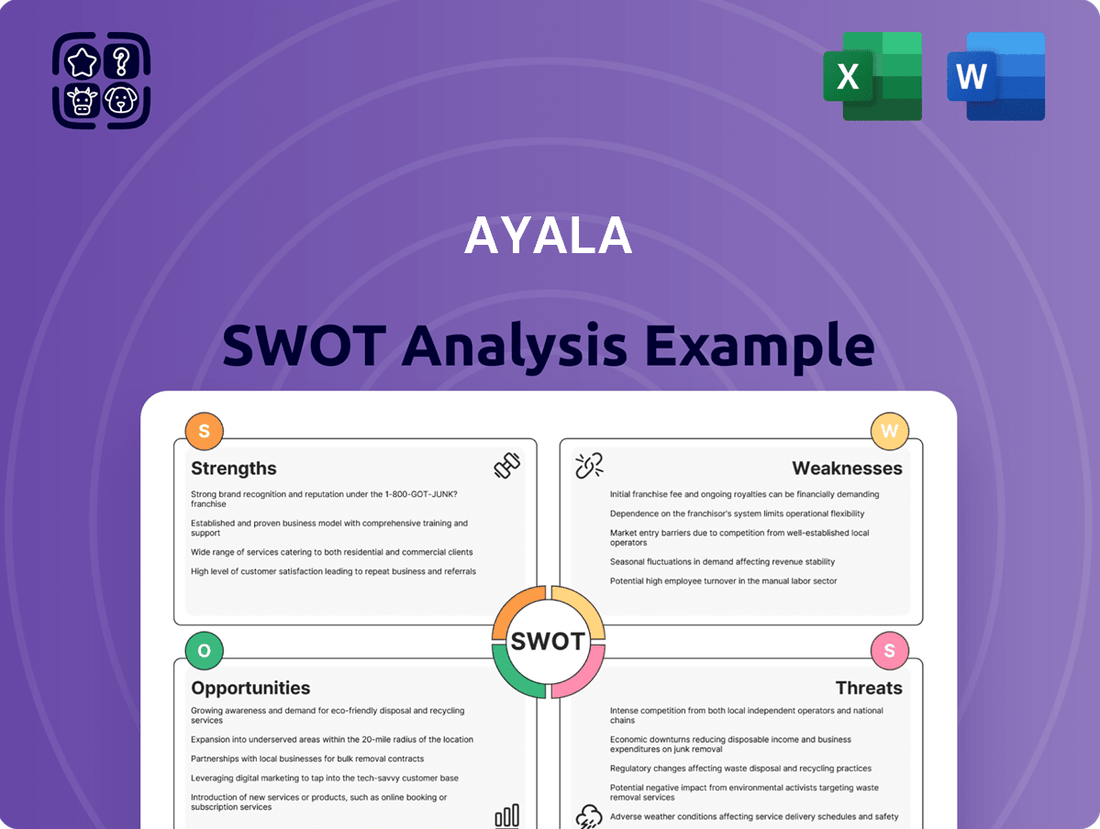

Ayala SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Ayala's robust financial backing and diversified portfolio are key strengths, but navigating evolving market dynamics presents a significant challenge. Understanding these intricate details is crucial for informed decision-making.

Want the full story behind Ayala's competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Ayala Corporation's diversified business portfolio is a significant strength, encompassing key sectors like real estate, financial services, telecommunications, and power. This broad reach, extending into industrial technologies, healthcare, and education, creates a robust structure that can weather economic fluctuations by not depending on any single industry.

This strategic diversification acts as a natural risk mitigator, ensuring multiple income streams that bolster the company's overall stability. For example, strong results from its banking arm, Bank of the Philippine Islands (BPI), and its real estate developments have recently provided a crucial buffer against softer performance in its telecommunications and energy segments.

Ayala Corporation has showcased impressive financial resilience, achieving a record core net income of P45 billion in 2024. This strong performance was maintained even as certain business segments navigated challenging market conditions.

The company's balance sheet remains robust, characterized by healthy liquidity and consistent access to capital markets. As of the first quarter of 2025, Ayala reported a consolidated cash position amounting to P75.9 billion, underscoring its financial stability.

This solid financial footing empowers Ayala to pursue ambitious capital expenditure plans. For 2025, the company has earmarked P230 billion for capital expenditures, facilitating ongoing growth initiatives and strategic investments across its diverse portfolio.

Ayala Corporation, the Philippines oldest conglomerate, boasts a powerful market leadership and a deeply ingrained brand reputation. This legacy, built over decades, translates into significant competitive advantages across its diverse business portfolio.

Key subsidiaries like Bank of the Philippine Islands (BPI) and Ayala Land Inc. (ALI) are not just participants but leaders in their respective industries. For instance, BPI consistently ranks among the top Philippine banks by assets, demonstrating its financial strength and market dominance. Similarly, Ayala Land is a premier developer, shaping urban landscapes and commanding a significant share of the property market.

This established market position and the trust associated with the Ayala brand foster strong customer loyalty and provide a solid foundation for attracting new business ventures and partnerships. In 2024, Ayala's continued focus on innovation and customer-centricity further solidifies its leadership, ensuring sustained growth and resilience.

Commitment to Sustainability and ESG Practices

Ayala's deep integration of sustainability into its core strategy, targeting net-zero greenhouse gas emissions by 2050, is a significant strength. This commitment is not just aspirational; it's backed by tangible recognition and financial backing. The company's robust Environmental, Social, and Governance (ESG) performance earned it a spot in the prestigious FTSE4Good Index Series.

Furthermore, Ayala's dedication to ESG principles has translated into substantial financial inflows. By the close of 2024, the company had secured $6.2 billion in sustainable financing from international investors. This strong financial endorsement underscores the market's confidence in Ayala's long-term vision and its ability to create value while adhering to high sustainability standards.

- Net-Zero Target: Ayala aims for net-zero greenhouse gas emissions by 2050, embedding climate action into its business model.

- ESG Recognition: Inclusion in the FTSE4Good Index Series highlights the company's strong performance in environmental, social, and governance factors.

- Sustainable Financing: By the end of 2024, Ayala attracted $6.2 billion in sustainable financing, demonstrating investor trust in its ESG strategy.

- Long-Term Value: This focus on sustainability is projected to enhance long-term value creation and bolster stakeholder relationships.

Strategic Investments in Emerging Sectors

Ayala is strategically investing in high-potential emerging sectors to fuel future growth. These include significant capital allocation towards healthcare through AC Health, mobility solutions with AC Mobility focusing on electric vehicles, and logistics via AC Logistics. These ventures, while some are still developing their profitability, represent key inflection points for the conglomerate's expansion.

The company's deliberate capital deployment and ongoing rationalization efforts are designed to nurture these new businesses. The objective is to enable them to achieve significant scale and begin contributing meaningfully to Ayala's overall earnings in the near future. For instance, AC Mobility's push into EVs aligns with global sustainability trends, positioning Ayala to capitalize on a rapidly expanding market.

- Healthcare Expansion: AC Health continues to grow its network of clinics and pharmacies, aiming to provide accessible healthcare services across the Philippines.

- Mobility Innovation: AC Mobility is making strides in electric vehicle adoption, with plans to expand its EV fleet and charging infrastructure.

- Logistics Development: AC Logistics is investing in modern warehousing and supply chain solutions to enhance efficiency and reach.

- Future Earnings Potential: These strategic investments are anticipated to diversify Ayala's revenue streams and drive long-term value creation.

Ayala Corporation's diversified business portfolio is a significant strength, encompassing key sectors like real estate, financial services, telecommunications, and power. This broad reach, extending into industrial technologies, healthcare, and education, creates a robust structure that can weather economic fluctuations by not depending on any single industry.

This strategic diversification acts as a natural risk mitigator, ensuring multiple income streams that bolster the company's overall stability. For example, strong results from its banking arm, Bank of the Philippine Islands (BPI), and its real estate developments have recently provided a crucial buffer against softer performance in its telecommunications and energy segments.

Ayala Corporation has showcased impressive financial resilience, achieving a record core net income of P45 billion in 2024. This strong performance was maintained even as certain business segments navigated challenging market conditions.

The company's balance sheet remains robust, characterized by healthy liquidity and consistent access to capital markets. As of the first quarter of 2025, Ayala reported a consolidated cash position amounting to P75.9 billion, underscoring its financial stability.

This solid financial footing empowers Ayala to pursue ambitious capital expenditure plans. For 2025, the company has earmarked P230 billion for capital expenditures, facilitating ongoing growth initiatives and strategic investments across its diverse portfolio.

Ayala Corporation, the Philippines oldest conglomerate, boasts a powerful market leadership and a deeply ingrained brand reputation. This legacy, built over decades, translates into significant competitive advantages across its diverse business portfolio.

Key subsidiaries like Bank of the Philippine Islands (BPI) and Ayala Land Inc. (ALI) are not just participants but leaders in their respective industries. For instance, BPI consistently ranks among the top Philippine banks by assets, demonstrating its financial strength and market dominance. Similarly, Ayala Land is a premier developer, shaping urban landscapes and commanding a significant share of the property market.

This established market position and the trust associated with the Ayala brand foster strong customer loyalty and provide a solid foundation for attracting new business ventures and partnerships. In 2024, Ayala's continued focus on innovation and customer-centricity further solidifies its leadership, ensuring sustained growth and resilience.

Ayala's deep integration of sustainability into its core strategy, targeting net-zero greenhouse gas emissions by 2050, is a significant strength. This commitment is not just aspirational; it's backed by tangible recognition and financial backing. The company's robust Environmental, Social, and Governance (ESG) performance earned it a spot in the prestigious FTSE4Good Index Series.

Furthermore, Ayala's dedication to ESG principles has translated into substantial financial inflows. By the close of 2024, the company had secured $6.2 billion in sustainable financing from international investors. This strong financial endorsement underscores the market's confidence in Ayala's long-term vision and its ability to create value while adhering to high sustainability standards.

- Net-Zero Target: Ayala aims for net-zero greenhouse gas emissions by 2050, embedding climate action into its business model.

- ESG Recognition: Inclusion in the FTSE4Good Index Series highlights the company's strong performance in environmental, social, and governance factors.

- Sustainable Financing: By the end of 2024, Ayala attracted $6.2 billion in sustainable financing, demonstrating investor trust in its ESG strategy.

- Long-Term Value: This focus on sustainability is projected to enhance long-term value creation and bolster stakeholder relationships.

Ayala is strategically investing in high-potential emerging sectors to fuel future growth. These include significant capital allocation towards healthcare through AC Health, mobility solutions with AC Mobility focusing on electric vehicles, and logistics via AC Logistics. These ventures, while some are still developing their profitability, represent key inflection points for the conglomerate's expansion.

The company's deliberate capital deployment and ongoing rationalization efforts are designed to nurture these new businesses. The objective is to enable them to achieve significant scale and begin contributing meaningfully to Ayala's overall earnings in the near future. For instance, AC Mobility's push into EVs aligns with global sustainability trends, positioning Ayala to capitalize on a rapidly expanding market.

- Healthcare Expansion: AC Health continues to grow its network of clinics and pharmacies, aiming to provide accessible healthcare services across the Philippines.

- Mobility Innovation: AC Mobility is making strides in electric vehicle adoption, with plans to expand its EV fleet and charging infrastructure.

- Logistics Development: AC Logistics is investing in modern warehousing and supply chain solutions to enhance efficiency and reach.

- Future Earnings Potential: These strategic investments are anticipated to diversify Ayala's revenue streams and drive long-term value creation.

| Key Financial & Operational Highlights (2024-Q1 2025) | ||

| Core Net Income (2024) | P45 billion | Record performance |

| Consolidated Cash Position (Q1 2025) | P75.9 billion | Strong liquidity |

| Capital Expenditures (2025) | P230 billion | Investment for growth |

| Sustainable Financing (End 2024) | $6.2 billion | Investor confidence in ESG |

What is included in the product

Delivers a strategic overview of Ayala’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address strategic challenges, transforming potential roadblocks into actionable insights.

Weaknesses

Ayala's telecommunications and energy sectors, while crucial, faced headwinds in early 2025. Globe Telecom, the group's telco arm, saw its core net income fall by 22% in the first quarter of 2025. This downturn was attributed to a combination of softer revenues, increased financing expenses, and a rise in operational costs.

Similarly, ACEN, Ayala's energy platform, experienced a 28% decrease in net income during the same period. Factors contributing to this decline included reduced electricity generation output, less favorable spot market prices for power, and the impact of depreciation from recently commissioned energy facilities.

Ayala's strategic investments in newer ventures, like AC Mobility and AC Logistics, are currently weighing on its financial performance. These emerging businesses experienced widening net losses in the first quarter of 2025 and collectively reported equity losses in 2024.

While AC Health managed to reduce its net loss, these newer companies are still in their initial development stages. Consequently, they are not yet consistently generating positive contributions to Ayala's overall profitability, presenting a short-term drag on earnings.

Ayala Corporation, as a diversified conglomerate, faces significant risks from prevailing economic headwinds. Global trade tensions and geopolitical instability can ripple across its various business segments, from telecommunications to real estate, dampening growth prospects. For instance, the Philippine economy, a key market for Ayala, experienced a GDP growth of 5.6% in the first quarter of 2024, a slowdown from the previous year, indicating potential softening demand across sectors.

Persistently high interest rates present another considerable weakness. Elevated borrowing costs directly impact Ayala's diverse business units by increasing interest expenses, thereby pressuring profitability. While Ayala maintains strong access to credit, as evidenced by its robust balance sheet and established banking relationships, higher interest rates can still constrain its ability to pursue new investments or expansions, potentially limiting future growth opportunities.

Dependence on Core Businesses for Profitability

Ayala's significant reliance on its four major listed companies—BPI, Ayala Land, Globe, and ACEN—presents a notable weakness. While these core businesses are robust, they contribute the lion's share of the conglomerate's equity earnings, making Ayala susceptible to downturns in these specific sectors. For instance, in 2024, these established units were still the primary drivers of Ayala's record core earnings, underscoring this dependency.

Despite ongoing initiatives to bolster the profitability of smaller ventures, the concentration of earnings remains a key concern. This concentrated revenue stream means that any adverse performance from BPI, Ayala Land, Globe, or ACEN could disproportionately impact Ayala Corporation's overall financial health and investor confidence.

- Core Business Contribution: The majority of Ayala's equity earnings in 2024 were derived from BPI, Ayala Land, Globe, and ACEN.

- Profitability Concentration: Smaller businesses are still working towards significant profitability, leaving the conglomerate heavily dependent on its established pillars.

- Risk Exposure: This reliance exposes Ayala to sector-specific risks that could affect its consolidated financial performance.

Market Competition Across Diverse Sectors

Ayala Corporation faces intense competition across its core business segments. In real estate, for instance, developers like SM Prime Holdings and Robinsons Land are also actively expanding their land banks and launching new projects, intensifying the race for prime locations and market share. This crowded landscape means Ayala must constantly innovate and differentiate its offerings to maintain its competitive edge.

The telecommunications sector, dominated by Globe Telecom (an Ayala subsidiary) and PLDT, is characterized by rapid technological advancements and aggressive pricing strategies. Both players are investing heavily in network upgrades, including 5G deployment, to capture a larger subscriber base. For example, Globe invested PHP 50.5 billion in capital expenditures in 2023, a significant portion of which went towards network expansion and modernization, highlighting the capital-intensive nature of this competition.

In financial services, Ayala's Bank of the Philippine Islands (BPI) competes with other major universal banks like BDO Unibank and Metrobank, all vying for deposits, loans, and fee-based income. The digital transformation in banking further intensifies this rivalry, with all institutions pouring resources into enhancing their online and mobile banking platforms. BPI's digital initiatives, alongside those of its competitors, are crucial for retaining and attracting customers in a rapidly evolving financial landscape.

- Intensified Real Estate Competition: Competitors like SM Prime and Robinsons Land are expanding aggressively, mirroring Ayala Land's growth strategies.

- Telecommunications Network Race: Globe Telecom and PLDT are locked in a battle for 5G leadership, requiring substantial capital investment. Globe's 2023 capex reached PHP 50.5 billion.

- Financial Services Digitalization: BPI, BDO, and Metrobank are all heavily investing in digital platforms to compete for customers in the evolving banking sector.

Ayala's diversification into newer sectors like AC Mobility and AC Logistics is currently a drag on its financial performance, with these businesses reporting widening net losses in early 2025 and overall equity losses in 2024. While AC Health showed improvement, these nascent ventures are not yet contributing positively to overall profitability, impacting short-term earnings.

Preview Before You Purchase

Ayala SWOT Analysis

The preview you see is the actual Ayala SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professionally structured and comprehensive report, ready for your strategic planning.

Opportunities

Ayala is strategically positioned to capitalize on the growth of its emerging businesses, including AC Health and AC Mobility. These ventures represent significant opportunities for future revenue streams and market expansion.

The company has ambitious plans to achieve profitability for these smaller ventures within a two-year timeframe. This focus on rapid scaling and efficiency is a key driver for their development.

With a substantial capital expenditure plan of P230 billion slated for 2025, Ayala is demonstrating a strong commitment to investing in the infrastructure and expansion of these new ventures, particularly in the healthcare, electric vehicle, and logistics sectors.

Ayala Land Inc. (ALI) is poised for significant growth, with a P100 billion capital expenditure planned for 2024 and continued investments in 2025, including major mall redevelopments. This aggressive expansion strategy in its core real estate business highlights a strong opportunity for sustained revenue generation and market share enhancement.

The Bank of the Philippine Islands (BPI) is also a key growth driver, benefiting from robust loan expansion and improving net interest margins. These favorable financial trends within BPI create a solid foundation for continued earnings growth, further solidifying Ayala's position in the banking sector.

Leveraging the established market leadership of both ALI and BPI presents a prime opportunity for synergistic growth and further penetration across their respective sectors. Their strong track records and ongoing strategic investments are expected to drive continued expansion and profitability.

Ayala can capitalize on the burgeoning fintech sector, mirroring the success of GCash, an e-wallet under Globe Telecom. Mynt, GCash's parent company, demonstrated this potential with an impressive 86% surge in contributions during Q1 2025, significantly bolstering Globe's pre-tax net income. This trend underscores a prime opportunity for Ayala to leverage digital platforms, thereby broadening its customer reach, enriching its financial service offerings, and venturing into new digital business avenues.

Sustainable Investing and Green Initiatives

Ayala's robust commitment to sustainability, evidenced by its net-zero greenhouse gas emissions target by 2050 and substantial sustainable financing, creates significant opportunities in the burgeoning green economy. The company's strategic investments in renewable energy and eco-friendly real estate development are poised to attract environmentally conscious investors and unlock new project avenues.

Ayala's proactive integration of Environmental, Social, and Governance (ESG) principles into its core strategy is a key differentiator. This focus is particularly relevant given the increasing global demand for sustainable investments. For instance, Ayala's significant sustainable financing transactions, such as its green bonds, underscore this commitment and its ability to tap into this growing market segment.

- Net-Zero Target: Ayala aims for net-zero greenhouse gas emissions by 2050, aligning with global climate goals.

- Sustainable Financing: The company has actively engaged in significant sustainable financing deals, demonstrating financial commitment to green initiatives.

- Renewable Energy Focus: Ayala is expanding its footprint in renewable energy, a rapidly growing sector driven by climate concerns.

- ESG Integration: Embedding ESG factors into its business strategy enhances its appeal to a wider investor base and opens doors for new green projects.

Favorable Philippine Economic Outlook

The Philippine economic forecast for 2025 remains positive, with projections indicating sustained growth. This is largely attributed to anticipated lower inflation rates, strong domestic consumption patterns, and a rise in investment activities. For instance, the Bangko Sentral ng Pilipinas (BSP) has indicated a potential easing of monetary policy if inflation continues to trend downwards, which could further stimulate economic activity.

This favorable economic climate presents a significant opportunity for Ayala Corporation's diverse portfolio. Businesses within the group that are heavily influenced by consumer spending, such as retail and telecommunications, are poised for increased demand. Similarly, Ayala's infrastructure and property development segments stand to benefit from the projected uptick in investments, creating avenues for market expansion and enhanced revenue generation.

- Projected GDP Growth: The Philippine economy is expected to grow by 6.0% to 7.0% in 2025, according to the Philippine government's Development Budget Coordination Committee (DBCC).

- Inflation Control: Inflation is forecast to moderate, with the BSP targeting the 2% to 4% range for 2025, supporting consumer purchasing power.

- Investment Drivers: Increased foreign direct investment (FDI) and public-private partnerships (PPPs) are anticipated to drive infrastructure development, a key sector for Ayala.

- Consumer Spending: Remittances from Overseas Filipino Workers (OFWs) are expected to remain robust, bolstering household consumption, which forms a significant portion of the country's GDP.

Ayala is well-positioned to leverage the burgeoning fintech sector, much like Globe Telecom's success with GCash. Mynt, GCash's parent, saw an 86% surge in contributions in Q1 2025, boosting Globe's pre-tax net income. This demonstrates a clear opportunity for Ayala to expand its digital platforms, reach more customers, and enhance its financial service offerings.

Threats

Ayala Corporation operates in highly competitive arenas, with rivals actively enhancing their services and product portfolios. In telecommunications, for instance, Globe Telecom, a key Ayala subsidiary, faces robust competition from players like PLDT. This intense rivalry can put pressure on pricing and market share, impacting revenue streams in 2024 and beyond.

The real estate sector, dominated by Ayala Land, also sees fierce competition from developers like SM Prime Holdings and Robinsons Land. These competitors are also investing heavily in new projects and expanding their reach, creating a challenging environment for Ayala Land to maintain its growth trajectory and pricing power in the coming years.

Furthermore, in financial services, Bank of the Philippine Islands (BPI), another significant Ayala holding, contends with other major banking institutions. The digital transformation and aggressive customer acquisition strategies of competitors necessitate continuous innovation and investment for BPI to retain its competitive edge and market position.

Ayala Corporation, as a major player in the Philippine economy, faces significant risks from evolving government regulations and policy shifts. For instance, potential changes in environmental policies could increase compliance costs for its infrastructure and energy businesses, impacting project viability and profitability.

Furthermore, alterations to tax laws, such as adjustments to corporate income tax rates or specific industry levies, could directly affect Ayala's bottom line across its diverse portfolio, including telecommunications and banking. The company's extensive reach means it must navigate a complex web of national and local statutes, where even minor amendments can necessitate substantial operational adjustments and increased expenditure.

While the Philippine economy shows resilience, global economic headwinds like slowing trade and geopolitical instability present a significant threat to Ayala. For instance, a projected global GDP growth of 2.6% in 2024 by the IMF, down from 3.0% in 2023, indicates a cooling global environment that could spill over.

A substantial economic slowdown in the Philippines, perhaps mirroring a global recession, would directly dampen consumer spending and business investment. This directly impacts Ayala's diverse operations, from property development and banking to telecommunications and infrastructure, potentially leading to reduced revenue and profitability across its segments.

Disruptive Technologies and Shifting Consumer Habits

Rapid technological advancements and evolving consumer preferences pose a significant threat to Ayala's diverse portfolio. For instance, in the telecommunications sector, the ongoing shift towards 5G and beyond, coupled with the rise of over-the-top (OTT) services, challenges traditional revenue models. Similarly, in retail, the accelerated adoption of e-commerce and changing shopping behaviors, particularly post-pandemic, demands constant adaptation.

Ayala's investments in digital transformation and new mobility solutions are crucial, but a lag in responding to disruptive technologies or significant shifts in consumer habits could impact its competitive edge. For example, while Globe Telecom, a key Ayala subsidiary, is investing heavily in 5G, failing to anticipate the next wave of digital communication or the increasing demand for personalized retail experiences could erode market share. The company must remain agile to ensure the sustained profitability and relevance of both its established and nascent business ventures.

- Telecommunications: Globe Telecom reported a 9% increase in capital expenditures to PHP 102 billion in 2023, focusing on network expansion and modernization to combat evolving digital demands.

- Retail: Ayala Malls is actively enhancing its omnichannel strategies, with a growing percentage of sales now attributed to online channels and integrated loyalty programs, reflecting changing consumer purchasing habits.

- New Mobility: The burgeoning electric vehicle (EV) market and the rise of integrated mobility platforms present both opportunities and threats, requiring continuous innovation to stay ahead of emerging competitors.

Climate Change Risks

Ayala faces significant climate change risks that could impact its operations and financial performance. Extreme weather events, a growing concern, could disrupt energy generation and supply chains, two critical areas for the conglomerate. Furthermore, the evolving landscape of environmental regulations presents a challenge, potentially requiring substantial adjustments to business practices and investments.

To proactively address these threats, Ayala is undertaking a comprehensive climate risk assessment scheduled for 2025. This assessment aims to ensure that the company's strategic planning remains robust and adaptable in the face of a changing climate. The company's commitment to climate action, while a strength, also means it is directly exposed to these emerging risks.

- Physical Risks: Increased frequency and intensity of extreme weather events like typhoons and prolonged droughts could damage infrastructure and disrupt operations, particularly in the energy and water sectors where Ayala has significant investments.

- Transition Risks: Shifting global and local regulations towards decarbonization and sustainability could lead to increased compliance costs, carbon pricing mechanisms, and potential obsolescence of certain assets if not managed proactively.

- Operational Disruptions: Supply chain vulnerabilities exacerbated by climate impacts can lead to material shortages and increased logistics costs for Ayala's diverse businesses.

- Financial Implications: These risks can translate into higher insurance premiums, potential asset write-downs, and reduced access to capital if climate resilience is not adequately demonstrated.

Intensified competition across its core sectors, including telecommunications, real estate, and financial services, poses a significant threat to Ayala's market share and profitability. Competitors are actively innovating and expanding, necessitating continuous investment and strategic adaptation to maintain a competitive edge. Evolving regulatory landscapes and potential policy shifts, such as changes in tax laws or environmental regulations, could directly impact operational costs and business viability, requiring careful navigation and compliance efforts.

Global economic slowdowns, geopolitical instability, and rapid technological advancements present substantial challenges by potentially dampening consumer spending and demanding agile responses to disruptive innovations. Climate change risks, including extreme weather events and stricter environmental regulations, also pose a threat, potentially disrupting operations and increasing compliance costs across Ayala's diverse portfolio.

| Threat Category | Specific Example | Potential Impact | 2024/2025 Data/Outlook |

|---|---|---|---|

| Competition | Intensified rivalry in telecommunications (Globe vs. PLDT) | Pressure on pricing and market share | Globe's 2023 CAPEX of PHP 102 billion highlights ongoing investment to counter competition. |

| Regulatory Changes | Potential shifts in tax laws or environmental policies | Increased compliance costs, impact on profitability | Ongoing monitoring of Philippine tax reforms and environmental legislation is critical for 2025 planning. |

| Economic Headwinds | Global GDP growth slowdown (IMF forecast 2.6% for 2024) | Reduced consumer spending and business investment | A projected slowdown in global trade could impact export-oriented segments of Ayala's businesses. |

| Technological Disruption | Rise of OTT services and e-commerce adoption | Erosion of traditional revenue models, need for digital transformation | Ayala Malls' focus on omnichannel strategies reflects adaptation to changing consumer behavior. |

| Climate Change | Increased frequency of extreme weather events | Infrastructure damage, operational disruptions, higher insurance costs | Ayala's planned 2025 climate risk assessment aims to mitigate impacts on energy and water assets. |

SWOT Analysis Data Sources

This analysis draws from comprehensive data including Ayala Corporation's official financial reports, detailed market research from reputable industry analysts, and expert opinions from financial and business publications to provide a robust strategic overview.