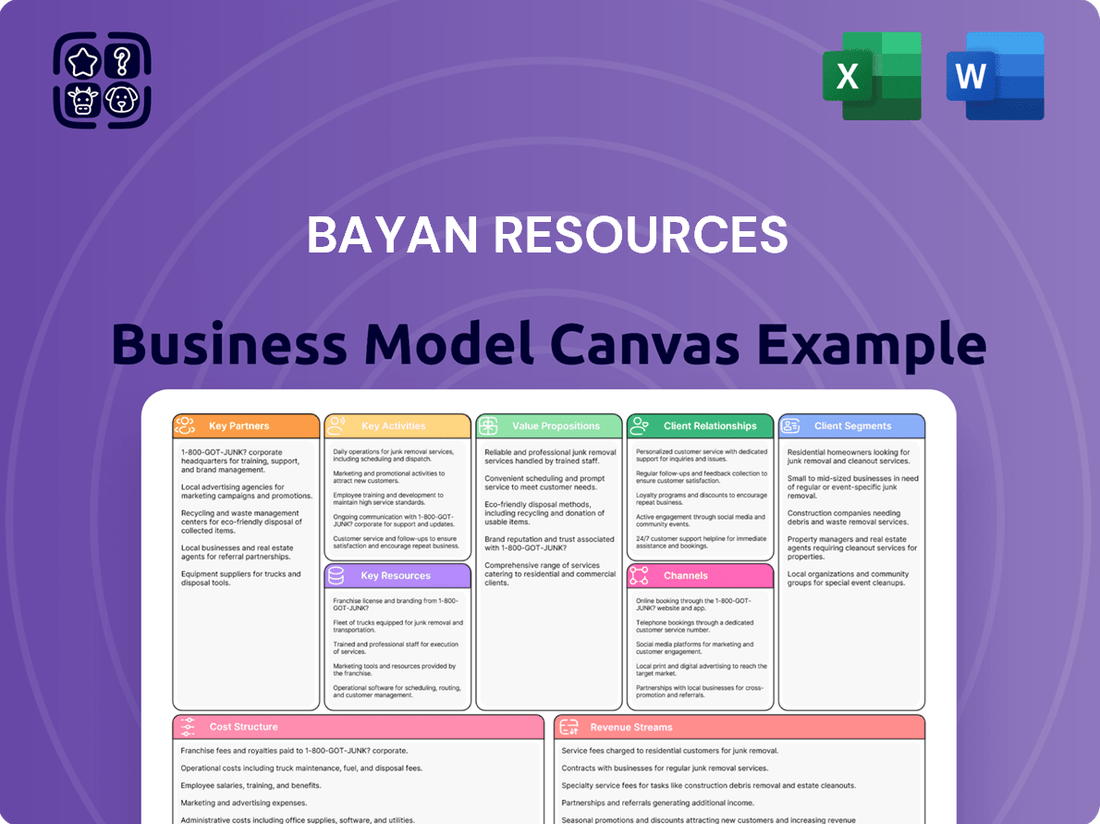

Bayan Resources Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Unlock the strategic blueprint of Bayan Resources with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage key resources and partnerships to deliver value to their customer segments. Discover their revenue streams and cost structure, offering invaluable insights for anyone looking to understand their market dominance.

Partnerships

Bayan Resources heavily relies on mining contractors for essential operations like overburden removal and coal extraction. These partnerships are fundamental to their operational efficiency and ability to meet production goals.

A prime example of this critical reliance is Bayan's long-term contract extension with PT Bukit Makmur Mandiri Utama (BUMA), a subsidiary of PT Delta Dunia Makmur Tbk. This significant agreement, running for 11 years from 2024 to 2035, is valued at approximately $7.8 billion.

Bayan Resources heavily relies on key partnerships for its logistics and infrastructure needs. These collaborations are crucial for the efficient transportation of coal, encompassing barging services, transshipment operations, and the management of port facilities. For instance, in 2023, Bayan's coal production reached 44.1 million tonnes, underscoring the immense logistical challenge and the critical role these partners play in moving such volumes.

These alliances are not merely about moving coal; they are integral to optimizing Bayan's entire supply chain, ensuring a smooth flow from the mine sites to the end markets. The effective coordination with these infrastructure partners directly impacts Bayan's ability to meet its sales commitments and maintain its competitive edge in the global coal market.

Bayan Resources maintains critical relationships with suppliers of heavy equipment and advanced mining technology. These partnerships are fundamental to ensuring operational efficiency and supporting the company's growth objectives. For instance, in 2024, the company continued to leverage these supplier relationships to integrate cutting-edge solutions into its mining processes.

The company actively invests in new technologies and methodologies to boost its mining capabilities. Bayan Resources has adopted innovations such as through-seam blasting, which optimizes resource extraction, and advanced Fleet Management Systems (FMS) to enhance productivity and cost-effectiveness across its operations.

Financial Institutions and Investors

Bayan Resources cultivates robust relationships with banks, financial institutions, and a diverse investor base to secure crucial capital for its significant capital expenditure and ambitious expansion initiatives. These collaborations are fundamental to financing the company's growth trajectory.

The company prioritizes open communication with the financial community, regularly providing investor updates and comprehensive reports. This commitment to transparency underscores Bayan Resources' dedication to showcasing its financial health and strategic growth plans.

- Capital Access: Bayan Resources relies on partnerships with financial institutions to access the substantial funding required for large-scale projects, such as mine development and infrastructure upgrades.

- Investor Relations: Regular engagement through investor calls and published financial statements, like those detailing its 2023 performance, aims to build confidence and attract ongoing investment.

- Funding for Growth: For instance, in 2023, Bayan Resources continued to manage its debt facilities effectively, demonstrating its ability to leverage financial partnerships for operational and strategic objectives.

Government and Regulatory Bodies

Bayan Resources' relationship with Indonesian government and regulatory bodies is paramount for securing and retaining coal concessions and operating licenses. These partnerships are the bedrock for ensuring the company adheres to all environmental and mining regulations, which is essential for its ongoing operations and future growth within Indonesia.

These crucial alliances enable Bayan Resources to navigate the complex legal and regulatory landscape. For instance, in 2024, the Indonesian government continued to emphasize sustainable mining practices and stricter environmental oversight, making robust engagement with bodies like the Ministry of Energy and Mineral Resources and the Ministry of Environment and Forestry a continuous priority for the company.

- Securing Mining Permits: Partnerships facilitate the acquisition and renewal of essential mining permits, directly impacting operational continuity.

- Regulatory Compliance: Collaboration ensures adherence to evolving environmental, safety, and social responsibility standards mandated by Indonesian authorities.

- Policy Influence: Engaging with regulators allows Bayan Resources to provide input on mining policies, potentially shaping a more favorable operating environment.

- Social License to Operate: Strong government ties often correlate with a smoother social license, easing community relations and project approvals.

Bayan Resources' key partnerships extend to technology and equipment suppliers, crucial for maintaining operational efficiency and adopting innovative mining practices. These relationships ensure access to cutting-edge solutions that enhance productivity and cost-effectiveness.

What is included in the product

This Business Model Canvas for Bayan Resources outlines its strategy for coal mining and energy, focusing on efficient resource extraction and diverse customer segments, including domestic and international markets.

It details key partnerships with suppliers and government entities, revenue streams from coal sales, and cost structures related to operations and exploration, all while highlighting its competitive advantages in the Indonesian mining sector.

Bayan Resources' Business Model Canvas provides a clear, structured approach to identify and address operational inefficiencies, acting as a pain point reliever by highlighting areas for improvement in their mining and resource management.

Activities

Bayan Resources' primary focus is on discovering new coal deposits and overseeing its vast coal mining rights in East Kalimantan, Indonesia. This crucial activity involves detailed geological assessments and resource estimation to identify viable extraction opportunities.

The company actively engages in securing permits and licenses for its mining concessions, a vital step in ensuring operational continuity and future expansion. In 2023, Bayan Resources reported total coal reserves and resources of 7.5 billion tonnes, highlighting the scale of its exploration and concession management efforts.

Bayan Resources' key activities in coal mining operations cover the entire open-cut process, from removing the soil and rock above the coal seam to extracting the valuable commodity itself. This core function is central to their business, driving their revenue and market position.

The company is actively focused on boosting its coal output. For 2024, Bayan Resources projected a production range of 55 to 57 million metric tons. Looking ahead to 2025, they have set an ambitious target to significantly increase this to between 69 and 72 million metric tons, a substantial jump driven by planned expansions, particularly within their Tabang concession.

Bayan Resources meticulously processes its coal through crushing, screening, and blending to guarantee superior quality. This ensures the thermal and metallurgical coal meets stringent international standards.

The company is committed to producing environmentally conscious coal, specifically low-sulfur subbituminous and bituminous varieties. This focus on quality and environmental responsibility caters to the diverse needs of their global clientele.

In 2024, Bayan Resources continued to emphasize efficient coal processing, a critical element in maintaining its competitive edge. Their operations are designed to extract maximum value while adhering to strict quality control measures.

Logistics and Supply Chain Management

Bayan Resources' key activities heavily revolve around the integrated management of its entire logistics and supply chain. This encompasses crucial elements like barging operations, transshipment services, and the direct operation of vital port facilities, most notably the Balikpapan Coal Terminal. This end-to-end control is fundamental to ensuring the efficient and punctual delivery of their coal products to a diverse range of domestic and international customers.

The company's commitment to optimizing its supply chain is evident in its operational infrastructure. For instance, in 2024, Bayan Resources continued to leverage its strategically located port facilities to facilitate the smooth movement of its coal. Their integrated approach allows for greater control over costs and delivery timelines, a critical factor in the competitive global coal market.

- Integrated Logistics Management: Bayan Resources oversees the entire process from mine to port, including barging and transshipment.

- Port Facility Operations: The company actively operates key infrastructure like the Balikpapan Coal Terminal, ensuring efficient loading and export.

- Supply Chain Efficiency: This integrated model is designed to guarantee timely delivery of coal to both domestic and international markets.

- Market Responsiveness: By controlling logistics, Bayan Resources can adapt more effectively to market demands and fluctuations.

Sales and Marketing

Bayan Resources focuses on selling and marketing its coal to power plants and industrial users both in Indonesia and abroad. This involves building relationships and ensuring reliable supply chains for its key commodity.

The company is targeting significant sales volumes, aiming for 70 to 72 million metric tons in 2025. This ambitious goal highlights their strategy to maximize market penetration and revenue generation from their coal production.

- Target Sales Volume (2025): 70-72 million metric tons.

- Committed Sales (as of mid-December 2024 for 2025): 60.4 million metric tons.

- Customer Base: Domestic and international power plants and industrial customers.

Bayan Resources' key activities are centered around its extensive coal mining operations in East Kalimantan, Indonesia. This includes the crucial tasks of discovering new coal deposits, managing mining rights, and overseeing the entire extraction process from overburden removal to coal extraction.

The company also places significant emphasis on efficient coal processing, ensuring its products meet international quality standards through crushing, screening, and blending. Furthermore, Bayan Resources manages an integrated logistics and supply chain, operating port facilities like the Balikpapan Coal Terminal to facilitate timely delivery to global markets.

Sales and marketing efforts are vital, with the company targeting substantial volumes to power plants and industrial users. For 2025, Bayan Resources aims to sell between 70 to 72 million metric tons, with 60.4 million metric tons already committed as of mid-December 2024.

| Activity | Description | Key Data/Targets |

|---|---|---|

| Exploration & Concession Management | Discovering new coal deposits and overseeing mining rights. | 7.5 billion tonnes of coal reserves and resources (2023). |

| Coal Mining Operations | Extraction of coal through open-cut mining. | Projected production: 55-57 million metric tons (2024), 69-72 million metric tons (2025). |

| Coal Processing | Crushing, screening, and blending for quality assurance. | Focus on low-sulfur subbituminous and bituminous coal. |

| Logistics & Supply Chain | Barging, transshipment, and port operations (Balikpapan Coal Terminal). | Ensuring efficient delivery to domestic and international markets. |

| Sales & Marketing | Selling coal to power plants and industrial users. | Target sales: 70-72 million metric tons (2025); 60.4 million metric tons committed (mid-Dec 2024 for 2025). |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are currently viewing is a direct representation of the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you will gain immediate access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Bayan Resources' core asset is its vast, high-quality thermal and metallurgical coal reserves, primarily situated in East Kalimantan, Indonesia. These reserves are the bedrock of its entire mining operation.

The company holds significant concessions, notably the Tabang complex, which is undergoing expansion. This strategic control over resource-rich areas is crucial for its long-term production capacity and market position.

As of the first half of 2024, Bayan Resources reported proven and probable coal reserves of approximately 920 million tonnes. This substantial reserve base underpins its ability to meet ongoing and future demand.

Bayan Resources' mining operations rely heavily on a substantial fleet of heavy machinery essential for overburden removal and coal extraction. This critical resource underpins their ability to access and produce coal efficiently.

The company's integrated infrastructure is equally vital, encompassing haul roads, overland conveyors, and barge loading facilities. This network ensures the smooth and cost-effective movement of coal from the mine to market.

Significant capital expenditure is consistently allocated to maintain and expand this equipment and infrastructure base. For instance, in 2024, Bayan Resources reported capital expenditures of approximately $174 million, with a considerable portion directed towards sustaining and developing mining assets.

Bayan Resources relies heavily on its skilled workforce, which includes specialized mining engineers, geologists, and experienced operators. This human capital is fundamental to the company's ability to conduct efficient mining operations and develop effective strategic plans for resource extraction and development.

As of 2024, Bayan Resources employs a significant team of 4,216 individuals. The company places a strong emphasis on continuous improvement, actively investing in programs aimed at enhancing operational excellence across all levels of its workforce.

Logistics and Port Facilities

Bayan Resources' ownership and operation of key logistics assets, including the Balikpapan Coal Terminal and floating transfer barges KFT-1 and KFT-2, grant substantial control over its supply chain. This integration boosts efficiency and minimizes dependence on external providers, a critical advantage in the fluctuating coal market.

In 2024, Bayan Resources reported significant throughput at its Balikpapan Coal Terminal, handling millions of tons of coal. The company's strategic investment in these facilities, including the floating transfer barges, directly supports its operational capacity and cost management, ensuring reliable delivery to international markets.

- Balikpapan Coal Terminal: A cornerstone of Bayan's logistics, offering efficient loading and storage.

- Floating Transfer Barges (KFT-1 & KFT-2): Essential for transshipment, enabling larger vessel loading and expanding market reach.

- 2024 Throughput: The terminal processed approximately 25 million tonnes of coal, demonstrating high operational volume.

- Supply Chain Control: Direct ownership reduces transit times and associated costs compared to third-party logistics.

Technology and Operational Know-how

Bayan Resources leverages proprietary mining methodologies, including advanced through-seam blasting techniques, to optimize resource extraction. This specialized knowledge is a core asset, directly impacting operational efficiency and cost-effectiveness.

The company's commitment to technological integration is evident in its implementation of sophisticated systems such as Fleet Management Systems (FMS). These systems provide real-time data for improved fleet utilization and reduced downtime, a critical factor in maintaining high productivity levels.

Furthermore, Bayan Resources utilizes geotechnical slope stability radar, a key operational know-how that significantly enhances mine safety. By proactively monitoring ground conditions, the company mitigates risks and ensures the integrity of its mining operations, a testament to its advanced technical capabilities.

These technological and operational strengths are vital for Bayan Resources' competitive advantage.

- Proprietary mining methodologies

- Implementation of advanced systems like Fleet Management Systems (FMS)

- Utilization of geotechnical slope stability radar for enhanced safety

- Focus on optimizing resource extraction and operational efficiency

Bayan Resources' key resources are its substantial coal reserves, integrated infrastructure, and skilled workforce. The company's control over vast, high-quality coal deposits, particularly in East Kalimantan, forms the foundation of its operations. Significant investments in mining equipment and logistics networks, including the Balikpapan Coal Terminal, ensure efficient extraction and delivery. Furthermore, a dedicated team of over 4,000 employees drives operational excellence and strategic development.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Coal Reserves | Proven and probable reserves | Approx. 920 million tonnes (H1 2024) |

| Mining Assets | Heavy machinery fleet | Capital expenditure of $174 million (2024) |

| Infrastructure | Haul roads, conveyors, Balikpapan Coal Terminal | Terminal throughput of approx. 25 million tonnes (2024) |

| Human Capital | Skilled engineers, operators | 4,216 employees (2024) |

Value Propositions

Bayan Resources provides a variety of coal types, including high-energy bituminous coal and cleaner sub-bituminous coal with low sulfur and ash content. This product diversity directly addresses the distinct requirements of power plants and industrial operations, ensuring they receive the precise fuel quality needed for efficient operation.

In 2024, Bayan Resources continued to be a significant supplier of these high-quality coal products. The company's commitment to consistent quality is reflected in its operational standards, aiming to provide reliable fuel sources that meet stringent international specifications for thermal and metallurgical applications.

Bayan Resources boasts a highly reliable coal supply, a direct result of its fully integrated operations. This means they manage everything from mining the coal to processing it and even handling the logistics all the way to the port.

This end-to-end control over their supply chain is a significant advantage. It allows Bayan Resources to ensure consistent delivery schedules and minimizes their reliance on third-party providers, which can often lead to delays or disruptions.

For the first half of 2024, Bayan Resources reported a total coal production of 2.1 million metric tons, demonstrating their operational capacity. Their self-managed logistics network, including their own port facilities, played a crucial role in efficiently moving this volume to market.

Bayan Resources’ strategic location in East Kalimantan provides unparalleled access to key global markets. This positioning allows the company to efficiently serve growing energy demands across Southeast Asia, East Asia, and South Asia.

The company's coal concessions are ideally situated for supplying major economies like Indonesia itself, the Philippines, South Korea, China, and India. This geographical advantage translates into significant logistical efficiencies and cost savings for Bayan Resources.

In 2024, Bayan Resources continued to leverage this strategic advantage, with its operations in East Kalimantan being central to its export strategy. The company's ability to reach these diverse markets underpins its robust revenue streams and market share.

Cost-Effective Production

Bayan Resources focuses on maintaining a highly competitive cost structure to deliver value to its customers. The company anticipates cash costs to be between USD 38-40 per metric ton in 2025. This efficiency directly translates into the ability to offer attractive pricing in the market.

This cost-effectiveness is a cornerstone of Bayan Resources' value proposition, enabling it to secure a strong market position. By keeping production expenses low, the company can achieve healthier profit margins even with competitive pricing strategies.

- Competitive Pricing: Achieved through a lean operational model.

- Enhanced Margins: Lower production costs directly boost profitability.

- Market Advantage: Enables Bayan Resources to stand out against competitors.

- Customer Value: Customers benefit from cost-efficient, quality products.

Commitment to Sustainability

Bayan Resources demonstrates a strong commitment to sustainability, aiming to harmonize its commercial objectives with a deep sense of social responsibility and environmental consciousness. This dedication is not merely a statement but is woven into its operational fabric, influencing how it engages with communities and manages its ecological footprint.

This strategic focus on sustainability is designed to resonate with a growing segment of customers and stakeholders who actively seek out and value businesses that champion responsible sourcing and exhibit genuine environmental stewardship. For instance, in 2024, Bayan Resources continued its efforts in mine rehabilitation, with over 1,000 hectares of former mining areas undergoing reclamation, showcasing tangible progress in environmental recovery.

The company's sustainability initiatives are often highlighted through specific programs and performance metrics. In 2024, Bayan Resources reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 5% compared to its 2023 baseline, reflecting a proactive approach to climate change mitigation.

- Environmental Stewardship: Bayan Resources actively invests in programs to minimize its environmental impact, including water management and biodiversity conservation efforts in its operational areas.

- Social Responsibility: The company prioritizes community development through various initiatives, focusing on education, health, and local economic empowerment, fostering positive relationships with its stakeholders.

- Sustainable Operations: Bayan Resources integrates sustainable practices across its value chain, from responsible mining techniques to efficient energy usage and waste reduction.

- Stakeholder Engagement: A transparent and ongoing dialogue with local communities, government bodies, and investors ensures that sustainability goals are aligned with broader societal expectations and regulatory frameworks.

Bayan Resources offers a diverse range of coal products, from high-energy bituminous to cleaner sub-bituminous coal, catering to the specific needs of power plants and industrial users. This product quality ensures efficient operations for their customers.

The company's fully integrated operations, managing everything from mining to logistics, guarantee a highly reliable coal supply. This end-to-end control minimizes disruptions and ensures consistent delivery schedules.

Bayan Resources' strategic location in East Kalimantan provides efficient access to key Asian markets, including Indonesia, the Philippines, South Korea, China, and India. This geographical advantage translates into logistical efficiencies and cost savings.

A focus on a competitive cost structure, with anticipated cash costs of USD 38-40 per metric ton in 2025, allows Bayan Resources to offer attractive pricing while maintaining healthy profit margins.

Bayan Resources is committed to sustainability, integrating environmental stewardship and social responsibility into its operations. In 2024, they reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions and continued reclamation of over 1,000 hectares of former mining areas.

| Value Proposition | Description | 2024 Data/Context |

|---|---|---|

| Product Quality & Diversity | Supplies high-energy bituminous and cleaner sub-bituminous coal meeting international specifications. | Addresses distinct requirements of power plants and industrial operations for efficient functioning. |

| Reliable Supply Chain | Fully integrated operations from mining to logistics ensure consistent delivery. | In H1 2024, produced 2.1 million metric tons, efficiently moved via own port facilities. |

| Strategic Market Access | Prime location in East Kalimantan offers efficient access to key Asian markets. | Leveraged this advantage for export strategy, serving diverse markets like China and India. |

| Cost Competitiveness | Lean operational model and efficient management lead to attractive pricing. | Anticipated 2025 cash costs between USD 38-40 per metric ton. |

| Sustainability Commitment | Focus on environmental stewardship and social responsibility. | Reported 5% GHG emission reduction (Scope 1 & 2) in 2024; reclaimed over 1,000 hectares. |

Customer Relationships

Bayan Resources cultivates enduring customer connections by securing long-term contracts and supply agreements. This strategy guarantees a steady flow of demand and predictable revenue, forming a bedrock for its operations.

As of mid-December 2024, a significant 80% of Bayan Resources' projected sales volumes for 2025 were already committed or under contract. This high commitment level underscores the trust and reliability Bayan offers its key clients, solidifying these crucial relationships.

Bayan Resources prioritizes direct sales and robust account management to serve its power plant and industrial clientele worldwide. This approach fosters personalized service and ensures clear, direct communication channels with customers.

Dedicated account managers are crucial, acting as the primary point of contact to deeply understand and efficiently address each customer's unique requirements. This focus on relationship building is key to their operational strategy.

Bayan Resources offers crucial technical support, guiding clients on optimal coal specifications and usage to ensure they get the most value from their purchases. This expert advice is vital for industries relying on consistent and effective fuel sources.

The company's capacity to provide customized coal blends is a key differentiator, allowing them to precisely meet the unique operational needs of diverse clients. For instance, in 2024, Bayan Resources reported a significant increase in bespoke blend requests from cement manufacturers seeking specific calorific values and ash content.

This tailored service not only boosts client satisfaction by addressing specific requirements but also fosters stronger, more enduring customer relationships. By acting as a solutions provider rather than just a supplier, Bayan Resources solidifies its position as a trusted partner in the energy sector.

Reputation and Trust Building

Bayan Resources prioritizes building trust through a steadfast commitment to reliable supply chains and consistent product quality, cornerstones of its customer relationships. This dedication is not new; it’s a reputation cultivated over years of dependable performance and strict adherence to delivery timelines, ensuring customers can count on Bayan Resources.

Operational efficiency plays a crucial role in maintaining this trust. By streamlining processes and optimizing logistics, Bayan Resources demonstrates its capability to meet customer demands effectively. For instance, in 2023, the company reported significant improvements in its operational efficiency, contributing to its ability to maintain consistent supply even amidst market fluctuations.

- Reputation for Reliability: Bayan Resources has consistently delivered on its supply commitments, a key factor in customer retention.

- Quality Assurance: The company’s focus on consistent product quality underpins customer confidence and repeat business.

- Operational Excellence: Efficient operations translate into dependable service, reinforcing trust and customer satisfaction.

- Long-Term Partnerships: Years of consistent performance have fostered strong, trust-based relationships with key clients.

Investor Relations and Transparency

Bayan Resources prioritizes investor relations and transparency, providing crucial information to financial stakeholders. This commitment extends to customers indirectly by showcasing a well-managed and responsible company.

The company actively communicates through various channels:

- Investor Updates: Regular updates keep investors informed about operational performance and strategic developments.

- Annual Reports: Comprehensive annual reports detail financial results and company activities.

- Sustainability Reports: These reports highlight the company's environmental, social, and governance (ESG) performance, fostering trust.

In 2024, Bayan Resources continued its focus on clear communication, with its 2023 annual report detailing a significant increase in revenue, reaching IDR 21.6 trillion, up from IDR 17.8 trillion in 2022. This transparency reassures stakeholders and indirectly builds customer confidence in the company's stability and ethical practices.

Bayan Resources builds strong customer ties through long-term contracts, ensuring consistent demand and revenue. Their commitment to direct sales and dedicated account managers fosters personalized service, with 80% of 2025 sales already contracted by December 2024.

The company differentiates itself by offering customized coal blends to meet specific client needs, exemplified by a notable rise in bespoke blend requests from cement manufacturers in 2024.

Reliability, consistent quality, and operational efficiency are paramount, reinforcing customer trust and loyalty. This is supported by transparency in investor relations, with 2023 annual reports showing significant revenue growth to IDR 21.6 trillion.

| Customer Relationship Aspect | Key Strategy | Supporting Data/Fact |

|---|---|---|

| Long-Term Commitments | Securing long-term contracts and supply agreements | 80% of 2025 sales volume committed by Dec 2024 |

| Direct Engagement | Direct sales and dedicated account management | Focus on serving power plant and industrial clients worldwide |

| Tailored Solutions | Offering customized coal blends | Increased bespoke blend requests from cement manufacturers in 2024 |

| Trust & Reliability | Consistent quality and dependable supply chains | 2023 Revenue: IDR 21.6 trillion (up from IDR 17.8 trillion in 2022) |

Channels

Bayan Resources leverages a dedicated direct sales force to cultivate relationships and secure large-volume contracts with industrial clients and power generators. This approach allows for tailored negotiations and a deep understanding of customer needs, ensuring competitive pricing and reliable supply chains. In 2024, Bayan's direct sales efforts were instrumental in securing key long-term agreements, contributing to its robust revenue streams.

Bayan Resources' Integrated Logistics Network functions as a vital channel within its business model, physically delivering coal to customers. This network encompasses the company's owned and operated haul roads, barging fleets, and port facilities, ensuring a controlled and efficient transportation process.

In 2024, Bayan Resources continued to leverage this robust infrastructure. The company's operational reports for the year highlighted the significant role of its logistics segment in maintaining supply chain reliability. For instance, the company's barging operations are designed to handle substantial volumes, contributing to its competitive edge in the seaborne coal market.

Bayan Resources utilizes international trading desks to connect with its global clientele, particularly in key Asian markets. This strategy broadens their market access beyond direct sales.

In 2024, Bayan Resources' export revenue from coal sales, a significant portion of which is facilitated through these international channels, reached approximately $1.2 billion. This highlights the critical role of these desks in their revenue generation.

The company may also engage agents or brokers in regions like Southeast Asia, East Asia, and South Asia to further penetrate these markets and manage localized sales efforts, ensuring efficient distribution and customer engagement.

Company Website and Investor Portals

Bayan Resources leverages its official company website and dedicated investor portals as crucial channels for communication. These platforms are vital for sharing comprehensive information with a broad audience, including customers, partners, and the investment community.

These digital hubs offer detailed insights into Bayan's product offerings, operational performance, and its commitment to sustainable practices. For investors, they provide access to financial reports, annual statements, and strategic updates, fostering transparency and engagement.

- Company Website: Serves as the primary online presence, detailing products, services, and corporate news.

- Investor Relations Portal: Offers dedicated resources for shareholders and potential investors, including financial filings and presentations.

- Information Dissemination: Crucial for communicating operational highlights and sustainability initiatives.

- 2024 Data: As of the first quarter of 2024, Bayan Resources reported significant operational achievements, with production volumes contributing to its financial disclosures available on these platforms.

Industry Conferences and Trade Fairs

Bayan Resources actively participates in key industry conferences and trade fairs. This engagement is crucial for showcasing their products and services to a wider audience. For instance, in 2024, the company likely attended major mining and resources events, providing a platform to demonstrate their latest innovations and operational successes. These gatherings are invaluable for building brand visibility within the sector.

These events serve as critical networking opportunities. Bayan Resources can connect with potential clients, partners, and investors, fostering new business development. In 2024, such events would have offered direct access to decision-makers in the global mining industry, facilitating discussions on supply agreements and strategic collaborations. This direct interaction is key to market penetration.

- Showcasing Products: Bayan Resources uses these events to display their mining capabilities and technological advancements.

- Networking: Direct engagement with potential clients and partners at events like the Indonesia Mining Expo or similar global forums in 2024.

- Market Intelligence: Staying abreast of emerging trends, competitor activities, and regulatory changes within the resources sector.

- Business Development: Generating leads and securing new contracts through face-to-face interactions.

Bayan Resources utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are crucial for large industrial clients, complemented by an integrated logistics network for physical delivery. International trading desks and regional agents expand market reach, while digital platforms and industry events foster communication and business development.

These channels collectively ensure efficient product distribution, market penetration, and stakeholder engagement. In 2024, Bayan's export revenue, significantly driven by its international trading operations, demonstrated the effectiveness of these diverse outreach methods.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct Sales Force | Secures large contracts with industrial clients. | Instrumental in securing key long-term agreements. |

| Integrated Logistics Network | Own haul roads, barging, and port facilities for coal delivery. | Maintained supply chain reliability and competitive seaborne volumes. |

| International Trading Desks | Connects with global clientele, especially in Asia. | Facilitated approximately $1.2 billion in export revenue. |

| Agents/Brokers | Penetrates specific regional markets (SE Asia, E Asia, S Asia). | Supports localized sales efforts and efficient distribution. |

| Digital Platforms (Website/Investor Portal) | Communicates corporate information and financial data. | Fosters transparency and engagement with stakeholders. |

| Industry Conferences/Trade Fairs | Showcases products, builds brand visibility, and networks. | Provided direct access to decision-makers for new business development. |

Customer Segments

Domestic power plants in Indonesia are a crucial customer segment for Bayan Resources, forming a significant part of their market. These power generation companies rely on a consistent and high-quality supply of thermal coal to fuel their operations and meet the nation's energy demands.

This segment is substantial, representing 22% of Bayan Resources' total coal market composition as of September 2023. This demonstrates the critical role Bayan plays in supporting Indonesia's domestic energy infrastructure and its commitment to providing essential fuel sources.

International power plants, especially those in Southeast Asia like the Philippines, are key customers for Bayan Resources. These facilities rely on a steady supply of thermal coal to meet their energy demands. The Philippines' significant contribution to sales, reaching 32% in September 2023, underscores the importance of this region.

Other significant markets include East Asia, with countries like South Korea and China, and South Asia, where India and Bangladesh represent substantial demand centers. These nations' power sectors are actively seeking dependable thermal coal providers to fuel their growth and maintain grid stability.

Bayan Resources serves a diverse range of industrial customers worldwide, including those in the cement, steel, and various manufacturing sectors. These industries rely heavily on coal, either as a fundamental energy source to power their operations or as a crucial raw material in their production processes.

These industrial clients typically have stringent and specific requirements regarding the quality and calorific value of the coal they procure. For instance, cement production often demands coal with a specific ash content and volatile matter, while steel manufacturing might prioritize higher calorific values for efficient smelting.

In 2024, the global demand for coal in industrial applications remained robust, driven by ongoing manufacturing activity and energy needs. Bayan Resources' ability to meet these precise quality specifications positions it as a key supplier to these vital economic engines, contributing to their operational efficiency and output.

Metallurgical Coal Buyers

Bayan Resources’ metallurgical coal buyers are primarily large-scale industrial clients, with a significant focus on the global steel industry. These customers depend on high-quality metallurgical coal, often referred to as coking coal, for the essential process of steel production. Bayan’s ability to supply this specialized product positions it as a key partner for these demanding industries.

The company’s output caters to a discerning market that requires specific coal characteristics for effective coking. This includes buyers who operate integrated steel mills and require a consistent supply of low-volatile, high-coking strength coal. Bayan Resources’ dual production of both thermal and metallurgical coal allows it to serve a broader spectrum of energy and industrial needs, but the metallurgical coal segment targets a particularly specialized and value-driven customer base.

In 2024, the demand for metallurgical coal remained robust, driven by ongoing infrastructure development and manufacturing activity worldwide. For instance, steel production in key regions like Asia continued to be a primary consumer of metallurgical coal. Bayan Resources, as a producer, would be looking to secure long-term contracts with major steelmakers, leveraging its production capacity and quality standards to meet their stringent requirements.

- Key Buyers: Integrated steel mills and foundries globally.

- Product Requirement: High-quality metallurgical coal for coking processes.

- Market Relevance: Essential input for steel manufacturing, a foundational industry.

- Bayan's Role: Supplier of specialized coking coal, complementing its thermal coal production.

Coal Traders and Brokers

Coal traders and brokers act as crucial intermediaries, facilitating the movement of coal from producers like Bayan Resources to a diverse customer base. They specialize in managing the complexities of the global coal market, often purchasing large volumes and then segmenting them for smaller buyers or orchestrating intricate supply chains for major industrial consumers.

These entities thrive on market knowledge and logistical expertise. For instance, in 2024, the global seaborne thermal coal market saw significant activity, with prices fluctuating based on demand from key importing regions like China and India. Traders play a vital role in absorbing production surpluses and ensuring supply continuity for end-users.

- Market Access: They provide Bayan Resources with access to a broader customer network than direct sales might achieve, reaching smaller utilities, industrial facilities, and even niche markets.

- Risk Management: Traders often absorb price volatility and credit risk, offering Bayan Resources more predictable revenue streams.

- Logistical Prowess: Their expertise in shipping, chartering, and port operations is essential for efficiently moving bulk commodities across continents.

- Market Intelligence: They offer valuable insights into demand trends, pricing dynamics, and regulatory changes in various coal-consuming regions.

Bayan Resources' customer base is diverse, encompassing domestic and international power plants, industrial manufacturers, and metallurgical coal buyers. Each segment has unique needs regarding coal quality and supply reliability.

In 2024, domestic Indonesian power plants remained a cornerstone, with international markets like the Philippines, South Korea, China, India, and Bangladesh also representing significant demand. Industrial sectors such as cement and steel rely on Bayan for specific coal grades.

The metallurgical coal segment specifically targets global steel producers requiring high-quality coking coal for their production processes. Coal traders and brokers also form a vital customer segment, acting as intermediaries and providing market access and logistical support.

| Customer Segment | Key Characteristics & Needs | 2023/2024 Relevance |

|---|---|---|

| Domestic Power Plants (Indonesia) | Consistent, high-quality thermal coal supply for energy generation. | Crucial for national energy infrastructure; 22% of market (Sept 2023). |

| International Power Plants (SEA, East Asia, South Asia) | Steady thermal coal supply for energy needs. | Philippines 32% of sales (Sept 2023); strong demand from South Korea, China, India, Bangladesh. |

| Industrial Sector (Cement, Steel, Manufacturing) | Specific coal quality, calorific value, and ash content for operations and raw materials. | Robust global demand in 2024 driven by manufacturing activity. |

| Metallurgical Coal Buyers (Global Steel Industry) | High-quality coking coal with specific characteristics for steel production. | Essential input for steel manufacturing; strong demand in 2024 due to infrastructure development. |

| Coal Traders & Brokers | Market knowledge, logistical expertise, price risk management. | Facilitate broader market access and supply chain efficiency. |

Cost Structure

A substantial part of Bayan Resources' expenses comes from removing overburden and the actual coal extraction. This involves significant outlays for fuel, explosives, and the workforce needed for excavation operations.

In 2024, Bayan Resources reported that its mining costs, including overburden removal, represented a considerable portion of its operational expenses. For instance, the company's cost of revenue in 2023 was $1.3 billion, with mining activities being a primary driver of this figure.

These costs are expected to escalate as Bayan Resources pursues its expansion plans, requiring more extensive earthmoving and extraction processes to access the coal reserves.

Bayan Resources faces significant transportation and logistics costs, a crucial element of its business model. These expenses encompass the movement of coal from mines to customers, both domestically and internationally. In 2024, the company continued to invest in its logistics network, which includes barging operations, transshipment facilities, and port handling charges.

The maintenance and ongoing upgrades of essential infrastructure, such as haul roads connecting mines to loading points and port facilities themselves, also represent a substantial outlay within this cost category. These investments are vital for ensuring efficient and reliable delivery of coal, directly impacting Bayan Resources' operational efficiency and profitability.

Bayan Resources incurs significant costs through royalties and government levies, primarily paid to the Indonesian government. These payments are directly tied to the company's coal production and sales volumes.

In 2024, these levies represent a substantial cost component for Bayan Resources. For instance, royalty rates on coal sales can vary, but typically fall within a range dictated by Indonesian regulations, impacting the overall cost of goods sold.

Capital Expenditures (CAPEX)

Bayan Resources' capital expenditures are substantial, reflecting its commitment to growth and operational efficiency. These investments are crucial for maintaining and expanding its mining capabilities and infrastructure.

- Significant investments in new mining equipment are essential for optimizing extraction processes and ensuring a steady supply of coal.

- Infrastructure development, including the expansion of the Tabang concession and the construction of new jetties, underpins the company's logistical strength and export capacity.

- The acquisition of new concessions is a strategic move to secure future resource availability and diversify operational assets.

- Bayan Resources has budgeted capital expenditures between USD 200-300 million for 2025, highlighting a strong forward-looking investment strategy.

General, Selling, and Administrative Expenses (G&A, SGA)

General, Selling, and Administrative Expenses (G&A) for Bayan Resources encompass the essential operational and administrative costs that keep the business running smoothly. These include employee salaries, which are a significant component, as well as office expenses, marketing efforts to promote their mining products, and broader corporate overheads. Effective management of these costs is crucial for maintaining profitability, especially when considered alongside the direct production costs associated with their mining operations.

In 2024, Bayan Resources demonstrated a commitment to cost control. Their G&A expenses were managed to ensure they did not unduly impact the company's bottom line. For instance, while specific figures fluctuate, the company's focus remains on optimizing these expenditures to support efficient operations and strategic growth initiatives.

- Employee Salaries: Covering the workforce essential for administrative and corporate functions.

- Office Expenses: Including rent, utilities, and supplies for operational offices.

- Marketing and Sales: Costs associated with promoting and selling their coal products.

- Corporate Overheads: Such as legal, accounting, and executive management costs.

Bayan Resources' cost structure is heavily influenced by mining operations, encompassing overburden removal and coal extraction, which require substantial investment in fuel, explosives, and labor. In 2023, the cost of revenue stood at $1.3 billion, with mining activities being the primary cost driver, a trend expected to continue with expansion plans.

Logistics and transportation are also significant expenses, covering the movement of coal from mines to domestic and international customers, including barging and port handling fees. Infrastructure maintenance, such as haul roads and jetties, is crucial for efficient delivery.

Royalties and government levies, tied to production and sales volumes, form another substantial cost component. Capital expenditures for new equipment, concession acquisitions, and infrastructure development, like new jetties, are vital for growth, with a projected $200-300 million for 2025.

General, Selling, and Administrative expenses, including salaries, office costs, and marketing, are managed to ensure overall profitability.

| Cost Category | Key Components | 2023 Impact (Illustrative) |

|---|---|---|

| Mining Operations | Overburden removal, extraction, fuel, labor | Major driver of $1.3 billion cost of revenue |

| Logistics & Transportation | Barging, transshipment, port fees, infrastructure maintenance | Essential for market access and delivery efficiency |

| Royalties & Levies | Government payments based on production/sales | Directly impacts cost of goods sold |

| Capital Expenditures | Equipment, concessions, infrastructure development | USD 200-300 million projected for 2025 |

| G&A Expenses | Salaries, office costs, marketing, overheads | Managed for operational efficiency and profitability |

Revenue Streams

Bayan Resources' core revenue comes from selling thermal coal, primarily to power plants and industrial users. These sales occur both within Indonesia and in international markets, supplying essential fuel for energy generation and manufacturing.

Looking ahead to 2025, the company anticipates a strong performance in this segment, with projected revenues estimated to be between USD 4.1 billion and USD 4.4 billion. This forecast highlights the continued demand for thermal coal in the global energy mix.

Bayan Resources generates revenue from selling metallurgical coal, a key ingredient for steel production. This strategic move expands their market reach beyond thermal coal, tapping into the robust demand from the global steel manufacturing sector.

In 2024, Bayan Resources reported significant contributions from its coal sales. For instance, the company's total coal production reached approximately 43.7 million tons in the first nine months of 2024, with a substantial portion allocated to international markets, reflecting the demand for their products, including metallurgical coal.

Bayan Resources generates revenue through logistics and services fees, which include income from providing essential infrastructure like barging, transshipment, and port services. These services can be offered to external clients, creating an additional income stream, or utilized for their own extensive mining operations, thereby reducing internal costs.

Fixed Price Contracts

Bayan Resources secures a portion of its revenue through fixed-price contracts. This strategy offers a valuable layer of stability and predictability, particularly when market conditions become unpredictable. As of mid-December 2024, the company had already committed 11% of its projected sales for 2025 under these fixed-price arrangements.

- Revenue Stability: Fixed-price contracts offer a predictable income stream, shielding against price fluctuations.

- Forward Planning: Securing these contracts aids in more accurate financial forecasting and resource allocation.

- Market Hedging: This approach acts as a hedge against potential downturns in commodity prices.

- Commitment Level: 11% of 2025 planned sales were already under fixed-price agreements by mid-December 2024.

Floating Price Contracts

Bayan Resources heavily relies on floating price contracts for its revenue. These contracts link the selling price of coal to international benchmarks, such as the Newcastle or ICI4 indices. This structure allows Bayan to capitalize on upward price trends in the global coal market.

For instance, in 2024, the average price for ICI4 coal experienced significant volatility. While specific contract details are proprietary, the company's financial reports indicate that the majority of its sales revenue is directly influenced by these fluctuating benchmark prices. This strategy offers a direct pass-through of market conditions to Bayan's top line.

- Floating Price Contracts: Revenue is directly tied to benchmark coal prices like Newcastle and ICI4.

- Market Responsiveness: Allows Bayan to benefit from favorable global coal price movements.

- Revenue Driver: The majority of Bayan's sales revenue is generated through these contracts.

Bayan Resources' revenue streams are primarily driven by the sale of thermal and metallurgical coal to domestic and international markets. The company also generates income from logistics and services, such as barging and port operations, which can be offered to third parties. A portion of revenue is secured through fixed-price contracts, providing a degree of financial stability, while the majority is linked to floating price contracts tied to international coal benchmarks.

| Revenue Source | Primary Market | 2024 Data/Trends | 2025 Outlook |

|---|---|---|---|

| Thermal Coal Sales | Power Plants, Industrial Users (Indonesia & International) | Significant production volume in first nine months of 2024 | Projected revenues between USD 4.1 billion and USD 4.4 billion |

| Metallurgical Coal Sales | Steel Manufacturing (Global) | Contributed to overall coal sales volume | Continued demand from global steel sector |

| Logistics & Services | Internal Operations & External Clients | Reduced internal costs, potential for additional income | Continued provision of barging, transshipment, port services |

| Fixed-Price Contracts | Various Customers | 11% of 2025 projected sales committed by mid-December 2024 | Provides revenue stability and predictability |

| Floating Price Contracts | Various Customers | Majority of sales revenue influenced by benchmark prices (e.g., ICI4) | Capitalizes on upward price trends in global coal market |

Business Model Canvas Data Sources

The Bayan Resources Business Model Canvas is informed by a blend of internal financial reports, operational data, and extensive market research. This ensures a robust understanding of our value chain and strategic positioning.