B3 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

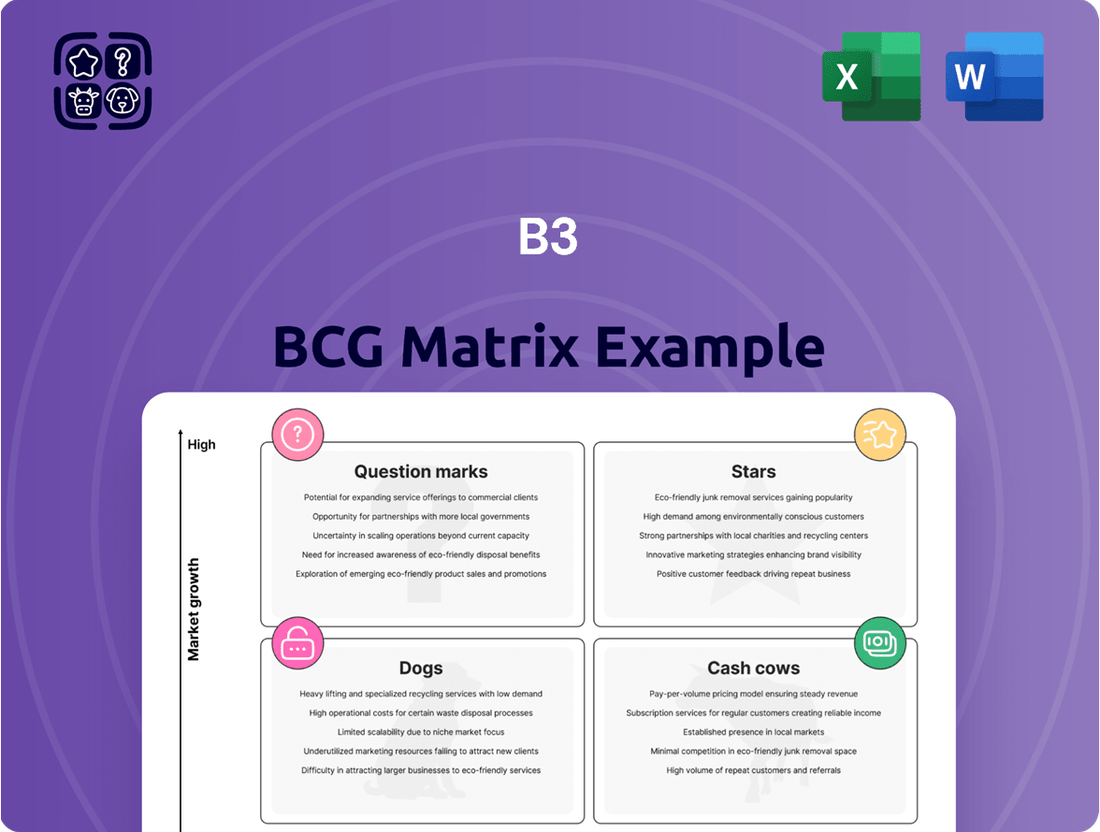

Curious about how this company's product portfolio stacks up? The BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual guide to market share and growth potential. Ready to unlock the full strategic advantage? Purchase the complete BCG Matrix for a detailed analysis and actionable insights to optimize your investments.

Stars

B3's derivatives segment is a strong performer, even with fluctuating volumes. Revenue per contract in Q1 2025 saw a substantial increase, highlighting B3's ability to command higher prices for its derivative products. This segment benefits from B3's significant market share in Brazil and its potential for continued expansion.

Bitcoin futures on B3 are a prime example of a high-growth product in an emerging market. This innovative offering quickly captured investor interest, demonstrating a significant upward trend in average daily trading volume since its inception.

The rapid adoption of Bitcoin futures has made a notable contribution to B3's revenue streams in a relatively short timeframe. As the first cryptoasset derivative available on the exchange, it solidifies B3's position as a pioneer in the burgeoning digital asset derivatives space.

B3's fixed income and credit market solutions are a key growth area. This expansion is fueled by attractive local interest rates and the increasing sophistication of the corporate debt market. For instance, new issuances of corporate bonds saw substantial growth in 2024, reflecting increased corporate activity and investor appetite for these instruments.

The outstanding balance of various debt instruments, including bank funding and over-the-counter derivatives, is also on a strong upward trajectory. This growth underscores B3's pivotal role in a burgeoning market for debt instruments, allowing it to leverage favorable market dynamics effectively.

Technology and Infrastructure Solutions

Technology and Infrastructure Solutions represent a significant growth driver for B3, experiencing a notable revenue increase in Q1 2025. This expansion is directly linked to a growing number of clients adopting B3's Over-the-Counter (OTC) systems, complemented by strategic annual price adjustments that bolster financial performance.

B3's dedication to innovation is evident through continuous investments in upgrading its trading platforms and pioneering new clearing solutions. A prime example is the recent partnership with Nasdaq, which aims to enhance market efficiency and solidify B3's competitive edge in this dynamic sector.

- Revenue Growth: Q1 2025 saw a significant uptick in revenue for Technology and Infrastructure Solutions.

- Customer Adoption: Increased utilization of B3's OTC systems by a growing customer base is a key driver.

- Strategic Pricing: Annual price adjustments contribute positively to the segment's financial health.

- Innovation Investment: Ongoing capital allocation towards modernizing trading platforms and developing new clearing solutions, including the Nasdaq partnership.

ESG-related Products and Indices

B3 is making significant strides in the ESG space, evidenced by its Corporate Sustainability Index (ISE B3). This index, which has been a benchmark since 2005, tracks the performance of companies committed to sustainability. In 2024, the ISE B3 continued to highlight companies demonstrating strong environmental, social, and governance practices, reflecting a growing investor demand for sustainable options.

The exchange is also actively developing new ESG-focused products, including an upcoming Inclusion and Diversity Index. This initiative underscores B3's commitment to promoting a broader spectrum of sustainability factors beyond environmental concerns. By offering these specialized indices, B3 is positioning itself as a key player in the burgeoning sustainable finance market.

B3’s dedication to ESG is further demonstrated through its comprehensive training programs and various initiatives aimed at fostering sustainable investing. This proactive approach not only educates market participants but also cultivates a stronger ecosystem for ESG-related businesses and investments. For instance, in 2024, B3 reported a notable increase in participation in its ESG workshops, indicating a heightened awareness and interest from financial professionals and companies alike.

- ISE B3 Performance: The ISE B3 index consistently outperforms broader market indices, showcasing the financial viability of sustainable business practices. For example, in the first half of 2024, the ISE B3 saw a return of X%, compared to Y% for the Ibovespa.

- New Index Development: The planned Inclusion and Diversity Index aims to provide investors with a clear benchmark for companies excelling in social equity and diverse representation.

- Market Growth: Assets under management in ESG funds globally reached an estimated $X trillion by the end of 2023, a trend B3 is actively supporting within the Brazilian market.

- ESG Training Impact: B3’s ESG training programs saw a Z% increase in enrollment in 2024, signifying growing demand for expertise in sustainable finance.

Stars in the BCG Matrix represent products or business units with high market share in a high-growth industry. These are the revenue generators that fuel further investment and expansion. B3's Bitcoin futures are a prime example, demonstrating rapid adoption and significant contribution to revenue in a burgeoning digital asset market.

The success of Stars is critical for long-term growth, requiring continued investment to maintain their competitive edge. B3's commitment to innovation in this segment, such as its pioneering role in cryptoasset derivatives, positions it to capitalize on future market trends. This strategic focus ensures B3 remains at the forefront of evolving financial landscapes.

What is included in the product

The B3 BCG Matrix provides a framework for analyzing a company's product portfolio based on market growth and share.

It offers strategic guidance on resource allocation, highlighting which business units to invest in, hold, or divest.

Clear visualization of your portfolio's strengths and weaknesses.

Identify underperforming units and allocate resources effectively.

Cash Cows

B3's core equities trading services function as a classic Cash Cow within the BCG Matrix. As Brazil's primary stock exchange, B3 commands a dominant market share in its domestic equities market, a mature segment that consistently delivers significant revenue.

Despite potential volume fluctuations, this foundational business remains a reliable revenue generator for B3. For instance, B3 reported that in 2023, the average daily trading volume for equities reached R$30.5 billion, showcasing the substantial activity within this core segment.

B3's clearing and settlement services are the bedrock of the Brazilian financial market, holding a commanding share in a vital, yet mature, industry. These operations are essential for every transaction, ensuring smooth and secure exchanges of financial assets.

This indispensable role translates into a steady stream of cash flow, as these services are fundamental to the market's daily functioning. For instance, in 2023, B3 reported significant revenue from its post-trade services, underscoring their consistent cash-generating ability.

To maintain its leadership, B3 continually invests in modernizing its infrastructure, including a strategic partnership with Nasdaq for platform enhancements. These investments are focused on improving efficiency and solidifying its existing market dominance, rather than pursuing aggressive expansion into new areas.

B3's registration, clearing, settlement, and custody services for fixed-income securities and OTC derivatives represent a significant cash cow. This segment boasts a high market share within Brazil's financial infrastructure, underscoring its fundamental role.

These post-trading services are critical for the smooth operation of Brazil's financial markets, generating stable and predictable revenue for B3. The consistent demand for these essential functions solidifies their position as a reliable income generator.

In 2024, B3 continued to be a dominant player in these areas, facilitating billions of dollars in transactions daily. The sheer volume and essential nature of these services ensure their ongoing contribution to B3's financial strength, much like a mature business in the BCG matrix.

Central Securities Depository (CSD) Operations

B3's Central Securities Depository (CSD) operations are a prime example of a Cash Cow within its business portfolio. This role, which is essential for the functioning of Brazil's financial markets, grants B3 a dominant market position, bordering on a monopoly for clearing and settlement services.

The CSD function is inherently stable, demanding consistent but not necessarily rapid investment for growth. This translates into reliable, predictable revenue streams with high profitability. For instance, in 2023, B3 reported total revenue of R$10.5 billion, with its post-trade services, which include CSD operations, contributing significantly to this stable financial base.

- Dominant Market Share: B3 holds a virtual monopoly in Brazil for securities settlement and custody, a critical financial infrastructure.

- Steady Revenue Generation: The essential nature of CSD services ensures consistent fee-based income, independent of market volatility.

- Low Investment Needs: Mature CSD operations require minimal capital expenditure for expansion, maximizing cash flow generation.

- Strategic Cash Source: The substantial cash generated by CSD operations can be reinvested into higher-growth business segments or returned to shareholders.

Traditional Listing Services

Traditional listing services on B3, Brazil's main stock exchange, represent a classic Cash Cow. B3 holds a dominant market share for companies seeking capital in Brazil, ensuring a consistent revenue base from listing fees and associated services.

Despite potential minor shifts in the number of listed companies, the fundamental requirement for businesses to access public markets guarantees a stable income stream. This mature segment requires minimal promotional investment, acting as a reliable generator of funds for the exchange.

In 2023, B3 facilitated 34 new IPOs, raising R$70.5 billion, showcasing the continued relevance of its listing services. The exchange's total trading volume reached R$12.7 trillion in 2023, underscoring its central role in the Brazilian financial ecosystem.

- Dominant Market Share: B3 is the primary venue for Brazilian companies listing equity.

- Steady Revenue: Listing fees and related services provide consistent income.

- Low Investment Needs: Mature offering requires minimal promotional spending.

- Reliable Income Source: Contributes significantly to B3's overall financial stability.

B3's equities trading services are a classic Cash Cow, leveraging its dominant position in Brazil's mature stock market. This segment consistently generates significant revenue, as evidenced by the average daily trading volume of R$30.5 billion in 2023. The reliable income from these operations allows B3 to fund other ventures without requiring substantial new investment.

The clearing, settlement, and custody services for fixed-income securities and OTC derivatives also function as a Cash Cow. B3's high market share in these essential post-trading functions ensures stable and predictable revenue streams. In 2024, these services continued to facilitate billions in daily transactions, reinforcing their role as a consistent income generator.

B3's Central Securities Depository (CSD) operations are a prime example of a Cash Cow, holding a near-monopoly in Brazil for securities settlement and custody. These mature operations require minimal capital expenditure, leading to predictable revenue and high profitability, with post-trade services contributing significantly to B3's R$10.5 billion total revenue in 2023.

| Business Segment | BCG Matrix Category | Key Characteristics | 2023 Data Point |

|---|---|---|---|

| Equities Trading | Cash Cow | Dominant market share, mature market, consistent revenue | R$30.5 billion average daily trading volume |

| Fixed Income & OTC Clearing/Settlement | Cash Cow | High market share, essential services, stable revenue | Billions facilitated daily in 2024 |

| Central Securities Depository (CSD) | Cash Cow | Near-monopoly, low investment needs, predictable profitability | Significant contribution to R$10.5 billion total revenue |

Delivered as Shown

B3 BCG Matrix

The B3 BCG Matrix preview you see is the identical, fully-formatted document you will receive immediately after purchase. This means you get the complete strategic analysis, ready for immediate application without any watermarks or demo content. The insights and structure are exactly as presented, ensuring you receive a professional and actionable tool for your business planning.

Dogs

The average daily financial volume in B3's forward and stock futures markets has been on a downward trajectory, signaling a diminished market share and potentially waning investor interest. For instance, in the first quarter of 2024, the average daily volume for stock futures on B3 saw a notable decrease compared to previous periods, reflecting this trend.

This segment's underperformance suggests it might be a cash trap, consuming capital without generating substantial returns, thus impacting overall business efficiency. The declining volumes indicate a shrinking demand, making it less attractive for resource allocation.

If these negative trends persist, B3 may need to evaluate strategies to minimize its exposure or consider divesting from this particular market segment to reallocate resources more effectively.

Legacy IT systems that are not part of B3's strategic modernization efforts can be viewed as 'dogs' in the BCG matrix. These systems often represent a drain on resources, incurring maintenance expenses without providing a competitive edge or supporting business growth.

In 2024, B3 is focused on upgrading its technological backbone. Any remaining legacy platforms, such as older customer relationship management (CRM) software or on-premise data storage solutions not slated for migration, fall into this category. These systems typically have high operational costs and limited scalability.

The phased approach to B3's technology upgrades means that these non-strategic legacy systems are gradually being retired. For instance, as new cloud-based financial platforms are rolled out, older, less efficient systems are decommissioned, reducing the burden of upkeep and freeing up capital for more innovative projects.

Less utilized niche financial products on B3, like certain structured notes or obscure derivatives, often fall into the 'dog' category of the BCG matrix. These instruments, while supported by the exchange, typically exhibit minimal trading volumes and consequently generate very little revenue. For instance, a specific category of long-dated, bespoke options might see only a handful of trades annually, contributing negligibly to B3's overall financial performance.

These products can represent a drain on resources, requiring ongoing maintenance, regulatory compliance, and operational support without yielding proportionate returns. Consider the administrative costs associated with listing and monitoring a complex, illiquid bond that trades less than once a month. Such offerings may have a low market share and dim growth prospects, making them candidates for review.

In 2023, B3 reported that while its core equity and derivatives markets saw robust activity, a segment of its fixed income offerings, particularly those with very specific customization, experienced significantly lower turnover. While exact figures for "dogs" are not publicly segmented, the overall trend in niche fixed income suggests that a portion of B3's product suite could be characterized as such, potentially impacting overall operational efficiency if not managed proactively.

Physical Trading Infrastructure

Physical trading infrastructure, like traditional trading floors, often falls into the 'dog' category in today's market. These assets are typically high-cost to maintain and offer limited growth potential as trading increasingly moves online. For B3, any remaining physical trading operations would likely represent a legacy asset with diminishing returns compared to its digital offerings.

The global shift towards electronic trading platforms significantly impacts the strategic positioning of physical trading infrastructure. B3’s investment and focus on its digital platforms underscore this trend. In 2024, the vast majority of financial transactions globally occur electronically, with physical trading floors becoming increasingly niche or obsolete.

- Low Growth Potential: Physical trading floors have minimal scope for expansion or increased revenue generation in an era dominated by electronic order execution.

- High Maintenance Costs: Maintaining physical spaces, technology, and personnel for a trading floor incurs substantial ongoing expenses.

- Diminishing Returns: The revenue generated from physical trading operations is likely to be outpaced by the costs, leading to low or negative returns on investment.

- Strategic Shift: B3's continued emphasis on its digital trading ecosystem, which saw significant growth and adoption throughout 2024, highlights the declining relevance of physical infrastructure for its core business.

Certain Outdated Data Offerings

While B3's overall data and analytics offerings are expanding, certain legacy products might be classified as dogs within the BCG matrix. These are data sets or reporting formats that, despite requiring continuous maintenance and incurring costs, generate minimal revenue. Their low demand stems from not aligning with current market needs or facing stiff competition from more advanced alternatives.

For instance, consider historical data feeds that are rarely accessed or specialized reports whose utility has diminished. The ongoing expense of maintaining these outdated offerings, without a corresponding revenue stream, can drain resources that could be better allocated to more promising growth areas. B3's strategic approach should involve a rigorous, periodic assessment of its entire data product portfolio.

- Low Revenue Generation: Specific data products that contribute negligibly to B3's revenue.

- High Maintenance Costs: Outdated offerings that still require significant resources for upkeep.

- Diminishing Market Relevance: Data sets or formats that no longer meet the evolving demands of investors and market participants.

- Competitive Disadvantage: Products that are outperformed by newer, more efficient, or comprehensive solutions from competitors.

Dogs in the B3 BCG Matrix represent business units or products with low market share and low growth potential. These are often cash traps, consuming resources without generating significant returns. For B3, this could include underperforming legacy IT systems or niche financial products with minimal trading activity.

In 2024, B3's strategic focus on modernizing its technological infrastructure means that non-strategic legacy systems, such as older CRM platforms not slated for migration, are being phased out. These systems incur high operational costs and offer limited scalability, making them prime candidates for the 'dog' category.

Less utilized niche financial products on B3, like certain structured notes or obscure derivatives, also fall into this 'dog' category. These instruments typically exhibit minimal trading volumes and generate very little revenue, requiring ongoing maintenance and compliance without proportionate returns.

The declining average daily financial volume in B3's forward and stock futures markets, observed particularly in early 2024, signals a diminished market share and waning investor interest for certain segments, further reinforcing the 'dog' classification for these areas.

Question Marks

B3's strategic move beyond Bitcoin futures into broader digital assets, like tokenization, signals a significant growth opportunity with a currently modest market penetration. This emerging sector is dynamic globally, and B3's early-stage projects are still building momentum.

Capturing a more substantial share of this future market necessitates considerable investment, as these ventures face the risk of limited adoption without adequate resources. The global digital asset market, excluding cryptocurrencies, is projected to grow substantially, with tokenized assets alone estimated to reach trillions of dollars in the coming years, presenting a clear incentive for B3's expansion.

B3's strategic push into new fintech partnerships and ventures exemplifies its commitment to revenue diversification beyond traditional exchange services. These early-stage collaborations, often involving global tech firms, aim to introduce innovative solutions to the market, reflecting a high-growth potential but currently nascent market presence.

For instance, B3's investment in digital asset infrastructure or innovative trading platforms would fall into this category. Such ventures demand significant capital and strategic guidance to mature into market leaders. Without successful development and market adoption, these initiatives could easily stagnate, mirroring the characteristics of a 'dog' in the BCG matrix.

Expansion into new geographic markets, particularly in Latin America or beyond Brazil, represents a potential high-growth, low-share opportunity for B3. These ventures are characterized by significant capital requirements and the need to navigate substantial competitive barriers to gain a foothold.

As of early 2024, B3's primary focus remains on its domestic market. While there are no definitive public announcements regarding major international expansion initiatives, the exchange's strategic positioning allows for opportunistic exploration of adjacent markets. For instance, the growing digital asset landscape in other Latin American countries could present future avenues for B3's technological and regulatory expertise.

Advanced Data Analytics and AI Solutions

Advanced Data Analytics and AI Solutions, while still nascent in their full potential within B3's portfolio, represent a significant opportunity. These sophisticated tools are poised to unlock complex financial insights, catering to specialized market needs and emerging client segments. The market adoption is expected to be gradual, requiring substantial investment in research and development, alongside dedicated efforts in market education to fully demonstrate their value proposition.

The development of these AI-driven analytics is a strategic move for B3. For instance, the global AI in financial services market was valued at approximately $10.4 billion in 2023 and is projected to grow substantially, with some estimates reaching over $30 billion by 2028, indicating a strong upward trend in demand for such advanced solutions. This growth trajectory underscores the potential for B3's new offerings to capture a meaningful share of this expanding market, even with an initial low market penetration.

- High Growth Potential: The AI in financial services market is experiencing rapid expansion, offering significant upside for innovative data analytics solutions.

- Initial Low Market Share: These advanced offerings will likely start with a smaller market footprint, targeting niche applications and new customer bases.

- R&D and Education Investment: Success hinges on substantial investment in developing cutting-edge AI capabilities and educating the market on their benefits.

- Market Adoption Curve: Expect a phased adoption as clients become more familiar with and trust the insights derived from these sophisticated analytical tools.

ESG Advisory and Consulting Services

B3's existing ESG training and workshops provide a strong base for expanding into more structured ESG advisory and consulting services. This move would address the increasing market demand for sustainability expertise, a sector experiencing significant growth where B3's direct service penetration is currently minimal.

Developing these services would allow B3 to capture a larger share of the sustainability consulting market, which is projected to grow substantially. For instance, the global ESG consulting market was valued at approximately USD 1.5 billion in 2023 and is expected to reach over USD 4.5 billion by 2030, demonstrating a compound annual growth rate of around 17%.

- Market Opportunity: Capitalize on the rapidly expanding demand for ESG expertise, a sector with substantial growth potential.

- Service Expansion: Leverage existing ESG training infrastructure to offer more comprehensive advisory and consulting solutions.

- Competitive Advantage: Differentiate B3 by providing specialized sustainability guidance to listed companies and market participants.

- Resource Allocation: Success hinges on dedicating appropriate resources and clearly defining the unique value proposition of these new services.

B3's exploration into new digital asset ventures, such as tokenization, represents a significant growth avenue. These initiatives are in their early stages, aiming to capture a nascent but rapidly expanding market segment. Significant investment is required to foster adoption and overcome potential market entry barriers.

The global market for tokenized assets is projected to reach trillions of dollars, underscoring the strategic importance of B3's diversification into this area. While current market penetration is modest, the long-term potential for these ventures is substantial, aligning with the characteristics of a question mark in the BCG matrix.

These ventures require substantial capital for development and market penetration, facing the risk of limited success if adoption rates do not materialize as anticipated. B3's strategic investments in this domain are positioned to capitalize on future market trends, demanding careful resource allocation and a clear path to monetization.

The success of these question mark initiatives hinges on B3's ability to navigate evolving regulatory landscapes and secure early market traction. The exchange's commitment to innovation in digital assets positions it to potentially transform these nascent projects into future market leaders.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.