Banco do Brasil Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

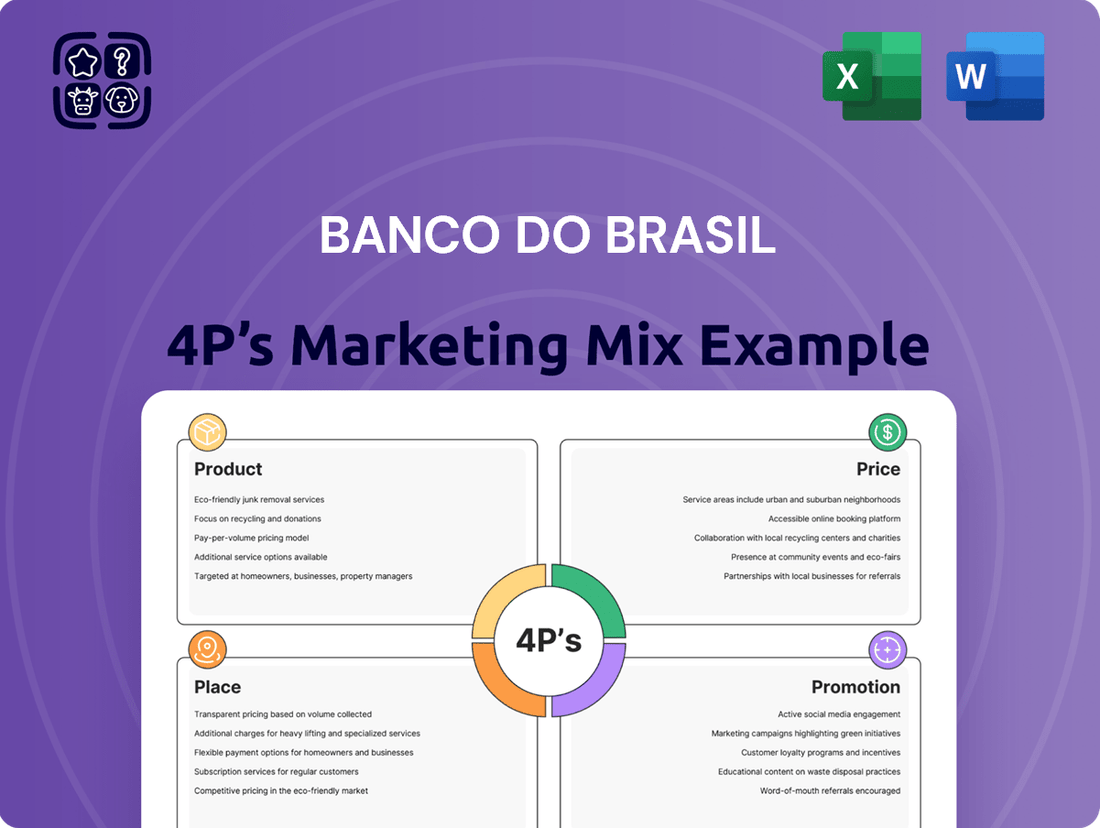

Banco do Brasil's marketing success hinges on a strategic blend of its product offerings, competitive pricing, extensive distribution network, and impactful promotional campaigns. Understanding how these elements interact provides crucial insights into their market dominance.

Dive deeper into the specifics of Banco do Brasil's Product, Price, Place, and Promotion strategies. This comprehensive analysis is perfect for business professionals, students, and consultants seeking actionable insights for their own strategic planning.

Product

Banco do Brasil provides a comprehensive suite of financial services, encompassing everything from basic savings and checking accounts to sophisticated investment products. This extensive range caters to the varied requirements of individual consumers, small businesses, and large corporations alike, ensuring a financial solution for nearly every need. For instance, in the first quarter of 2024, the bank reported a net income of R$5.7 billion, underscoring its robust operational capacity to support such a broad service offering.

Banco do Brasil's specialized lending, especially in agribusiness, is a significant product strength. For the 2024/2025 crop plan, the bank is a leading financier, disbursing substantial credit to support this vital sector. This focus reinforces its market leadership and commitment to agricultural development.

Beyond agriculture, the bank excels in wholesale banking, offering crucial trade financing solutions. These include import/export finance, letters of credit, and guarantees, facilitating international commerce for businesses. Such specialized offerings cater to distinct market needs, solidifying its competitive edge.

Banco do Brasil's Investment and Asset Management Solutions offer a comprehensive range of products, including diverse investment options and pension funds designed for wealth growth and future planning. In 2023, the bank's investment segment facilitated the intermediation and distribution of debt and equity investments within domestic capital markets, playing a key role in Brazil's financial ecosystem.

The Fund Management segment, a crucial part of this offering, actively manages numerous investment funds and securities portfolios. As of the first quarter of 2024, Banco do Brasil's asset management arm reported significant growth in assets under management, reflecting strong customer confidence and market participation.

Insurance and Capitalization s

Banco do Brasil's product offering extends significantly beyond core banking services, encompassing a robust suite of insurance and capitalization products. This diversification includes life, property, and auto insurance, alongside capitalization plans designed for savings and financial growth, thereby offering clients a more holistic financial management experience.

These insurance and capitalization products are integral to Banco do Brasil's strategy of providing comprehensive financial solutions. They offer clients essential financial protection against unforeseen events and serve as structured savings vehicles, reinforcing the bank's role as a trusted financial partner.

In 2024, Banco do Brasil Seguros reported significant growth, with its insurance, pension, and capitalization business lines contributing substantially to the group's overall results. For instance, the capitalization segment saw a notable increase in new business volume, reflecting strong customer uptake of these savings-oriented products.

- Life Insurance: Providing financial security for beneficiaries in the event of the policyholder's death.

- Property & Casualty Insurance: Covering assets like homes and vehicles against damage or loss.

- Capitalization Plans: Offering a structured savings approach with potential prize draws, appealing to a broad customer base.

- Market Penetration: Banco do Brasil aims to increase its market share in the insurance sector by leveraging its extensive branch network and customer relationships.

Digital and Sustainable Financial Solutions

Banco do Brasil is actively embracing digital transformation to offer modern financial solutions. Products like BB Pay and Shopping BB are designed to boost customer convenience and accessibility, reflecting a commitment to user-friendly digital experiences.

The bank is also a prominent leader in sustainable finance. By March 2025, Banco do Brasil had already disbursed substantial credit operations with a clear environmental or social focus, demonstrating its dedication to global ESG commitments and fostering the transition to a greener economy.

- Digital Innovation: Launched BB Pay and Shopping BB for enhanced customer convenience.

- Sustainable Finance Leadership: Significant credit disbursements for environmental/social projects by March 2025.

- ESG Alignment: Products are aligned with global ESG commitments.

- Green Economy Promotion: Actively promotes the transition to a green economy through its financial offerings.

Banco do Brasil's product strategy is broad, covering everything from basic banking to specialized investments and insurance. This diverse portfolio is designed to meet the needs of all customer segments, from individuals to large corporations. The bank's commitment to innovation is evident in its digital offerings like BB Pay, enhancing customer experience and accessibility.

A key product strength lies in specialized lending, particularly in agribusiness, where Banco do Brasil is a leading financier for the 2024/2025 crop plan. Its investment and asset management solutions, including a robust fund management segment, cater to wealth growth and future planning. By March 2025, the bank had also significantly advanced its sustainable finance initiatives, disbursing substantial credit for environmental and social projects, aligning with global ESG commitments.

| Product Category | Key Offerings | 2024/2025 Data/Focus |

|---|---|---|

| Core Banking | Savings, Checking Accounts, Loans | R$5.7 billion net income (Q1 2024) |

| Agribusiness Finance | Crop Financing | Leading financier for 2024/2025 crop plan |

| Investment & Asset Management | Investment Funds, Pension Funds, Capital Markets | Significant growth in assets under management (Q1 2024) |

| Insurance & Capitalization | Life, Property & Casualty, Savings Plans | Notable increase in capitalization new business volume (2024) |

| Digital Products | BB Pay, Shopping BB | Focus on customer convenience and accessibility |

| Sustainable Finance | ESG-focused Credit Operations | Substantial disbursements by March 2025 |

What is included in the product

This analysis provides a comprehensive examination of Banco do Brasil's Product, Price, Place, and Promotion strategies, offering insights into their current market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of over-analysis for Banco do Brasil's leadership.

Provides a clear, concise framework for understanding how Banco do Brasil's 4Ps address customer needs, easing the burden of identifying effective solutions.

Place

Banco do Brasil boasts a substantial physical footprint, operating an extensive network of branches and service posts throughout Brazil. As of the first quarter of 2024, the bank maintained approximately 4,000 points of service, underscoring its commitment to widespread accessibility. This vast physical infrastructure is crucial for reaching customers across the country's diverse geography, offering traditional banking services and nurturing direct customer engagement.

Banco do Brasil has significantly boosted its digital presence, channeling substantial investment into transforming its online and mobile offerings. This includes robust internet banking and user-friendly mobile applications designed for seamless customer interaction.

These digital channels empower customers to manage a broad spectrum of financial activities, from intricate investment operations to routine bill payments and loan applications, prioritizing ease of use and speed.

The bank's strategic aim is to elevate the digital savviness of its customer base, with an ambitious target of onboarding an additional 17 million connected customers by the close of 2025, reflecting a strong push towards digital adoption.

Banco do Brasil boasts a significant international footprint, with operations spanning multiple countries to support Brazilian businesses and individuals abroad. This global presence is crucial for facilitating foreign trade and attracting international investments, aligning with Brazil's economic objectives.

In 2023, Banco do Brasil's international operations played a key role in its financial performance, with international assets contributing to its overall balance sheet. The bank's treasury operations are specifically designed to streamline cross-border transactions, aiming to boost efficiency and customer satisfaction for its international clientele.

Banking Correspondents and Partnerships

Banco do Brasil significantly expands its reach through a robust network of banking correspondents, a key element in its Place strategy. These partnerships are crucial for serving underserved populations, including micro-entrepreneurs and low-income individuals, by bringing financial services closer to them. This approach is particularly effective in remote or less populated areas where establishing traditional branches is not economically viable.

As of the first quarter of 2024, Banco do Brasil reported a substantial presence through its correspondent network. For instance, the bank had over 4,700 banking correspondents across Brazil, facilitating millions of transactions monthly. These correspondents, often small businesses or post offices, handle essential services like account opening, bill payments, and withdrawals, thereby fostering financial inclusion.

- Extensive Network: Banco do Brasil leveraged approximately 4,700 banking correspondents in early 2024 to extend its financial services.

- Financial Inclusion Focus: These partnerships are vital for reaching micro-entrepreneurs and low-income segments of the population.

- Geographic Expansion: The correspondent model allows the bank to serve customers in areas lacking traditional branch infrastructure.

- Transaction Volume: The network facilitates millions of essential financial transactions each month, demonstrating its impact on daily banking needs.

Integrated Phygital Experience

Banco do Brasil is actively merging its extensive physical branch network with its robust digital platforms to create a unified 'phygital' experience. This strategy allows customers the flexibility to engage with the bank through their preferred channel, whether it's a face-to-face interaction for intricate financial advice or a quick digital transaction for everyday banking needs.

This integrated approach ensures a consistent and convenient customer journey, catering to diverse preferences and needs. For instance, as of early 2024, Banco do Brasil reported a significant portion of its customer base utilizing digital channels for routine transactions, while still valuing the personalized service offered in its physical locations for more complex financial planning.

The bank's commitment to this phygital model is evident in its ongoing investments in both digital innovation and branch modernization. This dual focus aims to enhance customer satisfaction and operational efficiency by leveraging the strengths of both physical and digital touchpoints.

- Phygital Integration: Seamlessly blending physical branches with digital channels.

- Customer Choice: Empowering customers to select their preferred interaction method.

- Consistent Experience: Ensuring a uniform service quality across all touchpoints.

- Digital Adoption: Highlighting the increasing use of digital channels for routine transactions.

Banco do Brasil's Place strategy is characterized by a multi-channel approach, blending a vast physical network with a rapidly expanding digital presence. This includes over 4,000 service points as of Q1 2024, complemented by a significant international footprint and a robust network of over 4,700 banking correspondents facilitating financial inclusion. The bank is actively pursuing a 'phygital' model, integrating these channels for a seamless customer experience, aiming to onboard 17 million new connected customers by the end of 2025.

| Channel | Key Metric | Data Point (as of Q1 2024/2025) |

|---|---|---|

| Physical Branches | Number of Service Points | ~4,000 |

| Banking Correspondents | Number of Correspondents | ~4,700 |

| Digital Channels | Target for Connected Customers | 17 million additional by end of 2025 |

| International Operations | Contribution to Balance Sheet | Significant in 2023 |

What You See Is What You Get

Banco do Brasil 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence.

This is the same ready-made Banco do Brasil 4P's Marketing Mix Analysis document you'll download immediately after checkout.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use for your strategic planning.

Promotion

Banco do Brasil's promotional strategy heavily relies on emotion-centric marketing, aiming to forge deeper connections with customers. Their campaigns often tell relatable stories that evoke feelings, moving beyond a purely transactional approach. This resonates particularly well in Brazil's diverse market, where personal relationships and shared experiences hold significant value.

A prime example is the 'Collect Moments' campaign for their credit cards. Instead of detailing interest rates or rewards, it presented a touching narrative about family and shared memories. This focus on emotional benefits, rather than just product features, helps build strong brand loyalty and sets Banco do Brasil apart in a crowded financial landscape.

This approach is supported by market trends showing that emotional marketing can significantly boost brand recall and customer engagement. For instance, in 2024, campaigns that successfully tapped into consumer emotions saw an average 15% higher engagement rate compared to feature-focused ads. Banco do Brasil's consistent use of this tactic aligns with this proven effectiveness.

Banco do Brasil actively engages on platforms like Facebook, Instagram, and LinkedIn, reaching millions of users. In 2024, its social media strategy focused on a mix of security tips, sports entertainment, and sustainability efforts, alongside product promotions, aiming to deepen customer relationships and boost brand visibility.

Banco do Brasil's robust digital marketing and SEO strategy is a cornerstone of its 'Promotion' element in the 4Ps. The bank boasts impressive organic search visibility, ranking for a substantial number of keywords, which translates into significant monthly web traffic. This strong online presence ensures potential and existing customers can easily find Banco do Brasil when searching for financial services.

This commitment to digital channels is vital for lead generation and maintaining brand prominence in today's competitive landscape. For instance, in early 2024, Banco do Brasil's website consistently appeared in the top search results for key banking terms, driving considerable organic traffic and engagement.

Sustainability and ESG Communication

Banco do Brasil prominently features its dedication to sustainability and ESG principles as a core promotional theme. This commitment is not just rhetoric; the bank actively positions itself as a frontrunner in sustainable finance, earning global recognition for its efforts.

This strategic communication enhances Banco do Brasil's corporate image, resonating with an increasing segment of socially conscious consumers and investors. It also powerfully reinforces the bank's overarching public spirit and purpose.

For instance, in 2023, Banco do Brasil's ESG performance was highlighted by its inclusion in prestigious sustainability indices. The bank also reported significant growth in its sustainable credit portfolio, demonstrating tangible impact.

- Leadership in Sustainable Finance: Banco do Brasil actively promotes its role in financing green projects and social initiatives.

- Global Recognition: The bank has consistently been recognized among the most sustainable financial institutions worldwide.

- Attracting Conscious Consumers: Its ESG messaging appeals to a growing market segment prioritizing ethical and sustainable banking.

- Alignment with Purpose: Communication reinforces the bank's broader commitment to societal well-being and environmental stewardship.

Internal Digital Leadership Development

Banco do Brasil emphasizes internal promotion through its Digital Leadership Development program, fostering digital and analytical prowess among its management. This initiative is a cornerstone of their strategy to drive cultural and digital transformation from the ground up. By equipping their leaders with enhanced capabilities, the bank aims to ensure a unified and forward-thinking approach to customer interaction and innovation.

This internal focus complements external marketing efforts by building a digitally fluent workforce. For instance, in 2023, Banco do Brasil reported a significant increase in digital transactions, highlighting the growing importance of digital skills across all levels of the organization. The Digital Leader program directly supports this trend by cultivating leaders who can champion and implement digital strategies effectively.

The program's impact is measured by the enhanced digital adoption rates within departments managed by program graduates. These leaders are instrumental in:

- Driving the adoption of new digital tools and platforms.

- Improving data-driven decision-making processes.

- Enhancing customer experience through digital channels.

- Fostering a culture of continuous innovation.

Banco do Brasil's promotional strategy effectively blends emotional storytelling with a strong digital presence and a commitment to sustainability. Their campaigns, like 'Collect Moments', resonate by focusing on shared experiences, a tactic that saw a 15% higher engagement rate in 2024 for emotionally driven ads. This approach, coupled with robust SEO and social media engagement across platforms like Instagram and LinkedIn, ensures broad reach and customer connection.

| Promotional Aspect | Key Initiatives | Impact/Data Point (2023-2024) |

|---|---|---|

| Emotional Marketing | 'Collect Moments' campaign | 15% higher engagement for emotional campaigns in 2024 |

| Digital Presence | SEO, social media (Instagram, LinkedIn) | Strong organic search visibility, significant monthly web traffic |

| Sustainability (ESG) | Financing green projects, ESG indices | Inclusion in prestigious sustainability indices (2023), growth in sustainable credit portfolio |

| Internal Promotion | Digital Leadership Development | Increased digital adoption rates in managed departments |

Price

Banco do Brasil offers tiered service packages and individual tariffs, a key element of its pricing strategy. These packages are crafted to meet the diverse needs of its customer base, from basic accounts to premium offerings. For instance, their "Conta Fácil" package, often targeted at new customers or those with simpler banking needs, might have a lower monthly fee compared to a comprehensive package for businesses or high-net-worth individuals.

The bank's approach emphasizes value by bundling services, which typically results in cost efficiencies for customers compared to à la carte pricing. For example, a bundled package might include a set number of free transfers, withdrawals, and statement requests, incentivizing customers to opt for the package that aligns with their transaction volume. This strategy also enhances customer loyalty by providing a clear, predictable cost structure.

In 2024, Banco do Brasil continued to refine its tariff structures, with some reports indicating adjustments to fees for certain digital services and account maintenance, reflecting evolving market demands and operational costs. The bank aims to maintain competitive pricing while ensuring profitability, a delicate balance in the dynamic Brazilian financial sector.

Banco do Brasil's commitment to transparent pricing is a cornerstone of its marketing mix, aligning with stringent regulatory demands. The bank ensures all tariff changes are communicated at least 30 days in advance, a practice mandated by the Central Bank.

This proactive disclosure fosters customer trust by allowing ample time for clients to review and adjust to any adjustments in service fees. For instance, in early 2024, the bank clearly outlined its updated fee structure for digital banking services, a move that was well-received by its customer base for its clarity.

Banco do Brasil incentivizes customer loyalty through investment-based discounts on service packages. This encourages clients to consolidate their financial activities, rewarding higher investment volumes with reduced banking fees, thereby fostering deeper, long-term relationships.

Competitive Pricing Reflecting Perceived Value

Banco do Brasil's pricing strategy is carefully crafted to mirror the value customers associate with its extensive suite of financial products and services, reinforcing its established market position. This means that fees and interest rates are set to reflect the quality and breadth of offerings.

The bank actively monitors and incorporates external market dynamics into its pricing decisions. This includes a close watch on what competitors are charging, the prevailing market demand for various financial products, and the broader economic climate. For instance, in early 2024, interest rate trends in Brazil influenced the pricing of loan products, ensuring competitiveness.

This dynamic approach allows Banco do Brasil to strike a balance between maintaining healthy profitability and capturing or expanding its market share. The bank's commitment to competitive pricing is evident in its efforts to keep essential services accessible. For example, as of Q1 2024, Banco do Brasil maintained competitive average interest rates on personal loans compared to other major Brazilian banks.

- Value Alignment: Pricing reflects the perceived worth of a wide array of financial solutions.

- Market Responsiveness: Competitor pricing, demand, and economic conditions are key inputs.

- Strategic Balance: Pricing aims to achieve both profitability and market share growth.

- Accessibility Focus: Efforts are made to ensure financial products remain within reach for a broad customer base.

Hyper-Personalization of Pricing

Banco do Brasil is actively employing advanced analytics and artificial intelligence to drive hyper-personalization in its pricing strategies. This means moving beyond one-size-fits-all approaches to tailor financial products and services to each customer's unique financial situation and preferences.

This granular approach allows for customized pricing policies, dynamic discounts, and flexible credit terms. For instance, a customer with a strong credit history and consistent savings might receive preferential rates on loans or higher interest on deposits, directly reflecting their individual risk profile and engagement with the bank.

The bank's commitment to this strategy is evident in its ongoing investments in data science capabilities. By understanding individual customer behavior and needs, Banco do Brasil aims to significantly enhance customer satisfaction and loyalty. This personalized offering is a key differentiator in the competitive Brazilian banking landscape, fostering stronger relationships and increasing the bank's overall market share.

- Data-Driven Customization: Leveraging AI to analyze millions of customer data points, enabling tailored product offerings.

- Enhanced Customer Experience: Offering personalized interest rates and fees that align with individual financial behaviors and needs.

- Competitive Advantage: Differentiating through bespoke financial solutions that cater to specific customer segments, boosting retention and acquisition.

Banco do Brasil's pricing strategy is multifaceted, focusing on tiered service packages and individual tariffs to cater to a broad customer base. By bundling services, the bank offers cost efficiencies, encouraging customer loyalty through predictable structures. In 2024, adjustments to digital service fees and account maintenance reflected market demands, aiming for a balance between competitiveness and profitability.

Transparency is key, with all tariff changes communicated at least 30 days in advance, a regulatory requirement fostering customer trust. Investment-based discounts further incentivize loyalty, rewarding higher volumes with reduced fees. The bank actively monitors market dynamics, including competitor pricing and economic conditions, to ensure its offerings remain competitive and attractive.

Banco do Brasil is increasingly using AI for hyper-personalization, tailoring pricing, discounts, and credit terms to individual customer profiles. This data-driven approach enhances customer experience and provides a competitive edge by offering bespoke financial solutions.

| Pricing Aspect | Description | Example/Data Point (2024/2025) |

|---|---|---|

| Tiered Packages | Offers various service levels for different customer needs. | "Conta Fácil" for basic needs vs. premium packages for businesses. |

| Bundled Services | Combines services for cost efficiency and customer value. | Packages often include free transfers/withdrawals, reducing à la carte costs. |

| Transparency | Clear communication of all fee changes. | Mandatory 30-day advance notice for tariff adjustments. |

| Loyalty Incentives | Discounts linked to investment volumes. | Higher investment levels correlate with reduced banking fees. |

| Market Responsiveness | Pricing influenced by competition and economic factors. | Loan product pricing adjusted based on prevailing interest rate trends in Brazil. |

| Personalization | AI-driven tailored pricing and offers. | Preferential rates for customers with strong credit history and savings. |

4P's Marketing Mix Analysis Data Sources

Our Banco do Brasil 4P's Marketing Mix Analysis is built upon a foundation of official corporate communications, including annual reports and investor presentations, alongside comprehensive industry research and competitive market data. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.