Bank of America PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

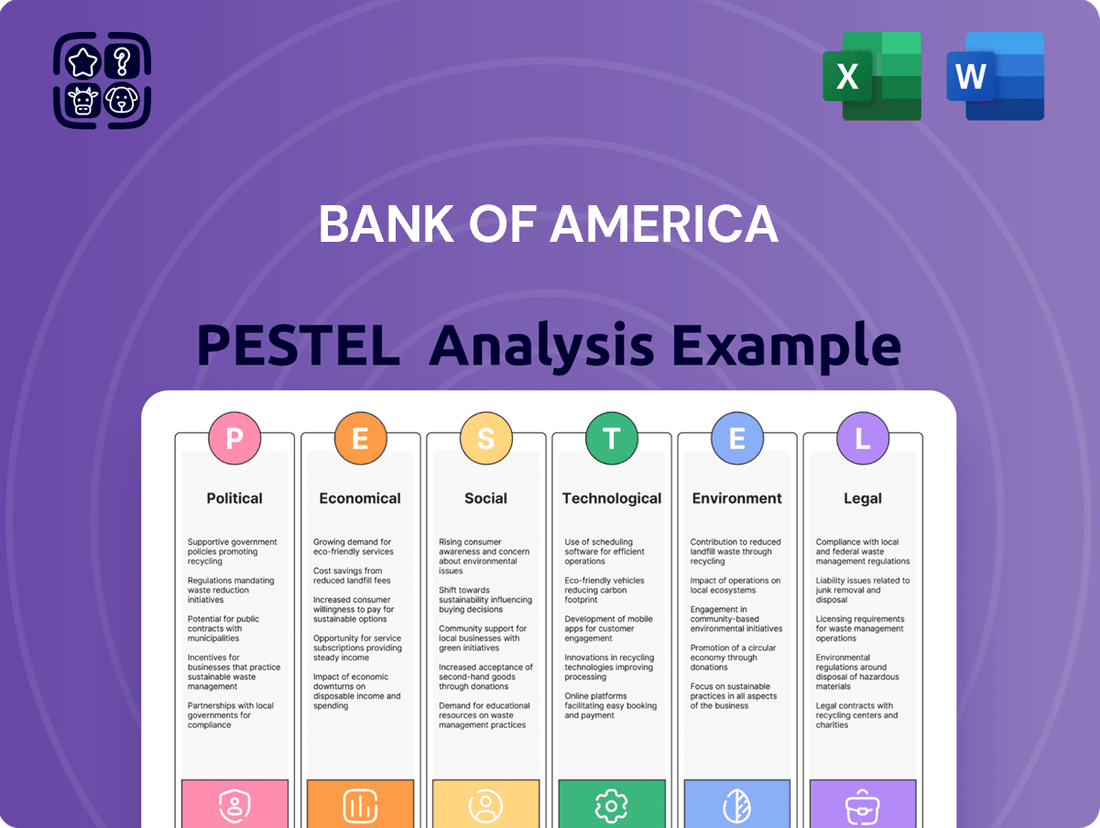

Navigate the complex external forces shaping Bank of America's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its strategic decisions and market position. Gain a competitive advantage by leveraging these critical insights to refine your own business strategy.

Ready to make informed decisions about Bank of America? Our expertly crafted PESTLE analysis delivers actionable intelligence on everything from regulatory shifts to emerging technologies. Download the full version now and unlock the strategic foresight you need to thrive.

Political factors

Government policy and regulation are critical for Bank of America. Decisions on financial regulations, like capital requirements and lending standards, directly shape the bank's operational landscape and profitability. For instance, the Federal Reserve's monetary policy, including interest rate adjustments, significantly impacts Bank of America's net interest income, a core revenue driver. In 2023, the Fed raised interest rates multiple times, which generally boosted bank profitability, but also increased the cost of funding.

Political shifts introduce further complexity. Recent court decisions, such as those potentially limiting the power of federal regulators, can alter the enforcement and scope of existing rules. Furthermore, the prospect of a new administration in 2025 could lead to a rollback or amendment of prior policies, creating an environment of regulatory uncertainty. Bank of America must maintain flexibility to adapt to these evolving political and regulatory pressures, which could affect everything from compliance costs to market access.

Changes in trade policies, such as the imposition of tariffs, significantly influence global economic conditions and, by extension, the financial services industry. For instance, ongoing trade tensions between major economies can disrupt supply chains and investment flows, impacting Bank of America's international operations and client portfolios.

Geopolitical events and shifts in global policy priorities create an increasingly unpredictable landscape for international financial institutions. The ongoing re-evaluation of global alliances and trade agreements, as seen in recent years, adds layers of complexity and risk to cross-border banking and investment strategies for entities like Bank of America.

Governments are actively bolstering financial system stability, with a keen eye on operational and cyber risks. This focus translates into new regulatory frameworks designed to enhance resilience across the sector.

For instance, the UK's Critical Third Party Oversight Regime and the EU's Digital Operational Resilience Act (DORA) are significant developments. These regulations mandate stricter management of operational risks and third-party dependencies, directly impacting how institutions like Bank of America conduct business and manage their vendor ecosystem.

These initiatives underscore a global trend towards greater regulatory scrutiny of financial institutions' operational integrity. For Bank of America, compliance with such measures is crucial for maintaining market confidence and avoiding potential penalties, especially as the financial landscape becomes increasingly digitized and interconnected.

Political Action Committee (PAC) Influence

Bank of America, like many large financial institutions, actively engages in the political arena through its Political Action Committee (PAC). This PAC aggregates voluntary contributions from employees, enabling the bank to support candidates across the political spectrum who align with its business interests. This strategic involvement is crucial for navigating regulatory changes and advocating for policies that impact the financial services sector.

The bank's political contributions and lobbying activities are publicly disclosed, offering transparency into its efforts to shape policy. For instance, in the 2022 election cycle, Bank of America's PAC reported significant expenditures, reflecting its commitment to influencing legislative outcomes. This engagement is a key component of its strategy to manage political risks and opportunities.

- PAC Contributions: Bank of America's PAC actively supports candidates from both major political parties, demonstrating a bipartisan approach to political engagement.

- Advocacy Efforts: Through its PAC, the bank advocates for policies favorable to the financial industry, addressing regulatory and economic issues.

- Transparency: All PAC contributions and lobbying expenditures are publicly reported, adhering to federal election laws and promoting accountability.

- 2022 Election Cycle Data: Bank of America's PAC was a notable contributor in the 2022 election cycle, with reported disbursements reflecting its active role in political campaigns.

Consumer Protection and Market Competitiveness

Regulatory bodies are increasingly prioritizing consumer protection and market competitiveness within the financial sector. This trend directly impacts Bank of America, compelling greater transparency in its offerings and operational practices. For instance, the Consumer Financial Protection Bureau (CFPB) continues to scrutinize fees and lending practices, with over 200 enforcement actions in 2023 alone, aiming to ensure fair treatment for all customers.

This heightened regulatory environment influences Bank of America's product development and service delivery. The bank must adapt to evolving standards designed to foster a more level playing field and safeguard consumers from potential predatory practices. This includes clear communication on interest rates, fees, and terms, as well as robust complaint resolution mechanisms.

Key areas of regulatory focus impacting Bank of America include:

- Enhanced Disclosure Requirements: Mandates for clearer, more accessible information on financial products, particularly mortgages and credit cards.

- Fair Lending Enforcement: Increased scrutiny of lending decisions to prevent discriminatory practices, with significant penalties for violations.

- Data Privacy and Security: Stricter regulations around the handling and protection of customer financial data, a critical concern for institutions like Bank of America.

- Market Competition Initiatives: Policies aimed at reducing barriers to entry for new financial technology firms and promoting innovation to benefit consumers.

Government policy and regulatory changes remain a significant factor for Bank of America. Monetary policy decisions by the Federal Reserve, such as interest rate adjustments, directly influence the bank's profitability, particularly its net interest income. For example, the Fed's rate hikes in 2023 aimed to curb inflation but also increased borrowing costs.

Political stability and shifts in government can lead to changes in financial regulations. For instance, potential policy reversals following an election could impact capital requirements or lending standards. Geopolitical events also play a role, affecting global economic stability and international banking operations.

Consumer protection and market competition are increasingly emphasized by regulators. This means Bank of America must ensure transparency in its product offerings and practices, with bodies like the CFPB scrutinizing fees and lending. For example, the CFPB's actions in 2023 highlight a focus on fair customer treatment.

| Regulatory Area | Impact on Bank of America | Example/Data Point |

|---|---|---|

| Monetary Policy | Affects net interest income and cost of funds | Federal Reserve interest rate hikes in 2023 |

| Consumer Protection | Requires enhanced transparency and fair practices | CFPB enforcement actions in 2023 |

| Operational Resilience | Mandates stricter management of operational and cyber risks | EU's Digital Operational Resilience Act (DORA) |

What is included in the product

This PESTLE analysis examines the external forces impacting Bank of America, covering political stability, economic trends, social shifts, technological advancements, environmental concerns, and legal frameworks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE data into actionable insights for Bank of America's strategic discussions.

Economic factors

Interest rates play a crucial role in Bank of America's financial performance, directly affecting its net interest income. While rates have seen a modest decrease from their 2023 peaks, they are still elevated compared to the pre-pandemic era. This higher interest rate environment influences how businesses approach borrowing and investment strategies.

For instance, the Federal Reserve's Federal Funds Rate, which influences broader market rates, was maintained in the 5.25%-5.50% range through early 2024, a significant climb from near zero in prior years. This sustained higher cost of capital can temper corporate expansion plans and capital expenditures, indirectly impacting the demand for Bank of America's lending services.

Bank of America Global Research anticipates a steady trajectory for US GDP growth in 2025, projecting that the American economy and corporate earnings will demonstrate resilience and outpace other developed nations. This forecast suggests a favorable environment for financial institutions like Bank of America.

The economic outlook is further bolstered by indications of accelerating productivity growth, a key driver for sustained economic expansion. This positive momentum creates a solid foundation for the bank's strategic planning and operational efficiency.

Sticky inflation continues to be a significant economic challenge, impacting everything from consumer purchasing power to the operational costs for businesses like Bank of America. This persistent inflation directly influences how much people spend and how much it costs companies to operate, which in turn shapes the decisions made by central banks regarding interest rates.

Bank of America's economic projections for 2024 and into 2025 are heavily influenced by these ongoing inflationary pressures. For instance, while the US Consumer Price Index (CPI) showed a moderation in early 2024, core inflation, excluding volatile food and energy prices, remained elevated. This situation creates a complex environment for the bank, potentially affecting the demand for loans and the valuation of its investment portfolios.

Consumer Spending and Savings Trends

Consumer spending and savings trends are pivotal for the banking sector, directly impacting deposit levels and loan demand. For Bank of America, understanding how different demographics, particularly Gen Z, allocate their resources is crucial. This generation is projected to see a significant increase in their earning potential in the coming years.

Gen Z's evolving consumption habits, with a strong preference for digital integration and online shopping, are reshaping banking expectations. Their anticipated income growth, estimated to reach trillions in the coming decade, presents a substantial opportunity for financial institutions that can adapt to their tech-centric and convenience-driven demands.

- Gen Z's projected income growth: By 2030, Gen Z is expected to control a significant portion of consumer spending power, with estimates suggesting they could represent over 30% of total wealth by the early 2030s.

- Shift towards digital banking: A 2024 survey indicated that over 85% of Gen Z prefer mobile banking for everyday transactions.

- E-commerce influence: This demographic's comfort with online platforms translates to a demand for seamless digital onboarding and integrated financial services within their digital lives.

Global Market Volatility and Investor Confidence

Global markets are navigating a period of significant volatility, driven by geopolitical tensions and shifting economic landscapes. This uncertainty directly affects investor confidence, making them more cautious about deploying capital. For instance, the ongoing geopolitical conflicts in Eastern Europe and the Middle East continue to disrupt supply chains and energy markets, contributing to inflationary pressures and economic slowdown fears throughout 2024 and into early 2025.

Bank of America, as a major financial institution, acts as a key indicator of the health of the financial sector. Its performance is intrinsically linked to these broader macroeconomic trends. In the first quarter of 2025, for example, Bank of America reported a slight dip in net income compared to the previous year, partly attributed to higher operating expenses and a more challenging interest rate environment. This mirrors the broader sentiment of caution among investors.

- Geopolitical Instability: Continued conflicts and trade disputes are major drivers of market uncertainty.

- Inflationary Pressures: Persistent inflation in major economies impacts consumer spending and corporate profitability.

- Interest Rate Sensitivity: Fluctuations in central bank policies regarding interest rates directly influence borrowing costs and investment valuations.

- Economic Growth Outlook: Divergent growth prospects across regions create varied investment opportunities and risks.

Economic factors continue to shape Bank of America's operational landscape, with interest rates remaining a key determinant of profitability. While the Federal Reserve maintained its target range for the Federal Funds Rate between 5.25%-5.50% through early 2025, this elevated level impacts borrowing costs and lending activity. Projections for US GDP growth in 2025, anticipated by Bank of America Global Research to remain robust and outpace other developed nations, provide a positive backdrop, further supported by expected gains in productivity growth.

Inflationary pressures, though showing signs of moderation, persist as a significant economic challenge, influencing consumer spending and the bank's operational costs. The evolving financial habits of Gen Z, who are projected to command substantial earning potential and a preference for digital banking solutions, present both opportunities and strategic considerations for the institution. Global market volatility, fueled by geopolitical events, adds another layer of complexity, affecting investor sentiment and capital deployment throughout 2024 and into 2025.

| Economic Factor | 2024-2025 Trend | Impact on Bank of America |

|---|---|---|

| Interest Rates (Fed Funds Rate) | Maintained 5.25%-5.50% range | Influences net interest income, borrowing costs, and loan demand |

| US GDP Growth | Projected resilient, outperforming peers | Supports loan growth and overall financial sector health |

| Inflation | Persistent, though moderating | Affects consumer spending, operational costs, and central bank policy |

| Consumer Spending & Savings | Gen Z's growing influence, digital preference | Shapes deposit levels, loan demand, and digital banking strategy |

| Global Market Volatility | Elevated due to geopolitical factors | Impacts investor confidence, trading revenue, and investment portfolio valuations |

Full Version Awaits

Bank of America PESTLE Analysis

The Bank of America PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bank of America, providing crucial insights for strategic planning.

Sociological factors

Bank of America must adapt to shifting consumer demographics, with Gen Z, born between 1997 and 2012, now entering their prime earning and spending years. This generation's increasing economic power, projected to reach $33 trillion in wealth by 2030, necessitates a focus on their preferences.

Key to engaging Gen Z is their strong inclination towards digital-first banking experiences and a demand for transparency and ethical practices, including a focus on sustainability. Banks that fail to cater to these evolving preferences risk alienating a significant future customer base.

The surge in digital adoption fundamentally reshapes how Bank of America interacts with its customers. A significant 79% of consumer and small business households were actively engaged with digital platforms in 2024, underscoring a clear shift in customer preference and behavior.

This trend compels Bank of America to prioritize digital innovation, focusing on enhancing user experience and expanding its digital service offerings to meet evolving customer expectations.

Bank of America actively promotes financial health and literacy, aiming to empower all clients, especially those new to banking or from lower-income backgrounds, to reach their financial objectives. This focus is evidenced by their consistent recognition for outstanding customer satisfaction in financial health support, underscoring their dedication to client well-being.

Community Engagement and Social Responsibility

Bank of America actively engages with communities, demonstrating a strong commitment to social responsibility. This is evident in their efforts to provide financial relief during natural disasters, a critical function that builds trust and goodwill. For instance, in 2023, the bank contributed significant resources to disaster relief efforts across the United States, aiding recovery and rebuilding processes.

Their support for local economic change is also noteworthy. Events like sponsoring the Chicago Marathon not only promote healthy lifestyles but also inject considerable economic activity into the host city. In 2024, the marathon is projected to generate over $200 million in economic impact, a portion of which is directly supported by corporate partners like Bank of America.

- Community Investment: Bank of America's commitment to community development is substantial, with a reported $1.1 billion invested in communities across the U.S. in 2023 through grants, investments, and volunteerism.

- Disaster Relief: The bank consistently provides financial and volunteer support for disaster-stricken areas, with significant contributions made in response to events like the California wildfires and hurricanes impacting the Gulf Coast in recent years.

- Economic Empowerment Programs: Initiatives focused on financial literacy and small business support aim to foster local economic growth, reaching thousands of individuals and entrepreneurs annually.

- Employee Volunteerism: In 2023, Bank of America employees volunteered over 1 million hours globally, directly impacting local communities and reinforcing the bank's social mission.

Workforce Development and Human Capital Management

Bank of America's strategic emphasis on workforce development and human capital management directly addresses sociological shifts impacting the financial sector. The bank is investing in employee training and development, including leveraging AI for enhanced professional growth and realistic client interaction simulations. This focus is designed to boost both employee productivity and the quality of client service, crucial in today's competitive landscape.

This commitment to human capital is reflected in tangible investments. For instance, in 2023, Bank of America invested $300 million in employee development programs, aiming to equip its workforce with the skills needed for evolving client demands and technological advancements. The bank's approach includes:

- AI-powered learning platforms: Offering personalized training modules and skill-building opportunities.

- Simulated client interactions: Providing a safe environment for employees to practice and refine their customer service skills.

- Focus on future-ready skills: Prioritizing training in areas like digital banking, data analytics, and cybersecurity.

- Employee engagement initiatives: Aiming to foster a culture of continuous learning and professional advancement.

Bank of America is adapting to evolving consumer demographics, particularly the growing influence of Gen Z, who are projected to hold significant wealth by 2030. Their preference for digital-first, transparent, and ethical banking experiences is shaping the bank's service offerings.

The bank's commitment to financial literacy and community engagement is a key sociological driver. In 2023, Bank of America invested $1.1 billion in communities through grants and volunteerism, demonstrating a dedication to social responsibility and economic empowerment.

Workforce development is also a priority, with a $300 million investment in employee training in 2023 to equip staff with skills for digital banking and evolving client needs.

| Sociological Factor | Impact on Bank of America | Key Data/Initiatives (2023-2024) |

|---|---|---|

| Demographic Shifts | Need to cater to Gen Z's digital-first and ethical preferences. | Gen Z wealth projected to reach $33 trillion by 2030. 79% of consumer and small business households engaged digitally in 2024. |

| Financial Literacy & Health | Focus on empowering clients, especially underserved segments. | Consistent recognition for customer satisfaction in financial health support. |

| Community Engagement & Social Responsibility | Building trust through disaster relief and local economic support. | $1.1 billion invested in communities in 2023. Employees volunteered over 1 million hours globally in 2023. |

| Workforce Development | Investing in employee skills for evolving client demands and technology. | $300 million invested in employee development programs in 2023. Focus on AI-powered learning and digital skills. |

Technological factors

Bank of America is aggressively integrating artificial intelligence, earmarking $4 billion for AI and technology investments in 2025. This strategic push is already yielding tangible results, with over 95% of its global workforce now utilizing AI tools.

The widespread adoption of AI across the organization is directly contributing to enhanced operational efficiency, evidenced by measurable improvements in processing speed, data accuracy, and client interaction quality in various business units.

Bank of America is seeing a massive increase in digital engagement. In the first quarter of 2024, clients logged into their digital banking platforms a record 2.5 billion times. Proactive alerts, designed to keep customers informed, also hit an all-time high, demonstrating a clear shift towards digital interactions.

The bank's robust digital banking ecosystem, boasting nearly 58 million verified digital users, is a significant technological asset. This widespread adoption of mobile platforms and digital tools is crucial for improving customer satisfaction and fueling the bank's expansion in an increasingly digital financial landscape.

As financial services become increasingly digital, robust cybersecurity and data protection measures are paramount for institutions like Bank of America. In 2024, the financial sector continued to face a significant threat landscape, with cyberattacks costing businesses billions globally. Effective data protection is not just a compliance issue but a fundamental requirement for maintaining customer trust and operational integrity.

Operational resilience regulations, such as the EU's Digital Operational Resilience Act (DORA), which fully came into effect in January 2025, are pushing financial institutions to strengthen their ability to withstand and recover from cyber risks. This regulatory push is critical for Bank of America, as it mandates comprehensive testing and risk management frameworks to ensure continuity of critical services in the face of digital threats.

Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLTs) represent a significant technological frontier for Bank of America, promising to reshape various operational aspects. While specific Bank of America implementations are not detailed, the industry trend indicates a strong push towards exploring DLT for enhanced payment systems, improved transaction security, and greater operational efficiency. For instance, by mid-2024, major financial institutions were actively piloting blockchain solutions for cross-border payments, aiming to reduce settlement times and costs.

The potential impact on Bank of America's infrastructure is substantial. DLTs offer a decentralized and immutable record-keeping system, which could revolutionize areas like trade finance, securities settlement, and identity verification. By the end of 2024, several consortia, including those Bank of America participates in, were reporting significant progress in developing interoperable DLT platforms. These advancements aim to streamline complex financial processes, making them faster and more transparent.

Bank of America's strategic interest in these technologies is likely driven by the potential for:

- Enhanced Security: DLT's cryptographic nature can bolster the security of financial transactions and customer data against cyber threats.

- Increased Efficiency: Automating processes through smart contracts on a distributed ledger can reduce manual intervention and operational costs.

- New Product Development: DLT could enable the creation of innovative financial products and services, such as tokenized assets.

Innovation in Financial Products and Services

Bank of America is actively innovating, as shown by its introduction of Pay by Bank, a secure online payment solution developed with Banked Ltd. This move reflects a broader trend of financial institutions leveraging technology to enhance customer experience and streamline transactions. The bank's commitment to technological advancement fuels the creation of novel financial products and services designed to address the dynamic requirements of its clientele.

Technological advancements are directly influencing the financial sector, prompting banks like Bank of America to invest heavily in research and development. This investment is crucial for staying competitive and meeting the evolving demands of consumers and businesses. For instance, in 2023, Bank of America reported significant technology investments, with digital channels serving over 57 million users, underscoring the importance of innovation in their strategy.

- Digital Transformation: Bank of America's digital platforms are central to its innovation strategy, enabling new service delivery models.

- Payment Solutions: The Pay by Bank initiative exemplifies the bank's focus on creating efficient and secure payment technologies.

- Client-Centric Development: Innovation efforts are geared towards developing financial products that directly address identified client needs and preferences.

- Competitive Landscape: Continuous technological innovation is essential for Bank of America to maintain its market position against both traditional competitors and emerging fintech companies.

Bank of America's technological focus is evident in its substantial investments, with $4 billion allocated for AI and technology in 2025, and over 95% of its workforce utilizing AI tools. This digital push is driving significant client engagement, with a record 2.5 billion digital logins in Q1 2024 and nearly 58 million verified digital users, highlighting the critical role of digital platforms in customer satisfaction and expansion.

The bank is also prioritizing cybersecurity and operational resilience, especially with regulations like DORA effective January 2025, which mandates robust risk management for digital threats. Furthermore, Bank of America is exploring blockchain and DLTs to enhance payment systems, transaction security, and efficiency, with industry pilots showing promise in reducing cross-border payment times and costs by mid-2024.

| Technology Area | Bank of America Investment/Usage (2024/2025) | Impact/Benefit | Key Initiative/Trend |

|---|---|---|---|

| Artificial Intelligence (AI) | $4 billion investment for 2025; >95% workforce utilizing AI tools | Enhanced operational efficiency, improved processing speed, data accuracy, client interaction quality | AI integration across business units |

| Digital Engagement | 2.5 billion digital logins (Q1 2024); ~58 million verified digital users | Increased customer satisfaction, fueling digital landscape expansion | Robust digital banking ecosystem, proactive alerts |

| Cybersecurity & Resilience | Adherence to DORA (effective Jan 2025) | Strengthened ability to withstand and recover from cyber risks, maintaining customer trust | Comprehensive testing and risk management frameworks |

| Blockchain & DLT | Industry exploration and piloting | Potential for enhanced payment systems, improved transaction security, new product development (e.g., tokenized assets) | Pilots for cross-border payments, trade finance, securities settlement |

Legal factors

Bank of America, like all major financial institutions, navigates a dynamic regulatory environment. New compliance mandates, such as those stemming from the Dodd-Frank Act's ongoing implementation and evolving capital requirements, necessitate continuous adaptation. For instance, in 2024, the Federal Reserve continued its stress testing, with Bank of America's capital ratios remaining robust, demonstrating its preparedness for regulatory shifts.

Bank of America, like other global financial institutions, faces increasing regulatory pressure to bolster its operational resilience. Regulations such as the UK's Critical Third Party (CTP) Oversight Regime and the EU's Digital Operational Resilience Act (DORA) are paramount. These frameworks mandate enhanced risk management, robust ICT security, and stringent third-party oversight to ensure financial firms can effectively withstand and recover from operational disruptions.

Bank of America, like all major financial institutions, must navigate evolving regulatory landscapes. The implementation of Basel 3.1 standards, for instance, is designed to bolster financial resilience by tightening capital requirements and enhancing risk management frameworks. This means the bank needs to rigorously assess its existing capital monitoring and risk management models to identify and address any potential shortfalls, ensuring compliance and maintaining a robust financial position.

Anti-Money Laundering (AML) and Sanctions Compliance

Bank of America, like all major financial institutions, operates under a stringent and evolving framework of anti-money laundering (AML) and sanctions compliance. These regulations are critical for preventing illicit financial activities and maintaining global financial stability. The bank must continuously adapt its internal processes and technology to meet these demands, which often involve significant investment in compliance personnel and systems. Failure to adhere can result in substantial fines and reputational damage.

The landscape of AML and sanctions is dynamic, with regulatory bodies frequently updating lists and requirements. For instance, in 2024, governments worldwide continued to implement and enforce sanctions against various entities and individuals, necessitating robust screening and monitoring capabilities. Bank of America's commitment to compliance is not just a legal obligation but a cornerstone of its operational integrity and customer trust. The bank dedicates considerable resources to ensuring its operations align with these complex legal mandates.

Key aspects of Bank of America's compliance efforts include:

- Customer Due Diligence (CDD) and Know Your Customer (KYC): Implementing rigorous procedures to verify customer identities and understand their financial activities to identify and mitigate risks.

- Transaction Monitoring: Utilizing advanced analytics and systems to detect suspicious transactions that may indicate money laundering or terrorist financing.

- Sanctions Screening: Regularly screening customers and transactions against global sanctions lists, such as those maintained by the U.S. Treasury Department's Office of Foreign Assets Control (OFAC).

- Reporting Suspicious Activity: Promptly reporting any identified suspicious activities to relevant regulatory authorities, such as filing Suspicious Activity Reports (SARs).

Consumer Protection Laws and Data Privacy

Bank of America, like all financial institutions, operates under a stringent framework of consumer protection laws. Regulations such as the Consumer Duty, implemented in the UK and influencing global practices, demand enhanced transparency and fair treatment of customers, directly impacting how Bank of America structures its product offerings and client interactions.

Data privacy is another critical legal factor. The bank must rigorously adhere to regulations like the California Consumer Privacy Act (CCPA) and similar global frameworks, ensuring robust protection of customer financial data. This involves significant investment in cybersecurity and data governance to prevent breaches and maintain customer trust.

- Consumer Duty Compliance: Mandates fair value, good customer outcomes, and clear communication, influencing product design and service delivery.

- Data Privacy Regulations: Adherence to CCPA, GDPR, and other data protection laws necessitates secure data handling and transparent privacy policies.

- Financial Disclosure Requirements: Ongoing obligations for clear and accurate disclosure of fees, terms, and risks associated with financial products.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Strict legal requirements to prevent financial crime, impacting account opening procedures and transaction monitoring.

Bank of America's legal obligations are extensive, covering areas like consumer protection and data privacy. Regulations such as the UK's Consumer Duty emphasize fair value and clear communication, impacting how Bank of America designs its products and interacts with clients. For instance, in 2024, the bank continued to refine its customer communication strategies to align with these evolving standards.

Stringent adherence to data privacy laws like the California Consumer Privacy Act (CCPA) is paramount, requiring significant investment in cybersecurity and data governance to safeguard customer information. Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols are critical, with ongoing efforts in 2024 to enhance transaction monitoring and sanctions screening to combat financial crime.

The bank also faces evolving capital requirements and operational resilience mandates, such as those influenced by Basel 3.1 standards and the EU's DORA. These regulations necessitate continuous adaptation of risk management frameworks and technology investments to ensure compliance and maintain financial stability.

Bank of America's compliance efforts in 2024 included significant expenditure on AML/KYC systems and personnel, reflecting the critical need to prevent illicit financial activities and maintain global financial stability. Failure to comply can lead to substantial fines and reputational damage.

Environmental factors

Bank of America is actively pursuing net-zero greenhouse gas emissions across its financing, operations, and supply chain by 2050, aligning with the Paris Climate Agreement. This significant commitment shapes its environmental strategy and investment priorities, influencing how the bank engages with clients and manages its own footprint.

In 2023, Bank of America directed $1.5 trillion in sustainable finance, a substantial portion of which supports climate-related initiatives. This demonstrates a tangible financial commitment to environmental goals, driving innovation and investment in low-carbon solutions.

Bank of America is actively pursuing sustainable finance, aiming to mobilize $1.5 trillion by 2030. A significant portion of this capital is earmarked for the clean energy transition, supporting areas like low-carbon energy generation and sustainable transportation solutions.

Bank of America is actively integrating environmental and social risk management into its operations, as detailed in its Environmental and Social Risk Policy Framework. This commitment extends to thoroughly evaluating climate and environmental risks within its core banking and lending portfolios.

In 2023, Bank of America reported that its financed emissions, a key metric for environmental impact, were 115.4 million metric tons of CO2e. The bank is targeting a 50% reduction in financed emissions intensity by 2030 compared to a 2019 baseline, demonstrating a clear focus on measurable environmental progress.

Operational Sustainability and Resource Efficiency

Bank of America is actively enhancing its operational sustainability and resource efficiency. The company achieved carbon neutrality and secured 100% renewable electricity for its operations by 2019, ahead of its initial goals. This commitment is further demonstrated through ongoing initiatives focused on waste reduction and resource conservation across its global footprint.

Key aspects of Bank of America's environmental strategy include:

- Carbon Neutrality: Achieved and maintained carbon neutrality in its operations.

- Renewable Electricity Procurement: Sourced 100% renewable electricity for its operations by 2019.

- Waste Reduction: Implementing programs to minimize waste generation across all business units.

- Resource Conservation: Focusing on efficient use of water and other natural resources.

ESG Reporting and Transparency

Bank of America is a leader in environmental, social, and governance (ESG) reporting, offering extensive disclosures on its sustainability efforts. The company aligns its reporting with recognized frameworks such as the Global Reporting Initiative (GRI) standards, providing stakeholders with clear insights into its progress. This commitment to transparency is vital for building trust and demonstrating accountability in its ESG initiatives.

In 2023, Bank of America reported a 48% reduction in financed emissions intensity from its global commercial real estate portfolio compared to a 2019 baseline. Furthermore, the company issued $25 billion in environmental bonds in 2023, supporting projects that advance climate solutions. These figures highlight a tangible commitment to environmental stewardship and transparently communicating these achievements.

- Industry-Leading Disclosures: Bank of America provides comprehensive ESG reports, aligning with frameworks like GRI.

- Environmental Progress: Achieved a 48% reduction in financed emissions intensity in its global commercial real estate portfolio by 2023 (vs. 2019 baseline).

- Climate Finance: Issued $25 billion in environmental bonds in 2023 to fund climate-focused projects.

- Stakeholder Trust: Transparency in reporting is crucial for building stakeholder confidence and demonstrating ESG commitment.

Bank of America's environmental strategy is deeply integrated into its business, aiming for net-zero emissions by 2050. The bank is a significant player in sustainable finance, directing substantial capital towards climate solutions and renewable energy. This commitment is backed by measurable progress in reducing financed emissions and a strong focus on operational efficiency.

In 2023, Bank of America reported financed emissions of 115.4 million metric tons of CO2e, with a target to reduce financed emissions intensity by 50% by 2030 from a 2019 baseline. The bank also achieved carbon neutrality in its operations and sourced 100% renewable electricity by 2019, showcasing proactive environmental management.

The bank's environmental bond issuance demonstrates its role in funding climate-focused projects, with $25 billion issued in 2023 alone. This financial commitment, alongside transparent ESG reporting, underscores Bank of America's dedication to environmental stewardship and building stakeholder trust.

| Environmental Metric | 2023 Data/Target | Baseline Year |

|---|---|---|

| Financed Emissions (million metric tons CO2e) | 115.4 | N/A |

| Financed Emissions Intensity Reduction Target | 50% | 2019 |

| Sustainable Finance Mobilization Target | $1.5 trillion | 2030 |

| Environmental Bonds Issued (2023) | $25 billion | N/A |

| Operational Carbon Neutrality | Achieved | 2019 |

| Renewable Electricity Procurement | 100% | 2019 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of America is built on a comprehensive review of data from official government reports, financial regulatory bodies, and leading economic forecasting agencies. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.