Bank of America Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

Bank of America navigates a complex financial landscape, facing intense rivalry from established players and the constant threat of new digital disruptors. Understanding the bargaining power of its customers and the availability of substitutes is crucial for its strategic positioning.

The complete report reveals the real forces shaping Bank of America’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers hold significant bargaining power over Bank of America, particularly those offering critical infrastructure like cloud services or specialized AI solutions. Bank of America's reliance on these technologies for everything from digital banking to robust cybersecurity means disruptions or price hikes from these suppliers can have a substantial impact. The cost and complexity of switching major technology vendors for an institution of Bank of America's size are exceptionally high, further strengthening the suppliers' position.

Suppliers such as payment networks like Visa and Mastercard, along with clearinghouses and exchanges, are critical for Bank of America's extensive global markets and payment processing. These entities are few in number, and the substantial costs and regulatory hurdles to establish new competing infrastructure significantly limit alternatives for banks like Bank of America, thereby granting these suppliers considerable leverage. For instance, Visa and Mastercard process trillions of dollars in transactions annually, making their networks indispensable for financial institutions.

The bargaining power of human capital is significant in the financial services industry, directly impacting Bank of America. Top talent in areas like investment banking and wealth management, especially those with expertise in emerging fields such as artificial intelligence or intricate financial products, can negotiate substantial compensation packages. For instance, in 2024, the demand for AI specialists in finance continued to drive up salaries, with some senior roles commanding base salaries well over $200,000, plus substantial bonuses.

Information and Data Services

The bargaining power of suppliers in the information and data services sector is significant for Bank of America. Companies providing financial data, market insights, and credit ratings are essential for informed decision-making, risk assessment, and shaping investment strategies. The unique and comprehensive nature of the data these suppliers offer can grant them substantial leverage.

For instance, Bloomberg, a major player in financial data, reported revenues of approximately $11 billion in 2023, highlighting the scale of investment in these services. The proprietary algorithms and extensive historical data sets maintained by these providers are not easily replicated, making switching costs high for Bank of America.

- High Switching Costs: Migrating data and integrating new systems from different information providers can be complex and expensive, limiting Bank of America's ability to easily change suppliers.

- Data Uniqueness and Depth: Specialized financial data and analytical tools offered by key suppliers are often difficult to find elsewhere, giving these suppliers pricing power.

- Concentration of Suppliers: A few dominant firms often control significant portions of the financial data market, reducing competition and increasing supplier leverage.

- Criticality of Services: The essential nature of real-time data and market intelligence for trading, risk management, and strategic planning means Bank of America is reliant on these suppliers.

Real Estate and Infrastructure

Bank of America's reliance on real estate for its vast branch network and corporate offices means suppliers in this sector hold considerable sway. The availability of prime locations, especially in high-demand urban centers, directly impacts leasing costs and terms. In 2024, commercial real estate markets continued to see fluctuations, with some areas experiencing tight supply, thus amplifying landlord bargaining power.

This bargaining power is further amplified by the specialized nature of some real estate needs, such as large-scale corporate campuses or secure data center facilities. Suppliers who can meet these specific requirements often face less competition. For instance, a 2024 report indicated that vacancy rates for Class A office space in major financial hubs remained low, giving landlords a stronger negotiating position with large corporate tenants like Bank of America.

- Limited Availability: Prime real estate locations often have constrained supply, increasing supplier leverage.

- High Demand: Strong demand for commercial properties in key financial districts empowers landlords.

- Specialized Needs: Unique real estate requirements can reduce the pool of suitable suppliers, boosting their bargaining power.

Suppliers of critical infrastructure and specialized technology, including cloud service providers and AI solution developers, wield significant bargaining power over Bank of America. The immense cost and complexity involved in switching these essential systems, coupled with the bank's deep integration of these technologies, solidify the suppliers' leverage. For example, in 2024, the demand for advanced cloud computing capabilities continued to outpace supply in certain sectors, allowing providers to command premium pricing.

| Supplier Category | Key Services | Impact on Bank of America | Supplier Bargaining Power Factors | 2024 Market Trend Example |

|---|---|---|---|---|

| Technology Providers | Cloud Computing, AI Solutions, Cybersecurity | High reliance, high switching costs | Proprietary technology, economies of scale | Increased demand for specialized AI talent driving up service costs |

| Payment Networks | Transaction Processing, Clearing Services | Indispensable for operations, high barriers to entry for alternatives | Network effects, regulatory hurdles | Continued dominance of Visa and Mastercard in global payment flows |

| Information & Data Services | Market Data, Financial Analytics, Credit Ratings | Crucial for decision-making and risk management | Data uniqueness, high integration costs | Bloomberg's substantial revenue ($11 billion in 2023) indicates high value placed on data services |

What is included in the product

This analysis uncovers the competitive landscape for Bank of America, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Bank of America's vast customer base, numbering in the tens of millions of individual consumers, presents a unique dynamic in customer bargaining power. While any single customer's leverage is minimal, the collective voice of these individuals can significantly impact the bank's strategic decisions.

Dissatisfaction with factors like account fees, interest rates on savings and loans, or the quality of digital banking services can drive customers to seek alternatives. In 2023, the U.S. banking industry saw continued competition in deposit rates, with many institutions offering higher yields to attract and retain customers, a trend that directly impacts how banks like Bank of America must respond to maintain their individual customer base.

Small and middle-market businesses often require a broad range of banking services, from securing loans and managing payments to sophisticated treasury operations. This diversity means they have significant leverage when negotiating terms.

Their bargaining power is typically moderate, as they can shop around, comparing the rates and services offered by multiple traditional banks and increasingly by fintech or non-traditional lenders. For instance, in 2024, the Small Business Administration (SBA) reported that loan approval rates at community banks, often serving this segment, varied, encouraging businesses to explore all avenues for better financing.

Large corporations and government bodies, by their very nature, demand sophisticated financial solutions like investment banking, large syndicated loans, and intricate global cash management services. Their sheer scale of operations and the unique, specialized requirements they present grant them considerable leverage in negotiations, enabling them to secure more advantageous pricing and terms from financial institutions.

Wealth and Investment Management Clients

Clients in wealth and investment management, particularly high-net-worth and ultra-high-net-worth individuals, along with institutional investors, wield considerable bargaining power. These clients manage substantial assets, often in the millions or billions of dollars, and possess sophisticated financial needs. Their capacity to shift large volumes of capital and their demand for highly tailored services directly influence the terms and pricing offered by Bank of America's wealth management divisions.

The bargaining power of these clients is amplified by their ability to seek out and compare offerings from numerous financial institutions. For instance, Bank of America's Global Wealth & Investment Management division reported total client balances of $3.7 trillion as of the first quarter of 2024. This sheer volume of assets means that losing even a small percentage of these clients can have a significant impact on revenue and profitability. Consequently, Bank of America must focus on delivering competitive returns, superior service, and personalized advice to retain these valuable relationships.

- Significant Asset Base: Clients manage vast sums, giving them leverage.

- Sophisticated Needs: Demand for specialized services requires tailored offerings.

- Mobility of Capital: The ease with which clients can move large amounts of money increases their power.

- Competitive Landscape: Clients can easily switch to competitors offering better terms or services.

Digital-Savvy Clients

Digital-savvy clients wield significant bargaining power due to their heightened expectations for seamless, personalized, and convenient banking experiences. In 2024, the widespread adoption of digital channels means customers can readily compare offerings and switch providers. This ease of transition empowers them to demand better services and lower fees, as evidenced by the increasing competition from agile fintech firms and neobanks.

- Digital Adoption: In 2024, over 70% of banking transactions for major US banks were conducted digitally, highlighting customer preference and reliance on these platforms.

- Customer Expectations: Clients now anticipate intuitive interfaces, instant support, and tailored financial advice delivered through digital channels.

- Competitive Landscape: The rise of fintechs offering specialized digital solutions means traditional banks must continuously innovate to retain customers.

- Switching Costs: While historically high, digital tools have lowered the perceived switching costs for customers, increasing their leverage.

The bargaining power of Bank of America's customers is multifaceted, influenced by customer segment, the nature of services required, and the overall competitive environment. While individual retail customers have limited power, their collective action and the ease with which they can switch providers, especially in the digital realm, exert pressure on fees and service quality. Large corporate clients and high-net-worth individuals, managing substantial assets and demanding complex services, possess significant leverage to negotiate favorable terms.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | 2024 Data/Trends |

|---|---|---|---|

| Retail Consumers | Low to Moderate | Account fees, interest rates, digital service quality, ease of switching | Continued competition in deposit rates; over 70% of major bank transactions were digital in 2024. |

| Small/Medium Businesses | Moderate | Loan rates, treasury services, comparison shopping across banks and fintechs | SBA loan approval rates varied in 2024, encouraging businesses to explore multiple financing options. |

| Large Corporations/Governments | High | Scale of operations, demand for specialized services (investment banking, syndicated loans) | Negotiate advantageous pricing and terms due to significant transaction volumes. |

| Wealth/Investment Management Clients | High | Assets under management, need for tailored services, mobility of capital | Bank of America managed $3.7 trillion in client balances in Q1 2024, highlighting the impact of retaining these clients. |

Same Document Delivered

Bank of America Porter's Five Forces Analysis

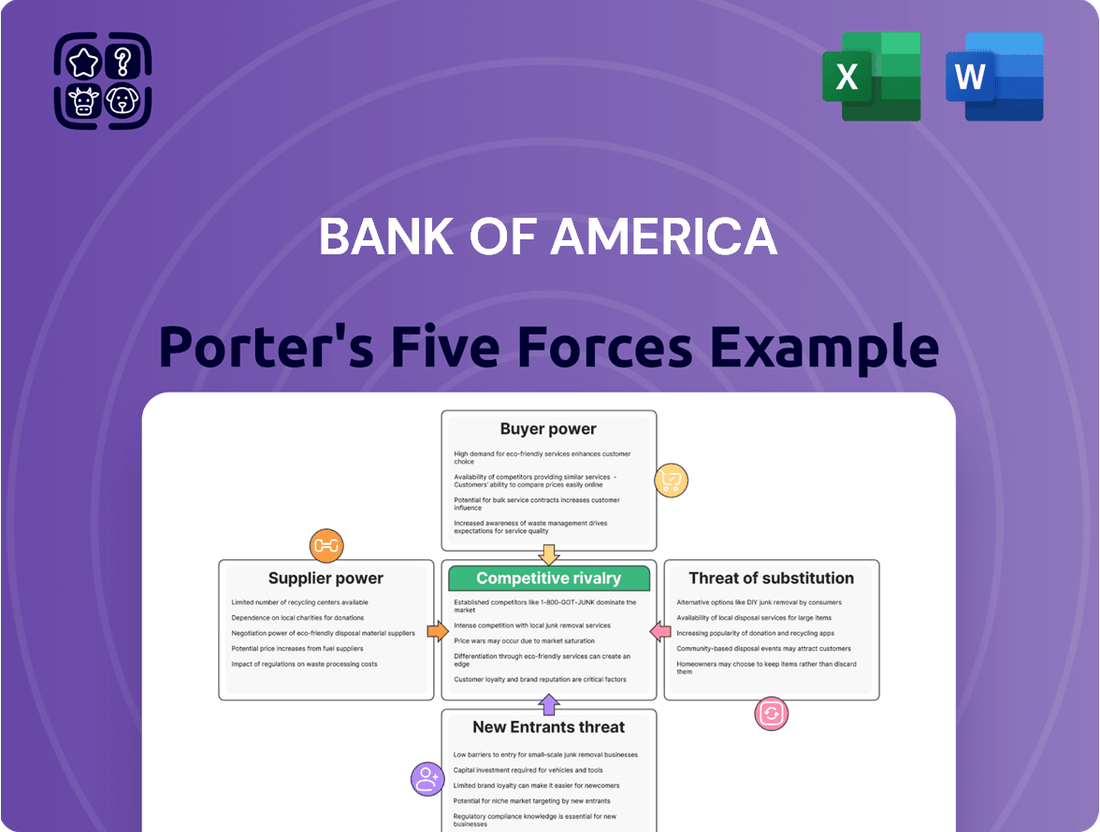

This preview showcases the comprehensive Bank of America Porter's Five Forces Analysis, detailing the competitive landscape of the banking industry. The document displayed here is the exact, fully formatted analysis you’ll receive, providing in-depth insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

Bank of America navigates a highly competitive landscape, facing formidable rivals such as JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Citigroup. These universal banks offer a broad spectrum of financial services, from consumer banking to complex investment strategies, directly challenging Bank of America for customers and market dominance.

This intense rivalry is underscored by the sheer scale and diversification of these institutions. For instance, as of the first quarter of 2024, JPMorgan Chase reported total assets exceeding $3.9 trillion, a figure comparable to Bank of America's own substantial asset base, illustrating the magnitude of the competitive forces at play.

Regional and community banks, though smaller, present a persistent competitive force for Bank of America. They actively vie for local consumer deposits and small business lending opportunities, often outmaneuvering larger institutions through deep community roots and tailored customer service. For instance, in 2023, community banks held approximately $2.4 trillion in assets, demonstrating their significant presence in local markets.

Bank of America faces stiff competition from specialized investment banking boutiques. These firms, often nimble and focused on niche advisory services such as mergers and acquisitions or restructuring, can offer deep expertise for complex transactions.

These boutiques, while smaller in scale, can leverage their focused talent and client relationships to win mandates, especially in specialized areas where clients seek tailored solutions. For instance, in 2023, boutique firms played a significant role in a substantial number of M&A deals, demonstrating their continued relevance and competitive edge in specific market segments.

Digital-First Banks and Fintech Companies

The competitive rivalry from digital-first banks and fintech companies is a significant force for Bank of America. These agile players, unburdened by legacy infrastructure, are rapidly innovating and often offer more attractive pricing or user experiences. For instance, by mid-2024, neobanks and fintechs continued to chip away at traditional banking market share, particularly in areas like digital payments and small business lending.

- Digital innovation: Fintechs are leveraging advanced technology to create seamless, user-friendly interfaces for banking services.

- Cost efficiency: Many digital-first banks operate with lower overheads, allowing them to offer competitive interest rates and lower fees.

- Market capture: By mid-2024, fintech adoption rates remained high, with a notable percentage of consumers, especially younger demographics, preferring digital channels for most financial transactions.

Consolidation and M&A Activity

The financial services sector, including asset management and traditional banking, is actively undergoing consolidation. This trend is driven by a desire for greater scale and efficiency in a competitive landscape.

This wave of mergers and acquisitions (M&A) is creating larger, more diversified financial institutions. For Bank of America, this means facing rivals that are not only growing in size but also broadening their service portfolios, thereby intensifying competitive pressures.

For example, in 2024, the financial industry continued to see significant M&A deals. These transactions often aim to achieve cost synergies and expand market reach, directly impacting the competitive dynamics for established players like Bank of America.

- Increased Scale: Acquiring entities gain greater market share and operational leverage.

- Diversified Offerings: Merged firms can provide a wider array of products and services, challenging competitors.

- Enhanced Efficiency: Consolidation often leads to cost savings through economies of scale and technology integration.

- Heightened Rivalry: Stronger, more integrated competitors can exert greater pricing power and innovation demands.

Bank of America faces intense competition from major universal banks like JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Citigroup, all of whom offer a similar breadth of services. The sheer scale of these rivals, with JPMorgan Chase holding over $3.9 trillion in assets as of Q1 2024, highlights the magnitude of this rivalry. Beyond these giants, regional banks and specialized fintech firms also exert significant competitive pressure, often by focusing on specific customer segments or leveraging digital innovation for cost efficiency and user experience.

| Competitor Type | Key Characteristics | Example Data/Trend (as of Q1 2024 or 2023/2024) |

|---|---|---|

| Universal Banks | Broad service offerings, large scale, diversification | JPMorgan Chase assets: ~$3.9 trillion (Q1 2024) |

| Regional/Community Banks | Local focus, tailored service, community roots | Community banks' total assets: ~$2.4 trillion (2023) |

| Investment Boutiques | Niche expertise, agility, client relationships | Significant role in M&A deals (2023) |

| Fintech/Digital Banks | Digital innovation, cost efficiency, user experience | Continued market share gains in payments and lending (mid-2024) |

SSubstitutes Threaten

Fintech companies are increasingly offering compelling alternatives to traditional banking services, particularly in payments and lending. For instance, mobile payment solutions and peer-to-peer lending platforms are gaining traction, providing consumers and small businesses with convenient, faster, and often cheaper options. This directly challenges Bank of America’s established customer base in these crucial areas.

The threat is amplified by the rapid adoption of these technologies. By the end of 2023, the global digital payments market was valued at over $2.5 trillion, with significant growth projected. Similarly, alternative lending platforms saw substantial increases in loan origination volumes, indicating a clear shift in customer preference away from traditional channels for certain financial needs.

The threat of substitutes for Bank of America's wealth management services is significant, primarily from direct investment platforms and robo-advisors. These digital alternatives allow individual investors, and even some smaller institutional clients, to bypass traditional advisory relationships. For instance, platforms like Vanguard Digital Advisor and Schwab Intelligent Portfolios offer automated, low-cost investment management, directly competing with Bank of America's human-advised services by providing accessible, automated solutions.

Cryptocurrencies and blockchain technology present a growing threat of substitution for traditional banking services. These digital assets and decentralized systems can facilitate cross-border payments and remittances, bypassing established banking channels. For instance, in 2024, global remittance flows were projected to reach $833 billion, a significant market where crypto alternatives could gain traction by offering lower fees and faster transaction times.

The potential for decentralized finance (DeFi) platforms to offer lending and borrowing services without traditional intermediaries also poses a substitution risk. As of early 2024, the total value locked in DeFi protocols surpassed $100 billion, indicating increasing user adoption and a viable alternative to traditional credit markets.

Peer-to-Peer (P2P) Lending and Crowdfunding

Peer-to-peer (P2P) lending and crowdfunding platforms present a growing threat of substitutes for traditional banking services, particularly for businesses and individuals seeking capital. These digital platforms disintermediate the lending process, directly connecting borrowers with a pool of investors. This bypasses traditional financial institutions, offering alternative avenues for funding that can be quicker and more accessible for certain segments of the market.

These platforms can offer more competitive interest rates or more flexible repayment structures compared to conventional bank loans, especially for startups or those with less established credit histories. For instance, by mid-2024, the global P2P lending market was projected to reach hundreds of billions of dollars, indicating significant adoption and a substantial alternative to bank financing. Crowdfunding, too, has seen explosive growth, with platforms enabling businesses to raise millions for new ventures.

- Increased Accessibility: P2P and crowdfunding platforms often cater to borrowers who may not meet the stringent criteria of traditional banks, broadening access to capital.

- Competitive Rates: By reducing overhead and directly connecting investors, these platforms can sometimes offer more attractive interest rates for borrowers.

- Market Growth: The P2P lending market alone was estimated to grow at a compound annual growth rate of over 20% leading up to 2024, demonstrating its increasing relevance as a substitute.

In-House Corporate Finance and Treasury Functions

Large corporations increasingly possess the resources and expertise to bring financial functions in-house, potentially reducing their need for external banking services. This trend impacts Bank of America by potentially decreasing demand for its treasury management, foreign exchange, and investment banking services.

For instance, in 2024, many multinational corporations are investing heavily in sophisticated treasury management systems and hiring specialized finance professionals. This allows them to execute complex transactions, manage liquidity, and hedge currency exposures more efficiently internally, bypassing traditional banking channels for certain activities.

Key in-house functions that substitute for bank services include:

- Treasury Management: Direct management of cash, working capital, and debt.

- Foreign Exchange Hedging: Internal execution of currency forwards and options.

- Investment Management: Direct management of corporate investment portfolios.

- Trade Finance: In-house credit facilities or alternative financing arrangements.

The threat of substitutes for Bank of America is substantial, driven by innovative fintech solutions and evolving consumer preferences. Digital payment platforms and alternative lending services offer convenience and cost savings, directly challenging traditional banking models. By 2024, the digital payments market continued its rapid expansion, surpassing trillions of dollars globally, highlighting a significant shift in how consumers and businesses manage their finances.

Robo-advisors and direct investment platforms also present a strong substitute threat to Bank of America's wealth management division. These platforms provide automated, low-cost investment solutions, attracting investors seeking accessible and efficient portfolio management. The total assets under management for robo-advisors alone were projected to reach hundreds of billions by 2024, indicating a growing preference for digital-first investment strategies.

Furthermore, cryptocurrencies and decentralized finance (DeFi) are emerging as potent substitutes, particularly for cross-border transactions and lending. DeFi platforms, with over $100 billion in total value locked as of early 2024, offer alternatives to traditional banking intermediaries, promising lower fees and faster settlement times.

| Substitute Category | Key Characteristics | Impact on Bank of America | Market Trend (as of 2024) |

|---|---|---|---|

| Fintech Payment Solutions | Convenience, Speed, Lower Fees | Reduced transaction volumes, customer attrition | Global digital payments market exceeding $2.5 trillion |

| Robo-Advisors/Direct Investment | Low Cost, Accessibility, Automation | Loss of wealth management clients, fee compression | Robo-advisor AUM projected in hundreds of billions |

| Cryptocurrencies/DeFi | Decentralization, Cross-border Efficiency, Novelty | Disintermediation of payments and lending, potential for new financial ecosystems | DeFi Total Value Locked exceeding $100 billion |

Entrants Threaten

Entering the banking sector, especially at the scale of a major player like Bank of America, demands immense upfront capital. For instance, in 2024, regulatory capital requirements, such as Basel III, necessitate significant liquidity and solvency buffers, making it prohibitively expensive for new firms to compete.

These high capital requirements serve as a formidable barrier to entry. New entrants would need to secure billions in funding just to meet initial regulatory compliance and build the necessary infrastructure, a hurdle that deters many potential competitors from even attempting to enter the market.

The financial services sector, including banking, is notoriously complex due to a stringent regulatory landscape. Compliance with rules like the Bank Secrecy Act for anti-money laundering, consumer protection laws, and measures ensuring financial stability requires significant investment and ongoing effort. For instance, in 2024, the cost of regulatory compliance for large banks continued to be a substantial operational expense, often running into billions of dollars annually, effectively acting as a high barrier to entry for potential new competitors.

Established banks like Bank of America have cultivated decades of brand recognition and customer trust, creating a significant barrier for new entrants. This deep-seated trust is a crucial asset in financial services, as consumers entrust their money and financial futures to institutions they believe are stable and reliable. New players must invest substantial resources and time to replicate this level of confidence, a challenge compounded by the sheer scale of Bank of America's existing customer base.

Economies of Scale and Scope

Bank of America's vast operational scale allows it to benefit significantly from economies of scale and scope. This means that as its operations grow, its average cost per unit of service decreases, and it can offer a wider range of products more efficiently. For instance, in 2024, the bank's substantial asset base, exceeding $3 trillion, enables it to spread fixed costs like technology infrastructure and regulatory compliance over a much larger volume of transactions and customer relationships.

New competitors entering the banking sector would face immense difficulty in replicating Bank of America's cost efficiencies and the breadth of its service offerings. To even approach Bank of America's level of operational leverage, new entrants would require massive upfront capital investment and considerable time to build a comparable customer base and service network. This creates a substantial barrier to entry, as matching the existing infrastructure and market penetration is a daunting task.

- Economies of Scale: Bank of America's extensive branch network and digital platforms, serving millions of customers, allow for significant cost reductions per transaction.

- Economies of Scope: Offering a wide array of financial products, from retail banking to investment management, enables cross-selling and shared operational costs.

- Capital Requirements: Establishing a banking operation of comparable size and scope would necessitate billions of dollars in capital, far exceeding what most new entrants can readily secure.

- Technological Investment: Keeping pace with Bank of America's advanced digital banking and cybersecurity infrastructure requires continuous, substantial technological investment.

Technological Investment and Infrastructure

The significant capital required for developing and maintaining advanced technological infrastructure, including robust cybersecurity and AI capabilities, presents a substantial barrier to entry. New entrants must make massive, ongoing investments to even approach the digital sophistication of established players like Bank of America.

For instance, in 2024, major banks continue to pour billions into digital transformation initiatives. Bank of America, for example, has consistently invested heavily in technology, with reported technology and operations expenses often in the tens of billions of dollars annually. This sustained commitment means new competitors face an immediate and steep uphill battle to match the existing technological prowess.

- Massive Capital Outlay: New entrants need substantial funding to build competitive digital platforms and security systems.

- Ongoing Investment Needs: Technology evolves rapidly, requiring continuous investment in upgrades and innovation.

- AI and Cybersecurity Demands: Advanced capabilities in these areas are non-negotiable for modern banking, adding to the cost.

The threat of new entrants for Bank of America remains relatively low due to the immense capital requirements and stringent regulatory environment. In 2024, meeting capital adequacy ratios and compliance standards necessitates billions in investment, a substantial hurdle for newcomers.

Established brand loyalty and trust also act as significant deterrents, as customers are hesitant to switch from trusted institutions. Furthermore, the need for massive, ongoing investment in advanced technology, including AI and cybersecurity, creates a steep uphill battle for any potential competitor aiming to match Bank of America's capabilities.

| Barrier to Entry | Description | 2024 Impact for New Entrants |

|---|---|---|

| Capital Requirements | Meeting regulatory capital and liquidity needs. | Billions required for initial setup and ongoing compliance. |

| Regulatory Landscape | Adhering to complex financial laws and consumer protection. | High compliance costs and operational complexity. |

| Brand Loyalty & Trust | Established customer relationships and reputation. | Requires significant time and resources to build comparable confidence. |

| Economies of Scale/Scope | Cost advantages from large operations and diverse offerings. | New entrants struggle to match efficiency and product breadth. |

| Technological Investment | Maintaining advanced digital platforms and cybersecurity. | Requires continuous, multi-billion dollar investments to compete. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of America is built upon a foundation of publicly available financial statements, annual reports, and investor relations materials. We also incorporate insights from reputable financial news outlets, industry-specific research reports, and regulatory filings to provide a comprehensive view of the competitive landscape.