Bayan Resources Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

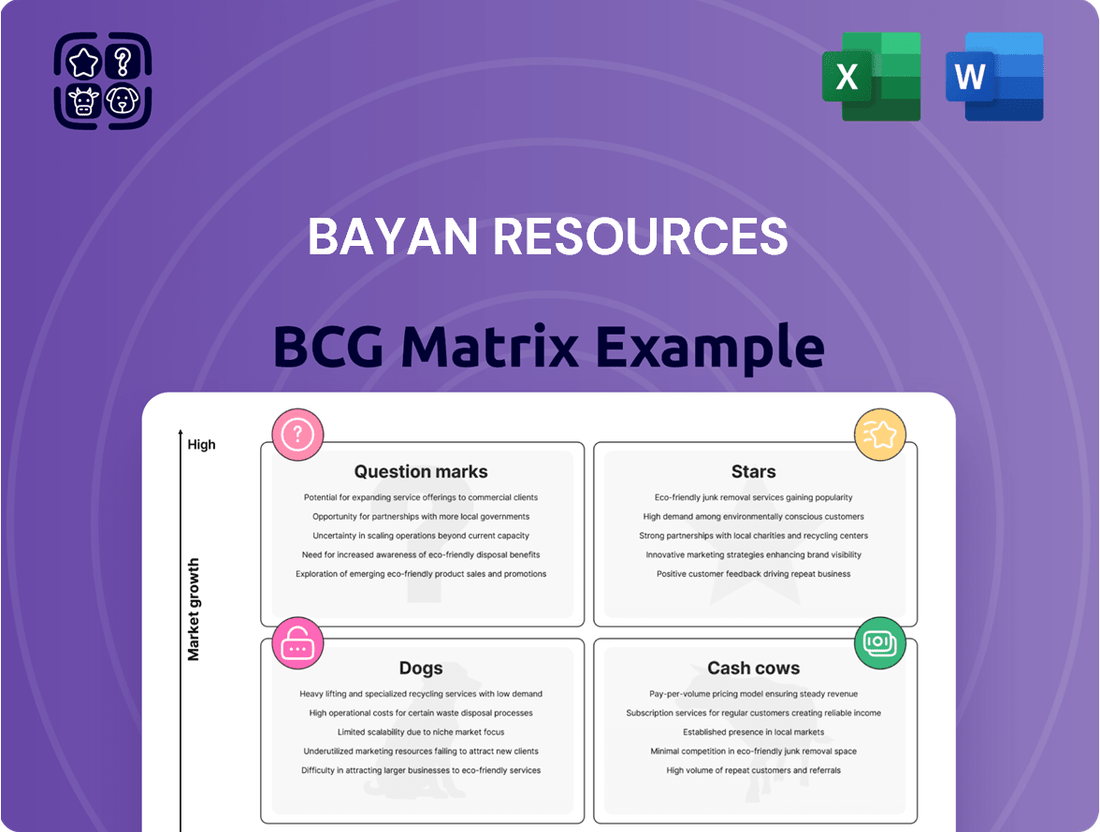

Curious about Bayan Resources' strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's market share and growth potential, highlighting which segments are poised for success and which require careful consideration.

This initial overview is just the tip of the iceberg. Unlock the full Bayan Resources BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights and data-driven recommendations for optimizing their business strategy.

Don't miss out on the complete picture; purchase the full BCG Matrix today to receive detailed quadrant analysis and a clear roadmap for informed investment and resource allocation decisions that can drive Bayan Resources' future growth.

Stars

The expansion of the Tabang concession, specifically the North Pakar mine, is a major contributor to Bayan Resources' increased coal output. This strategic move is expected to significantly boost production figures in the coming years.

Bayan Resources forecasts a substantial rise in coal production, targeting 55-57 million tons for 2024 and an ambitious 69-72 million tons for 2025. This growth is primarily fueled by the Tabang concession's development, solidifying its status as a Star in the BCG matrix.

Bayan Resources' high-quality thermal coal production is a cornerstone of its business, catering to the persistent global demand for power generation. This segment boasts a significant market share within the energy sector, supported by expanding production volumes.

The company's focus on environmentally friendly, low-sulfur sub-bituminous and bituminous coal further solidifies its competitive edge. In 2024, Bayan Resources reported a substantial increase in coal sales volume, reaching 43.7 million tons, a significant rise from previous periods, underscoring the strength of this product line.

Bayan Resources' integrated logistics and infrastructure, including the Balikpapan Coal Terminal (BCT) and Muara Pahu Jetty, are crucial for its competitive edge. This control over barging and transshipment ensures efficient, cost-effective coal delivery, directly supporting its market share and profitability.

In 2023, Bayan Resources reported significant capital expenditure focused on enhancing its logistics network. For instance, the company continued to invest in its port facilities, aiming to optimize coal handling and reduce turnaround times for vessels. These infrastructure investments are key to maintaining Bayan's position as a low-cost producer.

Strategic Sales Commitments

Bayan Resources demonstrates strong market positioning with its strategic sales commitments, a key indicator for its placement as a Star in the BCG Matrix. The company had secured commitments for approximately 80-82% of its planned 2024 coal sales volume by December 2023.

Further solidifying its Star status, Bayan Resources had committed 80% of its planned 2025 coal sales volume by December 2024. This high level of forward sales indicates a dominant market share and predictable, consistent revenue streams.

- Secured 2024 Sales: 80-82% of planned volume committed by December 2023.

- Secured 2025 Sales: 80% of planned volume committed by December 2024.

- Market Indicator: High forward commitments signify robust demand and a strong market position.

Strong Financial Performance and Growth Targets

Bayan Resources is showing impressive financial strength. For 2024, the company is targeting revenues between $1.1 billion and $1.2 billion, with EBITDA projected at $550 million to $600 million. These figures reflect healthy profit margins and a strong operational performance.

Looking ahead to 2025, Bayan Resources anticipates even greater success. Revenue is expected to climb to between $1.3 billion and $1.4 billion, with EBITDA forecast to reach $650 million to $700 million. This growth trajectory is supported by planned increases in production and sales volumes, demonstrating the company's expanding market presence.

The company's ability to manage cash costs effectively further bolsters its financial standing. This operational efficiency, combined with rising output, positions Bayan Resources as a leader in its segment. Continued investment is crucial to maintain this momentum and capitalize on future opportunities.

- 2024 Revenue Target: $1.1 billion - $1.2 billion

- 2024 EBITDA Target: $550 million - $600 million

- 2025 Revenue Target: $1.3 billion - $1.4 billion

- 2025 EBITDA Target: $650 million - $700 million

Bayan Resources' coal operations, particularly those in the Tabang concession, are performing exceptionally well, indicating strong market growth and high demand. This performance solidifies their position as Stars in the BCG matrix, characterized by high market share in a high-growth industry.

The company's strategic expansion and focus on high-quality, environmentally friendly coal have led to significant sales volume increases. With substantial forward sales commitments for both 2024 and 2025, Bayan Resources demonstrates a robust market position and predictable revenue streams.

Financial projections for 2024 and 2025 show impressive revenue and EBITDA targets, underscoring the profitability and operational efficiency of their Star products. Continued investment in logistics and infrastructure further supports this strong market standing.

| Metric | 2024 Target | 2025 Target |

|---|---|---|

| Coal Production (Million Tons) | 55-57 | 69-72 |

| Revenue ($ Billion) | 1.1 - 1.2 | 1.3 - 1.4 |

| EBITDA ($ Million) | 550 - 600 | 650 - 700 |

| 2024 Sales Committed (%) | 80-82 (by Dec 2023) | N/A |

| 2025 Sales Committed (%) | N/A | 80 (by Dec 2024) |

What is included in the product

Highlights which units to invest in, hold, or divest for Bayan Resources.

A clear visual of Bayan Resources' portfolio, highlighting Stars and Cash Cows, alleviates the pain of uncertainty about strategic resource allocation.

Cash Cows

Bayan Resources' established coal mining operations, excluding the Tabang expansion, are classic cash cows. These mature assets hold a significant market share in a mature, albeit cyclical, coal market. They are the company's primary income generators, requiring minimal capital for continued operation.

In 2024, Bayan Resources reported that its thermal coal production remained robust, with established mines contributing the bulk of this output. These operations are characterized by stable, predictable cash flows, allowing them to fund other business segments and pay dividends. For instance, the company's consistent operational performance in its older concessions underscores their cash-generating capabilities.

Bayan Resources' existing port facilities and transshipment operations are a clear cash cow. These established assets are already humming along, efficiently handling coal and facilitating exports, which translates into a steady stream of revenue. In 2023, Bayan Resources reported that its integrated logistics and infrastructure segment, which includes these port operations, contributed significantly to its operational performance, demonstrating their role as reliable revenue generators.

This segment operates within a mature market, meaning it doesn't require extensive marketing or development spending to maintain its position. Think of them as the dependable workhorses of the company. The stability of these operations allows them to consistently generate cash, which can then be reinvested into other areas of the business, like potential growth opportunities or innovation.

Domestic coal sales for Bayan Resources likely represent a steady source of revenue, serving the established Indonesian market. This segment benefits from existing infrastructure and customer relationships, ensuring consistent demand. In 2024, Bayan Resources reported that its domestic sales volume remained robust, contributing significantly to its overall financial performance and providing a reliable cash flow stream with manageable operational costs and lower marketing expenditure compared to exploring new international markets.

Long-Term Supply Contracts (Fixed Price Element)

Bayan Resources' long-term supply contracts with a fixed-price component function as cash cows within its business portfolio. These agreements, while capping potential gains during price surges, ensure a steady and reliable income, crucial for stable financial performance.

This predictable revenue stream is particularly valuable in mature market segments where price volatility is less pronounced. For example, in 2024, Bayan Resources continued to benefit from these contracts, contributing significantly to its consistent cash generation capabilities.

- Predictable Revenue: Fixed-price contracts provide a baseline income, insulating Bayan from short-term market fluctuations.

- Stable Cash Flow: This predictability supports consistent cash generation, vital for funding ongoing operations and investments.

- Mature Market Contribution: These contracts are most effective in established markets where price stability is a key feature.

Revenue from Non-Coal Segments (e.g., Crude Palm Oil, Services)

Bayan Resources diversifies its income beyond coal, venturing into areas like crude palm oil (CPO) and providing essential services such as mining contracting and power supply.

These non-coal operations, particularly if they are established and generate steady income, can function as cash cows within the BCG matrix. They offer a reliable stream of revenue that requires minimal additional investment for growth, thereby supporting other business units.

For instance, Bayan Resources's commitment to expanding its service offerings, including mining contracting and power generation, aims to create stable, recurring revenue streams. In 2023, the company reported significant contributions from its non-coal segments, demonstrating their potential to act as stable income generators.

- Diversified Revenue Streams: Bayan Resources's involvement in crude palm oil and services like mining contracting and power supply creates multiple income sources.

- Cash Cow Potential: Mature and stable non-coal segments can act as cash cows, providing consistent income with lower investment needs.

- 2023 Performance Indicators: While specific segment revenues are proprietary, the company's overall strategy indicates a focus on strengthening these non-coal cash-generating businesses to complement its core coal operations.

Bayan Resources' mature coal mining operations, excluding new expansions, are prime examples of cash cows. These established mines hold substantial market share in a stable, albeit cyclical, coal sector. They are the company's primary income generators, requiring minimal capital investment to sustain their output and generate consistent profits.

In 2024, Bayan Resources continued to see robust performance from its established mines, which form the backbone of its thermal coal production. These operations are characterized by predictable cash flows, enabling them to fund other business segments and support dividend payments. The company's consistent operational efficiency in its older concessions highlights their reliable cash-generating capabilities.

Bayan Resources' existing port and transshipment facilities represent another significant cash cow. These mature assets efficiently handle coal exports, generating a steady revenue stream. In 2023, the integrated logistics and infrastructure segment, encompassing these port operations, notably contributed to the company's overall financial performance, underscoring their role as dependable revenue generators.

These operations thrive in a mature market, needing little in the way of extensive marketing or development spending to maintain their competitive edge. They act as the company's reliable income generators, consistently producing cash that can be strategically reinvested into other areas of the business, including potential growth initiatives or innovation projects.

Domestic coal sales for Bayan Resources are a key cash cow, serving the established Indonesian market with consistent demand. This segment benefits from existing infrastructure and strong customer relationships, ensuring predictable revenue. In 2024, Bayan Resources reported that domestic sales volumes remained strong, contributing significantly to its financial results with manageable operational costs and lower marketing expenses compared to new market exploration.

| Segment | BCG Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Established Coal Mines | Cash Cow | High market share, mature market, low investment needs, stable cash flow. | Primary income generator, funding other segments. |

| Port & Transshipment Facilities | Cash Cow | Efficient operations, essential infrastructure, steady revenue, low marketing costs. | Reliable revenue stream from logistics. |

| Domestic Coal Sales | Cash Cow | Established market, consistent demand, existing infrastructure, predictable revenue. | Significant contribution to financial performance. |

What You See Is What You Get

Bayan Resources BCG Matrix

The Bayan Resources BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a complete and unwatermarked analysis. This comprehensive report, meticulously prepared, will be delivered to you in its final, ready-to-use format, enabling immediate strategic application. You can confidently expect the exact same detailed market positioning and strategic recommendations that are presented here, without any alterations or demo content. This ensures you gain full access to a professionally designed and analysis-ready tool for your business planning needs.

Dogs

Underperforming smaller concessions within Bayan Resources' portfolio represent coal operations with notably low production volumes and minimal contribution to the company's overall revenue. These segments often struggle with high operational costs relative to their output, creating a drag on profitability.

For instance, if a smaller concession produced only 50,000 tonnes in 2024 while incurring operational costs of $70 per tonne, compared to a larger, more efficient concession producing 2 million tonnes at $40 per tonne, the disparity in performance becomes clear. Such operations can tie up valuable capital and management attention without generating significant returns.

These concessions may also face limited growth prospects due to geological constraints, market access issues, or aging infrastructure. Bayan Resources, like many resource companies, continually evaluates such assets to optimize capital allocation and focus on more promising ventures.

Older or less efficient equipment and machinery, characterized by frequent breakdowns and high operating expenses, can significantly drag down a company's profitability. For instance, in 2024, some mining operations might still rely on machinery that has an average downtime of 15% and fuel consumption rates 20% higher than modern equivalents. This inefficiency directly impacts the cost per ton extracted, making it harder to compete.

Such assets often fall into the Dogs category of the BCG Matrix because their low market share and low growth potential are compounded by their escalating maintenance costs and reduced productivity. The return on investment for upgrading or overhauling these units is typically minimal, often failing to justify the capital expenditure. For example, a significant repair bill for a piece of machinery that only contributes 5% to overall output might be better allocated to newer, more productive assets.

Non-core, underperforming investments in Bayan Resources' portfolio would likely fall into the Dogs quadrant of the BCG matrix. These are ventures that have failed to capture substantial market share and operate within industries experiencing minimal growth. For instance, if Bayan Resources had a small stake in a legacy coal-fired power plant in a region rapidly transitioning to renewables, this would represent a classic Dog.

These "Dogs" typically generate low returns and often require significant capital to maintain, diverting resources from more promising areas. In 2024, the global energy sector saw continued investment shifts away from fossil fuels, with many older, less efficient coal assets struggling to remain profitable. Such an investment would consume management attention and capital without contributing to Bayan's strategic goals of diversification and sustainability.

Coal Products with Declining Demand or Niche Markets

Within Bayan Resources' portfolio, specific coal products experiencing a decline in demand or serving very limited, shrinking markets would fall into the Dogs category of the BCG matrix. These are products that likely have a low market share and are in industries with minimal growth prospects, often due to the global shift towards cleaner energy sources. For instance, certain grades of thermal coal, especially those with higher impurity levels, might be increasingly phased out by power generators seeking more efficient and environmentally friendly options.

The demand for these types of coal products is projected to continue its downward trend. For example, by 2024, the global coal consumption for power generation, while still significant, has seen a noticeable decrease in many developed economies. This is driven by regulatory pressures and the increasing competitiveness of renewable energy sources. Bayan's strategic focus on high-quality thermal and metallurgical coal helps mitigate exposure to these declining segments, but any remaining products in this category would represent a challenge.

- Declining Demand: Thermal coal grades with higher sulfur content or lower calorific value face reduced demand from power plants prioritizing emissions standards and efficiency.

- Niche Markets: Some specialized coal products might cater to very specific industrial applications, but these markets are often small and susceptible to technological obsolescence or substitution.

- Low Growth Potential: Products in this category are unlikely to see significant market expansion due to the overarching global energy transition away from fossil fuels.

- Strategic Consideration: Bayan Resources' strategy likely involves minimizing investment in or divesting from these Dog products to reallocate capital to more promising areas of their business.

Inefficient or Redundant Infrastructure Assets

Inefficient or redundant infrastructure assets, such as specific jetties or roads that are no longer optimally utilized and incur ongoing maintenance costs without significant operational benefit, could be classified as Dogs within the Bayan Resources BCG Matrix.

These assets represent a drain on resources, tying up capital and management attention that could be better allocated to more promising areas of the business. For instance, a port facility built for a specific commodity that is no longer a significant part of Bayan Resources' operations would fit this description. In 2023, Bayan Resources reported significant capital expenditure on its mining operations, highlighting the need to divest non-core or underperforming assets to improve overall capital efficiency.

Identifying and addressing these Dog assets is crucial for optimizing the company's portfolio. Divesting or decommissioning them can free up capital, reduce operating expenses, and allow for a sharper focus on core, high-growth business units.

- Underutilized Jetties: Infrastructure assets like jetties that have seen declining cargo throughput due to shifts in commodity markets or operational changes.

- Obsolete Road Networks: Road infrastructure within mining concessions that are no longer essential for current extraction activities or have been superseded by more efficient transport solutions.

- Maintenance Costs vs. Revenue: Assets incurring significant ongoing maintenance expenses without generating proportionate operational revenue or strategic value.

Dogs within Bayan Resources' portfolio represent assets with low market share and low growth prospects, often characterized by declining demand and high operational costs. These segments, like certain legacy coal products or underutilized infrastructure, consume resources without yielding substantial returns. For example, a specific grade of thermal coal facing regulatory headwinds and reduced demand from power plants would be a Dog.

In 2024, the global energy transition continued to pressure fossil fuel assets, making older, less efficient operations or products with limited market appeal prime candidates for the Dog category. Bayan Resources' strategic focus on high-quality, in-demand coal grades aims to mitigate exposure to these underperforming segments. The company's ongoing evaluation of its asset base is crucial for divesting or optimizing these Dogs to reallocate capital effectively.

These assets typically exhibit low profitability and minimal potential for future growth, often requiring significant capital for maintenance rather than expansion. For instance, a jetty built for a now-obsolete commodity would be a Dog, incurring upkeep costs without contributing to current revenue streams. By identifying and addressing these Dogs, Bayan Resources can improve overall capital efficiency and focus on its more promising Stars and Cash Cows.

The strategic imperative for Bayan Resources is to manage or divest these Dog assets to free up capital and management focus for more lucrative ventures. This aligns with the broader industry trend of optimizing portfolios in response to evolving market demands and regulatory landscapes.

Question Marks

New exploration and greenfield projects for Bayan Resources, as part of its BCG matrix, represent the company's ventures into untapped markets or the development of entirely new coal assets. These initiatives are characterized by their high potential for future growth, mirroring the 'Question Mark' category, but currently hold a minimal market share within the broader coal industry.

Such undertakings demand substantial capital investment and carry inherent risks due to uncertain future returns and market acceptance. For instance, in 2024, Bayan Resources continued to assess potential new exploration areas, though specific greenfield project investments remain subject to detailed feasibility studies and prevailing market conditions.

Bayan Resources' potential diversification into renewable energy or other industries would position these ventures as Stars or Question Marks within the BCG Matrix. These sectors represent high-growth markets, but Bayan's current market share is minimal, necessitating significant investment to build a competitive foothold.

For instance, in 2024, global renewable energy investment reached record highs, with solar and wind power leading the charge. Bayan's entry into this space, while promising for future growth, would initially require substantial capital expenditure to develop infrastructure and gain market traction, mirroring the characteristics of a Question Mark.

Bayan Resources' investment in advanced mining technologies like through-seam blasting and fleet management systems positions them for potential future growth. These innovations, while still in early adoption phases across their operations, aim to boost efficiency and reduce costs. For instance, the global mining technology market is projected to reach $20.7 billion by 2027, indicating a strong trend towards digitalization and automation.

Expansion into New International Markets

Expansion into new international markets for Bayan Resources, if characterized by high growth potential but a low existing market share, would position these ventures as Stars within the BCG Matrix. These markets demand substantial upfront investment in marketing and logistics to establish a foothold and build brand recognition.

- High Investment Needs: Entering new international coal markets requires significant capital for establishing distribution networks, understanding local regulations, and building customer relationships. For instance, in 2024, emerging Asian economies continued to show strong demand for thermal coal, presenting opportunities but also requiring substantial investment to compete with established players.

- Potential for High Growth: These markets are attractive due to their projected growth in energy consumption, often driven by industrialization and infrastructure development. Bayan Resources' strategic focus on securing new export markets aligns with this potential, aiming to diversify revenue streams beyond its traditional operational areas.

- Low Initial Market Share: The defining characteristic is the nascent stage of Bayan Resources' presence. Building market share in these regions is a primary objective, necessitating aggressive sales strategies and potentially competitive pricing to gain traction against incumbents.

- Future Cash Flow Generation: Successful penetration of these markets is expected to yield significant future cash flows as market share grows and operational efficiencies are realized, solidifying their Star status and contributing to the company's overall portfolio strength.

Future Carbon Capture or Emission Reduction Technologies

Investments in future carbon capture or emission reduction technologies for Bayan Resources would likely be classified as Question Marks in a BCG matrix. This reflects the high-growth, rapidly evolving nature of this market, where significant capital is required for research and development.

While immediate returns are uncertain, these ventures hold substantial potential for long-term strategic advantage and market leadership in a sustainability-focused global economy. For instance, the global carbon capture, utilization, and storage (CCUS) market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly, with some estimates reaching over USD 8 billion by 2030, indicating a high-growth trajectory.

- High Investment Needs: Development and scaling of advanced carbon capture technologies require substantial upfront capital for R&D, pilot projects, and infrastructure.

- Uncertain Returns: The economic viability and widespread adoption of these technologies are still developing, leading to unpredictable short-term profitability.

- Evolving Market: The regulatory landscape and technological advancements in emission reduction are dynamic, creating both opportunities and risks.

- Strategic Long-Term Potential: Early investment can position Bayan Resources as a leader in a critical future industry, offering competitive advantages as environmental regulations tighten.

New ventures for Bayan Resources, like exploration in undeveloped coal fields or potential diversification into new industries, are categorized as Question Marks. These represent high-growth potential opportunities but currently have a minimal market share, demanding significant investment and carrying inherent risks due to uncertain future returns.

For instance, Bayan Resources' exploration activities in 2024 continued to identify potential new coal assets, which, if developed, would initially represent Question Marks. Similarly, any move into the burgeoning renewable energy sector, while offering high growth, would start with a negligible market share, requiring substantial capital for infrastructure and market penetration.

These Question Mark initiatives, such as investing in advanced mining technologies or exploring new international markets, require considerable upfront capital. The success of these ventures hinges on their ability to capture market share and generate future cash flows, a common characteristic of Question Marks within the BCG framework.

The company's potential investments in future carbon capture technologies also fall under the Question Mark category. This reflects the high-growth, rapidly evolving nature of this market, where significant capital is needed for research and development, with uncertain short-term profitability but substantial long-term strategic potential.

| Bayan Resources BCG Matrix: Question Marks | Characteristics | Examples/Context |

|---|---|---|

| Definition | High market growth, low market share. Require significant investment to grow. | New exploration projects, potential diversification into renewables. |

| Investment Needs | Substantial capital for R&D, market entry, and infrastructure development. | 2024 exploration assessments; potential renewable energy infrastructure. |

| Risk & Return Profile | High risk due to uncertain future returns and market acceptance; potential for high future rewards. | Uncertainty in new coal asset development or renewable energy market share capture. |

| Strategic Goal | To increase market share and eventually become Stars or Cash Cows, or divest if unsuccessful. | Building a foothold in new energy markets or advanced mining tech adoption. |

BCG Matrix Data Sources

Our Bayan Resources BCG Matrix is built on comprehensive financial disclosures and detailed market analysis, incorporating industry growth rates and competitor performance data for strategic clarity.