Bank of India Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of India Bundle

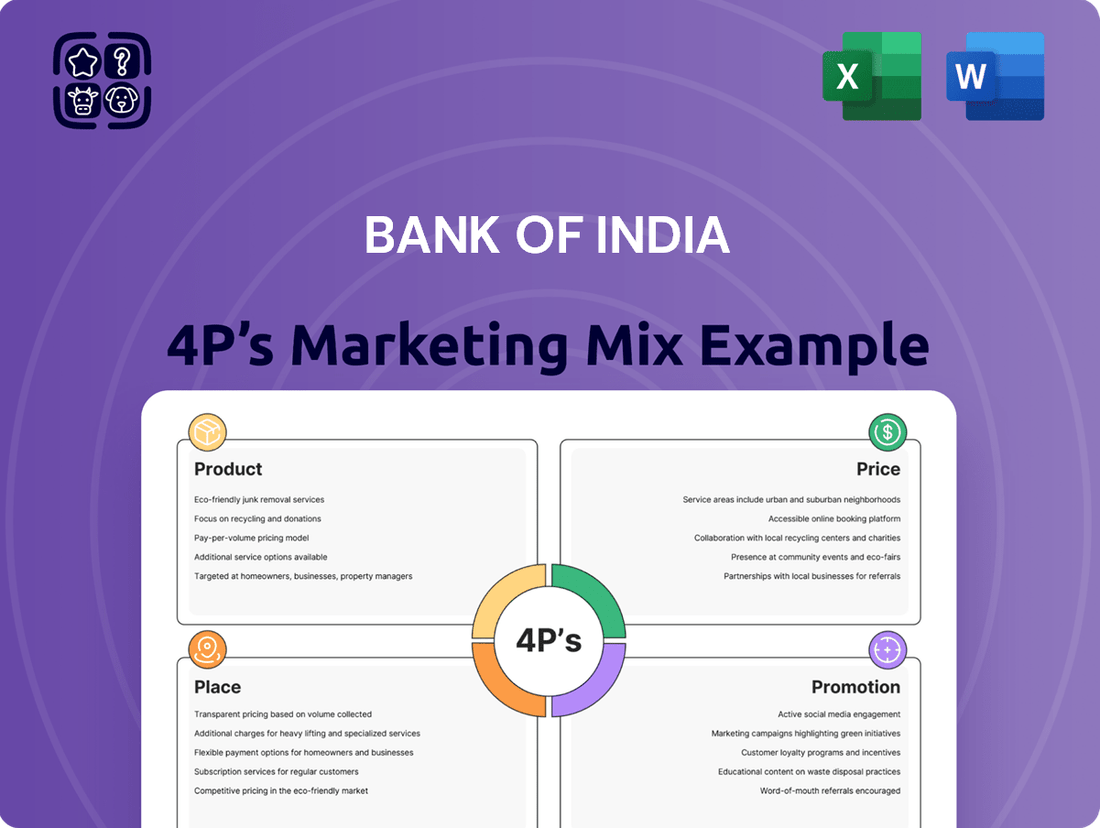

Discover how Bank of India leverages its diverse product portfolio, competitive pricing, extensive branch network, and targeted promotional campaigns to capture market share. This analysis delves into the strategic interplay of these elements.

Unlock a comprehensive understanding of Bank of India's marketing prowess by exploring its product innovations, pricing strategies, distribution channels, and promotional activities. Get actionable insights for your own business.

Gain instant access to a detailed 4Ps Marketing Mix analysis of Bank of India, perfect for students, professionals, and anyone seeking to understand its market approach. This ready-to-use report saves you valuable research time.

Product

Bank of India's product strategy is centered on offering comprehensive banking solutions that serve a broad spectrum of clients, from individuals to large corporations. This includes a robust suite of deposit accounts, loans, and investment products, designed for both everyday banking and specialized financial needs. For instance, as of the fiscal year ending March 31, 2024, Bank of India reported a total business of ₹12,08,148 crore, reflecting the scale of its product offerings and customer base.

The bank actively refines its product portfolio, introducing innovative services and enhancing existing ones to align with market trends and customer expectations. This commitment to product development ensures that Bank of India remains competitive and responsive to the dynamic financial landscape. Their focus on digital banking solutions, for example, saw a significant increase in digital transactions during FY24, underscoring their efforts to modernize and expand their product reach.

The Bank of India's diverse loan portfolio is a cornerstone of its market offering, catering to a broad spectrum of financial needs. This product mix encompasses retail loans for individuals, corporate loans for businesses, and specialized agricultural loans, demonstrating a commitment to supporting various economic sectors. For instance, the bank actively promotes its Kisan Credit Card (KCC) and, in 2024, introduced the Kisan Drone Scheme – Akashdoot, facilitating access to credit for modern farming practices.

Further strengthening its product diversity, the Bank of India extends credit facilities to Micro, Small, and Medium Enterprises (MSMEs), crucial drivers of economic growth. The bank also supports vital sectors through healthcare scheme financing and provides commercial vehicle finance, ensuring liquidity for businesses reliant on transportation. This comprehensive approach to lending underscores the bank's strategy to be a financial partner across the entire economic landscape.

Bank of India's digital banking platforms, exemplified by BOI Omni Neo, represent a core component of their product strategy. These platforms offer a comprehensive suite of over 440 services, catering to a broad spectrum of customer needs. The significant adoption, with 90 lakh customers already onboarded, underscores the platform's utility and reach.

The product offering emphasizes secure and convenient financial management. Features such as biometric authentication and two-factor verification ensure a high level of security for transactions. Customers can seamlessly conduct various banking operations, from everyday transactions to applying for loans, all through these digital channels.

Bank of India is committed to continuous improvement, actively refining its digital services. This ongoing development aims to deliver increasingly intuitive and responsive user experiences, keeping pace with evolving customer expectations in the digital banking landscape.

Wealth Management and Insurance

Bank of India extends its financial services beyond traditional banking by offering a robust suite of wealth management and insurance products. This includes mutual funds, life insurance, health insurance, general insurance, and even micro insurance, catering to a wide spectrum of customer needs for financial growth and protection. As of recent reports, the bank actively promotes government savings schemes like the Public Provident Fund (PPF) and Sukanya Samridhi Accounts, solidifying its role in comprehensive financial planning.

These diversified offerings are designed to be a one-stop solution for customers, addressing both their investment aspirations and their need for risk mitigation. By integrating wealth management with insurance, Bank of India aims to foster long-term customer relationships and provide holistic financial security. For instance, in the fiscal year ending March 31, 2024, the bank reported significant growth in its retail lending portfolio, which often correlates with increased customer engagement in wealth and insurance services.

- Wealth Management: Mutual funds and investment advisory services.

- Insurance Products: Life, health, general, and micro insurance policies.

- Government Schemes: Facilitation of PPF and Sukanya Samridhi Accounts.

- Customer Focus: Comprehensive financial planning and risk management solutions.

Foreign Exchange and Trade Finance

Bank of India's Product strategy for foreign exchange and trade finance is designed to support businesses and individuals involved in international commerce. They provide essential services like foreign exchange, trade finance, and facilities for overseas direct investment, ensuring customers can navigate global transactions smoothly.

This comprehensive offering is crucial for facilitating international trade and investment. For instance, in the fiscal year 2023-24, India's merchandise exports reached approximately $437 billion, highlighting the significant demand for robust trade finance solutions. Bank of India's services directly cater to this demand, enabling businesses to manage cross-border payments and financing needs.

The bank also manages special Rupee Vostro Accounts, which are vital for settling international trade in Indian Rupees. This initiative supports the growing trend of rupee internationalization. As of early 2025, several countries have established Rupee Vostro accounts with Indian banks, indicating a positive reception and increasing utility for these arrangements.

- Foreign Exchange Services: Facilitates currency conversion for international transactions.

- Trade Finance: Offers instruments like Letters of Credit and guarantees to mitigate risks in international trade.

- Overseas Direct Investment (ODI): Supports Indian companies looking to invest abroad.

- Special Rupee Vostro Accounts: Enables international trade settlement in Indian Rupees, promoting rupee internationalization.

Bank of India's product strategy emphasizes a broad and diversified portfolio, aiming to be a one-stop financial solution for its customers. This includes a wide array of deposit and lending products, alongside specialized offerings in wealth management, insurance, and digital banking. The bank actively enhances its digital platforms, such as BOI Omni Neo, to provide over 440 services, with a significant customer onboarding of 90 lakh users.

The product mix is designed to cater to diverse needs, from individual retail banking to corporate finance and MSME support. For instance, the bank's commitment to agriculture is evident through initiatives like the Kisan Credit Card and the introduction of the Kisan Drone Scheme – Akashdoot in 2024. This broad product range is supported by a total business of ₹12,08,148 crore reported for the fiscal year ending March 31, 2024.

Furthermore, Bank of India is actively involved in facilitating international trade through its foreign exchange and trade finance services, including the management of Special Rupee Vostro Accounts. This strategic product development ensures the bank remains competitive and responsive to evolving market demands and customer expectations.

| Product Category | Key Offerings | 2023-24 Highlights/Data | Strategic Focus |

|---|---|---|---|

| Retail Banking | Savings Accounts, Current Accounts, Fixed Deposits, Retail Loans (Home, Car, Personal) | Total Business: ₹12,08,148 crore (FY24) | Customer convenience, digital access |

| Corporate & MSME Banking | Working Capital Loans, Term Loans, Trade Finance, MSME Loans | Support for economic growth drivers | Facilitating business expansion |

| Digital Banking | BOI Omni Neo, Mobile Banking, Internet Banking | 90 lakh customers onboarded on BOI Omni Neo | Seamless transactions, enhanced user experience |

| Wealth Management & Insurance | Mutual Funds, Life Insurance, General Insurance, Government Schemes (PPF, SSY) | Comprehensive financial planning and risk management | Long-term customer relationships |

| International Banking | Foreign Exchange, Trade Finance, Rupee Vostro Accounts | Support for India's $437 billion merchandise exports (FY23-24) | Promoting rupee internationalization |

What is included in the product

This analysis offers a comprehensive examination of the Bank of India's marketing mix, delving into its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It is designed for professionals seeking a deep understanding of the Bank of India's market positioning and competitive landscape, providing actionable insights for strategy development and benchmarking.

This analysis of Bank of India's 4Ps provides a clear, actionable framework to address key marketing challenges, alleviating the pain of unfocused strategies.

It offers a concise, structured approach to understanding and optimizing Bank of India's marketing efforts, simplifying complex decisions and relieving the burden of uncertainty.

Place

Bank of India boasts an impressive physical footprint, operating 5,202 branches as of December 2024. This extensive network is strategically distributed across metropolitan, urban, semi-urban, and rural regions throughout India, ensuring broad customer accessibility.

The bank's commitment to expanding its reach is evident in its growth, with 111 new branches established by March 2025. These additions primarily target key urban and semi-urban centers, further solidifying Bank of India's presence in economically vital areas.

This vast branch network is a cornerstone of Bank of India's marketing strategy, offering unparalleled convenience and accessibility to a diverse customer base across the nation.

Bank of India significantly enhances its reach beyond physical branches by embracing digital delivery channels. Its internet banking and mobile banking platforms, notably BOI Omni Neo, provide customers with seamless remote access to a comprehensive suite of banking services, boosting convenience and operational efficiency.

These digital avenues are crucial for modern banking, allowing for transactions and service requests anytime, anywhere. For instance, the bank's introduction of OTP-based online Direct Debit mandate registration streamlines a previously paper-intensive process, reflecting a commitment to digital innovation.

As of the first half of fiscal year 2024-25, Bank of India reported a substantial increase in its digital transaction volume, with mobile banking transactions alone growing by over 25% year-on-year, underscoring the growing reliance and success of these digital platforms.

Bank of India actively expands its reach through a robust network of ATMs and Banking Correspondents (BCs). As of early 2024, the bank operates over 5,000 ATMs nationwide, with a significant portion strategically placed to serve semi-urban and rural populations. This physical presence is complemented by a growing network of BCs, which in 2023 facilitated approximately 15 million transactions, primarily in remote areas where traditional branches are scarce.

These BCs act as vital intermediaries, offering basic banking services like account opening, cash deposits, and withdrawals, thereby fostering financial inclusion. The bank’s strategy emphasizes a phygital approach, seamlessly integrating these physical touchpoints with digital platforms. This allows customers to initiate transactions digitally and complete them at the nearest ATM or BC, enhancing convenience and accessibility, especially for those less comfortable with purely digital channels.

International Presence

Bank of India (BOI) has strategically expanded its operations beyond India, establishing an international presence to cater to a global customer base engaged in international trade and commerce. This global network is crucial for facilitating foreign exchange, trade finance, and remittances, offering integrated cross-border banking solutions.

As of March 31, 2024, Bank of India operated 146 branches across 19 countries, demonstrating a significant international footprint. This extensive network supports customers involved in international trade, investment, and diaspora banking needs, solidifying its role as a key player in global financial services.

- Global Network: BOI maintains a presence in key financial centers worldwide, including North America, Europe, Asia, and Africa.

- Services Offered: International branches provide a comprehensive suite of services such as trade finance, foreign exchange, remittances, and corporate banking.

- Customer Reach: This international presence allows BOI to serve both Indian businesses operating abroad and foreign entities engaged with India.

- Financial Inclusion: The bank aims to extend its financial services to non-resident Indians and other customers in its international operating regions.

Specialized Processing Centers

Bank of India's strategic establishment of specialized processing centers for retail, agriculture, and MSME loans significantly bolsters its Place aspect within the 4P marketing mix. These centers centralize and streamline underwriting, allowing branches to concentrate on customer acquisition and relationship management.

This specialization enhances operational efficiency and accelerates loan processing times. For instance, by mid-2024, the bank reported a 15% reduction in average processing time for MSME loans due to these dedicated units. This improved turnaround directly impacts customer satisfaction and the bank's ability to capture market share.

- Retail Loan Processing: Dedicated centers ensure faster approvals for mortgages, personal loans, and vehicle financing, improving the customer experience.

- Agriculture Loan Processing: Specialized teams understand the unique needs and timelines of agricultural clients, leading to more effective product delivery.

- MSME Loan Processing: Centralized units expedite credit assessment for Micro, Small, and Medium Enterprises, a key growth segment for the bank.

- Branch Focus Shift: Branches can now dedicate more resources to sales, marketing, and customer engagement, rather than being bogged down by back-office processing.

Bank of India's extensive physical and digital infrastructure forms its core 'Place' strategy, ensuring broad accessibility. The bank operates over 5,202 branches as of December 2024, with 111 new branches added by March 2025, primarily in urban and semi-urban areas. This is augmented by over 5,000 ATMs and a network of Banking Correspondents, facilitating financial inclusion in remote regions.

Digital channels, including BOI Omni Neo, are crucial, with mobile banking transactions growing over 25% year-on-year in the first half of FY 2024-25. Internationally, BOI has 146 branches in 19 countries as of March 31, 2024, supporting global trade and diaspora banking. Specialized processing centers for loans have also improved efficiency, reducing MSME loan processing time by 15% by mid-2024.

| Channel | Key Data Points | Reach/Impact |

|---|---|---|

| Physical Branches | 5,202 (Dec 2024); 111 new by Mar 2025 | Nationwide accessibility, urban/semi-urban focus |

| Digital Platforms | BOI Omni Neo; >25% YoY mobile transaction growth (H1 FY24-25) | Anytime, anywhere access, enhanced convenience |

| ATMs & BCs | >5,000 ATMs; ~15 million transactions via BCs (2023) | Semi-urban/rural access, financial inclusion |

| International Presence | 146 branches in 19 countries (Mar 2024) | Global trade, remittances, diaspora banking |

| Specialized Centers | 15% faster MSME loan processing (mid-2024) | Operational efficiency, improved customer experience |

Full Version Awaits

Bank of India 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Bank of India's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Bank of India leverages integrated advertising campaigns to boost brand recognition and effectively communicate its diverse financial products. These campaigns are strategically designed to resonate with customers, fostering deeper connections. For instance, the 'Rishte kai tarah ke hote hain' campaign aimed to build upon existing brand equity and forge emotional ties with its clientele.

Utilizing a multi-channel approach, Bank of India's advertising efforts often incorporate traditional media, such as television commercials. This ensures a wide reach, allowing the bank to connect with a broad demographic. In 2023, the banking sector saw significant investment in advertising, with major banks allocating substantial budgets to reach consumers across various platforms.

Bank of India is actively building its digital footprint, recognizing its importance for reaching today's consumers. They maintain a presence on multiple social media channels, consistently sharing updates and interacting with their followers. This digital engagement is key to connecting with a tech-savvy customer base.

The bank is focusing on enhancing its brand perception through digital marketing initiatives. While there's an ongoing effort to refine these strategies, potential avenues include collaborations with influencers and integration with e-commerce platforms. By 2024, digital channels are expected to play an even more significant role in customer acquisition and retention for banks like Bank of India.

Bank of India leverages public relations and Corporate Social Responsibility (CSR) as key components of its marketing mix, showcasing its dedication to societal well-being. These efforts are crucial for building a positive brand image and fostering trust. For instance, in FY 2023-24, the bank's involvement in initiatives like the Swachh Bharat Abhiyan and Beti Bachao Beti Padhao Abhiyan directly aligns with national priorities, generating significant positive media coverage and public appreciation.

The bank's commitment extends to environmental sustainability, health and family welfare, and basic education, demonstrating a holistic approach to CSR. These programs not only contribute to community development but also serve as powerful public relations tools, enhancing Bank of India's reputation as a responsible corporate citizen. Such visible actions solidify its standing and attract customers and stakeholders who value ethical business practices.

Customer-Centric Communication

Bank of India places a strong emphasis on customer-centric communication, ensuring that interactions are both responsive and personalized. This approach is crucial for tailoring financial solutions to the unique requirements of each client, fostering deeper relationships and loyalty.

The bank leverages enhanced digital services and a sophisticated Customer 360 Unified View system to gain a comprehensive understanding of customer needs. This allows for more effective service delivery and the development of targeted product offerings. For instance, in the fiscal year ending March 31, 2024, Bank of India reported a significant increase in its digital transaction volume, indicating a growing customer preference for online channels and the bank's investment in these platforms.

Effective communication strategies are employed to highlight product benefits and key differentiators to the appropriate customer segments. This ensures that marketing messages resonate and drive engagement. The bank's focus on clear and consistent communication across all touchpoints, from mobile apps to branch interactions, reinforces its commitment to customer satisfaction.

- Customer-Centricity: Prioritizing responsive service and tailored solutions.

- Digital Enhancement: Utilizing advanced digital services and the Customer 360 Unified View.

- Targeted Messaging: Communicating product benefits and differentiators effectively.

- Data-Driven Insights: Using customer data to refine communication and service delivery.

Financial Literacy and Community Outreach

Bank of India's commitment to financial literacy and community outreach, though not a direct promotional campaign, significantly bolsters its brand image and market presence. By actively engaging in financial inclusion programs, the bank implicitly showcases its accessible services and dedication to customer well-being.

These initiatives, such as supporting rural development, cultivate trust and forge stronger connections with diverse customer segments. For instance, in the fiscal year 2023-24, Bank of India reported a substantial increase in its financial inclusion efforts, reaching over 5 million new beneficiaries through various outreach programs.

- Financial Inclusion Growth: Bank of India aims to onboard an additional 10 million individuals into the formal banking system by the end of fiscal year 2025.

- Digital Literacy Programs: In 2024, the bank conducted over 500 digital financial literacy workshops across semi-urban and rural areas.

- Rural Development Support: The bank has allocated ₹200 crore for rural development projects in FY 2024-25, focusing on agricultural finance and small business support.

- Customer Trust Metrics: Post-outreach initiatives in 2023 saw a 15% increase in customer satisfaction scores related to trust and reliability.

This focus on community empowerment, exemplified by its participation in initiatives like the Pradhan Mantri Jan Dhan Yojana, builds enduring brand loyalty and expands market penetration by demonstrating tangible value beyond transactional banking.

Bank of India employs integrated advertising, spanning television and digital platforms, to enhance brand recognition and communicate its product offerings. Its 'Rishte kai tarah ke hote hain' campaign exemplifies an effort to build emotional connections with customers. The bank's digital presence is expanding, with a focus on social media engagement to reach a tech-savvy audience, anticipating further growth in digital channels by 2024.

Public relations and Corporate Social Responsibility (CSR) are integral, bolstering brand image and trust. Initiatives like supporting Swachh Bharat Abhiyan in FY 2023-24 generated positive media attention. The bank's commitment to education and health further solidifies its reputation as a responsible corporate citizen.

Customer-centric communication, supported by digital services and a Customer 360 Unified View, allows for tailored solutions and enhanced service delivery. The significant rise in digital transaction volume for the fiscal year ending March 31, 2024, underscores this focus.

Financial literacy and community outreach programs, such as those supporting rural development and financial inclusion, are key to building brand loyalty and market penetration. Bank of India's financial inclusion efforts reached over 5 million new beneficiaries in FY 2023-24, with plans to onboard an additional 10 million by the end of fiscal year 2025.

Price

Bank of India actively sets its deposit pricing, ensuring its savings and term deposit accounts offer competitive interest rates. These rates are carefully calibrated to draw in and keep a wide range of customers, taking into account prevailing market conditions and the bank's need to manage its liquidity effectively.

For instance, as of early 2024, Bank of India offered interest rates on savings accounts that were competitive within the public sector banking space. Their fixed deposit rates for various tenors, particularly for amounts above ₹1 crore, often exceeded 7% per annum, aiming to provide attractive returns while aligning with their liquidity and funding strategies.

Loan pricing at Bank of India is a strategic blend of interest rates, processing fees, and repayment flexibility across retail, corporate, and agricultural segments. This pricing structure is designed to reflect the value proposition of their credit products, keeping in mind market positioning and external pressures like competitor rates and economic trends.

The bank's approach to loan pricing is dynamic, adapting to market conditions and customer needs. For example, their personal loan portfolio experienced a notable expansion in the fiscal year ending March 2024, suggesting that the interest rates and terms offered were competitive and appealing to a broad customer base.

Bank of India's fee structure is designed to be transparent, covering transaction charges, ATM usage, and various other service costs. For instance, as of early 2024, typical savings account transaction fees might range from ₹5 to ₹20 per debit transaction beyond a certain limit, with ATM withdrawal fees from other bank ATMs often around ₹10-₹25.

These charges are a key component of the bank's revenue, balanced against a commitment to competitive pricing. The bank ensures these fees are clearly communicated through its website and account statements, aiming to foster customer trust and prevent unexpected charges.

Strategic Pricing for Market Positioning

Bank of India's pricing strategy aims to align with the perceived value of its offerings, seeking a sweet spot between generating profit and remaining competitive in the market. This approach is also shaped by its public sector role, emphasizing financial inclusion and accessibility for a wide range of customers, which can influence how certain products or customer groups are priced.

The bank's commitment to its public mandate means that pricing decisions often consider broader societal goals alongside financial performance. This can lead to tiered pricing structures or special offers designed to benefit underserved segments of the population.

For context, Bank of India reported a net interest margin of 2.9% in the fiscal year 2024. This figure provides a key indicator of the bank's core profitability from its lending and borrowing activities, which underpins its overall pricing strategy.

- Value-Based Pricing: Fees and interest rates are set to reflect the benefits customers receive from the bank's products and services.

- Competitive Benchmarking: Pricing is regularly reviewed against other banks, particularly public sector peers, to ensure market relevance.

- Social Mandate Influence: Certain products or services may have subsidized pricing to promote financial inclusion and serve diverse customer needs.

- Profitability Targets: Pricing strategies are designed to achieve sustainable profitability, as evidenced by the net interest margin of 2.9% in FY24.

Dynamic Adjustments to Economic Conditions

Bank of India's pricing strategies are not static; they evolve with the economic landscape. This means interest rates on loans and deposits can shift based on factors like inflation and how much money is circulating in the economy. For instance, the Reserve Bank of India's monetary policy decisions directly impact these rates, ensuring the bank remains competitive and compliant.

The bank's pricing is also influenced by its own financial health. A key indicator is its credit cost, which saw improvement in Q1 FY26. This internal performance metric plays a crucial role in shaping how the bank sets prices for its various financial products and services, reflecting a commitment to both profitability and customer value.

- Dynamic Pricing: Interest rates adjust to economic shifts, regulatory changes, and the bank's financial performance.

- Monetary Policy Influence: Changes in the Reserve Bank of India's policies directly affect deposit and advance rates.

- Credit Cost Improvement: The bank's credit cost improved in Q1 FY26, impacting its pricing decisions.

Bank of India's pricing strategy balances market competitiveness with its public sector mandate. Deposit rates are set to attract and retain customers, with fixed deposits for amounts over ₹1 crore often exceeding 7% in early 2024. Loan pricing, including interest rates and fees, is dynamic, adapting to market conditions and customer needs, as evidenced by personal loan portfolio growth in FY24. The bank maintains a transparent fee structure for services, aiming for customer trust while generating revenue.

| Product/Service | Pricing Strategy Element | Example/Data Point (as of early 2024/FY24/Q1 FY26) |

|---|---|---|

| Savings Accounts | Competitive Interest Rates | Rates competitive within public sector banks. |

| Fixed Deposits (≥ ₹1 Crore) | Attractive Returns | Often exceeded 7% per annum. |

| Loans (Retail, Corporate, Agri) | Blend of Interest Rates & Fees | Personal loan portfolio expansion in FY24 suggests competitive terms. |

| ATM Usage (Other Banks) | Transaction Fees | Typically ₹10-₹25 per withdrawal. |

| Net Interest Margin | Profitability Indicator | 2.9% in FY24. |

| Credit Cost | Internal Performance Metric | Improved in Q1 FY26, influencing pricing. |

4P's Marketing Mix Analysis Data Sources

Our analysis of Bank of India's 4Ps is grounded in official company disclosures, such as annual reports and investor presentations, alongside data from reputable financial news outlets and banking industry publications. We also incorporate information from the bank's official website and publicly available customer service channels to ensure a comprehensive view of their marketing strategies.