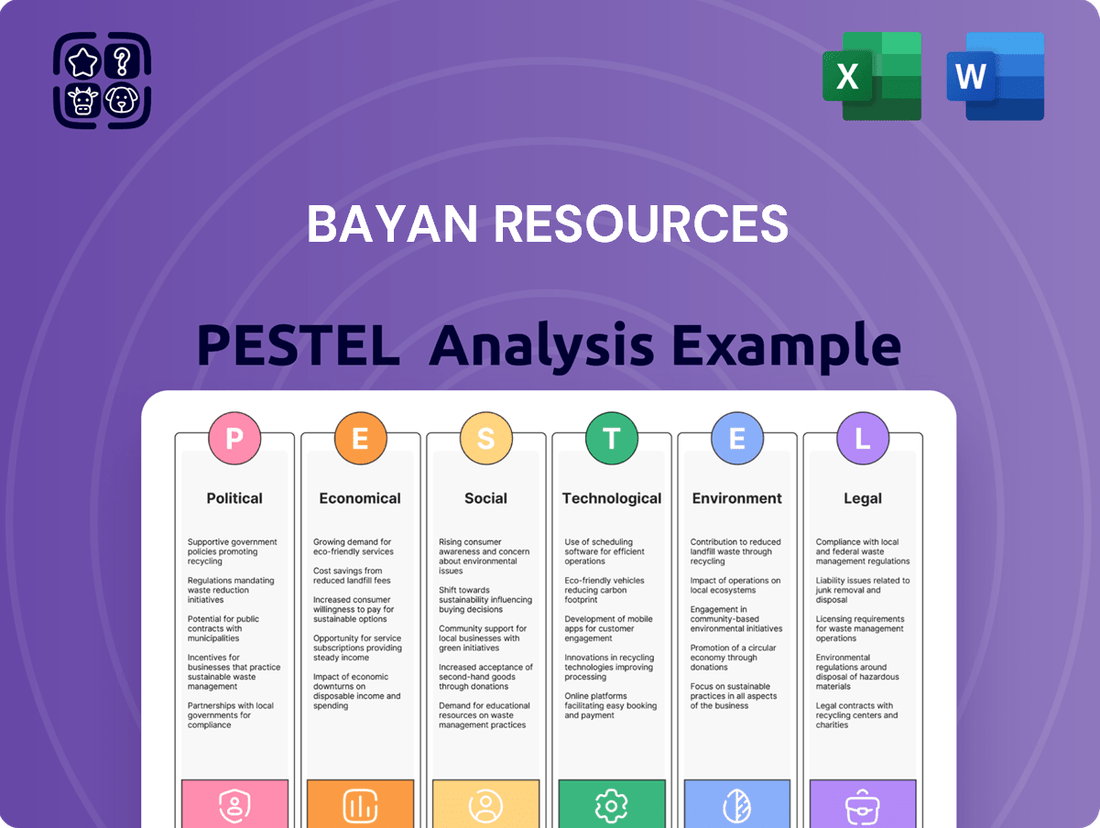

Bayan Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Navigate the complex external landscape impacting Bayan Resources with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are shaping the company's strategic direction. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Purchase the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

The Indonesian government's policies on coal production and exports significantly shape Bayan Resources' operational landscape. Recent directives, including the Domestic Market Obligation (DMO) requiring a portion of production to be sold domestically, and discussions around potential export duties, directly affect the company's sales volumes and revenue streams. For instance, in 2023, the government continued to emphasize the DMO, ensuring a stable supply for domestic power generation, which can limit export opportunities for companies like Bayan.

Furthermore, the government's objective to bolster state revenues through adjustments in royalty rates for coal and other mineral products presents another critical political factor. These adjustments, which can be implemented with relative speed, directly impact Bayan Resources' cost structure and profitability. The ongoing focus on optimizing non-tax revenues suggests a potential for evolving royalty frameworks, requiring Bayan to remain agile in its financial planning and operational strategies.

Indonesia is actively pursuing an energy transition, aiming to boost the share of new and renewable energy in its primary mix. For instance, the government has set ambitious targets, such as increasing the renewable energy portion to 23% by 2025.

However, progress has been uneven, with some targets being missed, which could mean continued reliance on coal for a period. This situation presents both challenges and opportunities for companies like Bayan Resources.

The incoming administration's stance on clean energy and climate goals will be a significant factor influencing the pace and direction of this transition, directly impacting the future energy landscape for Bayan Resources.

Global and regional geopolitical shifts, particularly concerning trade relations and energy security in key importing nations, directly influence international coal demand and pricing. Bayan Resources, operating in both domestic and international arenas, must closely track these evolving dynamics to refine its marketing approaches.

The International Energy Agency (IEA) projects that global coal demand will remain relatively stable through 2025, though significant regional disparities are anticipated. For instance, while demand in some Asian economies might see slight increases, other regions are expected to experience declines as they transition to cleaner energy sources.

Regulatory Stability and Investment Climate

Regulatory stability is a cornerstone for investment in Indonesia's mining sector. Recent legislative updates in 2024 and projected refinements in 2025 are designed to bring greater clarity and predictability to mining laws. This focus on streamlining processes and enhancing legal certainty directly impacts companies like Bayan Resources, influencing their ability to secure long-term operational planning and pursue expansion initiatives.

The Indonesian government's commitment to a stable regulatory environment aims to bolster investor confidence. For Bayan Resources, this translates to a more predictable operational landscape, reducing the risk associated with potential policy shifts. The effectiveness of these regulatory changes will be a key determinant in attracting and retaining both domestic and foreign capital within the vital coal mining industry.

- Regulatory Clarity: Laws enacted in 2024 and planned for 2025 aim to simplify mining permit processes.

- Investment Certainty: Stable regulations are critical for attracting and retaining capital in the Indonesian mining sector.

- Bayan Resources Impact: Predictability in mining laws directly affects Bayan Resources' long-term strategic planning and investment decisions.

Government Involvement in the Mining Sector

The Indonesian government's active role in the mining sector is a significant political factor for Bayan Resources. Recent policies, such as prioritizing certain entities for special mining business permits, including religious organizations and state-owned enterprise subsidiaries, are reshaping the competitive environment. This increased government involvement could lead to new opportunities or heightened competition, requiring Bayan Resources to be agile in its strategic planning.

Navigating this evolving regulatory landscape is crucial for Bayan Resources. The company may need to explore strategic alliances or adapt its operational strategies to align with government priorities and potential shifts in market access. For instance, the government's focus on downstream processing of mineral resources could present opportunities for companies willing to invest in value-added activities.

In 2024, the Indonesian government continued its push for greater domestic control and value addition in the mining industry. This includes policies aimed at encouraging the development of smelters and processing facilities. Companies like Bayan Resources, which primarily export raw or semi-processed commodities, must consider how these policies might affect their operations and market access in the coming years.

Key aspects of government involvement include:

- Permit Allocation: Government decisions on granting and renewing mining permits directly impact operational continuity and expansion plans for companies like Bayan Resources.

- Resource Nationalism: Policies promoting domestic ownership and control over natural resources can influence foreign investment and operational requirements.

- Environmental and Social Governance (ESG): Increasingly stringent environmental regulations and social responsibility expectations set by the government require continuous adaptation and investment in sustainable practices.

Government policies on coal, such as the Domestic Market Obligation (DMO), continue to influence Bayan Resources' sales volumes and revenue, with the DMO remaining a key factor in 2023 and likely continuing into 2024. Adjustments to royalty rates are also a persistent concern, directly impacting the company's cost structure and profitability. The Indonesian government's energy transition goals, aiming for a significant increase in renewable energy by 2025, present a long-term challenge to coal demand, although the pace of this transition will be shaped by the incoming administration's priorities.

What is included in the product

This PESTLE analysis of Bayan Resources examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive understanding of the external landscape.

Provides a concise version of the Bayan Resources PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external risks and market positioning.

Economic factors

Global coal demand hit an unprecedented peak in 2024, primarily fueled by China, India, and other developing nations, though the pace of this expansion has moderated. For 2025, projections indicate global coal demand will likely stabilize around the 2024 figures. This stability is anticipated despite expected downturns in China and India, where slower electricity demand growth and a greater reliance on renewable energy sources are key drivers.

Conversely, countries such as the United States and those within the ASEAN region are forecast to see increased coal consumption. Bayan Resources' operational performance, specifically its sales volumes and revenue streams, will be directly impacted by these shifting global and domestic demand patterns in its core markets.

International thermal coal prices showed resilience in early 2025, with benchmarks like the Newcastle benchmark hovering around $130 per tonne. Bayan Resources' average selling price for its thermal coal is anticipated to align with this trend, reflecting a stable but sensitive market environment.

The company’s profitability remains closely tied to these price fluctuations. Global supply-demand imbalances, particularly as nations navigate their energy transition strategies, alongside ongoing geopolitical tensions, continue to introduce volatility. For instance, disruptions in key exporting regions in late 2024 contributed to price spikes, highlighting the sensitivity of the market.

Rising operational costs, particularly those associated with overburden removal, directly affect Bayan Resources' production efficiency and profitability. For instance, the company's 2023 financial report indicated a notable increase in mining costs per tonne, driven by deeper pits and the need for more extensive earthmoving.

Bayan Resources' capacity to mitigate these escalating expenses through technological adoption and process enhancements is paramount for sustaining its market competitiveness. Innovations in mining equipment and optimized blasting techniques are key strategies being explored to improve efficiency and reduce the cost per tonne of coal extracted.

Investment and Capital Expenditure

Bayan Resources is actively investing in capital expenditure to boost coal production, focusing on development, infrastructure, and new equipment. For instance, the company planned capital expenditure of approximately USD 200 million for 2024, a significant portion of which is earmarked for these growth initiatives. The cost and availability of financing are critical, directly impacting the company's capacity to execute these expansion plans and pursue other strategic opportunities in the coming years.

The company's ability to secure favorable financing terms will be a key determinant in its capital expenditure execution. In 2023, Bayan Resources successfully secured a USD 300 million sustainability-linked loan, demonstrating access to capital markets. This access is vital for funding not only production expansion but also investments in infrastructure and technology upgrades necessary to maintain competitiveness and operational efficiency.

- Capital Expenditure Allocation: Bayan Resources dedicated substantial funds in 2024 towards enhancing coal production through infrastructure and equipment upgrades.

- Financing Influence: The cost and availability of capital are crucial for funding expansion and other strategic projects.

- Recent Financing Success: The company secured a USD 300 million sustainability-linked loan in 2023, indicating positive access to financing.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Bayan Resources, an Indonesian company with substantial international sales. The Indonesian Rupiah (IDR) versus the US Dollar (USD) exchange rate directly impacts the value of its export revenues when converted back into Rupiah. For instance, a stronger USD against the IDR would generally boost the Rupiah equivalent of Bayan's dollar-denominated sales.

Conversely, shifts in this exchange rate also affect the cost of imported goods and services essential for Bayan's operations, such as heavy machinery or specialized equipment. A weaker IDR would make these imports more expensive, potentially squeezing profit margins if not adequately hedged or passed on to customers.

- IDR/USD Volatility: The IDR has experienced notable volatility against the USD in recent years. For example, in early 2024, the IDR traded around IDR 15,500-16,000 per USD, a level that can significantly influence Bayan's financial performance.

- Impact on Revenue: Bayan Resources' reported revenues are directly tied to the IDR/USD conversion. A strengthening USD in 2024, for instance, would translate higher dollar earnings into a larger Rupiah sum for the company.

- Cost of Imports: The cost of capital expenditure, such as purchasing new mining equipment, is often denominated in USD. A depreciating IDR increases these capital costs, impacting the company's investment outlays.

- Hedging Strategies: Companies like Bayan often employ currency hedging strategies to mitigate the risks associated with exchange rate volatility, aiming to lock in favorable rates for future transactions.

Global coal demand is projected to stabilize in 2025 after a peak in 2024, with growth moderating in key markets like China and India due to increased renewable energy adoption. Conversely, regions like the US and ASEAN are expected to see higher coal consumption, directly influencing Bayan Resources' sales volumes and revenue. International thermal coal prices, exemplified by the Newcastle benchmark around $130 per tonne in early 2025, indicate a stable yet sensitive market environment, impacting Bayan's average selling prices and profitability amidst supply-demand shifts and geopolitical factors.

| Economic Factor | 2024/2025 Outlook | Impact on Bayan Resources | Key Data Points |

| Global Coal Demand | Stabilization after 2024 peak; moderating growth in China/India; increased consumption in US/ASEAN. | Directly affects sales volumes and revenue streams. | Newcastle benchmark ~$130/tonne (early 2025). |

| Interest Rates & Financing Costs | Potential for continued elevated rates impacting borrowing costs. | Influences capital expenditure execution and ability to fund expansion. | Bayan secured a USD 300 million sustainability-linked loan in 2023. |

| Currency Exchange Rates (IDR/USD) | Continued volatility expected. | Affects Rupiah value of dollar-denominated revenues and cost of USD-denominated imports. | IDR traded around 15,500-16,000 per USD (early 2024). |

Same Document Delivered

Bayan Resources PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bayan Resources delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

Bayan Resources' operations in East Kalimantan are deeply intertwined with local community relations, directly influencing its social license to operate. Maintaining strong ties is paramount, as issues like land acquisition and local employment opportunities significantly shape the company's reputation and the stability of its operations.

In 2023, Bayan Resources reported significant investment in community development programs, contributing to local infrastructure and education initiatives. This focus on ESG compliance, particularly community engagement, is crucial for attracting investors and safeguarding its corporate image, especially as the global push for responsible mining intensifies.

Bayan Resources' approach to labor relations, focusing on fair wages and safe working conditions, directly impacts its productivity and ability to attract skilled mining professionals. In 2024, the Indonesian government continued to emphasize worker welfare, with minimum wage adjustments potentially influencing operational costs.

The integration of advanced mining technologies, such as autonomous haulage systems, is a key strategic consideration for Bayan Resources. This shift necessitates significant investment in retraining and upskilling its existing workforce, a process that requires robust human resource management to ensure a smooth transition and maintain operational efficiency through 2025.

Growing global and local pressure from civil society and non-governmental organizations concerning the environmental and social impacts of coal mining significantly shapes public perception of Bayan Resources. This sentiment directly impacts investor confidence and market access, as demonstrated by the increasing divestment from fossil fuels by major institutional investors in 2024. For instance, the Indonesian Forum for the Environment (WALHI) has been vocal in its criticism of coal mining operations, highlighting potential water contamination and land degradation issues, which can deter environmentally conscious consumers and investors.

Health and Safety Standards

Bayan Resources places a strong emphasis on maintaining robust health and safety standards for its entire workforce, including employees and contractors. This commitment is vital for operational continuity and ethical business conduct.

Adherence to stringent safety regulations, such as those mandated by Indonesian mining authorities, is non-negotiable. The company actively pursues continuous improvement in its safety protocols to minimize risks and prevent workplace incidents.

In 2023, Bayan Resources reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.55 per million man-hours worked, demonstrating a commitment to reducing workplace accidents. This focus not only protects personnel but also safeguards against potential production disruptions and regulatory fines.

- Focus on Prevention: Implementing proactive safety measures to identify and mitigate hazards before they lead to accidents.

- Training and Awareness: Regularly updating safety training programs for all personnel to ensure awareness of best practices and emergency procedures.

- Incident Investigation: Thoroughly investigating all safety incidents to learn from them and prevent recurrence.

- Compliance: Ensuring full compliance with all national and international health and safety regulations applicable to the mining sector.

Impact on Local Livelihoods and Displacement

Mining activities by companies like Bayan Resources can significantly alter local economies. Displacement of communities, while not always the case, can occur, necessitating careful management of social impacts. Bayan Resources, as of its latest reporting, has emphasized community development programs aimed at mitigating such effects.

Ensuring fair compensation and fostering alternative income streams are crucial for maintaining social harmony and operational continuity. For instance, in 2024, Bayan Resources continued its focus on local employment and supplier development initiatives, aiming to integrate the local economy with its operations.

- Community Engagement: Bayan Resources actively engages with local stakeholders to address concerns regarding land use and potential displacement.

- Livelihood Support: Programs are in place to provide vocational training and support for alternative income generation for communities affected by mining operations.

- Social Impact Assessments: Regular assessments are conducted to understand and manage the socio-economic effects of mining on local populations.

- Compensation Frameworks: Transparent and equitable compensation policies are applied when land acquisition or operational impacts necessitate community relocation or livelihood adjustments.

Bayan Resources' social license to operate hinges on its community relations, particularly in East Kalimantan, where land acquisition and local employment are key concerns. The company's 2023 investments in community development, focusing on infrastructure and education, underscore its commitment to ESG principles and positive public perception, especially amidst growing global scrutiny of mining practices.

Labor relations are critical, with 2024 seeing continued government emphasis on worker welfare and potential minimum wage adjustments impacting costs. Bayan Resources' focus on fair wages and safe working conditions is vital for attracting skilled professionals and maintaining productivity.

Societal expectations regarding mining's environmental and social impacts are rising, influencing investor confidence. Civil society groups like WALHI actively highlight concerns such as water contamination, affecting market access for companies perceived as less sustainable.

Bayan Resources prioritizes robust health and safety standards, evidenced by its 2023 Total Recordable Injury Frequency Rate (TRIFR) of 0.55 per million man-hours, demonstrating a commitment to minimizing workplace accidents and ensuring operational continuity.

Technological factors

Bayan Resources is increasingly seeing the impact of automation and robotics in coal mining. Technologies like autonomous haul trucks and drill rigs are becoming more common, significantly boosting productivity and reducing the need for workers in hazardous areas. This shift allows for continuous, 24/7 operations, a key advantage for efficiency.

In 2024, the global mining automation market was valued at approximately $4.5 billion and is projected to grow substantially. Bayan Resources can leverage these advancements to lower operational costs and improve safety records, directly impacting its bottom line and competitive standing in the Indonesian market.

Digital twin platforms are revolutionizing mining by creating virtual replicas of operations. These systems integrate data from IoT sensors, allowing for continuous optimization of processes. For Bayan Resources, this translates to enhanced operational control and predictive maintenance capabilities, boosting overall efficiency.

Advanced real-time monitoring platforms are crucial for improving environmental performance. These systems can track and manage air quality, contributing to safer working conditions and reduced environmental impact. Furthermore, they play a key role in optimizing energy consumption, a significant cost factor in mining operations.

Bayan Resources can leverage these technological advancements to gain a competitive edge. By implementing digital twin and real-time monitoring solutions, the company can achieve greater predictive accuracy in equipment maintenance, minimize downtime, and ultimately drive down operational costs. This proactive approach is vital in the dynamic mining sector.

Bayan Resources is leveraging data analytics and artificial intelligence (AI) to enhance its operations. AI and machine learning are increasingly employed for predictive maintenance, optimizing resource extraction processes, and analyzing vast geological datasets to identify new exploration targets. For instance, in 2024, the mining industry saw significant investment in AI for efficiency gains, with companies reporting up to a 15% reduction in operational costs through predictive analytics.

The implementation of AI-driven solutions is expected to yield substantial benefits for Bayan Resources. These include a notable reduction in equipment downtime, which is critical in the resource extraction sector, and a streamlined approach to exploration, potentially cutting discovery timelines by as much as 20%. Furthermore, AI's capacity for sophisticated data analysis will bolster decision-making accuracy, leading to more strategic resource allocation and improved overall project profitability.

Environmental Technologies and Emission Reduction

Technological advancements are reshaping environmental management in the coal sector. Innovations like advanced methane capture systems are becoming vital, as methane is a potent greenhouse gas. For instance, the International Energy Agency reported in 2024 that coal mining remains a significant source of methane emissions globally, underscoring the need for effective capture technologies. Bayan Resources can leverage these innovations to reduce its operational impact.

Furthermore, sophisticated dust suppression techniques are critical for improving air quality around mining sites. Similarly, advanced water management technologies are essential for responsible resource utilization and preventing pollution. These technologies not only aid in environmental compliance but also present opportunities for operational efficiency. Bayan Resources’ commitment to adopting such technologies will be key to its long-term sustainability and regulatory adherence, especially as environmental standards tighten globally.

- Methane Capture: Innovations in capturing methane, a potent greenhouse gas, are crucial for reducing emissions from coal mining operations.

- Dust Suppression: Advanced technologies for controlling dust are essential for improving air quality and worker safety at mine sites.

- Water Management: Efficient water management systems are necessary for responsible resource use and preventing water contamination.

- Regulatory Alignment: Investing in these environmental technologies helps companies like Bayan Resources meet increasingly stringent environmental regulations and mitigate their ecological footprint.

Infrastructure and Logistics Technology

Bayan Resources' strategic control over its logistics chain, encompassing barging, transshipment, and port facilities, is a cornerstone of its operational efficiency. Technological advancements in logistics and supply chain management are pivotal for further optimizing coal delivery to global markets, directly impacting Bayan Resources' cost-effectiveness and market competitiveness. For instance, the implementation of advanced tracking systems and predictive analytics in 2024 could significantly reduce transit times and fuel consumption, enhancing the company's ability to meet delivery schedules reliably.

The company's investment in its own infrastructure, including dedicated port facilities, allows for greater control over the flow of goods. Technological upgrades in these areas, such as automated loading and unloading systems and real-time inventory management software, are expected to boost throughput and minimize demurrage costs. Bayan Resources reported that its integrated logistics network contributed to a significant portion of its operational cost savings in 2023, a trend anticipated to continue with further technological integration in 2024 and 2025.

Key technological factors influencing Bayan Resources' infrastructure and logistics include:

- Advanced Fleet Management Systems: Real-time tracking and optimization of barging fleets to reduce fuel consumption and improve delivery schedules.

- Automated Port Operations: Investment in automated loading/unloading systems to increase port efficiency and reduce turnaround times for vessels.

- Supply Chain Visibility Software: Implementation of end-to-end tracking solutions for coal from mine to port, enhancing transparency and enabling proactive issue resolution.

- Data Analytics for Demand Forecasting: Utilizing sophisticated algorithms to predict market demand, optimizing inventory levels and transportation planning.

Technological advancements are fundamentally reshaping Bayan Resources' operational landscape, driving efficiency and safety. The integration of autonomous haul trucks and drill rigs, for instance, is enhancing productivity and minimizing human exposure in hazardous environments, a trend supported by the global mining automation market's projected substantial growth through 2025.

Furthermore, digital twin platforms and advanced real-time monitoring systems are enabling Bayan Resources to achieve greater operational control, optimize processes, and improve environmental management through predictive maintenance and enhanced safety tracking.

The company's strategic adoption of data analytics and artificial intelligence (AI) is crucial for predictive maintenance and resource extraction optimization, with AI investments in the mining sector in 2024 showing up to a 15% reduction in operational costs through predictive analytics.

These technological integrations are vital for Bayan Resources to maintain a competitive edge, reduce downtime, improve environmental compliance, and ensure long-term sustainability in the evolving mining industry.

Legal factors

Bayan Resources operates under extensive coal concessions in East Kalimantan, Indonesia. The Indonesian government introduced new regulations in 2024, further clarified in 2025, that are reshaping the landscape for special mining business license holders. These updates are crucial as they outline provisions for rolling 10-year license extensions, directly impacting the long-term operational security and planning for companies like Bayan Resources.

Indonesian law mandates that mining companies like Bayan Resources prioritize supplying the domestic market. This Domestic Market Obligation (DMO) requires a certain percentage of coal production to be sold within Indonesia before any can be exported. For instance, in 2023, the DMO for coal was set at 25% of production, a policy that continues to shape Bayan's sales strategy.

This legal framework directly influences Bayan Resources' revenue streams and operational planning, as it dictates the allocation of its substantial coal output. Failure to meet the DMO can result in penalties, underscoring its importance in the company's compliance and market access strategy. Bayan's ability to navigate these regulations is crucial for its financial performance.

Bayan Resources operates under a strict environmental regulatory framework, demanding meticulous attention to waste management, emissions control, and land rehabilitation. These regulations are not static; they are evolving with increased government scrutiny and higher standards for assessing environmental impact.

The Indonesian government, through bodies like the Ministry of Environment and Forestry, enforces these rules, with potential penalties for non-compliance. For instance, in 2023, the Ministry continued its efforts to monitor and enforce environmental laws across various industries, including mining. This necessitates significant investment in compliance technologies and practices for Bayan Resources to avoid sanctions and maintain its operational license.

Taxation and Royalty Regimes

New government regulations, such as Presidential Regulation Number 19 of 2025, have introduced revised royalty tariffs for coal and mineral products. These adjustments are designed to enhance government revenue streams, directly impacting the financial landscape for companies like Bayan Resources.

These changes alter the cost structure for Bayan Resources, potentially affecting its profit margins. For instance, a new royalty rate of 7% on coal sales, compared to previous rates that varied by price, means a predictable increase in operational expenses.

- Revised Royalty Tariffs: PP Number 19, 2025 mandates updated royalty percentages for key commodities.

- Revenue Optimization: The government's objective is to increase its share from natural resource extraction.

- Impact on Profitability: Higher royalty payments directly reduce the net income of mining companies.

- Financial Planning: Bayan Resources must adapt its financial models to account for these new fiscal obligations.

Labor Laws and Occupational Safety Regulations

Bayan Resources must strictly comply with Indonesia's labor laws, which cover worker safety, employment terms, and social security provisions. Failure to adhere to these mandates can lead to significant legal challenges, financial penalties, and damage to the company's reputation as a responsible employer. For instance, in 2023, Indonesian labor courts saw a notable increase in disputes related to contract employment and wage discrepancies, underscoring the critical need for meticulous compliance. This includes ensuring safe working environments, as mandated by regulations like those overseen by the Ministry of Manpower.

The company's operations are directly impacted by occupational safety regulations designed to protect employees from workplace hazards, particularly in the mining sector. Adherence to these standards is not just a legal requirement but also essential for operational continuity and employee well-being. In 2024, the Indonesian government continued to emphasize stricter enforcement of safety protocols in heavy industries, with fines for non-compliance potentially reaching millions of Rupiah. Bayan Resources' commitment to these safety standards directly influences its operational efficiency and risk management strategy.

Key legal considerations for Bayan Resources include:

- Compliance with Law No. 13 of 2003 concerning Manpower: This foundational law governs employment contracts, wages, working hours, and termination procedures.

- Adherence to Occupational Safety and Health (OSH) regulations: Ensuring safe mining practices, provision of personal protective equipment (PPE), and regular safety training are paramount.

- Social Security System contributions: Bayan Resources is obligated to contribute to the national social security programs for its employees, including health and pension funds.

Bayan Resources' operational framework is heavily shaped by Indonesian mining and environmental laws, with significant updates expected in 2024 and 2025. The government's focus on sustainable resource management means companies must navigate evolving compliance standards for everything from land rehabilitation to emissions control. These legal requirements directly influence operational costs and the company's social license to operate.

Environmental factors

The global imperative to decarbonize, driven by climate change concerns, directly impacts Bayan Resources. Many nations, including major economies, are setting ambitious net-zero emissions targets, which inherently puts pressure on fossil fuel industries like coal. For instance, the International Energy Agency (IEA) projected in 2024 that while coal demand might see some fluctuations, the long-term trend is towards its phase-out in many developed nations by 2050.

This transition necessitates strategic adaptation for companies like Bayan Resources. While coal continues to be a vital energy component in many developing economies, the increasing regulatory and market pressures for cleaner energy sources will require diversification or significant investment in carbon capture technologies. The Indonesian government, for example, has signaled its commitment to renewable energy targets, which could influence future domestic demand for coal.

Bayan Resources' core business, coal mining and consumption, directly contributes to greenhouse gas emissions. This is a significant environmental factor, as global efforts to combat climate change intensify.

The company faces increasing pressure from regulators, investors, and the public to reduce its carbon footprint. This means Bayan Resources needs to explore operational efficiencies and adopt cleaner technologies in its mining and energy production processes.

In 2023, Indonesia, where Bayan Resources operates, was ranked among the top emitters of greenhouse gases globally, largely due to its reliance on coal. This context underscores the urgency for companies like Bayan to implement strategies such as carbon capture or offset mechanisms to align with national and international climate goals.

Bayan Resources' open-cut mining operations in Indonesia, particularly in Kalimantan, directly contribute to land degradation, impacting ecosystems and natural habitats. For instance, in 2023, the company managed rehabilitation efforts across 1,200 hectares of former mining sites, a crucial part of its environmental stewardship.

Addressing biodiversity loss is a key requirement. Bayan Resources is committed to conservation programs, including the protection of endemic species within its operational areas. Their 2024 sustainability report highlighted a 15% increase in funding allocated to biodiversity monitoring and habitat restoration projects compared to the previous year.

Water Management and Pollution

Bayan Resources' operations, particularly in East Kalimantan, face significant environmental considerations regarding water. Mining can impact both the quality and availability of local water sources, necessitating stringent management practices.

The company must implement robust water management strategies to mitigate pollution risks and ensure sustainable water usage. This includes effective wastewater treatment and responsible discharge protocols.

- Water Scarcity Concerns: East Kalimantan, while having rainfall, can experience localized water stress, impacting operational needs and community access.

- Pollution Control Measures: Bayan Resources is committed to managing mine water, including sediment control and preventing the release of contaminants into rivers and groundwater.

- Regulatory Compliance: Adherence to Indonesian environmental regulations regarding water quality standards and discharge permits is crucial for operational continuity and social license.

Waste Management and Tailings Disposal

Bayan Resources faces significant environmental challenges related to waste management and tailings disposal. The sheer volume of mining waste and tailings generated necessitates robust strategies to prevent contamination of soil, water, and air. Adherence to stringent environmental regulations is paramount, requiring substantial investment in infrastructure and processes for safe handling and disposal.

In 2023, Bayan Resources reported a total waste generation of approximately 30.5 million tonnes, with a significant portion comprising overburden and tailings. The company's commitment to environmentally sound practices is reflected in its ongoing investments in tailings management facilities, including the development of new dry stacking technologies to minimize water usage and the physical footprint of waste. For instance, their Sangatta mine utilizes a filtered dry stack tailings system, a method increasingly favored for its reduced environmental impact compared to traditional wet storage.

- Waste Generation: Bayan Resources generated over 30.5 million tonnes of waste in 2023, underscoring the scale of its waste management needs.

- Regulatory Compliance: The company must continually adapt to evolving environmental regulations governing waste disposal and tailings management in Indonesia.

- Technological Investment: Significant capital is allocated to advanced tailings management solutions, such as dry stacking, to mitigate environmental risks and improve resource efficiency.

- Environmental Impact Mitigation: Efforts are focused on minimizing the potential for contamination through careful site selection, construction, and ongoing monitoring of disposal facilities.

The global push for decarbonization significantly pressures Bayan Resources, as nations aim for net-zero emissions. The International Energy Agency (IEA) noted in 2024 that while coal demand might fluctuate, a long-term phase-out is expected in developed countries by 2050. This necessitates strategic shifts for companies like Bayan, especially given Indonesia's renewable energy targets, which could affect domestic coal demand.

Bayan Resources' operations, particularly its open-cut mining in Kalimantan, lead to land degradation. In 2023, the company focused on rehabilitation efforts across 1,200 hectares of former mining sites to mitigate these impacts. Furthermore, biodiversity loss is a key concern, with Bayan increasing funding for conservation and habitat restoration by 15% in 2024.

Water management is critical, with operations in East Kalimantan needing robust strategies to prevent pollution and ensure sustainable usage. Bayan is committed to managing mine water, including sediment control and preventing contaminant release, while complying with Indonesian water quality regulations.

Waste management is another significant environmental factor, with Bayan generating over 30.5 million tonnes of waste in 2023. The company is investing in advanced tailings management, such as dry stacking technologies, to reduce environmental risks and water usage, exemplified by their Sangatta mine's filtered dry stack system.

| Environmental Factor | Key Data/Action (2023-2024) | Implication for Bayan Resources |

|---|---|---|

| Decarbonization Pressure | IEA 2024 projection: Long-term coal phase-out in developed nations by 2050. Indonesia's renewable energy targets. | Need for diversification or carbon capture investment; potential impact on domestic demand. |

| Land Degradation & Rehabilitation | 1,200 hectares rehabilitated in 2023. | Ongoing commitment to environmental stewardship and operational footprint management. |

| Biodiversity Conservation | 15% funding increase for biodiversity monitoring and habitat restoration (2024). | Focus on protecting endemic species and mitigating operational impact on ecosystems. |

| Water Management | Commitment to robust water management, wastewater treatment, and discharge protocols. | Ensuring compliance with regulations and minimizing impact on local water sources. |

| Waste Management | 30.5 million tonnes waste generated (2023). Investment in dry stacking technology. | Significant capital expenditure required for safe disposal and environmental risk mitigation. |

PESTLE Analysis Data Sources

Our Bayan Resources PESTLE Analysis draws from a comprehensive blend of official government publications, international financial institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable data.