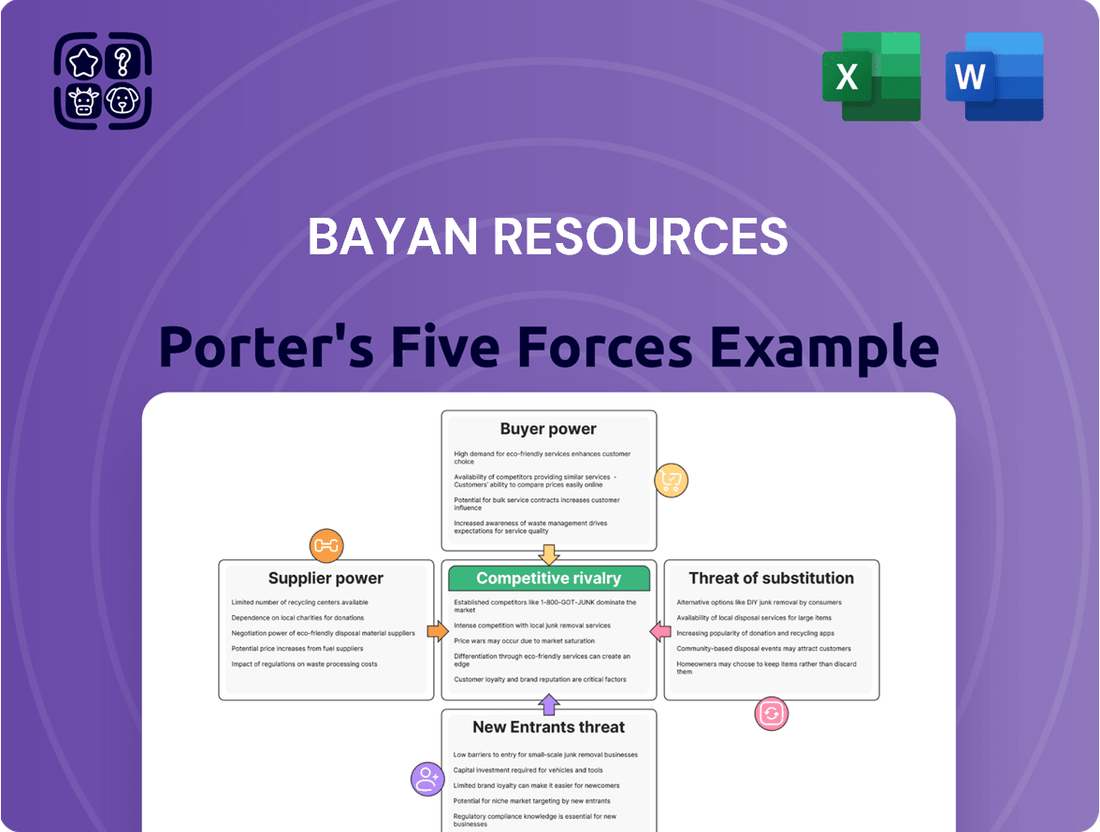

Bayan Resources Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Bayan Resources faces significant competitive pressures, with substantial bargaining power from buyers and a moderate threat from new entrants in the coal mining sector. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Bayan Resources’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bayan Resources faces a heightened bargaining power from its suppliers if the market for critical inputs, such as specialized mining machinery or advanced logistics services, is dominated by a small number of powerful companies. This concentration means Bayan has fewer alternatives, allowing these suppliers to potentially dictate terms and pricing. For example, if only a few global manufacturers produce the specific heavy-duty excavators Bayan relies on, their leverage is significantly amplified.

The uniqueness of inputs significantly impacts supplier bargaining power. If Bayan Resources relies on highly specialized or proprietary components for its mining operations, like custom-engineered parts for its fleet or patented software essential for efficiency, suppliers of these inputs hold considerable leverage. For instance, in 2024, the mining equipment sector saw continued demand for specialized parts, with lead times for certain critical components extending, indicating supplier strength.

When inputs are unique, switching to an alternative supplier becomes costly and time-consuming for Bayan Resources. This difficulty in finding comparable substitutes or the expense associated with retooling or retraining to accommodate new suppliers directly strengthens the bargaining position of the current suppliers. This was evident in early 2025, where reports indicated that the cost of integrating new, non-proprietary software systems for large-scale mining operations could run into millions of dollars, highlighting the financial barrier to switching.

The threat of forward integration by suppliers, while generally low for major equipment manufacturers, could empower suppliers of critical services or components. For instance, a specialized logistics provider could potentially expand into managing mining operations or transportation, thereby increasing their bargaining power over Bayan Resources.

Cost of Switching Suppliers

The cost of switching suppliers significantly influences the bargaining power of suppliers for Bayan Resources. If it's expensive or difficult for Bayan Resources to change to a different supplier, then existing suppliers have more leverage. This leverage allows them to potentially dictate terms, increase prices, or reduce the quality of goods and services. For a company like Bayan Resources, reliant on a steady flow of critical materials and specialized equipment for its mining operations, high switching costs can be a substantial factor.

These switching costs can manifest in several ways. For instance, investing in new machinery or modifying existing infrastructure to accommodate a different supplier's specifications can be a major expense. Furthermore, retraining staff to operate new equipment or integrate different logistical systems adds to the overall burden. Disruptions to ongoing mining projects due to the transition process can also lead to significant financial losses, making the decision to switch suppliers a carefully considered one.

- High switching costs empower suppliers by making it difficult and expensive for Bayan Resources to change providers.

- Costs include potential investments in new equipment, retraining personnel, and the risk of operational disruptions.

- For Bayan Resources, these costs are amplified by the need for continuous mining operations and robust infrastructure management.

Importance of Supplier's Input to Bayan's Cost or Differentiation

The criticality of a supplier's input directly impacts Bayan Resources' cost structure and product differentiation. If a supplier provides essential components or technologies, like advanced mining equipment that significantly lowers extraction costs or enhances coal quality, that supplier gains considerable bargaining power. Bayan would then be more susceptible to price hikes or altered supply terms from such vital partners.

For instance, specialized drilling equipment or unique processing chemicals that are instrumental in Bayan's operational efficiency or in achieving premium coal grades give those suppliers leverage. Bayan's reliance on these specific inputs means they have less room to negotiate unfavorable terms without risking operational disruptions or a decline in their product's market appeal.

Consider the 2024 landscape where advancements in mining technology are rapidly evolving. Suppliers of cutting-edge, proprietary equipment that demonstrably increase output or reduce environmental impact hold a strong hand. Bayan's ability to maintain its competitive edge may hinge on securing these technologies, thereby increasing the bargaining power of the firms that provide them.

- Supplier Dependence: The degree to which Bayan relies on a supplier for unique or critical inputs.

- Input's Impact: How significantly a supplier's product affects Bayan's cost of production or the quality/differentiation of its coal.

- Switching Costs: The expenses and difficulties Bayan would face if it decided to switch to an alternative supplier.

- Supplier's Market Power: The overall strength and market position of the supplier itself.

Bayan Resources faces significant supplier bargaining power when its essential inputs, such as specialized mining equipment or crucial raw materials, are concentrated among a few dominant providers. This limited supplier base, coupled with the unique nature of certain components, amplifies their leverage. For example, in 2024, the global market for high-capacity haul trucks saw limited manufacturers, with lead times extending for key models, directly impacting mining operations like Bayan's.

The high cost of switching suppliers, encompassing potential investments in new infrastructure and retraining, further entrenches supplier power. Bayan's reliance on proprietary technology for efficient extraction means that transitioning to alternative, less specialized equipment could incur millions in costs and operational downtime. This was highlighted in early 2025 reports detailing the substantial financial implications of integrating new mining software systems.

The criticality of a supplier's input to Bayan's production efficiency and product quality is a key determinant of supplier leverage. Suppliers of advanced drilling technology or specialized processing agents that directly impact coal recovery rates and market value hold considerable sway. Bayan's dependence on these inputs to maintain its competitive edge in 2024 made it more susceptible to price adjustments and less flexible in negotiating terms.

| Factor | Impact on Bayan Resources | Supporting Data/Example (2024-2025) |

|---|---|---|

| Supplier Concentration | Increases bargaining power due to fewer alternatives. | Limited number of global manufacturers for specialized heavy-duty mining excavators. |

| Input Uniqueness/Specialization | High leverage for suppliers of proprietary or custom components. | Extended lead times for critical mining equipment parts in 2024 due to high demand for specialized technology. |

| Switching Costs | Deters Bayan from changing suppliers, strengthening existing relationships. | Millions of dollars in integration costs for new mining software systems cited in early 2025. |

| Input Criticality | Suppliers of essential technologies gain leverage by impacting Bayan's efficiency and product differentiation. | Bayan's reliance on cutting-edge drilling equipment to achieve premium coal grades in 2024. |

What is included in the product

This analysis delves into the competitive forces shaping Bayan Resources' operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the coal industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Bayan Resources.

Customers Bargaining Power

Bayan Resources' customer base includes domestic and international power plants and industrial users. If a few large utility companies or industrial groups represent a substantial portion of Bayan's sales, these concentrated buyers gain significant bargaining power. The potential loss of a major client could severely affect Bayan's financial performance.

Customers of thermal and metallurgical coal, especially large industrial users, often experience low costs when switching between suppliers, provided the coal quality and specifications are similar. This ease of switching significantly amplifies their bargaining power.

For instance, if Bayan Resources were to increase prices or not meet delivery expectations, these buyers could readily divert their business to competitors. In 2024, the global coal market saw continued price volatility, with some regions experiencing supply constraints, which could either increase or decrease buyer power depending on the specific market dynamics and the availability of alternative suppliers.

Bayan Resources' customers, primarily power plants, exhibit significant price sensitivity. As coal is a major input cost for electricity generation, any changes in its price directly impact operational expenses for these buyers.

The commodity nature of coal means that customers have numerous alternatives, intensifying their focus on price. In 2024, global coal prices have seen fluctuations, and Bayan's ability to maintain competitive pricing is crucial for retaining its customer base, especially when supply is abundant or demand softens.

Threat of Backward Integration by Buyers

The bargaining power of customers is significantly influenced by the threat of backward integration. If Bayan's major clients, like large power generation companies, possess the financial strength and technical know-how to establish their own coal mining facilities, their leverage over Bayan escalates.

This potential for self-sufficiency compels Bayan to consider offering more competitive pricing and favorable contract terms to maintain these crucial customer relationships. For instance, by 2024, several major global utilities have explored or initiated vertical integration strategies to secure their energy supply chains, directly impacting coal suppliers.

- Increased Leverage: Major customers can negotiate better prices or terms if they can mine coal themselves.

- Risk Mitigation for Buyers: Backward integration allows buyers to control supply, quality, and costs.

- Impact on Bayan: Bayan may need to offer concessions to retain large, capable customers.

- Industry Trend: Some large power producers have been actively investigating or implementing backward integration to ensure stable coal supply.

Availability of Substitute Products for Buyers

The availability of substitute products significantly influences the bargaining power of customers for Bayan Resources. If buyers can readily access alternative energy sources or different grades of coal with comparable qualities to Bayan's offerings, their ability to negotiate favorable terms increases. For instance, a strong market presence of natural gas or a surge in renewable energy adoption can diminish demand for thermal coal, empowering buyers to demand lower prices or better contract conditions.

The ease with which customers can switch suppliers or energy sources is a critical factor. In 2024, the global energy market continued its diversification trend. For example, while coal remains a significant energy source, the International Energy Agency reported that natural gas consumption in many Asian markets, key for Bayan, remained competitive, offering a viable alternative for power generation. This substitutability directly translates to increased buyer leverage.

- Increased Buyer Leverage: The presence of readily available substitutes like natural gas and renewable energy sources empowers customers to negotiate better pricing and terms with Bayan Resources.

- Market Diversification Impact: In 2024, the ongoing global shift towards diverse energy portfolios means buyers have more options, reducing their reliance on any single coal producer.

- Switching Costs: While switching to renewable energy may involve higher initial investment, the operational cost savings and environmental benefits can make it an attractive substitute, thereby increasing buyer power against traditional coal suppliers like Bayan.

Bayan Resources' customers, primarily large power plants and industrial users, wield considerable bargaining power due to the commodity nature of coal and the availability of numerous suppliers. This power is amplified when buyers can easily switch between providers, especially if quality specifications are similar. In 2024, the global coal market's volatility, influenced by supply constraints in some regions, could either strengthen or weaken buyer power depending on specific market conditions and the availability of alternatives.

Customers' price sensitivity is high, as coal represents a significant operational cost. The potential for backward integration, where major clients might consider developing their own mining operations, further increases their leverage. This trend was observed in 2024, with some global utilities exploring vertical integration to secure their supply chains, prompting coal suppliers like Bayan to offer more competitive terms.

The availability of substitute energy sources, such as natural gas and renewables, also empowers customers. In 2024, the continued diversification of energy portfolios meant that buyers had more options, reducing their dependence on coal. For instance, natural gas remained a competitive alternative in key Asian markets, as noted by the International Energy Agency, directly impacting Bayan's customer leverage.

| Factor | Impact on Bayan Resources | 2024 Context |

| Customer Concentration | High if a few large buyers dominate sales. | Major utilities in Asia, a key market for Bayan, often have significant purchasing power. |

| Switching Costs | Low for customers with similar coal quality needs. | Ease of switching between suppliers remains a constant pressure point. |

| Price Sensitivity | High, as coal is a major input cost for power generation. | Fluctuating global coal prices in 2024 directly impacted customer purchasing decisions. |

| Availability of Substitutes | High due to natural gas and renewables. | Diversification of energy sources continued in 2024, increasing buyer options. |

| Threat of Backward Integration | Moderate to High for large, financially capable customers. | Some global power producers explored vertical integration in 2024 to secure supply. |

Same Document Delivered

Bayan Resources Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of Bayan Resources meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the Indonesian coal mining industry. This in-depth report is designed to equip you with actionable insights for strategic decision-making.

Rivalry Among Competitors

The Indonesian coal mining sector is a crowded field, featuring a mix of substantial companies and many smaller operations. Bayan Resources stands out as a significant entity within this landscape, holding the position of the third-largest coal producer in Indonesia. This means it competes directly with giants like PT Bumi Resources Tbk. and PT Adaro Energy Indonesia Tbk., indicating a market where intense competition shapes how companies operate and price their products.

The Indonesian coal industry anticipates positive growth, with coal production forecasted to reach 17 exajoules by 2028. This expansion, however, is tempered by a projected slight slowdown in the coal and lignite mining sector during 2024, followed by a recovery in 2025.

A decelerating growth rate can heighten competitive pressures. When the market expands more slowly, existing players often intensify their efforts to capture a greater share of the available demand, potentially leading to more aggressive pricing and marketing strategies among companies like Bayan Resources.

While Bayan Resources primarily deals in thermal and metallurgical coal, which are largely commoditized products, the company leverages its integrated infrastructure. This includes control over barging, transshipment, and port facilities, offering a degree of differentiation in its supply chain, even if the core product has limited unique features. This infrastructure control is crucial in a market where price competition is often intense due to the commodity nature of coal.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the coal mining industry, as they can trap companies with substantial fixed assets and long-term commitments, even when operations are unprofitable. This forces these entities to continue competing, often aggressively, to recover their investments, thereby intensifying the overall market competition.

Bayan Resources, for instance, faces considerable exit barriers due to its extensive investments in mining concessions and the necessary infrastructure. These include large-scale mining equipment, processing facilities, and transportation networks. For example, as of the first half of 2024, Bayan Resources reported significant capital expenditures, underscoring the substantial, sunk costs involved in its operations.

- Significant Fixed Assets: Bayan Resources operates with a vast fleet of heavy machinery, including excavators and haul trucks, and extensive infrastructure such as conveyor systems and port facilities, representing billions in invested capital.

- Long-Term Contracts: The company is often bound by long-term coal supply agreements, which, while providing revenue stability, also create obligations that make exiting the market difficult without incurring penalties or breaching commitments.

- Concession Commitments: Holding mining concessions involves adherence to specific operational and development timelines, making early termination or abandonment financially punitive and complex.

Diversity of Competitors

Bayan Resources faces a competitive landscape populated by companies with differing strategic objectives, cost bases, and operational geographies. This heterogeneity can manifest in unpredictable competitive actions, as each player pursues its unique path to market success.

Key rivals for Bayan Resources include PT Bumi Resources Tbk, PT Adaro Energy Indonesia Tbk, Dian Swastatika Sentosa, and United Tractors. For instance, as of late 2023, PT Adaro Energy Indonesia Tbk reported a significant increase in its EBITDA, reaching $2.1 billion for the first nine months of 2023, showcasing a strong operational performance that influences competitive dynamics.

- Diverse Strategic Goals: Competitors may prioritize market share over profitability, or focus on specific market segments, leading to varied competitive approaches.

- Varied Cost Structures: Differences in operational efficiency, access to capital, and scale can result in competitors employing tactics such as aggressive pricing or strategic cost management.

- Geographic Focus: Some rivals might concentrate on domestic markets, while others pursue international expansion, creating distinct competitive pressures and opportunities.

- Unpredictable Tactics: This diversity can spur a range of competitive maneuvers, from price wars to mergers and acquisitions, making the market environment dynamic and challenging to navigate.

The competitive rivalry in Indonesia's coal sector is intense, with Bayan Resources, the third-largest producer, facing formidable rivals like PT Bumi Resources and PT Adaro Energy Indonesia. The market's commoditized nature, particularly for thermal coal, drives aggressive pricing strategies among these players.

Despite a projected market slowdown in 2024, the continued expansion of coal production to an anticipated 17 exajoules by 2028 means companies must fight harder for market share. Bayan Resources differentiates itself through integrated infrastructure, including port facilities, which is vital in a price-sensitive environment.

High exit barriers, stemming from substantial investments in mining assets and long-term contracts, compel companies to remain active and competitive, even during challenging periods. This persistence further fuels the rivalry, as players are committed to recovering their significant capital outlays.

| Key Competitors | 2023 Performance Indicator | Significance |

|---|---|---|

| PT Adaro Energy Indonesia Tbk. | $2.1 billion EBITDA (first 9 months 2023) | Demonstrates strong operational performance and competitive strength. |

| PT Bumi Resources Tbk. | Largest coal producer in Indonesia | Directly competes for market share and pricing influence. |

| Dian Swastatika Sentosa | Significant player in coal trading and mining | Contributes to market fragmentation and competitive pressure. |

SSubstitutes Threaten

The most significant substitutes for coal, Bayan Resources' primary product, are alternative energy sources like natural gas, solar, wind, and hydropower. Indonesia, where Bayan operates, has set targets for renewable energy integration into its power generation mix, aiming for 23% by 2025, though actual implementation has faced challenges and coal remains dominant.

Globally, the push towards cleaner energy and the falling costs of renewable technologies present a growing long-term threat to coal's market share. For instance, the International Energy Agency reported in 2024 that renewable energy capacity additions reached record levels, signaling a shift away from fossil fuels.

Technological advancements are significantly bolstering the threat of substitutes for traditional energy sources like coal, which is central to Bayan Resources. Ongoing progress in renewable energy technologies, particularly solar and wind power, coupled with improvements in battery storage, makes these alternatives increasingly competitive and cost-effective. For instance, global renewable energy capacity is projected to see substantial growth, with the International Energy Agency (IEA) reporting that renewables are expected to account for over 95% of the increase in global power capacity through 2026.

While Indonesia's renewable energy target for 2025 may have seen adjustments, the overarching global and national trend is a clear push towards greater renewable energy integration. This technological progress directly enhances the viability and attractiveness of substitutes, presenting a continuous challenge to established fossil fuel industries. The declining costs of solar photovoltaic (PV) and wind power, driven by innovation and economies of scale, mean that these alternatives are no longer niche options but are becoming mainstream energy solutions.

Stricter environmental regulations and government policies aimed at reducing carbon emissions and promoting cleaner energy sources directly increase the threat of substitutes for coal. For instance, Indonesia's ambitious decarbonization goals, as highlighted by its commitment to the Just Energy Transition Partnership (JETP), are expected to drive policies that favor renewable energy sources over coal. This regulatory push is already accelerating the global shift away from fossil fuels, making alternatives more competitive and accessible.

Customer Preference for Sustainable Options

Customer preference for sustainable options presents a significant threat of substitutes for Bayan Resources. As environmental awareness grows, particularly among international buyers, there's an increasing demand for greener energy alternatives. This shift could gradually reduce the reliance on coal, impacting Bayan's market share.

While coal remains a vital component for many industries, the rising tide of sustainability goals means customers are actively exploring and adopting renewable energy sources. This trend is not just a niche concern; it's becoming a mainstream consideration in procurement decisions.

- Growing Demand for Renewables: Global renewable energy capacity is projected to expand significantly. For instance, the International Energy Agency (IEA) reported in 2024 that renewable electricity generation is set to grow by over 25% between 2023 and 2028.

- Corporate Sustainability Targets: Many of Bayan's key customers, especially those in developed markets, have set ambitious net-zero emission targets, pushing them to diversify their energy portfolios away from fossil fuels.

- Policy and Regulatory Shifts: Governments worldwide are implementing policies that favor cleaner energy, making alternatives more economically attractive and accessible, thereby increasing the threat of substitution for coal.

Development of Coal Downstreaming Technologies

The advancement of coal downstreaming technologies, such as gasification into Dimethyl Ether (DME), presents a nuanced threat. While not a direct substitute for coal's primary energy functions, these developments aim to enhance the value of domestic mineral resources and decrease import dependency. This strategic shift could potentially alter demand for specific coal grades.

For instance, Indonesia, a significant coal producer, has been exploring coal gasification projects to produce DME, a cleaner alternative to LPG. By 2024, the government continued to push for the commercialization of these projects, aiming to reduce the nation's LPG import bill, which stood at billions of dollars annually. This initiative highlights how technological adaptation can redefine the market position of traditional commodities like coal.

- Coal Gasification Projects: Indonesia's focus on converting coal to DME aims to cut LPG imports, a market valued in the billions of dollars.

- Value Addition: Downstreaming technologies seek to increase the economic benefit derived from coal resources within the producing country.

- Market Adaptation: These efforts represent coal's adaptation to evolving energy needs and policy objectives, potentially influencing demand patterns for certain coal types.

The threat of substitutes for Bayan Resources' coal is significant and growing, primarily driven by the increasing competitiveness and adoption of renewable energy sources. Falling costs in solar and wind power, coupled with advancements in energy storage, make these alternatives more viable. For example, the International Energy Agency (IEA) reported a record increase in renewable capacity additions globally in 2024, signaling a clear shift away from fossil fuels.

Government policies and corporate sustainability goals further amplify this threat. Many nations, including Indonesia with its Just Energy Transition Partnership (JETP) commitments, are actively promoting cleaner energy. This regulatory push, alongside growing customer demand for sustainable options, pressures industries to diversify away from coal. By 2024, many international customers had set ambitious net-zero targets, influencing their procurement decisions.

While coal gasification projects, like converting coal to Dimethyl Ether (DME) in Indonesia, aim to add value to coal resources and reduce import dependency, they represent an adaptation rather than a complete removal of the substitute threat. These projects, supported by government initiatives to cut billions in LPG imports, highlight how traditional energy sources are trying to remain relevant in an evolving market.

| Substitute Type | Key Drivers | Impact on Coal Demand |

|---|---|---|

| Renewable Energy (Solar, Wind) | Falling costs, technological advancements, government incentives | Increasingly competitive, reducing market share for coal |

| Natural Gas | Lower emissions than coal, existing infrastructure | Competes directly in power generation, especially in the short to medium term |

| Energy Storage (Batteries) | Improved efficiency, cost reduction | Enhances the reliability of intermittent renewables, further displacing coal |

| Coal Gasification (DME) | Government policy, import reduction goals | Potential to shift demand for specific coal grades, but not a direct substitute for energy generation |

Entrants Threaten

The sheer scale of investment needed to enter the coal mining sector, especially for companies with integrated operations like Bayan Resources, presents a formidable barrier. For instance, establishing a new, large-scale mine demands hundreds of millions, if not billions, of dollars for exploration, site development, and the acquisition of specialized heavy machinery.

Beyond the mine itself, the costs associated with building essential infrastructure, such as dedicated barging facilities and port access, further escalate the capital hurdle. These integrated logistical requirements mean that new players must not only fund mining operations but also the complex supply chain necessary to bring the product to market.

Bayan Resources' control over essential infrastructure, including barging, transshipment, and port facilities, presents a formidable hurdle for potential new entrants. Developing comparable infrastructure requires substantial capital investment and a significant time commitment, effectively deterring many from entering the market.

For instance, establishing a new coal terminal with the capacity to handle large volumes, similar to those Bayan Resources operates, can easily cost hundreds of millions of dollars. Without this critical infrastructure, new players would struggle to efficiently transport and export their products, making it difficult to compete on cost and reliability.

The Indonesian mining sector, including coal production, is subject to stringent government regulations. New entrants must navigate a complex web of permits, licenses, and environmental and social standards mandated by bodies like the Ministry of Energy and Mineral Resources. For instance, in 2024, the government continued to emphasize sustainable mining practices, requiring significant upfront investment in compliance for any new operator.

These regulations, such as the need for specific mining business permits (IUP) and adherence to production quotas set by the Ministry, create a substantial barrier to entry. Obtaining these concessions is a time-consuming and capital-intensive process, effectively deterring smaller or less experienced players from entering the market. This regulatory hurdle significantly limits the threat of new entrants in the Indonesian mining landscape.

Economies of Scale

Established players like Bayan Resources leverage significant economies of scale in production, procurement, and logistics, a direct result of their extensive operations. As one of Indonesia's largest coal producers, Bayan benefits from lower per-unit costs that are difficult for newcomers to match.

New entrants would likely struggle to achieve similar cost efficiencies initially. This disadvantage in per-unit costs makes competing on price a substantial hurdle for any new company entering the Indonesian coal market.

- Economies of Scale Advantage: Bayan Resources, as a major Indonesian coal producer, benefits from cost reductions due to its large-scale operations.

- Procurement and Logistics Efficiencies: Bulk purchasing and optimized logistics further reduce Bayan's operational expenses compared to smaller or new competitors.

- Cost Barrier for New Entrants: New companies face higher per-unit costs until they reach comparable production volumes, hindering their ability to compete on price.

Incumbent Advantages (e.g., brand loyalty, proprietary technology, experience)

Bayan Resources leverages its deep operational history, dating back to 1973, providing a significant advantage over potential newcomers. This extensive experience in Indonesian coal mining translates into refined operational efficiencies and a robust understanding of the local regulatory landscape. For instance, in 2023, Bayan Resources reported a production volume of 40.7 million tonnes, demonstrating its established capacity and operational scale.

The company has cultivated strong, long-term relationships with its customer base, built on reliability and consistent supply. These established partnerships are crucial in the commodity sector where trust and dependable delivery are paramount. New entrants would face the considerable hurdle of building similar rapport and trust within the market.

Furthermore, Bayan Resources may possess proprietary mining techniques or operational optimizations developed over decades of practice. These could include advanced extraction methods or cost-saving processes that are not readily transferable or replicable by new competitors, thereby creating a barrier to entry.

- Established Presence: Operating since 1973 provides decades of market knowledge and operational refinement.

- Customer Relationships: Long-standing ties with buyers ensure consistent demand and reduce customer acquisition costs for Bayan.

- Operational Expertise: Decades of experience likely lead to efficiencies and potentially proprietary mining techniques.

The threat of new entrants for Bayan Resources is significantly mitigated by the substantial capital requirements for establishing integrated coal mining and logistics operations in Indonesia. New players must contend with immense upfront investments for mine development, heavy machinery, and crucial infrastructure like dedicated barging and port facilities, making entry prohibitively expensive.

Furthermore, stringent government regulations, including the need for specific permits and adherence to environmental standards, add layers of complexity and cost. For example, in 2024, the Indonesian government continued its focus on sustainable mining practices, requiring new operators to invest heavily in compliance from the outset.

Bayan Resources' established economies of scale, procurement advantages, and decades of operational expertise, evidenced by its 2023 production of 40.7 million tonnes, create a cost barrier that newcomers will find difficult to surmount in the immediate term. These factors collectively limit the ease with which new competitors can enter and challenge Bayan's market position.

Porter's Five Forces Analysis Data Sources

Our Bayan Resources Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and official filings with regulatory bodies. We also integrate insights from reputable industry research firms and financial news outlets to provide a thorough understanding of the competitive landscape.