Bank Albilad PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Albilad Bundle

Uncover the critical political, economic, and technological forces shaping Bank Albilad's trajectory. Our expert-crafted PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now and gain a significant competitive advantage.

Political factors

Bank Albilad's strategy is deeply intertwined with Saudi Vision 2030, a transformative national plan focused on economic diversification and modernization. This vision guides the bank's efforts to support key sectors and initiatives, reflecting a commitment to the Kingdom's long-term development goals.

The bank actively aligns its operations and investments with Vision 2030's objectives, which include fostering financial inclusion and supporting large-scale infrastructure and development projects. For instance, Vision 2030 targets a 70% non-oil revenue contribution to GDP by 2030, a goal that financial institutions like Bank Albilad are instrumental in achieving through increased lending and investment in new industries.

The Financial Sector Development Program (FSDP), a cornerstone of Saudi Arabia's Vision 2030, directly fuels the growth and modernization of the financial industry. This program is designed to cultivate a more robust and innovative financial ecosystem, which is a significant positive for institutions like Bank Albilad.

Bank Albilad is poised to capitalize on the FSDP's strategic objectives, particularly those focused on accelerating digital transformation and broadening access to financing. These initiatives are creating a more competitive and dynamic market, presenting opportunities for enhanced customer service and product development.

For instance, the FSDP aims to increase the financial sector's contribution to the non-oil GDP, with a target of 15% by 2030. Bank Albilad's investments in digital platforms and new financing solutions align perfectly with this national ambition, positioning it to benefit from increased market share and customer engagement.

The Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) are pivotal in dictating the operational environment for Bank Albilad. These bodies issue regulations and guidelines that directly influence the bank's strategic planning and compliance efforts.

Initiatives like the Open Banking Framework, which SAMA has been actively promoting, are designed to foster innovation and competition within the Saudi financial sector. Similarly, the CMA's oversight of capital markets impacts how banks like Albilad engage with investment activities and corporate governance.

Bank Albilad’s adherence to Sharia governance enhancements, a key focus for SAMA, is critical for maintaining its Islamic banking license and customer trust. These regulatory frameworks necessitate continuous adaptation in Bank Albilad's business models and risk management practices, with SAMA reporting a 15% increase in digital transaction volumes in Q1 2024, partly driven by open banking initiatives.

Geopolitical Stability and Regional Role

Saudi Arabia's robust political stability and its increasing role in regional affairs provide a solid foundation for financial institutions such as Bank Albilad. This stability is a key factor attracting both domestic and international capital.

While global geopolitical shifts can introduce volatility, Saudi Arabia's economic resilience, bolstered by its Vision 2030 agenda, acts as a significant buffer. This strategic vision aims to diversify the economy, reducing reliance on oil and fostering a more stable investment climate.

The Kingdom's proactive foreign policy and its commitment to regional development further enhance its attractiveness as an investment hub. This positions Bank Albilad to capitalize on expanding economic opportunities.

- Saudi Arabia's GDP growth forecast for 2024 is projected at 3.5%, indicating a strong economic outlook.

- Foreign Direct Investment (FDI) into Saudi Arabia saw a significant increase, reaching SAR 32.1 billion in 2023, up 13% year-on-year.

- Vision 2030 aims to attract $100 billion in FDI annually by 2030.

- The World Bank ranks Saudi Arabia 62nd out of 190 economies in its Ease of Doing Business report (2020 data, though recent trends indicate continued improvement).

Government Support for Key Sectors

The Saudi government's commitment to diversifying the economy away from oil, as outlined in Vision 2030, is a powerful driver for Bank Albilad. This strategic push includes substantial investment in sectors like infrastructure, real estate, and small and medium-sized enterprises (SMEs).

Bank Albilad is well-positioned to benefit from these government initiatives. The bank actively aligns its lending strategies and investment focus to support these key growth areas, which directly translates into an expansion of its loan portfolios and an increase in fee-based revenue streams.

- Vision 2030 aims to significantly increase the contribution of non-oil sectors to GDP.

- Bank Albilad's lending to the real estate sector saw robust growth in 2024, driven by government housing initiatives.

- Support for SMEs is a cornerstone of economic diversification, creating new avenues for business lending.

- Fee-based income for Saudi banks, including Bank Albilad, has been growing as they offer more specialized financial services tied to development projects.

Saudi Arabia's political landscape, characterized by stability and a clear developmental roadmap through Vision 2030, provides a conducive environment for financial institutions like Bank Albilad. The government's proactive stance in economic diversification and its increasing regional influence attract both domestic and international capital, creating a secure base for banking operations.

Regulatory bodies such as the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) are actively shaping the financial sector's future through initiatives like the Open Banking Framework. These frameworks encourage innovation and competition, directly benefiting banks that adapt, with SAMA reporting a 15% rise in digital transaction volumes in Q1 2024, partly due to these advancements.

Bank Albilad's strategy is closely aligned with national objectives, particularly supporting the economic diversification targets set by Vision 2030, which aims for a 70% non-oil revenue contribution to GDP by 2030. The bank's investments in digital transformation and its support for key sectors are crucial for achieving these national economic goals.

| Political Factor | Impact on Bank Albilad | Supporting Data/Initiative |

|---|---|---|

| Vision 2030 & Economic Diversification | Drives strategic alignment, increased lending opportunities in non-oil sectors. | Saudi Arabia's GDP growth forecast for 2024 is 3.5%; Vision 2030 aims to attract $100 billion in FDI annually by 2030. |

| Regulatory Environment (SAMA, CMA) | Mandates compliance, fosters innovation through frameworks like Open Banking. | SAMA reported a 15% increase in digital transaction volumes in Q1 2024, partly driven by open banking. |

| Political Stability & Regional Role | Enhances investor confidence, attracts capital, and creates a stable operating environment. | Foreign Direct Investment (FDI) into Saudi Arabia reached SAR 32.1 billion in 2023, up 13% year-on-year. |

What is included in the product

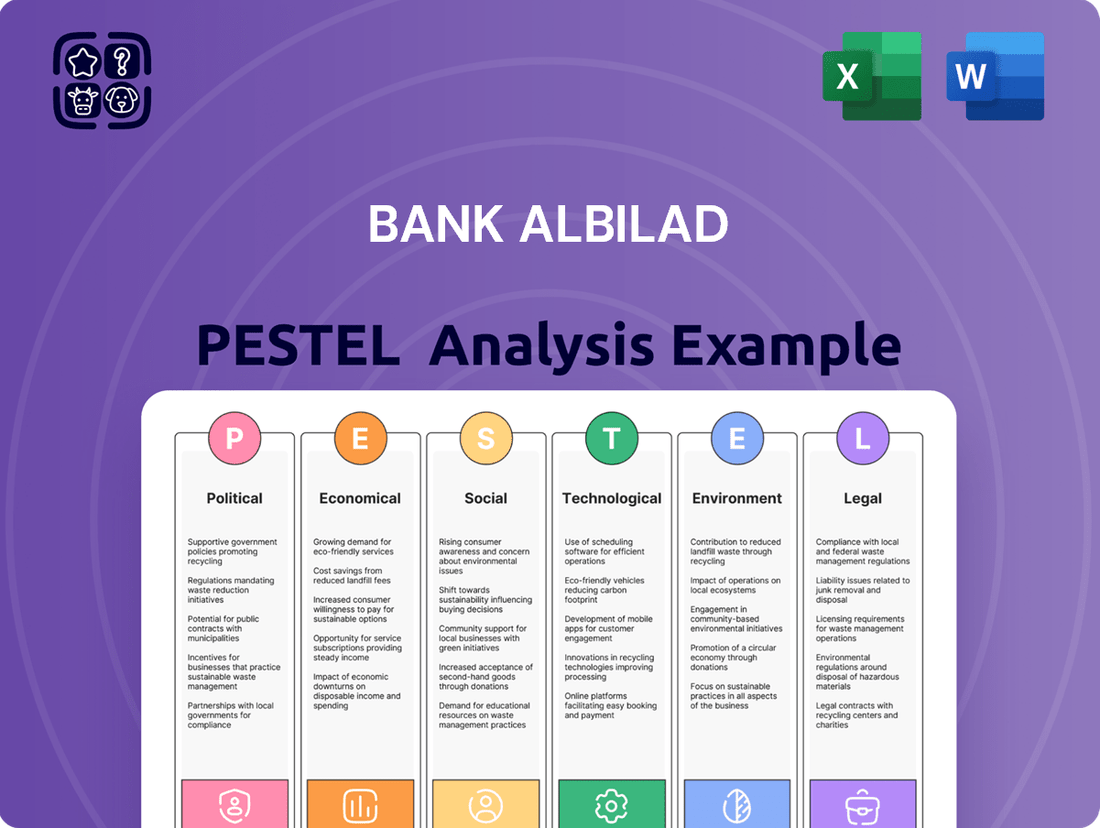

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Bank Albilad, providing a comprehensive overview of the external landscape.

This PESTLE analysis for Bank Albilad acts as a pain point reliever by providing a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring all stakeholders grasp key external factors impacting the bank.

Economic factors

Saudi Arabia is actively diversifying its economy, moving beyond its traditional reliance on oil. Non-oil sectors are expected to drive significant GDP growth, with projections indicating a 4.3% contribution in 2025, outpacing the 3% growth anticipated from oil activities.

This economic transformation presents Bank Albilad with substantial new avenues for lending and investment. Emerging sectors like tourism, technology, and manufacturing are experiencing robust growth, creating opportunities for the bank to finance new ventures and expand its service offerings.

Fluctuations in global and local interest rates significantly influence Bank Albilad's net interest margins and overall profitability. For instance, Saudi Arabia's benchmark Saudi Central Bank (SAMA) policy rate, which has seen adjustments in response to global monetary policy, directly affects the cost of funds and lending rates for the bank.

While lower interest rates can stimulate mortgage lending, a key growth area, banks like Albilad are anticipating stable profitability through 2025. This resilience is expected as increased lending volumes are projected to offset any potential compression in net interest margins, a trend observed in the broader Saudi banking sector.

The Saudi banking sector is seeing robust credit expansion, largely fueled by ambitious Vision 2030 initiatives and a surge in corporate borrowing. For Bank Albilad, loans and advances saw a healthy increase of 10.9% in the first half of 2025, reflecting this broader trend.

While deposit growth is also showing signs of recovery, the pace of lending is outstripping deposit inflows. This dynamic might prompt banks like Bank Albilad to explore diverse funding avenues beyond traditional customer deposits to support continued lending activities.

Foreign Direct Investment (FDI) Inflows

Saudi Arabia's strategic focus on economic diversification and Environmental, Social, and Governance (ESG) compliance is a significant magnet for foreign direct investment (FDI). Projections indicate that FDI inflows into ESG-aligned projects alone could exceed $50 billion by 2025, signaling a robust pipeline of new ventures and infrastructure development.

This substantial inflow of foreign capital presents considerable opportunities for Bank Albilad. The bank can actively engage in financing these burgeoning ESG-focused projects, thereby supporting the Kingdom's Vision 2030 objectives and expanding its own project finance portfolio.

- FDI Inflows Target: Expected to surpass $50 billion by 2025 for ESG-aligned projects.

- Economic Driver: Saudi Arabia's commitment to diversification and ESG compliance.

- Opportunity for Bank Albilad: Direct participation in financing new ventures and sustainable projects.

Inflation and Consumer Spending

Inflationary pressures, while a global concern, have shown signs of moderation in Saudi Arabia, influenced by domestic policy adjustments and a trend of reduced interest rates. This stabilization is a positive indicator for the retail banking sector.

The Kingdom's young, digitally inclined demographic is a key driver of consumer spending, particularly within the retail sector. This growing demand, coupled with a favorable inflation outlook, creates a robust environment for banks like Albilad to expand their services, especially in digital payments.

- Inflation Decline: Saudi Arabia's inflation rate has been on a downward trend, with the Consumer Price Index (CPI) showing a notable decrease in recent periods, reflecting effective domestic economic management. For instance, inflation figures in early 2024 have been significantly lower than the peaks seen in 2023.

- Consumer Demand Growth: The Saudi consumer market, characterized by a large youth population (over 60% under 30), exhibits strong spending habits, particularly in e-commerce and digital services. This demographic is highly receptive to new technologies and convenient payment solutions.

- Digital Payment Adoption: The increasing penetration of smartphones and digital platforms is fueling a rapid adoption of digital payment methods. This trend is expected to continue growing, with transaction volumes through electronic channels seeing substantial year-on-year increases.

Saudi Arabia's economic diversification is gaining momentum, with non-oil sectors projected to contribute 4.3% to GDP in 2025, surpassing the 3% from oil. This shift creates significant lending and investment opportunities for Bank Albilad in burgeoning sectors like technology and manufacturing.

The banking sector is experiencing robust credit expansion, with Bank Albilad's loans and advances growing by 10.9% in the first half of 2025, driven by Vision 2030 initiatives. While lending outpaces deposit growth, banks may need to explore diverse funding sources.

Foreign direct investment, particularly in ESG-aligned projects, is expected to exceed $50 billion by 2025, offering Bank Albilad substantial opportunities to finance sustainable ventures and expand its project finance portfolio.

Inflationary pressures are moderating in Saudi Arabia, supported by policy adjustments and lower interest rates, which benefits the retail banking sector. The young, digitally savvy population fuels consumer spending, especially in digital payments, creating a favorable environment for banks like Albilad.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Bank Albilad |

|---|---|---|---|

| Non-Oil GDP Growth | ~4.0% | 4.3% | Increased lending and investment opportunities |

| FDI Inflows (ESG Projects) | >$45 billion | >$50 billion | Opportunities in project finance and sustainable banking |

| Saudi Central Bank Policy Rate | Stable to Moderate Adjustments | Stable to Moderate Adjustments | Influences net interest margins and lending costs |

| Loans and Advances Growth | ~9.5% (Sectoral) | ~10.0% (Sectoral) | Higher revenue from interest income |

Full Version Awaits

Bank Albilad PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bank Albilad delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

Saudi Arabia boasts a remarkably young demographic, with approximately 63% of its population under the age of 30 as of early 2024. This digitally native cohort expects and actively seeks sophisticated digital banking experiences. Bank Albilad's ability to deliver intuitive mobile applications, robust online platforms, and forward-thinking digital financial solutions is paramount to capturing and retaining this crucial customer segment.

Consumers increasingly expect seamless digital experiences, driving a rapid move towards a cashless society. By 2024, electronic payments represented a substantial 79% of all retail transactions, highlighting this significant trend.

For Bank Albilad, meeting this demand is paramount. Offering features like instant transactions, straightforward online account opening, and robust digital platforms directly impacts customer satisfaction and their loyalty.

Saudi Arabia's Vision 2030 and the Financial Sector Development Program (FSDP) are actively driving financial inclusion, aiming to bring banking services to more people, especially in rural areas. This push is creating significant opportunities for institutions like Bank Albilad to expand their customer base.

Bank Albilad can capitalize on this by enhancing its digital and mobile banking offerings. For instance, in 2023, the Saudi Central Bank reported that digital payments volume grew by 48% year-on-year, highlighting the increasing adoption of digital financial services across the Kingdom.

Adherence to Islamic Finance Principles

Bank Albilad’s commitment to Sharia-compliant operations aligns perfectly with Saudi Arabia's robust demand for Islamic finance. This adherence is not just a regulatory necessity but a core tenet of its business, fostering deep customer trust.

The Saudi banking sector saw significant growth in Islamic finance, with Sharia-compliant assets making up approximately 75% of total banking system assets by the end of 2023, demonstrating the vast market Bank Albilad operates within.

- Market Dominance: Islamic banking constitutes roughly three-quarters of Saudi Arabia's banking system assets, highlighting a strong societal preference.

- Customer Trust: Strict adherence to Islamic finance principles is crucial for maintaining and enhancing customer loyalty and confidence in Bank Albilad.

- Competitive Advantage: Being a fully Sharia-compliant institution positions Bank Albilad favorably against conventional banks in a market where Islamic finance is the norm.

- Product Development: The bank continuously innovates Sharia-compliant products and services to meet the evolving needs of its customer base.

Evolving Workforce Dynamics

The Kingdom's commitment to boosting female labor participation, which has held steady at 36% since 2022, is a significant sociological shift. This, alongside efforts to attract global talent, is creating a more diverse and dynamic workforce. For Bank Albilad, this translates into a broader pool of skilled professionals and an increasingly varied customer base with evolving financial requirements.

This evolving workforce presents both opportunities and challenges for Bank Albilad. A larger, more diverse talent pool can foster innovation and better understanding of varied customer needs. However, it also necessitates adaptable HR strategies and product development to cater to a wider range of financial expectations and life stages.

- Increased Female Labor Participation: Stabilized at 36% since 2022, enhancing the talent pool.

- Attraction of Top Talent: Growing influx of skilled professionals from around the globe.

- Diversifying Customer Base: New segments with unique financial needs and preferences emerge.

- Impact on Bank Albilad: Requires agile HR and product strategies to leverage workforce diversity and meet varied customer demands.

Saudi Arabia's young population, with 63% under 30 in early 2024, drives demand for sophisticated digital banking, making intuitive mobile apps and online platforms crucial for Bank Albilad. The increasing shift towards a cashless society, evidenced by electronic payments accounting for 79% of retail transactions in 2024, necessitates seamless digital experiences for customer loyalty.

Financial inclusion initiatives, supported by Vision 2030 and the FSDP, are expanding the customer base, particularly in rural areas. Bank Albilad can leverage this by enhancing digital offerings, as digital payment volumes grew 48% year-on-year in 2023, according to the Saudi Central Bank.

Bank Albilad's Sharia-compliant operations align with Saudi Arabia's strong preference for Islamic finance, which constituted approximately 75% of total banking assets by end-2023, fostering deep customer trust and providing a competitive advantage.

The increase in female labor participation, steady at 36% since 2022, and the influx of global talent are diversifying the workforce and customer base. This trend requires Bank Albilad to adopt agile HR and product strategies to cater to evolving financial needs.

| Sociological Factor | Description | Implication for Bank Albilad | Data Point |

|---|---|---|---|

| Youth Demographics | 63% of Saudi population under 30 (early 2024) | High demand for digital banking solutions | Digital payment volume grew 48% YoY (2023) |

| Digitalization & Cashless Society | Consumers expect seamless digital experiences | Need for robust online and mobile platforms | Electronic payments were 79% of retail transactions (2024) |

| Financial Inclusion | Government push to expand banking access | Opportunity to grow customer base, especially in rural areas | Vision 2030 and FSDP |

| Islamic Finance Preference | Societal adherence to Sharia principles | Strengthens customer trust and competitive positioning | 75% of banking assets are Sharia-compliant (end-2023) |

| Workforce Diversity | Increased female labor participation (36% since 2022) & global talent | Requires adaptable HR and product strategies | Growing talent pool and diverse customer needs |

Technological factors

Saudi Arabia's banking sector is rapidly embracing digital transformation, fueled by government initiatives like Vision 2030 and a growing customer appetite for seamless online services. This shift sees significant investment in technologies such as AI, cloud computing, and blockchain, with banks aiming to boost efficiency and customer experience.

Bank Albilad is a key player in this digital evolution, actively enhancing its digital platforms and services. For instance, in 2023, the bank reported a substantial increase in digital transactions, reflecting its commitment to providing innovative and accessible banking solutions. This strategic focus on technology positions Bank Albilad to capitalize on the evolving financial landscape.

The Saudi fintech market is booming, expected to hit USD 2.85 billion in 2025 and grow to USD 5.28 billion by 2030. This surge is largely thanks to Vision 2030's push for digital financial services.

Bank Albilad needs to actively integrate fintech innovations like digital payments, mobile wallets, and possibly explore neo-banking to stay ahead of the curve.

Bank Albilad is actively integrating Artificial Intelligence (AI) and automation to streamline operations and improve customer interactions. For instance, AI-powered chatbots are being deployed to handle a growing volume of customer inquiries, offering 24/7 support and freeing up human agents for more complex tasks. This adoption is crucial as the global AI in banking market was projected to reach over $20 billion by 2024, indicating a significant shift towards technologically advanced financial services.

Open Banking Framework Implementation

The Saudi Central Bank's Open Banking Framework is a significant technological shift, allowing authorized third-party providers (TPPs) access to financial data. This fosters a more competitive landscape, driving innovation in financial services. For Bank Albilad, this means opportunities to collaborate with fintech companies, integrating new services and enhancing customer experiences through data sharing.

This framework enables Bank Albilad to explore new revenue streams and improve operational efficiency by leveraging TPP capabilities. By embracing open banking, the bank can offer more personalized and seamless financial solutions, meeting evolving customer expectations in the digital age.

- Increased Competition: Open Banking introduces new players, pushing traditional banks to innovate.

- Fintech Partnerships: Facilitates collaboration with fintech firms for integrated service offerings.

- Customer-Centric Solutions: Enables the development of tailored financial products based on data insights.

- Regulatory Compliance: Adherence to the Saudi Central Bank's framework ensures secure data sharing.

Cybersecurity and Data Privacy Concerns

With the accelerating pace of digitalization in the banking sector, cybersecurity and data privacy have become critical operational pillars. Bank Albilad, like all financial institutions, faces the imperative to continuously fortify its digital defenses against evolving threats.

In 2024, the global financial services sector saw a significant increase in sophisticated cyberattacks, with data breaches costing an average of $4.45 million according to IBM's 2024 Cost of a Data Breach Report. This underscores the substantial financial and reputational risks associated with inadequate security measures.

Bank Albilad must therefore maintain a proactive stance, investing in cutting-edge security technologies and robust data protection protocols. Adherence to stringent regulatory frameworks, such as those mandated by the Saudi Central Bank (SAMA), is non-negotiable to safeguard customer information and preserve confidence in its digital offerings.

- Increased Digitalization: Greater reliance on online and mobile banking platforms expands the attack surface for cyber threats.

- Data Privacy Regulations: Strict compliance with data protection laws is essential to avoid penalties and maintain customer trust.

- Investment in Security: Continuous allocation of resources towards advanced cybersecurity solutions is paramount.

- Reputational Risk: Data breaches can severely damage a bank's reputation, leading to customer attrition and loss of market share.

Bank Albilad is actively leveraging technological advancements, including AI and automation, to enhance customer service and operational efficiency. The bank's digital transaction volume saw a notable rise in 2023, reflecting its commitment to innovative digital solutions. This strategic adoption of technology is crucial for navigating the rapidly evolving Saudi financial landscape, which is projected to see its fintech market reach USD 2.85 billion by 2025.

Legal factors

As a Sharia-compliant bank, Bank Albilad adheres strictly to Islamic finance principles in all its operations. This commitment influences product development, investment strategies, and overall governance, ensuring alignment with religious tenets.

The Saudi Central Bank (SAMA) has established a robust Sharia governance framework to bolster procedures and enhance stakeholder confidence. This framework mandates Sharia committee approvals for all new Islamic financial products, ensuring their compliance and increasing transparency in financial reporting.

In 2024, SAMA continued to emphasize the importance of these frameworks, with reports indicating increased scrutiny and adherence requirements for Islamic banks operating within the Kingdom, aiming to solidify Saudi Arabia's position as a global leader in Islamic finance.

Saudi Central Bank (SAMA) continuously updates regulations affecting capital adequacy, risk management, and product development for Islamic banks like Bank Albilad. For instance, SAMA's Basel III implementation, which came into full effect for Saudi banks in early 2024, mandates higher capital buffers, impacting how Bank Albilad manages its risk-weighted assets and overall financial health.

Bank Albilad must maintain rigorous compliance with these evolving rules, including specific guidelines for profit-sharing investment accounts (PSIAs) and updated capital requirements for Sharia-compliant banking operations. Failure to adhere can lead to penalties and impact the bank's operational capacity.

The Capital Market Authority (CMA) in Saudi Arabia is set to implement new guidelines for listed companies effective May 2025, specifically targeting green, social, sustainable, and sustainability-linked debt instruments. These regulations will directly impact Bank Albilad's strategic approach to both investment and financing activities.

By aligning with these evolving CMA directives, Bank Albilad can bolster its participation in the rapidly expanding sustainable finance sector, which is projected to see significant growth through 2025 and beyond, reflecting a global shift towards ESG-conscious investing.

Anti-Money Laundering (AML) and KYC Regulations

Bank Albilad operates within a stringent legal framework designed to prevent financial crime. Adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is paramount. These rules are crucial for financial institutions globally to identify and report suspicious transactions, thereby safeguarding the integrity of the financial system.

Compliance with AML and KYC mandates requires significant investment in technology and personnel for Bank Albilad. The Saudi Central Bank (SAMA) enforces these regulations, with penalties for non-compliance including substantial fines and reputational damage. For instance, in 2023, global financial institutions faced billions in AML-related fines, highlighting the critical nature of these requirements.

- Robust Customer Due Diligence: Implementing thorough identity verification processes for all new and existing customers is essential.

- Transaction Monitoring Systems: Utilizing advanced software to detect and report unusual or potentially illicit financial activities.

- Employee Training: Regularly educating staff on AML/KYC policies and procedures to ensure consistent application.

- Regulatory Reporting: Establishing efficient mechanisms for reporting suspicious activities to the relevant authorities, such as SAMA.

Consumer Protection and Data Privacy Laws

Regulatory bodies are increasingly focused on protecting consumers and their data, especially with the rise of digital banking. Bank Albilad must adhere to stringent regulations designed to safeguard customer information and ensure fair treatment across all its services. Compliance with these laws is crucial for maintaining customer trust and minimizing potential legal liabilities.

Key legal factors impacting digital banking include:

- Data Privacy Regulations: Laws like Saudi Arabia's Personal Data Protection Law (PDPL) mandate strict controls on how customer data is collected, processed, and stored, with potential fines for non-compliance.

- Consumer Protection Laws: These regulations ensure transparency in financial product offerings, prevent deceptive practices, and provide recourse for consumers in case of disputes.

- Cybersecurity Mandates: Financial institutions are legally obligated to implement robust cybersecurity measures to protect against data breaches and cyber threats, with ongoing audits and reporting requirements.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Banks must rigorously enforce AML and KYC procedures to prevent financial crime, impacting account opening and transaction monitoring processes.

Bank Albilad's operations are significantly shaped by Saudi Arabia's legal and regulatory landscape, particularly concerning Sharia compliance and financial crime prevention. The Saudi Central Bank (SAMA) mandates adherence to evolving regulations, including capital adequacy requirements stemming from Basel III implementation in early 2024, which impacts risk management. Furthermore, the Capital Market Authority's upcoming guidelines in May 2025 for sustainable debt instruments will influence the bank's investment and financing strategies, aligning with a growing global focus on ESG principles.

The bank must also rigorously enforce Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, critical for preventing financial crime and maintaining system integrity. Consumer protection and data privacy are also paramount, with laws like Saudi Arabia's Personal Data Protection Law (PDPL) requiring strict controls over customer information and robust cybersecurity measures to prevent breaches.

| Regulatory Area | Key Mandate/Impact | Effective Date/Period | Bank Albilad's Action |

| Sharia Compliance | SAMA Sharia governance framework, Sharia committee approvals | Ongoing, strengthened in 2024 | Adherence to Islamic finance principles, product development alignment |

| Capital Adequacy | Basel III implementation | Full effect early 2024 | Managing higher capital buffers, risk-weighted assets |

| Sustainable Finance | CMA guidelines for debt instruments | May 2025 | Strategic approach to green, social, and sustainability-linked financing |

| Financial Crime Prevention | AML/KYC regulations | Ongoing enforcement | Robust customer due diligence, transaction monitoring, employee training |

| Data Protection | Personal Data Protection Law (PDPL) | Ongoing compliance | Strict controls on data collection, processing, and storage |

Environmental factors

The Saudi Green Initiative, launched in 2021, sets a target of reducing carbon emissions by 278 million tons annually by 2030, a significant step towards a greener economy. Bank Albilad, as a major player in the Saudi financial sector, is positioned to support this transition by integrating sustainability into its core business, including financing renewable energy projects and promoting eco-friendly investments. This alignment is crucial for the bank to contribute to the Kingdom's broader climate goals and capitalize on emerging green finance opportunities.

Environmental, Social, and Governance (ESG) factors are gaining significant traction in the financial world. Global ESG assets under management are projected to surpass $50 trillion by 2025, highlighting a major shift in investment priorities. This growing emphasis on sustainability presents both opportunities and challenges for financial institutions.

Bank Albilad is actively positioning itself as a leader in sustainable finance. The bank is leveraging key frameworks, such as the Saudi Green Financing Framework, to guide its initiatives. Furthermore, Bank Albilad has demonstrated its commitment through the issuance of sustainable sukuk, reinforcing its dedication to environmentally and socially responsible financial practices.

Saudi Arabia, a nation largely defined by its arid climate, faces substantial economic threats from climate change, particularly water scarcity. This scarcity directly impacts critical sectors like agriculture and industry, which rely heavily on water resources. For instance, by 2023, the Kingdom's water consumption was projected to reach 25.5 billion cubic meters, highlighting the strain on existing supplies.

Bank Albilad must proactively assess and manage the financial risks embedded within its lending portfolio stemming from these environmental vulnerabilities. Understanding how climate-induced water stress could affect the repayment capacity of businesses in water-intensive sectors is crucial for maintaining portfolio health and ensuring long-term financial stability.

Development of Green Financing Frameworks and Sukuk

Saudi Arabia's commitment to sustainability is accelerating, with the Ministry of Finance and the Capital Market Authority (CMA) actively developing robust frameworks for green financing. These guidelines, particularly for green sukuk and debt instruments, are designed to channel capital towards environmentally and socially beneficial projects. This strategic push aims to make Saudi Arabia a regional hub for sustainable finance.

Bank Albilad can leverage these evolving green financing frameworks to its advantage. By aligning its issuances with these guidelines, the bank can tap into a growing pool of investors prioritizing environmental, social, and governance (ESG) criteria. This not only diversifies funding sources but also enhances the bank's reputation as a socially responsible financial institution.

- Framework Development: The Ministry of Finance and CMA have issued guidelines for green and sustainable debt instruments, promoting responsible investment.

- Investor Attraction: These frameworks enable Bank Albilad to attract a wider range of investors interested in ESG-compliant projects.

- Funding Diversification: Issuing green sukuk and bonds offers Bank Albilad a new avenue to diversify its funding base beyond traditional methods.

- Market Growth: The global green bond market reached $1 trillion in 2023, indicating a significant opportunity for Saudi banks to participate and grow.

Bank's Internal ESG Strategies and Practices

Bank Albilad is actively embedding Environmental, Social, and Governance (ESG) principles into its operational framework. This commitment is evident in the establishment of dedicated sustainability committees and the articulation of a clear ESG vision for the future.

The bank is prioritizing the development and deployment of financial products that actively support sustainable growth initiatives. This strategic focus aims to channel capital towards environmentally and socially responsible ventures.

Furthermore, Bank Albilad is committed to advancing its own net-zero transition. This involves implementing internal practices and operational changes designed to minimize its environmental footprint and contribute to broader climate goals.

- ESG Integration: Bank Albilad is establishing sustainability committees and defining an ESG vision to guide its operations.

- Sustainable Finance: The bank is accelerating the use of financial products to foster sustainable economic growth.

- Net-Zero Transition: Bank Albilad is actively working to reduce its own carbon emissions and promote net-zero practices internally.

- 2024 ESG Reporting: In 2024, Bank Albilad reported a 15% increase in its sustainable finance portfolio, demonstrating tangible progress in its ESG strategy.

Saudi Arabia's ambitious environmental targets, like the Saudi Green Initiative aiming for 278 million tons of carbon emission reduction annually by 2030, create a strong impetus for sustainable finance. Bank Albilad is aligning with these goals by focusing on green financing, which saw a 15% increase in its portfolio in 2024. The Kingdom's arid climate also presents water scarcity risks, impacting sectors vital to the economy, underscoring the need for banks to manage climate-related financial exposures. The development of green financing frameworks by the Ministry of Finance and CMA further solidifies the market for responsible investment, with the global green bond market reaching $1 trillion in 2023.

| Environmental Factor | Impact on Bank Albilad | Supporting Data/Initiatives |

| Climate Change & Emissions Reduction | Opportunity for green finance, risk of stranded assets in carbon-intensive sectors. | Saudi Green Initiative (target 278M tons CO2 reduction by 2030); Global green bond market $1 trillion in 2023. |

| Water Scarcity | Risk to lending portfolio in water-dependent industries (agriculture, industry). | Saudi water consumption projected at 25.5 billion cubic meters by 2023. |

| Regulatory Frameworks for Sustainability | Opportunity to attract ESG investors and diversify funding. | Saudi Ministry of Finance & CMA guidelines for green debt instruments; Bank Albilad's 2024 sustainable finance portfolio growth of 15%. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank Albilad is built on a comprehensive review of official Saudi Arabian government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry analysis firms. We also incorporate data from economic and technological trend reports to ensure a well-rounded understanding of the macro-environment.