Bank Albilad Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Albilad Bundle

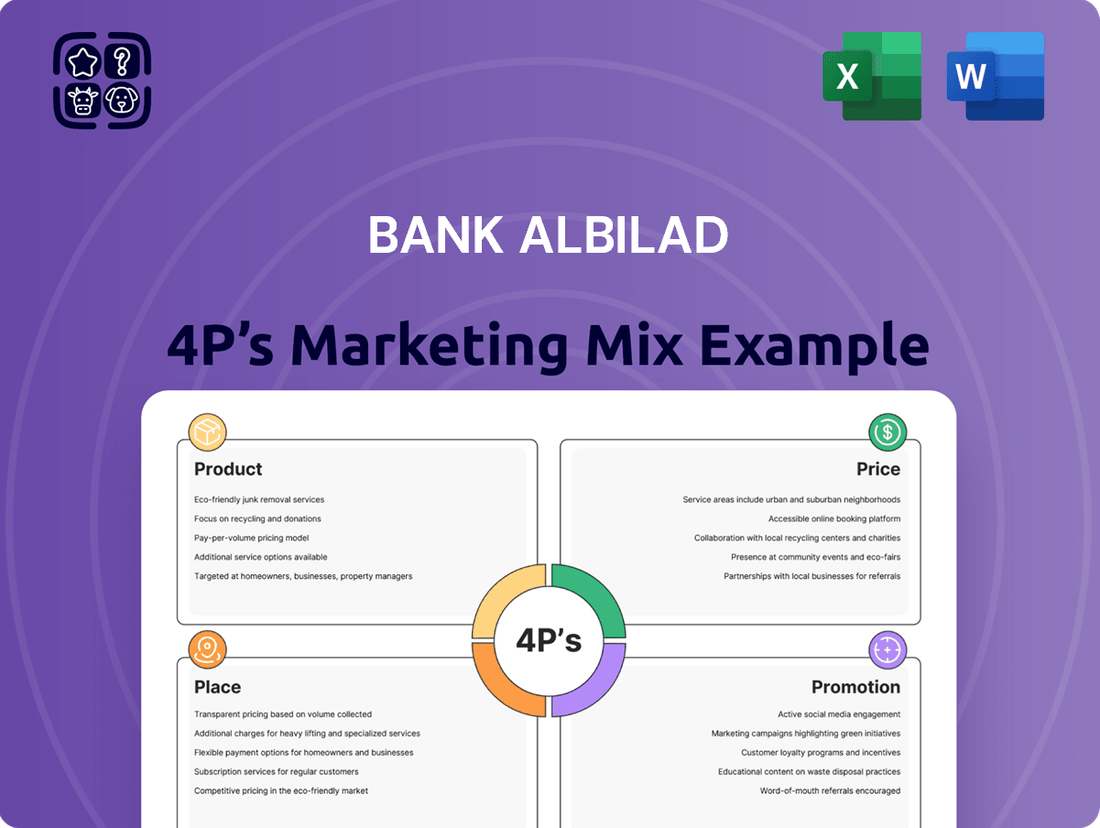

Discover how Bank Albilad strategically leverages its product offerings, competitive pricing, accessible distribution channels, and impactful promotional campaigns to connect with its target market. This analysis provides a foundational understanding of their marketing approach.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Bank Albilad’s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Bank Albilad's Sharia-compliant financial solutions form a cornerstone of its product strategy, offering a full spectrum of banking services that strictly adhere to Islamic finance principles. This commitment ensures that all offerings, from personal accounts to corporate financing, align with ethical and religious guidelines, meeting a significant demand within the Saudi Arabian market.

In 2024, Bank Albilad continued to expand its Sharia-compliant portfolio, reflecting the growing global interest in ethical finance. The bank reported a significant increase in assets under management for its Islamic banking windows, demonstrating strong customer adoption of these principles. This growth highlights the product's success as a key differentiator.

Bank Albilad's diverse business banking portfolio encompasses corporate, investment, and treasury divisions, offering sophisticated solutions. This includes advanced treasury services and asset management tailored for a broad range of industries, aiming to enhance financial efficiency.

The bank's strategic focus on sectors like infrastructure, real estate, and Small and Medium-sized Enterprises (SME) financing directly supports Saudi Arabia's Vision 2030. For instance, in 2024, Bank Albilad reported significant growth in its SME lending portfolio, contributing to the Kingdom's economic diversification goals.

Bank Albilad offers a comprehensive suite of investment and financing products, forming the core of its revenue and asset expansion strategies. This includes a wide array of financing solutions, notably mortgages, where the bank actively participates in portfolio transactions to bolster the housing finance market.

The bank's strategic emphasis on both retail and corporate lending, with a substantial allocation towards mortgages, highlights a well-rounded and diversified product strategy. For instance, in Q1 2024, Bank Albilad reported a net financing and investment income of SAR 2.18 billion, demonstrating the significant contribution of these products to its financial performance.

Digital Banking Innovations

Bank Albilad's commitment to digital innovation is a cornerstone of its marketing strategy, evident in its robust digital banking platforms. These advancements aim to enhance customer experience and operational efficiency.

The bank's investment in technology translates into user-friendly mobile applications and AI-powered customer service, streamlining interactions and offering personalized support. For instance, by Q1 2024, Bank Albilad reported a significant increase in digital transaction volumes, demonstrating the success of these initiatives.

- Digital Platforms: Offering comprehensive online and mobile banking services.

- AI Integration: Utilizing artificial intelligence for enhanced customer service and personalized banking.

- Efficiency Gains: Driving operational improvements through technology adoption.

- Customer Focus: Prioritizing convenience and seamless experiences across digital channels.

Subsidiary-Enhanced Services

Bank Albilad's product offering is significantly broadened by its wholly owned subsidiaries, creating a comprehensive suite of financial solutions. These subsidiaries extend the bank's reach into specialized areas, offering clients a more integrated banking experience. This strategic approach allows Bank Albilad to cater to a wider range of financial needs beyond traditional banking services.

Albilad Investment Company is a key subsidiary, actively involved in investment services, asset management, and securities trading. As of early 2024, the Saudi Arabian investment management sector has seen robust growth, with assets under management reaching substantial figures, indicating a strong market for these services. Albilad Real Estate Company streamlines processes related to real estate guarantees, a crucial element for many banking clients. Enjaz Payment Services Company and Financial Solutions Company for Investment further diversify the bank's capabilities, providing specialized payment and investment solutions. This integrated model enhances customer loyalty and provides multiple touchpoints for engagement.

- Albilad Investment Company: Offers investment services, asset management, and securities.

- Albilad Real Estate Company: Manages real estate guarantee procedures.

- Enjaz Payment Services Company: Expands payment solutions.

- Financial Solutions Company for Investment: Broadens specialized investment services.

Bank Albilad's product strategy centers on Sharia-compliant financial solutions, encompassing retail, corporate, and investment banking. This diversified portfolio, including significant mortgage offerings, directly supports Saudi Arabia's Vision 2030, particularly in SME financing. The bank's digital platforms and AI integration enhance customer experience and operational efficiency, as evidenced by increased digital transaction volumes in early 2024.

| Product Category | Key Offerings | 2024/2025 Relevance | Financial Impact (Q1 2024) |

|---|---|---|---|

| Sharia-Compliant Banking | Personal & Corporate Accounts, Financing | Growing global demand for ethical finance | Strong asset growth in Islamic windows |

| Corporate & Investment Banking | Treasury Services, Asset Management, Real Estate Finance | Supporting Vision 2030 sectors (Infrastructure, SMEs) | Net financing and investment income: SAR 2.18 billion |

| Digital Banking | Mobile Apps, AI Customer Service | Enhanced customer experience, operational efficiency | Significant increase in digital transaction volumes |

| Subsidiary Services | Investment, Real Estate, Payment Solutions | Integrated financial ecosystem, expanded reach | Robust growth in Saudi investment management sector |

What is included in the product

This analysis offers a comprehensive examination of Bank Albilad's marketing mix, detailing its product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Bank Albilad's market positioning and competitive strategies through a detailed 4Ps breakdown.

This analysis distills Bank Albilad's 4Ps into actionable insights, offering a clear roadmap to address customer pain points and enhance their banking experience.

It provides a concise, strategic overview of Bank Albilad's marketing efforts, directly tackling common customer frustrations with practical solutions.

Place

Bank Albilad boasts an extensive physical footprint across Saudi Arabia, operating over 107 branches as of March 2024. This significant network ensures widespread accessibility for customers seeking traditional banking services and personalized interactions.

These branches act as vital centers for customer engagement, facilitating a range of banking transactions. Bank Albilad is also investing in modernizing its physical presence through the introduction of new-generation branches, designed to offer an enhanced and technologically advanced customer experience.

Bank Albilad complements its physical presence with a robust suite of electronic channels, including Albilad Net, Albilad Mobile, and Albilad Phone Banking. These digital platforms are designed for customer convenience and security, allowing access to banking services anytime, anywhere. This focus on digital accessibility is a key element of their strategy to offer modern banking solutions.

Bank Albilad strategically deploys a comprehensive network of ATMs across Saudi Arabia, offering customers convenient access to essential self-service banking. This extensive ATM infrastructure supports a wide range of transactions, including cash withdrawals and deposits, reinforcing the bank's commitment to customer accessibility.

While precise, up-to-the-minute figures for the total number of ATMs are not publicly disclosed, the bank's significant presence underscores its dedication to providing widespread coverage. This broad reach is crucial for maximizing customer convenience in their day-to-day financial management.

Regional GCC Footprint

Bank Albilad is actively broadening its presence across the GCC, forging strategic alliances and enhancing cross-border service offerings. This regional push is designed to tap into new revenue streams beyond Saudi Arabia and serve a wider array of clients.

By extending its reach into neighboring economies, the bank aims to support international business requirements and capitalize on burgeoning growth prospects. For instance, in 2024, Bank Albilad continued to strengthen its digital banking services, a key enabler for seamless cross-border transactions and customer acquisition within the GCC. As of Q3 2024, the bank reported a significant increase in its international customer base, reflecting the success of its regional expansion strategy.

- GCC Expansion Strategy Bank Albilad is focusing on strategic partnerships to enhance its regional footprint.

- Revenue Diversification The move aims to reduce reliance on the domestic market and explore new income sources.

- International Business Support The bank is positioning itself to cater to the financial needs of businesses operating across borders within the GCC.

- Leveraging Growth Opportunities Expansion targets economies with strong growth potential to maximize returns.

Digital Hub and Innovation Centers

Bank Albilad is heavily investing in its digital infrastructure, creating dedicated digital hubs and fostering innovation to deliver a superior banking experience. This focus on digital transformation is evident in their commitment to AI-driven customer service, aiming for more responsive and personalized interactions. The bank's strategy prioritizes technological advancement to solidify its position as a leader in the Saudi banking landscape.

These digital advancements are not just about customer convenience; they directly impact operational efficiency. By integrating advanced digital platforms and AI, Bank Albilad is streamlining processes, which in turn, enhances customer service quality and boosts customer loyalty. For instance, in 2024, the bank reported a significant increase in digital transaction volumes, demonstrating the success of these initiatives in driving customer engagement.

- Digital Hub Development: Bank Albilad is establishing physical and virtual spaces dedicated to digital innovation and customer engagement.

- AI Integration: Significant investments are being made in artificial intelligence to power customer service chatbots and personalized banking solutions.

- Platform Enhancement: Continuous upgrades to digital banking platforms aim to provide seamless, intuitive, and secure user experiences.

- Efficiency Gains: These digital initiatives are projected to improve operational efficiency by up to 15% by the end of 2025, according to internal bank projections.

Bank Albilad's 'Place' element is defined by its extensive physical and digital accessibility. The bank operates over 107 branches across Saudi Arabia as of March 2024, ensuring a strong traditional banking presence. This is complemented by a wide network of ATMs for self-service banking, and a robust digital ecosystem including Albilad Net and Albilad Mobile, catering to anytime, anywhere access.

What You See Is What You Get

Bank Albilad 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Bank Albilad's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know exactly what you're getting.

Promotion

Bank Albilad actively pursues strategic sponsorships and partnerships to boost its brand presence. A prime example is its three-year deal with the Saudi Arabian Formula 1 Grand Prix, a significant national event. This collaboration not only elevates the bank's visibility but also underscores its commitment to Saudi Arabia's Vision 2030.

These high-profile alliances offer a powerful avenue for broad public engagement and create strong brand associations. For instance, in 2023, the Saudi Arabian Grand Prix alone attracted over 150,000 spectators, providing Bank Albilad with substantial exposure. Such initiatives are crucial for aligning the bank with key national development goals and fostering a positive public image.

Bank Albilad heavily utilizes digital platforms and social media for its marketing efforts, a strategy highlighted by its 'Experience the Thrill' campaign tied to its Formula 1 sponsorship. This digital focus is designed to boost brand recognition and cultivate interest across its target demographics by engaging them on preferred online channels.

The bank's robust social media presence is central to its communication strategy, aiming to foster deeper connections and drive engagement with its customer base. For instance, in Q1 2024, Bank Albilad reported a significant increase in its social media following, demonstrating the effectiveness of its digital outreach in building a wider audience.

Bank Albilad's Customer Experience Enhancement is intrinsically linked to delivering convenient, streamlined services and competitive value-added offers. The bank aims to foster customer loyalty and satisfaction by persuasively conveying product benefits and differentiators. This focus on a performance-driven culture prioritizes customer needs, a strategy that saw Bank Albilad achieve a net profit of SAR 1.3 billion in the first nine months of 2024, reflecting strong operational performance and customer engagement.

Public Relations and Corporate Communications

Bank Albilad actively manages its public relations and corporate communications to foster stakeholder confidence. For instance, in Q1 2024, the bank reported a net profit of SAR 1.05 billion, a 14% increase year-on-year, underscoring its financial strength and strategic execution. These communications, including details on capital increases or dividend announcements, are crucial for building trust and transparency.

The bank's commitment to sustainable growth is also a key theme in its corporate messaging. By regularly sharing updates on its financial performance and strategic initiatives, Bank Albilad reinforces its market position and commitment to stakeholders.

- Financial Performance Transparency: Bank Albilad regularly discloses financial results, such as its Q1 2024 net profit of SAR 1.05 billion, to inform investors and stakeholders.

- Strategic Initiative Communication: Announcements regarding capital increases and dividend distributions are used to build trust and demonstrate the bank's growth trajectory.

- Market Position Reinforcement: Open communication about achievements and strategic direction solidifies the bank's standing in the financial sector.

- Commitment to Sustainability: Public relations efforts highlight the bank's dedication to sustainable growth and responsible corporate practices.

Targeted Marketing for Business Segments

Bank Albilad’s promotional strategies are finely tuned to resonate with its varied business clientele. This includes distinct campaigns showcasing its specialized corporate banking, investment banking, and treasury solutions, alongside dedicated initiatives for Small and Medium-sized Enterprises (SMEs).

The bank actively promotes its expertise in addressing the unique challenges and aspirations of its business customers. For instance, in 2024, Bank Albilad reported a significant increase in its SME financing portfolio, demonstrating a commitment to this segment through targeted outreach and tailored product offerings.

- Corporate Banking Focus: Highlighting services like trade finance and cash management to large enterprises.

- SME Financing Initiatives: Promoting accessible loan products and advisory services for growing businesses.

- Investment & Treasury Solutions: Communicating expertise in capital markets and liquidity management for sophisticated clients.

- Problem/Desire Fulfillment: Messaging centers on how the bank's solutions drive growth and efficiency for businesses.

Bank Albilad's promotion strategy is multifaceted, leveraging high-profile sponsorships like the Saudi Arabian Formula 1 Grand Prix to enhance brand visibility and align with national goals. Digital engagement, particularly through social media campaigns like 'Experience the Thrill,' is key to reaching target demographics and fostering customer connections.

The bank also emphasizes its commitment to customer experience by highlighting convenient services and value-added offers, which contributed to a net profit of SAR 1.3 billion in the first nine months of 2024. Transparency in financial performance, such as the Q1 2024 net profit of SAR 1.05 billion, builds stakeholder confidence and reinforces its market position.

Targeted promotion for business clients includes specialized campaigns for corporate banking, investment banking, and treasury solutions, alongside dedicated initiatives for SMEs. This focus on tailored offerings and expertise, evidenced by growth in its SME financing portfolio in 2024, aims to drive client growth and efficiency.

Price

Bank Albilad's pricing strategy is designed to align with the perceived value of its Sharia-compliant financial products and services, ensuring they are both competitive and attractive to its customer base. The bank emphasizes offering value-added propositions that go beyond basic transactions.

This approach involves a careful calibration between maintaining profitability and securing a strong market position, while also ensuring the bank's offerings are readily accessible to its intended audience. For instance, in 2024, Bank Albilad reported a net profit of SAR 2,000 million, showcasing its ability to balance competitive pricing with financial success.

Bank Albilad has demonstrated a strategic focus on optimizing its Net Interest Margins (NIMs), a key driver of profitability. This focus has resulted in an upward trend in NIMs, directly boosting the bank's funded income. For instance, in the first quarter of 2024, Bank Albilad reported a net special commission income of SAR 1.01 billion, a 19% increase year-on-year, reflecting this effective NIM management.

The bank is well-positioned to benefit from potential interest rate reductions. Its balanced approach to lending, coupled with contributions from its investment portfolio, suggests a proactive pricing strategy that considers market dynamics and asset risk, ensuring continued performance even in a changing rate environment.

Bank Albilad's commitment to transparent fee and commission structures is evident in its financial reporting. While explicit fee schedules aren't always front and center, the bank's robust growth in total operating income, particularly from fees and commissions, indicates a well-defined and structured approach to generating non-interest income. This suggests that customers can expect clarity regarding the pricing of banking services.

Dividend Distribution and Shareholder Value

Bank Albilad's commitment to shareholder value is evident in its dividend policy, which acts as an indirect pricing mechanism by signaling financial strength. The board's approval of substantial cash dividends for the first half of 2025 underscores this dedication. This consistent return of capital can bolster investor confidence, potentially impacting the bank's market valuation and its ability to command favorable pricing for its services.

The bank's financial performance directly supports its dividend distribution strategy, reinforcing its market position. For H1 2025, Bank Albilad announced a cash dividend of SAR 0.60 per share, totaling SAR 1.2 billion. This payout ratio of 50% of net profit for the period reflects a balanced approach to reinvestment and shareholder returns.

- Dividend Payout: SAR 0.60 per share for H1 2025.

- Total Distribution: SAR 1.2 billion for H1 2025.

- Payout Ratio: 50% of net profit for H1 2025.

- Impact on Investor Perception: Enhances confidence in financial health and stability.

Capital Management and Solvency

Bank Albilad demonstrates strong capital management, evidenced by strategic capital increases that bolster its financial solvency. For instance, the approval of a 20% capital hike in April 2025 significantly reduces its dependence on external funding sources. This enhanced capital base provides greater operational flexibility and a stronger competitive edge.

A robust capital position directly impacts Bank Albilad's ability to offer competitive pricing and innovative products. By strengthening its capital base, the bank is better equipped to navigate economic downturns and capitalize on emerging growth avenues. This strategic financial management is a cornerstone of its long-term stability and market competitiveness.

- Capital Adequacy: The 20% capital increase approved in April 2025 is a key driver for solvency.

- Reduced Financing Costs: A stronger capital base lowers the cost of external financing.

- Competitive Pricing: Enhanced solvency allows for more aggressive and flexible pricing strategies.

- Risk Absorption: The bank's ability to withstand economic shocks is significantly improved.

Bank Albilad's pricing strategy is centered on delivering value through its Sharia-compliant offerings, balancing competitiveness with profitability. The bank's focus on Net Interest Margins (NIMs) directly impacts its income, with a notable 19% year-on-year increase in net special commission income to SAR 1.01 billion in Q1 2024, demonstrating effective pricing and income generation.

The bank's transparent fee structures, while not always explicitly detailed, contribute to its robust growth in total operating income, particularly from fees and commissions. This indicates a clear approach to service pricing that customers can rely on.

Bank Albilad's dividend policy, including a SAR 0.60 per share payout for H1 2025 totaling SAR 1.2 billion (50% of net profit), indirectly signals financial strength and can influence investor perception and market valuation, impacting its ability to price services competitively.

A strong capital base, bolstered by a 20% capital increase approved in April 2025, enhances Bank Albilad's solvency and operational flexibility. This improved financial standing allows for more competitive and adaptable pricing strategies, reinforcing its market position.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Net Profit | SAR 2,000 million | 2024 | Demonstrates profitability alongside competitive pricing. |

| Net Special Commission Income | SAR 1.01 billion | Q1 2024 | Represents a 19% YoY increase, highlighting effective NIM management. |

| Dividend Per Share | SAR 0.60 | H1 2025 | Signals financial health and supports investor confidence. |

| Capital Increase | 20% | April 2025 | Enhances solvency and supports flexible pricing strategies. |

4P's Marketing Mix Analysis Data Sources

Our Bank Albilad 4P's Marketing Mix Analysis is meticulously constructed using a blend of official bank communications, Saudi Arabian Monetary Authority (SAMA) reports, and reputable financial news outlets. We also incorporate data from industry-specific publications and competitive intelligence platforms to ensure a comprehensive view of their Product, Price, Place, and Promotion strategies.