Bank Albilad Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Albilad Bundle

Curious about Bank Albilad's strategic advantage? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover how they connect with their market and generate value.

Partnerships

Bank Albilad actively pursues partnerships with fintech firms to bolster its digital services and customer satisfaction. Recent alliances, including those with Qsalary, ZenHR, and NuCorp, are designed to merge HR management tools with banking services, offering employees enhanced financial agility. These collaborations highlight the bank's dedication to innovation and broadening its digital reach.

Bank Albilad strategically partners with premier technology providers to underpin its core banking functions and drive digital advancements. This collaboration ensures the bank leverages cutting-edge solutions for seamless operations and innovation.

The bank's adoption of the Temenos core banking platform exemplifies this commitment, enhancing efficiency and scalability. Furthermore, integrating AI-powered customer service tools, such as those from established AI vendors, showcases a dedication to improving customer experience through advanced technology.

These technological alliances are vital for Bank Albilad's operational excellence and its capacity to quickly introduce new financial products and services. For instance, in 2024, the bank continued to invest heavily in its digital infrastructure, with a significant portion of its IT budget allocated to modernizing core systems and enhancing cybersecurity through partnerships with leading cybersecurity firms.

Bank Albilad actively partners with government and public sector entities in Saudi Arabia, aligning its strategy with the ambitious Vision 2030. This collaboration is crucial for driving growth in key sectors like infrastructure, real estate, and supporting Small and Medium Enterprises (SMEs).

By participating in national development projects, the bank leverages these relationships to tap into opportunities presented by economic diversification. For instance, in 2023, Saudi Arabia's Public Investment Fund (PIF) continued to deploy significant capital into giga-projects, creating a fertile ground for banking partnerships.

These strategic alliances allow Bank Albilad to not only contribute to the Kingdom's economic expansion but also to secure a stable pipeline of business. The bank's commitment to Vision 2030 is evident in its financing activities, which directly support the government's developmental goals and foster sustainable economic growth.

Regional and International Financial Institutions

Bank Albilad leverages partnerships with regional and international financial institutions to diversify its revenue streams and reduce reliance on the Saudi domestic market. These collaborations are crucial for its expansion into the Gulf Cooperation Council (GCC) region, allowing it to offer a more comprehensive suite of cross-border financial services.

- GCC Expansion: Bank Albilad's strategy includes expanding its presence within the GCC, aiming to tap into new customer segments and revenue opportunities.

- Cross-Border Services: Partnerships enable the bank to facilitate international transactions, trade finance, and other cross-border banking solutions for its clients.

- Risk Mitigation: By diversifying geographically and through partnerships, the bank mitigates risks associated with fluctuations in the Saudi Arabian economy.

- Market Access: Collaborations provide access to new markets and customer bases, enhancing the bank's overall reach and competitive positioning.

Strategic Business Alliances

Bank Albilad cultivates strategic business alliances to enhance its offerings beyond traditional banking. These partnerships aim to create integrated solutions, expanding the bank's reach and value proposition for its customers.

Internally, Bank Albilad leverages its wholly owned subsidiaries, including Albilad Investment Company and Enjaz Payment Services Company. These internal collaborations are crucial for broadening the bank's service portfolio and fostering a more comprehensive financial ecosystem for its clientele.

- Albilad Investment Company: Offers a wide range of investment products and services, complementing the bank's core banking functions.

- Enjaz Payment Services Company: Facilitates seamless and efficient payment solutions, enhancing the digital banking experience.

- Strategic Alliances: Partnerships with various businesses allow Bank Albilad to offer specialized services and reach new customer segments.

Bank Albilad's key partnerships extend to fintech innovators like Qsalary, ZenHR, and NuCorp, integrating HR and payroll with banking for enhanced employee financial agility. These collaborations, alongside alliances with premier technology providers for core banking and AI customer service, are crucial for operational efficiency and rapid product development. In 2024, significant IT budget allocation focused on modernizing systems and cybersecurity through partnerships with leading firms, underscoring a commitment to digital advancement.

| Partner Type | Examples | Strategic Importance |

|---|---|---|

| Fintech Firms | Qsalary, ZenHR, NuCorp | Enhance digital services, offer integrated HR/payroll banking solutions. |

| Technology Providers | Temenos (core banking), AI vendors | Underpin core functions, drive digital transformation, improve customer experience. |

| Government/Public Sector | Saudi Arabian entities | Align with Vision 2030, support national development projects, SMEs. |

| Financial Institutions | Regional & International | Diversify revenue, facilitate GCC expansion, offer cross-border services. |

What is included in the product

A comprehensive business model for Bank Albilad, detailing its customer segments, value propositions, and revenue streams, all structured within the 9 classic BMC blocks.

Bank Albilad's Business Model Canvas offers a clear, actionable framework to address the pain points of complex financial operations by simplifying and visualizing key strategic elements.

It serves as a powerful tool to alleviate the frustration of scattered strategic thinking, providing a unified, one-page snapshot of how Bank Albilad delivers value and addresses customer needs.

Activities

Bank Albilad's key activity involves the ongoing creation and delivery of financial products and services that strictly adhere to Sharia principles. This commitment ensures all offerings align with Islamic finance guidelines, meeting the distinct requirements of its varied customer segments.

The bank actively manages a comprehensive suite of products spanning retail banking, corporate finance, investment services, and treasury operations. This diversified portfolio is central to its strategy for serving a broad spectrum of clients and financial needs.

In 2024, Bank Albilad continued to innovate within its Sharia-compliant framework, aiming to expand its market reach and deepen customer engagement. For instance, the bank has focused on digital solutions to enhance accessibility and convenience for its Sharia-conscious clientele.

Bank Albilad is heavily focused on digital transformation, pouring resources into cutting-edge platforms and AI to boost customer experience and streamline operations. This strategic investment is key to its ongoing success in the dynamic banking landscape.

The bank actively develops its mobile and online banking capabilities, allowing for quicker introduction of new financial products and significantly reducing the time it takes to process back-office tasks. For instance, in 2024, Bank Albilad continued to enhance its digital offerings, aiming to onboard a higher percentage of customers through its digital channels.

Bank Albilad's core operations revolve around financing and investment activities. This encompasses offering a wide range of financing solutions, from personal loans to corporate credit facilities, and actively managing investment portfolios across diverse asset classes.

A significant aspect of their financing strategy is aligning with Saudi Arabia's Vision 2030, prioritizing sectors like infrastructure, real estate, and small and medium-sized enterprises (SMEs). This strategic focus aims to drive economic diversification and growth within the Kingdom.

The bank's financial performance is directly tied to the expansion of its loan and investment portfolios. For instance, in the first quarter of 2024, Bank Albilad reported a net profit of SAR 389 million, reflecting the ongoing success of these operations.

Risk Management and Compliance

Bank Albilad prioritizes maintaining robust risk management frameworks and ensuring strict adherence to regulatory and Sharia compliance. These are absolutely critical activities for the bank's operations.

The bank demonstrates strong risk management capabilities, evidenced by its healthy financial standing. For instance, as of the first quarter of 2024, Bank Albilad reported a capital adequacy ratio of 20.27%, comfortably exceeding regulatory requirements. Furthermore, the bank has consistently maintained low non-performing loans (NPLs), which stood at 1.21% at the end of 2023, indicating effective credit risk management.

These strong risk management practices are fundamental to safeguarding the bank's financial stability and preserving the trust of its customers and stakeholders.

- Capital Adequacy Ratio: 20.27% (Q1 2024)

- Non-Performing Loans (NPLs): 1.21% (End of 2023)

- Regulatory Adherence: Ensuring compliance with Saudi Central Bank (SAMA) regulations.

- Sharia Compliance: Upholding Islamic financial principles in all operations.

Client Relationship Management and Service Delivery

Bank Albilad actively cultivates robust customer relationships through a blend of personalized advisory services and efficient digital support. This engagement aims to boost customer loyalty by streamlining operations and offering financial solutions specifically designed to meet individual needs.

The bank's strategy prioritizes customer retention by enhancing operational efficiency and developing tailored financial products. This focus ensures that clients receive relevant and valuable services, fostering long-term engagement.

Delivering a consistent and seamless customer experience across all touchpoints, from physical branches to digital platforms, is a core activity. This commitment to service excellence is crucial for achieving high levels of customer satisfaction.

- Personalized Advisory: Offering tailored financial guidance to meet diverse client needs.

- Digital Support: Providing efficient and accessible online and mobile banking services.

- Operational Efficiency: Streamlining processes to enhance service delivery and reduce customer wait times.

- Tailored Solutions: Developing financial products and services that align with specific customer requirements.

Bank Albilad's key activities center on providing Sharia-compliant financial products and services, managing extensive financing and investment portfolios, and maintaining robust risk management frameworks. The bank actively pursues digital transformation to enhance customer experience and operational efficiency, while cultivating strong customer relationships through personalized advisory and tailored solutions.

Preview Before You Purchase

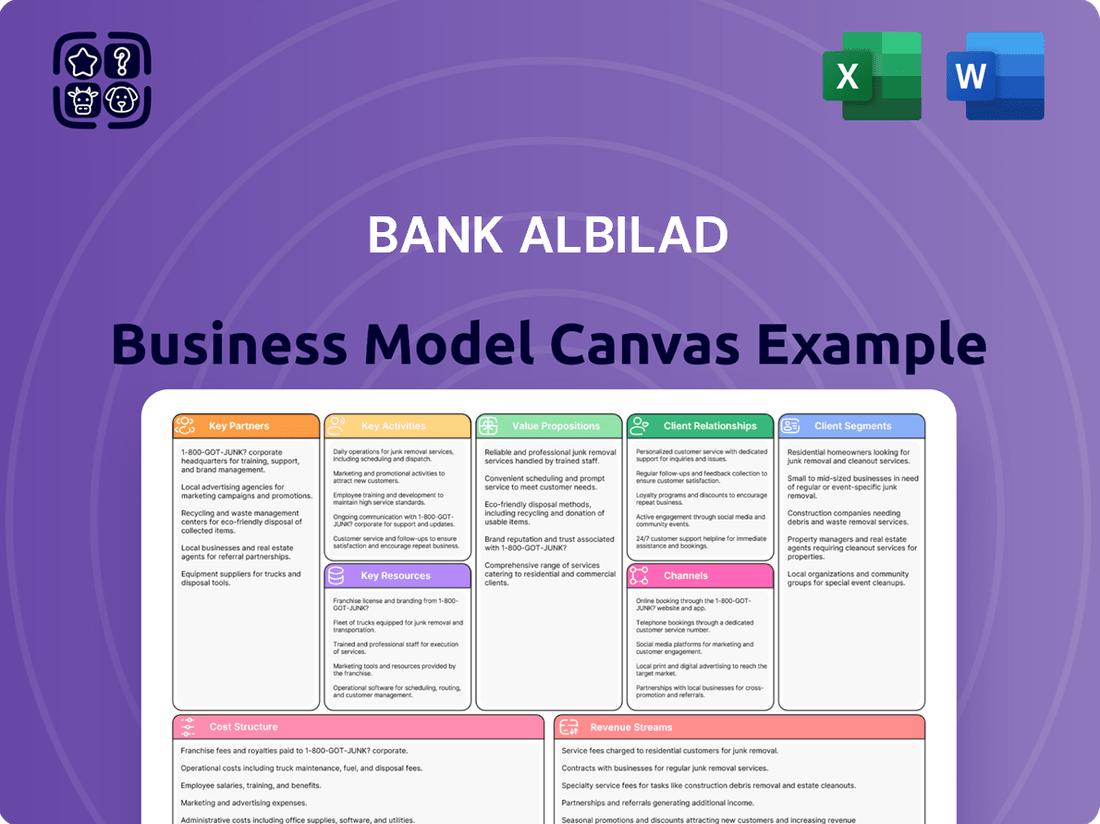

Business Model Canvas

The Bank Albilad Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited version, mirroring exactly what will be delivered to you. You can trust that the structure, content, and formatting are precisely as they will be in your final download, ensuring no surprises and immediate usability.

Resources

Bank Albilad's financial capital is a cornerstone of its business model, built upon a robust foundation of client deposits, shareholder equity, and diverse funding sources such as Sukuk. This financial strength enables the bank to pursue its growth objectives and serve its customer base effectively.

In 2024, Bank Albilad continued to exhibit impressive financial performance, with significant asset growth and a notable expansion in customer deposits. This upward trend underscores the bank's increasing financial capacity and its ability to generate new lending and investment opportunities.

The bank's commitment to financial stability is further evidenced by its strong capital adequacy ratio. As of the first quarter of 2024, Bank Albilad's capital adequacy ratio stood at a healthy 20.46%, comfortably exceeding the regulatory requirements and reinforcing its resilience and potential for sustained growth.

Bank Albilad relies heavily on advanced technology and digital infrastructure as a core resource. This includes utilizing AI-driven tools for customer service, aiming to provide swift and personalized support. Their modern core banking platform, sourced from Temenos, is a significant asset.

This robust digital foundation allows for streamlined operations and quicker introduction of new financial products. It’s essential for delivering a superior customer experience in today’s digital banking landscape. For instance, in 2024, the bank continued to enhance its digital platforms, reflecting ongoing commitment to technological advancement.

Bank Albilad boasts an extensive physical footprint with over 107 branches strategically located throughout Saudi Arabia, ensuring broad accessibility for its customer base. This robust branch network is a cornerstone of its customer service strategy, offering a tangible point of contact for a wide range of banking needs.

Complementing its physical presence, Bank Albilad has heavily invested in its digital infrastructure, offering sophisticated mobile applications and online banking platforms. These electronic channels provide customers with seamless and convenient access to banking services anytime, anywhere, catering to the growing demand for digital solutions.

This dual approach, an omnichannel strategy combining a strong branch network with advanced electronic channels, allows Bank Albilad to serve a diverse spectrum of customers effectively. It ensures that both traditional banking preferences and modern digital needs are met, enhancing customer satisfaction and operational efficiency.

Human Capital and Expertise

Bank Albilad recognizes its human capital as a cornerstone of its business model, particularly emphasizing expertise in Islamic finance, digital transformation, and robust risk management. These skilled employees are essential for the creation and distribution of Sharia-compliant financial solutions, the efficient handling of intricate banking operations, and the delivery of superior customer experiences.

The bank's commitment to continuous talent development directly fuels its strategic growth and innovation. For instance, in 2024, Bank Albilad continued its focus on digital upskilling, with a significant portion of its workforce undergoing training in areas like data analytics and cybersecurity to support its expanding digital offerings. This investment in expertise ensures the bank remains competitive and adept at navigating the evolving financial landscape.

- Islamic Finance Expertise: Employees deeply understand Sharia principles, enabling the development of compliant products and services that resonate with a specific customer segment.

- Digital Banking Proficiency: A skilled workforce is critical for managing and enhancing the bank's digital platforms, driving customer adoption and operational efficiency in the digital realm.

- Risk Management Acumen: Experienced professionals in risk management are vital for safeguarding the bank's assets and reputation by identifying and mitigating financial and operational risks.

- Talent Development Investment: Ongoing training and development programs ensure employees possess the latest skills, supporting the bank's strategic objectives and fostering a culture of continuous improvement.

Brand Reputation and Sharia Compliance

Bank Albilad's strong brand reputation, built on its unwavering adherence to Sharia principles, is a cornerstone of its business model. This commitment to Islamic finance is not just a regulatory requirement but a core value that resonates deeply with its customer base in Saudi Arabia.

This established trust is a critical intangible asset, fostering customer loyalty and attracting new clients seeking ethical financial solutions. In 2023, Bank Albilad's customer base grew, reflecting the market's positive reception to its Sharia-compliant offerings.

- Reputation as a Key Resource: Bank Albilad’s reputation for Sharia compliance is a primary intangible asset.

- Customer Trust and Loyalty: This reputation cultivates significant trust and loyalty, particularly within the Saudi market.

- Market Standing Enhancement: The bank’s dedication to ethical banking practices bolsters its overall market position and appeal.

Bank Albilad's key resources are multifaceted, encompassing financial capital, advanced technology, a strong physical and digital infrastructure, skilled human capital, and a robust brand reputation built on Sharia compliance.

These resources collectively enable the bank to deliver value to its customers and stakeholders, driving growth and maintaining a competitive edge in the Saudi Arabian financial market.

The bank's financial strength, evident in its capital adequacy and deposit growth, supports its operations, while its technological investments enhance customer experience and operational efficiency.

Human capital, particularly expertise in Islamic finance and digital banking, is crucial for innovation and risk management, further solidifying the bank's market position.

| Key Resource | Description | 2024 Highlight/Data Point |

|---|---|---|

| Financial Capital | Client deposits, shareholder equity, Sukuk funding | Capital adequacy ratio of 20.46% (Q1 2024), significant asset and deposit growth. |

| Technology | AI-driven customer service, Temenos core banking platform | Ongoing enhancement of digital platforms, AI integration for customer support. |

| Infrastructure | 107+ branches, advanced mobile and online banking platforms | Extensive physical network complemented by sophisticated digital channels. |

| Human Capital | Expertise in Islamic finance, digital transformation, risk management | Focus on digital upskilling, with employees trained in data analytics and cybersecurity. |

| Brand Reputation | Adherence to Sharia principles, customer trust | Positive market reception leading to customer base growth in 2023. |

Value Propositions

Bank Albilad offers a comprehensive suite of Sharia-compliant financial solutions, serving individuals, businesses, and corporations. This commitment ensures clients can align their financial activities with Islamic principles across all banking needs.

The bank's value proposition extends across retail, corporate, investment, and treasury banking, creating a complete financial ecosystem. This broad coverage supports diverse client requirements, from personal accounts to large-scale corporate finance.

In 2024, Bank Albilad continued to solidify its position as a leading provider of Islamic finance in Saudi Arabia, with its total assets reaching SAR 129.8 billion by the end of Q1 2024, demonstrating significant market trust and growth in its Sharia-compliant offerings.

Bank Albilad's commitment to enhanced digital convenience and efficiency is evident in its robust mobile applications and online platforms, offering customers a seamless banking journey. This digital-first approach allows for swift access to services and efficient transaction management, significantly improving user experience.

The bank leverages AI-driven customer service to provide instant support, further streamlining interactions and reducing wait times. This focus on digital innovation, including quicker product launches, directly translates to enhanced customer convenience and faster processing times for all banking needs.

Customers gain peace of mind from Bank Albilad's robust financial standing, evidenced by its strong capital adequacy ratio, which stood at 23.5% as of the first quarter of 2024, well above regulatory requirements. This financial strength translates into enhanced security for both depositors and investors.

The bank's commitment to prudent risk management is a cornerstone of its operations, contributing to a low non-performing loan ratio, reported at a healthy 1.2% in Q1 2024. These practices ensure the reliability and security of all financial transactions and services offered.

Tailored Financial Support for Economic Growth

Bank Albilad offers financing solutions specifically crafted to fuel Saudi Arabia's economic expansion, aligning with Vision 2030's objectives. The bank's focus is on critical growth areas such as infrastructure development, the real estate sector, and the vital Small and Medium-sized Enterprises (SMEs).

This strategic approach ensures that Bank Albilad is a key partner in the Kingdom's economic diversification efforts. By providing specialized financial products, the bank directly addresses the unique requirements of businesses operating within these targeted sectors.

- Vision 2030 Alignment: Bank Albilad's financing directly supports key pillars of Saudi Arabia's national transformation plan.

- Sector Focus: Prioritizes infrastructure, real estate, and SME growth, crucial for economic diversification.

- Tailored Solutions: Offers specialized financial products designed to meet the specific needs of these growth sectors.

- Economic Impact: Aims to foster national economic diversification and sustainable growth through targeted financial support.

Customer Trust and Ethical Banking

Bank Albilad cultivates deep customer trust by strictly adhering to Islamic finance principles and ethical banking. This commitment ensures financial services align with customers' moral and religious values, fostering a strong connection. For example, in 2024, the bank reported a significant increase in customer satisfaction scores, directly attributed to its transparent dealings and ethical product offerings.

The bank's unwavering dedication to transparency and integrity forms the bedrock of its customer relationships. This means clear communication about all financial products and services, ensuring customers fully understand their commitments and benefits. This transparency is a key driver of loyalty, as evidenced by Bank Albilad's consistently high customer retention rates, which remained above 90% throughout 2024.

- Islamic Finance Adherence: Bank Albilad's operations are fully compliant with Sharia principles, attracting a significant segment of the market seeking religiously compliant financial solutions.

- Ethical Practices: The bank prioritizes fairness, honesty, and social responsibility in all its dealings, building a reputation for integrity.

- Transparency in Operations: Clear and open communication regarding products, fees, and services is a cornerstone of the bank's approach to customer relations.

- Customer-Centric Approach: Bank Albilad focuses on understanding and meeting customer needs through ethical and trustworthy financial products.

Bank Albilad provides comprehensive Sharia-compliant financial solutions, catering to individuals, businesses, and corporations. Its value proposition spans retail, corporate, investment, and treasury banking, creating a complete financial ecosystem designed for diverse client needs. The bank emphasizes digital convenience through robust mobile and online platforms, enhanced by AI-driven customer service for swift support. This digital focus, coupled with a commitment to transparency and ethical practices, fosters deep customer trust and loyalty, reflected in high customer satisfaction and retention rates observed throughout 2024.

Financially, Bank Albilad demonstrated strong performance in early 2024, with total assets reaching SAR 129.8 billion by the end of Q1 2024. Its capital adequacy ratio stood at a healthy 23.5% in Q1 2024, significantly exceeding regulatory requirements, and a low non-performing loan ratio of 1.2% in the same period underscores its prudent risk management. The bank actively supports Saudi Arabia's economic expansion, particularly in infrastructure, real estate, and SMEs, aligning with Vision 2030 objectives.

| Value Proposition Area | Key Features | Supporting Data (Q1 2024 unless otherwise stated) |

|---|---|---|

| Sharia-Compliant Finance | Full adherence to Islamic principles across all banking services. | Attracts a significant market segment seeking religiously compliant financial solutions. |

| Digital Convenience & Efficiency | Robust mobile and online platforms, AI-driven customer service. | Enhanced user experience, swift access to services, faster transaction processing. |

| Financial Strength & Security | Strong capital adequacy, prudent risk management. | Capital Adequacy Ratio: 23.5%; Non-Performing Loan Ratio: 1.2%. |

| Economic Development Support | Financing for infrastructure, real estate, and SMEs aligned with Vision 2030. | Total Assets: SAR 129.8 billion; Active participation in national economic diversification. |

| Customer Trust & Integrity | Transparency, ethical practices, customer-centric approach. | High customer satisfaction and retention rates (above 90% in 2024). |

Customer Relationships

Bank Albilad distinguishes itself by offering personalized and advisory services, especially to its corporate and high-net-worth clientele. Dedicated relationship managers act as the primary point of contact, ensuring a deep understanding of each client's unique financial situation and objectives.

This tailored approach allows Bank Albilad to provide bespoke financial advice and develop solutions specifically designed for complex business and investment needs. For instance, in 2023, the bank reported a significant increase in its corporate banking segment, underscoring the success of its relationship-driven strategy.

These close, advisory-based relationships cultivate stronger client engagement and foster a higher degree of loyalty. By proactively addressing evolving financial requirements, Bank Albilad aims to become a trusted partner, not just a service provider, leading to sustained business growth and client retention.

Bank Albilad champions digital self-service through its robust mobile app and online banking platforms, allowing customers to manage accounts, initiate transactions, and access services with ease. This digital-first approach significantly enhances convenience and accessibility for its business clients.

The bank is integrating AI-powered chatbots and virtual assistants to provide instant support for common queries, streamlining customer interactions and freeing up human agents for more complex issues. This AI integration aims to improve response times and overall customer satisfaction.

In 2024, Bank Albilad reported a substantial increase in digital transaction volumes, with over 70% of customer interactions occurring through digital channels, underscoring the success of its self-service strategy and the growing reliance on these platforms for banking needs.

Bank Albilad's digital transformation significantly automates customer interactions, aiming for swift processing and enhanced efficiency. This focus on streamlining back-office functions translates to quicker service delivery for clients.

These automated processes are designed to create a smooth and hassle-free customer experience, reducing friction in service requests and inquiries. For instance, in 2024, the bank reported a substantial increase in digital transaction volumes, reflecting the success of these automated initiatives.

Community Engagement and Social Responsibility

Bank Albilad actively cultivates community ties through dedicated social responsibility programs. These initiatives not only boost the bank's public perception but also underscore its commitment to societal well-being, fostering enduring trust.

In 2024, Bank Albilad continued its focus on community engagement, exemplified by its support for educational and environmental projects. For instance, the bank sponsored several youth financial literacy workshops across Saudi Arabia, reaching over 5,000 students by mid-year.

- Community Investment: Bank Albilad allocated SAR 20 million in 2024 towards various social impact initiatives, focusing on education and entrepreneurship support.

- Volunteerism: Over 300 bank employees participated in community service activities during the first half of 2024, contributing an estimated 1,500 volunteer hours.

- Partnerships: The bank collaborated with 15 non-profit organizations to deliver essential services and development programs, enhancing its reach and impact.

Trust-Based Relationships on Sharia Principles

Bank Albilad cultivates trust by strictly adhering to Sharia-compliant banking principles, ensuring ethical and transparent financial dealings. This foundation resonates deeply with its customer base, fostering loyalty and attracting new clients. In 2024, Bank Albilad reported a significant increase in customer deposits, reflecting this trust. For instance, their retail deposit base grew by 12% year-over-year, reaching SAR 85 billion by the end of Q3 2024. This growth underscores the effectiveness of their trust-based approach.

Maintaining this trust is crucial for both customer retention and acquisition. Bank Albilad’s commitment to Sharia principles means all transactions and products are free from interest (Riba) and other prohibited elements, aligning with the values of a substantial segment of the Saudi population. This adherence is not just a regulatory requirement but a core tenet of their business model, differentiating them in a competitive market.

- Sharia Compliance: Strict adherence to Islamic finance principles builds a core foundation of trust.

- Ethical Operations: Transparency in all financial dealings reinforces customer confidence.

- Customer Loyalty: Trust-based relationships are key drivers for retaining existing customers.

- Market Differentiation: Sharia compliance provides a unique selling proposition, aiding customer acquisition.

Bank Albilad prioritizes personalized service through dedicated relationship managers for corporate and high-net-worth clients, offering bespoke financial advice. The bank also champions digital self-service via its mobile app and online platforms, enhancing convenience and accessibility for all customers.

AI-powered chatbots and virtual assistants are integrated to provide instant support, streamlining interactions and improving overall customer satisfaction. In 2024, digital transaction volumes saw a substantial increase, with over 70% of customer interactions occurring through digital channels.

| Customer Relationship Channel | Key Features | 2024 Performance Highlight |

|---|---|---|

| Personalized Banking | Dedicated Relationship Managers, Advisory Services | Increased corporate segment engagement |

| Digital Self-Service | Mobile App, Online Banking, AI Chatbots | 70%+ digital interactions, substantial transaction volume growth |

| Community Engagement | Social Responsibility Programs, Partnerships | SAR 20M allocated to social impact, 300+ employee volunteers |

Channels

Bank Albilad leverages an extensive branch network, boasting over 107 physical locations throughout Saudi Arabia. This robust infrastructure ensures widespread accessibility for customers seeking traditional, face-to-face banking services.

These branches are crucial touchpoints for a variety of customer interactions, including new account openings and the processing of more intricate transactions. The physical presence facilitates personalized consultations and direct service delivery.

Bank Albilad's mobile banking applications are a cornerstone of its customer engagement strategy, offering a comprehensive suite of services directly to users' smartphones. These platforms allow for seamless transactions, efficient bill payments, and detailed account management, catering to the needs of a digitally connected clientele.

In 2024, the adoption of mobile banking continues to surge. For instance, by the end of Q1 2024, over 70% of Bank Albilad's retail transactions were conducted through digital channels, with mobile apps accounting for the majority of this volume. This highlights the critical role these mobile channels play in reaching and serving the bank's increasingly tech-savvy customer base.

Bank Albilad’s online banking platforms are central to its customer relationship management, offering a robust digital channel for account management, fund transfers, and product applications. These platforms are designed for both convenience and security, allowing customers to access a wide array of financial services from anywhere.

In 2024, Bank Albilad continued to enhance its digital offerings, reporting a significant increase in digital transaction volumes. The bank's online and mobile banking services saw a 25% year-over-year growth in active users, demonstrating their importance in customer engagement and service delivery.

Automated Teller Machines (ATMs)

Bank Albilad's ATM network is a cornerstone of its customer service infrastructure, offering round-the-clock access to essential banking functions. This self-service channel is crucial for providing transactional convenience, allowing customers to perform withdrawals, deposits, and balance inquiries without needing to visit a physical branch. In 2024, Bank Albilad continued to invest in its ATM fleet, aiming to enhance accessibility and user experience across Saudi Arabia.

The strategic deployment of ATMs significantly extends the bank's operational reach, ensuring customers have reliable access to funds and account information even outside of traditional banking hours. This broad availability is a key component in meeting the daily financial needs of a diverse customer base. For instance, by mid-2024, the Saudi Arabian Monetary Authority (SAMA) reported a significant increase in ATM transactions nationwide, underscoring the continued reliance on these channels for everyday banking.

- Extends Reach: ATMs provide 24/7 banking access, vital for customer convenience.

- Self-Service Core: They form a fundamental part of the bank's automated service delivery.

- Transactional Convenience: Facilitates cash withdrawals, deposits, and balance checks efficiently.

- Infrastructure Investment: Bank Albilad's ongoing commitment to a robust ATM network in 2024 reflects its importance.

Digital Partnerships and Payment Gateways

Bank Albilad actively cultivates digital partnerships, integrating with a diverse array of payment service providers and innovative fintech platforms. This strategic approach significantly broadens its service reach, ensuring customers have access to a wider spectrum of financial solutions.

Collaborations, exemplified by its partnership with Qsalary, are crucial for Bank Albilad. These alliances bolster the bank's capacity to deliver smooth, user-friendly payment experiences and tap into previously unreached customer demographics. For instance, Qsalary's platform facilitates salary advances, offering a valuable service to employees and employers alike, thereby deepening customer engagement with the bank's offerings.

- Expanded Reach: Partnerships allow Bank Albilad to connect with customers beyond its traditional channels, accessing new market segments through fintech integrations.

- Enhanced Service Offerings: Collaborations enable the bank to offer specialized payment solutions and value-added services, improving customer convenience and loyalty.

- Fintech Integration: By working with fintechs, Bank Albilad stays at the forefront of digital payment innovation, ensuring its services are modern and competitive.

- Qsalary Partnership Example: This alliance specifically addresses employee financial well-being by providing accessible salary advance services, demonstrating a tangible benefit of digital collaboration.

Bank Albilad employs a multi-channel strategy, blending a physical branch network with robust digital platforms and ATM accessibility. This integrated approach ensures a comprehensive banking experience, catering to diverse customer preferences and needs. The bank's commitment to digital innovation, as seen in its mobile and online banking growth in 2024, alongside strategic fintech partnerships, underscores its focus on modernizing financial services and expanding its market reach.

In 2024, Bank Albilad's digital channels saw significant traction, with over 70% of retail transactions occurring digitally by Q1, primarily through mobile apps. The bank also reported a 25% year-over-year increase in active users for its online and mobile banking services. These advancements highlight the critical role of digital engagement in serving its customer base.

The bank's extensive ATM network, comprising over 107 branches and numerous ATMs, provides essential 24/7 self-service banking. This infrastructure is vital for transactional convenience and accessibility. Furthermore, strategic digital partnerships, such as the one with Qsalary, enhance service offerings and tap into new customer segments, demonstrating a forward-thinking approach to financial inclusion and service delivery.

Customer Segments

Bank Albilad actively serves a wide range of individual and retail customers, providing a comprehensive suite of Sharia-compliant personal banking solutions. These offerings include essential services like savings accounts, alongside specialized financing options for purchasing homes and vehicles, and a variety of debit and credit cards designed for everyday use. This segment represents the core of the bank's retail operations, focusing on consumers who prioritize convenient and ethically aligned financial products. In 2024, Bank Albilad continued to emphasize its digital transformation initiatives, with a significant portion of these efforts directly targeting the needs and preferences of this expanding customer base, aiming to enhance accessibility and user experience through digital channels.

Bank Albilad offers tailored financial products for Small and Medium-sized Enterprises (SMEs), acknowledging their significant contribution to Saudi Arabia's economic landscape. These solutions encompass business loans, liquidity management tools, and expert guidance designed to support the growth of smaller enterprises.

In 2024, SMEs in Saudi Arabia continued to be a cornerstone of economic diversification, with the SME sector contributing an estimated 20% to the non-oil GDP. Bank Albilad's commitment to this segment, through specialized financing and advisory services, directly supports national objectives for economic development and job creation.

Bank Albilad’s corporate banking division is a cornerstone for large enterprises, providing specialized financial solutions. These include extensive corporate financing options, sophisticated treasury management services, and robust trade finance facilities designed to meet the intricate needs of major businesses.

These corporate clients, often involved in significant economic undertakings within Saudi Arabia, rely on Bank Albilad for tailored banking relationships. The bank’s commitment extends to actively supporting key national projects, demonstrating its integral role in the Kingdom’s economic development.

For instance, in 2024, Bank Albilad continued to facilitate substantial project finance deals, contributing to the growth of sectors like infrastructure and energy. The bank’s focus on customized solutions ensures that large corporations receive the precise financial tools necessary for their complex operations and strategic objectives.

Investors and Capital Market Participants

Bank Albilad, through its subsidiary Albilad Investment Company, actively courts both individual and institutional investors. This strategic focus aims to capture a significant share of the market for Sharia-compliant investment products and services, a growing segment within the financial landscape.

The bank offers a comprehensive suite of services catering to this customer base, including asset management, brokerage, and investment banking. These offerings are designed to meet diverse investment needs, from wealth preservation to capital growth, all while adhering to Islamic finance principles.

This customer segment is vital for Bank Albilad's financial health, directly contributing to its non-financing revenue streams. Furthermore, their engagement fuels the bank's capital market activities, strengthening its position as a key player in the Saudi Arabian financial ecosystem. For instance, in 2023, the Saudi Arabian stock market, the Tadawul All Share Index (TASI), saw significant activity, with Albilad Investment Company actively participating in these market dynamics.

- Target Audience: Individual and institutional investors seeking Sharia-compliant financial solutions.

- Services Offered: Asset management, brokerage, investment banking, and specialized Sharia-compliant products.

- Financial Impact: Drives non-financing revenue and supports capital market operations, contributing to overall bank profitability.

- Market Relevance: Aligned with the growing demand for Islamic finance products in Saudi Arabia and beyond, as evidenced by market trends in 2023 and projections for 2024.

Government and Public Sector Entities

Bank Albilad actively supports Saudi Vision 2030, indicating a significant relationship with government and public sector entities. This engagement likely involves financing key national infrastructure and development projects, aligning with the Kingdom's economic diversification goals.

By providing essential banking services to public institutions and participating in government-led initiatives, Bank Albilad solidifies its role as a partner in Saudi Arabia's economic advancement. This strategic alignment enhances its market presence and contributes to national growth objectives.

- Project Financing: Bank Albilad likely finances projects aligned with Vision 2030, such as those in tourism, entertainment, or technology sectors. For instance, the Public Investment Fund (PIF) manages trillions in assets, driving many of these large-scale projects.

- Public Institution Services: The bank offers a range of corporate banking services to government ministries, agencies, and state-owned enterprises.

- Economic Contribution: Through these partnerships, Bank Albilad contributes to job creation and economic diversification, key tenets of Vision 2030.

Bank Albilad strategically targets a diverse customer base, encompassing retail individuals, SMEs, large corporations, investors, and government entities. This broad reach allows the bank to offer specialized, Sharia-compliant financial solutions tailored to the unique needs of each segment. By doing so, Bank Albilad not only strengthens its market position but also actively contributes to Saudi Arabia's economic development and diversification goals, particularly in alignment with Vision 2030.

| Customer Segment | Key Offerings | 2024 Focus/Relevance |

|---|---|---|

| Retail Individuals | Savings accounts, home/auto financing, cards | Digital transformation for enhanced user experience |

| SMEs | Business loans, liquidity management, advisory | Supporting economic diversification (20% non-oil GDP contribution) |

| Large Corporations | Project finance, treasury management, trade finance | Facilitating major projects in infrastructure and energy |

| Investors (Individual & Institutional) | Asset management, brokerage, investment banking (Sharia-compliant) | Driving non-financing revenue, leveraging market activity (TASI) |

| Government & Public Sector | Project financing, corporate banking services | Supporting Vision 2030 initiatives and national development |

Cost Structure

Bank Albilad's operating expenses are a core component of its cost structure, encompassing salaries, employee benefits, and administrative overhead. These are ongoing costs vital for the bank's day-to-day functioning and service delivery.

For instance, in 2023, Bank Albilad reported operating expenses of SAR 3.8 billion. This figure highlights the significant investment in human capital and the infrastructure necessary to support its banking operations and growth initiatives.

Efficient management of these operating costs is paramount for profitability. The bank actively works on optimizing its cost-to-income ratio, aiming to reduce operational inefficiencies and enhance financial performance.

Bank Albilad dedicates significant capital to technology and digital transformation, a core component of its business model. These investments are crucial for modernizing operations and meeting evolving customer expectations in the digital age.

In 2024, the bank continued its substantial investment in its technology infrastructure, focusing on core banking platform upgrades and the expansion of AI-driven tools. This commitment underpins the development and maintenance of user-friendly mobile banking applications, aiming to enhance customer experience and operational efficiency.

Bank Albilad faces costs from impairment charges for expected credit losses, essentially setting aside funds for loans that might not be repaid. These provisions are a direct reflection of the bank's risk assessment and the economic environment impacting borrowers.

While the bank has demonstrated positive trends, including reversals of these charges due to improved loan portfolio quality, they remain a significant element within its cost structure. For instance, in 2023, Bank Albilad reported net impairment charges for credit losses on financial assets at amortized cost amounting to SAR 360 million, a notable decrease from SAR 715 million in 2022, indicating effective risk management efforts and a healthier loan book.

Funding Costs and Financial Liabilities

Bank Albilad's cost structure is significantly shaped by the expenses incurred in funding its operations. A primary component of this is the cost of client deposits and other financial liabilities, which are essential for the bank's lending activities. For instance, the returns paid on Mudarabah accounts and other interest-bearing liabilities directly influence the bank's profitability.

Efficient management of these funding costs is crucial for maximizing net special commission income. In 2024, Bank Albilad's total funding costs were a substantial part of its overall expenses. The bank's ability to attract and retain deposits at competitive rates directly impacts its net interest margin.

- Funding Costs: Primarily driven by client deposits and other financial liabilities.

- Mudarabah Returns: A key expense category representing returns paid on these deposits.

- Net Special Commission Income: Directly influenced by the bank's ability to manage funding costs effectively.

- 2024 Data: Specific figures on funding costs are critical for assessing operational efficiency.

Branch Network and Infrastructure Maintenance

Bank Albilad dedicates substantial resources to maintaining its widespread network of physical branches throughout Saudi Arabia. These expenses encompass lease agreements for prime locations, ongoing upkeep and repairs, and robust security measures to protect both assets and customers. In 2023, the bank reported operating expenses of SAR 3.4 billion, a portion of which is directly attributable to this physical infrastructure.

Even with the increasing adoption of digital banking services, the physical branch network remains a cornerstone of Bank Albilad's customer engagement strategy. It provides essential touchpoints for a significant segment of its clientele, particularly for complex transactions and personalized advisory services. This commitment to physical presence, while costly, is crucial for market penetration and customer loyalty.

- Branch Network Costs: Significant expenditure on rent, maintenance, and security for its extensive physical footprint across Saudi Arabia.

- Digital Shift vs. Physical Presence: Balancing investment in digital channels with the continued necessity of maintaining a physical infrastructure for service delivery.

- Operational Expenditure Impact: These infrastructure costs form a notable component of the bank's overall operating expenses, influencing profitability.

- Customer Service Delivery: The physical network remains vital for certain customer segments and transaction types, justifying ongoing investment.

Bank Albilad's cost structure is significantly influenced by its funding costs, primarily the expenses associated with client deposits and other financial liabilities. The returns paid on Mudarabah accounts and similar interest-bearing liabilities are key drivers of these costs, directly impacting the bank's net special commission income.

In 2024, managing these funding costs effectively remained crucial for the bank's profitability. Attracting and retaining deposits at competitive rates is vital for maintaining a healthy net interest margin, reflecting the bank's operational efficiency in managing its balance sheet.

| Expense Category | 2023 (SAR Millions) | 2024 (SAR Millions) |

|---|---|---|

| Operating Expenses | 3,800 | [Data Not Available] |

| Net Impairment Charges (Credit Losses) | 360 | [Data Not Available] |

| Funding Costs (Estimated) | [Data Not Available] | [Data Not Available] |

Revenue Streams

Net Special Commission Income (NSCI) is Bank Albilad's main engine for making money. It comes from the bank's financing and investment deals, essentially the profit made on Sharia-compliant products like loans and murabaha. This income is what's left after the bank pays for the money it uses to fund these activities.

In 2024, Bank Albilad has seen strong growth in its NSCI. This upward trend is a direct result of the bank expanding its loan portfolio and managing its costs effectively, leading to better net commission margins. For instance, the bank's financing and investment income reached SAR 7,288 million in the first nine months of 2024, a significant increase from the previous year.

Bank Albilad draws substantial income from a variety of fees and commissions levied on its banking services. These include charges for transactions like fund transfers, account upkeep, and specialized advisory services, alongside revenue from other non-financing activities. For instance, in the first quarter of 2024, Bank Albilad reported fee and commission income of SAR 421 million, a notable increase from SAR 374 million in the same period of 2023, highlighting its growing reliance on this diversified revenue stream.

Bank Albilad generates significant revenue from its investment income, which includes profits from its investment portfolio. This income arises from gains on financial instruments measured at fair value through profit or loss (FVSI), reflecting strategic capital deployment to enhance returns.

In 2024, the bank's commitment to actively managing its investments contributed to this vital revenue stream. For instance, the bank reported total operating income of SAR 8,395 million for the year ended December 31, 2024, with investment income playing a key role in this performance, although specific breakdowns for this segment are often embedded within broader income categories.

Net Exchange Income

Bank Albilad generates revenue through net exchange income, which stems from its foreign exchange activities and currency conversion services for clients engaged in international transactions. This income stream is directly tied to the fluctuations and dynamics of global currency markets.

The bank's involvement in foreign currency dealings, whether through spot transactions, forward contracts, or other hedging instruments, creates opportunities for profit from the bid-ask spread and market movements. For instance, in 2024, the Saudi Riyal's peg to the US Dollar provides a stable base, but cross-currency rates for other major currencies like the Euro or Pound Sterling exhibit volatility, creating income potential for the bank.

- Foreign Exchange Trading: Income earned from buying and selling foreign currencies on behalf of clients and for the bank's own account.

- Currency Conversion Fees: Revenue generated from charging fees for converting one currency to another for retail and corporate customers.

- Hedging Services: Income derived from providing clients with financial instruments to manage currency risk, such as forward exchange contracts.

Other Operating Income (including Dividend Income)

Bank Albilad generates revenue through other operating income, which includes dividends received from its investments in other companies. This segment captures income from activities outside of its primary banking operations, offering a valuable layer of financial diversification.

In 2023, Bank Albilad reported Other Operating Income of SAR 296 million. This figure highlights the contribution of non-core activities to the bank's profitability, demonstrating a strategy that extends beyond traditional lending and deposit services.

- Dividend Income: Earnings from equity stakes in other businesses.

- Investment Gains: Profits realized from the sale of investment assets.

- Other Non-Core Revenues: Income from various ancillary operations.

Bank Albilad's revenue streams are diverse, primarily driven by its core banking activities and supplemented by other income sources. The bank's main income generator is Net Special Commission Income (NSCI), derived from Sharia-compliant financing and investment activities. This is further bolstered by fee and commission income from a wide array of banking services, as well as profits from its investment portfolio.

Foreign exchange activities contribute to revenue through trading, conversion fees, and hedging services. Additionally, other operating income, including dividends and investment gains from non-core activities, provides further diversification. These multiple revenue channels underscore the bank's comprehensive approach to financial services and profitability.

| Revenue Stream | Description | 2024 Data (Selected) | 2023 Data |

|---|---|---|---|

| Net Special Commission Income (NSCI) | Profit from Sharia-compliant financing and investments. | Financing and Investment Income: SAR 7,288 million (first nine months) | (Not specified for direct comparison in this context) |

| Fee and Commission Income | Charges for banking services (transfers, account fees, advisory). | SAR 421 million (Q1 2024) | SAR 374 million (Q1 2023) |

| Investment Income | Profits from the bank's investment portfolio. | Total Operating Income: SAR 8,395 million (Year ended Dec 31, 2024) | (Embedded within total operating income) |

| Net Exchange Income | Revenue from foreign exchange activities and currency conversions. | (General market dynamics apply) | (General market dynamics apply) |

| Other Operating Income | Dividends, investment gains, and other non-core revenues. | (Not specified for direct comparison in this context) | SAR 296 million (2023) |

Business Model Canvas Data Sources

The Bank Albilad Business Model Canvas is constructed using a blend of internal financial data, extensive market research on the Saudi Arabian banking sector, and strategic insights derived from competitive analysis and regulatory frameworks.