks intensifies competition, giving customers more choices and thus more leverage.

- Price Sensitivity: Fintechs often attract customers with lower fees and more competitive rates, making users more sensitive to pricing from traditional banks.

- Digital Experience Expectations: Users accustomed to seamless digital interfaces from fintechs expect similar or better experiences from incumbent banks, raising the bar for service quality.

- Switching Costs: While historically high, switching costs for banking services are decreasing due to improved interoperability and user-friendly onboarding processes offered by fintechs.

Customers Leveraging Open Banking/Finance

The expansion of Open Banking and Open Finance in Brazil significantly bolsters customer bargaining power. This framework allows consumers to easily share their financial data, facilitating seamless comparison and switching between banks and financial institutions. For instance, by mid-2024, a substantial portion of Brazilian consumers had already initiated the sharing of their financial data, driven by the desire for better rates and services.

This increased transparency and reduced switching costs empower customers to demand more competitive offerings from incumbent players like Banco do Brasil. They can readily access personalized financial products and services from a wider array of providers, forcing existing institutions to innovate and offer more attractive terms to retain their customer base.

- Increased Data Portability: Customers can easily move their transaction history and personal financial information, reducing the effort required to switch providers.

- Enhanced Price Transparency: Open Banking facilitates direct comparison of fees, interest rates, and product features across multiple financial institutions.

- Demand for Better Value: Consumers are more likely to switch for even marginal improvements in service or cost, pressuring banks to offer competitive pricing and superior customer experiences.

- Access to New FinTech Solutions: Customers can leverage innovative FinTech apps that aggregate financial services, further increasing their options and bargaining leverage.

The bargaining power of customers with Banco do Brasil is influenced by several factors, including the rise of fintechs, the implementation of Open Finance, and the specific segment of the customer base. While individual retail customers have limited individual power, collective action and the availability of alternatives significantly increase their leverage.

The digital transformation and regulatory changes in Brazil have undeniably shifted the balance. Customers now have unprecedented access to information and alternative financial service providers, forcing traditional banks like Banco do Brasil to remain competitive in pricing and service quality.

For instance, the sheer volume of Pix transactions, reaching 10.7 billion in 2023, highlights how ingrained digital payment systems are, making it easier for customers to switch providers if they find better terms. Similarly, the over 100 million digital accounts opened by the end of 2023, many facilitated by fintechs, demonstrates a clear trend towards greater customer mobility and choice.

Corporate clients and government entities, due to their substantial transaction volumes and strategic importance, continue to hold significant bargaining power, enabling them to negotiate more favorable terms for their extensive financial dealings with Banco do Brasil.

What You See Is What You Get

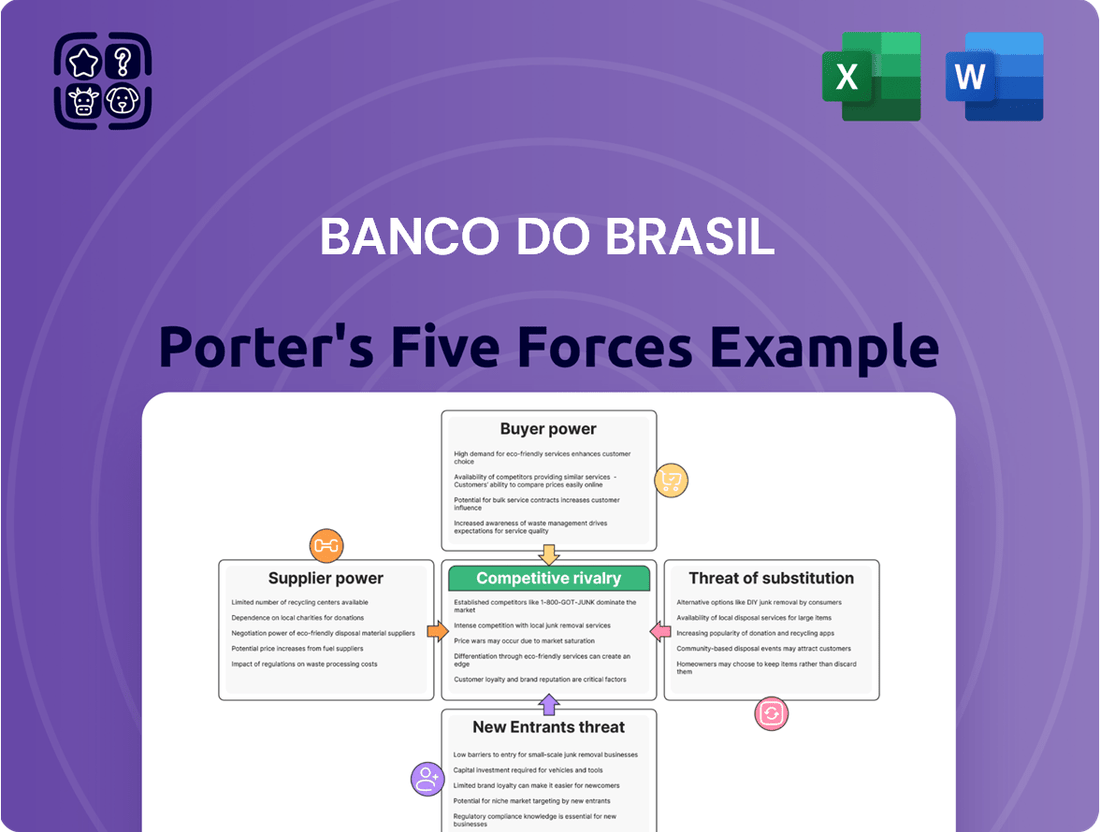

Banco do Brasil Porter's Five Forces Analysis

This preview shows the exact Banco do Brasil Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the Brazilian banking sector. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, all detailed within this complete document.

Rivalry Among Competitors

Banco do Brasil faces formidable competition from major domestic players like Itaú Unibanco and Bradesco, which are equally entrenched in the Brazilian financial landscape. These rivals actively vie for market share across retail, corporate, and investment banking sectors, leveraging their widespread branch presence and advanced digital platforms.

Digital banks and fintechs are intensely competing with traditional institutions like Banco do Brasil in Brazil. Companies such as Nubank, Banco Inter, and C6 Bank are aggressively acquiring customers with streamlined digital offerings and competitive pricing. By mid-2024, these challengers had amassed millions of customers, significantly impacting market share for established players.

The rapid expansion of instant payment systems like Pix in Brazil has significantly heightened competitive pressures within the financial sector. This innovation has diminished customer loyalty to traditional banking payment methods, compelling institutions like Banco do Brasil to adapt swiftly.

As of late 2023, Pix transactions in Brazil had already surpassed 16 billion, demonstrating its overwhelming user adoption and impact on transaction volumes. This surge necessitates banks to not only integrate Pix seamlessly but also to explore alternative revenue streams beyond traditional payment fees.

International Banks and Foreign Investment

The competitive rivalry among international banks and foreign investment in Brazil is intensifying. While the Brazilian banking sector was once dominated by a few large domestic players, recent regulatory shifts, including the simplification of foreign investment procedures, are paving the way for increased participation from global financial institutions. This trend is expected to heighten competition for Banco do Brasil.

International banks bring substantial capital, advanced technological capabilities, and diverse product offerings, directly challenging incumbent banks. For instance, as of early 2024, several foreign banks have been actively expanding their operations or exploring new ventures in Brazil, attracted by the country's large consumer base and developing financial markets. This influx can lead to more aggressive pricing strategies and innovative service delivery.

- Increased Foreign Direct Investment: Brazil saw significant growth in foreign direct investment in its financial services sector in recent years, indicating a strong appetite from international players.

- Technological Advancements: Global banks are introducing sophisticated digital platforms and fintech solutions, forcing local banks to accelerate their own digital transformation efforts.

- Market Share Pressure: The entry of well-capitalized foreign banks poses a direct threat to the market share of established domestic institutions like Banco do Brasil, particularly in segments like corporate banking and wealth management.

Diversification of Financial Services

Competitive rivalry at Banco do Brasil is intense, extending far beyond traditional banking into diverse financial services like asset management, insurance, and investment products. This broadens the competitive landscape significantly.

Banco do Brasil faces specialized firms in each of these segments, necessitating a comprehensive and competitive service offering. For instance, in the Brazilian asset management sector, firms like XP Investimentos and BTG Pactual are major players, often outperforming traditional banks in specific niche areas. In 2023, the Brazilian asset management market saw significant growth, with total assets under management reaching over R$8 trillion, highlighting the scale of competition.

- Broadened Competition: Rivalry spans banking, asset management, insurance, and investment products, not just traditional lending.

- Specialized Rivals: Banco do Brasil competes with dedicated firms in each financial service segment.

- Market Dynamics: The Brazilian asset management sector alone managed over R$8 trillion in assets in 2023, indicating a highly competitive environment.

Banco do Brasil contends with fierce competition from established domestic giants like Itaú Unibanco and Bradesco, who are equally dominant in the Brazilian market. The rise of digital-only banks and fintechs, such as Nubank and Banco Inter, has further intensified this rivalry, rapidly capturing millions of customers with streamlined, cost-effective digital services by mid-2024.

The widespread adoption of instant payment systems like Pix, with over 16 billion transactions by late 2023, has reshaped customer behavior and payment preferences, forcing traditional banks to adapt. Additionally, increasing foreign direct investment and the entry of international banks, attracted by Brazil's large consumer base, are introducing advanced technologies and aggressive pricing strategies, intensifying competition across all banking segments.

| Competitor Type | Key Players | Impact on Banco do Brasil |

|---|---|---|

| Domestic Banks | Itaú Unibanco, Bradesco | Strong market share, extensive branch networks, digital offerings |

| Digital Banks/Fintechs | Nubank, Banco Inter, C6 Bank | Rapid customer acquisition, competitive pricing, agile digital services |

| International Banks | Various global institutions | Capital infusion, advanced technology, diverse product portfolios, potential for aggressive pricing |

SSubstitutes Threaten

The proliferation of digital payment platforms and e-wallets like Pix presents a significant threat of substitutes for traditional banking services. These digital solutions offer users faster, often fee-free, and more convenient ways to conduct daily transactions, directly bypassing the need for many services traditionally offered by banks. For instance, Pix, launched in Brazil in late 2020, saw an astonishing adoption rate, with over 140 million users registered by the end of 2023, processing trillions of reais annually.

Fintech lending platforms, including online and peer-to-peer services, offer a significant alternative to traditional bank loans for individuals and small businesses. These platforms streamline the credit application and approval process, often providing faster access to capital. This directly challenges Banco do Brasil's established loan business by diverting potential borrowers seeking more convenient or specialized lending solutions.

The growth of these fintech disruptors is substantial. For instance, the global fintech market was valued at approximately $11.2 trillion in 2023 and is projected to grow significantly. In Brazil specifically, fintech lending has seen rapid adoption, with platforms processing billions of reais in loans annually, directly impacting the market share of incumbent banks like Banco do Brasil.

The rise of cryptocurrencies and blockchain technology poses a significant threat to traditional financial institutions like Banco do Brasil. These decentralized systems offer alternative avenues for payments, remittances, and asset management, potentially bypassing established banking infrastructure. Brazil's own Central Bank Digital Currency (CBDC), known as DREX, is a prime example of this evolving landscape, aiming to modernize financial transactions and potentially reduce reliance on incumbent banks for certain services.

Investment Platforms and Robo-advisors

The rise of online investment platforms and robo-advisors presents a significant threat of substitutes for traditional banking services like those offered by Banco do Brasil. These digital alternatives often provide lower fees and greater accessibility, attracting investors seeking cost-effective wealth management solutions. For instance, the global robo-advisory market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer preference.

These platforms empower individuals with automated investment strategies and user-friendly interfaces, directly competing with bank-provided investment products. Many robo-advisors boast expense ratios significantly lower than actively managed mutual funds, a key differentiator for cost-conscious investors. By offering streamlined digital experiences, they can capture market share from younger demographics and tech-savvy individuals who may find traditional banking processes cumbersome.

The threat is amplified by the continuous innovation in fintech, leading to more sophisticated and personalized digital investment tools. Consider the increasing adoption of AI in wealth management, which further enhances the appeal of these substitute services. As of early 2024, many of these platforms are reporting strong asset growth, demonstrating their competitive edge.

- Lower Fees: Robo-advisors typically charge annual management fees around 0.25% to 0.50%, compared to traditional advisors who might charge 1% or more.

- Accessibility: Many platforms allow investment with very low minimums, sometimes as little as $1, making them accessible to a broader range of investors.

- Digital Convenience: Automated portfolio rebalancing and online access provide a seamless user experience that appeals to modern consumers.

- Growing Market Share: The assets under management by robo-advisors have seen consistent double-digit annual growth in recent years.

Embedded Finance Solutions

Embedded finance solutions present a significant threat by integrating financial services directly into non-financial platforms. This means customers can access loans, payments, or insurance directly within their shopping cart or ride-sharing app, bypassing traditional banking channels. For instance, many e-commerce platforms now offer buy-now-pay-later (BNPL) options at checkout, a form of embedded finance.

This trend allows companies like Nubank, which has heavily invested in embedded finance partnerships, to reach customers where they are. In 2024, the embedded finance market is projected to reach substantial figures, with some estimates suggesting it could process trillions of dollars in transactions globally.

The key threat lies in the disintermediation of traditional banks like Banco do Brasil. As more financial transactions occur within these non-financial ecosystems, the direct customer relationship with banks weakens.

- Disintermediation: Embedded finance reduces the need for customers to directly engage with banks for everyday financial needs.

- Convenience: Offering financial services at the point of need within non-financial apps increases customer stickiness for those platforms.

- Market Reach: Non-financial companies can leverage their existing customer base to offer financial products, expanding their market beyond traditional banking demographics.

- Data Utilization: Platforms integrating finance can utilize customer data to offer highly personalized and competitive financial products.

The threat of substitutes for Banco do Brasil is substantial, driven by the rapid evolution of digital financial services and alternative platforms. These substitutes offer convenience, lower costs, and specialized functionalities that directly challenge traditional banking models.

Digital payment systems like Pix have fundamentally altered transaction habits, with over 140 million users in Brazil by the end of 2023, processing trillions of reais annually. This bypasses many traditional banking services, offering a faster and often fee-free alternative for daily money movement.

Fintech lending platforms and online investment services, including robo-advisors, are also significant substitutes. These platforms streamline processes and offer lower fees, attracting customers who seek more efficient or cost-effective financial solutions, directly impacting Banco do Brasil's loan and wealth management businesses.

The rise of embedded finance, where financial services are integrated into non-banking platforms, further disintermediates traditional banks. This trend, projected to handle trillions globally in 2024, weakens the direct customer relationship by offering financial convenience at the point of need.

| Substitute Type | Key Features | Impact on Banco do Brasil | Example/Data Point |

|---|---|---|---|

| Digital Payments (e.g., Pix) | Speed, Low/No Fees, Convenience | Reduced transaction revenue, decreased branch usage | 140M+ users in Brazil (end 2023) |

| Fintech Lending | Faster approvals, Specialized products | Loss of loan market share, competition on rates | Billions of reais processed annually in Brazil |

| Robo-Advisors | Lower fees, Accessibility, Automation | Competition in wealth management, reduced advisory fees | 0.25%-0.50% typical management fees vs 1%+ for traditional |

| Embedded Finance | Integration into non-financial platforms, Point-of-need service | Disintermediation, weakened customer relationships | Global market projected to process trillions in 2024 |

Entrants Threaten

The Brazilian banking sector is characterized by a robust regulatory framework, with the Central Bank of Brazil imposing strict capital requirements and licensing processes. These stringent regulations effectively deter potential new entrants by demanding substantial upfront investment and adherence to complex compliance standards.

In 2024, the average capital adequacy ratio for Brazilian banks remained well above the Basel III minimums, signaling a high bar for any new institution aiming to enter the market. For instance, major banks consistently reported ratios exceeding 15%, a level that requires significant financial muscle to match.

Established brand reputation and customer trust act as significant barriers to entry for new players. Banco do Brasil, for instance, benefits from decades of operation, fostering deep-rooted customer loyalty and a perception of reliability that newcomers struggle to replicate. In 2024, Brazilian banks with strong historical presence continued to leverage their established networks and customer relationships, making it challenging for digital-only banks or fintechs to rapidly gain substantial market share and trust.

New entrants face significant hurdles in matching the technological investment and infrastructure already established by incumbents like Banco do Brasil. Developing and maintaining the sophisticated digital platforms, robust cybersecurity measures, and advanced data analytics capabilities essential for modern banking requires immense capital outlay. For instance, in 2023, major banks globally continued to pour billions into digital transformation, with IT spending in the financial sector projected to reach over $600 billion annually by 2024.

Network Effects and Economies of Scale

Large, established financial institutions like Banco do Brasil possess significant advantages due to network effects and economies of scale. These allow them to offer a broad spectrum of financial products and services at highly competitive price points. For instance, in 2023, Banco do Brasil reported a net income of R$33.8 billion, demonstrating its robust operational capacity and ability to absorb costs across a vast customer base.

The extensive physical branch network, coupled with a sophisticated digital platform, creates substantial barriers to entry for potential new competitors. This integrated approach enables Banco do Brasil to reach and serve a diverse clientele efficiently, reinforcing its market position.

- Economies of Scale: Banco do Brasil's size allows for lower per-unit costs in service delivery and technology investment.

- Network Effects: A larger customer base and more extensive branch/digital network attract more customers, further strengthening the network.

- Competitive Pricing: These advantages enable the bank to offer more attractive rates and fees than smaller or newer entrants.

Fintech Acceleration and Regulatory Sandboxes

The threat of new entrants for Banco do Brasil is being reshaped by technological advancements and supportive regulatory frameworks. While established players benefit from scale and brand recognition, the Central Bank of Brazil's push for Open Banking and the establishment of regulatory sandboxes are significantly lowering entry barriers for innovative fintech companies.

These initiatives are designed to encourage competition and allow new players to test their business models with reduced regulatory hurdles. For instance, the gradual rollout of Open Finance in Brazil, which began in 2021, facilitates data sharing between financial institutions and third-party providers, creating opportunities for fintechs to offer specialized services and potentially disrupt traditional banking models.

- Open Banking/Finance Initiatives: Brazil's Open Finance framework, moving towards full implementation, allows consumers to share their financial data securely with authorized third-party providers, fostering competition in services like payments and credit.

- Regulatory Sandboxes: The Central Bank of Brazil has actively used regulatory sandboxes to permit innovative financial solutions to be tested in a controlled environment, lowering the initial compliance burden for new entrants.

- Fintech Growth: By mid-2024, the Brazilian fintech sector continued its robust expansion, with numerous startups gaining traction by offering digital-first solutions, challenging incumbents on cost and customer experience.

The threat of new entrants in Brazil's banking sector remains moderate, significantly influenced by a strong regulatory environment and established players' advantages. High capital requirements, stringent licensing, and the need for substantial technological investment create considerable barriers.

However, Brazil's push for Open Finance and regulatory sandboxes, actively implemented through 2024, are creating pathways for innovative fintechs. These initiatives, designed to foster competition, allow new entrants to test novel financial solutions with reduced initial regulatory burdens, potentially chipping away at incumbents' market share.

| Factor | Impact on New Entrants | Banco do Brasil Advantage |

|---|---|---|

| Regulatory Requirements | High barrier (capital, licensing) | Established compliance and resources |

| Technological Investment | Significant upfront cost | Existing advanced infrastructure |

| Brand & Trust | Difficult to build | Decades of customer loyalty |

| Open Finance/Sandboxes | Opportunity for innovation | Adaptation required for new models |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Banco do Brasil is built upon a foundation of verified data, including the bank's annual reports, filings with the Brazilian Central Bank (BACEN), and reports from reputable financial news outlets and industry analysis firms.