Bank of America Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

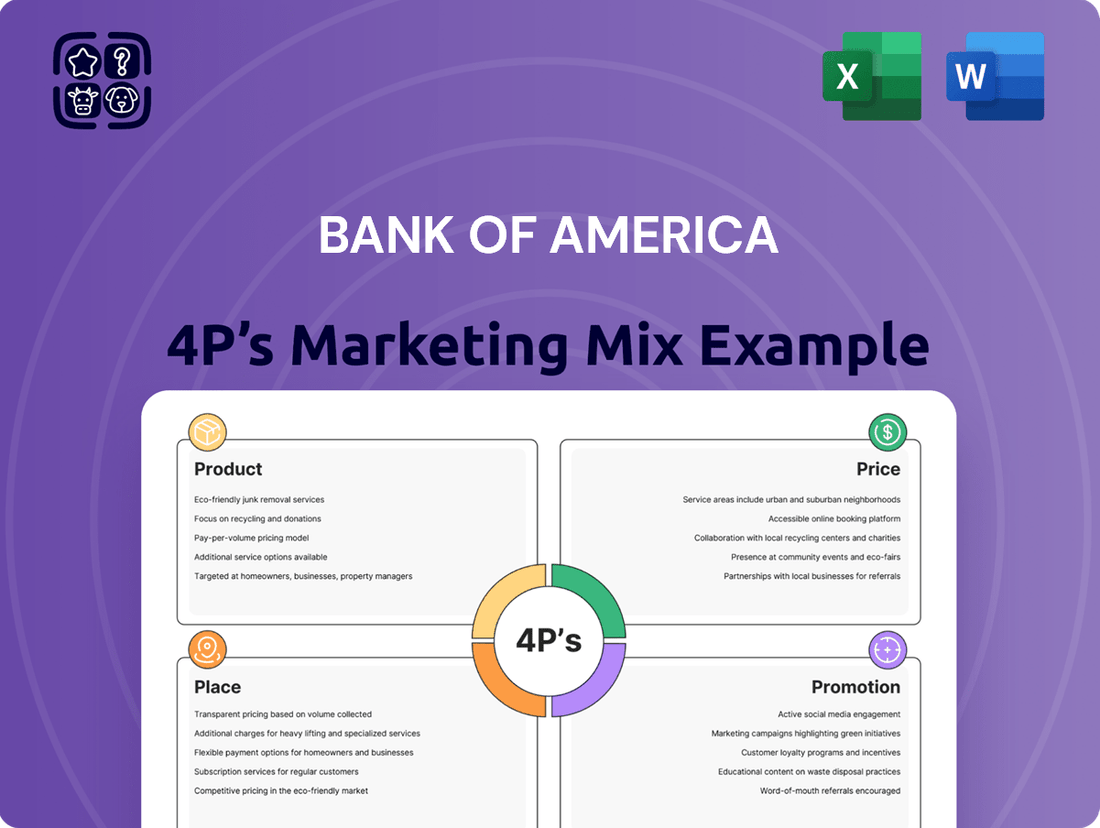

Bank of America's marketing success hinges on a strategic blend of its Product offerings, Price points, Place of service, and Promotion tactics. Understanding how these elements intertwine reveals a powerful approach to customer acquisition and retention in the competitive financial sector.

Dive deeper into the intricate strategies behind Bank of America's market dominance. Our comprehensive 4Ps Marketing Mix Analysis unpacks their product innovation, competitive pricing, accessible distribution channels, and impactful promotional campaigns.

Unlock actionable insights and a ready-to-use framework by exploring the full Bank of America 4Ps Marketing Mix Analysis. This detailed report is your key to understanding their strategic execution and applying proven marketing principles.

Product

Bank of America's business banking accounts, particularly its Business Advantage Banking suite, directly address the Product element of the marketing mix by offering a diverse portfolio of checking and savings solutions tailored for small and middle-market businesses. These accounts are designed to facilitate essential daily operations, from transaction processing to liquidity management.

In 2024, Bank of America continued to emphasize digital integration within these accounts, offering tools that streamline cash flow management and provide real-time financial insights. This focus on digital enablement is crucial for businesses seeking efficient operational control.

The tiered structure of Business Advantage Banking provides scalable solutions, ensuring that businesses of varying sizes can find an account that aligns with their specific financial needs and growth stages, a key aspect of product differentiation.

Bank of America's commercial lending and credit solutions offer a robust suite of products designed to fuel business expansion. These include commercial loans, flexible lines of credit, equipment leasing, and Small Business Administration (SBA) loans, all aimed at facilitating capital expenditures and growth initiatives. For instance, in 2024, Bank of America continued to be a leading SBA lender, with significant origination volume supporting small businesses nationwide.

These tailored solutions empower businesses to invest in critical areas such as new technology adoption, operational scaling, and crucial staffing requirements. The bank's approach ensures that loan terms, available amounts, and interest rates are precisely calibrated to the individual client's credit profile and unique business objectives, reflecting a personalized approach to financial partnership.

Global Wealth & Investment Management, through Merrill and Bank of America Private Bank, offers advanced wealth management and investment services. These cater to affluent individuals, business owners, and institutions, providing investment advisory, asset management, and private banking solutions to foster wealth growth and preservation.

The wealth management division experienced substantial growth in 2024. This expansion was fueled by the acquisition of new client relationships and a rise in asset management fees, highlighting the effectiveness of their sophisticated service offerings.

Cash Management and Treasury Solutions

Bank of America's Product strategy for cash management and treasury solutions focuses on providing sophisticated tools for large corporations and institutions. These offerings include advanced cash management, working capital optimization, and comprehensive merchant services designed to simplify both business-to-consumer payments and consumer-to-business collections.

The bank's commitment to enhancing financial efficiency and global liquidity management is evident in its continued investment in digital platforms. A prime example is CashPro, which directly addresses the complex operational and financial requirements of its institutional clientele. This digital infrastructure is crucial for facilitating seamless transactions and providing real-time visibility into financial operations.

- Streamlined Payments: Facilitates efficient B2C payment processing and C2B collections for large enterprises.

- Working Capital Optimization: Offers solutions to improve cash flow and manage working capital more effectively.

- Global Liquidity Management: Provides tools for businesses to manage their finances across multiple geographies and currencies.

- Digital Innovation: Continual investment in platforms like CashPro to enhance user experience and operational efficiency.

Investment Banking and Global Markets Operations

Bank of America's Investment Banking and Global Markets operations are a cornerstone of its product offering, providing a full spectrum of services to major corporations and governments. This includes crucial support in debt and equity underwriting, distribution, and advisory for mergers and acquisitions. For instance, in 2023, Bank of America Merrill Lynch advised on numerous significant M&A transactions, demonstrating its robust advisory capabilities.

The Global Markets segment acts as a vital engine, offering market-making, financing, and sophisticated risk management solutions across diverse asset classes like equities, fixed income, currencies, and commodities. This segment is crucial for clients seeking to navigate volatile market conditions and optimize their portfolios. In the first half of 2024, the firm reported strong trading revenues in its Global Markets division, reflecting active client engagement.

Key offerings within these segments include:

- Debt and Equity Underwriting: Facilitating capital raising for corporations and governments.

- Mergers & Acquisitions Advisory: Strategic guidance on corporate transactions.

- Market-Making: Providing liquidity across various financial markets.

- Financing and Risk Management: Offering tailored solutions to manage financial exposures.

These integrated services empower clients to effectively manage their financial strategies and capital structures, solidifying Bank of America's position as a leading financial institution in global markets.

Bank of America's product strategy is extensive, covering everything from basic business checking accounts to complex global markets services. For small to medium-sized businesses, the Business Advantage Banking suite offers tailored checking, savings, and lending solutions, with a continued emphasis on digital tools for cash flow management in 2024. Larger corporations benefit from sophisticated cash management and treasury solutions, including the CashPro platform, designed for global liquidity and efficient payment processing.

The bank also provides robust investment banking and global markets services, assisting major corporations and governments with debt and equity underwriting, M&A advisory, and market-making across various asset classes. In the first half of 2024, Bank of America saw strong trading revenues in its Global Markets division, indicating active client engagement and the effectiveness of its market-making and financing solutions.

| Product Category | Key Offerings | 2024/2025 Focus/Data |

|---|---|---|

| Business Banking | Checking, Savings, Loans, SBA Loans | Continued digital integration for cash flow management. Leading SBA lender in 2024. |

| Wealth Management | Investment Advisory, Asset Management, Private Banking | Substantial growth in 2024 driven by new client relationships and rising asset management fees. |

| Treasury & Cash Management | Cash Management, Working Capital Optimization, Merchant Services | Enhancements to CashPro platform for institutional clients; focus on global liquidity. |

| Investment Banking & Global Markets | M&A Advisory, Underwriting, Market-Making, Financing | Strong trading revenues in Global Markets in H1 2024; significant M&A advisory in 2023. |

What is included in the product

This analysis provides a comprehensive breakdown of Bank of America's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for competitive benchmarking and strategic planning.

Simplifies the complex Bank of America 4Ps analysis into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Bank of America's marketing strategy, easing the burden of understanding for cross-functional teams.

Place

Bank of America boasts an extensive physical branch network, offering customers convenient access to banking services and expert financial advice across the nation. This commitment to physical presence is underscored by plans to open more than 150 new financial centers by the end of 2027, building on a significant investment of over $5 billion in its network since 2016.

Bank of America's robust online and mobile banking platforms are central to its distribution strategy. A substantial majority of customer interactions now happen digitally, highlighting the importance of these channels. In the first quarter of 2024, the bank reported 46.7 million verified digital users, with 32.4 million active mobile users, demonstrating significant engagement.

Bank of America boasts a vast ATM network, a key element of its accessibility. As of early 2024, the bank operates over 16,000 ATMs across the United States, providing unparalleled convenience for cash withdrawals, deposits, and account management. This widespread availability ensures customers can access essential banking services readily, complementing their branch and digital banking experiences.

Dedicated Financial Specialists and Advisors

Bank of America leverages its dedicated financial specialists and advisors to deliver personalized service across its network. These experts are accessible both in physical financial centers and through digital platforms, assisting clients with a wide range of complex financial needs, including wealth management and business solutions. This approach aims to cultivate deeper client relationships by offering tailored advice, aligning with their commitment to meeting clients wherever and however they prefer to bank.

In 2024, Bank of America continued to invest in its human capital, with a significant portion of its workforce comprising financial professionals dedicated to client advisory roles. For instance, the company reported approximately 17,000 financial advisors across its Merrill and Bank of America Private Bank divisions as of early 2024, underscoring the scale of its personalized service offering. Clients can readily schedule appointments, both in-person and virtually, to receive guidance on their financial journeys.

- Personalized Guidance: Financial specialists offer tailored advice for wealth management, investments, and banking needs.

- Omnichannel Access: Clients can connect with advisors through financial centers, phone, or digital channels.

- Relationship Building: The focus is on fostering long-term client relationships through expert support.

- Client-Centric Approach: Bank of America emphasizes meeting clients' needs on their terms, enhancing convenience and trust.

Global Operational Presence

Bank of America's global operational presence extends across more than 35 countries and U.S. territories, a crucial element for its corporate and institutional clients. This broad reach allows the bank to effectively manage the complex, international financial requirements of large corporations and governmental bodies, streamlining cross-border transactions and global business operations.

This extensive international footprint is not just about servicing existing clients; it's a strategic avenue for significant growth. By bolstering its international capabilities, Bank of America positions itself to capture new opportunities in diverse markets, further solidifying its role as a global financial partner.

- Global Reach: Operates in over 35 countries and U.S. territories.

- Client Focus: Supports global financial needs of corporations and governments.

- Transaction Facilitation: Enables international transactions and cross-border business.

- Growth Strategy: International expansion is a key area for future development.

Bank of America's "Place" strategy is multi-faceted, encompassing a vast physical branch and ATM network, robust digital platforms, and a global operational footprint. This ensures accessibility and convenience for a diverse client base, from individual consumers to large corporations. The bank is actively investing in expanding its physical presence and enhancing its digital capabilities to meet evolving customer preferences.

| Channel | Key Metric (as of Q1 2024/Early 2024) | Significance |

|---|---|---|

| Physical Branches | Plans for >150 new centers by end of 2027; $5B+ invested since 2016 | Convenient access to services and advice |

| Digital Users | 46.7 million verified digital users; 32.4 million active mobile users | Dominant interaction channel |

| ATM Network | Over 16,000 ATMs nationwide | Unparalleled convenience for cash and account management |

| Financial Advisors | Approx. 17,000 advisors (Merrill & Private Bank) | Personalized, expert financial guidance |

| Global Operations | Presence in >35 countries/territories | Supports international corporate and institutional clients |

What You Preview Is What You Download

Bank of America 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Bank of America 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Bank of America is heavily focused on its digital offerings, making them a core part of its marketing mix. Their AI-powered virtual assistant, Erica, is a prime example, assisting millions of customers and managing billions of interactions, demonstrating a commitment to accessible digital support.

The bank further leverages AI across its platforms, such as CashPro Chat for business clients, aiming to boost operational efficiency and elevate client service. This integration of advanced technology underscores their strategy to deliver both convenience and tailored financial guidance.

Bank of America employs a comprehensive multi-channel advertising strategy, leveraging television, radio, print, and digital platforms to connect with a broad consumer base. These campaigns frequently spotlight key offerings like their mobile banking app or savings accounts, underscoring ease of use and financial health.

The bank's commitment to brand presence is evident in its significant advertising spend during high-profile events such as the Super Bowl, a prime example of its promotional efforts in 2024. Furthermore, sponsorships of events like the Chicago Marathon in 2024 and 2025 reinforce its visibility and community engagement.

Bank of America actively promotes financial literacy through its 'Better Money Habits' platform, a free online resource providing extensive educational content. This commitment extends to 'The Academy,' which focuses on professional development and financial skills, utilizing AI for enhanced employee training and client service.

Community Engagement and Corporate Social Responsibility (CSR)

Bank of America's commitment to community engagement and Corporate Social Responsibility (CSR) is a cornerstone of its marketing strategy, directly impacting its 'Promotion' element. The bank actively invests in critical areas such as financial inclusion, affordable housing, and small business development, demonstrating a tangible dedication to societal well-being. These initiatives are not merely philanthropic; they are integrated into the bank's core operations and brand identity.

In 2024, Bank of America continued its robust support for communities, with a significant focus on financial empowerment. For instance, the bank's "Better Money Habits" program aims to improve financial literacy across diverse demographics. Furthermore, their commitment to affordable housing saw substantial investment, contributing to the creation and preservation of homes for low-to-moderate-income individuals and families. This aligns with their broader goal of fostering economic mobility and stability.

Key aspects of their community engagement and CSR efforts include:

- Philanthropic Investments: Bank of America consistently dedicates substantial resources to non-profit organizations and community programs, aiming to create lasting social impact.

- Employee Volunteerism: Initiatives like the annual Global Volunteer Month mobilize thousands of employees to contribute their time and skills to local communities, reinforcing the bank's presence and positive influence.

- Financial Inclusion Initiatives: Programs are designed to increase access to banking services and financial education for underserved populations, promoting economic empowerment.

- Affordable Housing Support: The bank provides significant capital and expertise to develop and preserve affordable housing, addressing a critical societal need.

Strategic Partnerships and Sponsorships

Bank of America actively cultivates strategic partnerships and sponsorships, notably with major sports entities such as NASCAR, the U.S. Olympic Team, and Major League Baseball. These collaborations offer extensive brand visibility and associate Bank of America with respected and popular organizations. For instance, in 2023, NASCAR reported an average viewership of 3.1 million for its Cup Series races, showcasing the significant reach of such sponsorships.

These affiliations are integral to the bank's 'Bank of Opportunity' campaign, designed to forge more meaningful connections with consumers. By aligning with events and teams that resonate with a broad audience, Bank of America aims to reinforce its brand image as a supportive financial partner. This strategy is evident in their continued investment in sports marketing, which remains a key component of their promotional efforts.

The financial impact of these sponsorships is substantial, contributing to brand recall and customer acquisition. For example, Bank of America's sponsorship of the U.S. Olympic Team not only generates goodwill but also provides access to a diverse and engaged demographic. The bank's commitment to these partnerships underscores a long-term vision for brand building and market penetration.

Key aspects of Bank of America's strategic partnerships and sponsorships include:

- Broad Brand Exposure: Aligning with major sports leagues and events ensures significant visibility across diverse consumer segments.

- Brand Association: Partnering with trusted organizations like the U.S. Olympic Team enhances brand credibility and positive perception.

- Consumer Engagement: The 'Bank of Opportunity' campaign leverages these partnerships to connect with customers on a more personal and aspirational level.

- Marketing Investment: Significant financial commitment to these sponsorships reflects their importance in the bank's overall marketing mix and customer acquisition strategy.

Bank of America's promotional strategy is multifaceted, utilizing digital engagement, broad advertising, and community investment. Their AI assistant, Erica, handled over 1 billion client instructions in 2023, showcasing digital reach. The bank's 2024 Super Bowl ad, a significant promotional spend, highlighted their commitment to customer support and financial well-being.

Community engagement, such as the Better Money Habits platform, aims to boost financial literacy. In 2024, they continued substantial investments in affordable housing and small business development. Employee volunteerism, exemplified by Global Volunteer Month, further solidifies their community presence.

Strategic partnerships with entities like NASCAR and the U.S. Olympic Team provide extensive brand visibility. These sponsorships, part of the 'Bank of Opportunity' campaign, aim to build positive brand associations and connect with a wider audience, reinforcing their market position.

| Promotional Tactic | Key Initiative/Example | 2023/2024 Data Point |

|---|---|---|

| Digital Engagement | Erica AI Assistant | Over 1 billion client instructions handled (2023) |

| Advertising | Super Bowl 2024 Campaign | Significant spend, focused on customer support |

| Community Investment | Better Money Habits | Continued focus on financial literacy and affordable housing in 2024 |

| Sponsorships | NASCAR Partnership | High viewership, broad brand exposure |

Price

Bank of America utilizes tiered account fee structures for its business banking offerings, a key component of its pricing strategy. These structures often include monthly maintenance fees that can be waived by meeting specific criteria, such as maintaining a minimum combined average monthly balance across linked accounts. For example, the Business Advantage Relationship Banking account has a monthly fee that is typically avoidable through sufficient balance management.

Bank of America structures its transaction and service charges to align with its product offerings. For instance, specific services like outgoing wire transfers can incur fees, with domestic wires often costing around $30 and international wires approximately $50 as of early 2024. Certain card-related fees, such as those for expedited card replacement, also contribute to the overall cost structure.

While many core banking services are bundled, customers are encouraged to consult the Personal Schedule of Fees and Deposit Agreement and Disclosures for a complete picture of potential charges. This transparency helps manage expectations regarding fees for services like stop payments, which can range from $20 to $35.

The bank also implements policies designed to mitigate customer exposure to fees, notably overdraft fees. For example, Bank of America offers options like linking accounts to avoid overdrafts, with the aim of reducing the incidence of these charges for their customers.

Bank of America's pricing strategy for deposits centers on competitive interest rates for savings accounts and Certificates of Deposit (CDs), aiming to attract and retain customer funds. For lending products, including personal loans, mortgages, and business lines of credit, interest rates are dynamically set based on borrower creditworthiness, the specific loan product, and prevailing market conditions. For instance, as of early 2024, the Federal Reserve's benchmark rate influenced many of these lending rates, with prime rates hovering around 8.5% and consumer loan rates varying significantly based on risk profiles.

Net interest income, a crucial driver of Bank of America's profitability, is directly impacted by the spread between the interest earned on loans and the interest paid on deposits. In the first quarter of 2024, the bank reported substantial net interest income, reflecting the higher interest rate environment. Loan originations and terms are always subject to the bank's rigorous credit approval processes and, for small business loans, adherence to Small Business Administration (SBA) guidelines, ensuring risk management and regulatory compliance.

Fee-Based Revenue from Wealth Management and Investment Banking

Bank of America's fee-based revenue is a cornerstone of its financial performance, primarily driven by its robust wealth management and investment banking operations. These divisions generate substantial income through asset management fees and advisory services related to investment banking activities. The fee structure is generally tied to the assets clients entrust to the bank's management or the complexity of the transactions advised upon.

In 2024, Bank of America's wealth management segment saw notable growth in asset management fees. This increase reflects a growing client base and successful strategies in managing and growing assets. Such fee-based income provides a stable and predictable revenue stream, less susceptible to market volatility than net interest income.

- Wealth Management Fees: Asset management fees, a key component, grew significantly in 2024, indicating strong client acquisition and retention.

- Investment Banking Fees: Fees from advisory services, underwriting, and mergers and acquisitions contribute substantially to the bank's overall fee income.

- Revenue Stability: Fee-based revenue offers a more consistent income stream compared to interest-based earnings, enhancing financial predictability.

- Client Trust: Growth in asset management fees underscores the increasing trust clients place in Bank of America's expertise to manage their wealth.

Competitive Pricing and Value Proposition

Bank of America positions its pricing to be competitive, ensuring its extensive suite of financial products and services offers strong perceived value. This approach considers current market demand, competitor pricing structures, and prevailing economic conditions to set advantageous rates and fees.

While some fees may be adjusted, Bank of America actively provides avenues for customers to waive these charges, such as maintaining minimum balances or utilizing direct deposit. The bank's broad array of offerings, from digital banking tools to personalized financial advice, underpins its pricing strategy by demonstrating significant customer benefit.

- Competitive Interest Rates: For instance, as of late 2024, Bank of America's savings account APYs often compete within the top tier of major banks, aiming to attract deposits.

- Fee Waivers: Many checking accounts offer opportunities to waive monthly maintenance fees, typically through electronic deposits or maintaining a minimum daily balance, a common strategy across the industry.

- Value-Added Services: The pricing reflects access to advanced mobile banking features, extensive ATM networks, and financial advisory services, contributing to a comprehensive customer experience.

Bank of America's pricing strategy is multifaceted, balancing competitive rates with fee structures designed to incentivize customer engagement and loyalty. For instance, in early 2024, the bank's savings account Annual Percentage Yields (APYs) were often positioned competitively among major financial institutions, aiming to attract and retain customer deposits. Many checking accounts also feature opportunities to waive monthly maintenance fees, typically achievable through direct electronic deposits or by maintaining a minimum daily balance, a common practice in the banking sector.

The pricing also reflects the value of its extensive digital banking tools, a vast ATM network, and access to financial advisory services, all contributing to a comprehensive customer experience. For lending products, interest rates are dynamic, influenced by borrower creditworthiness, loan type, and market conditions, with prime rates in early 2024 around 8.5%, directly impacting loan costs.

| Product/Service | Pricing Component | Example/Data Point (Early 2024) | Fee Waiver/Mitigation |

|---|---|---|---|

| Checking Accounts | Monthly Maintenance Fee | Typically $0 - $25 | Waived with minimum balance or direct deposit |

| Savings Accounts | Interest Rate (APY) | Competitive rates, often 0.01% - 4.50%+ depending on balance and account type | N/A (interest is a benefit) |

| Wire Transfers | Service Fee | Domestic: ~$30; International: ~$50 | N/A |

| Overdraft Protection | Overdraft Fee | ~$35 per item | Link to savings/credit line, opt-out of overdraft on ATM/one-time debit |

| Loans (e.g., Personal, Mortgage) | Interest Rate | Varies based on credit score, market conditions (Prime Rate ~8.5%) | Creditworthiness, loan terms |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Bank of America is grounded in a comprehensive review of their official financial disclosures, including SEC filings and annual reports. We also leverage insights from investor presentations, press releases, and the bank's own digital platforms to understand their strategic actions and market positioning.