Bayan Resources SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Bayan Resources possesses significant strengths in its established mining operations and a strong market presence, but faces opportunities in expanding its product portfolio and navigating evolving environmental regulations. Uncover the full strategic picture, including potential threats and detailed recommendations, by purchasing our comprehensive SWOT analysis.

Strengths

Bayan Resources holds extensive coal concessions in East Kalimantan, Indonesia, boasting significant high-quality thermal and metallurgical coal reserves. This strategic advantage underpins consistent, large-scale production, positioning the company favorably in the competitive global coal market.

As of early 2024, Bayan Resources reported substantial proven and probable coal reserves, estimated to be in the hundreds of millions of tonnes, ensuring long-term operational viability. The company's diverse product mix, including both thermal and metallurgical coal, allows it to serve a broad spectrum of industrial demands, from energy generation to critical steel manufacturing processes.

Bayan Resources' integrated logistics and infrastructure, encompassing barging, transshipment, and port facilities, is a significant strength. This control over the entire supply chain, from mine to market, allows for greater efficiency and cost savings. For instance, in 2023, Bayan reported that its integrated logistics capabilities contributed to a competitive cost structure for its coal exports.

Bayan Resources is setting aggressive production targets, aiming for 55-57 million tons in 2024 and a significant leap to 69-72 million tons in 2025. This upward revision from 2023's 48 million tons underscores a strong growth strategy.

The expansion is notably driven by increased output from the North Pakar mine in Tabang, showcasing the company's ability to scale operations effectively. This focus on boosting production is a clear indicator of Bayan's commitment to capturing greater market share and meeting escalating demand for its products.

Strong Financial Performance and Dividend Payouts

Bayan Resources demonstrates significant financial strength, with projected revenues between USD 3.3 billion and USD 3.6 billion for 2024, and an expected increase to USD 4.1 billion to USD 4.4 billion in 2025. This robust performance underpins its capacity for shareholder returns.

The company has a consistent track record of effectively managing its cash, prioritizing debt reduction and distributing surplus capital to its investors. Over the past four years, Bayan Resources has distributed a substantial USD 3.9 billion in dividends, a figure that stands out as the highest among Indonesian coal companies.

- Projected 2024 Revenue: USD 3.3 billion - USD 3.6 billion

- Projected 2025 Revenue: USD 4.1 billion - USD 4.4 billion

- Total Dividends Paid (Last 4 Years): USD 3.9 billion

- Dividend Leadership: Highest among Indonesian listed coal companies

Diversified Market Presence and Sales Commitments

Bayan Resources benefits from a broad market reach, catering to both domestic Indonesian needs and a wide array of international clients. This diversification is key to its stability.

The company has demonstrated strong sales execution, with 80%-82% of its 2024 sales plan already committed by late 2023. This proactive approach ensures a solid revenue base.

Bayan's customer base is geographically diverse, spanning the Philippines, Indonesia, South Korea, China, India, Bangladesh, and Malaysia. This spread mitigates risks associated with reliance on any single market.

Looking ahead, committed and contracted sales for 2025 reached an impressive 65.9 million metric tons by April 2025, underscoring continued demand and effective sales management.

Bayan Resources' extensive coal reserves and integrated logistics provide a significant competitive edge, ensuring efficient and cost-effective operations. The company's aggressive production targets for 2024 and 2025, aiming for 55-57 million tons and 69-72 million tons respectively, highlight its capacity for growth and market capture.

Financially, Bayan Resources is robust, with projected revenues of USD 3.3-3.6 billion for 2024 and USD 4.1-4.4 billion for 2025. Its strong cash management and commitment to shareholder returns are evident in the USD 3.9 billion in dividends distributed over the past four years, the highest among Indonesian listed coal companies.

The company's broad market reach, serving diverse domestic and international clients across Asia, mitigates single-market dependency. Strong sales execution, with 80-82% of 2024 sales committed by late 2023 and 65.9 million metric tons contracted for 2025, demonstrates effective demand management and a solid revenue foundation.

| Metric | 2024 Projection | 2025 Projection | 2023 Actual | 2025 Committed Sales |

|---|---|---|---|---|

| Production (Million Tons) | 55-57 | 69-72 | 48 | N/A |

| Revenue (USD Billion) | 3.3-3.6 | 4.1-4.4 | N/A | N/A |

| Dividends Paid (USD Billion, Last 4 Yrs) | N/A | N/A | 3.9 | N/A |

| Committed Sales (Million Tons) | 80-82% of 2024 Plan | 65.9 (as of Apr 2025) | N/A | 65.9 |

What is included in the product

Delivers a strategic overview of Bayan Resources’s internal and external business factors, highlighting its strengths in coal production and market position, while also identifying potential weaknesses and external threats in the volatile commodity market.

Provides a clear, actionable SWOT analysis of Bayan Resources, highlighting key strengths and opportunities to overcome market challenges.

Weaknesses

Bayan Resources faces significant vulnerability due to the unpredictable nature of global coal prices. While 2025 forecasts suggest stability, the company's earnings are directly tied to these market swings. For instance, Bayan's average coal selling price saw a notable decrease to an estimated USD 60-USD 65 per ton in 2024, a considerable drop from USD 76 per ton in 2023 and USD 118 per ton in 2022, underscoring this inherent weakness.

Bayan Resources has grappled with operational hurdles, notably in Q3 2024, where coal extraction fell short of budgeted figures. This shortfall was primarily attributed to difficulties in overburden removal, directly impacting the company's efficiency and its capacity to achieve ambitious production goals.

Bayan Resources faces a significant challenge with its high production costs, aiming to maintain them around USD 40-43 per ton. This figure encompasses the cost of goods sold, selling, general, and administrative expenses, and royalties, all of which contribute to the overall expense of operations.

Adding to this financial pressure, the company has substantial capital expenditure plans. Bayan has allocated USD 230-260 million for capital expenditure in 2024 and projects USD 200-300 million for 2025. These significant outlays are primarily directed towards crucial infrastructure development and equipment upgrades, which can strain the company's financial resources.

Dependence on Key Export Markets

Bayan Resources' significant reliance on a concentrated base of export markets presents a notable weakness. In 2023, China and India together accounted for approximately two-thirds of Indonesia's coal exports, highlighting the company's vulnerability to shifts in these key economies.

While China's demand has been a strong driver, its accelerating transition to cleaner energy sources introduces a long-term risk. Simultaneously, India's strategic focus on bolstering its domestic coal production could diminish its import needs, directly impacting Bayan's export volumes and revenue streams.

- Concentrated Export Markets: Over-reliance on China and India for coal sales.

- China's Energy Transition: Growing shift away from coal impacts future demand.

- India's Domestic Production Push: Potential reduction in import requirements.

- Vulnerability to Geopolitical Shifts: Changes in trade policies or economic conditions in these nations pose risks.

Environmental, Social, and Governance (ESG) Risks

As a coal mining company, Bayan Resources faces significant headwinds from growing environmental concerns, especially surrounding carbon emissions and the broader implications of climate change. This sector is under increasing scrutiny, impacting operational strategies and investor sentiment.

The company must navigate evolving Environmental, Social, and Governance (ESG) standards, which are becoming more stringent globally. Failure to adapt could result in higher operational expenses due to compliance requirements or restricted access to international capital markets, as many financial institutions are divesting from fossil fuel assets.

For instance, by the end of 2023, many global financial institutions had reinforced their commitments to net-zero emissions, often including stricter policies on financing coal projects. Bayan Resources' reliance on coal means it is directly exposed to these policy shifts.

- Increasing global pressure to reduce carbon emissions directly impacts coal mining operations.

- Evolving ESG standards may necessitate costly upgrades or operational changes.

- Potential future regulations on fossil fuels could limit market access or increase compliance costs.

- Reduced access to international financing due to ESG concerns could constrain growth and investment.

Bayan Resources' profitability is highly susceptible to the volatile nature of global coal prices, as evidenced by the significant drop in its average coal selling price. From USD 118 per ton in 2022 to an estimated USD 60-USD 65 per ton in 2024, this price fluctuation directly impacts earnings, despite forecasts for some stability in 2025.

Operational inefficiencies, such as the Q3 2024 shortfall in coal extraction due to overburden removal challenges, highlight a weakness in meeting production targets and maintaining consistent output. This directly affects the company's ability to capitalize on market opportunities.

The company's high production costs, aiming to remain between USD 40-43 per ton, coupled with substantial capital expenditure plans of USD 230-260 million in 2024 and USD 200-300 million in 2025 for infrastructure and equipment, place a considerable financial strain on the company's resources.

Furthermore, Bayan Resources' dependence on a narrow base of export markets, particularly China and India which constituted about two-thirds of Indonesian coal exports in 2023, exposes it to risks from policy changes or economic downturns in these key regions. The increasing focus on cleaner energy in China and India's drive for domestic production further amplify these vulnerabilities.

| Metric | 2022 | 2023 | 2024 (Est.) | 2025 (Proj.) |

|---|---|---|---|---|

| Average Coal Selling Price (USD/ton) | 118 | 76 | 60-65 | N/A |

| Capital Expenditure (USD million) | N/A | N/A | 230-260 | 200-300 |

| Production Costs (USD/ton) | N/A | N/A | 40-43 | N/A |

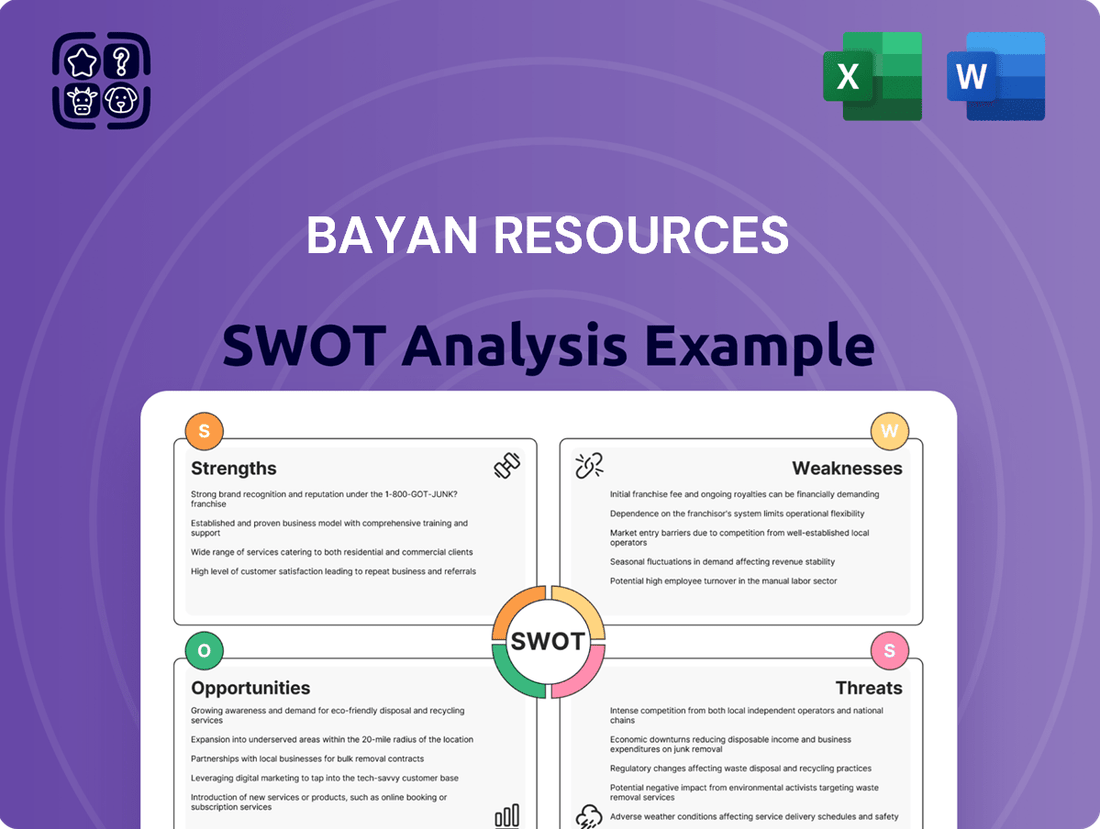

Preview the Actual Deliverable

Bayan Resources SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Bayan Resources SWOT analysis, complete with detailed insights into its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version.

Opportunities

Despite the global move towards cleaner energy sources, coal continues to be a vital energy component in Southeast Asia. Projections indicate that energy demand in this region will see a growth of approximately 3.0% in 2025, underscoring a sustained need for traditional fuel sources.

Nations such as the Philippines and Indonesia are notably increasing their reliance on coal for electricity generation. This trend solidifies a robust and enduring market for coal producers like Bayan Resources, presenting a significant opportunity for continued sales and revenue generation.

Bayan Resources is set to significantly boost its mining output through substantial capital investments. The company plans to expand its North Pakar mine in Tabang, alongside crucial infrastructure developments such as river diversion and the construction of new jetties. These strategic moves are designed to enhance operational efficiency and capacity.

The anticipated outcome of this expansion is a notable increase in production. Bayan Resources projects a 15-20% rise in coal production for 2024, followed by an even more ambitious 20-25% increase in 2025. This aggressive growth strategy is a key opportunity to solidify its market position and capitalize on demand.

Bayan Resources has actively pursued strategic acquisitions, notably the acquisition of PT Enggang Alam Sawita. This move, completed in 2024, is expected to bolster its coal concessions and operational capacity, potentially adding significant reserves to its portfolio.

Further strategic partnerships present a clear opportunity for Bayan to enhance its market penetration and explore diversification within the broader energy landscape. Collaborations could accelerate technological adoption, such as in carbon capture or renewable energy integration, thereby strengthening its long-term competitive position.

Potential for Downstream Processing and Value-Added Products

Indonesia's government is actively encouraging downstream processing to boost the value derived from its mineral wealth. This presents a significant opportunity for Bayan Resources to move beyond raw coal sales.

Bayan could strategically invest in technologies that transform coal into higher-value products or by-products. This diversification would not only create new revenue streams but also lessen the company's dependence on the volatile raw coal market.

Consider these specific areas:

- Coal Gasification: Converting coal into synthesis gas (syngas) for chemicals, fertilizers, or even hydrogen production.

- Coal Liquefaction: Transforming coal into liquid fuels, offering an alternative to traditional oil products.

- Coking Coal Production: Focusing on producing metallurgical coal, essential for steelmaking, which often commands higher prices than thermal coal.

- Research and Development: Investing in R&D for novel coal-based materials or chemicals could unlock future value.

Commitment to ESG Principles and Sustainable Practices

Bayan Resources' commitment to ESG principles, exemplified by initiatives like 'Bayan Peduli' for community development and its focus on good mining practices, positions it favorably in an increasingly sustainability-conscious market. This dedication can significantly bolster its corporate image and appeal to a growing segment of socially responsible investors.

Strengthening these ESG efforts offers a tangible opportunity to attract capital from funds prioritizing environmental and social impact, potentially unlocking access to green financing and lower-cost capital. For instance, in 2024, the global sustainable investment market continued its upward trajectory, with assets under management in ESG funds reaching new highs, indicating strong investor appetite for companies with robust sustainability credentials.

- Enhanced Reputation: Demonstrating a strong ESG framework improves public perception and stakeholder trust.

- Investor Attraction: Socially responsible investors are increasingly allocating capital to companies with clear ESG commitments.

- Green Financing: A solid ESG profile can open doors to specialized financing options, potentially at more favorable rates.

- Risk Mitigation: Proactive management of environmental and social risks can prevent future liabilities and operational disruptions.

The sustained demand for coal in Southeast Asia, with energy needs projected to grow by approximately 3.0% in 2025, presents a significant market opportunity for Bayan Resources.

Bayan's aggressive production expansion plans, targeting a 20-25% increase in coal output for 2025, are well-aligned to capitalize on this regional demand.

Strategic downstream integration, such as coal gasification or liquefaction, offers a pathway to higher-value products and revenue diversification.

Strengthening ESG initiatives can attract socially responsible investors, with global ESG fund assets continuing to grow, potentially unlocking green financing opportunities.

Threats

The accelerating global transition towards cleaner energy sources, driven by climate change concerns and government policies, presents a substantial long-term threat to companies like Bayan Resources, which are heavily invested in coal. This shift is already impacting international coal trade, with many nations actively seeking to reduce their reliance on fossil fuels.

For instance, the International Energy Agency (IEA) reported in its 2024 outlook that while coal demand saw a slight increase in 2023 due to energy security concerns, the long-term trajectory points towards a decline. Projections suggest that global coal consumption could peak and then begin a steady descent in the coming years as renewable energy capacity expands significantly.

This trend directly translates to a potential decrease in demand for thermal coal, Bayan Resources' primary product, in key export markets. As countries implement stricter emissions standards and invest more heavily in solar, wind, and other renewable technologies, the competitive advantage of coal diminishes, posing a significant risk to future revenue streams and market share.

Indonesian coal producers, including Bayan Resources, face a significant hurdle with the Domestic Market Obligation (DMO). This requires 25% of their production to be sold domestically before any exports can occur, and there's a risk this obligation could be further prioritized, directly impacting the volume of coal available for international sales.

Furthermore, the Indonesian government has been tightening mining regulations. A notable example is the increase in Value-Added Tax (VAT) from 11% to 12%, effective April 1, 2024. This rise in taxation directly adds to operational costs, potentially squeezing profit margins for companies like Bayan Resources.

Global coal markets are seeing a significant uptick in competition, with key producing nations like the Philippines and Australia actively expanding their production capabilities. This surge in supply from international players directly impacts Indonesian producers.

Within Indonesia, Bayan Resources, while the third-largest coal producer, contends with formidable domestic rivals. Major competitors such as PT Bumi Resources Tbk. and PT Adaro Energy Indonesia Tbk. command larger market shares and possess greater operational scale, intensifying the competitive landscape for Bayan.

Fluctuations in Commodity Prices and Exchange Rates

While coal prices are projected to find stability, the market continues to be vulnerable to unforeseen swings. These fluctuations are driven by factors like global economic expansion, geopolitical developments, and the interplay of supply and demand. For Bayan Resources, this means potential volatility in its primary revenue stream.

Exchange rate shifts present another significant threat. As Bayan Resources engages in international sales and reports its financials in USD, fluctuations in currency values can directly affect its reported revenues and operational costs. This exposure adds another layer of financial risk that requires careful management.

- Commodity Price Volatility: Global economic growth and geopolitical events continue to influence coal price stability, posing a risk to revenue forecasts.

- Exchange Rate Risk: Changes in currency exchange rates, particularly against the USD, can impact Bayan's international sales revenue and cost of operations.

- Supply-Demand Dynamics: Unpredictable shifts in the global supply and demand for coal can lead to price volatility, affecting profitability.

Land Acquisition Disputes and Operational Delays

Land acquisition disputes can significantly disrupt operations and delay expansion projects. For instance, the Ministry of Energy and Mineral Resources has cited these issues as a factor in setting lower production targets for Indonesia's coal industry in 2025, impacting companies like Bayan Resources.

These kinds of unforeseen operational delays, stemming from land disputes or other challenges, pose a direct threat to Bayan's growth strategies. Such disruptions could impede the company's ability to ramp up production and meet its own projected output levels.

- Land Disputes Impact: Ministry of Energy and Mineral Resources' 2025 Indonesian coal production targets are influenced by land acquisition issues.

- Operational Risk: Unforeseen delays due to land disputes threaten Bayan's expansion plans and production targets.

- Financial Ramifications: Delays can lead to increased costs and reduced revenue, impacting profitability.

The global shift towards cleaner energy sources poses a significant long-term threat to Bayan Resources, as many nations aim to reduce fossil fuel reliance. While the IEA noted a slight 2023 demand increase due to energy security, the long-term trend indicates a decline as renewables expand. This directly impacts thermal coal demand, Bayan's core product, in export markets due to stricter emissions standards and increased investment in renewables.

| Threat | Description | Data/Example |

|---|---|---|

| Energy Transition | Global shift away from coal to cleaner energy sources. | IEA 2024 outlook: Long-term decline projected for coal consumption as renewables capacity grows. |

| Domestic Market Obligation (DMO) | Government requirement for a percentage of production to be sold domestically. | 25% of production must be sold domestically before exports, with potential for increased prioritization. |

| Regulatory Changes | Tightening mining regulations and increased taxation. | VAT increased from 11% to 12% effective April 1, 2024, raising operational costs. |

| Increased Competition | Surge in production from international and domestic rivals. | Competitors like PT Bumi Resources and PT Adaro Energy Indonesia hold larger market shares. |

| Price Volatility | Unforeseen swings in coal prices due to global economic and geopolitical factors. | Global economic growth and geopolitical developments influence coal price stability. |

| Exchange Rate Risk | Fluctuations in currency values impacting international sales and costs. | As Bayan reports in USD, currency shifts affect reported revenues and operational expenses. |

| Land Acquisition Disputes | Disruptions to operations and delays in expansion projects. | Ministry of Energy and Mineral Resources cited land issues impacting lower 2025 production targets. |

SWOT Analysis Data Sources

This Bayan Resources SWOT analysis is built upon a robust foundation of data, including the company's official financial reports, comprehensive industry market analyses, and expert opinions from seasoned professionals in the mining sector.