Bank Albilad Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Albilad Bundle

Bank Albilad navigates a dynamic banking landscape where customer loyalty is a significant factor, and the threat of new entrants, while present, is somewhat mitigated by regulatory hurdles. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Bank Albilad’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The banking sector, including institutions like Bank Albilad, often depends on a limited number of providers for essential services such as core banking systems and specialized financial data. This concentration means these suppliers can wield considerable influence, potentially dictating higher prices or less advantageous contract terms for banks.

For Bank Albilad, a concentrated supplier base for critical IT infrastructure and software solutions can translate into increased operational costs. For instance, the global market for core banking software is dominated by a few major players, and switching costs can be substantial, reinforcing supplier leverage.

The bargaining power of suppliers for Bank Albilad is significantly influenced by high switching costs associated with core banking systems and IT infrastructure. Changing these fundamental systems can incur substantial expenses and lead to considerable operational disruption, limiting the bank's ability to negotiate favorable terms.

The intricate integration processes and the inherent operational risks involved in migrating to new technology providers make it challenging for banks like Albilad to readily switch suppliers. This dependency grants existing IT and service vendors considerable leverage in their dealings with the bank.

The availability of Sharia-compliant solutions directly impacts the bargaining power of suppliers for Bank Albilad. Because the bank strictly adheres to Islamic finance principles, the number of suppliers offering compatible software, financial instruments, and expert advisory services is inherently limited. This specialization narrows the field of potential providers, giving those who can meet these specific Sharia requirements more leverage in negotiations.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers wield considerable influence over banks like Bank Albilad. This is due to the complex and ever-evolving legal landscape governing financial institutions, particularly in Saudi Arabia. Expertise in Saudi Central Bank (SAMA) regulations and Sharia compliance is paramount, making specialized legal, auditing, and consulting firms indispensable.

These suppliers, especially those with a proven track record and deep understanding of local nuances, can command higher fees and dictate terms. For instance, the cost of compliance consulting services for Saudi banks saw an upward trend in 2023, reflecting the demand for specialized knowledge. Bank Albilad's reliance on these providers for navigating SAMA directives and Islamic finance principles directly translates to increased bargaining power for these external entities.

- High demand for specialized compliance expertise

- Essential for adherence to SAMA regulations and Sharia principles

- Limited number of highly qualified providers

- Potential for increased service fees due to regulatory complexity

Talent Pool and Human Capital

The availability of skilled professionals, particularly in niche areas like Islamic finance, cybersecurity, and advanced data analytics, acts as a crucial supplier factor for Bank Albilad. A constrained supply of such talent grants these individuals and their training institutions considerable leverage, potentially escalating labor expenses and complicating the staffing of essential positions.

In 2024, the demand for specialized financial expertise continued to surge. For instance, reports indicated a global shortage of cybersecurity professionals, with the cybersecurity workforce gap estimated at 3.4 million in 2024. This scarcity directly impacts the cost of acquiring and retaining talent for banks like Albilad.

- Talent Scarcity: Limited availability of experts in Islamic finance and digital banking technologies increases their bargaining power.

- Rising Labor Costs: High demand for specialized skills, like AI and data science in finance, drives up salaries and benefits, impacting operational costs.

- Training Institutions as Suppliers: Universities and specialized training providers offering in-demand financial skills can command higher fees for their programs.

- Impact on Staffing: Difficulty in filling critical roles due to talent shortages can lead to project delays and increased recruitment expenses for Bank Albilad.

The bargaining power of suppliers for Bank Albilad is amplified by the limited availability of specialized IT infrastructure and core banking software providers. High switching costs associated with these critical systems, estimated to be millions of dollars for major banking platforms, mean that banks are often locked into existing relationships, granting vendors significant leverage. This dependence can lead to higher prices for software licenses, maintenance, and upgrades, directly impacting Bank Albilad's operational expenses.

Furthermore, the need for Sharia-compliant financial solutions narrows the supplier pool, giving providers who can meet these specific requirements greater pricing power. Similarly, the scarcity of highly skilled professionals in areas like cybersecurity and Islamic finance, with a global cybersecurity workforce gap of 3.4 million in 2024, drives up labor costs for banks, as they compete for limited talent.

| Supplier Category | Key Dependency for Bank Albilad | Impact on Bargaining Power | Illustrative 2024 Data Point |

|---|---|---|---|

| Core Banking System Providers | Essential for all banking operations | High; significant switching costs and integration complexity | Switching costs for enterprise banking software can range from $50M to $500M+ |

| Sharia-Compliant Software Vendors | Adherence to Islamic finance principles | High; limited specialized providers | N/A (Specific market data not publicly available, but niche nature implies higher power) |

| Regulatory Compliance Consultants | Navigating Saudi Central Bank (SAMA) regulations | High; specialized knowledge and limited qualified firms | Consulting fees for financial compliance in Saudi Arabia increased by an estimated 5-10% in 2023 |

| Specialized IT Talent Providers | Cybersecurity, AI, Data Analytics expertise | High; global talent shortages | Global cybersecurity workforce gap estimated at 3.4 million in 2024 |

What is included in the product

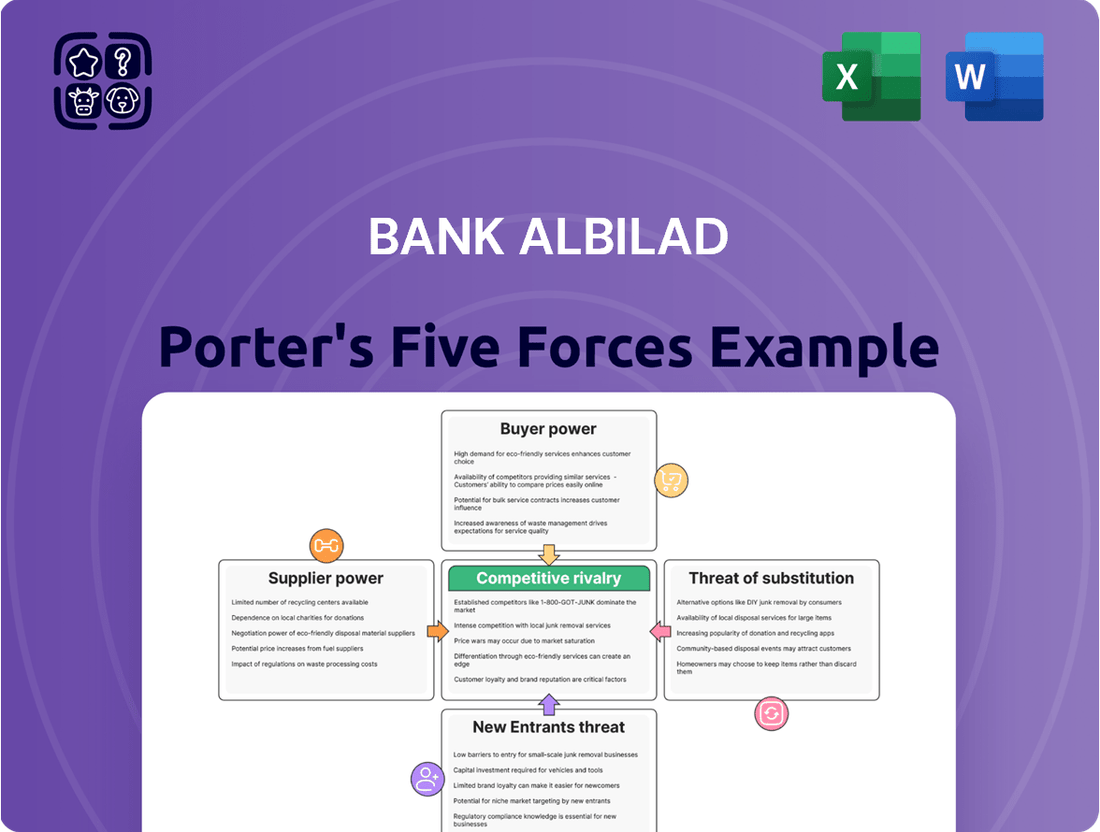

This Porter's Five Forces analysis for Bank Albilad provides a comprehensive examination of the competitive forces shaping its operating environment, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Instantly identify and mitigate competitive threats by visualizing Bank Albilad's Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

Customer price sensitivity is a significant factor in retail banking, where individuals and businesses readily compare interest rates on loans, profit rates on deposits, and service fees across different institutions. In 2024, for instance, the Saudi Central Bank (SAMA) reported average personal loan interest rates hovering around 5-7%, a figure customers actively monitor when choosing a provider. If Bank Albilad's offerings are perceived as similar to competitors, customers wield more power to switch for better pricing, impacting the bank's profitability.

Customers face low switching costs when choosing a bank, especially with the rise of digital banking. Initiatives like open banking in Saudi Arabia are making it even simpler to move accounts and services. For instance, by mid-2024, over 60% of Saudi banking customers were actively using digital channels, highlighting the ease of accessing and transferring financial information.

Customers today have unprecedented access to information about banking products, services, and what competitors offer. This is largely thanks to online platforms, comparison sites, and handy mobile apps. This transparency means customers can easily compare options and pick the best deals, giving them more sway.

The rise of digital banking is a major factor. In Saudi Arabia, for instance, a 2024 survey revealed that a significant 81% of people use mobile apps to manage their banking. This widespread adoption of digital channels further amplifies the customer's ability to research and choose, directly impacting their bargaining power with institutions like Bank Albilad.

Customer Segmentation and Product Differentiation

Bank Albilad's customer segmentation, serving individuals, businesses, and corporations with Sharia-compliant offerings, provides a degree of differentiation. However, within these broad segments, customers often have multiple banking options. For instance, Saudi Arabia's banking sector is competitive, with major players like Al Rajhi Bank and National Commercial Bank also offering Sharia-compliant services, presenting customers with choices.

The bank's ability to develop truly unique and value-added Sharia-compliant products is crucial in mitigating customer bargaining power. If Bank Albilad can consistently offer distinct features or superior service that competitors cannot easily replicate, customers are less likely to switch based on minor price variations. This is particularly relevant as the Saudi Vision 2030 economic diversification plan encourages financial innovation.

Conversely, a perceived lack of significant differentiation among Sharia-compliant products can empower customers. In such scenarios, customers may default to choosing providers based on convenience, existing relationships, or marginal differences in fees or profit rates. For example, while Bank Albilad reported a net profit of SAR 2,276 million in 2023, a 10.7% increase from 2022, the overall market offerings influence customer perception of uniqueness.

- Customer Choice: Despite catering to specific segments with Sharia-compliant products, Bank Albilad faces competition from other Saudi banks offering similar services, giving customers options.

- Differentiation Impact: The strength of Bank Albilad's unique product features directly influences how much bargaining power customers wield; greater differentiation reduces this power.

- Market Dynamics: In 2023, Saudi banks collectively saw significant growth, with total assets reaching SAR 3.7 trillion, indicating a robust market where customer choice is a key factor.

- Value Proposition: If customers perceive minimal differences in value or service among Sharia-compliant banks, they are more prone to select based on convenience or minor cost advantages.

Large Customer Base and Diversification

Bank Albilad benefits from a broad and diversified customer base spanning retail, corporate, and investment banking. This widespread customer distribution, with client deposits reaching SAR 121.77 billion by the close of December 2024, a 7.93% year-over-year increase, generally dilutes the bargaining power of any single customer or small group of customers.

However, the bank's overall customer bargaining power is also influenced by the concentration within specific segments.

- Diversified Revenue Streams: A large and varied customer base across retail, corporate, and investment banking segments helps mitigate the impact of any single customer's demands.

- Deposit Growth: Bank Albilad's client deposits grew to SAR 121.77 billion by the end of December 2024, reflecting an increase of 7.93% compared to the previous year.

- Segment Concentration Risk: If a significant portion of revenue originates from a few large corporate clients, these clients would possess considerably higher bargaining power.

- Customer Loyalty: The bank's ability to maintain customer loyalty across its diverse offerings can further reduce individual customer bargaining leverage.

Customers' bargaining power at Bank Albilad is amplified by the availability of numerous banking alternatives in Saudi Arabia, a market characterized by intense competition. The ease with which customers can switch providers, particularly with the growth of digital banking and open banking initiatives, further strengthens their position. This means Bank Albilad must continually offer competitive pricing and superior service to retain its clientele.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024 unless specified) |

|---|---|---|

| Availability of Alternatives | High | Saudi banking sector assets SAR 3.7 trillion (2023); multiple Sharia-compliant providers. |

| Switching Costs | Low | Over 60% of Saudi banking customers using digital channels; open banking initiatives. |

| Information Availability | High | Widespread use of online platforms and comparison sites. |

| Digital Adoption | High | 81% of Saudi users manage banking via mobile apps. |

| Product Differentiation | Moderate to High | Bank Albilad's net profit SAR 2,276 million (2023); differentiation is key to mitigating power. |

| Customer Base Diversification | Lowers individual power | Client deposits SAR 121.77 billion (end Dec 2024), up 7.93% YoY. |

Preview Before You Purchase

Bank Albilad Porter's Five Forces Analysis

This preview shows the exact Bank Albilad Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the Saudi Arabian banking sector. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors, all presented in a professionally formatted document ready for immediate use.

Rivalry Among Competitors

The Saudi Arabian banking sector is quite crowded, featuring numerous large conventional and Islamic banks. This significant number of competitors, especially those of similar scale and market dominance, naturally ramps up the competition as they all target the same pool of customers.

This intense rivalry often translates into banks offering more aggressive pricing strategies, boosting their marketing efforts, and facing pressure on their profit margins. For instance, the top 10 listed Saudi banks demonstrated robust financial results in the first quarter of 2025, indicating a dynamic and competitive market where efficiency and customer acquisition are key.

While the Saudi Arabian economy and its banking sector are on an upward trajectory, fueled by ambitious Vision 2030 initiatives and a burgeoning non-oil economy, the landscape is not without its competitive pressures. Even in these growth phases, rivalry can intensify, especially in specific market segments or during periods of economic recalibration, leading to more aggressive customer acquisition and retention strategies among financial institutions.

The Saudi banking sector is projected to maintain its profitability through 2025, bolstered by robust credit expansion. Lending growth is anticipated to remain strong, with estimates pointing to a healthy rate of around 10%.

Product and service differentiation in the Saudi banking sector presents a complex challenge for Bank Albilad. While its core offering is Sharia-compliant services, this is a foundational element shared by numerous other Islamic banks operating within the Kingdom, limiting its distinctiveness on this front alone.

The real battle for differentiation lies in areas like digital innovation and customer experience. For instance, by the end of 2023, Saudi banks collectively saw a significant increase in digital transactions, with mobile banking becoming increasingly dominant. Bank Albilad's ability to offer truly superior digital platforms, highly personalized customer interactions, or unique product features beyond mere compliance will be crucial in mitigating intense competitive rivalry.

Switching Costs for Banks' Customers

Lower switching costs for Bank Albilad’s customers significantly intensify competitive rivalry. When it’s simple for individuals and businesses to move their accounts and services to a competitor, banks face continuous pressure to offer attractive rates and superior service to retain their client base. This ease of movement is a major driver of competition in the banking sector.

The rapid advancement and widespread adoption of smartphone banking and digital platforms have dramatically lowered these switching costs. Customers can now open new accounts, transfer funds, and manage their finances with a few taps on their mobile devices, making the process nearly instantaneous and virtually eliminating the friction that once deterred account changes. For instance, in 2024, the global adoption rate of mobile banking services continued to climb, with many regions reporting over 70% of banking transactions occurring digitally, highlighting the ease with which customers can navigate between financial institutions.

- Digital Onboarding: Many banks now offer digital onboarding processes that can take as little as five minutes, allowing customers to switch providers with minimal effort.

- Interoperability: Features like instant payment systems and easy direct debit management further reduce the hassle of moving banking relationships.

- Customer Acquisition Costs: Banks often offer attractive sign-up bonuses and introductory rates to lure customers away from competitors, a direct consequence of low switching costs. In 2023, some neobanks reported customer acquisition costs as low as $20-$50 per new customer, a testament to the efficiency of digital switching.

Regulatory Environment and Vision 2030 Initiatives

The Saudi Central Bank (SAMA) is actively fostering competition and innovation within the banking sector. Reforms include licensing new digital banks and supporting fintech advancements, directly impacting competitive rivalry.

These SAMA-driven initiatives, aligned with Vision 2030, are designed to lower entry barriers for new financial entities. This creates a more dynamic and intensely competitive landscape for established institutions like Bank Albilad.

- Increased Competition: SAMA's licensing of new digital banks and fintechs intensifies rivalry.

- Lowered Barriers to Entry: Regulatory reforms make it easier for new players to enter the market.

- Vision 2030 Alignment: Initiatives support the broader economic diversification goals of Saudi Arabia.

- Market Growth: The Saudi financial ecosystem reached a significant $267 billion milestone in 2024, indicating expansion and potential for new entrants.

Competitive rivalry within the Saudi banking sector is notably high, driven by a substantial number of large, established institutions and the increasing presence of digital-only players. This intense competition forces banks like Bank Albilad to constantly innovate and offer attractive terms to retain and attract customers. The ease with which customers can switch between banks, facilitated by digital platforms, further exacerbates this rivalry, pushing institutions to focus on superior customer experience and unique product offerings.

| Metric | 2023 Value | 2024 Projection | 2025 Projection |

|---|---|---|---|

| Saudi Banking Sector Lending Growth | ~9% | ~10% | ~10% |

| Digital Transactions Share (Global Average) | ~65% | ~70%+ | ~75%+ |

| Saudi Financial Ecosystem Value | $250 Billion (approx.) | $267 Billion (approx.) | $285 Billion (approx.) |

SSubstitutes Threaten

The growing popularity of digital payment solutions, including e-wallets and Buy Now, Pay Later (BNPL) services, poses a substantial threat to traditional banking. These alternatives provide enhanced convenience and often more competitive pricing, diminishing the reliance on conventional bank accounts and credit cards for many everyday transactions.

In Saudi Arabia, the digital banking sector is experiencing rapid growth, with its market size projected to increase from USD 87.60 Million in 2024 to USD 278.19 Million by 2033. This trend is further supported by the fact that electronic payments already constitute a significant portion of retail transactions, reaching 70% of the total in 2023.

Various non-bank financial institutions (NBFIs) present a significant threat of substitution to traditional banks. These include specialized financing companies, innovative peer-to-peer lending platforms, and agile asset management firms. They often provide tailored solutions for loans, investments, and wealth management, directly competing for customer business.

The growing landscape of NBFIs means customers have more choices beyond conventional banking. For instance, by the close of 2024, the Saudi Central Bank (SAMA) had licensed 62 finance companies, indicating a robust and expanding alternative financial sector. This diversification allows consumers and businesses to seek out services that may be more efficient or cost-effective than those offered by full-service banks, thereby diverting potential revenue streams.

Larger corporations often have the option to bypass traditional bank lending by accessing capital markets directly. This can be achieved through issuing corporate bonds, including Sharia-compliant Sukuk, or by offering new equity. For instance, in 2023, Saudi companies successfully raised billions through IPOs and sukuk issuances, demonstrating the growing viability of these direct financing channels.

As Saudi Arabia's capital markets continue to mature and become more accessible, an increasing number of companies are likely to leverage these avenues for their funding needs. This trend directly substitutes for the need for conventional bank loans, potentially reducing the market share of traditional lenders like Bank Albilad. The Capital Market Authority's recent initiatives, such as approving omnibus accounts and easing debt offering regulations, further encourage this shift towards direct corporate financing.

Internal Corporate Financing

Large corporations with robust cash reserves can opt for internal financing, bypassing the need for bank loans. This self-funding capability directly substitutes for traditional corporate financing, diminishing the demand for bank services among these entities. For instance, Saudi Aramco, a major player in the Saudi economy, often utilizes its significant retained earnings for capital expenditures, reducing its reliance on external debt financing.

This trend is amplified for established, cash-rich companies that generate substantial free cash flow. In 2024, many large industrial and energy companies reported strong earnings, enabling them to fund growth initiatives internally. This reduces the volume of corporate lending opportunities available to banks.

- Internal financing as a substitute for corporate loans

- Reduced demand for traditional banking services from cash-rich corporations

- Well-established, financially sound entities are more prone to self-financing

- Significant cash flows in 2024 enabled many large companies to fund projects internally

Emergence of Crypto and Blockchain-based Finance

The emergence of crypto and blockchain-based finance presents a potential, albeit currently limited, threat of substitution for traditional banking services. While cryptocurrencies and tokenized assets are prohibited in Saudi Arabia as of 2024, with no regulatory framework established, the underlying decentralized finance (DeFi) technologies could eventually offer alternative avenues for transactions, lending, and investments. These nascent technologies, if they mature and gain regulatory acceptance, could bypass traditional banking intermediaries.

The long-term disruptive potential lies in DeFi's ability to offer peer-to-peer financial services. For instance, decentralized lending platforms could provide alternatives to bank loans, and tokenized assets might offer new investment vehicles. However, the current regulatory stance in Saudi Arabia, prohibiting crypto and tokenized assets, significantly mitigates this threat in the immediate to medium term. The global DeFi market capitalization, while volatile, reached hundreds of billions of dollars in recent years, indicating the underlying technological promise.

- Regulatory Prohibition: Cryptocurrencies and tokenized assets are currently banned in Saudi Arabia, with no established regulatory framework as of 2024.

- Nascent Technology: Decentralized Finance (DeFi) and blockchain solutions are still in early stages of development and adoption globally.

- Potential Disruption: If regulations evolve, DeFi could offer alternative transaction, lending, and investment channels, bypassing traditional banks.

- Market Indicators: Global DeFi market capitalization has shown significant growth in recent years, highlighting the underlying technological potential.

The threat of substitutes for Bank Albilad is significant, driven by the rise of digital payment solutions and non-bank financial institutions (NBFIs). Digital wallets and Buy Now, Pay Later services are increasingly preferred for their convenience, impacting traditional banking services. Saudi Arabia's digital banking market is projected to grow substantially, from USD 87.60 million in 2024 to USD 278.19 million by 2033, with electronic payments already dominating retail transactions at 70% in 2023.

NBFIs, including specialized lenders and peer-to-peer platforms, offer tailored financial products that directly compete with banks. The Saudi Central Bank had licensed 62 finance companies by the end of 2024, underscoring the expanding alternative financial landscape. This diversification allows customers to find more efficient or cost-effective services elsewhere, diverting revenue from traditional banks.

Corporations also present a substitute threat by accessing capital markets directly through bond issuances or equity offerings, bypassing bank loans. In 2023, Saudi companies raised billions via IPOs and sukuk, demonstrating the viability of these direct financing channels. Furthermore, cash-rich companies can utilize internal financing, reducing their reliance on bank lending. For example, major industrial and energy firms in 2024 reported strong earnings, enabling internal funding for growth initiatives.

| Substitute Type | Description | Impact on Banks | 2023/2024 Data Point | Future Trend |

|---|---|---|---|---|

| Digital Payments | E-wallets, BNPL services | Reduced transaction fees, lower demand for traditional accounts | 70% of retail transactions were electronic in 2023 | Growing adoption, especially among younger demographics |

| Non-Bank Financial Institutions (NBFIs) | P2P lending, specialized finance companies | Competition for loans and investments, loss of market share | 62 finance companies licensed by SAMA by end of 2024 | Increasing diversification and specialization of services |

| Capital Markets Access | Corporate bonds, equity offerings | Reduced corporate lending opportunities | Billions raised by Saudi companies via IPOs and sukuk in 2023 | Maturing markets offer more direct financing options |

| Internal Financing | Using retained earnings for capital expenditures | Lower demand for corporate loans from cash-rich companies | Strong earnings reported by large industrial/energy firms in 2024 | Established companies with robust cash flow prioritize self-funding |

Entrants Threaten

The threat of new entrants in the Saudi banking sector is significantly mitigated by stringent regulatory barriers and demanding licensing requirements. Securing a banking license in Saudi Arabia is a complex, capital-intensive undertaking, designed to safeguard financial stability.

The Saudi Central Bank (SAMA) actively manages new entries, and while it has permitted new digital banks, the overall regulatory landscape presents a substantial challenge for potential new players. As of March 2025, SAMA had licensed a total of 65 finance companies, underscoring the controlled nature of market entry.

Establishing a bank, like Bank Albilad, demands immense capital. Think about the costs for physical branches, advanced IT systems, and meeting strict regulatory demands. In 2024, the global banking sector saw significant investments in digital transformation, with major banks allocating billions to upgrade their technological infrastructure, further escalating these entry barriers.

This massive financial commitment serves as a formidable hurdle for any aspiring new player. It effectively filters out those without substantial backing, ensuring that only financially robust organizations can realistically contemplate entering the banking market, thereby protecting incumbent institutions.

Bank Albilad benefits from strong brand loyalty and deeply ingrained customer trust, cultivated through years of reliable service. Newcomers must invest heavily in marketing and offer compelling incentives to sway customers from established institutions, a significant hurdle in the Saudi banking sector.

Overcoming this loyalty is a major barrier; a 2024 survey revealed that while Saudi consumers are increasingly comfortable with digital banking, trust in established brands remains a powerful factor in their choices.

Access to Distribution Channels and Technology

New entrants face significant hurdles in accessing established distribution channels, particularly physical branch networks. Bank Albilad, for instance, has invested heavily in its extensive branch and ATM infrastructure, creating a strong physical presence. This requires considerable capital and time to replicate, giving incumbents a distinct advantage in customer reach.

While digital-only banks can bypass the need for physical branches, they still require substantial investment in secure and robust technology. This includes developing user-friendly mobile applications, secure payment gateways, and sophisticated data analytics capabilities. The cost and complexity of building and maintaining such digital infrastructure can be a barrier for new players.

Established banks like Bank Albilad benefit from existing customer relationships and a higher degree of technological maturity. In 2024, Saudi Arabia's banking sector continued its digital transformation, with traditional banks actively upgrading their digital offerings to compete with emerging fintechs. This ongoing investment in technology by incumbents further solidifies their competitive position.

- Substantial Investment: Replicating Bank Albilad's extensive branch network and digital channels requires significant capital outlay and considerable time.

- Digital Infrastructure Costs: New digital banks must invest heavily in secure, reliable, and advanced technological infrastructure to compete.

- Incumbent Advantages: Established banks possess existing customer bases and a more mature technological foundation, providing a competitive edge.

- Digital Adoption in KSA: While digital banking adoption is high in Saudi Arabia, traditional banks are also enhancing their digital services, intensifying competition.

Sharia-Compliant Niche and Expertise

New entrants into Bank Albilad's market face a significant hurdle due to the specialized nature of Sharia-compliant finance. Beyond standard banking regulations, they must demonstrate a deep understanding of Islamic principles, requiring unique governance frameworks and product development expertise. This specialized knowledge acts as a barrier, limiting the number of institutions equipped to compete directly in this niche.

The Islamic finance sector, particularly in Saudi Arabia, is a dominant global player, with the Kingdom holding a substantial share of the worldwide Islamic finance market. This established dominance, coupled with the stringent Sharia compliance requirements, can deter conventional banks from entering the Islamic finance space without significant adaptation, thereby reducing the overall threat of new entrants.

- Specialized Knowledge: Adherence to Sharia principles necessitates distinct expertise in financial structuring and operations.

- Governance Requirements: New entrants must establish Sharia supervisory boards and comply with specific governance mandates.

- Product Development: Creating Sharia-compliant products requires a unique approach to innovation and risk management.

- Market Dominance: Saudi Arabia's leading position in global Islamic finance presents a high barrier for newcomers.

The threat of new entrants for Bank Albilad is low due to high capital requirements, stringent regulations from the Saudi Central Bank (SAMA), and the need for specialized Sharia compliance expertise. These factors create substantial barriers to entry, demanding significant investment in infrastructure, technology, and adherence to unique governance structures.

New players must overcome established brand loyalty and extensive distribution networks, which incumbents like Bank Albilad have cultivated over time. The considerable financial commitment and specialized knowledge required to operate within Saudi Arabia's dominant Islamic finance sector further deter potential competitors, ensuring a protected market for existing institutions.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | Stringent licensing and compliance with SAMA regulations. | High barrier, requiring extensive legal and financial resources. |

| Capital Intensity | Significant investment in branches, IT, and operations. | High barrier, demanding substantial financial backing. |

| Brand Loyalty & Trust | Established customer relationships and reputation. | High barrier, requiring extensive marketing and incentives to attract customers. |

| Sharia Compliance Expertise | Deep understanding of Islamic finance principles and governance. | High barrier, limiting entry to specialized institutions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank Albilad is built upon a foundation of publicly available financial statements, annual reports, and investor relations disclosures. We also incorporate insights from reputable industry research reports and Saudi Central Bank (SAMA) regulatory filings to ensure a comprehensive understanding of the competitive landscape.