B3 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

Uncover the critical external factors shaping B3's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces driving change and identify potential opportunities and threats. Empower your strategic planning with actionable intelligence—download the full PESTLE analysis today and gain a decisive market advantage.

Political factors

Government stability in Brazil is a crucial element for B3, the Brazilian stock exchange. A predictable political environment fosters investor confidence, which is vital for market liquidity and growth. For instance, periods of heightened political uncertainty have historically correlated with increased volatility on B3, as seen in the market's reaction to significant political events in recent years.

Regulatory certainty, stemming from a stable government, directly impacts B3's operational framework and the attractiveness of Brazilian capital markets. Investors are more likely to commit capital when they are assured of consistent regulations and a clear legal system. This stability encourages both domestic and international participation, boosting trading volumes and overall market capitalization.

The Brazilian government's commitment to fiscal responsibility and economic reforms plays a significant role in shaping investor sentiment towards B3. Positive fiscal indicators and successful reform implementation can attract substantial foreign direct investment, thereby enhancing market depth. Conversely, concerns about fiscal deficits or policy reversals can lead to capital flight and reduced market activity.

Government and regulatory bodies like the Central Bank of Brazil and the CVM are the architects of B3's operational framework, setting forth rules for market infrastructure, listing, and trading. For instance, in 2023, the CVM continued its focus on enhancing transparency and investor protection, issuing new directives impacting listed companies.

Shifts in these regulations, such as proposed changes to capital requirements or new reporting standards, directly influence B3's business model and necessitate ongoing compliance efforts. The effectiveness of the regulatory environment in fostering fair competition and preventing market manipulation is paramount for B3's long-term stability and investor confidence.

Brazil's standing in the global economic landscape and its existing trade pacts significantly shape foreign investment into the nation, directly impacting the B3 stock exchange. When Brazil enjoys positive international relations, it tends to draw more foreign capital, which naturally enhances market liquidity and trading activity on the B3.

Conversely, trade conflicts or broader geopolitical instability can dampen foreign investor enthusiasm for Brazilian assets. This reduced interest can lead to lower trading volumes and potentially fewer international companies choosing to list on the B3, affecting its global reach and the depth of its market.

For instance, in early 2024, Brazil's efforts to strengthen ties with Mercosur partners and explore new trade agreements with the European Union were seen as positive signals for foreign investment. Data from the Central Bank of Brazil indicated a notable inflow of foreign direct investment in the first quarter of 2024, suggesting a favorable reception to Brazil's outward-looking trade policy.

Fiscal Policy and Public Debt Management

The Brazilian government's approach to fiscal policy and managing public debt significantly influences the investment climate on the B3. For instance, Brazil's gross debt-to-GDP ratio stood at approximately 75% as of early 2024, a figure closely watched by investors. Prudent fiscal management, characterized by efforts to control spending and reduce deficits, can lead to lower interest rates and a more stable economic environment, thereby boosting investor confidence and trading volumes on the B3.

Conversely, concerns about rising public debt or the sustainability of fiscal policies can deter foreign and domestic investment. A high debt burden may necessitate higher taxes or reduced public services, impacting corporate profitability and consumer spending. This can translate into increased risk premiums for Brazilian assets, potentially dampening activity on the B3.

- Fiscal Deficit: Brazil's primary surplus target for 2024 was set at 0.5% of GDP, a key indicator of fiscal discipline.

- Interest Rate Impact: The Central Bank of Brazil's Selic rate, influenced by fiscal conditions, directly affects borrowing costs for businesses and consumers, impacting B3 valuations.

- Investor Sentiment: Credit rating agencies' assessments of Brazil's fiscal health, such as Moody's or S&P ratings, are critical in shaping foreign investor appetite for B3-listed securities.

Political Will for Market Development

The Brazilian government's commitment to modernizing its capital markets directly impacts B3. Initiatives focused on enhancing financial literacy, such as programs launched by the Central Bank of Brazil, aim to broaden the investor base. For instance, by the end of 2024, the aim is to see a significant increase in the number of individual investors participating in the stock market, building on the 5.5 million recorded in early 2024.

Policies supporting the introduction of new financial instruments and streamlining market access are crucial for B3's growth. The ongoing regulatory efforts to simplify the process for listing new companies and the development of digital platforms for investment are key examples of this political will. These measures are expected to boost trading volumes and attract more diverse financial products to the exchange.

This supportive political environment can significantly drive growth in B3's core business areas. By expanding the investor base and encouraging a wider range of product offerings, these government-led initiatives create a more dynamic and robust market. For example, the planned regulatory framework for tokenized assets, expected to be finalized in 2025, could open up entirely new revenue streams for B3.

- Government initiatives to boost financial literacy are underway, targeting a broader participation in capital markets.

- Regulatory reforms aim to simplify market access and encourage the listing of new companies on B3.

- The development of new financial instruments, such as tokenized assets, is supported by forward-looking policies.

- These political factors are expected to expand B3's investor base and product offerings, fostering market growth.

Government stability and predictable policy frameworks are paramount for B3, the Brazilian stock exchange. Periods of political uncertainty can lead to increased market volatility, impacting investor confidence and trading volumes. For instance, market reactions to significant political events in recent years have demonstrated this correlation.

Regulatory certainty, directly influenced by government stability, is key to attracting both domestic and international investment to B3. A clear and consistent legal system encourages capital commitment, boosting market liquidity and overall capitalization. For example, the CVM's continued focus on enhancing transparency and investor protection in 2023 highlights the importance of regulatory direction.

Brazil's international trade relations and geopolitical standing significantly affect foreign investment into the nation and, consequently, B3. Positive global ties tend to draw more foreign capital, enhancing market liquidity. Conversely, trade conflicts can dampen investor enthusiasm, leading to lower trading volumes and fewer international listings on B3, as seen in early 2024 with Brazil's efforts to strengthen Mercosur ties.

| Political Factor | Impact on B3 | Supporting Data/Example |

|---|---|---|

| Government Stability | Investor Confidence, Market Volatility | Historical correlation between political events and B3 volatility. |

| Regulatory Framework | Market Access, Investor Protection | CVM directives on transparency (2023); planned tokenized asset framework (2025). |

| Fiscal Policy | Investment Climate, Interest Rates | Brazil's gross debt-to-GDP ratio ~75% (early 2024); primary surplus target of 0.5% (2024). |

| Trade Relations | Foreign Investment, Market Liquidity | Increased FDI in Q1 2024 linked to trade initiatives; strengthening Mercosur ties. |

What is included in the product

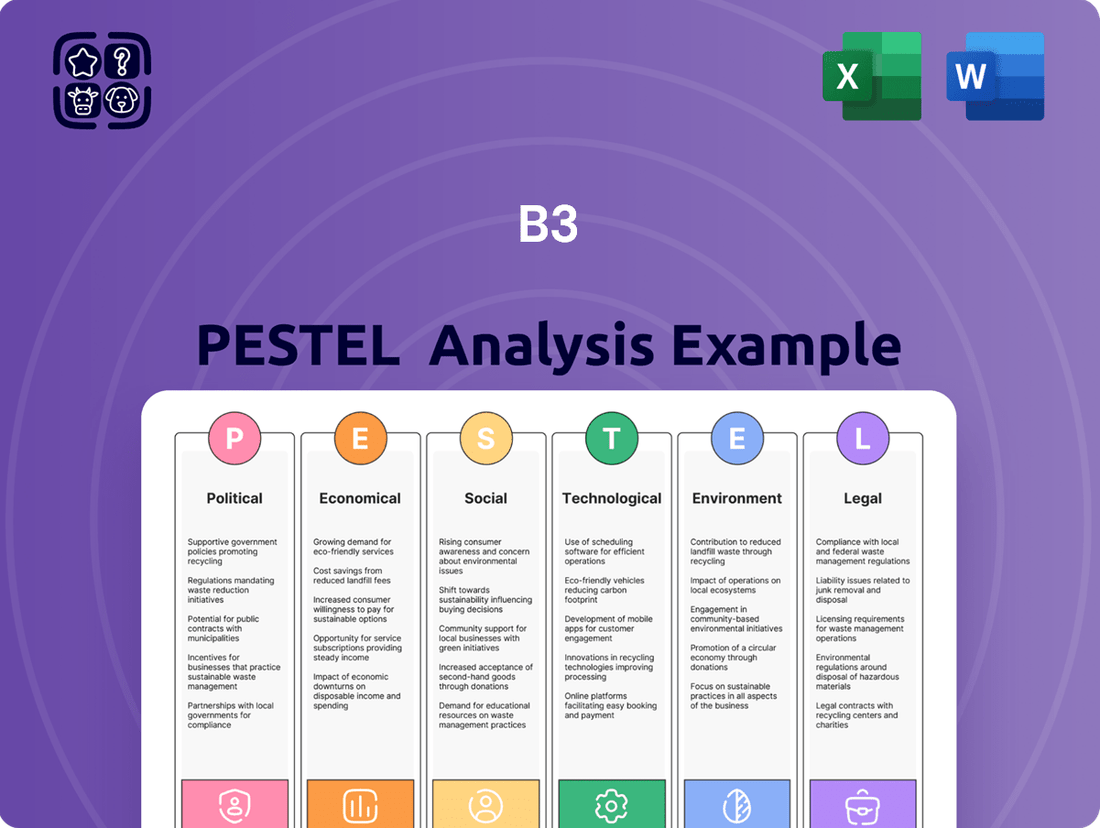

The B3 PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the B3, providing a comprehensive understanding of the external landscape.

The B3 PESTLE Analysis provides a structured framework that simplifies the often overwhelming task of understanding complex external factors, thereby alleviating the pain of information overload and enabling more focused strategic decision-making.

Economic factors

Brazil's economic health is a key driver for B3. For instance, the Brazilian economy grew by an estimated 2.9% in 2023, a solid performance that generally boosts investor confidence. Projections for 2024 suggest continued, albeit potentially slower, growth, with many analysts anticipating around 1.8% to 2.0% GDP expansion. This economic momentum directly influences corporate profitability and, consequently, the valuations of companies listed on the B3.

Inflation and employment figures are also critical. Brazil's inflation rate has shown a downward trend, with the IPCA closing 2023 at 4.62%. Lower inflation typically supports consumer spending and business investment, which are positive for the stock market. Similarly, a healthy employment market, with unemployment rates hovering around 7.8% in early 2024, indicates a stable consumer base, further bolstering the outlook for businesses and B3 activity.

When the Brazilian economy is strong, with rising GDP, controlled inflation, and falling unemployment, B3 tends to see increased trading volumes and higher market capitalization. Investors are more willing to take on risk, driving demand for equities. Conversely, economic headwinds, such as a slowdown in GDP growth or a resurgence in inflation, can lead to increased investor caution, potentially reducing trading activity and market valuations on the exchange.

The Central Bank of Brazil's monetary policy, primarily dictated by the Selic rate, is a major driver for investment choices. In early 2024, the Selic rate began a downward trend from its peak, aiming to stimulate economic activity. For instance, the Selic rate was reduced from 13.75% in August 2023 to 10.50% by May 2024, reflecting a shift in policy stance.

When interest rates are high, fixed-income investments often become more appealing than stocks, potentially pulling money away from the B3. Conversely, a lower interest rate environment typically boosts equity investments, energizing trading on the exchange. This dynamic is crucial for understanding capital flows into and out of the Brazilian stock market.

Brazil's B3 stock exchange is significantly influenced by foreign direct investment (FDI) and portfolio capital flows. In the first half of 2024, foreign investors were net buyers of Brazilian equities, injecting approximately R$40 billion into the market, a notable increase compared to the same period in 2023. This influx of foreign capital directly bolsters liquidity and depth on B3, driving up demand for Brazilian stocks and contributing to higher valuations.

Conversely, shifts in global risk appetite or domestic economic concerns can trigger capital outflows, which can negatively impact B3. For instance, during periods of global economic uncertainty, such as the early stages of the COVID-19 pandemic in 2020, Brazil experienced significant capital repatriation, leading to sharp declines in market activity and asset prices on the exchange.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly influences the B3. Fluctuations in the Brazilian Real (BRL) against major currencies directly affect how attractive Brazilian assets are to foreign investors. For instance, if the BRL strengthens, foreign investors might see their returns diminish when converting back to their home currency, potentially making Brazilian investments less appealing. Conversely, a weaker BRL can boost returns for foreign investors, but it also increases the cost of imported goods and services for Brazilian companies.

Companies listed on the B3 with international operations are particularly sensitive to these movements. A stable or appreciating BRL can improve the profitability of Brazilian firms that import raw materials or components, as these costs become cheaper in local currency. However, significant BRL depreciation can deter foreign investment and raise hedging costs for international participants looking to invest in or do business with Brazil. For example, throughout 2024, the BRL experienced periods of notable depreciation against the US dollar, impacting import costs for many Brazilian businesses and requiring careful financial management.

- Impact on Foreign Investment: A depreciating BRL in early 2024 made Brazilian assets more expensive for dollar-denominated investors, potentially slowing foreign capital inflows.

- Corporate Profitability: Companies with significant import needs, such as automakers or technology firms, faced higher operating costs due to BRL weakness.

- Hedging Costs: Increased BRL volatility in 2024 led to higher costs for companies needing to hedge their foreign currency exposures, impacting net profits.

- Trade Balance: A weaker BRL can make Brazilian exports more competitive internationally, potentially improving the country's trade balance.

Capital Market Liquidity and Investor Confidence

Capital market liquidity in Brazil, crucial for B3's operations, remained robust in early 2024. The average daily trading volume on B3's equity market reached approximately R$15 billion in Q1 2024, indicating healthy participation and ease of transaction. This liquidity is a direct reflection of investor confidence, which has been bolstered by a stable macroeconomic outlook and positive corporate earnings reports.

Investor confidence is a key driver for B3, influencing both trading volumes and the influx of new capital. Surveys from early 2024 indicated a significant uptick in retail investor participation, with the number of individual investors on B3 growing by over 15% year-on-year, reaching over 6 million by April 2024. This confidence is underpinned by B3's commitment to market transparency and strong investor protection measures.

The interplay between liquidity and confidence is evident in B3's performance. For instance, periods of heightened investor sentiment have historically correlated with increased trading activity and, consequently, higher revenue for B3 from trading and listing fees. The exchange's continuous investment in its trading infrastructure, including advancements in its trading systems and data dissemination, further solidifies this positive feedback loop.

- Liquidity Indicator: Average daily equity trading volume on B3 was around R$15 billion in Q1 2024.

- Investor Confidence Metric: Retail investor accounts on B3 surpassed 6 million by April 2024, a 15% year-on-year increase.

- Contributing Factors: Market transparency, investor protection policies, and advanced trading infrastructure.

- Impact on B3: Higher liquidity and confidence translate to increased trading activity and revenue streams.

Brazil's economic growth trajectory directly impacts B3's performance. The country's GDP expanded by an estimated 2.9% in 2023, and forecasts for 2024 suggest a continued, though moderated, growth of around 1.8% to 2.0%. This economic expansion fuels corporate earnings and investor sentiment, which are vital for the stock exchange.

Inflation and employment are key indicators influencing consumer spending and business investment. Brazil's inflation rate closed 2023 at 4.62%, showing a downward trend. Coupled with an unemployment rate around 7.8% in early 2024, these figures point to a stable economic environment conducive to market activity.

Monetary policy, particularly the Selic rate, significantly shapes investment decisions. The Central Bank of Brazil began reducing the Selic rate from 13.75% in August 2023 to 10.50% by May 2024, aiming to stimulate the economy and making equity investments more attractive relative to fixed income.

| Economic Indicator | 2023 (Actual/Estimate) | Early 2024 (Estimate/Trend) | Impact on B3 |

|---|---|---|---|

| GDP Growth | 2.9% | 1.8% - 2.0% | Positive correlation with investor confidence and corporate valuations. |

| Inflation (IPCA) | 4.62% (Year-end) | Downward trend | Lower inflation supports consumer spending and business investment. |

| Unemployment Rate | ~8.5% (Year-end) | ~7.8% | A stable or falling rate indicates a healthy consumer base. |

| Selic Rate | 13.75% (August 2023 peak) | 10.50% (May 2024) | Lower rates generally boost equity market attractiveness. |

Preview Before You Purchase

B3 PESTLE Analysis

The B3 PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, showcasing the comprehensive PESTLE framework for B3. This means you'll get the complete, professionally structured analysis without any surprises.

The content and structure shown in this preview is the same document you’ll download after payment, providing you with a ready-to-use tool for your strategic planning.

Sociological factors

The financial literacy of Brazilians significantly impacts how many people invest on the B3 exchange. When more people understand financial markets and investment options, more individuals are likely to invest, which in turn increases trading activity and the demand for B3's services. For instance, a 2023 survey indicated that only around 30% of Brazilians felt confident managing their finances, highlighting a significant opportunity for growth through education.

Brazil's demographic landscape is evolving, with an aging population and a growing middle class influencing financial behaviors. As of 2024, projections indicate a continued shift towards an older demographic, potentially impacting savings rates and the demand for retirement-focused investment products. This demographic trend, coupled with increasing financial literacy, is expected to drive greater participation in capital markets.

The accumulation of wealth within Brazil, particularly among the expanding middle class, directly fuels demand for B3's listed instruments. As more Brazilians engage in financial planning, there's a noticeable propensity to invest in equities and other capital market products. This trend is not only increasing overall investment volume but also shaping the types of financial instruments investors are seeking, moving beyond traditional savings accounts.

Brazil's significant income inequality, with the top 10% earning over 40% of the national income in 2023, poses a risk to social stability. This disparity can fuel public discontent and protests, creating an unpredictable environment that discourages investment. Such unrest can directly impact investor confidence in the Brazilian market, affecting B3's operational landscape.

Cultural Attitudes Towards Investing and Risk

Brazilian cultural attitudes significantly shape investment behavior on the B3 exchange. A growing appreciation for long-term financial planning and a willingness to embrace market volatility are fostering a more active investor base. For instance, as of early 2024, the number of individual investors on B3 surpassed 5 million, a substantial increase from previous years, indicating a shift towards capital market participation.

Conversely, traditional preferences for fixed-income savings products and a lingering aversion to perceived market risks can still temper broader engagement. This cultural dynamic means that while participation is growing, a segment of the population remains hesitant to venture into equity markets, impacting the overall depth and liquidity of the B3.

- Growing Investor Base: B3's individual investor count exceeded 5 million by early 2024, signaling increased confidence in capital markets.

- Cultural Shift: There's an observable trend towards valuing long-term savings and investing, moving away from solely traditional savings accounts.

- Risk Aversion Remains: Despite growth, a portion of the Brazilian population still prefers lower-risk, traditional savings vehicles over market investments.

- Impact on B3: These cultural attitudes directly influence the breadth and depth of participation in the Brazilian stock exchange.

ESG Awareness and Ethical Investing Trends

Investor and public awareness regarding Environmental, Social, and Governance (ESG) factors is significantly shaping investment strategies. This growing consciousness is fueling a demand for investments that align with sustainable and ethical principles.

In response, B3 is actively working to support the listing and trading of ESG-compliant financial products. This includes initiatives to improve its own sustainability reporting and operational practices to meet evolving stakeholder expectations.

- ESG Assets Under Management: Global sustainable investment assets reached an estimated $37.8 trillion in early 2024, demonstrating a substantial shift in investor priorities.

- Investor Demand: Surveys indicate that over 70% of institutional investors consider ESG factors material to their investment decisions, with a growing segment actively seeking ESG-integrated portfolios.

- Regulatory Push: Many jurisdictions are introducing or strengthening regulations related to ESG disclosure and sustainable finance, further encouraging market participants like B3 to adapt.

- B3's Role: B3's commitment to ESG includes developing new indices and trading platforms that highlight sustainable companies, thereby facilitating capital allocation towards more responsible businesses.

Sociological factors significantly influence participation and behavior on Brazil's B3 exchange. Growing financial literacy is a key driver, with educational initiatives aiming to boost confidence in investment management. Brazil's demographic shifts, including an aging population and an expanding middle class, are also reshaping investment preferences towards long-term planning and retirement products.

Wealth accumulation, particularly within the growing middle class, directly correlates with increased demand for B3's listed instruments, moving beyond traditional savings. However, substantial income inequality remains a concern, potentially impacting social stability and investor confidence. Cultural attitudes are also evolving, with a noticeable shift towards long-term financial planning and a greater willingness to embrace market volatility, as evidenced by the surge in individual investors.

| Sociological Factor | Impact on B3 | Supporting Data (2023-2024) |

|---|---|---|

| Financial Literacy | Increased investor participation and trading volume | ~30% of Brazilians confident managing finances (2023 survey) |

| Demographics | Demand for retirement products, shift in investment behavior | Aging population trend continuing (2024 projections) |

| Wealth Accumulation | Higher demand for equities and capital market products | Growing middle class fueling investment |

| Income Inequality | Potential social instability, impacting investor confidence | Top 10% earning >40% of national income (2023) |

| Cultural Attitudes | Growing acceptance of long-term investing, increased market participation | Individual investors on B3 exceeded 5 million (early 2024) |

Technological factors

The ongoing digitalization of financial markets is fundamentally reshaping B3's operations, driving efficiency through automated trading, clearing, and settlement processes. This digital transformation translates to quicker transactions and lower operational expenses, a crucial advantage in today's fast-paced environment.

B3's commitment to digital infrastructure is paramount for maintaining its competitive edge. For instance, in 2023, B3 reported a 12.7% increase in net revenue, partly fueled by investments in technology and the expansion of its digital offerings, demonstrating the tangible benefits of this strategic focus.

To keep pace with evolving market demands and technological advancements, B3 must consistently upgrade its digital capabilities. This includes exploring innovations like distributed ledger technology for post-trade services, aiming to further enhance speed, security, and transparency for its participants.

B3, as a vital financial market operator, is a prime target for sophisticated cyberattacks, ranging from ransomware to data breaches. In 2024, global financial services firms experienced a significant increase in cyber incidents, with costs averaging millions of dollars per breach, underscoring the immense financial and reputational risk.

Implementing advanced cybersecurity protocols is not merely a defensive measure but a strategic imperative for B3 to safeguard sensitive client information and maintain the trust essential for market operations. The integrity of the financial system hinges on the ability to prevent disruptions and protect data.

Furthermore, B3 must navigate an evolving landscape of data protection laws, such as LGPD in Brazil and GDPR globally. Non-compliance can result in substantial fines, impacting profitability and client relationships, making robust data governance a critical component of its technological strategy.

The adoption of artificial intelligence (AI) and machine learning (ML) is significantly reshaping financial markets, and B3, as a major exchange, is well-positioned to leverage these advancements. These technologies can bolster B3's market surveillance and fraud detection systems, leading to a more secure trading environment. For instance, AI-powered algorithms can analyze vast datasets in real-time, identifying anomalous trading patterns that might indicate manipulation. This proactive approach is crucial for maintaining market integrity and investor confidence.

Furthermore, AI and ML offer substantial opportunities to enhance B3's risk management frameworks. Predictive analytics, driven by these technologies, can help anticipate market volatility and potential systemic risks, allowing for more robust mitigation strategies. By processing historical and real-time data, AI can provide deeper market insights, enabling B3 to offer more sophisticated services to its participants. This includes personalized data analytics and advanced trading tools, fostering innovation and driving efficiency across the exchange.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are reshaping financial markets, offering B3 significant opportunities for enhanced efficiency and transparency, especially in post-trade processing and asset tokenization. For instance, the global market for blockchain in financial services was projected to reach $10.5 billion in 2024, highlighting its growing adoption.

B3 must actively explore the integration of these technologies to streamline operations and unlock new revenue streams, such as digital asset trading. However, this integration comes with the challenge of navigating evolving regulatory landscapes and ensuring seamless compatibility with existing infrastructure. The potential for DLT to reduce settlement times and costs, a key benefit for exchanges like B3, is substantial.

Consider the following implications for B3:

- Efficiency Gains: DLT can automate reconciliation processes, reducing manual intervention and operational risks in areas like clearing and settlement.

- Asset Tokenization: The tokenization of traditional assets on blockchain could create new, more liquid markets, expanding B3's product offerings.

- Regulatory Adaptation: B3 needs to work closely with regulators to ensure compliance as DLT-based financial instruments become more prevalent.

- Digital Asset Trading: Exploring platforms for trading tokenized securities and other digital assets aligns with market trends and future growth potential.

Fintech Innovation and Competition

The Brazilian fintech landscape is booming, presenting both challenges and opportunities for B3. In 2023, Brazil saw a significant increase in fintech adoption, with over 70% of the population using digital financial services, a testament to the sector's rapid growth and its potential to disrupt traditional financial models. This surge means new players are constantly emerging, offering innovative solutions that could directly compete with B3's established revenue streams in areas like trading, clearing, and settlement.

To stay competitive, B3 needs to be proactive. One strategy is to foster partnerships with these agile fintech companies, gaining access to their cutting-edge technologies and customer bases. Alternatively, strategic acquisitions of promising fintechs could integrate new capabilities directly into B3's operations. Developing its own innovative digital offerings is also crucial for B3 to maintain its market leadership and diversify its service portfolio in this rapidly evolving financial ecosystem.

Consider these key areas for B3's fintech strategy:

- Partnerships: Collaborating with fintechs for co-branded products or integrated services, leveraging their agility and tech expertise.

- Acquisitions: Identifying and acquiring fintechs with complementary technologies or market reach to bolster B3's digital capabilities.

- Internal Innovation: Investing in research and development to create proprietary fintech solutions that enhance B3's existing offerings or create new market segments.

- Data Analytics: Utilizing advanced data analytics derived from fintech interactions to better understand market trends and customer needs.

Technological advancements are driving significant operational efficiencies for B3 through digitalization, as seen in its 2023 net revenue growth of 12.7% partly attributed to tech investments.

B3 must continuously upgrade its digital capabilities, potentially integrating technologies like DLT to improve post-trade services, mirroring the projected $10.5 billion market for blockchain in financial services in 2024.

The exchange faces substantial cybersecurity risks, with global financial services firms experiencing millions in costs per breach in 2024, necessitating robust protective measures.

AI and ML offer B3 opportunities to enhance market surveillance and risk management, with AI algorithms capable of real-time anomaly detection to maintain market integrity.

Legal factors

B3, Brazil's stock exchange, operates within a robust regulatory environment overseen by key entities such as the Comissão de Valores Mobiliários (CVM) and the Central Bank of Brazil. These bodies dictate stringent rules on market practices, financial product development, and capital adequacy, ensuring market integrity and investor protection. For instance, CVM Resolution 161 of 2022 outlines specific requirements for the listing and trading of securities, impacting B3's operational procedures and compliance costs.

Staying compliant with evolving legal frameworks is crucial for B3's business model. Changes in capital market laws or increased enforcement actions can trigger substantial investments in technology and personnel to adapt operations, directly affecting B3's overhead and strategic agility. The ongoing digital transformation of financial markets also presents new regulatory challenges, requiring constant vigilance and proactive engagement with policymakers.

Brazil's Lei Geral de Proteção de Dados (LGPD) significantly impacts B3's operations, mandating strict rules for handling personal and financial information. Failure to comply can result in substantial penalties, potentially impacting B3's financial health and reputation. For instance, LGPD fines can reach up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction, as of 2024 data.

B3 must maintain robust data governance and security measures to align with LGPD's evolving requirements, ensuring client trust and operational integrity. This includes ongoing investments in technology and training to safeguard sensitive data against breaches and unauthorized access. The exchange's commitment to data privacy is paramount for its continued success in the digital age.

B3, as a crucial player in Brazil's financial ecosystem, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to combat financial crime and ensure the integrity of the market. In 2023, Brazil's Financial Intelligence Unit (COAF) reported a significant increase in suspicious transaction alerts, highlighting the ongoing importance of robust AML/KYC frameworks for entities like B3.

Compliance with these regulations requires B3 to implement sophisticated systems for monitoring transactions and rigorously verifying the identities of its participants. Failure to adhere to these mandates can result in substantial penalties and reputational damage, underscoring the critical nature of these legal requirements for maintaining trust and stability within the financial markets.

Corporate Governance and Shareholder Rights

Laws in Brazil, like the Lei das S.A. (Corporate Law), establish the framework for corporate governance and shareholder rights for companies traded on B3. These regulations dictate board structures, disclosure requirements, and minority shareholder protections, directly influencing market fairness. For instance, as of early 2024, Brazil's corporate governance landscape continues to evolve, with ongoing discussions around enhancing transparency and accountability for listed entities.

B3 itself plays a crucial role by implementing its own listing rules, often going beyond statutory minimums to foster higher standards of corporate conduct. These B3 rules are designed to ensure investor confidence and market integrity. A key aspect is B3's Novo Mercado segment, which requires companies to adhere to stricter governance practices than those mandated by law, attracting investors seeking robust corporate structures.

Changes in Brazilian legislation concerning corporate governance and shareholder rights can necessitate adjustments in B3's listing criteria and oversight mechanisms. For example, any new regulations aimed at increasing transparency or protecting dissenting shareholders would require B3 to update its rulebook and enforcement procedures. This dynamic legal environment ensures B3 remains a relevant and trusted marketplace.

Key aspects of corporate governance and shareholder rights impacting B3-listed companies include:

- Board Independence: Regulations often mandate a certain percentage of independent directors on company boards to ensure objective decision-making.

- Shareholder Voting Rights: Laws define the voting power of different share classes and the procedures for shareholder meetings and resolutions.

- Disclosure Obligations: Companies are legally required to provide timely and accurate financial and operational information to the market.

- Minority Shareholder Protection: Legal frameworks exist to safeguard the interests of minority shareholders against potential abuses by controlling shareholders.

Taxation Policies on Capital Gains and Investments

Government taxation policies on capital gains, dividends, and other investment income are critical for B3. For instance, Brazil's federal government has been adjusting its tax framework. In 2023, discussions continued around potential changes to income tax on investments, including capital gains. These adjustments directly influence investor returns and their willingness to engage with the B3.

Favorable tax regimes can significantly stimulate trading activity on B3. Conversely, higher taxes on investment income can deter both domestic and foreign investors, potentially reducing market liquidity and demand for B3's services. B3 must closely monitor these evolving policies to understand their impact on market dynamics and its own business strategy.

- Capital Gains Tax: Brazil's current capital gains tax rates for individuals can range from 15% to 22.5% depending on the profit amount, impacting investor profitability on B3 trades.

- Dividend Taxation: While dividends were historically tax-exempt for individuals in Brazil, recent proposals and potential future changes could alter this landscape, affecting dividend-paying stocks traded on B3.

- Impact on Trading Volume: Changes in tax policies can directly influence investor behavior, leading to fluctuations in trading volumes and overall market participation on B3.

- International Competitiveness: B3's attractiveness to foreign investors is also shaped by Brazil's tax policies relative to other global exchanges.

Legal factors significantly shape B3's operational landscape, from regulatory oversight by the CVM and Central Bank to data protection under LGPD. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is paramount, as highlighted by increased suspicious transaction alerts reported by Brazil's Financial Intelligence Unit (COAF) in 2023. Evolving corporate governance laws, such as the Lei das S.A., and B3's own listing rules, particularly for its Novo Mercado segment, dictate market fairness and investor confidence.

Environmental factors

The growing emphasis on Environmental, Social, and Governance (ESG) criteria is reshaping investment landscapes and corporate practices globally. B3 is actively fostering this shift by introducing ESG-linked financial instruments, curating sustainability indexes, and urging its listed companies to improve their ESG reporting practices.

This strategic alignment with sustainability trends is a significant driver for B3's business, particularly in its sustainable finance offerings. For instance, in 2024, the Brazilian ESG investment market saw substantial growth, with assets under management in ESG-focused funds reaching an estimated R$70 billion by the end of the year, reflecting a strong investor appetite for sustainable options.

Climate change presents significant physical risks to Brazil's economy, such as increased frequency of extreme weather events like droughts and floods, which can disrupt agricultural output and damage infrastructure. For companies listed on B3, these events can lead to supply chain disruptions and increased operational costs. For instance, a severe drought in the Cerrado region during 2023 impacted soybean production, a key export commodity.

Transition risks, stemming from policy shifts and technological advancements aimed at decarbonization, also pose challenges. Brazil's commitment to reducing emissions, as outlined in its Nationally Determined Contributions (NDCs) under the Paris Agreement, could lead to new regulations affecting energy-intensive industries. Companies need to adapt to a lower-carbon economy, potentially facing increased compliance costs or needing to invest in greener technologies.

B3 is actively working to address these climate-related factors by exploring avenues to facilitate green finance, aiming to channel capital towards sustainable projects. They are also focused on providing investors with better data to assess climate risks and opportunities within their portfolios, recognizing the growing importance of Environmental, Social, and Governance (ESG) factors in investment decisions. This includes initiatives to enhance climate-related disclosures by listed companies.

B3, as a major financial exchange, faces increasing pressure to manage its operational carbon footprint. In 2024, the company continued its efforts to reduce energy consumption across its data centers and offices, aiming to align with Brazil's national climate commitments. This focus on sustainability not only addresses regulatory expectations but also resonates with investors and clients who prioritize environmental, social, and governance (ESG) performance.

Sustainable Finance Initiatives and Green Bonds

The global sustainable finance market is experiencing robust growth, with green bonds leading the charge. In 2023, the issuance of green bonds reached an estimated $600 billion, a notable increase from the previous year, reflecting strong investor demand for environmentally conscious investments. This trend is expected to continue, with projections suggesting the market could surpass $1 trillion by 2025.

B3 has a significant opportunity to capitalize on this trend by fostering the development and trading of sustainable finance instruments. By offering a platform for green bonds, social bonds, and sustainability-linked loans, B3 can attract new issuers and investors, thereby expanding its product portfolio and revenue streams. This aligns with the increasing regulatory and investor pressure for companies to demonstrate strong ESG (Environmental, Social, and Governance) performance.

- Green bond issuance globally is projected to reach $1 trillion by 2025.

- The sustainable debt market, including green, social, and sustainability-linked bonds, saw significant issuance in 2023.

- B3 can attract new capital by facilitating the listing of these ESG-focused financial products.

- This expansion diversifies B3's offerings and caters to a growing investor preference for sustainable investments.

Resource Scarcity and Operational Resilience

Resource scarcity presents a significant challenge for companies listed on B3, especially those heavily reliant on natural resources. For instance, water scarcity in key agricultural or industrial regions of Brazil could directly impact crop yields and manufacturing output, leading to increased operational costs and potential production halts. The Brazilian government reported that rainfall in the Southeast region, crucial for hydropower generation, was 20% below average in early 2024, highlighting immediate concerns for energy-intensive industries.

B3 must proactively assess how these environmental vulnerabilities could ripple through the market. Disruptions to resource availability can lead to price volatility for commodities and affect the financial health of numerous listed companies, potentially impacting overall market stability. Considering that Brazil is a major global exporter of agricultural products and minerals, a severe resource shortage could also affect its trade balance and economic growth, indirectly influencing B3's performance.

- Water Stress: Regions like the São Francisco River basin, vital for agriculture and energy, face increasing water stress, impacting companies in agribusiness and energy sectors.

- Commodity Price Volatility: Scarcity of key commodities, such as iron ore or agricultural goods, can lead to price spikes, affecting input costs for manufacturers and profitability for producers.

- Operational Disruptions: Extreme weather events linked to resource scarcity, like prolonged droughts or floods, can cause direct damage to infrastructure and disrupt supply chains for B3-listed firms.

Environmental factors significantly influence B3's operations and the performance of its listed companies. Growing investor demand for sustainable investments is driving the market for green finance. For instance, global green bond issuance was projected to reach $1 trillion by 2025, indicating a strong trend B3 can leverage by facilitating these instruments.

Climate change poses both physical risks, such as extreme weather impacting agriculture, and transition risks, related to decarbonization policies. Brazil's commitment to reducing emissions could affect energy-intensive industries. B3 is responding by promoting green finance and improving climate-related disclosures for its listed entities.

Resource scarcity, particularly water stress in key regions, presents operational challenges for companies. This can lead to commodity price volatility and disrupt supply chains, impacting B3-listed firms and Brazil's broader economy, especially its significant export sector.

| Environmental Factor | Impact on B3 Listed Companies | B3's Response/Opportunity |

|---|---|---|

| Climate Change (Physical Risks) | Disruption to agriculture (e.g., drought in Cerrado affecting soybeans), infrastructure damage, increased operational costs. | Facilitating green finance, improving climate risk data for investors, enhancing climate disclosures. |

| Climate Change (Transition Risks) | Increased compliance costs for decarbonization, need for investment in greener technologies, regulatory changes affecting energy-intensive sectors. | Aligning with national climate commitments, reducing own operational carbon footprint. |

| Resource Scarcity (e.g., Water) | Reduced agricultural yields, manufacturing output impacts, higher operational costs, potential production halts. | Assessing vulnerabilities, managing commodity price volatility, ensuring market stability. |

| Sustainable Finance Demand | Investor preference for ESG-aligned assets, growth in green bond market (projected $1 trillion by 2025). | Developing and trading sustainable finance instruments (green bonds, social bonds), attracting new issuers and investors. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including the World Bank, International Monetary Fund (IMF), and various national statistical agencies. We also incorporate insights from leading industry research firms and government policy documents to ensure comprehensive and accurate macro-environmental understanding.