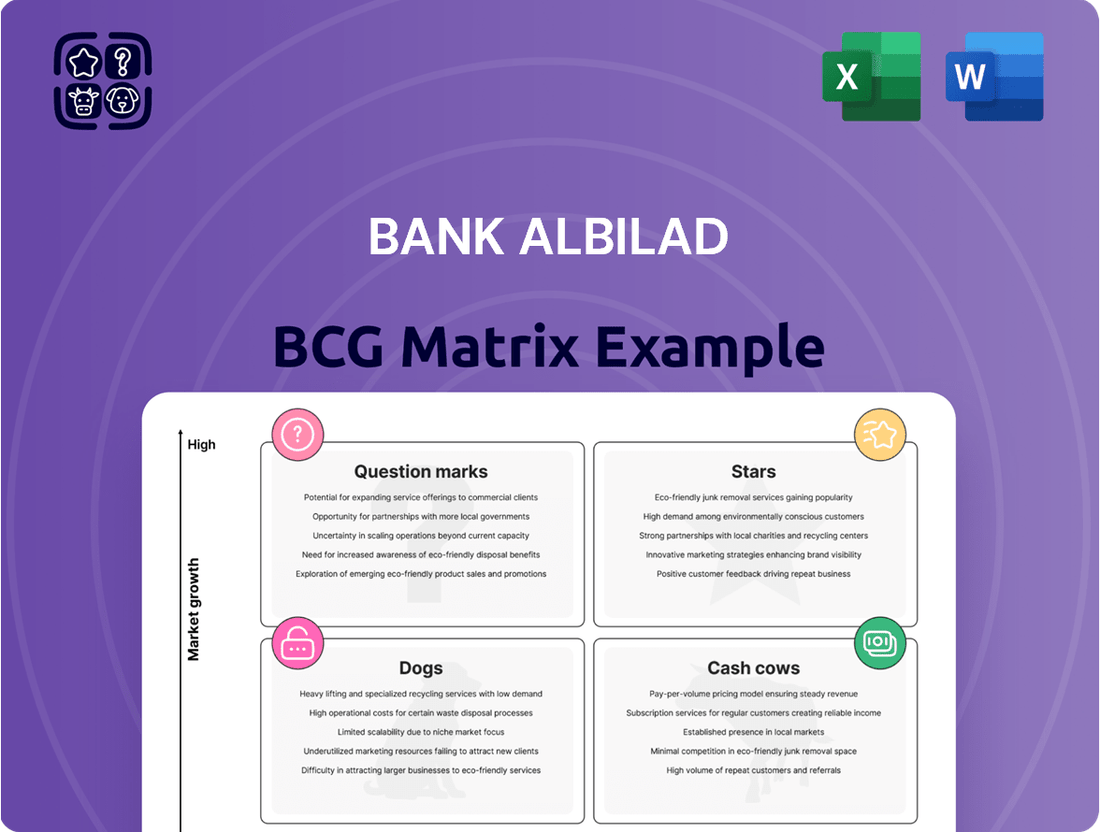

Bank Albilad Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Albilad Bundle

Uncover the strategic positioning of Bank Albilad's product portfolio through its BCG Matrix. See which offerings are driving growth and which require careful consideration. This glimpse is just the beginning of understanding their market dynamics.

Purchase the full Bank Albilad BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with data-backed insights and actionable strategies to optimize your investment and product decisions.

Stars

Bank Albilad's digital banking and mobile app services are a clear star in its BCG Matrix. The bank's significant investment in digital transformation, including AI-powered customer service, has fueled a notable 9.8% rise in retail banking revenue during 2024. This digital-first approach is clearly resonating with customers, as evidenced by 71% of new retail customers onboarding through digital channels, showcasing robust market penetration and growth potential.

Bank Albilad's strategic commitment to financing Small and Medium-sized Enterprises (SMEs) directly supports Saudi Arabia's Vision 2030, particularly its goals for economic diversification and private sector growth. This focus positions the bank to benefit from a sector experiencing significant expansion within the Saudi economy.

The bank's expanding loan portfolios and established market presence demonstrate its leadership in SME financing. For instance, in 2023, Bank Albilad reported a notable increase in its SME loan book, reflecting a robust strategy to capture this high-potential market segment.

This deliberate emphasis on SME lending is a key driver for the bank's projected overall credit growth. As SMEs continue to expand and contribute more to the national GDP, Bank Albilad is well-positioned to capitalize on this trend, anticipating continued strong performance in this area through 2024 and beyond.

Bank Albilad's strategic focus on infrastructure and real estate financing aligns perfectly with Saudi Arabia's Vision 2030, a key driver for significant growth in these sectors. The bank is well-positioned to capitalize on substantial government-led investments, which are expected to boost loan portfolios and generate fee-based income.

This strategic exposure translates into a balanced lending mix, with a notable presence in mortgages. For instance, in 2023, the Saudi real estate sector saw a 15% increase in mortgage financing compared to 2022, a trend that benefits banks like Albilad, especially with the current environment of declining interest rates.

Sharia-Compliant Investment Products

Bank Albilad, as a Sharia-compliant institution, has developed a robust suite of investment products designed for a discerning and expanding market. This focus on ethical finance resonates with a significant customer base.

The performance of these Sharia-compliant offerings is demonstrably strong, as evidenced by a notable 15.67% increase in net income from investment assets during 2024. This growth underscores the market's positive reception and the effectiveness of Bank Albilad's strategy in this segment.

- Sharia-Compliant Offerings: Bank Albilad provides investment products adhering to Islamic financial principles, serving a niche yet growing market.

- 2024 Performance: The bank reported a 15.67% rise in net income from investment assets in 2024, highlighting strong demand and successful product performance.

- Innovative Products: The 'Proxy Investment' account exemplifies the bank's commitment to innovation, offering competitive returns within the Sharia-compliant framework.

Regional Expansion and Cross-border Services

Bank Albilad's strategic push into the Gulf Cooperation Council (GCC) region, facilitated by partnerships and the development of cross-border services, positions it for significant growth. This expansion diversifies its revenue base, moving beyond reliance solely on the Saudi domestic market. By leveraging regional economic opportunities, the bank is targeting a high-growth, high-potential segment.

This regional expansion is crucial for Bank Albilad's future. For instance, in 2023, the bank reported a net profit of SAR 1.5 billion, a 13.7% increase year-on-year, demonstrating its ability to grow even within its existing markets. Expanding into neighboring GCC countries could amplify this growth trajectory.

- GCC Market Penetration: Bank Albilad is actively exploring opportunities to establish a stronger presence in key GCC markets, aiming to replicate its domestic success.

- Partnership Strategies: The bank is forming strategic alliances with regional financial institutions to streamline cross-border transactions and offer integrated services.

- Revenue Diversification: By tapping into the economic growth of the GCC, Bank Albilad aims to create new income streams and reduce its exposure to single-market risks.

- Future Growth Potential: This proactive regional strategy is indicative of a forward-looking approach, targeting areas with substantial untapped potential for financial services.

Bank Albilad's digital banking and mobile app services are a clear star in its BCG Matrix. The bank's significant investment in digital transformation, including AI-powered customer service, has fueled a notable 9.8% rise in retail banking revenue during 2024. This digital-first approach is clearly resonating with customers, as evidenced by 71% of new retail customers onboarding through digital channels, showcasing robust market penetration and growth potential.

The bank's strategic focus on infrastructure and real estate financing aligns perfectly with Saudi Arabia's Vision 2030, a key driver for significant growth in these sectors. The bank is well-positioned to capitalize on substantial government-led investments, which are expected to boost loan portfolios and generate fee-based income. This strategic exposure translates into a balanced lending mix, with a notable presence in mortgages. For instance, in 2023, the Saudi real estate sector saw a 15% increase in mortgage financing compared to 2022, a trend that benefits banks like Albilad, especially with the current environment of declining interest rates.

Bank Albilad, as a Sharia-compliant institution, has developed a robust suite of investment products designed for a discerning and expanding market. This focus on ethical finance resonates with a significant customer base. The performance of these Sharia-compliant offerings is demonstrably strong, as evidenced by a notable 15.67% increase in net income from investment assets during 2024. This growth underscores the market's positive reception and the effectiveness of Bank Albilad's strategy in this segment.

Bank Albilad's strategic push into the Gulf Cooperation Council (GCC) region, facilitated by partnerships and the development of cross-border services, positions it for significant growth. This expansion diversifies its revenue base, moving beyond reliance solely on the Saudi domestic market. By leveraging regional economic opportunities, the bank is targeting a high-growth, high-potential segment.

| Business Segment | BCG Category | 2024 Performance Highlight | Strategic Importance |

|---|---|---|---|

| Digital Banking & Mobile App | Star | 9.8% rise in retail banking revenue; 71% new retail customers via digital channels | High market share, high growth potential; customer acquisition and engagement |

| Infrastructure & Real Estate Financing | Star | Benefits from 15% rise in Saudi mortgage financing (2023 vs 2022) | Alignment with Vision 2030, capitalizes on government investment |

| Sharia-Compliant Offerings | Star | 15.67% increase in net income from investment assets (2024) | Serves a growing niche market, strong product performance |

| GCC Market Expansion | Star | 13.7% year-on-year net profit increase (2023) to SAR 1.5 billion | Revenue diversification, access to new high-growth markets |

What is included in the product

Strategic allocation of resources, identifying Stars for growth and Cash Cows for funding, while assessing Question Marks and Dogs for divestment or repositioning.

The Bank Albilad BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis.

Cash Cows

Bank Albilad's traditional retail banking services, including deposits and financing, are a cornerstone of its business, acting as a stable cash cow. This segment boasts a significant market share and has demonstrated robust growth, with client deposits reaching SAR 122.34 billion by September 2024, underscoring strong customer confidence and market penetration.

While the growth prospects for this mature segment are relatively modest, its consistent and substantial cash flow generation, coupled with high profitability, makes it a vital contributor to the bank's overall financial health. This reliable income stream allows for reinvestment in other areas of the business or distribution to shareholders.

Bank Albilad's corporate banking services, encompassing deposits and trade finance, represent a strong Cash Cow. This mature segment consistently generates significant cash flow, underpinning the bank's overall financial stability.

Despite recent moderation in corporate loan expansion, this division remains a crucial engine for the bank's lending activities and a reliable income stream. For instance, in 2024, corporate deposits formed a substantial portion of the bank's funding base, contributing to its robust liquidity position.

Bank Albilad's Treasury and Money Market Services function as a classic Cash Cow within its BCG matrix. These operations, deeply embedded in Saudi Arabia's stable financial landscape, consistently generate substantial and predictable revenue streams. The division leverages its expertise in managing liquidity and executing transactions to provide essential services to corporate clients and other financial institutions.

In 2024, Bank Albilad's treasury operations likely benefited from a robust economic environment in Saudi Arabia, characterized by strong non-oil GDP growth. The bank's prudent management of its investment portfolio, focusing on secure and yield-generating instruments, directly fuels the cash generation for this segment, underpinning its Cash Cow status.

Established Branch Network

Bank Albilad's established branch network, boasting over 107 locations across Saudi Arabia, represents a significant Cash Cow. This extensive physical presence is crucial for customer acquisition and service, even as digital channels evolve. The network underpins a stable, high market share in traditional banking services.

This widespread physical footprint directly contributes to deposit growth and customer retention. In 2024, the bank continued to leverage this network for its core banking operations.

- 107+ Branches: A substantial physical footprint across Saudi Arabia.

- Customer Acquisition & Service: A reliable channel for attracting and serving customers.

- Deposit Growth: Supports a stable base for funding and growth.

- Traditional Banking Strength: Reinforces market share in established banking segments.

Fee and Commission Income

Fee and commission income represents a significant portion of Bank Albilad's operating income, acting as a stable cash generator. This revenue stream, derived from diverse banking services and transactions, demonstrates resilience and is less susceptible to interest rate volatility.

In 2024, Bank Albilad reported a substantial increase in net fee and commission income, contributing positively to its overall financial performance. This growth underscores the bank's success in leveraging its service offerings to generate consistent revenue.

- Net Fee and Commission Income Growth: Bank Albilad has consistently seen its net fee and commission income grow, a key driver of its operating income.

- Stability and Resilience: This income source is less impacted by interest rate fluctuations, providing a reliable cash flow for the bank.

- Contribution to Operating Income: Fees and commissions play a vital role in the bank's overall profitability, supporting its operational stability.

- 2024 Performance: The bank's financial results for 2024 highlighted a strong performance in this segment, reinforcing its position as a cash cow.

Bank Albilad's traditional retail banking, including deposits and financing, serves as a stable cash cow with a significant market share. Client deposits reached SAR 122.34 billion by September 2024, reflecting strong customer confidence.

While growth is modest, this segment's consistent cash flow and high profitability are vital for the bank's financial health, enabling reinvestment and shareholder returns.

Corporate banking, encompassing deposits and trade finance, is another strong Cash Cow, consistently generating substantial cash flow and underpinning financial stability. Despite moderated loan expansion, this division remains a crucial income stream.

Fee and commission income, derived from diverse services, acts as a stable cash generator, showing resilience and less susceptibility to interest rate volatility. In 2024, net fee and commission income saw a substantial increase, contributing positively to overall performance.

| Segment | BCG Category | Key Financial Indicator (as of Sep 2024) | 2024 Performance Highlight |

| Retail Banking (Deposits & Financing) | Cash Cow | Client Deposits: SAR 122.34 billion | Strong customer confidence and market penetration |

| Corporate Banking (Deposits & Trade Finance) | Cash Cow | Substantial portion of funding base | Crucial engine for lending activities and reliable income stream |

| Fee and Commission Income | Cash Cow | Significant contributor to operating income | Substantial increase in net fee and commission income |

Preview = Final Product

Bank Albilad BCG Matrix

The Bank Albilad BCG Matrix you are previewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content—just the comprehensive, analysis-ready BCG Matrix report, meticulously prepared for strategic decision-making and professional presentation.

Dogs

Bank Albilad's underperforming legacy systems represent potential 'dogs' in its BCG Matrix. While the bank is actively pursuing digital transformation, these older systems may not be fully integrated or optimized, leading to resource drain without significant growth contributions.

These legacy infrastructures might require substantial maintenance costs, impacting overall efficiency. For instance, in 2024, many financial institutions are still grappling with the costs associated with maintaining outdated core banking systems, which can divert capital from more innovative ventures.

The bank's focus on improving its cost-to-income ratio, which saw a positive trend in recent years, suggests ongoing efforts to streamline operations and potentially phase out or modernize these less productive assets.

Unprofitable niche services with low adoption represent the 'dogs' in Bank Albilad's potential BCG matrix. These are specialized offerings that, despite initial investment, have struggled to capture significant market share or customer interest. For instance, a hypothetical digital wealth management platform tailored for a very specific, small demographic might fall into this category.

Such services often continue to incur operational expenses, including technology maintenance and marketing, without generating enough revenue to justify their existence. Without concrete data on Bank Albilad's specific product portfolio, it's challenging to pinpoint exact examples, but imagine a bespoke advisory service for a declining industry that requires specialized expertise but serves a shrinking client base.

In 2024, the banking sector saw a trend towards consolidation and a focus on profitable core services. Banks that maintained underperforming niche products often faced pressure to divest or discontinue them to reallocate resources. For example, a report from S&P Global Market Intelligence in late 2023 highlighted that many regional banks were reviewing their product lines, with a particular focus on shedding low-margin or low-adoption offerings to improve overall profitability.

Certain traditional banking products at Bank Albilad might be classified as dogs if they've been overshadowed by newer, digital-first alternatives. These could include specific savings accounts with low interest rates or physical check-cashing services that see declining transaction volumes. For instance, while digital payments and mobile banking surged in 2024, traditional branch-based transactions for certain legacy products likely saw a continued dip, impacting their market share.

Inefficiently Located or Underutilized Branches

Certain Bank Albilad branches might be classified as dogs if they are situated in low-growth regions or experience significantly low customer traffic compared to their operational expenses. These underperforming locations can drain capital and resources, offering minimal returns and impacting the bank's overall efficiency. For instance, a branch in a declining urban area with a shrinking customer base might struggle to generate sufficient revenue to cover its rent, staffing, and maintenance costs.

Optimizing a bank's physical footprint is an ongoing strategic challenge. In 2024, many financial institutions are re-evaluating their branch networks to align with evolving customer preferences, such as increased digital banking adoption. This often involves consolidating underperforming branches or repurposing them for different functions, like specialized advisory services. For Bank Albilad, identifying and addressing these "dog" branches is crucial for resource allocation and enhancing profitability across the entire network.

- Underutilized Assets: Branches in low-demand areas may represent significant fixed costs without commensurate revenue generation.

- Resource Drain: Capital and human resources tied up in inefficient branches could be better deployed in growth areas or digital initiatives.

- Strategic Re-evaluation: Continuous assessment of branch performance against market potential and operational costs is vital for network health.

Specific High-Risk Loan Portfolios with High NPLs

While Bank Albilad boasts a healthy overall asset quality, certain loan portfolios could be categorized as Dogs within a BCG Matrix framework if they consistently show elevated non-performing loans (NPLs) and demand substantial credit loss provisions. These segments tie up valuable capital and management resources without delivering commensurate returns, essentially becoming cash traps for the bank.

For instance, if specific commercial lending segments, such as those focused on highly cyclical industries or emerging businesses with unproven track records, were to experience a sustained increase in defaults, they would fit this Dog profile. The bank's reported NPL ratio of 2.1% as of Q1 2025 is indeed robust against industry benchmarks, but a granular analysis might reveal pockets of underperformance.

These problematic portfolios would necessitate strategic decisions, potentially involving restructuring, sale, or increased provisioning.

- High NPL Portfolios: Specific loan segments with NPL ratios significantly above the bank's overall 2.1% (Q1 2025) and the industry average.

- Capital Drain: These portfolios consume capital due to provisioning requirements and lower risk-adjusted returns.

- Management Focus: They divert management attention from more profitable or growth-oriented business areas.

- Potential Actions: Strategies could include portfolio restructuring, enhanced collection efforts, or divestment to free up resources.

Certain traditional banking products at Bank Albilad might be classified as dogs if they've been overshadowed by newer, digital-first alternatives. These could include specific savings accounts with low interest rates or physical check-cashing services that see declining transaction volumes. For instance, while digital payments and mobile banking surged in 2024, traditional branch-based transactions for certain legacy products likely saw a continued dip, impacting their market share.

Bank Albilad's underperforming legacy systems represent potential 'dogs' in its BCG Matrix. While the bank is actively pursuing digital transformation, these older systems may not be fully integrated or optimized, leading to resource drain without significant growth contributions. These legacy infrastructures might require substantial maintenance costs, impacting overall efficiency. For instance, in 2024, many financial institutions are still grappling with the costs associated with maintaining outdated core banking systems, which can divert capital from more innovative ventures.

Unprofitable niche services with low adoption represent the 'dogs' in Bank Albilad's potential BCG matrix. These are specialized offerings that, despite initial investment, have struggled to capture significant market share or customer interest. In 2024, the banking sector saw a trend towards consolidation and a focus on profitable core services. Banks that maintained underperforming niche products often faced pressure to divest or discontinue them to reallocate resources.

Certain Bank Albilad branches might be classified as dogs if they are situated in low-growth regions or experience significantly low customer traffic compared to their operational expenses. In 2024, many financial institutions are re-evaluating their branch networks to align with evolving customer preferences, such as increased digital banking adoption. For Bank Albilad, identifying and addressing these dog branches is crucial for resource allocation and enhancing profitability across the entire network.

| Category | Description | Example for Bank Albilad | Potential Impact | 2024 Trend |

| Dogs | Low market share, low growth | Legacy IT systems, underperforming branches, niche products with low adoption | Resource drain, high maintenance costs, reduced profitability | Focus on consolidation, digital transformation, shedding non-core assets |

Question Marks

Bank Albilad's strategic alliances with FinTech innovators like Qsalary exemplify their 'Stars' in the BCG matrix. These ventures, focused on enabling employees to access earned wages, tap into a high-growth market segment. While currently holding a low market share, the potential for significant expansion is substantial, requiring continued investment to capture market dominance.

Bank Albilad's investments in advanced AI-driven customer service tools are currently in the question mark quadrant of the BCG matrix. While initial digital transformation efforts have yielded positive results, particularly in boosting retail revenue, the full potential and profitability of these more sophisticated AI applications remain uncertain.

The scaling and optimization of these tools for deeper customer engagement and complex issue resolution necessitate significant ongoing investment. The return on investment for these advanced AI capabilities is not yet clearly established, making them a strategic area requiring careful evaluation and further development.

For context, the global AI in customer service market was projected to reach $14.7 billion in 2024, with a compound annual growth rate of 23.5% through 2030. This indicates a growing market, but Bank Albilad's specific deployment and market impact of its advanced AI tools are still in the early stages of realization.

Expanding into specific, untapped niche markets within the GCC, such as specialized Islamic finance for SMEs or sustainable real estate financing, represents a potential question mark for Bank Albilad. These areas offer significant growth prospects, mirroring the broader regional expansion trend, but demand considerable upfront investment and a deep understanding of unique customer needs.

For instance, while Saudi Arabia's Vision 2030 drives diversification, entering a niche like Sharia-compliant venture capital for tech startups in the UAE requires establishing new networks and tailored product development. This carries higher risk than leveraging existing strengths in more established segments, with the potential for high rewards if successful.

Development of Highly Specialized Investment Banking Products

Bank Albilad's investment banking division, though a smaller contributor to the bank's overall revenue, is exploring the development of highly specialized products. These offerings are designed to cater to niche high-net-worth individuals and specific corporate finance requirements, indicating a strategic move into more complex financial solutions. The initial phase of such product development demands substantial investment in specialized talent and robust infrastructure, with market acceptance and subsequent profitability remaining uncertain.

The success of these specialized products is crucial for the growth of Bank Albilad's investment banking segment. For instance, in 2024, the Saudi Arabian investment banking sector saw significant activity, with deal volumes increasing, driven by capital markets transactions and mergers and acquisitions. While specific figures for Bank Albilad's investment banking product launches in 2024 are not publicly detailed, the broader market trend suggests potential opportunities for specialized offerings.

The bank's approach to these specialized products can be viewed through a BCG matrix lens, where they likely represent a question mark. This classification stems from their high potential for growth and profitability, coupled with the inherent uncertainty regarding market penetration and competitive response. The bank must carefully manage the resources allocated to these ventures, balancing the need for innovation with risk mitigation.

- High upfront investment in expertise and infrastructure for specialized products.

- Uncertainty in market adoption and initial profitability of complex financial instruments.

- Investment banking segment represents a smaller portion of Bank Albilad's overall business operations.

- Broader Saudi market trends in 2024 indicate increased investment banking activity, offering potential for specialized products.

Sonic Branding Initiatives

Bank Albilad's recent foray into sonic branding, a move that aligns with Saudi Arabia's Vision 2030, positions it as an innovator in the financial sector. This strategy focuses on enhancing brand recognition and customer experience through auditory elements, a relatively new approach in banking.

While the long-term impact of sonic branding on market share and revenue within the banking industry is still being evaluated, it represents a forward-thinking investment. For instance, by 2024, the global market for sonic branding was projected to grow significantly, indicating a broader trend towards audio identity.

- Investment in Brand Recognition: Sonic branding aims to create a memorable auditory signature for Bank Albilad, differentiating it from competitors.

- Customer Experience Enhancement: The initiative seeks to foster a more engaging and consistent customer journey across various touchpoints.

- Uncertainty in Direct Financial Impact: The direct correlation between sonic branding expenditure and immediate increases in market share or revenue remains a key question for the bank.

- Alignment with Vision 2030: This innovative marketing approach supports the broader national agenda of digital transformation and enhanced service delivery.

Bank Albilad's advanced AI customer service tools and niche market expansions in areas like specialized Islamic finance for SMEs are classic examples of Question Marks. These initiatives require substantial investment to understand their market potential and competitive landscape, with uncertain but potentially high returns.

The investment banking division's development of highly specialized products for niche clients also falls into this category. While the Saudi investment banking sector showed increased activity in 2024, the success of these bespoke offerings is not guaranteed, demanding careful resource allocation and risk management.

Similarly, the bank's investment in sonic branding represents a forward-thinking, albeit uncertain, strategy to enhance brand recognition and customer experience. The direct financial impact of such an intangible asset is still under evaluation, aligning with the characteristics of a Question Mark in the BCG matrix.

The bank must carefully nurture these ventures, providing adequate resources for growth while closely monitoring their performance to decide whether to divest or invest further for market leadership.

| Initiative | BCG Category | Rationale | Market Context (2024) | Key Considerations |

| Advanced AI Customer Service | Question Mark | High growth potential, uncertain market share/profitability. | Global AI in customer service market projected to reach $14.7 billion. | Requires significant ongoing investment for optimization and deeper engagement. |

| Niche GCC Market Expansion (e.g., Islamic finance for SMEs) | Question Mark | Significant growth prospects, but demand considerable upfront investment and unique understanding. | Saudi Vision 2030 drives diversification, UAE tech sector growth. | Higher risk than established segments, requires new networks and tailored products. |

| Specialized Investment Banking Products | Question Mark | High potential for growth and profitability, but uncertain market penetration and competitive response. | Saudi investment banking sector saw increased activity, driven by capital markets and M&A. | Demands investment in specialized talent and infrastructure; market acceptance is key. |

| Sonic Branding | Question Mark | Innovative approach to brand recognition and customer experience, with uncertain direct financial impact. | Growing global market for sonic branding indicates a broader trend towards audio identity. | Focus on differentiation and engaging customer journeys, long-term impact under evaluation. |

BCG Matrix Data Sources

Our Bank Albilad BCG Matrix is built on comprehensive data, including financial statements, market share analysis, industry growth rates, and strategic reports. This ensures a robust foundation for understanding the bank's product portfolio and market positioning.