B3 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

Curious about the core drivers behind B3's market performance? This glimpse into their SWOT analysis reveals key strengths and potential challenges, but the real strategic advantage lies in the full report.

Want to truly understand B3's competitive edge and future trajectory? Unlock the complete SWOT analysis to access detailed insights, actionable strategies, and a comprehensive understanding of their market position.

Strengths

B3's position as Brazil's sole stock exchange grants it unparalleled market dominance, making it the central hub for virtually all financial transactions within the country. This entrenched position allows B3 to capture a significant share of trading, clearing, and settlement volumes, creating a powerful network effect that further solidifies its centrality.

In 2024, B3 continued to leverage this dominance, facilitating a substantial portion of Brazil's capital market activity. The exchange reported significant growth in trading volumes across equities and derivatives, underscoring its critical role in the nation's financial ecosystem. This centrality translates into a strong competitive moat, as new entrants would face immense challenges in replicating B3's comprehensive infrastructure and established client base.

B3's strength lies in its diversified revenue streams, extending well beyond simple stock trading. The company provides a full spectrum of financial services, including fixed income, currencies, and derivatives, creating a more resilient business model. This broad offering significantly reduces reliance on any single market segment.

The strategic expansion into areas like over-the-counter (OTC) derivatives and Bitcoin Futures further bolsters B3's revenue base. This diversification is a key advantage, making the company less susceptible to downturns in specific asset classes. For instance, B3 reported strong growth in its technology and platform revenues during the first quarter of 2025, underscoring the success of its broader service diversification strategy.

B3's robust technology and infrastructure are foundational strengths, providing the essential systems that power Brazil's financial markets. In 2023, B3 continued its significant investments in technology, with approximately R$1.2 billion allocated to modernization and innovation projects, enhancing its operational efficiency.

This commitment to technological advancement, including optimizing project management, directly supports B3's ability to handle high trading volumes, which averaged over 20 million daily trades in late 2024, and facilitates the expansion of its diverse service offerings.

Strong Financial Performance

B3's financial performance remains a significant strength, showcasing impressive growth trajectories. In 2024, the company achieved a 7% increase in total revenue, a testament to its expanding market presence and operational efficiency.

This positive trend continued into the first quarter of 2025, with total revenue climbing by an additional 7.7%. More impressively, B3's net income saw a substantial surge of 16.5% in Q1 2025, highlighting effective cost management and a robust business model capable of navigating economic uncertainties.

- Revenue Growth: 7% in 2024, 7.7% in Q1 2025.

- Net Income Growth: 16.5% in Q1 2025.

- Resilient Business Model: Demonstrates ability to perform well amidst macroeconomic challenges.

Commitment to ESG and Sustainability

B3's dedication to Environmental, Social, and Governance (ESG) principles is a significant strength. The company is actively embedding ESG solutions into its business model and championing sustainability across the Brazilian capital market.

This strategic focus is yielding tangible results, as evidenced by a substantial 64% revenue growth from new ESG initiatives in 2024. This surge underscores B3's successful alignment with growing global investor appetite for sustainable investments.

Furthermore, B3 actively cultivates diversity and inclusion, demonstrated by its efforts in creating a dedicated diversity index. This commitment reflects a broader understanding of social responsibility and its importance in building a resilient and forward-thinking organization.

- ESG Integration: B3 is actively incorporating ESG solutions into its operations and promoting sustainability within the Brazilian capital market.

- Revenue Growth from ESG: The company experienced a 64% increase in revenue from new ESG initiatives in 2024, showcasing its successful strategy in this area.

- Diversity and Inclusion Focus: B3 is committed to fostering diversity and inclusion, exemplified by initiatives like the creation of a diversity index.

B3's strength is its unparalleled market dominance as Brazil's sole stock exchange, acting as the central hub for financial transactions. This position, solidified by a robust network effect, allows B3 to capture significant trading, clearing, and settlement volumes, making it incredibly difficult for competitors to enter the market.

The exchange boasts diversified revenue streams, extending beyond equities to include fixed income, currencies, and derivatives, creating a resilient business model. Strategic expansion into areas like OTC derivatives and Bitcoin Futures, alongside strong growth in technology and platform revenues in early 2025, further bolsters its financial base.

B3's technological infrastructure is a core strength, supporting high trading volumes, which averaged over 20 million daily trades in late 2024, and facilitating its diverse service offerings. This is backed by substantial investments, with approximately R$1.2 billion allocated to modernization and innovation projects in 2023.

Financially, B3 has demonstrated impressive growth, with total revenue increasing by 7% in 2024 and an additional 7.7% in Q1 2025. Net income saw a significant surge of 16.5% in Q1 2025, indicating effective cost management and a robust business model.

B3's commitment to ESG principles is a notable strength, with a 64% revenue growth from new ESG initiatives in 2024. This strategic focus on sustainability and diversity, including the creation of a diversity index, aligns with growing investor demand.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| Total Revenue Growth | 7% | 7.7% |

| Net Income Growth | N/A | 16.5% |

| ESG Revenue Growth | 64% | N/A |

| Average Daily Trades | Over 20 million (late 2024) | N/A |

What is included in the product

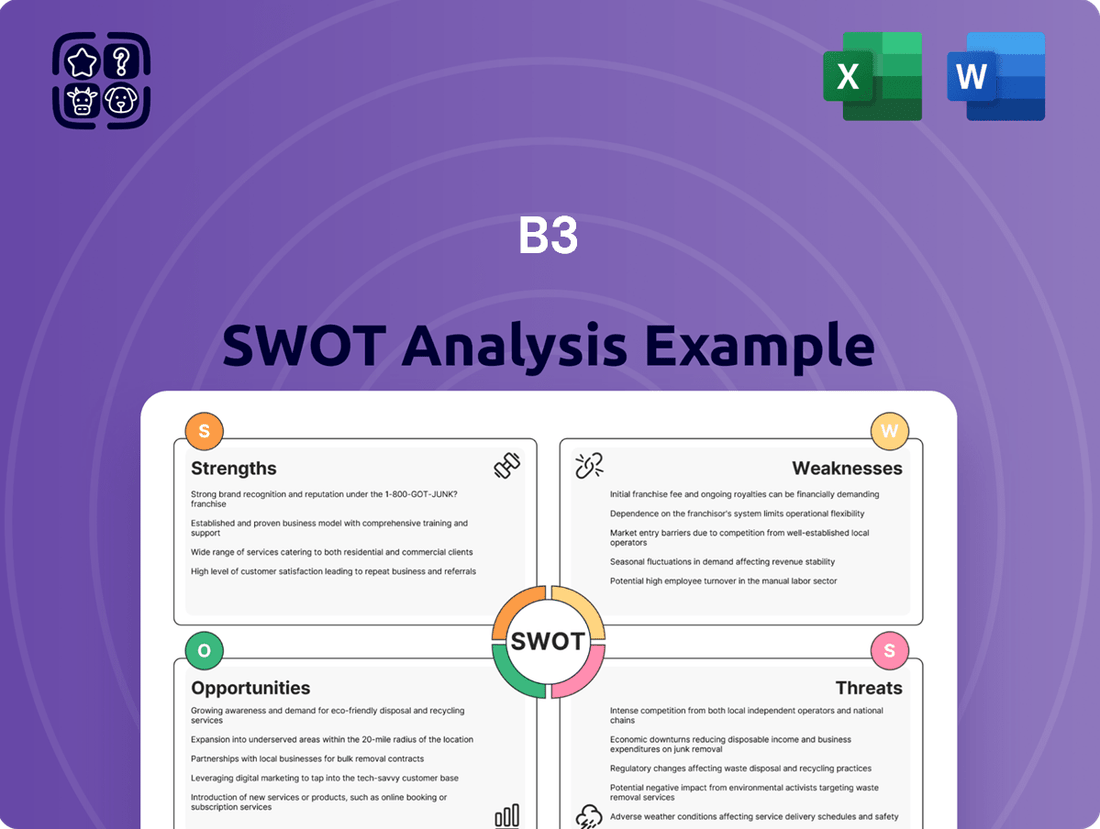

Delivers a strategic overview of B3’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

The B3 SWOT Analysis eliminates the frustration of disorganized strategy by providing a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

B3's fortunes are closely tied to Brazil's economic health, which has shown considerable ups and downs. Persistent inflation and elevated interest rates, for instance, can dampen investor enthusiasm and slow down trading activity. In 2024, the Brazilian stock market saw a dip when measured in U.S. dollars, illustrating the impact of these macroeconomic headwinds.

B3's significant reliance on the Brazilian domestic market presents a notable weakness. As the sole stock exchange in Brazil, its revenue streams are heavily concentrated within a single jurisdiction, making it susceptible to country-specific economic and political volatility. This lack of geographic diversification limits its resilience against localized downturns.

For instance, in 2023, B3's revenue was overwhelmingly derived from its Brazilian operations, with limited contributions from international markets. This concentration means that any adverse regulatory shifts or economic contractions within Brazil can disproportionately impact B3's financial performance, unlike exchanges with broader international footprints.

While higher interest rates can be beneficial for certain B3 segments, such as fixed income, a sustained period of elevated rates can dampen investor appetite for equities and negatively affect trading volumes across other business lines. Brazil's Central Bank has been actively adjusting its benchmark Selic rate, which directly influences how capital flows within the local economy and shapes overall market participation.

Competition from Emerging Financial Technologies

The burgeoning fintech sector, particularly with innovations like Pix, poses a significant competitive threat to B3. While B3 is actively investing in its technological infrastructure, agile fintech startups can rapidly introduce disruptive digital payment and trading solutions, potentially eroding B3's established market share across various financial services.

Brazil's status as a leading fintech hub in Latin America underscores the intensity of this competition. By mid-2024, the number of registered fintechs in Brazil continued to grow, many offering streamlined, user-friendly platforms that appeal to a broad consumer base, directly challenging B3's traditional offerings.

- Fintech Disruption: New digital platforms challenge B3's traditional services.

- Pix Impact: The rapid adoption of Pix by millions of Brazilians demonstrates a shift towards digital payments, potentially impacting B3's transaction volumes in certain areas.

- LATAM Fintech Hub: Brazil's dynamic fintech ecosystem means B3 faces constant innovation from new entrants.

Operational Costs and Technology Investment Concentration

B3 faces a weakness in its operational costs, particularly concerning significant technology investments. These expenditures are often concentrated in specific quarters, driven by project timelines and the need for continuous innovation. For instance, in the first quarter of 2024, B3 reported technology-related expenses that, alongside other operational factors, influenced its short-term profitability.

This concentration of spending, coupled with potential extraordinary expenses such as those related to personnel adjustments, necessitates robust cost management strategies. The company must carefully balance its commitment to technological advancement with the need to maintain consistent financial performance throughout the year. This dynamic can create pressure on margins, especially when these investments don't immediately translate into proportional revenue gains.

- Concentrated Technology Spending: B3's significant investments in technology are often weighted towards specific quarters, impacting short-term financial results.

- Seasonal Cost Fluctuations: Project delivery schedules and innovation cycles lead to predictable but sometimes substantial quarterly increases in operational expenses.

- Impact of Extraordinary Expenses: Personnel changes or other unforeseen costs can further exacerbate the pressure on profitability during periods of high technology investment.

- Need for Agile Cost Management: Effective cost control is crucial to mitigate the short-term financial impact of these concentrated and sometimes unpredictable operational expenditures.

B3's heavy reliance on the Brazilian market makes it vulnerable to domestic economic downturns and political instability. For example, in 2023, B3's revenue was almost entirely generated from Brazil, highlighting this lack of geographic diversification. This concentration means that any adverse regulatory changes or economic contractions within Brazil can significantly impact B3's financial performance, unlike exchanges with broader international operations.

The competitive landscape is intensifying due to agile fintech startups. Brazil's position as a leading fintech hub in Latin America means B3 faces continuous innovation from new entrants. The rapid adoption of digital payment solutions like Pix by millions of Brazilians in 2024 illustrates a clear shift towards digital transactions, potentially affecting B3's transaction volumes in certain segments.

B3 experiences significant operational costs, particularly from its substantial technology investments. These expenditures are often concentrated in specific quarters due to project timelines and the need for ongoing innovation. For instance, B3 reported increased technology-related expenses in Q1 2024, which, alongside other operational factors, influenced its short-term profitability. This concentration of spending, coupled with potential extraordinary expenses, requires robust cost management to maintain consistent financial performance and profit margins.

| Weakness | Description | Impact/Example |

|---|---|---|

| Market Concentration | Heavy reliance on the Brazilian domestic market. | In 2023, revenue was overwhelmingly derived from Brazilian operations, making it susceptible to country-specific economic and political volatility. |

| Fintech Competition | Disruption from agile fintech startups and digital payment solutions. | The rapid adoption of Pix in 2024 by millions of Brazilians highlights a shift towards digital payments, potentially impacting B3's transaction volumes. |

| Operational Costs | Significant and concentrated technology investments. | Q1 2024 saw increased technology-related expenses, impacting short-term profitability and requiring careful cost management to maintain margins. |

What You See Is What You Get

B3 SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Brazil's rapid embrace of digital payments, with Pix transactions reaching over 20 billion in 2023, presents a prime opportunity for B3. The ongoing drive for financial inclusion further amplifies this, creating a larger addressable market for digital financial services.

Initiatives like Open Finance are reshaping the financial landscape, allowing B3 to innovate and launch new digital products. This evolution caters to an increasingly tech-savvy investor demographic, expanding B3's market reach and engagement.

B3's strategic expansion into new product areas is yielding significant results. The introduction of Bitcoin Futures, for instance, has seen robust trading volumes, reflecting growing investor interest in digital assets. Similarly, the TreasuryDirect platform has facilitated greater access to government debt for retail investors, contributing to market depth and B3's revenue streams.

Further diversification through innovation in derivatives and fixed income presents a clear growth path. B3 is well-positioned to capitalize on the increasing demand for ESG-linked products, aligning with global sustainability trends and attracting a new cohort of investors. This focus on innovative financial instruments is key to B3's ongoing revenue diversification strategy.

The burgeoning private credit market in Brazil offers a substantial opportunity for B3 to expand its offerings and capture new market share. As of early 2024, the private credit market in Brazil has shown consistent double-digit growth, presenting B3 with a fertile ground for developing new products and services that cater to this expanding segment.

Brazil's position as a key emerging market continued to draw substantial foreign investment throughout 2024, with reports indicating significant inflows. This influx highlights the persistent global interest in Brazilian assets.

Concurrently, B3 has witnessed a robust and consistent rise in its individual investor base. This growth is a testament to increased financial literacy and a desire for investment opportunities within the country.

Factors such as the anticipation of interest rate adjustments and the appeal of current market valuations are fueling this expansion. The growing participation from both foreign and domestic individual investors broadens the liquidity and depth of B3's market. This larger pool of participants directly translates into increased trading volumes and a greater demand for B3's diverse investment products and services.

Leveraging Regulatory Evolution and Innovation

The Brazilian Central Bank's strategic focus for 2025 and 2026, encompassing virtual asset regulations, the continued expansion of Open Finance, and the careful oversight of artificial intelligence in financial services, creates a fertile ground for B3's proactive engagement. This evolving regulatory environment allows B3 to anticipate and integrate emerging technologies and financial models into its existing infrastructure.

By strategically aligning with these anticipated regulatory shifts, B3 can seize opportunities to pioneer new, compliant financial products and services. This forward-thinking approach not only solidifies its market leadership but also enhances its competitive edge in a rapidly transforming financial ecosystem.

- Anticipating Virtual Asset Frameworks: B3 can develop regulated platforms for digital asset trading, mirroring the growth seen in global markets where digital asset trading volumes are projected to reach trillions by 2030.

- Enhancing Open Finance Integrations: Further integration into the Open Finance ecosystem can unlock new data-driven revenue streams and improve customer experience, building on the existing participation of over 10 million Brazilians in Open Finance initiatives as of early 2024.

- Leveraging AI for Operational Efficiency: Implementing AI for enhanced market surveillance, risk management, and customer service can lead to significant cost savings and improved operational resilience, with AI adoption in financial services expected to yield substantial ROI.

Strategic Acquisitions and Partnerships in Technology and Data

B3's strategic acquisitions, like the integration of Neurotech, have already bolstered its data and analytics prowess. This ongoing strategy offers significant opportunities to further enhance its service portfolio and operational efficiency. By targeting technology and data platforms, B3 can unlock new revenue streams, particularly in advanced data analytics solutions.

For instance, in 2024, B3 continued to invest in technology, aiming to leverage data for new product development and client services. The company's focus on data-driven insights aligns with market trends, as evidenced by the increasing demand for sophisticated analytical tools across the financial industry.

- Acquisition of specialized data analytics firms to expand service offerings.

- Partnerships with AI and machine learning companies to integrate cutting-edge technologies.

- Development of new data monetization strategies leveraging proprietary market data.

- Expansion into emerging data-intensive financial services to capture new market segments.

B3 is poised to benefit from Brazil's accelerating digital transformation, with Pix transactions exceeding 20 billion in 2023, expanding the digital financial services market. The ongoing Open Finance initiatives provide avenues for B3 to introduce innovative digital products, attracting a growing base of tech-savvy investors.

The exchange is strategically expanding into new products, such as Bitcoin Futures, which have seen strong trading activity, and the TreasuryDirect platform, enhancing retail access to government debt. Further diversification into derivatives and fixed income, including ESG-linked products, aligns with global trends and attracts new investor segments.

The burgeoning Brazilian private credit market, experiencing consistent double-digit growth in early 2024, offers B3 significant opportunities for product expansion and market share capture. Concurrently, substantial foreign investment continued to flow into Brazil in 2024, underscoring global interest in its assets and boosting market liquidity.

B3's individual investor base has seen a robust and consistent rise, fueled by increased financial literacy and attractive market valuations, particularly with anticipated interest rate adjustments. This expanded participation from both foreign and domestic investors enhances market depth and demand for B3's offerings.

The Brazilian Central Bank's 2025-2026 agenda, focusing on virtual asset regulation, Open Finance expansion, and AI oversight in finance, creates a favorable environment for B3 to proactively develop compliant, innovative financial products and services.

B3's strategic acquisitions, like Neurotech, have significantly enhanced its data and analytics capabilities, presenting opportunities for further service portfolio expansion and operational efficiency through technology and data platforms.

| Opportunity Area | Key Driver | B3's Action/Benefit | Relevant Data Point |

|---|---|---|---|

| Digital Transformation & Inclusion | Pix adoption, Financial Inclusion | Expand digital services, larger addressable market | 20+ billion Pix transactions in 2023 |

| Open Finance | Regulatory push | New digital products, enhanced customer experience | 10+ million Brazilians in Open Finance (early 2024) |

| Product Diversification | Investor demand for new assets | Bitcoin Futures, TreasuryDirect, ESG products | Robust trading volumes in Bitcoin Futures |

| Private Credit Market Growth | Market expansion | New product development, market share capture | Double-digit growth in private credit (early 2024) |

| Foreign & Domestic Investment | Emerging market appeal, valuations | Increased liquidity, demand for B3 products | Significant foreign investment inflows (2024) |

| Regulatory Evolution | Central Bank initiatives | Pioneer compliant digital asset platforms, AI integration | Virtual asset regulation, AI oversight planned (2025-2026) |

| Data & Analytics Enhancement | Acquisitions (Neurotech) | New revenue streams, operational efficiency | Investment in technology for data-driven development (2024) |

Threats

Persistent inflation and elevated interest rates in Brazil, coupled with ongoing fiscal concerns, are likely to continue suppressing capital market activity and eroding investor confidence. For instance, Brazil's inflation rate hovered around 4.62% in April 2024, a slight decrease but still a factor influencing monetary policy.

While economic growth is anticipated to moderate, external pressures such as global trade disputes and policy ambiguity, alongside domestic fiscal hurdles, present considerable downside risks for B3's operating landscape. Brazil's GDP growth for 2024 is projected by the IMF to be around 2.3%, a slowdown from previous periods, highlighting the sensitivity to these external and internal factors.

The Brazilian financial market is seeing a surge in competition, with new entrants like the Rio stock exchange 'Base' commencing testing in early 2025. This heightened rivalry poses a significant threat to B3's established market position. The potential for market share erosion and downward pressure on pricing and profitability across B3's diverse service offerings is a key concern.

B3, as a vital financial market infrastructure, is constantly under siege from increasingly sophisticated cyber threats. The landscape in 2024 and 2025 is particularly concerning, with the emergence of AI-driven attacks and the persistent threat of ransomware, which can cripple operations and compromise sensitive data.

The exploitation of vulnerabilities within the growing Internet of Things (IoT) ecosystem presents another significant risk. These evolving threats necessitate continuous and substantial investment in advanced security protocols and infrastructure to maintain data integrity, ensure system availability, and safeguard overall operational resilience.

Unfavorable Regulatory Changes and Compliance Burden

Unfavorable regulatory shifts, especially concerning taxation of financial activities, present a significant threat to B3. For instance, an increase in taxes on credit or foreign exchange transactions could directly dampen trading volumes and revenue streams. The compliance burden associated with new or evolving regulations also adds substantial operational costs and complexities, potentially impacting B3's efficiency and profitability.

The evolving regulatory landscape poses a considerable challenge. For example, potential changes in capital requirements or data reporting standards could necessitate significant investment in new systems and processes. B3 must remain agile to adapt to these shifts, which could otherwise hinder its competitive edge and financial performance. In 2024, the global financial services sector saw increased scrutiny on data privacy and cybersecurity, leading to higher compliance costs for exchanges worldwide.

- Increased operational costs due to new compliance mandates.

- Potential reduction in trading volumes from unfavorable tax changes on financial transactions.

- Need for continuous investment in technology to meet evolving regulatory requirements.

Shift to Decentralized Finance and New Technologies

The ongoing evolution of decentralized finance (DeFi) presents a significant long-term threat to traditional exchanges like B3. As blockchain and tokenization technologies mature, they have the potential to bypass established, regulated financial infrastructure. This could erode the dominance of centralized institutions if they fail to adapt.

For instance, the global DeFi market capitalization reached over $70 billion by early 2024, demonstrating substantial user adoption and capital inflow. If B3 does not actively integrate these emerging technologies and business models, it risks becoming less relevant to a growing segment of the financial market. This necessitates continuous investment in innovation to maintain its competitive edge and franchise value.

- DeFi Market Growth: The DeFi sector saw significant expansion, with total value locked (TVL) in DeFi protocols exceeding $100 billion in late 2023, indicating a strong shift in capital towards decentralized systems.

- Technological Integration: B3's ability to adapt to blockchain and tokenization will be crucial. For example, the Hong Kong Stock Exchange's exploration of tokenized securities in 2024 highlights a trend towards integrating digital assets within traditional frameworks.

- Regulatory Adaptation: The regulatory landscape for DeFi is still developing, but a failure to anticipate and adapt to potential shifts could leave B3 vulnerable to disintermediation by more agile, less regulated platforms.

The competitive landscape is intensifying with new entrants like the Rio stock exchange, 'Base', which began testing in early 2025, posing a direct threat to B3's market dominance. This increased competition could lead to market share erosion and downward pressure on B3's pricing and profitability across its various services.

B3 faces significant cybersecurity risks, especially with the rise of AI-driven attacks and ransomware in 2024-2025, necessitating ongoing investment in advanced security measures. Furthermore, unfavorable regulatory changes, such as increased taxes on financial transactions, could directly impact trading volumes and revenue, while also increasing compliance costs.

The rapid growth of decentralized finance (DeFi) presents a long-term challenge, as these technologies could bypass traditional financial infrastructure. For instance, the DeFi market capitalization exceeded $70 billion by early 2024, indicating a significant shift in capital. B3's failure to integrate these emerging technologies risks diminishing its relevance.

SWOT Analysis Data Sources

This B3 SWOT analysis is built upon a robust foundation of data, drawing from official B3 financial reports, comprehensive market intelligence, and expert industry analyses to provide a nuanced and actionable strategic overview.