B3 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B3 Bundle

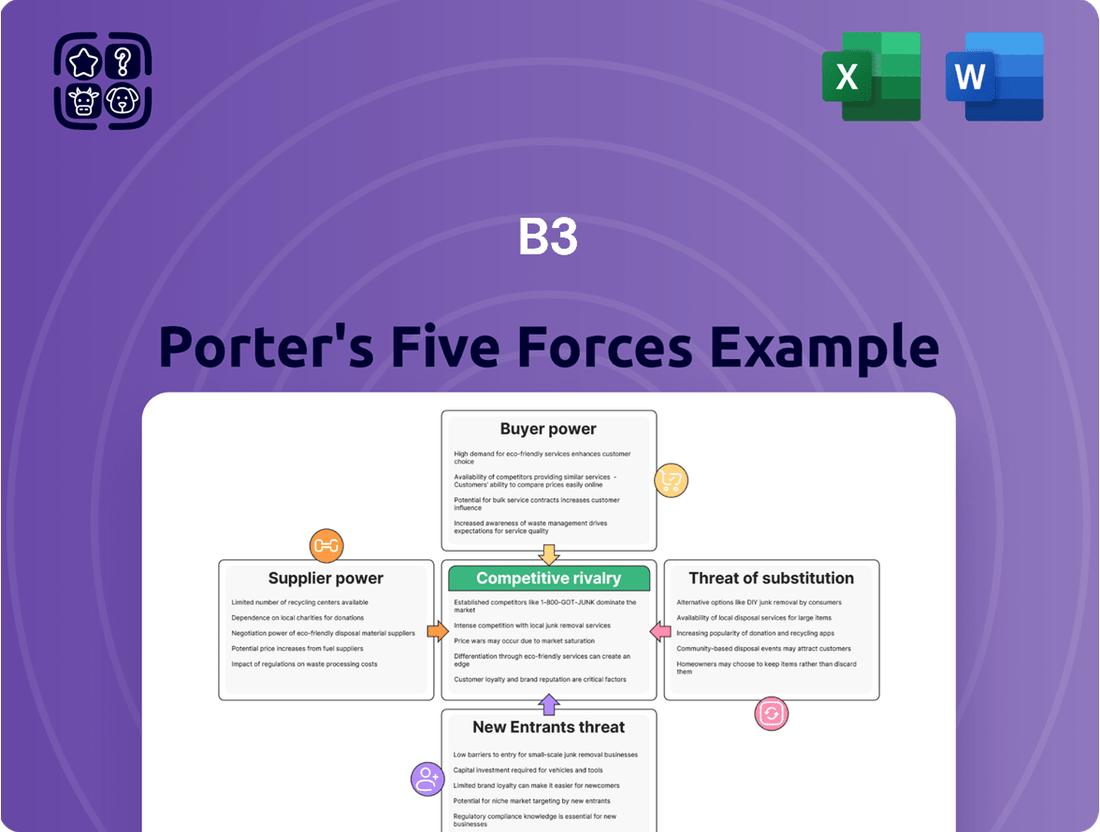

B3's competitive landscape is shaped by five key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic planning and identifying opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore B3’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

B3's reliance on specialized technology and infrastructure providers is a significant factor in supplier bargaining power. If only a handful of companies offer the advanced trading platforms, clearing systems, and robust network infrastructure B3 needs, these suppliers gain considerable leverage. This concentration means B3 could face higher costs for essential services or be subject to less favorable contract terms due to the limited alternatives available.

Specialized financial data and analytics providers hold considerable bargaining power over B3, given the critical nature of their offerings for B3's operational success and client services. If a few dominant firms control unique or proprietary datasets, they can dictate terms and pricing, impacting B3's costs and service delivery.

B3's increasing integration of data analytics solutions underscores its dependence on these specialized inputs. For instance, in 2023, the global market for financial analytics was valued at approximately $21.3 billion, and it's projected to grow significantly, highlighting the importance and potential leverage of key data providers within this expanding sector.

In Brazil's heavily regulated financial sector, B3 relies on specialized software for crucial functions like compliance and risk management. Vendors offering these essential services, particularly those with proven expertise in Brazilian financial laws, can wield significant bargaining power. This is amplified by the substantial costs and complexities associated with switching providers, making B3's reliance on these specialized solutions a key factor in supplier leverage.

Consulting and Professional Services

B3, the Brazilian stock exchange, relies on consulting and professional services for critical functions. When these services demand highly specialized expertise in areas like exchange operations or the intricacies of Brazilian financial markets, the bargaining power of suppliers can be significant. This is especially true for complex projects such as developing new trading platforms or implementing advanced regulatory compliance systems, where the number of qualified providers is inherently limited.

The concentration of specialized knowledge among a few consulting firms can lead to higher fees and more favorable contract terms for the suppliers. For instance, in 2024, major financial institutions often faced increased costs for bespoke IT solutions and strategic advisory services, reflecting the demand for niche expertise. This dynamic directly impacts B3's operational costs and strategic agility.

- Specialized Knowledge: Consulting firms with deep understanding of exchange technology and Brazilian financial regulations possess higher bargaining power.

- Limited Provider Pool: The scarcity of firms capable of handling complex projects like platform development concentrates power with the suppliers.

- Project Complexity: Highly intricate projects requiring unique skill sets further amplify the bargaining leverage of specialized consulting service providers.

- 2024 Cost Trends: Reports from 2024 indicated rising costs for specialized IT and strategic consulting within the financial sector, impacting institutions like B3.

Human Capital (Skilled Labor)

The availability of highly skilled professionals is crucial for B3, particularly in rapidly evolving sectors like financial technology, market operations, cybersecurity, and regulatory compliance. A scarcity of these specialized talents within the Brazilian economic landscape can significantly amplify the bargaining power of employees.

This increased leverage for skilled workers translates directly into upward pressure on labor costs. For B3, this could manifest as higher salary demands, more attractive benefits packages, and greater investment in training and development to attract and retain top talent. For instance, in 2023, the average salary for cybersecurity professionals in Brazil saw an increase of approximately 15% year-over-year, reflecting this competitive talent market.

- Talent Scarcity: Limited supply of specialized skills in fintech, cybersecurity, and compliance.

- Increased Labor Costs: Higher salary expectations and benefit demands from skilled professionals.

- Acquisition & Retention Challenges: Difficulty in attracting and keeping top-tier talent, potentially impacting operational efficiency.

- Wage Growth: Reports indicate significant wage growth for in-demand tech roles in Brazil, impacting B3's human capital expenses.

Suppliers to B3, particularly those providing specialized technology and data, wield significant bargaining power. This is due to the limited availability of providers offering critical infrastructure like trading platforms and compliance software, especially those tailored to Brazil's unique regulatory environment. The high cost and complexity of switching vendors further solidify this supplier leverage.

| Supplier Type | Bargaining Power Factors | 2024 Impact/Trend |

|---|---|---|

| Technology Infrastructure Providers | Concentration, specialized nature of services | Potential for increased costs for essential systems |

| Financial Data & Analytics Firms | Proprietary data, critical for operations | Ability to dictate pricing and terms for data access |

| Specialized Software Vendors (Compliance/Risk) | Expertise in Brazilian regulations, high switching costs | Limited alternatives can lead to less favorable contracts |

| Consulting & Professional Services | Niche expertise in exchange operations, regulatory intricacies | Higher fees for complex projects, impacting project budgets |

What is included in the product

B3 Porter's Five Forces Analysis dissects the competitive intensity and attractiveness of the B3's market, examining threats from new entrants, buyers, suppliers, and substitutes, alongside the rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Large institutional investors and brokerages wield significant bargaining power over B3. These entities, including major banks and asset managers, contribute substantially to B3's trading volume and overall revenue. Their ability to move large amounts of capital means they can negotiate favorable fee structures and demand customized services, leveraging their importance to B3's financial health.

Corporate issuers, the companies whose shares trade on B3, are significant customers. Their decision to list on B3 is influenced by the exchange's services, fees, and the market's visibility it provides. In 2023, B3 facilitated 33 new IPOs, demonstrating its continued role in capital raising for Brazilian companies.

While B3 is the dominant stock exchange in Brazil, the possibility of new entrants or alternative trading platforms could shift power towards issuers. If competitive alternatives emerge offering better terms or specialized services, corporate issuers might gain leverage to negotiate more favorable listing agreements and fee structures with B3.

Individual investors, while not directly engaging with B3, wield influence through their chosen brokerages. The substantial growth in Brazilian retail investors, with numbers reaching over 5 million by early 2024, amplifies this indirect power. As more individuals participate in the market, brokerages are incentivized to offer competitive services, which in turn can pressure B3 to maintain efficient and cost-effective operations to retain its brokerage clients.

Diversified Financial Institutions

Diversified financial institutions that engage with B3 across various segments like equities, fixed income, and derivatives often wield significant bargaining power. Their ability to consolidate business or shift volumes across these diverse service lines can directly impact B3's pricing structures and the scope of its service offerings.

For instance, a large bank utilizing B3's trading platforms for equities and its clearing services for derivatives might leverage its overall relationship to negotiate more favorable terms. This cross-segment engagement provides these institutions with leverage, as B3 values the comprehensive business relationship. In 2024, major financial institutions continued to seek integrated solutions, potentially increasing their collective sway over service providers like B3.

- Broad Service Utilization: Institutions using multiple B3 services (equities, fixed income, derivatives, tech) gain leverage.

- Consolidation Potential: The ability to shift business volume across B3's offerings influences pricing and services.

- Relationship Value: B3's interest in maintaining comprehensive client relationships enhances customer bargaining power.

International Investors

International investors wield considerable influence over Brazil's B3 stock exchange, with their capital flows significantly shaping market dynamics and liquidity. For instance, in 2023, foreign investors were net buyers of Brazilian equities, contributing to increased trading volumes and price discovery.

Recent regulatory adjustments aimed at simplifying foreign investment procedures in Brazil further amplify their bargaining power. These changes allow international investors greater flexibility in selecting their investment destinations, potentially leading them to collectively negotiate for improved market access and reduced transaction costs.

- Foreign Capital Inflows: In 2023, foreign investors were net buyers of R$53.3 billion in the Brazilian equity market, a significant driver of liquidity.

- Regulatory Simplification: Brazil's efforts to streamline foreign investment rules, such as the adoption of the "Invest in Brazil" program, enhance investor choice and bargaining leverage.

- Impact on Market Access: As foreign participation grows, their collective ability to demand better trading platforms and lower fees increases, directly affecting market infrastructure providers.

The bargaining power of customers for B3 is shaped by the concentration of its client base and the value they bring. Large institutional investors and brokerages, due to their significant trading volumes, can negotiate favorable terms. Similarly, corporate issuers, by choosing where to list their shares, influence B3's service offerings and fees.

The increasing number of individual investors, exceeding 5 million by early 2024, indirectly empowers them through their brokerages. International investors also hold substantial sway, with their capital flows impacting market liquidity and driving demands for improved market access and reduced costs.

| Customer Segment | Influence Factor | 2023/2024 Data Point |

|---|---|---|

| Institutional Investors & Brokerages | Trading Volume & Revenue Contribution | Negotiate fee structures and customized services. |

| Corporate Issuers | Listing Decisions & Market Visibility | 33 new IPOs facilitated by B3 in 2023. |

| Individual Investors | Growing Retail Participation (Indirect) | Over 5 million retail investors by early 2024. |

| International Investors | Capital Flows & Market Liquidity | Net buyers of R$53.3 billion in Brazilian equities in 2023. |

Preview Before You Purchase

B3 Porter's Five Forces Analysis

The preview you see is the exact B3 Porter's Five Forces Analysis document you will receive immediately after purchase, ensuring a transparent and accurate transaction. This comprehensive analysis is fully formatted and ready for your immediate use, providing valuable insights into competitive forces within the industry. You are looking at the actual document, so there will be no surprises or placeholder content upon completion of your purchase.

Rivalry Among Competitors

B3's historical dominance in the Brazilian stock exchange market is being tested by the emergence of new players. For instance, ATG, a subsidiary of Mubadala, is set to launch Base Exchange in Rio de Janeiro by late 2025. This new platform intends to compete across various asset classes, including equities, REITs, and ETFs, and may even venture into derivatives.

Central counterparties (CCPs) are vital for market stability and trade execution, a role B3 currently leverages for a substantial portion of its income through asset clearing.

However, the competitive landscape is shifting as new entities emerge. For instance, CSD BR, supported by significant financial backing, is slated to enter the CCP market by 2027, directly challenging B3's established position in this crucial area.

Some large brokerages and financial institutions in Brazil, including major players, are increasingly internalizing client orders. This means they match buy and sell orders within their own systems instead of sending them to the B3 exchange. This practice, while regulated, can lead to market fragmentation.

When orders are internalized, trading volume on the B3 exchange can decrease. For instance, in 2023, the total trading volume on B3 reached significant levels, but a portion of this could have been handled internally by some participants. This internal handling reduces the visible liquidity and price discovery mechanisms on the exchange, presenting a competitive challenge from within the financial ecosystem itself.

Global Exchanges and International Trading Platforms

The competitive rivalry for B3 is intensified by global exchanges and international trading platforms. Brazilian companies have the option to list on major international exchanges like the New York Stock Exchange (NYSE) or Nasdaq, which can attract significant capital and offer broader investor access. For instance, in 2023, several Brazilian companies explored or completed international listings, seeking global visibility and liquidity.

This global competition forces B3 to remain agile and innovative. To retain and attract listings and trading volume, B3 must offer services and fee structures that are competitive with international benchmarks. The ability for investors to trade Brazilian assets on foreign platforms means B3 faces direct competition for order flow, necessitating continuous investment in technology and product development.

- Global Listings: Brazilian companies can list on exchanges like NYSE and Nasdaq, offering access to a wider pool of international investors.

- International Trading: Foreign platforms allow investors to trade Brazilian securities, directly competing with B3 for trading volume.

- Innovation Imperative: B3 must innovate its services and pricing to remain competitive against established global exchanges.

Development of OTC Markets

While B3 offers services across both exchange-traded and over-the-counter (OTC) markets, the increasing sophistication and volume of transactions occurring directly between parties, bypassing centralized exchanges, represent a competitive force. This growth in the OTC space, particularly for derivatives and fixed income, can siphon business away from exchange-based platforms. For instance, in 2023, the Brazilian OTC derivatives market saw significant activity, with many transactions occurring outside B3's direct clearing and settlement services, impacting potential revenue streams.

The development of robust OTC markets means that counterparties can negotiate terms and execute trades directly, potentially offering greater flexibility and customization than standardized exchange products. This can be particularly attractive for large institutional investors or for hedging complex risks. B3's own OTC segment has experienced growth, but the continued expansion of independent OTC trading infrastructure and platforms presents a direct challenge by offering alternative venues for financial activity that might otherwise migrate to B3's regulated environment.

The competitive rivalry from the OTC market development is evident when considering the total volume of financial instruments traded. While B3 facilitates a substantial portion, a growing share of Brazil's fixed income and derivatives trading occurs bilaterally. This trend underscores the importance for B3 to continue innovating and offering competitive services within its OTC segment to retain market share and capture new business.

B3 faces increasing competition from new exchange entrants and the internalization of orders by large brokerages, which fragments liquidity. Global exchanges also pose a threat, as Brazilian companies can list internationally, and foreign platforms allow trading of Brazilian securities. The growth of the over-the-counter (OTC) market, particularly for derivatives and fixed income, further siphons business away from B3's traditional exchange-based services, necessitating continuous innovation to maintain its market position.

| Competitive Force | Description | Impact on B3 | 2023/2024 Data/Trend | Mitigation Strategy |

|---|---|---|---|---|

| New Exchange Entrants | Emergence of new trading platforms like Base Exchange. | Potential loss of market share and trading volume. | Base Exchange targeting launch by late 2025; CSD BR entering CCP market by 2027. | Focus on innovation, differentiated services, and competitive pricing. |

| Order Internalization | Brokerages matching client orders internally. | Reduced trading volume and price discovery on B3. | Significant portion of trades potentially handled internally, impacting exchange liquidity. | Enhance exchange technology and value proposition to incentivize order routing. |

| Global Exchanges | Brazilian companies listing on NYSE/Nasdaq; foreign platforms trading Brazilian assets. | Competition for listings, capital, and investor access. | Several Brazilian companies explored international listings in 2023. | Offer competitive listing fees, advanced trading technology, and global investor reach. |

| OTC Market Growth | Increased trading of derivatives and fixed income outside exchanges. | Loss of potential revenue from clearing and trading fees. | Significant activity in Brazil's OTC derivatives market in 2023, with bilateral transactions. | Strengthen B3's own OTC segment and offer integrated solutions. |

SSubstitutes Threaten

The over-the-counter (OTC) market presents a significant threat of substitution for B3's exchange-traded products. This includes a wide array of financial instruments like fixed income, currencies, and derivatives, which can be traded directly between parties, bypassing traditional exchanges.

In Brazil, the growth of the OTC market, especially in fixed income and derivatives, poses a direct challenge. For instance, as of early 2024, the Brazilian fixed income market, largely dominated by OTC transactions, continued to see substantial volume, potentially diverting trading activity and liquidity away from B3's listed segments.

This direct execution capability in OTC markets offers flexibility and potentially lower transaction costs for certain participants. As this market expands, it can absorb trading volume that might otherwise occur on B3's regulated exchanges, thereby weakening B3's position.

Companies looking for funding might bypass B3 by engaging in direct bilateral trading or private placements. This means they can secure capital directly from investors without the need for B3’s listing, trading, and clearing services. For instance, in 2023, private placements in Brazil saw significant activity, with many companies opting for this route to avoid the costs and complexities associated with public markets, particularly those considered smaller or niche.

The emergence of decentralized finance (DeFi) platforms, leveraging blockchain technology, presents a growing threat of substitutes for traditional financial exchange services. These platforms offer alternative avenues for trading, lending, and asset management, potentially bypassing established intermediaries.

While DeFi's penetration in Brazil is still developing, its global growth is undeniable. For instance, the total value locked (TVL) in DeFi protocols reached over $100 billion in early 2024, indicating significant user adoption and transaction volume on these alternative systems. This suggests a potential shift in how assets are managed and traded, directly impacting traditional exchanges.

Alternative Investment Vehicles

Investors increasingly explore alternative investment vehicles like private equity, venture capital, and direct real estate, which can divert capital from traditional stock exchanges like B3. These alternatives offer distinct risk-reward profiles and liquidity, presenting a significant threat by providing different avenues for capital deployment.

For instance, the global private equity market saw significant activity, with deal values reaching substantial figures in recent years, demonstrating investor appetite for non-publicly traded assets. In 2023, private equity fundraising remained robust, with major global funds securing billions, indicating a strong flow of capital into these alternative spaces.

- Growth in Alternative Assets: Global alternative investment assets under management (AUM) are projected to reach $23.2 trillion by 2027, up from $13.7 trillion in 2022, highlighting a significant shift in investment preferences.

- Private Equity Performance: In 2023, the median private equity fund IRR (Internal Rate of Return) for funds vintage 2020 was around 10-15%, competitive with or exceeding public market returns for certain periods.

- Venture Capital Focus: Venture capital, particularly in sectors like technology and biotech, continues to attract substantial investment, offering high growth potential that can pull investors away from B3 listings. Global VC funding in 2023, while experiencing a slowdown from peak years, still represented billions deployed into early-stage companies.

- Direct Real Estate Appeal: Direct real estate investments, especially in commercial or residential properties, provide tangible assets and potential rental income, appealing to investors seeking diversification and inflation hedges, thereby competing for capital that might otherwise be allocated to B3 equities.

Foreign Investment Platforms and Exchanges

Brazilian investors can access global markets through various foreign investment platforms or by directly trading on international exchanges. This offers a direct alternative to B3's services.

For instance, by mid-2024, major international exchanges like the NYSE and Nasdaq continued to attract significant foreign listings, presenting Brazilian companies with an alternative venue to raise capital. This global accessibility means that if B3's fees, liquidity, or product offerings are less competitive, investors and issuers might opt for these foreign alternatives.

The ease of cross-border transactions and the increasing availability of diversified investment options abroad pose a significant threat. For example, as of Q1 2024, the total value of Brazilian assets held by Brazilians in foreign custody accounts saw a notable increase, indicating a growing preference for international diversification, which directly substitutes for domestic exchange activity.

- Increased Accessibility: Online brokerage platforms have lowered the barrier for Brazilians to invest in U.S. equities and other international assets, directly competing with B3 for investor capital.

- Diversification Benefits: Access to a wider range of asset classes and geographies not readily available on B3 encourages investors to seek alternatives for portfolio diversification.

- Cost and Efficiency: Foreign platforms may offer lower transaction costs or more efficient trading mechanisms, making them an attractive substitute for B3 users.

- Regulatory Environment: Perceived advantages in regulatory frameworks or investor protections on foreign exchanges can also draw business away from B3.

The threat of substitutes for B3 stems from various financial instruments and platforms that offer alternative ways to invest or raise capital. These substitutes can siphon trading volume and investor interest away from B3's core exchange services.

The growth of the over-the-counter (OTC) market in Brazil, particularly in fixed income and derivatives, presents a significant challenge, as it allows direct trading between parties. Furthermore, the burgeoning decentralized finance (DeFi) sector, with its global total value locked exceeding $100 billion by early 2024, offers alternative avenues for asset management and trading.

Investors are also increasingly drawn to alternative assets like private equity and venture capital, which saw robust fundraising in 2023. Global alternative investment assets are projected to reach $23.2 trillion by 2027, indicating a substantial shift in capital allocation away from traditional exchanges.

The ease with which Brazilian investors can access global markets through foreign platforms also acts as a substitute. By mid-2024, major international exchanges continued to attract foreign listings, and Brazilian assets held abroad saw a notable increase in Q1 2024, underscoring this trend.

| Substitute Category | Key Characteristics | Impact on B3 | Relevant Data/Trend |

|---|---|---|---|

| Over-the-Counter (OTC) Markets | Direct bilateral trading, flexibility, potentially lower costs | Diverts trading volume and liquidity from listed segments | Brazilian fixed income market, largely OTC, shows substantial volume (early 2024) |

| Decentralized Finance (DeFi) | Blockchain-based trading, lending, asset management | Offers alternative avenues, bypassing intermediaries | Global DeFi TVL exceeded $100 billion (early 2024) |

| Alternative Investments (PE, VC, Real Estate) | Distinct risk-reward profiles, tangible assets, diversification | Attracts capital that might otherwise go to B3 listings | Global alternative AUM projected to reach $23.2T by 2027; PE fundraising robust in 2023 |

| Global Markets Access | Direct trading on foreign exchanges, cross-border transactions | Offers alternatives for capital raising and investment diversification | Brazilian assets in foreign custody accounts increased notably (Q1 2024) |

Entrants Threaten

The Brazilian stock exchange, B3, benefits from substantial barriers to entry, primarily due to rigorous regulatory requirements. Entities like the Central Bank of Brazil and the Brazilian Securities and Exchange Commission (CVM) impose strict compliance standards, demanding significant capital investment and sophisticated technological infrastructure.

These high entry hurdles, including substantial capital needs and the imperative to navigate complex legal and operational frameworks, effectively deter potential new competitors from entering the market. For instance, establishing a financial institution capable of operating within B3's ecosystem requires adherence to capital adequacy ratios and robust risk management systems, making it an exceptionally costly endeavor.

B3 benefits from robust network effects; the more participants on its platform, the more valuable it becomes for everyone. This creates a significant barrier for new entrants aiming to replicate its scale and attract enough trading volume to be competitive.

The established liquidity on B3, coupled with a wide array of financial instruments and integrated services, further solidifies its position. For instance, in 2023, B3's derivatives market saw significant activity, underscoring the depth of its existing ecosystem.

Newcomers would struggle to match B3's liquidity and the breadth of offerings, making it exceptionally difficult to attract a critical mass of users and financial institutions needed to build a viable alternative trading venue.

The significant capital outlay required for advanced trading and data infrastructure presents a substantial barrier. For instance, B3's ongoing commitment to technological upgrades, including its partnership with Nasdaq for platform enhancements, necessitates substantial investment, making it difficult for newcomers to match the existing operational sophistication.

Client Trust and Reputation

B3, Brazil's stock exchange, benefits from significant barriers to entry related to client trust and reputation. The financial sector, inherently risk-averse, places a premium on established credibility, making it difficult for newcomers to gain traction. B3 has cultivated this trust over decades, fostering strong relationships with investors and financial institutions.

New entrants would face the formidable task of replicating B3's long-standing reputation for reliability and security. For instance, in 2023, B3 reported a net income of R$4.9 billion, reflecting its stable and trusted operational performance, a figure that would be challenging for a new entity to match quickly.

- Established Trust: B3's history of reliable operations builds confidence among market participants.

- Reputational Barrier: New entrants must prove their trustworthiness in a sector where confidence is paramount.

- Financial Sector Risk Aversion: Investors and institutions are hesitant to engage with unproven entities, especially in financial markets.

Potential for Incumbent Retaliation

B3, as the dominant player in Brazil's stock exchange, possesses significant resources and market power. This allows it to react forcefully to new entrants. For instance, B3 could implement aggressive pricing adjustments or enhance its service portfolio to make entry less attractive. In 2023, B3 reported a net income of R$5.9 billion, demonstrating its financial strength to fund such retaliatory strategies.

The potential for B3's strong retaliation serves as a considerable deterrent. Prospective competitors must weigh the significant investment required against the likelihood of facing substantial competitive responses. This can discourage them from even attempting to enter the market, thereby reinforcing B3's existing market position.

- Dominant Market Position: B3's established infrastructure and client base provide a significant advantage.

- Financial Resources: With substantial profits, B3 can absorb short-term losses from price wars.

- Regulatory Influence: B3 may leverage its relationships to advocate for regulations that favor incumbents.

- Aggressive Response Tactics: Potential strategies include price cuts, increased marketing, or product innovation.

The threat of new entrants for B3, Brazil's stock exchange, is significantly mitigated by high capital requirements and stringent regulatory hurdles. For example, establishing a compliant trading platform requires substantial investment in technology and adherence to capital adequacy rules set by entities like the Central Bank of Brazil and the CVM. This financial and operational complexity acts as a powerful deterrent, making it exceptionally difficult for new players to enter the market and compete effectively with the incumbent.

Porter's Five Forces Analysis Data Sources

Our B3 Porter's Five Forces analysis is built upon a robust foundation of data, drawing from official B3 exchange filings, financial statements of listed companies, and reputable financial news outlets. This ensures a comprehensive understanding of industry dynamics and competitive pressures.