Bank of America Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

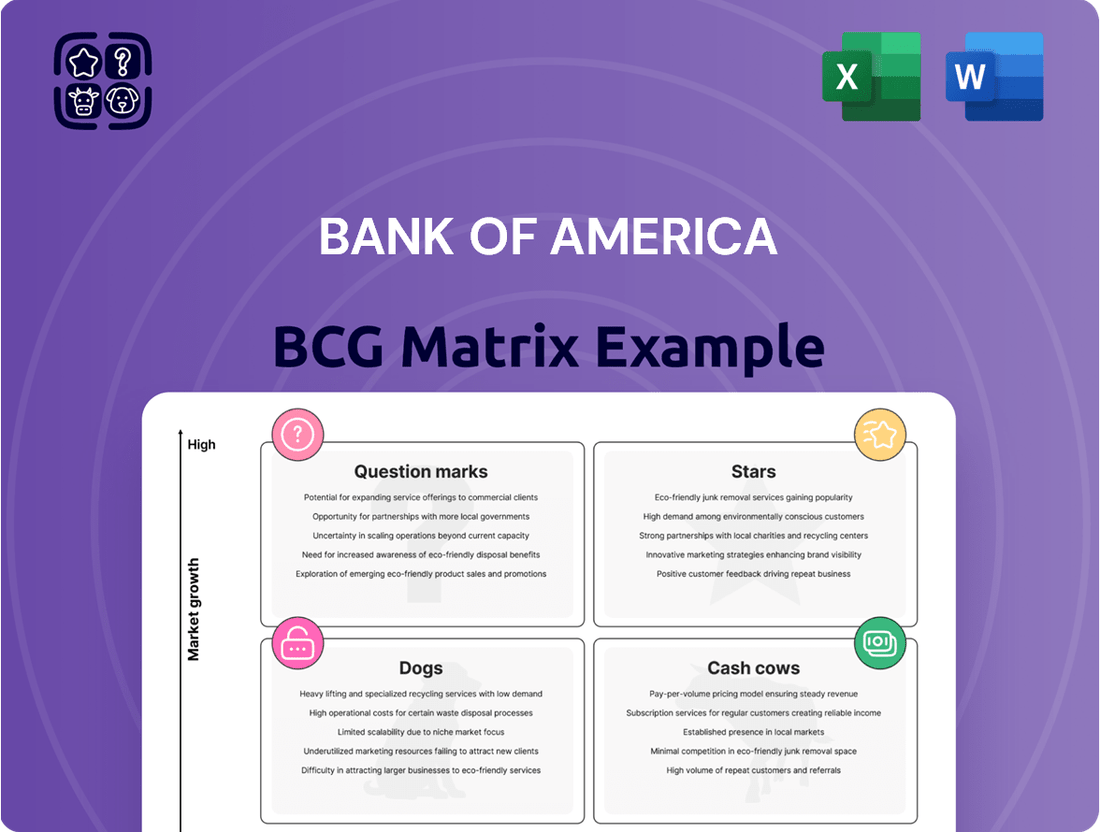

Unlock the strategic potential of Bank of America's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are market leaders, which are generating consistent profits, and which require careful evaluation. This preview offers a glimpse into the powerful insights available.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Bank of America's digital banking platform, including its mobile app and online services, is a strong Star in the BCG Matrix. With over 58 million verified digital users and 47 million active mobile users, it shows significant market penetration.

The platform's growth is further evidenced by a record 26 billion digital interactions in 2024, highlighting robust client engagement and high market demand. This sustained investment in digital innovation solidifies its leading position in a rapidly expanding sector.

Bank of America's AI-powered virtual assistant, Erica, is a prime example of a Star in the BCG Matrix. It has achieved over 2.5 billion interactions since its inception, with a remarkable 676 million of those occurring in 2024 alone. This demonstrates strong market growth and high customer engagement.

Erica's widespread adoption, now utilized by 20 million clients, underscores its success in providing personalized financial guidance and improving the overall customer experience. Its performance solidifies its position as a high-growth, high-market-share offering within the evolving landscape of AI-driven financial services.

Bank of America's Global Markets operations are a clear Star in its BCG Matrix. This segment is performing exceptionally well, with a significant increase in net income reported in the fourth quarter of 2024.

The robust growth, evidenced by an 18% year-on-year revenue increase, is largely fueled by a surge in sales and trading revenue and a strong performance in investment banking fees. This indicates Bank of America holds a substantial market share within a rapidly expanding and dynamic financial landscape.

Sustainable Finance Initiatives

Bank of America's sustainable finance initiatives are a clear Star within their BCG Matrix. The bank has committed to mobilizing an impressive $1.5 trillion by 2030, demonstrating a forward-looking strategy in a high-growth sector.

The tangible progress is already substantial, with over $741 billion deployed to date. This includes a significant $181 billion specifically mobilized in 2024, underscoring the momentum and scale of their efforts in this burgeoning market.

- Commitment: $1.5 trillion by 2030 in sustainable finance.

- Deployment to Date: Over $741 billion mobilized.

- 2024 Deployment: $181 billion deployed in the current year.

- Market Position: Leading position in the expanding clean-energy and sustainable economy.

Advanced Digital Payment Solutions (Zelle)

Zelle's rapid expansion in the digital payments arena firmly places it as a Star for Bank of America. Its user base and transaction volume are surging, indicating strong market momentum.

The platform's growth is undeniable, with Bank of America reporting significant year-over-year increases in Zelle usage.

- 23.7 million Bank of America clients used Zelle in 2024.

- 1.6 billion transactions were sent and received via Zelle, valued at $470 billion.

- This represents a 25% increase in client usage and a 26% increase in transaction value year-over-year.

- Zelle's adoption outpaces traditional payment methods like checks, underscoring its high growth and market share gains.

Bank of America's digital banking platform, including its mobile app and online services, is a strong Star in the BCG Matrix. With over 58 million verified digital users and 47 million active mobile users, it shows significant market penetration. The platform's growth is further evidenced by a record 26 billion digital interactions in 2024, highlighting robust client engagement and high market demand.

Erica, Bank of America's AI-powered virtual assistant, is another prime example of a Star. It has achieved over 2.5 billion interactions since its inception, with 676 million of those occurring in 2024 alone. Erica's widespread adoption, now utilized by 20 million clients, underscores its success in providing personalized financial guidance.

The bank's Global Markets operations are a clear Star, showing an 18% year-on-year revenue increase driven by strong sales, trading, and investment banking performance in Q4 2024. Sustainable finance initiatives are also Stars, with $181 billion mobilized in 2024 towards a $1.5 trillion goal by 2030, demonstrating significant progress in a growing sector.

Zelle's rapid expansion solidifies its Star status, with 23.7 million Bank of America clients using it in 2024 for 1.6 billion transactions totaling $470 billion, a 25% increase in client usage year-over-year.

| Business Unit | BCG Category | Key Metrics (2024 Data) | Growth Indicator | Market Share Indicator |

|---|---|---|---|---|

| Digital Banking Platform | Star | 58M verified digital users, 47M active mobile users, 26B digital interactions | High (26B interactions) | High (user base) |

| Erica (AI Assistant) | Star | 676M interactions in 2024, 20M clients using | High (2.5B total interactions) | High (client adoption) |

| Global Markets | Star | 18% YoY revenue increase, strong trading and investment banking fees | High (revenue growth) | High (segment performance) |

| Sustainable Finance | Star | $181B mobilized in 2024, $741B deployed to date, $1.5T goal by 2030 | High (deployment rate) | High (commitment scale) |

| Zelle | Star | 23.7M clients, 1.6B transactions ($470B value), 25% client usage increase | High (transaction volume & growth) | High (adoption rate) |

What is included in the product

This BCG Matrix overview for Bank of America details strategic positioning of its business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, visual roadmap of Bank of America's business units, alleviating the pain of strategic uncertainty.

Cash Cows

Bank of America's core consumer deposit accounts are true cash cows. With roughly 69 million consumer and small business clients, the bank boasts a vast and stable base of deposits. This translates to a significant market share within the mature banking industry.

These deposit accounts are key revenue generators, consistently providing net interest income that supports the bank's broader financial activities. The deep customer relationships fostered by these accounts ensure a reliable and steady stream of cash flow, a hallmark of a successful cash cow.

Bank of America's Global Wealth & Investment Management division is a classic Cash Cow. This segment consistently delivers strong financial results, with client balances increasing to $4.2 trillion and revenue growing by 8% year-over-year in Q1 2025.

It thrives in a stable, mature market where it holds a significant market share. This allows it to generate substantial asset management fees, providing a reliable source of cash flow.

The segment requires relatively lower investment compared to other areas of the bank, further solidifying its Cash Cow status.

Bank of America's traditional lending portfolios, including mortgages, auto loans, and credit cards, are firmly established as Cash Cows. These segments operate in mature markets with predictable demand, ensuring a consistent and reliable revenue stream from interest income. In 2024, Bank of America reported significant strength in its consumer lending divisions, with total loans and leases reaching substantial figures, underscoring the ongoing profitability of these core offerings.

Business and Commercial Banking Services

Bank of America's business and commercial banking services, encompassing cash management, working capital solutions, and investment banking, hold a significant market share. These offerings are critical for companies and institutions, generating consistent fee and interest income within a mature market. This segment acts as a dependable profit generator for the bank, demonstrating its strength in supporting corporate financial needs.

- Market Share: Bank of America consistently ranks among the top providers in commercial banking services in the United States.

- Revenue Contribution: In 2023, Bank of America's Global Banking segment, which includes these services, reported substantial net interest income and non-interest income, highlighting their importance.

- Stability: The demand for cash management and working capital solutions remains robust, providing a stable revenue stream even in fluctuating economic conditions.

- Strategic Importance: These services foster deep client relationships, often leading to opportunities in other areas of Bank of America's financial offerings.

Extensive ATM Network

Bank of America's extensive ATM network, comprising over 15,000 machines, continues to be a significant asset, serving approximately 69 million clients. This vast physical presence ensures widespread accessibility for essential banking needs.

While digital channels are experiencing higher growth rates, the ATM network maintains a high market share for cash access and basic transactions. This established infrastructure acts as a low-growth utility that generates steady revenue and supports overall customer convenience.

- High Market Share: Serves a substantial portion of Bank of America's 69 million clients.

- Low Growth Utility: Provides essential services with stable, albeit modest, revenue generation.

- Customer Convenience: Offers accessible cash and basic transaction points across its network.

- Established Infrastructure: Leverages a large physical footprint despite the rise of digital banking.

Bank of America's core consumer deposit accounts are true cash cows, leveraging a base of roughly 69 million clients. These stable, mature market offerings consistently generate net interest income, forming a reliable revenue stream. Their deep customer relationships ensure predictable cash flow, a defining trait of a successful cash cow.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024/2025 Data Points |

|---|---|---|---|

| Consumer Deposit Accounts | Cash Cow | Large, stable client base; mature market; consistent net interest income. | ~69 million consumer and small business clients. |

| Global Wealth & Investment Management | Cash Cow | Strong financial results; significant market share in a mature market; fee-based revenue. | Client balances at $4.2 trillion; 8% revenue growth (Q1 2025). |

| Traditional Lending Portfolios (Mortgages, Auto, Credit Cards) | Cash Cow | Mature markets; predictable demand; consistent interest income. | Significant loan and lease figures reported in 2024. |

| Business & Commercial Banking | Cash Cow | High market share; consistent fee and interest income; mature market. | Substantial net interest and non-interest income contribution (2023). |

| ATM Network | Cash Cow | Established infrastructure; high market share for basic transactions; low-growth utility. | Over 15,000 ATMs serving ~69 million clients. |

Delivered as Shown

Bank of America BCG Matrix

The Bank of America BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no unexpected changes – just the complete, ready-to-use strategic analysis.

Rest assured, the Bank of America BCG Matrix you see here is the exact final version that will be delivered to you after completing your purchase. It's a professionally crafted report, designed for immediate application in your strategic planning and decision-making processes.

Dogs

Bank of America's physical branch network is a prime example of a "Dog" in the BCG Matrix. In 2024, the bank continued its aggressive strategy of closing branches, with over 100 locations shuttered, a move mirroring industry-wide shifts. This segment experiences a shrinking market share in everyday customer transactions, driven by the undeniable ascendancy of digital and mobile banking platforms, which offer greater convenience and accessibility.

Traditional paper check processing at Bank of America is a classic example of a Dogs category in the BCG Matrix. This is primarily due to the dramatic shift towards digital payments. For instance, by the end of 2023, Zelle transactions were projected to exceed 2.2 billion, significantly outpacing the volume of checks written, which has seen a steady decline.

While checks remain a necessary service for certain customer segments, the manual nature of processing them consumes valuable resources. This segment offers minimal revenue growth potential and a shrinking market share. Bank of America is likely to focus on streamlining or reducing investment in this area to reallocate capital to more promising digital offerings.

Bank of America's investment in AI, like Erica, is shifting customer support. This means manual, in-person servicing for simple questions is a less attractive area for growth.

These routine, human-handled interactions are being automated, which naturally lowers their market share and growth prospects compared to digital solutions.

Outdated Legacy IT Systems

Outdated legacy IT systems within a financial institution like Bank of America, while not customer-facing products, can be categorized as Dogs in a BCG Matrix analysis due to their operational drag. These systems are often characterized by low efficiency and high maintenance expenditures, consuming significant resources without fostering innovation or competitive edge.

These systems can represent a substantial cost center. For instance, many financial institutions continue to grapple with the expense of maintaining systems built on older technologies. In 2024, the global IT spending on legacy system maintenance was projected to remain a significant portion of IT budgets, often exceeding 70% for some organizations, diverting funds that could be invested in modernizing infrastructure.

- Operational Inefficiency: Legacy systems frequently lack the speed and automation capabilities of modern platforms, leading to slower transaction processing and increased manual workarounds.

- High Maintenance Costs: Specialized skills are often required to maintain these older systems, driving up labor costs, and the risk of system failures increases with age.

- Limited Agility: The inability to quickly adapt or integrate new technologies hinders the bank's ability to respond to market changes or launch new digital services efficiently.

- Security Vulnerabilities: Older systems may not incorporate the latest security protocols, making them more susceptible to cyber threats.

Less Competitive Niche Investment Products

Certain niche or highly traditional investment products, particularly those that haven't embraced digital transformation or modern investor demands, can be categorized as question marks or even dogs in the Bank of America BCG Matrix. These offerings often face a low-growth environment and hold a small market share.

For instance, a specific type of legacy bond fund that relies solely on in-person sales and lacks online account management might struggle to attract younger, digitally-native investors. In 2024, the financial advisory sector saw a significant shift towards digital onboarding, with many firms reporting over 70% of new accounts opened online.

These less competitive niche products can become a drain on resources. They might require continued investment in outdated infrastructure or specialized sales teams with diminishing client bases, yielding minimal returns. Consider the scenario where a bank still heavily promotes physical check deposit services for investment accounts; this represents a resource allocation with very low client engagement in the current market.

- Low Growth Potential: Products failing to adapt to digital trends face stagnant or declining demand.

- Limited Market Share: Inability to compete with innovative, accessible alternatives shrinks client base.

- Resource Drain: Continued investment in outdated systems or sales channels yields poor returns.

- Example: Legacy mutual funds with no online presence or digital advisory services.

Bank of America's physical branch network exemplifies a "Dog" in the BCG Matrix, with over 100 branches closed in 2024 as digital banking gains dominance. This segment experiences a shrinking market share for everyday transactions due to the convenience of mobile platforms.

Traditional paper check processing at Bank of America also falls into the "Dog" category, given the significant shift to digital payments. By the end of 2023, Zelle transactions surpassed 2.2 billion, dwarfing check volumes.

While checks remain a necessity for some, their manual processing is resource-intensive with minimal growth potential and a declining market share. Bank of America is likely to reduce investment here, reallocating capital to more promising digital offerings.

Outdated legacy IT systems are also "Dogs" due to operational drag, characterized by low efficiency and high maintenance costs. In 2024, global IT spending on legacy system maintenance remained substantial, often exceeding 70% of IT budgets for some organizations.

| BCG Category | Bank of America Examples | Key Characteristics | Market Share Trend | Growth Trend |

| Dogs | Physical Branch Network | High Maintenance, Low Customer Traffic | Decreasing | Decreasing |

| Dogs | Paper Check Processing | Manual, Resource Intensive | Decreasing | Decreasing |

| Dogs | Legacy IT Systems | High Maintenance, Low Efficiency | N/A (Internal) | N/A (Internal) |

Question Marks

Bank of America's pilot of blockchain-backed deposit services for institutional clients positions it in a high-growth area for cross-border transactions. This initiative, while in its early stages, suggests a low current market share but substantial future potential.

The technology's ability to offer faster and more secure international payments could see these services evolve into a Star within the BCG matrix. In 2024, the global cross-border payments market was valued at over $37 trillion, highlighting the immense opportunity for disruption and growth.

Bank of America's involvement in niche carbon capture tax credit financing, exemplified by a $205 million deal in 2024, positions it in a high-potential, albeit nascent, sector. This specialized area falls into the question mark category of the BCG Matrix, indicating a high-growth market driven by increasing environmental regulations.

While this segment is experiencing rapid expansion, its current contribution to Bank of America's overall portfolio is relatively small. This necessitates ongoing strategic investment to capitalize on the market's growth trajectory and establish a stronger foothold.

Bank of America's Global Digital Disbursements service for commercial clients, launched in Canada, targets the burgeoning digital payments market. This service simplifies B2C and C2B transactions by leveraging email or mobile numbers, addressing a clear demand for more efficient business payment solutions.

The digital payments sector is experiencing robust growth, with global digital payment transaction revenues projected to reach $3.7 trillion by 2027, up from $1.9 trillion in 2023. While Bank of America's offering is well-positioned within this high-growth area, it's still in its early stages of market penetration and client adoption, suggesting it might be a 'question mark' in the BCG matrix, requiring further investment to solidify its position.

Generative AI-Based Coding Assistants for Developers

Bank of America is leveraging generative AI coding assistants, achieving an impressive 20% efficiency boost for its developers. This internal adoption positions the bank at the forefront of a rapidly expanding technological frontier.

- High Growth: The domain of AI-powered coding tools is experiencing significant expansion, with market projections indicating substantial growth through 2025 and beyond.

- Internal Focus, External Potential: While currently an internal asset, this technology possesses a high potential for wider industry adoption or future commercialization, signifying a low current external market share but high future impact.

- Transformative Impact: The 20% developer efficiency gain underscores the transformative power of these tools in accelerating software development cycles.

Augmented and Virtual Reality for Financial Services

Bank of America's strategic exploration into augmented and virtual reality for financial services is evident through its patent filings in Q1 2024. This suggests a proactive approach to leveraging these emerging technologies.

While AR/VR represents a high-growth sector with transformative potential for customer engagement and operational efficiency, its adoption within mainstream financial services remains in its early stages. Consequently, its current market share as a direct product or service offering is minimal, positioning it as a potential future growth area rather than a current dominant force.

- AR/VR Patent Filings: Bank of America filed patents in Q1 2024, signaling active R&D.

- High-Growth Potential: AR/VR is projected to significantly impact customer interactions and internal processes.

- Nascent Market Adoption: Mainstream financial services are still developing AR/VR applications, resulting in low current market share.

Bank of America's ventures into areas like carbon capture tax credit financing and its Global Digital Disbursements service represent investments in high-growth markets with uncertain future outcomes. These initiatives, while promising, currently hold a small market share, necessitating continued strategic capital allocation to determine their long-term viability and potential to become market leaders.

The bank's exploration of augmented and virtual reality in financial services also falls into this category. Despite significant growth potential and active patent filings in early 2024, widespread adoption in the financial sector is still in its infancy. This means these emerging technologies are question marks, requiring further development and market testing to ascertain their future success.

Similarly, the internal adoption of generative AI coding assistants, while yielding a 20% efficiency boost for developers in 2024, represents a nascent external market. The potential for broader application or commercialization exists, but its current market share as a standalone offering is negligible, classifying it as a question mark.

These question mark initiatives are crucial for Bank of America's future growth, as they target rapidly expanding sectors. However, their success is not guaranteed, and they require careful management and significant investment to navigate the inherent risks and capitalize on the potential rewards.

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, comprehensive market research reports, and publicly available company disclosures to provide a robust strategic overview.