Bank of America Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

Unlock the strategic blueprint behind Bank of America's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of how they dominate the financial landscape.

Dive deeper into the operational core of a financial giant. Our full Business Model Canvas for Bank of America provides an in-depth look at their key resources, activities, and partnerships, essential for anyone seeking to understand industry-leading strategies.

Ready to gain actionable insights from a market leader? Download the complete Bank of America Business Model Canvas to explore their cost structure, competitive advantages, and growth strategies, empowering your own business planning.

Partnerships

Bank of America actively partners with technology and fintech firms to bolster its digital capabilities and customer service. For instance, in 2024, the bank continued its integration of advanced AI for personalized financial advice and fraud detection, building on previous successes. These strategic alliances are crucial for staying ahead in the fast-paced digital banking environment.

Bank of America cultivates extensive relationships with correspondent banks and financial institutions globally. These vital partnerships are the backbone for facilitating international transactions and trade finance, enabling Bank of America to offer seamless cross-border services to its corporate and institutional clients. This network is particularly critical for the bank's global banking and markets segments, allowing it to operate effectively in diverse financial landscapes.

Bank of America cultivates strategic alliances to enhance its product and service portfolio, focusing on specialized areas that complement its core banking functions. For instance, partnerships with insurance companies bolster wealth management offerings, while collaborations with real estate entities streamline mortgage services.

These alliances allow Bank of America to broaden its appeal and provide a more comprehensive financial ecosystem to its clients. An example is its work with automotive manufacturers, facilitating indirect lending programs that reach a wider customer base. In 2024, such strategic partnerships are crucial for banks looking to expand market reach and offer integrated solutions.

Government Agencies and Regulatory Bodies

Bank of America, as a major financial institution, actively engages with government agencies and regulatory bodies worldwide. This is crucial for maintaining operational legitimacy and ensuring compliance with evolving financial laws. For instance, in 2023, Bank of America reported significant investments in compliance and risk management infrastructure to meet stringent regulatory requirements.

These partnerships are multifaceted, encompassing adherence to global and national compliance standards, active participation in policy formulation discussions, and collaborative efforts aimed at bolstering financial system stability. Such engagement is vital for navigating the complex legal landscape and contributing to a robust financial ecosystem.

- Regulatory Adherence: Bank of America consistently invests in systems and personnel to meet the requirements set by bodies like the Federal Reserve, SEC, and OCC.

- Policy Engagement: The bank participates in industry forums and consultations to provide input on proposed financial regulations, influencing policy development.

- Financial Stability: Collaboration with regulators on stress testing and capital adequacy ensures the bank's resilience and contribution to overall economic stability.

- Global Compliance: Operating in numerous countries necessitates adherence to diverse regulatory frameworks, requiring continuous monitoring and adaptation.

Community Organizations and Non-Profits

Bank of America actively collaborates with community organizations and non-profits, underscoring its commitment to corporate social responsibility. These alliances are crucial for driving local economic development and fostering financial well-being. For instance, in 2023, Bank of America invested $50 million in affordable housing initiatives across the country, directly impacting community growth.

These partnerships extend to vital financial literacy programs, equipping individuals with essential money management skills. Through initiatives like the Better Money Habits program, the bank reached millions of Americans in 2023, aiming to improve financial confidence and capability. This focus on education strengthens community resilience.

Furthermore, Bank of America provides critical support for disaster relief efforts, demonstrating its role as a responsible corporate citizen. Following major natural disasters, the bank often contributes significant funds and resources to aid recovery. In 2024, the bank pledged $1 million to support relief efforts for communities impacted by severe weather events.

- Community Development: Supporting local economic growth through investments and programs.

- Financial Education: Providing resources and programs to enhance financial literacy.

- Disaster Response: Contributing to relief efforts for communities facing crises.

- Reputation Enhancement: Building trust and a positive image as a socially responsible entity.

Bank of America's key partnerships extend to asset managers and investment firms, crucial for expanding its wealth management and investment banking services. These collaborations allow the bank to offer a wider array of investment products and expertise to its clients, thereby deepening client relationships and generating fee-based income. In 2024, the bank continued to leverage these relationships to enhance its digital investment platforms.

What is included in the product

A comprehensive overview of Bank of America's business model, detailing its customer segments, value propositions, and revenue streams across its diverse financial services.

This model highlights key partnerships, resources, and cost structures that enable Bank of America to serve individuals, businesses, and institutions globally.

The Bank of America Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that simplifies complex strategic thinking.

It helps alleviate the pain of information overload and lack of clarity by condensing essential business elements into a single, easily digestible page.

Activities

Bank of America's core banking operations are the engine of its business, focusing on taking deposits and making loans. This includes everything from your checking account to large commercial mortgages, forming the backbone of its consumer and global banking divisions. These activities are crucial for generating interest income, which is a primary driver of profitability.

In 2024, loans and leases represented Bank of America's largest revenue segment, underscoring the importance of these core activities. This means the bank's ability to effectively manage its lending portfolio and attract deposits directly impacts its financial performance and ability to grow.

Bank of America's Global Wealth & Investment Management division actively manages client assets, aiming to grow and preserve wealth. This involves strategic allocation across various asset classes to meet diverse risk appetites and financial objectives.

Brokerage services are a cornerstone, facilitating the buying and selling of securities for individual and institutional clients. In 2024, this segment continued to leverage technology to provide efficient trading platforms and market access.

Financial advisory is central, offering personalized guidance on investment strategies, retirement planning, and estate management. The firm emphasizes a holistic approach, ensuring clients receive comprehensive wealth planning tailored to their unique circumstances.

Global Banking and Markets Operations is a powerhouse for Bank of America, encompassing a wide array of financial services. This segment is crucial for facilitating complex transactions and providing essential market liquidity.

Investment banking activities include advising on mergers and acquisitions, underwriting debt and equity offerings, and assisting clients with capital raising. These services are vital for corporate growth and restructuring.

Global markets operations involve the sales and trading of various asset classes, such as fixed income, equities, and currencies. Bank of America's extensive network allows them to serve a diverse client base, including corporations, governments, and institutional investors worldwide.

In 2024, Bank of America's Global Banking and Markets segment reported significant revenue, underscoring its importance to the bank's overall financial performance. For instance, the firm consistently ranks among the top global investment banks for deal volume and trading activity.

Technology Development and Digital Innovation

Bank of America's commitment to technology development and digital innovation is a cornerstone of its strategy. The bank continuously invests to improve customer experience and operational efficiency across its vast network. This focus ensures they remain competitive in an increasingly digital financial landscape.

A significant portion of these investments is directed towards enhancing digital banking platforms and mobile applications. These digital channels are crucial for customer engagement and transaction processing. Bank of America is also leveraging advanced technologies like artificial intelligence to personalize services and streamline operations.

The bank's AI-driven virtual assistant, Erica, exemplifies this innovation. Erica assists customers with a wide range of banking needs, from checking balances to making payments, providing a more intuitive and efficient banking experience. This technology also helps automate internal processes, freeing up human resources for more complex tasks.

In 2025, Bank of America allocated a substantial $4 billion specifically for new AI projects. This significant investment underscores the bank's belief in AI's transformative potential for financial services, aiming to drive further advancements in customer service, risk management, and overall business performance.

- Digital Platform Enhancement: Ongoing development of user-friendly mobile and online banking interfaces.

- AI Integration: Deployment of AI tools like Erica for customer interaction and operational automation.

- Strategic Investment: $4 billion dedicated to AI projects in 2025, signaling a strong commitment to future technological capabilities.

- Operational Efficiency: Utilizing technology to streamline internal processes and improve service delivery.

Risk Management and Compliance

Bank of America's key activities heavily revolve around robust risk management and stringent compliance. This involves actively monitoring and mitigating various risks, including credit risk from loans, market risk from investment fluctuations, and operational risk from internal processes and systems. Ensuring adherence to a complex web of financial regulations, such as anti-money laundering (AML) and Know Your Customer (KYC) rules, is paramount to maintaining the bank's integrity and operational license.

In 2024, financial institutions like Bank of America are navigating an environment of evolving regulatory landscapes and increasing cybersecurity threats, making these activities even more critical. For instance, the bank's commitment to compliance safeguards its financial stability and reputation, directly impacting its ability to serve customers and operate profitably.

Key activities in this domain include:

- Credit Risk Management: Assessing borrower creditworthiness and managing loan portfolios to minimize defaults.

- Market Risk Mitigation: Employing strategies to hedge against adverse movements in interest rates, foreign exchange, and equity markets.

- Operational Risk Control: Implementing strong internal controls, cybersecurity measures, and business continuity plans.

- Regulatory Compliance: Adhering to all applicable laws and regulations, including those related to capital adequacy, consumer protection, and financial crime prevention.

Bank of America's key activities are multifaceted, encompassing core banking, wealth management, global markets, and significant investments in technology and risk management. These pillars work in concert to drive revenue and maintain operational integrity.

In 2024, loans and leases formed the largest revenue segment, highlighting the centrality of deposit-taking and lending. Simultaneously, the bank's digital transformation, including a $4 billion AI investment in 2025, is reshaping customer engagement and operational efficiency.

| Key Activity Area | Description | 2024 Relevance/Data Point |

|---|---|---|

| Core Banking | Deposit taking and lending activities. | Loans and leases were the largest revenue segment. |

| Wealth & Investment Management | Asset management and financial advisory services. | Facilitates wealth growth and preservation for clients. |

| Global Banking & Markets | Investment banking and trading operations. | Significant revenue contributor, consistently high deal volume. |

| Technology & Digital Innovation | Enhancing digital platforms and AI integration. | $4 billion allocated to AI projects in 2025. |

| Risk Management & Compliance | Mitigating credit, market, and operational risks; regulatory adherence. | Crucial for financial stability and maintaining operational licenses. |

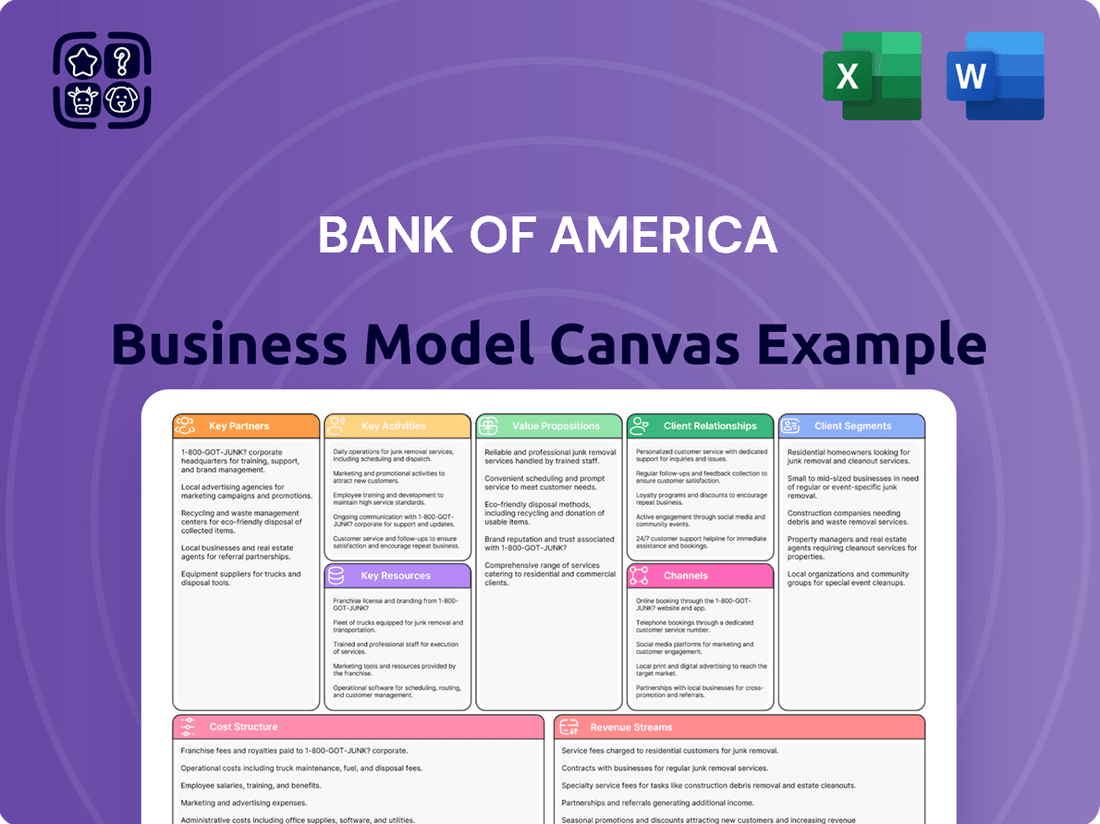

What You See Is What You Get

Business Model Canvas

The Bank of America Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This means the structure, content, and formatting are identical to the complete file, ensuring you know exactly what you're getting. Once your order is processed, you will gain full access to this same comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

Bank of America's financial capital is its bedrock, encompassing a massive pool of equity, customer deposits, and robust access to capital markets. This financial strength, evidenced by its $3.26 trillion in total assets as of 2024, is what allows the bank to function, lend money, invest, and importantly, weather economic downturns.

This substantial capital base directly fuels the bank's core operations, enabling it to provide a vast array of financial services from consumer banking to complex investment solutions. Without this financial muscle, Bank of America couldn't extend the credit and make the investments that are essential to its business model and to its clients' success.

Bank of America's human capital is its bedrock, comprising 213,000 employees worldwide as of early 2024. This vast workforce brings a diverse array of skills, from the intricate knowledge of investment bankers to the client-focused approach of financial advisors and the crucial support of technology and customer service professionals.

The collective expertise and commitment of these individuals are what truly power the bank's day-to-day operations and foster the deep relationships it holds with its clients. Their ability to navigate complex financial landscapes and deliver tailored solutions is a key differentiator.

Bank of America's technology infrastructure is a cornerstone of its operations, featuring robust data centers, secure networks, and custom-built software. This advanced setup supports the massive flow of customer information the bank manages.

The bank's significant investment in artificial intelligence and digital tools, backed by a $13 billion annual technology budget, allows for highly personalized customer experiences and streamlined operational efficiency. This focus on technology is critical for staying competitive in the modern financial landscape.

Brand Reputation and Trust

Bank of America's enduring brand reputation and the deep trust it has cultivated with its diverse client base are fundamental assets. This robust brand equity acts as a powerful magnet, drawing in new customers while simultaneously fostering loyalty among its existing clientele, thereby reinforcing its position as a market leader.

The bank's consistent recognition for high levels of customer satisfaction and its commitment to supporting clients through various financial cycles are key differentiators. In 2024, Bank of America continued to be a top-ranked institution for customer service, with numerous industry awards reflecting this dedication.

- Brand Equity: Bank of America's brand is consistently valued in the billions, a testament to decades of trust and reliability.

- Customer Loyalty: High retention rates in 2024 indicate that customers value the bank's stability and service.

- Market Perception: The bank is frequently cited in surveys as a preferred financial institution for its perceived financial strength and customer-centric approach.

- Digital Trust: Growing adoption of its digital platforms further solidifies trust, with millions of active digital users engaging daily.

Extensive Physical Network

Bank of America maintains a significant physical presence, operating around 3,700 retail financial centers and 15,000 ATMs throughout the United States. This extensive network is a crucial resource, offering clients convenient access to banking services, even as digital channels grow in importance. For many customers, especially those who value face-to-face interaction, these physical locations provide essential support and build trust.

This widespread footprint ensures broad accessibility for a diverse customer base. In 2024, Bank of America continued to invest in optimizing its physical network, balancing the need for in-person services with the increasing adoption of digital banking tools. This strategy allows them to cater to a wider range of customer preferences and needs.

Key aspects of this physical network include:

- Extensive Reach: Approximately 3,700 financial centers and 15,000 ATMs across the US provide broad geographic coverage.

- Customer Accessibility: Offers in-person service options for clients who prefer or require face-to-face interactions.

- Tangible Touchpoint: The physical presence serves as a tangible representation of the brand, fostering customer confidence and loyalty.

Bank of America's intellectual property, including proprietary algorithms, data analytics capabilities, and unique financial product designs, represents a significant, albeit often intangible, asset. This intellectual capital drives innovation and competitive advantage, enabling the bank to offer sophisticated solutions and maintain efficiency. For instance, their advanced fraud detection systems and personalized financial advice platforms are built upon years of data and development.

The bank's intellectual property is crucial for developing and delivering its services. This includes the underlying technology for its mobile banking app, its trading platforms, and its risk management models. In 2024, continued investment in R&D, particularly in areas like AI and machine learning, further bolstered this intellectual asset base, allowing for more predictive analytics and tailored customer offerings.

Key aspects of Bank of America's intellectual property include:

- Proprietary Software: Custom-built platforms for trading, banking, and client management.

- Data Analytics: Advanced algorithms for risk assessment, customer insights, and personalized product development.

- Patented Technologies: Innovations in financial technology and security measures.

Value Propositions

Bank of America provides a vast suite of financial products and services, encompassing everything from everyday banking and loans to advanced wealth management and investment banking. This extensive portfolio allows clients to consolidate their financial needs with a single provider, streamlining their financial management.

In 2024, Bank of America continued to leverage its broad product offering, serving millions of individuals and businesses. For instance, their consumer banking segment alone reported significant transaction volumes, underscoring the breadth of services utilized by their customer base.

Bank of America offers advanced digital tools, such as its mobile app and the AI assistant Erica, to provide clients with convenient and personalized financial insights. This digital-first approach meets contemporary customer expectations for easy banking and self-service capabilities.

In 2024, clients engaged with the bank through digital channels a record 26 billion times, highlighting the significant adoption and reliance on these innovative platforms for their financial needs.

Bank of America offers expert guidance and personalized service, crucial for individuals and businesses navigating complex financial landscapes. This commitment ensures tailored solutions, fostering deeper client relationships and satisfaction.

In 2024, Bank of America continued to emphasize its human capital, with a significant portion of its workforce dedicated to client-facing roles, including financial advisors and wealth management specialists. This focus allows them to provide strategic advice and customized financial planning, particularly beneficial for clients with intricate investment portfolios or business financing needs.

Global Reach and Market Access

Bank of America's global reach is a cornerstone of its value proposition, enabling clients to tap into international markets. By leveraging its multinational presence, the bank facilitates cross-border transactions and offers a suite of international banking services. This is especially crucial for large corporations and governmental entities engaged in global operations.

The bank's extensive network allows clients to navigate diverse financial landscapes and access opportunities worldwide. In 2024, Bank of America continued to serve clients in over 35 countries, solidifying its position as a key player in international finance. This broad footprint provides significant advantages for businesses seeking to expand their global footprint.

- Global Market Access: Facilitates entry and operations in international financial markets.

- International Banking Services: Offers a comprehensive range of services for cross-border needs.

- Cross-Border Financial Solutions: Supports multinational corporations and governments with tailored financial strategies.

- Extensive Geographic Footprint: Presence in over 35 countries enhances global connectivity for clients.

Financial Stability and Security

Bank of America's status as one of the world's largest financial institutions offers clients unparalleled financial stability and security for their funds. This immense scale and systemic importance translate into a deep sense of trust, especially during uncertain economic times. For instance, as of the first quarter of 2024, Bank of America reported total assets of approximately $3.3 trillion, underscoring its substantial financial foundation.

The bank's commitment to robust risk management frameworks and maintaining a strong capital position further bolsters client confidence. These measures are crucial in demonstrating its resilience and capacity to weather economic downturns. In the first quarter of 2024, Bank of America's Common Equity Tier 1 (CET1) capital ratio stood at a healthy 12.4%, well above regulatory requirements, signaling its financial strength.

- Systemic Importance: As a globally significant financial institution, its sheer size provides a bedrock of stability.

- Robust Risk Management: Proactive strategies are in place to mitigate potential financial threats.

- Strong Capital Position: High capital ratios, like the Q1 2024 CET1 ratio of 12.4%, demonstrate financial resilience.

- Client Confidence: These factors collectively instill a deep sense of security in customers regarding their assets.

Bank of America offers a comprehensive financial ecosystem, integrating everyday banking, lending, wealth management, and investment banking. This allows clients to manage all their financial needs through a single, trusted provider, simplifying financial operations.

In 2024, the bank's extensive product suite continued to serve millions, with its consumer banking segment processing billions in transactions, showcasing the wide adoption of its diverse offerings.

Bank of America's advanced digital platforms, including its AI assistant Erica, provide personalized financial insights and convenient self-service options. This digital focus aligns with modern customer expectations for accessibility and ease of use.

In 2024, digital engagement reached new heights, with clients interacting via digital channels approximately 26 billion times, highlighting the critical role these platforms play in daily financial management.

The bank provides expert, personalized advice to help clients navigate complex financial situations. This tailored approach fosters stronger client relationships and ensures solutions are precisely matched to individual or business needs.

In 2024, a substantial portion of Bank of America's workforce was dedicated to client-facing roles, including financial advisors, offering strategic guidance for intricate investment and financing requirements.

Bank of America’s global presence is a key differentiator, enabling clients to access international markets and conduct cross-border transactions seamlessly. This multinational network is particularly valuable for corporations and governments with global operations.

In 2024, the bank operated in over 35 countries, reinforcing its role as a global financial facilitator and providing clients with extensive reach and connectivity.

| Value Proposition | Description | 2024 Data/Impact |

| Comprehensive Financial Solutions | One-stop shop for diverse banking, lending, wealth, and investment needs. | Millions of individuals and businesses served; high transaction volumes in consumer banking. |

| Advanced Digital Experience | AI-powered tools and mobile apps for convenient, personalized financial management. | 26 billion digital client interactions in 2024. |

| Expert Advice and Personalization | Tailored guidance from financial professionals for complex financial planning. | Significant client-facing workforce focused on advisory roles. |

| Global Market Access and Services | Facilitation of international transactions and access to global financial markets. | Presence in over 35 countries; support for multinational corporations. |

Customer Relationships

Bank of America enhances customer relationships through personalized digital engagement, utilizing AI and data analytics. In 2024, their virtual assistant, Erica, continued to evolve, offering tailored financial insights and proactive alerts to millions of users, driving deeper digital interaction and client satisfaction.

Bank of America assigns dedicated relationship managers to its high-net-worth individuals, businesses, and institutional clients. These managers act as a primary point of contact, offering personalized service and deep understanding of unique client needs.

These dedicated managers develop customized financial strategies, fostering long-term trust and loyalty by consistently delivering tailored solutions. This approach is crucial for retaining valuable clients and deepening the bank's relationship with them.

In 2024, Bank of America continued to emphasize this client-centric model, with its Global Wealth & Investment Management division, which includes these dedicated services, reporting significant client asset growth, reflecting the success of personalized relationship management.

Bank of America offers robust self-service digital tools, enabling clients to manage their finances conveniently. Over 58 million verified digital users actively engage with the bank's online banking portal and mobile app, demonstrating a strong preference for independent account management, payments, and information access. This digital empowerment provides customers with significant control and flexibility in their banking interactions.

Community Involvement and Trust Building

Bank of America actively cultivates community involvement and champions responsible banking, aiming to solidify trust and showcase its dedication to local well-being. This strategic approach enhances its public image and strengthens customer loyalty.

In 2024, Bank of America continued its significant community investments. For instance, its philanthropic efforts in 2023 alone totaled $275 million, with a substantial portion directed towards community development and economic mobility initiatives. This demonstrates a tangible commitment beyond financial services.

- Community Development Investments: In 2023, Bank of America provided $10.1 billion in new credit and equity to support affordable housing and community development projects nationwide.

- Volunteerism: Employees contributed over 1.2 million volunteer hours in 2023, directly engaging with and supporting local communities through various programs.

- Financial Education: The bank offered free financial education resources to over 1.5 million individuals in 2023, empowering them with essential money management skills.

24/7 Customer Support

Bank of America offers round-the-clock customer support, a key element in its business model. This 24/7 availability is crucial for maintaining strong customer relationships in the financial sector, where timely assistance is paramount.

Clients can access support through multiple channels, including phone, online chat, and in-person visits to their extensive network of financial centers. This multi-channel approach ensures that customers can reach Bank of America through their preferred method, enhancing convenience and accessibility.

By providing prompt help and efficient issue resolution, Bank of America reinforces its image as a reliable and accessible financial institution. This commitment to customer service is vital for fostering loyalty and trust among its diverse customer base.

For instance, in 2024, Bank of America continued to invest in digital tools and customer service representatives to manage the high volume of inquiries, aiming to improve response times across all platforms.

- 24/7 Availability: Support accessible anytime, anywhere.

- Multi-channel Support: Options include phone, chat, and in-person at financial centers.

- Prompt Resolution: Focus on efficient and timely issue handling.

- Customer Trust: Building reliability through consistent service.

Bank of America cultivates deep customer relationships through a blend of personalized digital tools and dedicated human interaction. Their commitment extends to community engagement, fostering trust and long-term loyalty across diverse client segments.

The bank's strategy emphasizes accessibility, offering 24/7 support across multiple channels to ensure prompt assistance and efficient issue resolution, thereby strengthening customer confidence.

| Customer Relationship Strategy | Key Initiatives | 2024/2023 Data Highlights |

|---|---|---|

| Personalized Digital Engagement | AI-powered virtual assistant (Erica), tailored financial insights | Millions of users leveraging Erica for proactive alerts and insights. |

| Dedicated Relationship Management | Personalized service for high-net-worth, business, and institutional clients | Significant client asset growth in Global Wealth & Investment Management. |

| Self-Service Digital Tools | Online banking portal and mobile app | Over 58 million verified digital users actively engaged. |

| Community Involvement & Responsibility | Philanthropic efforts, community development investments, financial education | $275 million in philanthropic giving (2023); $10.1 billion in community development credit/equity (2023); 1.2 million volunteer hours (2023); 1.5 million individuals received financial education (2023). |

| Round-the-Clock Customer Support | Multi-channel support (phone, chat, in-person) | Continued investment in digital tools and staff to improve response times. |

Channels

Bank of America's retail financial centers are crucial for customer interaction, offering everything from basic transactions to personalized financial advice. These physical locations are vital for building relationships and serving a wide range of customer needs.

As of 2024, Bank of America maintains a significant presence with around 3,700 retail financial centers across the nation. This extensive network facilitates customer acquisition and provides essential in-person support.

These centers act as key touchpoints for acquiring new customers, resolving complex banking issues, and offering a tangible presence for financial services, reinforcing trust and accessibility.

Bank of America's digital banking platforms, encompassing both its web portal and mobile app, are central to its customer engagement strategy. These channels are designed for a comprehensive user experience, allowing clients to manage accounts, conduct transactions, and access financial insights.

The bank's mobile application has received numerous accolades, underscoring its user-friendliness and feature set. Through these digital touchpoints, customers can interact with advanced tools and services, including AI-powered assistance from Erica, which provides personalized financial guidance and support.

Digital sales have become a dominant force for Bank of America, reaching an impressive 55% of total sales in 2024. This significant shift highlights the increasing reliance of customers on digital channels for their banking needs and the bank's success in facilitating these interactions online.

Bank of America leverages its vast ATM network as a crucial component of its customer relationships, providing 24/7 access to essential banking services like cash withdrawals and deposits. This extensive network, which includes approximately 15,000 machines as of 2024, significantly enhances customer convenience and extends the bank's physical presence beyond traditional branch hours. These ATMs are key touchpoints for routine transactions, supporting customer self-service and reducing reliance on teller-assisted operations.

Contact Centers and Virtual Assistants

Bank of America utilizes its contact centers for comprehensive phone support, addressing a wide range of customer needs. These centers are crucial for handling complex issues and providing personalized assistance.

The bank is increasingly leveraging virtual assistants, notably Erica, to offer immediate, self-service options for customers. Erica has facilitated over 2.5 billion interactions since its 2018 launch, demonstrating significant adoption and efficiency in managing customer queries.

- Contact Centers: Provide human-led support for intricate banking needs and personalized problem-solving.

- Virtual Assistants (Erica): Handle high volumes of quick queries, offering instant guidance and transaction support.

- Efficiency Gains: These channels collectively reduce wait times and improve the overall customer experience by offering multiple access points.

- Scalability: Virtual assistants allow Bank of America to scale customer support efficiently, especially for common inquiries.

Dedicated Sales and Advisory Teams

Bank of America leverages specialized sales and advisory teams to cater to distinct customer segments, including large corporations, institutional investors, and wealth management clients. These dedicated professionals offer in-depth knowledge and personalized strategies, fostering strong client relationships and driving business growth.

These teams are crucial for delivering high-value services and bespoke financial solutions. For instance, in 2024, Bank of America continued to invest in its wealth management division, aiming to expand its advisor base to better serve its affluent clientele, a segment that often requires complex financial planning and investment management.

- Dedicated Teams: Focus on specific client needs for corporations, institutions, and high-net-worth individuals.

- Tailored Solutions: Provide specialized expertise and customized financial strategies.

- Client Engagement: Direct interaction to build and maintain strong, long-term relationships.

- Value Proposition: Deliver high-touch service and sophisticated financial advice.

Bank of America's channels are multifaceted, designed to meet diverse customer needs from basic transactions to complex financial advice. This includes a robust network of physical financial centers and an extensive ATM system, complemented by sophisticated digital platforms and dedicated contact centers.

The bank's digital presence is a cornerstone, with its mobile app and web portal facilitating a significant portion of customer interactions. In 2024, digital sales accounted for 55% of total sales, demonstrating a clear customer preference for online banking. The mobile app, featuring AI assistant Erica, has processed over 2.5 billion interactions since its 2018 launch, highlighting its efficiency and widespread adoption.

Beyond digital, Bank of America maintains approximately 3,700 retail financial centers and around 15,000 ATMs nationwide as of 2024, ensuring accessibility and in-person support. Specialized sales and advisory teams further enhance customer engagement, particularly for corporate, institutional, and high-net-worth clients, offering tailored strategies and high-touch service.

| Channel | Key Features | 2024 Data/Notes |

|---|---|---|

| Retail Financial Centers | In-person transactions, financial advice, relationship building | ~3,700 locations nationwide |

| Digital Platforms (Web/Mobile) | Account management, transactions, AI assistance (Erica) | 55% of total sales in 2024 |

| ATM Network | 24/7 access for withdrawals, deposits, and other services | ~15,000 machines |

| Contact Centers & Virtual Assistants | Phone support, immediate query resolution | Erica: >2.5 billion interactions since 2018 |

| Specialized Sales & Advisory Teams | Corporate, institutional, wealth management | Focus on high-value services and client relationships |

Customer Segments

Individual consumers represent a massive customer base for Bank of America, encompassing millions of people looking for everyday financial tools. This includes essential services like checking and savings accounts, credit cards for daily purchases, and personal loans for various needs.

Bank of America is a significant player in this market, serving roughly 69 million consumer and small business clients across the United States as of recent reports. The bank's strategy here centers on making banking easy and accessible for everyone.

Bank of America offers a comprehensive range of financial tools to small and middle-market businesses, covering everything from commercial loans to treasury management and business credit cards. These offerings are designed to fuel their expansion and manage day-to-day operations effectively.

In 2024, Bank of America continued its commitment to this segment, recognizing the vital role these businesses play in the economy. For instance, the bank's business lending portfolio in this sector has consistently shown robust activity, supporting capital expenditures and working capital needs for thousands of enterprises.

Bank of America, through its Merrill and Bank of America Private Bank divisions, actively serves High Net Worth (HNW) and Ultra High Net Worth (UHNW) individuals. These segments demand highly specialized wealth management and investment advisory services, often requiring intricate estate planning and bespoke lending solutions.

In 2024, Bank of America reported significant growth in its Global Wealth & Investment Management segment, which includes Merrill and the Private Bank. This segment serves a substantial portion of the wealthiest households in the U.S., leveraging deep client relationships and a comprehensive suite of financial products to meet their complex needs.

Large Corporations and Institutions

Bank of America's Global Banking and Global Markets divisions are key to serving large corporations and institutions. These divisions provide a comprehensive suite of services, including investment banking, corporate lending, and sophisticated capital markets solutions. They also offer robust risk management tools, essential for navigating complex global financial landscapes.

These clients are typically large, multinational corporations, sovereign governments, and significant institutional investors like pension funds and asset managers. For example, in 2024, Bank of America's Global Banking segment reported significant revenue contributions from its corporate and institutional clients, reflecting the scale of its operations in this area. The bank's ability to offer integrated financial solutions across various geographies and asset classes makes it a preferred partner for these sophisticated entities.

- Investment Banking: Underwriting securities, mergers and acquisitions advisory.

- Corporate Lending: Providing large-scale credit facilities and syndicated loans.

- Capital Markets Solutions: Equity and debt capital raising, trading services.

- Risk Management: Derivatives, hedging strategies, and treasury solutions.

Government Entities

Bank of America serves a wide array of government entities, from federal agencies to state and local municipalities. These partnerships are crucial for managing public funds and facilitating essential services.

The bank offers specialized treasury management solutions to help governments efficiently handle revenue collection, disbursements, and cash flow optimization. For example, in 2024, Bank of America continued to support numerous state and local governments with their complex financial operations, enabling smoother public service delivery.

Financing solutions are another key offering. Bank of America provides municipal financing, bond underwriting, and other credit facilities to fund infrastructure projects and public initiatives. This support is vital for economic development and community improvement.

Advisory services are also extended to public sector clients. These include strategic financial planning, debt management, and investment advice, all tailored to the unique regulatory and operational environments of government bodies.

- Treasury Management: Facilitates efficient handling of public funds.

- Financing Solutions: Supports infrastructure and public projects through municipal finance.

- Advisory Services: Provides strategic financial planning and debt management for public entities.

- Government Partnerships: Bank of America actively engages with federal, state, and local governments to meet their financial needs.

Bank of America caters to a broad customer base, segmented from individual consumers and small businesses to high-net-worth individuals and large corporations. Each segment receives tailored financial products and services designed to meet their specific needs, from everyday banking to complex investment strategies.

The bank's strategy emphasizes accessibility and comprehensive solutions, serving approximately 69 million consumer and small business clients in the U.S. alone. In 2024, Bank of America demonstrated strong performance across its Global Wealth & Investment Management, supporting a significant portion of affluent households.

Furthermore, Bank of America actively partners with government entities, providing essential treasury management, financing, and advisory services. Their Global Banking and Global Markets divisions are crucial for multinational corporations and institutional investors, offering sophisticated capital markets and risk management solutions.

Cost Structure

Employee salaries and benefits represent a substantial cost for Bank of America. In 2024, the company employed approximately 213,000 individuals worldwide, reflecting the significant investment in its human capital. This cost encompasses not only base salaries but also includes bonuses, healthcare, retirement plans, and other essential benefits designed to attract and retain talent.

Bank of America dedicates significant resources to its technology and digital infrastructure, a crucial element of its business model. This involves hefty spending on cybersecurity to protect sensitive data, as well as investments in artificial intelligence and advanced data analytics. These technological advancements are vital for streamlining operations and elevating the customer experience across all its digital touchpoints.

In 2024, Bank of America's commitment to technology is underscored by its substantial annual budget of $13 billion allocated to these areas. This investment reflects a strategic focus on innovation and digital transformation, aiming to maintain a competitive edge in the rapidly evolving financial services landscape.

Bank of America's extensive physical footprint, encompassing thousands of financial centers, corporate offices, and ATMs, represents a substantial cost. In 2023, the bank reported over 4,000 financial centers and approximately 15,000 ATMs, each incurring ongoing expenses.

These occupancy and equipment costs include lease payments for prime real estate, utilities to power these locations, regular maintenance to ensure functionality, and the depreciation of valuable assets like servers, ATMs, and office furnishings. For example, the depreciation and amortization expense for Bank of America in 2023 was over $6 billion, reflecting the ongoing cost of maintaining its vast physical and technological infrastructure.

Marketing and Advertising Expenses

Bank of America dedicates significant resources to marketing and advertising to connect with its broad customer base, from individual consumers to large corporations. These efforts are crucial for building brand loyalty and promoting its wide array of financial products and services.

In 2024, the company continued its robust investment in these areas, focusing on digital channels and personalized customer engagement. This strategy aims to attract new clients and retain existing ones by highlighting its technological capabilities and customer-centric approach.

- Brand Building: Campaigns reinforce Bank of America's image as a reliable financial institution.

- Product Promotion: Advertising highlights new and existing offerings like credit cards, loans, and investment services.

- Digital Outreach: Significant spending on online advertising, social media, and content marketing targets specific customer segments.

Regulatory and Compliance Costs

Bank of America, as a major financial institution, incurs significant expenses for regulatory compliance. These costs are essential for operating within the legal framework and maintaining public trust.

These expenses cover a wide range, including legal counsel, internal audit functions, and the implementation of robust risk management systems. Adhering to stringent financial regulations, such as those from the Federal Reserve and the Securities and Exchange Commission, demands continuous investment in compliance infrastructure and personnel.

In 2024, the financial services industry, including large banks like Bank of America, continued to navigate a complex regulatory environment. While specific figures for Bank of America's regulatory and compliance costs for 2024 are not publicly itemized in a way that isolates this exact category, industry-wide trends indicate sustained high spending. For instance, a 2023 report by the consulting firm McKinsey estimated that global banks spend upwards of $200 billion annually on compliance. This trend is expected to continue, reflecting ongoing efforts to prevent financial crime, protect consumers, and ensure market stability.

- Legal and Advisory Fees: Costs associated with external legal counsel and compliance consultants.

- Internal Audit and Risk Management: Expenses for dedicated teams and systems to monitor and mitigate risks.

- Technology and Systems: Investment in software and infrastructure to meet reporting and data security requirements.

- Training and Personnel: Costs for educating staff on evolving regulations and hiring compliance specialists.

Bank of America's cost structure is significantly influenced by its substantial investments in technology and its extensive physical infrastructure. Employee compensation and benefits also represent a major expenditure. Furthermore, the bank allocates considerable resources to marketing and advertising to maintain brand presence and attract customers, alongside significant spending on regulatory compliance to operate within legal frameworks.

| Cost Category | 2023 Data (Approximate) | 2024 Focus/Trend |

|---|---|---|

| Employee Salaries & Benefits | ~213,000 employees worldwide | Continued investment in talent retention and development. |

| Technology & Digital Infrastructure | $13 billion allocated annually | Cybersecurity, AI, data analytics, digital transformation. |

| Physical Footprint (Financial Centers & ATMs) | Over 4,000 financial centers, ~15,000 ATMs | Ongoing occupancy, utilities, maintenance, and depreciation costs. |

| Depreciation & Amortization | Over $6 billion | Reflects costs of maintaining physical and technological assets. |

| Marketing & Advertising | Significant investment | Focus on digital channels and personalized customer engagement. |

| Regulatory Compliance | Industry-wide spending estimated >$200 billion annually (McKinsey, 2023) | Navigating complex regulations, investment in systems and personnel. |

Revenue Streams

Net Interest Income (NII) is a cornerstone of Bank of America's profitability, reflecting the core banking activity of earning more on its assets than it pays out on its liabilities. This fundamental revenue stream is driven by the spread between interest earned on loans and investments and interest paid on deposits and borrowings.

In fiscal year 2024, Bank of America's loans and leases emerged as the most significant contributor to its revenue, generating a substantial $61.99 billion. This highlights the critical role of lending activities in driving the bank's net interest income and overall financial performance.

Bank of America generates significant revenue through its card products and associated service charges. This includes income from interchange fees, which merchants pay when customers use their cards, as well as annual fees and late payment fees levied on cardholders. In 2024, card income alone reached an impressive $6.28 billion, highlighting the substantial contribution of these revenue streams to the bank's overall financial performance.

Bank of America earns substantial revenue from fees generated by its investment and brokerage services. This encompasses income from wealth management, investment advisory, and brokerage activities catering to both individual and institutional clients.

These fees include asset management charges and commissions derived from executing trades. In 2024, Bank of America's Investment and Brokerage Services segment was a significant contributor, bringing in $17.77 billion.

Investment Banking Fees

Investment banking fees are a significant revenue driver for Bank of America. This segment generates income through advisory services for mergers and acquisitions (M&A), helping companies navigate complex transactions. It also includes fees from underwriting debt and equity offerings, where the bank helps businesses raise capital by selling securities to investors. Other capital markets activities also contribute to this revenue stream.

In 2024, Bank of America's investment banking fees saw a substantial increase, growing 31% year-over-year to reach $6.2 billion. This robust performance highlights the bank's strength in facilitating major corporate finance deals and capital raising activities.

- Mergers & Acquisitions Advisory: Fees earned from advising clients on buying, selling, or merging with other companies.

- Underwriting Services: Revenue generated from helping corporations and governments issue new debt or equity securities.

- Capital Markets Activities: Income from various financial market transactions, including trading and securitization.

- 2024 Performance: $6.2 billion in fees, a 31% increase from the previous year, demonstrating strong market presence.

Trading Income

Trading income is a significant revenue generator for Bank of America, stemming from its active participation in global financial markets. The bank engages in market-making activities, providing liquidity and facilitating transactions across a wide array of financial instruments. This includes trading in fixed income securities, foreign currencies, and commodities, showcasing the breadth of its global markets operations.

In 2024, these market-making and similar trading activities contributed substantially to the bank's top line. Specifically, revenue from these operations reached $12.97 billion. This highlights the bank's ability to profit from price fluctuations and client flows in dynamic market environments.

- Market-Making: Facilitating client trades and providing liquidity across various asset classes.

- Fixed Income Trading: Generating revenue from buying and selling bonds and other debt instruments.

- Currency Trading: Profiting from foreign exchange transactions and hedging activities.

- Commodities Trading: Engaging in the buying and selling of raw materials and energy products.

Bank of America's diverse revenue streams are crucial for its financial health, encompassing both traditional banking and sophisticated financial services. These income sources collectively demonstrate the bank's broad market reach and its ability to cater to a wide range of client needs.

The bank's revenue generation is clearly segmented, with Net Interest Income, card services, investment and brokerage, investment banking, and trading all playing vital roles. Understanding these distinct areas provides insight into Bank of America's business model and its performance drivers.

In 2024, Bank of America reported significant figures across these key revenue areas, underscoring its market position. Loans and leases led the way, followed by investment and brokerage services, and then trading income, showcasing the bank's diversified income generation capabilities.

| Revenue Stream | 2024 Revenue (in billions) | Key Activities |

|---|---|---|

| Net Interest Income (Loans & Leases) | $61.99 | Interest earned on loans and investments minus interest paid on deposits and borrowings. |

| Card Income | $6.28 | Interchange fees, annual fees, late payment fees from credit and debit cards. |

| Investment & Brokerage Services | $17.77 | Wealth management, advisory fees, brokerage commissions. |

| Investment Banking Fees | $6.20 (31% YoY growth) | M&A advisory, underwriting debt and equity, capital markets activities. |

| Trading Income | $12.97 | Market-making, fixed income, currency, and commodities trading. |

Business Model Canvas Data Sources

The Business Model Canvas for Bank of America is built upon a foundation of extensive financial statements, internal operational data, and comprehensive market research. These sources provide the necessary insights into customer behavior, competitive landscapes, and economic trends.