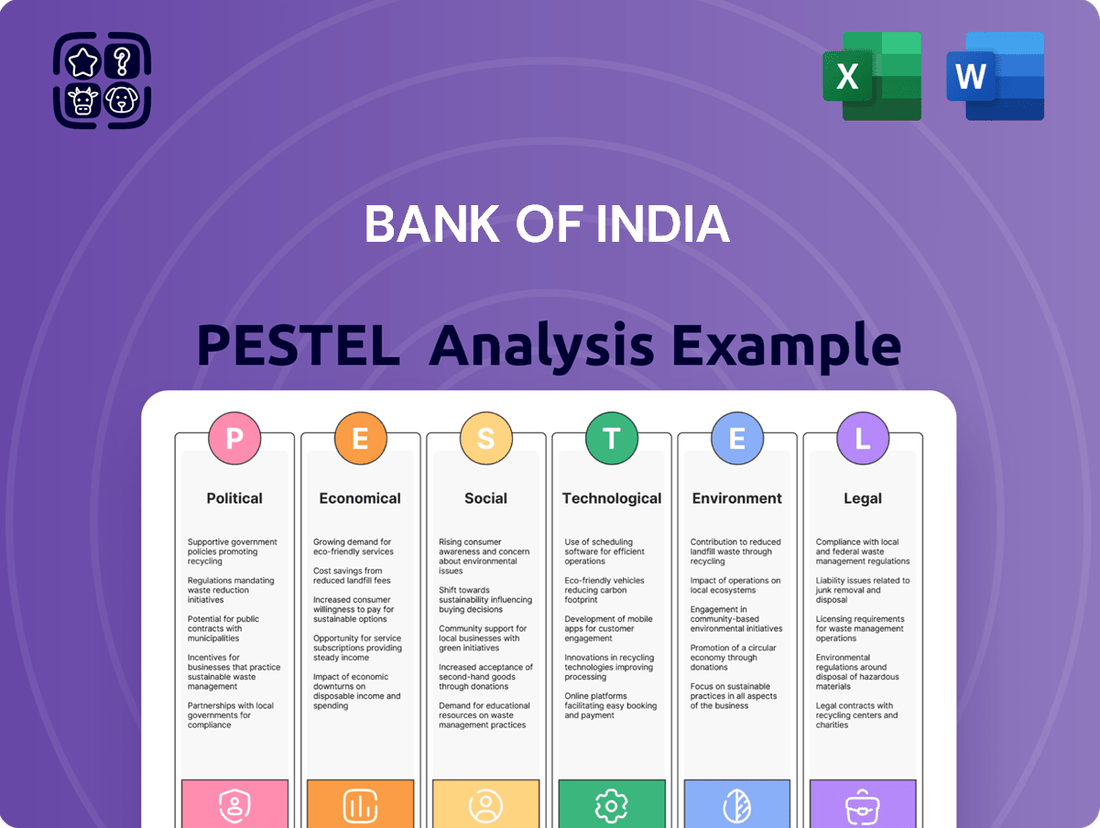

Bank of India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of India Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Bank of India's trajectory. Our meticulously researched PESTLE analysis provides a clear roadmap to understanding the external forces at play. Equip yourself with actionable intelligence to navigate challenges and seize opportunities.

Gain a competitive edge by understanding the intricate PESTLE landscape impacting Bank of India. From evolving regulations to technological advancements, our comprehensive analysis delivers the insights you need to strategize effectively. Download the full version now and unlock your strategic potential.

Political factors

As a public sector bank, Bank of India's strategic direction is heavily shaped by government policies. For instance, the Indian government's focus on financial inclusion, as evidenced by initiatives like the Pradhan Mantri Jan Dhan Yojana, directly impacts the bank's outreach and product development. In FY23, Bank of India reported a significant increase in its retail credit portfolio, partly driven by government schemes aimed at boosting credit access for small businesses and individuals.

The Reserve Bank of India (RBI) actively shapes the banking landscape through ongoing regulatory reforms. These changes, impacting areas like capital requirements and risk management, necessitate continuous adaptation by Bank of India. For instance, the RBI's Basel III framework implementation, which began in earnest, requires banks to maintain higher capital adequacy ratios, with Bank of India reporting a Capital Adequacy Ratio (CAR) of 14.56% as of March 31, 2024, well above the regulatory minimum.

These evolving guidelines, particularly concerning asset quality and digital banking, directly influence Bank of India's operational strategies and compliance efforts. The RBI's focus on strengthening governance and promoting digital financial inclusion means Bank of India must invest in robust risk management systems and innovative digital solutions to remain competitive and avoid potential penalties.

The Indian government's unwavering commitment to financial inclusion, exemplified by initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), directly influences public sector banks such as Bank of India. This agenda compels the bank to extend its services to previously unbanked segments of the population, often in rural and remote areas.

As of March 2024, PMJDY accounts had surpassed 510 million, underscoring the vast reach of this program. Bank of India's participation in these schemes necessitates expanding its physical footprint through new branches and promoting digital payment solutions, impacting its operational strategy and cost structure while aligning with national development goals.

Geopolitical stability and its impact on international operations

Bank of India's extensive international operations, spanning across 10 countries as of early 2024, expose it to the vagaries of geopolitical stability. For instance, the ongoing trade disputes between major global economies could impact cross-border trade finance volumes, a key revenue stream for the bank. Fluctuations in international relations directly influence currency exchange rates and the risk associated with foreign asset holdings, necessitating robust risk management strategies.

The bank's exposure to regions with heightened political tensions, such as parts of the Middle East and Africa, requires constant vigilance. Sanctions imposed on certain countries can disrupt correspondent banking relationships and limit the bank's ability to conduct transactions, potentially affecting profitability. In 2023, global geopolitical risks were cited as a significant concern by many financial institutions, impacting their international expansion plans and operational costs.

- Geopolitical Instability Impact: Disruptions to trade finance and foreign exchange operations due to international tensions.

- Sanctions Risk: Potential limitations on transactions and profitability stemming from global sanctions.

- Overseas Branch Profitability: Direct correlation between regional political stability and the financial performance of international branches.

- 2023 Global Concerns: Geopolitical risks were a prominent concern for financial institutions globally, influencing strategic decisions.

Privatization talks and public sector bank reforms

Discussions around the privatization or consolidation of public sector banks, including Bank of India, inject a degree of uncertainty into its future operational landscape. These potential reforms could reshape management structures, drive efficiency improvements, and alter investment strategies, all of which can influence employee sentiment and long-term strategic direction.

For instance, the Indian government has been actively exploring options for public sector bank consolidation. As of early 2024, reports indicated continued dialogue on merging certain public sector entities to create stronger, more competitive banking institutions. This ongoing conversation means Bank of India could potentially be part of a larger entity or face new competitive pressures depending on the government's final approach.

- Privatization Speculation: Ongoing government deliberations about privatizing select public sector banks create an environment of anticipation and potential structural shifts for Bank of India.

- Consolidation Impact: Any moves towards consolidation could significantly alter Bank of India's market position, operational footprint, and strategic alliances.

- Efficiency Drives: Reforms often aim to boost operational efficiency, which could translate into new technologies, streamlined processes, and altered service delivery models at Bank of India.

- Investment Strategy Shifts: Changes in ownership or governance could lead to a re-evaluation of Bank of India's investment portfolio and risk appetite.

Government policies significantly influence Bank of India's operations, particularly through financial inclusion initiatives like the Pradhan Mantri Jan Dhan Yojana. The bank's performance in FY23, showing a rise in its retail credit portfolio, reflects the impact of these government-backed schemes aimed at expanding credit access.

Regulatory frameworks set by the Reserve Bank of India, such as the Basel III capital requirements, necessitate continuous adaptation. Bank of India's Capital Adequacy Ratio stood at 14.56% as of March 31, 2024, demonstrating its compliance with these evolving prudential norms.

Geopolitical stability is crucial for Bank of India's international operations, which span 10 countries as of early 2024. Trade disputes and sanctions can disrupt cross-border finance and currency exchange rates, impacting the bank's foreign asset management and profitability.

Speculation regarding the privatization or consolidation of public sector banks, including Bank of India, introduces strategic uncertainty. Such reforms, with ongoing government discussions in early 2024, could lead to significant shifts in the bank's structure, efficiency, and market positioning.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Bank of India across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

A PESTLE analysis for the Bank of India provides a structured framework to identify and address external challenges, acting as a pain point reliever by proactively highlighting potential risks and opportunities.

By dissecting the political, economic, social, technological, environmental, and legal landscapes, the Bank of India can anticipate disruptions and develop informed strategies, thereby alleviating the pain of unexpected market shifts.

Economic factors

India's economic engine is showing robust momentum, with projections indicating a GDP growth rate of around 6.5% to 7% for the fiscal year 2024-25. This expansion is a significant driver for the banking sector, as it translates into greater demand for loans from both businesses and individuals. A healthy economy means more opportunities for Bank of India to extend credit, fueling its lending business.

The quality of Bank of India's loan book is intrinsically linked to these GDP trends. Strong economic growth generally supports borrowers' ability to repay, thereby keeping Non-Performing Assets (NPAs) in check. Conversely, any deceleration in economic activity could put pressure on loan repayments, potentially increasing NPAs and impacting the bank's profitability and asset quality.

The Reserve Bank of India's (RBI) monetary policy, especially its stance on benchmark interest rates, directly shapes Bank of India's Net Interest Margin (NIM). When the RBI hikes rates, the cost of borrowing for the bank increases, while lending rates may also rise, creating a dynamic that can compress or expand NIM depending on asset-liability repricing speeds. For instance, in the fiscal year 2023-24, the repo rate remained elevated, influencing the bank's funding costs and the yields on its loan portfolio.

Persistent inflation continues to be a significant concern, with India's retail inflation hovering around 5.05% in April 2024, a slight decrease from previous months but still above the Reserve Bank of India's (RBI) target of 4%. This erosion of purchasing power can directly impact borrowers' repayment capacity, potentially increasing non-performing assets for banks like Bank of India.

The RBI's monetary policy stance, primarily focused on managing inflation, directly influences the banking sector. For instance, the repo rate, currently at 6.50%, impacts borrowing costs for banks and their customers. Any further tightening to curb inflation could lead to higher interest expenses for Bank of India and potentially dampen credit demand, affecting its lending volumes and profitability.

Credit demand and industry-specific lending opportunities

The demand for credit across retail, corporate, and agricultural sectors directly influences Bank of India's operational scale and profitability. For instance, in the fiscal year ending March 2024, India's overall credit growth showed a robust trend, with bank credit to industry growing by 7.7% as of December 2023, indicating strong corporate demand.

Government policies and economic upturns can significantly boost lending in targeted industries. For example, increased government focus on infrastructure development in 2024 is likely to create substantial opportunities for corporate lending in construction and related sectors. Conversely, economic slowdowns in key sectors like manufacturing or real estate could present headwinds for the bank's loan portfolio.

- Retail credit demand remains strong, driven by consumer spending and housing loans.

- Corporate credit growth is influenced by capital expenditure cycles and industrial output, which saw a 7.7% increase in bank credit to industry by December 2023.

- Agricultural lending is often supported by government schemes and monsoon performance, crucial for rural economic activity.

- Sector-specific opportunities arise from government incentives in areas like renewable energy and affordable housing, fostering targeted lending.

Global economic slowdown/recession impact on trade finance

A global economic slowdown, particularly a recession, directly impacts Bank of India's trade finance operations due to reduced international trade volumes. As countries import and export less, the demand for essential trade finance instruments like letters of credit and guarantees naturally declines.

For Bank of India, this translates to a direct hit on its non-interest income, a crucial component of its profitability. For instance, if global trade contracts by, say, 5% in 2024 as some forecasts suggest, the bank could see a proportionate drop in fees generated from these services.

- Decreased Demand for Trade Instruments: A slowdown reduces the need for letters of credit, bank guarantees, and bills of exchange.

- Impact on Fee Income: Lower transaction volumes directly reduce the fee and commission income Bank of India earns from trade finance.

- Increased Credit Risk: Economic downturns can heighten the risk of default on trade finance facilities, potentially leading to higher provisioning.

- Foreign Exchange Volatility: Recessions often bring currency fluctuations, impacting the profitability and risk management of foreign exchange services tied to trade.

India's economic growth trajectory remains a primary driver for Bank of India. Projections for fiscal year 2024-25 indicate a GDP growth rate of around 6.5% to 7%, signaling robust demand for credit across various sectors. This expansion directly supports the bank's lending business and influences the health of its loan portfolio.

Inflationary pressures, with retail inflation around 5.05% in April 2024, continue to pose a challenge. Elevated inflation can erode purchasing power, potentially impacting borrowers' repayment capacity and increasing the risk of non-performing assets for Bank of India.

The Reserve Bank of India's monetary policy, including the current repo rate of 6.50%, significantly affects the bank's funding costs and lending rates. Any policy adjustments aimed at controlling inflation could influence credit demand and the bank's net interest margins.

| Economic Factor | Data Point (FY24-25 Projections/Latest Available) | Impact on Bank of India |

|---|---|---|

| GDP Growth | 6.5% - 7% | Boosts credit demand, supports loan book quality. |

| Retail Inflation | ~5.05% (April 2024) | Potential pressure on borrower repayment capacity. |

| Repo Rate | 6.50% | Influences funding costs and net interest margins. |

| Bank Credit to Industry Growth | 7.7% (as of Dec 2023) | Indicates strong corporate lending opportunities. |

What You See Is What You Get

Bank of India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bank of India PESTLE analysis covers all critical external factors impacting its operations. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

India's population, projected to reach over 1.4 billion by 2024, offers a vast customer base for Bank of India. The significant youth demographic, representing over 50% of the population under 25, demands digital-first banking solutions and personalized financial products. This presents a substantial opportunity for the bank to capture a new generation of customers.

The growing middle class, estimated to expand by 25% by 2025, fuels demand for sophisticated financial services like wealth management and investment products. Simultaneously, Bank of India must address the unique needs of the rural population, which still constitutes a significant portion of India's populace, by offering accessible and tailored banking solutions.

Financial literacy in India shows significant disparities. While urban populations generally exhibit higher awareness, a substantial portion of semi-urban and rural residents still struggle with basic financial concepts. This gap directly affects how effectively Bank of India can introduce and promote its products, particularly digital banking solutions.

For instance, a 2023 report indicated that only about 40% of rural Indian adults could correctly answer a basic financial literacy question, compared to over 65% in urban areas. This necessitates Bank of India to tailor its outreach, focusing on simplified communication and accessible channels to boost customer acquisition and product adoption in these underserved regions.

The widespread availability of smartphones and robust internet access has dramatically reshaped how people bank. In India, for instance, mobile banking transactions saw a substantial increase, with the Reserve Bank of India reporting over 10 billion digital payment transactions in the first half of FY2024. This trend strongly indicates a growing preference for digital channels like mobile apps and internet banking over traditional branch visits.

Bank of India needs to stay ahead of this curve by continually improving its digital offerings. A seamless user experience on its mobile app and internet banking portal is crucial for customer retention. As of late 2023, over 70% of banking transactions in India were estimated to be initiated digitally, highlighting the urgency for banks to prioritize user-friendly and secure digital platforms to attract and keep customers who value convenience and modern technology.

Workforce diversity and inclusion initiatives

Bank of India, as a significant public sector employer, is actively prioritizing workforce diversity and inclusion. This focus extends to enhancing employee well-being, fostering an inclusive workplace culture, and promoting gender equality. For instance, in the fiscal year 2023-24, the bank continued its efforts to increase representation across various employee groups.

These initiatives are vital for talent retention and boosting overall productivity. By investing in comprehensive training and development programs, Bank of India aims to equip its employees with the skills needed to adapt to evolving market demands. This commitment also strengthens its corporate image, making it an attractive employer in the competitive banking sector.

Key aspects of Bank of India's diversity and inclusion efforts include:

- Promoting gender equality: Initiatives to increase female representation in leadership roles and across all levels of the organization.

- Employee well-being programs: Implementation of health, wellness, and support services to ensure a positive work environment.

- Talent development: Continuous investment in training and upskilling programs to foster employee growth and career advancement.

- Inclusive hiring practices: Efforts to attract and retain talent from diverse backgrounds, including different age groups, ethnicities, and abilities.

Trust and reputation of public sector banks

Public sector banks in India, including Bank of India, often benefit from a deep-seated public trust built over decades. However, this trust is increasingly tested by perceptions of slower service and less agility compared to their private sector counterparts. For instance, while public sector banks hold a significant market share, customer satisfaction scores, particularly regarding digital services and complaint resolution, have shown room for improvement in recent surveys.

Bank of India must actively bolster its brand image and operational efficiency to solidify its standing. This involves not only improving customer service metrics but also enhancing transparency in its dealings. A recent report indicated that while public sector banks are crucial for financial inclusion, customer experience remains a key differentiator, with private banks often scoring higher in responsiveness.

- Public Sector Bank Market Share: Public sector banks collectively held approximately 58.5% of the total banking sector assets in India as of early 2024, underscoring their systemic importance.

- Customer Service Perception: Surveys in late 2023 and early 2024 often placed public sector banks slightly behind private banks in overall customer satisfaction, particularly in areas like digital platform usability and query resolution speed.

- Digital Transformation Initiatives: Bank of India, like other PSBs, is investing heavily in digital upgrades, aiming to bridge the gap in customer experience and operational efficiency by 2025.

- Trust Factor: Despite service challenges, a significant portion of the Indian population, especially in rural and semi-urban areas, continues to prefer public sector banks due to perceived stability and government backing.

India's demographic landscape presents Bank of India with a massive customer base, especially with over half its population under 25, who are increasingly seeking digital banking solutions. The expanding middle class, anticipated to grow by 25% by 2025, is driving demand for advanced financial services. Addressing the financial literacy gap, particularly in rural areas where only about 40% of adults understand basic financial concepts, remains crucial for product adoption.

The widespread adoption of smartphones and internet access has shifted banking preferences towards digital channels, with over 10 billion digital payment transactions recorded in the first half of FY2024 by the RBI. By late 2023, an estimated 70% of banking transactions were initiated digitally, emphasizing the need for Bank of India to enhance its mobile and internet banking platforms for a seamless user experience.

Bank of India's commitment to workforce diversity and inclusion, focusing on gender equality and employee well-being, is vital for attracting and retaining talent. Investing in training programs ensures employees are equipped for evolving market demands, thereby strengthening the bank's employer brand.

While public sector banks like Bank of India hold a significant market share, estimated at 58.5% of total banking assets in early 2024, they face perceptions of slower service compared to private banks. Improving customer experience, especially in digital services and query resolution, is key to maintaining customer trust, although government backing remains a strong pull factor for many.

Technological factors

Bank of India is actively pursuing digital transformation, focusing on modernizing its core banking systems. This strategic move aims to boost operational efficiency and elevate the customer experience. The bank is investing in upgrading its IT infrastructure and integrating advanced technologies to streamline processes.

These modernization efforts are crucial for offering seamless digital services and maintaining a competitive edge in the rapidly evolving banking sector. By embracing these technological advancements, Bank of India is positioning itself for future growth and customer satisfaction.

The Bank of India, like all financial institutions, faces escalating cybersecurity threats and data privacy concerns as its digital operations expand. Reports indicate a significant rise in cybercrime targeting banks globally, with financial losses mounting. For instance, global losses from cybercrime were estimated to reach $10.5 trillion annually by 2025, a stark reminder of the risks.

To counter these evolving threats, the Bank of India must prioritize robust cybersecurity infrastructure, including advanced data encryption and continuous monitoring. Adherence to stringent data privacy regulations, such as India's Digital Personal Data Protection Act, 2023, is not just a legal requirement but a critical component of maintaining customer trust and safeguarding sensitive financial information.

Bank of India is navigating a landscape where AI, ML, and blockchain are fundamentally reshaping banking. For instance, AI-powered chatbots are increasingly handling customer queries, freeing up human resources for more complex tasks. Machine learning algorithms are proving invaluable in identifying fraudulent transactions, with banks globally reporting significant reductions in fraud losses due to these systems.

The bank must strategically invest in these technologies to stay competitive. By leveraging ML for more accurate credit scoring, Bank of India can improve loan portfolio quality. Blockchain technology offers potential for streamlining interbank settlements and enhancing the security of financial transactions, a critical area for any major financial institution.

Fintech partnerships and competition

The burgeoning fintech sector presents a dual dynamic for Bank of India, acting as both a disruptor and a potential collaborator. Fintech firms are rapidly carving out market share in crucial banking areas such as digital payments and lending, intensifying competition. For instance, the Reserve Bank of India's UPI network facilitated over 12 billion transactions in the first half of 2024 alone, highlighting the scale of digital payment adoption often driven by fintech innovations.

However, this competitive landscape also opens avenues for strategic alliances. Bank of India can harness the agility and innovative capabilities of fintech partners to enhance its own service offerings and customer reach. These collaborations can lead to the development of new digital products, improved customer experience through seamless integration, and access to previously untapped market segments. By partnering, the bank can more effectively compete with agile fintech players and expand its digital footprint.

- Increased Competition: Fintechs are challenging traditional banking models in payments, lending, and wealth management.

- Partnership Opportunities: Collaborations can enable banks to adopt new technologies and reach new customer demographics.

- Digital Transformation: Fintech partnerships are crucial for banks aiming to modernize their operations and service delivery.

- Innovation Adoption: Working with fintechs allows banks to leverage cutting-edge solutions without building them entirely in-house.

Mobile banking and payment gateway advancements

The pervasive adoption of smartphones in India, with over 700 million active internet users by early 2025, underscores the critical need for Bank of India to excel in mobile banking. Advancements in mobile banking and payment gateways are paramount for capturing market share and enhancing customer experience. This requires continuous refinement of user interfaces and robust integration with popular payment systems like UPI, which saw over 120 billion transactions in 2024.

Bank of India's mobile platform must offer a seamless and secure environment for a wide array of services. This includes intuitive fund transfers, efficient bill payments, and easy access to account management features. Meeting the evolving digital expectations of a vast customer base is key to driving digital transaction volumes and maintaining a competitive edge in the rapidly digitizing Indian financial landscape.

- Over 700 million active internet users in India by early 2025.

- UPI transactions exceeded 120 billion in 2024, highlighting rapid digital payment adoption.

- User-friendly and secure mobile banking apps are crucial for customer retention and acquisition.

- Integration with diverse payment gateways enhances service offerings and convenience.

Bank of India's technological advancement is centered on digital transformation, aiming to enhance efficiency and customer experience through modernized core banking systems and upgraded IT infrastructure. The bank is actively integrating advanced technologies like AI, ML, and blockchain to streamline operations, improve credit scoring, and secure transactions. Furthermore, the rapid growth of fintechs necessitates strategic collaborations to leverage their innovative capabilities and expand digital reach, while the widespread adoption of smartphones demands a superior mobile banking experience, supported by robust payment gateway integrations.

| Technology Area | Impact on Bank of India | Key Data/Trends (2024-2025) |

|---|---|---|

| Digital Transformation | Modernizing core banking, improving operational efficiency and customer experience. | Investment in IT infrastructure upgrades. |

| AI & ML | Enhancing customer service (chatbots), fraud detection, and credit scoring accuracy. | Global cybercrime losses projected to reach $10.5 trillion annually by 2025. |

| Blockchain | Potential for streamlining interbank settlements and enhancing transaction security. | Focus on secure financial transaction processing. |

| Fintech Collaboration | Increased competition and opportunities for partnerships to offer new digital products. | UPI facilitated over 12 billion transactions in H1 2024. |

| Mobile Banking | Crucial for market share and customer experience given high smartphone penetration. | Over 700 million active internet users in India by early 2025; UPI transactions exceeded 120 billion in 2024. |

Legal factors

The Bank of India operates under the stringent guidelines of the Banking Regulation Act, 1949, and its various amendments. This legal bedrock dictates crucial aspects of its functioning, including licensing, capital adequacy, and corporate governance, ensuring its legitimacy and stability within India's financial landscape.

Recent amendments, such as those introduced to strengthen risk management and enhance transparency, directly impact the bank's operational strategies. For instance, the Reserve Bank of India's (RBI) Basel III norms, which came into full effect for Indian banks by March 2020, mandate higher capital requirements, influencing Bank of India's capital planning and risk-weighted asset management.

Bank of India's commitment to Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance is paramount, directly impacting its operational integrity and regulatory standing. These legal frameworks are designed to thwart financial crimes, including terrorist financing, and require rigorous customer identification and transaction monitoring. Failure to adhere can result in substantial penalties and reputational damage.

In 2023, Indian banks reported a significant increase in suspicious transaction reports (STRs) filed with the Financial Intelligence Unit-India (FIU-IND), underscoring the dynamic nature of these regulations. Bank of India must invest in robust technology and training to ensure its KYC/AML processes remain effective against sophisticated illicit activities, a challenge amplified by the digital transformation of financial services.

The Digital Personal Data Protection Act (DPDPA) in India, enacted in 2023, significantly impacts Bank of India's operations. This legislation mandates stringent rules for collecting, processing, and storing customer data, requiring explicit consent and robust security measures. Failure to comply can result in substantial penalties, potentially impacting profitability and customer confidence.

Insolvency and Bankruptcy Code (IBC) impact on NPA resolution

The Insolvency and Bankruptcy Code (IBC) has been a game-changer for Indian banks like Bank of India in tackling non-performing assets (NPAs). It provides a structured and time-bound process for resolving corporate insolvencies, which directly aids in recovering bad loans. This has led to a noticeable improvement in asset quality for many financial institutions.

Bank of India actively utilizes the IBC framework to manage and resolve its NPAs. While the code has accelerated the resolution process, its effectiveness and the speed of outcomes are still being shaped by ongoing legal interpretations and precedents. This means the recovery rates and timelines can vary.

As of early 2024, the IBC has facilitated the resolution of a significant number of cases, leading to substantial recovery for banks. For instance, by the end of FY23, over 6,000 corporate insolvency cases had been resolved under the IBC, with recovery rates improving over time. This demonstrates the IBC's growing impact on the banking sector's health.

- Streamlined Resolution: IBC offers a faster, more efficient process for NPA recovery compared to previous laws.

- Improved Asset Quality: Banks like Bank of India have seen a reduction in their NPA ratios due to IBC resolutions.

- Evolving Legal Landscape: The interpretation and application of IBC are continually refined, impacting resolution speeds and outcomes.

- Data-Driven Impact: By March 2024, the IBC had seen over 6,500 corporate insolvency cases admitted, with a growing number reaching resolution and improving recovery for lenders.

Cross-border banking regulations and compliance

Bank of India's international operations necessitate strict adherence to a multifaceted array of cross-border banking regulations. These include stringent rules governing foreign exchange transactions, international trade finance, and compliance with global sanctions regimes, such as those imposed by the United Nations and individual countries. For instance, in 2024, financial institutions globally faced increased scrutiny on anti-money laundering (AML) and know-your-customer (KYC) compliance, with significant fines levied for breaches.

Failure to comply with these diverse legal frameworks can result in substantial financial penalties, severe reputational damage, and operational restrictions, impacting the bank's ability to conduct business internationally. For example, a major international bank was fined over $100 million in early 2025 for sanctions violations, highlighting the significant risks involved.

- Foreign Exchange Controls: Navigating differing currency regulations and reporting requirements across multiple jurisdictions.

- International Trade Finance Compliance: Adhering to regulations like the Uniform Customs and Practice for Documentary Credits (UCP 600) and anti-fraud measures.

- Sanctions Screening: Implementing robust systems to screen customers and transactions against evolving global sanctions lists, a critical area of focus in 2024-2025.

- Data Privacy and Cross-Border Data Transfer: Complying with regulations like GDPR and similar frameworks in other regions concerning the handling of customer data.

The legal environment for Bank of India is shaped by the Banking Regulation Act, 1949, and its amendments, which govern licensing and capital adequacy. The Reserve Bank of India's (RBI) Basel III norms, fully implemented by March 2020, mandate higher capital requirements, influencing Bank of India's capital planning. The Digital Personal Data Protection Act (DPDPA) of 2023 imposes strict rules on customer data handling, requiring explicit consent and robust security measures. The Insolvency and Bankruptcy Code (IBC) has been instrumental in improving asset quality by streamlining NPA resolution, with over 6,500 corporate insolvency cases admitted by March 2024.

| Legal Factor | Impact on Bank of India | Key Regulations/Acts | Recent Developments/Data |

| Banking Regulation | Governs licensing, capital adequacy, corporate governance. | Banking Regulation Act, 1949 | Basel III norms fully effective March 2020. |

| Data Protection | Mandates strict rules for customer data collection, processing, and storage. | Digital Personal Data Protection Act (DPDPA), 2023 | Requires explicit consent and robust security measures. |

| Insolvency & Bankruptcy | Facilitates NPA resolution and improves asset quality. | Insolvency and Bankruptcy Code (IBC) | Over 6,500 corporate insolvency cases admitted by March 2024. |

| AML/KYC | Ensures compliance to prevent financial crimes. | Prevention of Money-Laundering Act, 2002 | Increased suspicious transaction reports (STRs) filed in 2023. |

Environmental factors

Bank of India, like other financial institutions, faces growing pressure for comprehensive ESG compliance and reporting. This includes integrating environmental, social, and governance factors into its core operations and lending strategies.

Investor and regulatory demands are pushing for greater transparency. For instance, as of March 2024, India's Securities and Exchange Board of India (SEBI) has mandated Business Responsibility and Sustainability Reporting (BRSR) for top listed companies, including banks, requiring detailed disclosure on ESG metrics.

This shift means Bank of India must actively manage its environmental footprint and ensure social responsibility in its business dealings. The bank's commitment to sustainable finance and responsible lending practices is becoming a key differentiator in the market.

Bank of India is actively participating in the burgeoning green financing sector, with a focus on loans for renewable energy, energy efficiency upgrades, and other environmentally sound projects. This strategic alignment with national climate objectives, such as India's commitment to achieving 500 GW of non-fossil fuel energy capacity by 2030, is crucial for its growth. By expanding its green product offerings, the bank aims to attract capital from a growing pool of environmentally conscious investors and clients, enhancing its market position.

Climate change presents significant risks to Bank of India's loan book, especially for sectors like agriculture and infrastructure that are susceptible to extreme weather, water shortages, and evolving environmental regulations. For instance, prolonged droughts or unseasonal floods can directly impact agricultural loan repayments, a key sector for many Indian banks.

The bank must actively assess and mitigate these climate-related financial exposures, which could manifest as increased borrower defaults or diminished collateral values. As of early 2024, India's agricultural sector, heavily reliant on monsoon patterns, continues to face climate volatility, underscoring the need for robust risk management frameworks.

Operational carbon footprint reduction

Bank of India is increasingly focusing on reducing its operational carbon footprint as a key environmental responsibility. This involves implementing energy-efficient technologies across its branches and exploring the adoption of renewable energy sources to power its operations. For instance, the bank is evaluating solar panel installations at select locations, aiming to decrease reliance on grid electricity.

Furthermore, the bank is enhancing its waste management protocols and prioritizing sustainable procurement practices for office supplies and equipment. These efforts are not only aligned with broader national and international environmental goals but also serve to bolster the bank's corporate image and appeal to environmentally conscious stakeholders. In 2024, the banking sector in India saw a push towards green financing, with banks like Bank of India exploring ways to integrate sustainability into their core business models.

Key initiatives include:

- Energy efficiency upgrades in existing branches.

- Piloting renewable energy solutions, such as solar power.

- Implementing robust waste segregation and recycling programs.

- Adopting sustainable sourcing policies for all procured goods.

Reputational risks from environmental non-compliance

Bank of India faces reputational risks if it fails to meet environmental standards or adopt sustainable practices. Public and media attention on funding projects that harm the environment, or a lack of transparent environmental policies, can result in negative press, customer dissatisfaction, and a decline in business and investor trust.

For instance, in 2024, the increasing focus on ESG (Environmental, Social, and Governance) criteria by investors means that banks with poor environmental track records might see a dip in their market valuation. A significant environmental incident linked to a financed project could lead to immediate public outcry, impacting the bank's brand image and customer loyalty.

- Reputational Damage: Negative publicity from environmental missteps can erode public trust.

- Customer Attrition: Environmentally conscious consumers may choose competitors.

- Investor Confidence: A poor ESG score can deter socially responsible investors.

- Regulatory Scrutiny: Non-compliance can attract increased oversight and potential penalties.

Environmental factors are increasingly shaping Bank of India's strategy, driven by regulatory mandates like SEBI's BRSR and growing investor demand for ESG transparency. The bank is actively engaging in green financing, aligning with India's ambitious renewable energy targets, such as the 500 GW goal by 2030.

Climate change poses tangible risks to Bank of India's loan portfolio, particularly in climate-sensitive sectors like agriculture, where extreme weather events can directly impact loan repayments. As of early 2024, the agricultural sector's vulnerability to monsoon variability highlights the critical need for robust climate risk assessment and mitigation measures.

Bank of India is also focused on reducing its operational carbon footprint through energy efficiency and renewable energy adoption, like piloting solar power at branches. These initiatives are crucial for enhancing its corporate image and attracting environmentally conscious stakeholders in a market where ESG performance is becoming a key differentiator.

Failure to meet environmental standards carries significant reputational risks, potentially leading to customer attrition and decreased investor confidence. In 2024, the market increasingly penalizes banks with poor ESG scores, making proactive environmental management essential for maintaining brand value and trust.

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Bank of India is meticulously crafted using data from official Indian government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific surveys and analyses.