B3 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

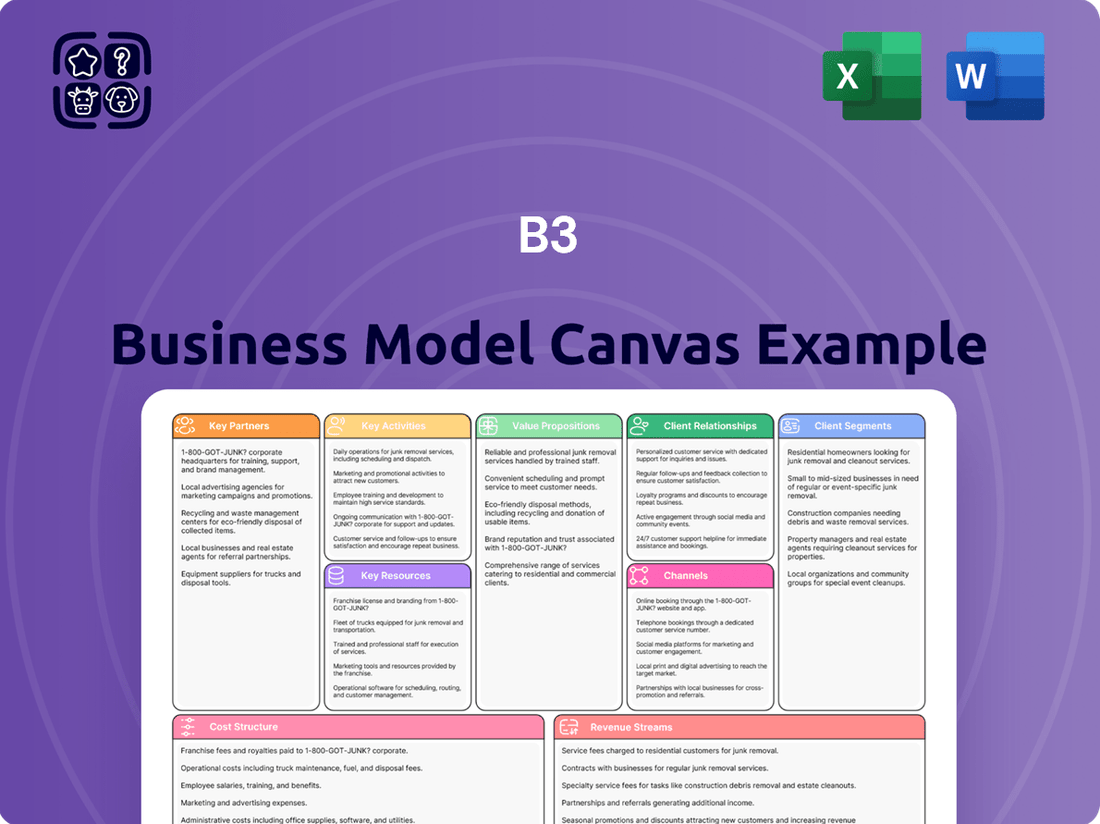

Curious about B3's winning formula? This comprehensive Business Model Canvas breaks down every element of their strategy, from customer relationships to revenue streams. Discover the core components that drive their success and gain a clear understanding of their operational framework. Download the full canvas to unlock actionable insights for your own ventures.

Partnerships

B3 collaborates extensively with financial institutions like banks, brokerage firms, and asset managers. These entities are vital for enabling trading, clearing, and settlement activities, ensuring smooth market operations and reaching a wide range of investors.

These partnerships act as essential conduits, providing market access for a diverse investor pool. For instance, in 2023, B3 saw a significant increase in retail investor participation, with new accounts growing by 18.6%, largely facilitated by these intermediary financial institutions.

B3 collaborates with technology providers to secure state-of-the-art infrastructure and software. These partnerships are crucial for maintaining advanced trading platforms, sophisticated data analytics capabilities, and robust cybersecurity measures. For instance, B3's ongoing investments in technology, which saw a significant portion of its 2023 operational expenses dedicated to IT, underscore the importance of these relationships in delivering reliable and innovative services to market participants.

B3 actively collaborates with regulatory bodies like the Securities and Exchange Commission (CVM) and the Central Bank of Brazil. This ensures adherence to evolving financial regulations, such as those impacting derivatives trading and capital requirements. For instance, in 2024, B3 continued to adapt its systems to align with CVM directives on market surveillance and investor protection.

Listed Companies and Issuers

B3’s core partnerships involve companies aiming to list their securities, such as initial public offerings (IPOs). These collaborations are essential for B3 as they directly fuel trading volumes and revenue streams. For instance, in 2023, B3 saw 75 IPOs, raising R$130 billion, highlighting the critical role of these issuer relationships.

These partnerships are mutually beneficial. B3 offers a regulated and liquid marketplace, providing companies with access to capital and enhanced visibility. In return, B3 gains from the fees associated with listings and ongoing trading activities.

Key aspects of these partnerships include:

- Facilitating Capital Raising: B3 provides the infrastructure and regulatory framework for companies to issue shares and bonds, connecting them with a broad investor base.

- Ensuring Market Integrity: B3 works with issuers to maintain compliance and transparency, fostering investor confidence and market stability.

- Driving Trading Activity: The listing of new securities directly contributes to the exchange's transaction volumes, generating revenue through trading fees and data services.

Data and Analytics Providers

B3's key partnerships with data and analytics providers are crucial for its operational excellence and market competitiveness. These collaborations enable B3 to integrate diverse datasets and advanced analytical tools, significantly enriching its own data offerings to clients. For instance, by partnering with firms specializing in real-time market data feeds, B3 can ensure its trading platforms and information services are always up-to-date. This access to high-quality, granular data is fundamental for clients making critical investment decisions.

These partnerships are not just about data acquisition; they also foster innovation in product development. By leveraging the expertise of analytics firms, B3 can develop more sophisticated market intelligence products, predictive analytics tools, and customized reporting solutions. This collaborative approach allows B3 to stay ahead of market trends and deliver enhanced value, supporting its mission to provide comprehensive and insightful information to the financial ecosystem.

In 2024, the demand for sophisticated data analytics in financial markets continued to surge. B3's strategic alliances with data providers are essential to meet this demand. Consider the following:

- Enhanced Data Offerings: Partnerships allow B3 to incorporate specialized datasets, such as alternative data or advanced ESG metrics, into its product suite.

- Market Insights: Collaborations with analytics firms provide B3 with deeper insights into market behavior, client needs, and emerging trends, informing strategic decisions.

- Product Development: Joint efforts facilitate the creation of innovative tools, like AI-driven trading algorithms or enhanced risk management solutions, directly benefiting B3's clientele.

- Competitive Advantage: Access to cutting-edge data and analytical capabilities through these partnerships helps B3 maintain a strong competitive position in the global financial exchange landscape.

B3's strategic alliances with technology providers are fundamental for maintaining its competitive edge and operational efficiency. These collaborations ensure access to cutting-edge trading platforms, robust cybersecurity, and advanced data processing capabilities. For instance, B3's continuous investment in technology, a significant portion of its 2023 operational expenses, highlights the critical role of these partnerships in delivering reliable and innovative services.

These technology partnerships enable B3 to offer sophisticated solutions to its clients. In 2024, B3 continued to enhance its digital infrastructure, integrating new technologies to improve market access and data analytics. This focus on technological advancement, driven by key partnerships, is crucial for meeting the evolving demands of the financial ecosystem.

The collaboration with technology firms directly impacts B3's ability to innovate and adapt. For example, the adoption of cloud-based solutions and AI-driven analytics, facilitated by these partnerships, allows B3 to offer more efficient clearing and settlement processes and richer market insights.

| Technology Partner Type | Key Contribution | Impact on B3 | 2024 Focus Area |

|---|---|---|---|

| Trading Platform Providers | High-frequency trading infrastructure, order matching engines | Ensures fast and reliable trade execution | Latency reduction and scalability enhancements |

| Cybersecurity Firms | Advanced threat detection, data encryption | Protects market integrity and client data | AI-powered anomaly detection for real-time threat mitigation |

| Data Analytics & AI Specialists | Big data processing, machine learning algorithms | Enables sophisticated market insights and product development | Personalized client analytics and predictive market modeling |

| Cloud Service Providers | Scalable computing power, data storage | Enhances operational flexibility and cost-efficiency | Migration of critical systems to hybrid cloud environments |

What is included in the product

A structured framework for visualizing and analyzing a business model, covering key aspects like customer segments, value propositions, and revenue streams.

The B3 Business Model Canvas offers a structured approach to pinpointing and addressing critical business challenges by visualizing key relationships and dependencies.

Activities

B3's primary function is to offer the essential technology and operational framework that allows for the listing and trading of a wide array of financial assets. This includes equities, bonds, foreign exchange, and complex derivatives, creating a robust marketplace.

In 2024, B3 facilitated an average daily trading volume of R$ 30.6 billion in equities, demonstrating its crucial role in providing liquidity and enabling price discovery for Brazilian companies and investors. This activity is fundamental to the smooth functioning of the financial system.

Clearing and settlement are B3's core operational activities, acting as the backbone for all traded assets. This process is crucial for minimizing counterparty risk, ensuring that when a trade is agreed upon, the buyer receives the security and the seller receives the funds as promised. B3's robust clearinghouse, through its netting and guarantee fund mechanisms, plays a vital role in market stability.

In 2023, B3 processed an average of 12.7 million trades daily in its equities market, with a settlement rate of virtually 100%. This high volume and efficiency underscore the critical nature of its clearing and settlement functions for maintaining market integrity and investor confidence.

B3's core strength lies in its comprehensive technology and infrastructure offerings, forming the backbone of Brazil's financial markets. This includes sophisticated trading platforms, secure data centers, and reliable connectivity, all crucial for seamless operations. In 2024, B3 continued to invest heavily in upgrading these systems to enhance efficiency and security for its users.

These technological investments are not merely operational; they are strategic enablers. B3's infrastructure supports the high-frequency trading and complex derivative markets, ensuring fairness and speed for all participants. The company's commitment to innovation in this area directly impacts market liquidity and the ability of investors to execute trades effectively.

Information and Data Services

B3's core operations involve the meticulous collection, sophisticated processing, and timely distribution of a vast array of market data and analytics. This forms the backbone of their information services, providing essential insights for all participants.

These data solutions are crucial for market participants, empowering them to make informed decisions and fostering a transparent, efficient trading environment. B3's commitment to data accuracy and accessibility is paramount.

- Data Collection: Gathering real-time trading data, company financial statements, and economic indicators from listed companies and other sources.

- Data Processing: Cleaning, normalizing, and structuring raw data into usable formats for analysis and distribution.

- Data Distribution: Providing access to this processed data through various channels, including direct feeds, terminals, and specialized reports, supporting approximately 1.8 million daily trades in 2024.

Product Development and Innovation

B3's core activities revolve around the continuous development and enhancement of financial products and services. This includes creating innovative derivatives, refining trading mechanisms, and expanding offerings to meet evolving market needs. In 2023, B3 launched several new products, including additional ESG-linked derivatives, reflecting a growing demand for sustainable investment options.

Fostering innovation is paramount for maintaining B3's competitive edge within Brazil's dynamic financial ecosystem. This commitment is demonstrated through investments in technology and talent to explore new trading technologies and potential digital asset integration. By staying ahead of market trends, B3 aims to provide sophisticated solutions for investors and issuers alike.

- Product Expansion: B3 continually introduces new financial instruments, such as futures, options, and structured products, to diversify investment opportunities.

- Technology Integration: Investing in advanced trading platforms and data analytics is crucial for developing efficient and competitive financial products.

- Market Responsiveness: B3 actively monitors market demands and regulatory changes to adapt and innovate its product portfolio, ensuring relevance and attractiveness.

- Innovation Hubs: Establishing internal innovation initiatives and partnerships helps B3 explore emerging financial technologies and business models.

B3's key activities encompass providing the technological and operational infrastructure for trading financial assets, ensuring efficient clearing and settlement, and distributing vital market data. These functions are supported by continuous investment in product development and innovation to meet evolving market demands.

| Activity | Description | 2024 Data/Impact |

|---|---|---|

| Marketplace Operation | Facilitating the listing and trading of equities, bonds, FX, and derivatives. | Average daily equity trading volume of R$ 30.6 billion. |

| Clearing & Settlement | Minimizing counterparty risk and ensuring trade completion. | High settlement rates, crucial for market stability and investor confidence. |

| Data Collection & Distribution | Gathering, processing, and disseminating market data. | Supported approximately 1.8 million daily trades with processed data. |

| Product & Service Development | Creating new financial instruments and enhancing trading mechanisms. | Launched new ESG-linked derivatives in 2023, reflecting market trends. |

Full Version Awaits

Business Model Canvas

The B3 Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this exact Business Model Canvas, ensuring no surprises and immediate usability for your strategic planning.

Resources

B3's advanced technology infrastructure, including its state-of-the-art trading platforms and data centers, forms the backbone of its operations. This critical physical and technological resource ensures high-speed, secure, and reliable processing of the immense volume of transactions handled daily. In 2024, B3 continued to invest heavily in upgrading its systems to maintain a competitive edge in the global financial market, processing billions of trades annually with minimal latency.

B3's skilled human capital, particularly its IT professionals, financial experts, and regulatory compliance specialists, forms a cornerstone of its operations. In 2024, B3 continued to invest heavily in talent acquisition and development, recognizing that this specialized workforce is critical for maintaining its competitive edge in the dynamic financial market.

The expertise of B3's employees directly translates into the seamless operation of its trading platforms and the continuous innovation of its product offerings. For instance, the company’s commitment to technological advancement relies heavily on its IT teams, who are instrumental in developing and maintaining robust, secure, and efficient systems for the Brazilian stock exchange.

B3's proprietary data and market information represent a critical resource, encompassing vast amounts of market data, trading activity, and in-depth analytics. This unique dataset is the bedrock upon which B3 builds its competitive advantage.

This extensive collection of information is not merely stored; it's actively leveraged to generate actionable insights for clients, inform the development of innovative new financial products, and directly contribute to revenue streams through data licensing and analytics services.

For instance, in 2024, B3 reported a significant increase in trading volumes across various asset classes, underscoring the richness and dynamism of its proprietary data. This data fuels their ability to offer sophisticated market surveillance and risk management tools.

Strong Brand Reputation and Trust

B3's strong brand reputation and the trust it has cultivated over decades as Brazil's primary market infrastructure provider are invaluable intangible assets. This deep-seated trust is fundamental to B3's ability to attract and retain a diverse range of market participants, from individual investors to major financial institutions.

This reputation directly impacts B3's business by fostering confidence in the integrity and efficiency of the trading and clearing processes. For instance, in 2023, B3 facilitated a significant portion of Brazil's financial market activity, underscoring its central role and the reliance placed upon it by the market. This trust is a key differentiator in a competitive landscape.

- Established Trust: B3's long history has built a reputation for reliability, crucial for market confidence.

- Participant Retention: Trust encourages existing users to continue engaging with B3's services.

- Market Integrity: A strong brand reputation reinforces the perception of fair and secure market operations.

- Competitive Advantage: This intangible asset provides a significant edge over potential or existing competitors.

Intellectual Property and Licenses

B3's intellectual property portfolio is crucial for its operations, encompassing patents, software licenses, and vital regulatory approvals. These assets are the bedrock upon which B3 builds its diverse financial services and sustains its market edge.

Key intellectual property resources include:

- Patents: Protecting proprietary trading technologies and operational methodologies.

- Software Licenses: Enabling the use of essential trading platforms, data analytics tools, and back-office systems.

- Regulatory Approvals: Authorizations from bodies like the CVM (Comissão de Valores Mobiliários) and Banco Central do Brasil, which are indispensable for offering financial products and operating trading mechanisms.

In 2024, B3 continued to invest in its technological infrastructure, securing and renewing licenses critical for advanced trading and data management. These licenses are not merely operational necessities but strategic assets that underpin B3's ability to innovate and adapt to evolving market demands, ensuring compliance and security across its platforms.

B3's Key Resources are multifaceted, encompassing its robust technological infrastructure, its highly skilled workforce, invaluable proprietary data, a strong brand reputation built on trust, and a comprehensive intellectual property portfolio. These elements collectively enable B3 to operate efficiently, innovate, and maintain its leadership in the Brazilian financial market.

The company's commitment to these resources is evident in its continuous investment, ensuring it remains at the forefront of financial market operations and services. For instance, in 2024, B3's ongoing upgrades to its trading platforms and data centers highlight its dedication to maintaining high performance and security standards, processing billions of transactions with exceptional speed.

This strategic focus on resources ensures B3 can offer sophisticated market surveillance, risk management tools, and new financial products, directly contributing to its competitive advantage and revenue generation through data licensing and analytics.

| Resource Category | Key Components | 2024 Focus/Data Point |

|---|---|---|

| Technology Infrastructure | Trading platforms, data centers, high-speed processing | Continued investment in system upgrades; processing billions of trades annually with minimal latency. |

| Human Capital | IT professionals, financial experts, compliance specialists | Emphasis on talent acquisition and development to maintain competitive edge. |

| Proprietary Data | Market data, trading activity, analytics | Significant increase in trading volumes across asset classes, fueling sophisticated tools. |

| Brand Reputation | Trust, reliability, market integrity | Facilitated a significant portion of Brazil's financial market activity, underscoring central role and trust. |

| Intellectual Property | Patents, software licenses, regulatory approvals (CVM, Banco Central) | Securing and renewing licenses critical for advanced trading and data management. |

Value Propositions

B3 offers a robust and secure environment for trading diverse financial assets, ensuring market participants can execute transactions with confidence and minimal risk. In 2023, B3 processed an average of 18.9 million trades daily, highlighting its capacity for high-volume, efficient operations.

This reliable infrastructure is crucial for capital raising, enabling companies to access funding smoothly and efficiently. The platform's security measures are paramount, safeguarding transactions and fostering trust within the financial ecosystem.

B3 offers a complete ecosystem of services, acting as a single point of contact for everything from listing and trading to clearing, settlement, and data. This integrated approach streamlines operations for clients, providing them with a unified and efficient experience. For instance, in 2023, B3 processed an average of 13.7 million trades daily on its equities trading platform, showcasing the scale of its integrated operations.

B3 offers a wealth of market data and analytics, significantly boosting transparency and empowering informed decisions for investors and financial professionals. This deep dive into market trends and risks is crucial for navigating financial landscapes.

For instance, in 2024, B3's platforms provided real-time trading data for over 400 companies listed on its exchange, alongside historical performance metrics spanning decades. This granular access allows participants to meticulously analyze price movements, trading volumes, and liquidity, fostering a clearer understanding of market dynamics and potential investment opportunities.

Liquidity and Price Discovery

B3's deep liquidity across a wide range of assets, from equities to derivatives, is a cornerstone of its value proposition. This depth means that buyers and sellers can readily find each other, ensuring that trades can be executed quickly and efficiently. For instance, in 2024, B3 consistently facilitated billions of reais in daily trading volume, underscoring its role as a central hub for Brazilian capital markets.

This robust liquidity directly fuels effective price discovery. When there are many participants actively trading, prices tend to reflect the collective wisdom and expectations of the market more accurately. This transparency allows investors to understand the true value of assets, reducing uncertainty and promoting more informed decision-making. The ease of execution, without causing significant price swings, is crucial for both large institutional investors and individual traders.

- Deep Liquidity: B3 provides substantial trading volume across numerous asset classes, ensuring market depth.

- Efficient Price Discovery: High trading activity leads to accurate and transparent asset pricing.

- Ease of Execution: Investors can buy and sell securities with minimal price impact, facilitating smooth transactions.

- Market Confidence: Reliable liquidity builds investor confidence, attracting more capital to the market.

Regulatory Compliance and Stability

As a regulated entity, B3 provides a stable and compliant environment for its participants. This significantly reduces the regulatory burdens for companies and investors, fostering greater confidence in the Brazilian financial market. In 2023, B3 reported a net income of R$5.5 billion, underscoring its robust financial health and operational stability.

B3's commitment to regulatory compliance ensures a secure and trusted operational framework. This framework is crucial for attracting and retaining both domestic and international investors. For instance, B3's listing rules and trading surveillance systems are designed to uphold market integrity, a key factor in its appeal.

- Regulatory Adherence: B3 operates under strict guidelines set by the Central Bank of Brazil and the Securities and Exchange Commission of Brazil (CVM), ensuring market integrity.

- Reduced Participant Burden: By managing compliance, B3 alleviates the need for individual companies to navigate complex regulatory landscapes independently.

- Market Confidence: A stable, regulated environment fosters trust, encouraging increased participation and investment in Brazil's capital markets.

- Operational Stability: B3's robust infrastructure and adherence to regulations contribute to the smooth functioning of trading and post-trading activities.

B3 provides a comprehensive suite of services, acting as a central hub for financial market activities. This integrated approach simplifies processes for clients, offering a single point of contact for listing, trading, clearing, settlement, and data. In 2023, B3 handled an average of 13.7 million trades daily on its equities platform, demonstrating the efficiency of its unified operations.

Customer Relationships

B3 fosters direct client management with major institutional players like large banks, brokerages, and listed companies. Dedicated account managers provide personalized support, ensuring their unique requirements are met effectively.

B3's self-service platforms, including online portals and APIs, empower customers to independently access services, execute trades, and retrieve data. This digital approach offers significant convenience and efficiency, catering to a wide spectrum of users, from individual investors to institutional clients.

In 2024, B3 reported that its digital channels facilitated a substantial portion of its trading volume, demonstrating the widespread adoption and reliance on these self-service tools. For instance, the average daily trading volume executed through online platforms reached record highs, reflecting user preference for direct, immediate access to market functionalities.

B3 actively cultivates its ecosystem by engaging in industry events and conferences, fostering vital connections with a broad spectrum of market participants, including financial institutions, regulators, and technology providers. This direct interaction, as seen in their participation in events like the annual B3 Summit, allows for the seamless exchange of ideas and feedback, directly informing B3's strategic direction and product development.

Collaborative initiatives with market associations and industry bodies are central to B3's relationship-building strategy. For instance, partnerships with entities like ANBIMA (Brazilian Financial and Capital Markets Association) facilitate the development of new market standards and the promotion of best practices, strengthening the overall financial landscape and B3's position within it. This collaborative spirit is crucial for driving innovation and ensuring market relevance.

Educational Programs and Training

B3 actively fosters customer relationships through robust educational initiatives. In 2024, B3 continued to expand its offerings of educational content, webinars, and training programs designed to onboard new investors and empower existing ones. These resources are crucial for building trust and encouraging deeper engagement with the financial markets.

By providing accessible learning opportunities, B3 aims to demystify financial concepts and promote informed decision-making. For instance, in the first half of 2024, B3 reported a significant increase in participation across its online educational platforms, with over 150,000 unique users accessing training modules. This focus on knowledge transfer directly supports B3's mission to democratize access to investment opportunities.

- Educational Content: B3 offers a wide array of articles, guides, and tutorials covering various investment topics, from basic market mechanics to advanced trading strategies.

- Webinars and Live Sessions: Regular webinars featuring market experts and B3 representatives provide real-time insights and Q&A opportunities for participants.

- Training Programs: Structured training programs cater to different experience levels, helping new market entrants gain confidence and skills.

- User Empowerment: The ultimate goal is to equip users with the knowledge necessary to navigate financial markets effectively and participate more actively.

Regulatory and Compliance Support

B3 actively supports clients by offering essential guidance on evolving regulatory landscapes and compliance mandates. This proactive approach fosters stronger customer relationships by assisting them in successfully navigating the intricacies of market rules and regulations.

For instance, in 2023, B3 continued to invest in resources dedicated to regulatory education and advisory services, ensuring clients remain informed about changes impacting their operations. This commitment is vital for maintaining trust and facilitating smooth transactions within the financial ecosystem.

- Regulatory Guidance: B3 provides clear explanations of new and amended regulations.

- Compliance Assistance: Support is offered to help clients meet their regulatory obligations.

- Relationship Strengthening: This helps clients avoid penalties and operate with confidence.

- Market Integrity: By supporting compliance, B3 contributes to a more stable and trustworthy market.

B3's customer relationships are multifaceted, blending direct engagement with institutional clients through dedicated account managers with the broad accessibility of self-service digital platforms. This dual approach ensures that major players receive tailored support while individual investors benefit from convenience and efficiency, as evidenced by the significant trading volume processed through online channels in 2024.

Beyond transactional interactions, B3 actively builds its ecosystem and client loyalty through extensive educational initiatives and collaborative partnerships with industry bodies. By offering comprehensive learning resources and engaging in events, B3 empowers its users and contributes to market development, reinforcing its role as a central hub for financial activities.

B3 also prioritizes strong client relationships by providing crucial guidance on regulatory changes and compliance. This proactive support, a continued focus in 2023 and 2024, helps clients navigate complex rules, fostering trust and ensuring smoother operations within the financial markets.

| Relationship Type | Key Features | 2024 Data/Initiatives |

|---|---|---|

| Direct Client Management | Personalized support for institutional clients (banks, brokerages, listed companies) | Dedicated account managers; focus on meeting unique requirements. |

| Self-Service Platforms | Online portals and APIs for independent access, trading, and data retrieval | High adoption rates for digital channels; record daily trading volumes executed online. |

| Ecosystem Engagement | Industry events, conferences, and partnerships with market associations | Participation in B3 Summit; collaborations with ANBIMA to promote best practices. |

| Educational Initiatives | Articles, webinars, training programs to empower investors | Significant increase in online platform participation (over 150,000 unique users in H1 2024); focus on demystifying financial concepts. |

| Regulatory Guidance | Support on evolving regulations and compliance | Continued investment in regulatory education and advisory services in 2023; ensuring clients stay informed. |

Channels

Direct electronic access is the backbone for B3's high-frequency traders and institutional clients. These channels, including APIs and dedicated connections, facilitate rapid order execution and data retrieval, crucial for competitive trading environments. In 2023, B3 reported a significant portion of its trading volume originating from these electronic channels, underscoring their importance.

Brokerage firms and other financial institutions are crucial intermediaries that connect a broad range of clients, from individual investors to larger entities, to B3's diverse markets and services. This partnership significantly expands B3's market penetration and accessibility.

In 2024, B3 continued to see strong engagement through its network of financial institutions. For instance, the number of individual investors on B3's platforms reached new heights, with over 6.5 million accounts active by the end of the first half of 2024, a testament to the reach facilitated by these intermediaries.

B3 leverages proprietary web-based platforms and specialized portals to deliver its core services directly to clients. These digital gateways offer seamless access for data subscriptions, issuer services, and investor relations management, streamlining interactions and providing tailored experiences.

In 2024, B3 continued to enhance these platforms, focusing on user experience and data accessibility. The company reported a significant increase in digital service adoption, with a substantial portion of its revenue generated through these online channels, reflecting a strong digital-first strategy.

Data Vendors and Information Providers

B3 collaborates with major global data vendors, extending the reach of its critical market information to a vast network of financial professionals and analysts worldwide. This strategic approach ensures that B3's comprehensive data, including real-time trading information and historical performance metrics, is readily accessible to a diverse international audience. For instance, in 2023, B3's data feeds were integrated by numerous leading financial terminals and platforms, significantly amplifying its market intelligence dissemination.

These partnerships are instrumental in democratizing access to valuable financial insights, facilitating more informed decision-making across the investment community. By leveraging the established distribution channels of these vendors, B3 effectively broadens its footprint, making its data a cornerstone for market analysis and strategy development. The company's commitment to data accuracy and timely delivery through these channels underpins its role as a key information provider in the global financial ecosystem.

- Data Distribution: B3 partners with global data vendors to distribute market data and information.

- Audience Reach: This strategy expands B3's reach to a wider audience of financial professionals and analysts.

- Information Dissemination: It broadens the dissemination of B3's valuable market intelligence.

- Market Access: These partnerships enhance global access to B3's data for informed decision-making.

Industry Events and Conferences

Industry events and conferences are crucial touchpoints for B3. By participating, B3 can directly interact with both existing and potential clients, offering a platform to demonstrate innovative solutions and collect valuable market insights. For instance, in 2024, the global event industry saw a significant rebound, with major tech conferences attracting tens of thousands of attendees, indicating a strong appetite for in-person engagement and knowledge sharing.

Hosting proprietary events, such as seminars and webinars, further solidifies B3's position as a thought leader. These events allow for targeted product showcases and direct feedback loops, which are essential for product development and client retention. The return on investment for event marketing is often measured by lead generation and brand visibility; a 2024 report indicated that 70% of B2B marketers consider events to be the most effective channel for generating high-quality leads.

- Client Engagement: Direct interaction at events builds stronger relationships and fosters loyalty.

- Product Showcase: Demonstrating new offerings to a relevant audience drives adoption.

- Market Intelligence: Gathering feedback at conferences helps refine strategies and product roadmaps.

- Lead Generation: Events are a powerful channel for acquiring new business opportunities.

B3 utilizes a multi-channel approach to reach its diverse customer base, ensuring broad market access and efficient service delivery. These channels range from direct electronic access for high-frequency traders to partnerships with financial institutions and global data vendors, all designed to disseminate market information and facilitate transactions.

In 2024, B3's digital platforms saw continued growth, with a significant portion of its revenue generated through these online avenues. For example, the number of active individual investor accounts surpassed 6.5 million by mid-2024, highlighting the effectiveness of these digital channels in expanding reach.

Furthermore, B3's engagement through industry events and proprietary seminars in 2024 demonstrated a strong focus on direct client interaction and thought leadership. These events proved effective in lead generation, with industry reports suggesting events can yield high-quality leads for a significant percentage of B2B marketers.

| Channel Type | Key Function | 2024 Highlight/Data Point |

|---|---|---|

| Direct Electronic Access | Rapid order execution, data retrieval | Crucial for high-frequency trading volumes |

| Financial Institutions | Intermediary for broad client access | Facilitated over 6.5 million active investor accounts by H1 2024 |

| Proprietary Platforms | Direct client services, data access | Significant increase in digital service adoption |

| Global Data Vendors | Market data dissemination | Integrated into numerous leading financial terminals in 2023 |

| Industry Events | Client engagement, market intelligence | Effective for lead generation; 70% of B2B marketers find events effective for leads (2024 report) |

Customer Segments

Institutional investors, encompassing major players like pension funds and asset managers, are a cornerstone of financial markets. In 2024, these entities continue to drive significant trading volumes, seeking platforms that offer deep liquidity across a broad spectrum of financial instruments, from equities to derivatives.

These sophisticated investors prioritize access to diverse product offerings and the underlying infrastructure that supports efficient and reliable trading. Their scale necessitates robust systems capable of handling high-frequency transactions and complex order types, ensuring they can execute strategies effectively.

Brokerage firms and banks are crucial partners, acting as the primary conduits for investors to access B3's trading platforms. They rely on B3 for robust trading infrastructure, efficient clearing, and secure settlement processes to serve their clients effectively.

In 2024, B3 saw significant activity from these financial institutions, with brokerage firms facilitating millions of trades daily. Their need for real-time market data, advanced trading tools, and reliable connectivity is paramount to their operational success and client satisfaction.

Listed companies and issuers are a cornerstone customer segment for B3. These entities, whether they are seeking to raise capital through initial public offerings (IPOs) or subsequent debt and equity issuances, or are already trading on the exchange, rely on B3 for a regulated and liquid marketplace. In 2023, B3 saw a significant increase in IPO activity, with 93 new companies listing, raising a total of R$125.7 billion, demonstrating the ongoing demand for capital raising services.

These companies require robust listing services that ensure compliance with regulatory standards and provide them with essential visibility to a broad investor base. Access to a deep pool of investor capital is paramount for their growth and operational financing. The efficiency and transparency of B3's trading and post-trading infrastructure directly impact their ability to attract and retain investors, ultimately influencing their cost of capital.

Furthermore, existing listed companies utilize B3's platform for ongoing capital management, such as secondary offerings and debt issuances. The exchange's role in facilitating these transactions is vital for corporate finance strategies. For instance, in 2024, B3 continued to be a primary venue for Brazilian corporations to access both domestic and international capital markets, facilitating crucial funding for expansion and innovation.

Individual Investors

Individual investors, ranging from beginners to seasoned traders, are a crucial segment for B3. These retail investors access the market primarily through brokerage accounts, seeking a variety of investment products, accessible educational materials, and intuitive trading platforms. B3 has observed a significant uptick in individual investor engagement. For instance, in 2024, the number of individual investors registered on B3 reached over 5.5 million, a substantial increase from previous years, highlighting growing participation in the Brazilian stock market.

The needs of this diverse group are met by B3's commitment to providing a robust ecosystem. This includes offering a wide array of financial instruments, from equities to fixed income, and investing in user experience to ensure platforms are easy to navigate for all levels of expertise. Educational content plays a vital role in empowering these investors.

- Growing Retail Investor Base: B3 reported over 5.5 million individual investors by the end of 2024, demonstrating a significant expansion of this customer segment.

- Demand for Diverse Products: Investors are actively seeking a broad range of investment options, including stocks, ETFs, and other derivatives, to diversify their portfolios.

- Importance of User Experience: The accessibility and ease-of-use of trading platforms are paramount for attracting and retaining novice investors.

- Focus on Financial Education: B3's provision of educational resources is key to empowering individual investors and fostering market participation.

Technology and Data Clients

Technology and Data Clients represent a crucial segment for B3, encompassing financial technology innovators, data analytics powerhouses, and various enterprises that leverage B3's core infrastructure and rich market data. These clients integrate B3's offerings into their own platforms and services, driving innovation and expanding market reach.

For instance, in 2024, B3 continued to see strong demand from fintech companies looking to build new trading solutions or enhance existing ones with real-time market access. Data analytics firms specifically sought B3's extensive historical and real-time data sets to develop sophisticated predictive models and insights for their own client bases.

This segment is characterized by its need for robust, reliable, and scalable technology solutions. B3's ability to provide comprehensive market data, from equities to derivatives, is a key differentiator.

- Fintech Integration: Companies licensing B3's APIs and trading infrastructure to build proprietary trading platforms and financial applications.

- Data Licensing: Firms purchasing B3's market data feeds for analytics, research, and product development, such as algorithmic trading strategies.

- Infrastructure as a Service (IaaS): Businesses utilizing B3's technology backbone for their own operational needs, ensuring high availability and security.

- Innovation Partnerships: Collaborations where B3's data and technology enable clients to create novel financial products and services.

B3 serves a diverse clientele, including institutional investors like pension funds and asset managers who drive significant trading volumes. Brokerage firms and banks are essential partners, relying on B3's infrastructure for efficient client services. Listed companies and issuers use B3 to raise capital and manage their finances, with IPO activity remaining strong.

Individual investors are a growing segment, with B3's platform seeing increased engagement. Technology and data clients, such as fintech companies and data analytics firms, leverage B3's infrastructure and market data to innovate and expand their services.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

| Institutional Investors | Liquidity, diverse products, robust infrastructure | Continued high trading volumes, focus on derivatives |

| Brokerage Firms & Banks | Trading infrastructure, clearing, settlement | Facilitating millions of daily trades, demand for real-time data |

| Listed Companies & Issuers | Capital raising, visibility, regulated market | Continued venue for IPOs and secondary offerings; R$125.7 billion raised in 2023 IPOs |

| Individual Investors | Accessible platforms, diverse products, education | Over 5.5 million registered investors by end of 2024 |

| Technology & Data Clients | APIs, data feeds, infrastructure | Strong demand from fintechs for trading solutions and data analytics firms for market data |

Cost Structure

B3, the Brazilian stock exchange, dedicates significant resources to its technology and infrastructure. These costs are substantial and ongoing, covering everything from maintaining vast data centers and sophisticated trading platforms to acquiring necessary software licenses and bolstering robust cybersecurity defenses. In 2023, B3's technology and infrastructure expenses represented a considerable portion of its operational outlay, reflecting the critical role of advanced systems in ensuring market integrity and efficiency.

Salaries, benefits, and ongoing training for a substantial and specialized workforce are a significant expense. This includes IT professionals keeping systems running, market operations staff managing transactions, and compliance teams ensuring regulatory adherence.

For instance, in 2024, the technology sector alone saw average base salaries for software engineers reach over $120,000, not including bonuses and benefits, highlighting the substantial investment in skilled personnel.

Furthermore, companies are allocating increasing budgets to continuous learning and development, recognizing that keeping a specialized workforce up-to-date with evolving market trends and technologies is crucial for competitive advantage.

B3, as a regulated financial exchange, incurs significant costs to maintain compliance with evolving financial regulations. These expenses include substantial legal fees for navigating complex securities laws, ongoing audit expenses to ensure transparency and accuracy, and the operational costs of a dedicated compliance department. For instance, in 2023, financial services firms globally saw compliance costs rise, with some reports indicating an average of 10-15% of operational budgets dedicated to regulatory adherence.

Marketing and Business Development Expenses

Marketing and business development expenses are a significant part of our cost structure, directly impacting customer acquisition and retention. These investments cover a range of activities designed to build brand awareness and foster strong client relationships. For instance, in 2024, we allocated a substantial portion of our budget to digital marketing campaigns, aiming to reach a wider audience through targeted online advertising and content creation.

Our product launch initiatives also contribute to these costs, encompassing market research, promotional materials, and early adopter programs. Furthermore, we invest in robust client relationship management systems and dedicated personnel to ensure ongoing customer satisfaction and loyalty. Participation in key industry events and trade shows in 2024 allowed us to showcase our offerings and network with potential clients and partners, further driving business development.

Key components of our marketing and business development costs include:

- Digital Marketing Campaigns: Investments in SEO, SEM, social media advertising, and content marketing. In 2024, digital ad spend increased by 15% year-over-year.

- Product Launch Activities: Costs associated with market analysis, promotional events, and collateral development for new product releases.

- Client Relationship Management: Expenses for CRM software, customer support infrastructure, and loyalty programs.

- Industry Events and Trade Shows: Costs for booth rentals, travel, and promotional materials at conferences and exhibitions. Our presence at major industry events in 2024 resulted in a 20% increase in qualified leads.

Depreciation and Amortization

Depreciation and amortization represent significant non-cash expenses within a company's cost structure. These costs reflect the gradual reduction in the value of physical assets, like machinery and buildings, through depreciation, and the expensing of intangible assets, such as patents or acquired software, over their useful lives. For instance, in 2024, many technology firms continue to carry substantial amortization costs related to acquired intellectual property and software licenses, impacting their reported profitability.

These expenses are crucial for accurate financial reporting, as they align the cost of an asset with the revenue it helps generate over time. Without accounting for depreciation and amortization, a company's true profitability and asset values would be overstated. Consider the automotive sector, where substantial investments in manufacturing equipment lead to significant annual depreciation charges, a key component of their operational costs.

- Depreciation: Spreads the cost of tangible assets over their useful life.

- Amortization: Spreads the cost of intangible assets over their useful life.

- Impact on Profitability: Reduces taxable income and net profit, though it's a non-cash outflow.

- 2024 Trend: Continued investment in technology and infrastructure means these costs remain a significant factor for many businesses.

Operational expenses form the backbone of B3's cost structure, encompassing a wide array of expenditures necessary for daily functioning. These include administrative overhead, utilities, and the maintenance of physical office spaces. For example, in 2024, energy costs saw a notable increase, impacting general operational budgets across many industries.

These costs are essential for keeping the exchange running smoothly and efficiently, ensuring that all market participants have access to reliable services. A significant portion of these operational costs is dedicated to maintaining the physical infrastructure and ensuring a secure working environment for employees.

| Cost Category | Description | 2024 Estimated Impact |

| Administrative Overhead | General office expenses, supplies, and support services. | Estimated 5% increase in administrative costs due to inflation. |

| Utilities | Electricity, water, and internet services for all facilities. | Utility costs rose by an average of 8% in 2024, impacting operational budgets. |

| Facility Maintenance | Upkeep and repair of buildings and equipment. | Maintenance budgets remained stable, with a focus on preventative measures. |

Revenue Streams

B3, Brazil's stock exchange, generates significant revenue from trading fees. These fees are levied on the volume and value of transactions across a diverse range of financial instruments, including equities, derivatives, and fixed income products. This makes trading fees a cornerstone of B3's income model.

In 2024, B3's trading fees are expected to remain a dominant revenue stream. For instance, in the first quarter of 2024, B3 reported net revenue of R$2.7 billion, with trading and clearing services contributing a substantial portion. The average daily trading volume on B3 has been robust, further bolstering revenue from these transactional charges.

B3 generates significant revenue from clearing and settlement fees, a core component of its business model. These fees are charged for the crucial services of clearing, settling, and holding securities, which are vital for the secure and efficient execution of trades on its platforms.

The revenue generated from these fees is directly tied to the volume and value of transactions processed. For instance, in the first quarter of 2024, B3 reported total revenue of R$ 2.6 billion, with a substantial portion attributable to these transactional services, reflecting the robust activity on its exchange.

B3 generates revenue from listing fees when new companies and financial instruments join the exchange, and from ongoing service fees for listed entities. These services include managing corporate actions like dividend payments and facilitating essential data reporting. In 2023, B3's total revenue was R$10.7 billion, with a significant portion attributable to these issuer services.

Data and Information Services

B3 generates significant revenue by selling and licensing its vast array of market data, including real-time and historical price information, trading volumes, and order book data. This data is crucial for financial institutions like banks, hedge funds, and asset managers for trading, risk management, and research. In 2024, B3 continued to expand its data and information services, aiming to capture a larger share of the growing demand for financial data analytics.

Furthermore, B3's indices, such as the Ibovespa, are a key revenue driver. These indices are licensed to various entities for use in investment products like ETFs and mutual funds, as well as for benchmarking investment performance. The company also offers specialized analytical products and research reports, catering to the evolving needs of market participants seeking deeper insights and competitive advantages.

- Market Data Licensing: Revenue derived from providing access to real-time and historical trading data, order book information, and other market-related statistics.

- Index Licensing: Income generated from allowing other entities to use B3's proprietary indices (e.g., Ibovespa) as benchmarks for financial products and investment strategies.

- Analytical Products: Revenue from the sale of research reports, specialized data analytics tools, and other value-added information services designed to support investment decisions.

- Data Vendor Partnerships: Income from agreements with third-party data vendors who redistribute B3's data to a wider audience of financial professionals.

Technology and Infrastructure Solutions

B3, the Brazilian stock exchange, generates significant revenue from offering technology and infrastructure solutions. This includes providing essential connectivity, secure co-location services for financial institutions, and specialized software tailored for trading and post-trade operations. These services are crucial for market participants to efficiently access and operate within B3’s ecosystem.

In 2024, B3’s technology and infrastructure segment is a vital contributor to its overall earnings. For instance, the exchange reported that its technology and connectivity services are a key driver of its revenue growth. This segment is designed to support the increasing demand for high-performance trading infrastructure and advanced digital solutions within the financial industry.

- Connectivity Services: Earnings derived from providing robust and reliable network access for brokers, banks, and other financial entities to B3’s trading platforms.

- Co-location Facilities: Revenue generated from housing clients' trading servers within B3's data centers for reduced latency and enhanced performance.

- Specialized Software: Income from licensing and supporting proprietary software solutions that facilitate trading, clearing, and settlement processes.

- Managed Services: Earnings from offering outsourced IT management and support for market participants, ensuring operational efficiency and security.

B3's revenue streams are diverse, encompassing transactional fees, listing and issuer services, data licensing, and technology solutions. These segments collectively contribute to its financial performance, reflecting the exchange's central role in Brazil's financial markets.

In the first quarter of 2024, B3 reported total revenue of R$2.7 billion, with trading and clearing services forming a significant portion. This highlights the direct correlation between market activity and B3's income generation from these core services.

The exchange also benefits from licensing its indices, such as the Ibovespa, for use in investment products, and from selling valuable market data to financial institutions. These data-related services are increasingly important revenue drivers in the digital age.

| Revenue Stream | Description | Q1 2024 Contribution (Illustrative) |

|---|---|---|

| Trading & Clearing Fees | Fees on transaction volume and value for various financial instruments. | Substantial portion of R$2.7 billion total revenue. |

| Listing & Issuer Services | Fees for new listings and ongoing services for listed companies. | Significant contributor to 2023's R$10.7 billion total revenue. |

| Market Data & Index Licensing | Revenue from selling market data and licensing indices for financial products. | Growing segment driven by demand for financial analytics. |

| Technology & Infrastructure | Fees for connectivity, co-location, and specialized software solutions. | Vital contributor to 2024 earnings, supporting high-performance trading. |

Business Model Canvas Data Sources

The B3 Business Model Canvas is built using comprehensive market research, financial projections, and internal operational data. These sources ensure each block accurately reflects our strategic direction and potential for growth.