Banco do Brasil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

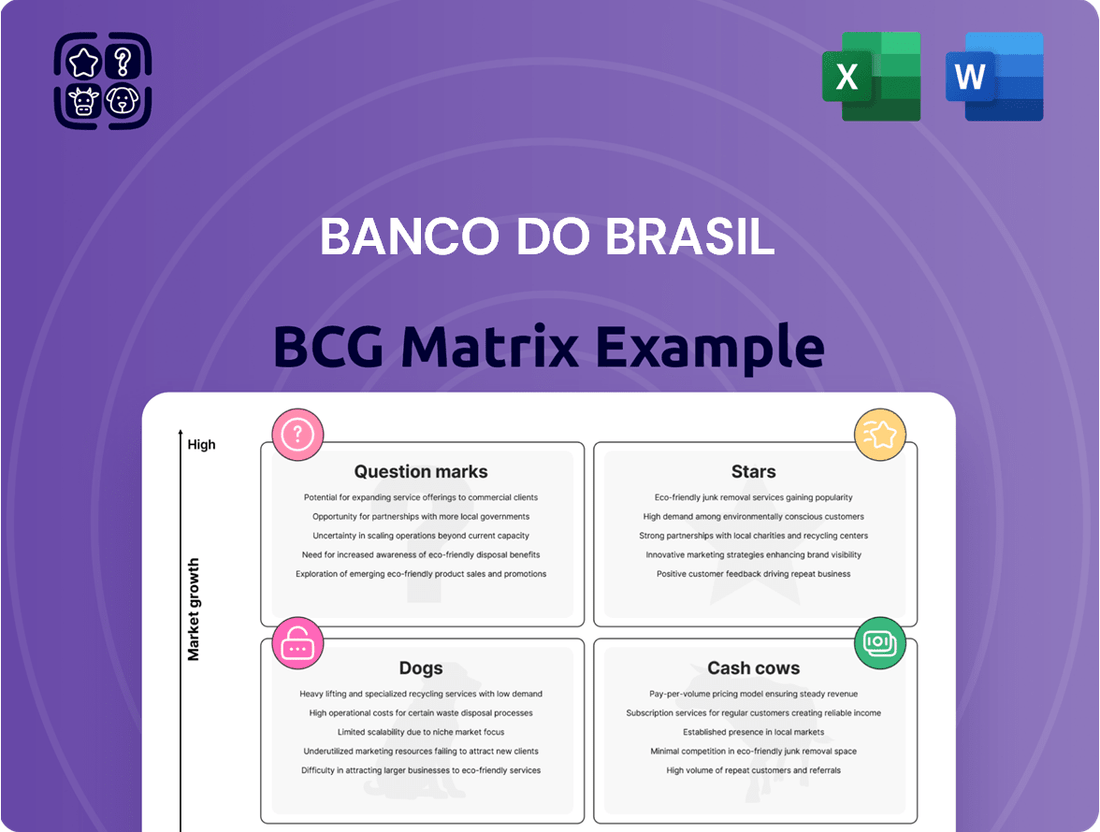

Uncover the strategic positioning of Banco do Brasil's diverse product portfolio with our insightful BCG Matrix preview. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

This glimpse is just the beginning of understanding Banco do Brasil's market dynamics. Purchase the full BCG Matrix report to gain detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Don't miss out on the complete picture; the full BCG Matrix offers a strategic advantage by revealing Banco do Brasil's competitive landscape and guiding your capital allocation decisions for maximum impact.

Stars

Banco do Brasil's agribusiness lending is a clear Star in its BCG Matrix. The bank commands a substantial 50.2% market share in this crucial sector, demonstrating its leadership. For the 2024/2025 harvest cycle, R$260 billion has been allocated, marking a significant 13% increase from the prior year, underscoring its commitment to a high-growth industry vital for Brazil's economy.

Banco do Brasil's digital banking services are a clear Star in its BCG Matrix. The bank is heavily investing in its digital transformation, with a goal of reaching 17 million digitally mature customers by 2025. This strategic push is driven by a user-friendly mobile app that provides comprehensive services, from basic payments to investment and insurance options, tapping into a high-growth financial sector.

Banco do Brasil's dedication to sustainable finance and ESG initiatives positions it as a Star. The bank has a robust Sustainability-Linked Finance Framework, adhering to international principles, with a target to achieve BRL 320 billion in sustainable credit by 2030.

This commitment is further underscored by its recognition as the most sustainable bank in the Global 100 ranking by Corporate Knights for the fourth consecutive time in 2023. This strong ESG performance attracts environmentally and socially conscious investors and clients, a segment experiencing significant growth in the global financial market.

Wholesale Banking and Trade Financing

Banco do Brasil's wholesale banking and trade finance operations are a cornerstone of its growth strategy, focusing on partnerships with Brazilian companies engaged in international commerce. This segment offers key products such as corporate banking services, import and export financing, letters of credit, and various guarantees.

Brazil's increasing prominence in global trade, coupled with Banco do Brasil's extensive network, positions this segment as a strong contender in the market. The bank's established presence and the dynamic nature of international trade contribute to both a high market share and significant growth potential, aligning it with the characteristics of a Star in the BCG matrix.

- Market Share: Banco do Brasil holds a substantial market share in Brazilian wholesale banking and trade finance.

- Growth Potential: The segment benefits from Brazil's expanding role in global trade, indicating high growth prospects.

- Key Offerings: Products include corporate banking, import/export finance, letters of credit, and guarantees.

- Strategic Focus: Agreements with Brazilian enterprises involved in international trade are central to this segment's strategy.

Investment Products and Fund Management

Banco do Brasil's investment products and fund management are key drivers of its business, actively participating in domestic capital markets. This includes the intermediation and distribution of various debt and equity instruments, alongside the management of a diverse range of investment funds. In 2024, the bank's asset management arm, BB Asset Management, managed over R$600 billion in assets, underscoring its significant market share and reach.

The growth of the Brazilian economy and increasing financial literacy are expected to fuel a greater demand for sophisticated investment products. This trend positions Banco do Brasil's offerings for high growth potential, leveraging the bank's established market presence and extensive distribution network. For instance, the bank has seen a notable uptick in demand for its ESG-focused funds, reflecting broader investor preferences in 2024.

- Strong Market Presence: Banco do Brasil's extensive branch network and digital platforms facilitate broad distribution of investment products.

- Growing Demand for Sophistication: As financial literacy rises, so does the appetite for more complex and tailored investment solutions.

- Asset Management Scale: BB Asset Management's substantial AUM (Assets Under Management) signifies significant influence and capability in the market.

- Product Diversification: The bank offers a wide array of investment vehicles, catering to various risk appetites and financial goals.

Banco do Brasil's agribusiness lending is a clear Star in its BCG Matrix, commanding a substantial 50.2% market share. For the 2024/2025 harvest cycle, R$260 billion has been allocated, a 13% increase, highlighting its leadership in a high-growth sector vital to Brazil's economy.

Digital banking services also shine as a Star, with a goal of 17 million digitally mature customers by 2025, fueled by a comprehensive mobile app. This focus taps into a rapidly expanding financial sector where user experience is paramount.

Sustainable finance and ESG initiatives are another Star, backed by a BRL 320 billion sustainable credit target by 2030 and recognition as the most sustainable bank globally by Corporate Knights for four consecutive years (up to 2023). This appeals to a growing segment of environmentally conscious investors.

Wholesale banking and trade finance represent a Star, benefiting from Brazil's increasing global trade presence and the bank's extensive network. The segment's focus on supporting Brazilian companies in international commerce, offering services like corporate banking and import/export financing, aligns with high growth potential.

Investment products and fund management are also Stars, with BB Asset Management managing over R$600 billion in assets in 2024. This segment capitalizes on rising financial literacy and a growing demand for sophisticated investment solutions, including ESG-focused funds.

| Business Segment | BCG Category | Key Metrics/Facts |

|---|---|---|

| Agribusiness Lending | Star | 50.2% market share; R$260 billion allocated for 2024/2025 harvest (+13% YoY) |

| Digital Banking | Star | Target of 17 million digitally mature customers by 2025; comprehensive mobile app |

| Sustainable Finance/ESG | Star | BRL 320 billion sustainable credit target by 2030; ranked most sustainable bank globally (Corporate Knights, 2023) |

| Wholesale Banking & Trade Finance | Star | Strong market share; benefits from Brazil's growing global trade role; offers corporate banking, import/export finance |

| Investment Products & Fund Management | Star | Over R$600 billion AUM managed by BB Asset Management (2024); growing demand for ESG funds |

What is included in the product

The Banco do Brasil BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

The Banco do Brasil BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Banco do Brasil's traditional retail banking operations, encompassing deposit accounts, loans, and credit cards, form a cornerstone of its business. This segment benefits from an extensive branch network and a deeply entrenched customer base, ensuring a stable and predictable revenue stream.

These mature services operate in a low-growth market but command a high market share. Consequently, they consistently generate substantial cash flow, requiring minimal promotional investment, effectively acting as a reliable source of funds for the bank.

In 2024, Banco do Brasil reported a net interest income of R$ 77.7 billion for its financial intermediation services, a significant portion of which is attributed to these traditional operations, underscoring their cash-generating power.

Banco do Brasil holds a dominant position in payroll lending, especially for INSS retirees and pensioners, evidenced by its substantial portfolio growth. This segment is characterized by lower risk due to direct payroll deductions and a dependable customer base, translating into steady income and healthy profit margins.

The bank’s strategic objective to lead all payroll loan sectors firmly establishes this product line as a Cash Cow. For instance, in the first quarter of 2024, Banco do Brasil reported a net income of R$3.4 billion, with its credit operations, including payroll lending, being a significant contributor to this strong performance.

Banco do Brasil's large corporate lending segment functions as a Cash Cow, boasting a substantial balance sheet with a focus on stable, established businesses. This mature segment, while experiencing slower growth, generates significant and predictable cash flow due to the sheer volume of lending and deep-rooted relationships with major corporations.

In 2024, Banco do Brasil's commitment to enhancing its systemic view of credit and mitigating risks within value chains is expected to further bolster the cash-generating capacity of this segment. For instance, the bank's robust performance in the large corporate segment in 2023, contributing significantly to its overall net income, underscores its Cash Cow status.

Insurance, Pension, and Capitalization Products

BB Seguridade, Banco do Brasil's insurance division, showcased robust performance with a net profit of R$1,964 million in the first quarter of 2025. This figure highlights the enduring strength and consistent cash flow generated by its insurance, pension, and capitalization products. The business arm continues to be a reliable source of income, even amidst fluctuating market conditions.

The insurance, pension, and capitalization products offered by BB Seguridade are considered Cash Cows within Banco do Brasil's BCG Matrix. This classification is due to their established market presence and consistent revenue generation. These segments, which include life, property, and automobile insurance along with private pension and capitalization plans, contribute significantly to the bank's overall profitability.

- BB Seguridade's Q1 2025 net profit reached R$1,964 million.

- The company benefits from a mature market for its insurance, pension, and capitalization products.

- These offerings represent a stable and significant source of cash for Banco do Brasil.

Payment Methods Services

Banco do Brasil's Payment Methods Services segment functions as a robust Cash Cow within its BCG Matrix. This division offers crucial funding, transmission, processing, and settlement services for a wide array of electronic transactions. The consistent fee income generated from these operations is a significant contributor to the bank's overall profitability.

Brazil's digital payment landscape, particularly with the widespread adoption of PIX, presents a fertile ground for these services. Banco do Brasil leverages its extensive infrastructure and a vast customer base to ensure a steady and predictable revenue stream. This established market position allows the bank to capitalize on the ongoing digital transformation in payments.

- Consistent Fee Income: The payment processing and settlement services generate recurring revenue, a hallmark of Cash Cows.

- High Digital Adoption: Brazil's rapid embrace of digital payments, including PIX, fuels demand for these services.

- Established Infrastructure: Banco do Brasil's existing network supports high transaction volumes efficiently.

- Broad Customer Base: A large and diverse customer base ensures continued utilization of payment services.

Banco do Brasil's traditional retail banking, including deposits and loans, acts as a Cash Cow. This segment benefits from a large customer base and extensive branch network, ensuring stable revenue despite low market growth. In 2024, net interest income from financial intermediation reached R$ 77.7 billion, with these mature operations being a significant contributor.

Payroll lending, particularly for INSS retirees, is another key Cash Cow. Its low risk profile and dependable customer base yield steady income. Banco do Brasil's strong performance in this sector in Q1 2024, contributing to a R$ 3.4 billion net income, highlights its profitability.

The bank's large corporate lending also functions as a Cash Cow. Despite slower growth, the sheer volume of lending and established relationships with major corporations generate substantial, predictable cash flow. The bank's robust performance in this segment in 2023 further solidifies its Cash Cow status.

BB Seguridade, the insurance arm, is a vital Cash Cow, reporting R$1,964 million in net profit for Q1 2025. Its insurance, pension, and capitalization products consistently generate strong cash flow in a mature market, contributing significantly to overall profitability.

Banco do Brasil's Payment Methods Services segment is a strong Cash Cow, driven by consistent fee income from electronic transactions. Brazil's high digital adoption, especially PIX, fuels demand, with the bank leveraging its infrastructure and customer base for predictable revenue streams.

| Business Segment | BCG Matrix Classification | Key Financial Indicator (2024/Q1 2025) | Market Characteristic | Strategic Implication |

| Traditional Retail Banking | Cash Cow | R$ 77.7 billion Net Interest Income (Financial Intermediation) | Low Growth, High Market Share | Generates stable cash flow, minimal investment needed |

| Payroll Lending | Cash Cow | Significant contributor to R$ 3.4 billion Net Income (Q1 2024) | Low Risk, Dependable Customer Base | Reliable and profitable income stream |

| Large Corporate Lending | Cash Cow | Significant contributor to 2023 Net Income | Mature Market, High Volume | Provides substantial and predictable cash flow |

| BB Seguridade (Insurance) | Cash Cow | R$1,964 million Net Profit (Q1 2025) | Mature Market, Consistent Revenue | Stable and significant cash generator |

| Payment Methods Services | Cash Cow | Consistent Fee Income from Transactions | High Digital Adoption, Established Infrastructure | Leverages digital trends for predictable revenue |

What You’re Viewing Is Included

Banco do Brasil BCG Matrix

The Banco do Brasil BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, offering a professional and ready-to-use report for your business planning needs.

Dogs

Banco do Brasil's international presence includes operations that may be classified as Dogs. These are typically smaller branches or less strategic ventures situated in markets experiencing slow growth and where the bank holds a minimal market share. Such units can become drains on resources, consuming capital without generating substantial returns or offering significant strategic advantage in today's competitive global financial environment.

These underperforming international operations often represent cash traps. For instance, if a specific Latin American branch, acquired in the early 2010s, is operating in a country with a projected GDP growth of only 1.5% for 2024 and holds less than 0.5% of the local banking market share, it would likely fit this category. The bank would need to evaluate options like divestiture or a substantial overhaul to improve efficiency and profitability, or even consider exiting these markets entirely if a turnaround is not feasible.

Banco do Brasil's legacy IT systems and infrastructure represent a significant challenge. These older, often inefficient platforms, while functional, can drain considerable resources on maintenance and upgrades, diverting funds that could otherwise fuel innovation or growth initiatives. In 2024, many large financial institutions like Banco do Brasil are still grappling with the high operational costs associated with these systems.

These legacy systems can act as a drag on agility, making it difficult for Banco do Brasil to quickly adapt to new market demands or introduce innovative digital services. The cost of modernizing or replacing these entrenched infrastructures is substantial, and often, expensive, piecemeal turnaround plans fail to deliver the desired competitive advantage or efficiency gains.

Certain specialized niche lending products at Banco do Brasil, particularly those in higher-risk agribusiness sub-segments, may be classified as Dogs due to persistently high default rates. These portfolios often consume significant capital through provisions for doubtful debts and recovery expenses, yielding less in interest income than their associated costs. For instance, while the overall agribusiness sector faced challenges, specific niche areas within it, potentially those with less diversified revenue streams or higher exposure to volatile commodity prices, could exhibit default rates necessitating substantial provisioning.

Physical Branch Network in Declining Areas

Branches in areas with declining populations and economic slowdown, alongside rising digital banking, are facing reduced customer visits and transaction volumes. These physical sites can become costly liabilities with low revenue generation.

In 2024, a significant portion of traditional bank branches across various countries continued to experience this trend. For instance, reports indicated that the number of physical bank branches in the United States decreased by over 3,000 between 2020 and 2023, reflecting a broader shift towards digital channels.

- High Operational Costs: Maintaining these underutilized branches incurs substantial expenses for rent, utilities, and staffing, often outweighing the generated revenue.

- Decreasing Transaction Volume: As more customers opt for online and mobile banking, the daily transactional activity at these physical locations diminishes, impacting their profitability.

- Strategic Re-evaluation: Financial institutions are increasingly analyzing these branches as potential candidates for consolidation or closure to optimize their network and reduce overhead.

- Focus on Digital Alternatives: The trend necessitates a stronger emphasis on digital service offerings and potentially smaller, more technologically advanced service points to cater to evolving customer preferences.

Non-Core, Non-Strategic Subsidiaries/Investments

Non-core, non-strategic subsidiaries or investments within Banco do Brasil's portfolio might include smaller financial services arms or historical ventures that have diverged from the bank's primary objectives. These could be entities operating in niche markets with limited growth potential and a small market share, such as certain specialized leasing operations or historical international branches that are no longer central to the bank's global strategy.

Such holdings, while perhaps once strategically important, may now represent a drain on resources. For instance, if a subsidiary focused on agricultural finance in a region with declining farming output has a market share below 5% and is experiencing negative growth, it would fit this category. Banco do Brasil's 2024 strategy emphasizes digital transformation and expanding services in high-growth urban centers, making these legacy assets less of a priority.

- Low Market Share: Subsidiaries with less than 10% market share in their respective segments.

- Low Growth Environment: Investments in industries experiencing less than 2% annual growth.

- Resource Drain: Entities requiring significant capital or management oversight without commensurate returns, potentially impacting the bank's ability to invest in core areas like digital banking solutions.

Banco do Brasil's "Dog" category likely includes underperforming international operations and legacy IT systems. These segments consume resources without generating significant returns, hindering the bank's agility and growth potential. For example, a small international branch in a slow-growing market with minimal market share would fit this description, potentially requiring divestiture or a significant overhaul to improve efficiency.

Niche lending products with high default rates and physical branches in declining areas also fall into the Dog quadrant. These areas demand substantial capital for provisions and maintenance, yielding low returns. The ongoing shift to digital banking further exacerbates the challenges for these physical locations, with many traditional branches seeing reduced customer activity.

Non-core subsidiaries operating in niche markets with limited growth potential and small market share also represent potential Dogs. These historical ventures may no longer align with Banco do Brasil's strategic focus on digital transformation and expansion in high-growth urban centers, making them a drain on resources.

| Category | Characteristics | Example Scenario (Banco do Brasil) | Potential Actions |

|---|---|---|---|

| Dogs | Low market share, low growth markets, high operational costs, declining transaction volumes | Small international branch in a market with <2% GDP growth and <0.5% market share; Legacy IT systems with high maintenance costs | Divestiture, consolidation, significant restructuring, exit strategy |

| Dogs | High default rates, resource-intensive | Niche agribusiness lending with persistently high default rates; Underutilized physical branches | Portfolio review, enhanced risk management, closure or repurposing of branches, focus on digital alternatives |

| Dogs | Non-core, declining relevance | Non-strategic subsidiaries in niche markets with <5% market share and negative growth | Strategic review, divestment, reallocation of capital to core growth areas |

Question Marks

Banco do Brasil is actively exploring partnerships and ventures within the burgeoning fintech sector, a move crucial for staying competitive amidst Brazil's digital financial transformation. Initiatives like Open Finance and the widespread adoption of PIX are reshaping customer expectations and creating new avenues for growth.

These emerging fintech collaborations, while holding significant potential to capture new market segments, may currently represent a smaller portion of Banco do Brasil's overall market share. For instance, as of late 2023, the bank reported a substantial increase in digital transactions, yet specific data on the market share captured by its nascent fintech ventures is still developing.

Significant investment is anticipated to nurture these ventures, aiming to elevate them from potential Question Marks to future Stars in the BCG matrix. The bank's strategy involves leveraging its established customer base and brand recognition to accelerate the adoption of these innovative digital solutions, anticipating substantial returns as the digital financial market matures further.

Banco do Brasil's aggressive push into new, unpenetrated international markets would classify as a Question Mark in the BCG Matrix. These markets, while offering high growth potential, demand significant capital for brand establishment, navigating diverse regulatory landscapes, and building market share from the ground up. For instance, expanding into a rapidly developing Asian economy with limited prior presence would fit this category.

Banco do Brasil is strategically investing in advanced AI and generative AI to refine its operations and elevate customer experiences. A key focus is leveraging data and analytics to craft highly personalized products, aiming to boost customer engagement and cross-selling opportunities. This push into AI-driven personalization represents a significant growth potential, though the current market share of these sophisticated offerings is likely still developing as the technology matures and integrates across the bank's services.

New, Innovative Credit Products for Underserved Segments

Banco do Brasil's development of innovative credit products for underserved segments, such as small businesses and low-income individuals, represents a significant growth opportunity. These initiatives are designed to tap into markets with unmet financial needs, potentially leading to substantial expansion. For instance, in 2024, the bank announced a partnership aimed at expanding credit access for agricultural producers in the Amazon region, a segment historically facing challenges in securing traditional financing.

While these new products offer high growth potential, they are likely to start with a low market share. Significant investment in marketing and robust risk management frameworks will be crucial for their successful scaling. By early 2025, Banco do Brasil had allocated an additional R$5 billion to its SME credit lines, underscoring the commitment to these higher-risk, higher-reward ventures.

- Targeted Product Development: Focus on creating tailored credit solutions for segments like micro-entrepreneurs and rural communities.

- Innovative Risk Assessment: Explore alternative data sources and credit scoring models to better serve individuals and businesses with limited credit history.

- Strategic Partnerships: Collaborate with fintechs and community organizations to reach and serve underserved populations more effectively.

- Scalability Investment: Allocate resources for marketing, digital platforms, and specialized risk management to ensure sustainable growth.

Specialized Green and Social Loan Products

Specialized green and social loan products, while part of the burgeoning sustainable finance sector, may currently represent a smaller segment within Banco do Brasil's portfolio. These niche offerings, such as financing for specific renewable energy technologies or targeted social impact projects, are in a rapidly expanding market but require focused effort to gain traction.

These specialized products are akin to Question Marks in the BCG Matrix. They operate in a high-growth area, indicating significant future potential, but their current market share is low. Banco do Brasil needs to invest in promoting and developing these offerings to capitalize on the increasing demand for sustainable finance solutions.

- High Growth Potential: The overall sustainable finance market is experiencing robust growth, with global sustainable debt issuance reaching record levels. For instance, in 2023, green bond issuance alone surpassed $500 billion.

- Low Current Market Share: Specific, highly specialized green and social loan products may have a limited uptake compared to broader sustainable finance categories, reflecting their novelty or targeted nature.

- Need for Investment: To move these products towards a Star status, Banco do Brasil must allocate resources for marketing, product development, and customer education to increase their visibility and adoption.

- Strategic Focus: Identifying which specialized products align best with market trends and the bank's strategic goals will be crucial for successful development and market share capture.

Banco do Brasil's ventures into new fintech collaborations and international markets are prime examples of Question Marks. These initiatives, while promising high growth, currently hold a small market share and require substantial investment to mature.

The bank's strategic focus on AI-driven personalization and specialized green/social loans also places them in the Question Mark category, needing further development and market penetration.

By allocating resources to these areas, Banco do Brasil aims to transform these nascent ventures into future revenue drivers, capitalizing on evolving market demands and technological advancements.

The bank's commitment is evident in its increased credit lines for SMEs and strategic partnerships, signaling a clear intent to nurture these high-potential, low-share businesses.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Fintech Partnerships | High | Low | Question Mark | Invest to gain market share |

| New International Markets | High | Low | Question Mark | Invest for brand building & market penetration |

| AI-Driven Personalization | High | Low | Question Mark | Develop and integrate for customer engagement |

| Specialized Green/Social Loans | High | Low | Question Mark | Promote and refine to capture sustainable finance demand |

| Credit for Underserved Segments | High | Low | Question Mark | Expand reach through partnerships and tailored products |

BCG Matrix Data Sources

Our Banco do Brasil BCG Matrix leverages official financial statements, regulatory filings, and internal performance data, augmented by market research and industry growth forecasts.