Ayala Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Discover the intricate workings of Ayala's business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Ready to dissect Ayala's strategic advantage? Our full Business Model Canvas provides an in-depth look at their value propositions, cost structure, and competitive differentiators, empowering you with actionable insights for your own ventures.

Unlock the secrets to Ayala's sustained growth. This downloadable Business Model Canvas offers a complete, professionally crafted view of their entire business architecture, from core activities to key partnerships. Get it now to elevate your strategic planning.

Partnerships

Ayala Corporation actively partners with government entities and regulatory bodies to navigate the complex landscape of infrastructure development, licensing, and policy adherence. These collaborations are crucial for projects in sectors like real estate, telecommunications, and energy, ensuring compliance and operational smoothness.

For instance, in 2024, Ayala Land's ongoing urban development projects rely heavily on permits and approvals from local government units and national agencies, streamlining land use and construction processes. Similarly, Globe Telecom's expansion of its 5G network necessitates ongoing engagement with the Department of Information and Communications Technology (DICT) and the National Telecommunications Commission (NTC) to secure spectrum rights and comply with service quality standards.

These strategic alliances are vital for Ayala Corporation's diverse business units, enabling them to operate efficiently and contribute to national development goals while adhering to the Philippines' evolving regulatory framework.

Ayala Corporation actively collaborates with a wide array of financial institutions to secure the necessary funding for its substantial capital investments and ambitious growth strategies. This includes leveraging debt financing through various credit facilities and engaging in capital market activities to raise funds.

Strategic investors are also crucial partners, injecting growth capital into Ayala's diverse business segments. For instance, AP Moller Capital's investment in AC Logistics in 2023, amounting to a significant undisclosed sum, exemplifies how external capital fuels specific venture expansions and strengthens the group's overall financial footing.

Ayala's strategic alliances with technology providers and innovators are crucial for its digital transformation. For instance, its significant investment in Globe Telecom, a major player in the Philippine telecommunications sector, necessitates ongoing partnerships for network infrastructure upgrades and the deployment of advanced technologies like 5G. These collaborations ensure Ayala can offer cutting-edge digital services to its customers.

Furthermore, Ayala's fintech arm, GCash, relies heavily on technology partners to maintain its leadership in digital payments. These partnerships are vital for enhancing platform security, expanding service offerings, and integrating with various financial ecosystems. In 2023, GCash processed over PHP 3 trillion in total transaction value, underscoring the critical role of its technology collaborators in achieving this scale and reliability.

International & Local Business Conglomerates

Ayala actively cultivates strategic alliances with prominent domestic and international business conglomerates. These collaborations are crucial for undertaking joint ventures and facilitating market expansion, effectively pooling resources and expertise.

Notable examples of these key partnerships include ventures with Mitsubishi Corporation and Anko in the retail sector, and an alliance with AP Moller Capital for logistics operations. These relationships enable Ayala to tap into established networks and operational efficiencies.

These strategic alliances are vital for Ayala's growth strategy, allowing for shared risk and reward in new ventures. For instance, in 2023, Ayala Corporation's net income grew by 27% to PHP 43.2 billion, partly driven by the performance of its diverse business units, many of which benefit from these partnerships.

The benefits derived from these partnerships are multifaceted:

- Access to new markets and customer segments

- Shared investment burden for large-scale projects

- Leveraging complementary technologies and operational capabilities

- Enhanced brand credibility through association with established global players

Healthcare & Education Institutions

Ayala's commitment to its growing healthcare and education sectors is significantly bolstered by strategic collaborations with leading academic and medical institutions. These partnerships are crucial for fostering talent development, driving innovation through research, and advancing the quality of services offered.

For instance, Ayala Land's healthcare arm, AC Health, actively partners with institutions like the University of the Philippines Manila. This collaboration focuses on crucial areas such as training healthcare professionals, conducting vital research, and developing new healthcare solutions. Such alliances ensure a pipeline of skilled talent and contribute to cutting-edge advancements in the medical field.

- Training and Development: Collaborations with universities provide specialized training programs for medical staff, enhancing the overall skill set within Ayala's healthcare facilities.

- Research and Innovation: Joint research initiatives with academic bodies aim to develop new treatments, diagnostic tools, and healthcare delivery models.

- Talent Acquisition: Partnerships facilitate the recruitment of top graduates from prestigious institutions, ensuring a high caliber of professionals across Ayala's education and healthcare ventures.

- Knowledge Exchange: These alliances foster a continuous exchange of knowledge and best practices between industry professionals and academic experts.

Ayala Corporation's Key Partnerships are diverse, spanning government, financial institutions, technology providers, other business conglomerates, and academic/medical bodies. These alliances are fundamental to its operational efficiency, growth strategies, and innovation efforts across its various business units.

In 2024, these partnerships are critical for navigating regulatory landscapes, securing capital, and integrating advanced technologies. For example, Globe Telecom's 5G expansion depends on collaboration with the DICT and NTC, while GCash's fintech success relies on technology partners for security and service expansion, processing over PHP 3 trillion in 2023.

Strategic collaborations, like AP Moller Capital's investment in AC Logistics in 2023, provide growth capital. Joint ventures with entities such as Mitsubishi Corporation and Anko in retail, and AP Moller Capital in logistics, enable market expansion and resource pooling.

Ayala's healthcare and education sectors also benefit significantly from partnerships with institutions like the University of the Philippines Manila, fostering talent development and research.

| Partner Type | Example Partner | Ayala Business Unit | Year of Example | Impact |

|---|---|---|---|---|

| Government/Regulatory | DICT, NTC | Globe Telecom | Ongoing (2024 focus) | Spectrum rights, service quality compliance |

| Financial Institutions | Various Banks | Group-wide | Ongoing (2024 focus) | Capital for investments, debt financing |

| Strategic Investors | AP Moller Capital | AC Logistics | 2023 | Growth capital injection |

| Technology Providers | Undisclosed | GCash | Ongoing (2023 data) | Platform security, service expansion (PHP 3T+ transactions) |

| Business Conglomerates | Mitsubishi Corporation | Retail | Ongoing (2023 data) | Market expansion, resource pooling |

| Academic/Medical | University of the Philippines Manila | AC Health | Ongoing (2024 focus) | Talent development, research advancement |

What is included in the product

A meticulously crafted business model canvas that details Ayala's strategic approach across all nine key blocks.

This canvas provides a clear, actionable blueprint of Ayala's operations, revenue streams, and customer relationships.

The Ayala Business Model Canvas simplifies complex strategies, offering a clear visual roadmap to identify and address operational inefficiencies and market gaps.

Activities

Ayala Land's core activity involves crafting expansive, integrated communities. This means meticulously planning and building environments that seamlessly blend living spaces, retail hubs, and recreational areas, fostering complete lifestyles within a single development.

The company's extensive portfolio in 2024 includes numerous master-planned estates across the Philippines. For instance, their commitment to ongoing management ensures these communities remain vibrant and well-maintained, contributing to long-term value for residents and stakeholders alike.

Ayala's key activity in financial services revolves around its subsidiary, the Bank of the Philippine Islands (BPI). BPI offers a broad spectrum of financial products, encompassing everyday banking, various loan facilities, and sophisticated investment management solutions.

In 2023, BPI reported a net income of PHP 49.4 billion, reflecting its robust performance and extensive reach within the Philippine financial landscape. This financial strength underpins Ayala's ability to serve a vast client base, from individual consumers to large corporations.

A significant focus for Ayala through BPI is the continuous expansion of its digital financial services. This strategic push aims to enhance customer experience and accessibility, catering to the evolving demands of a digitally-savvy market and further solidifying its position as a leading financial provider.

Globe Telecom, a cornerstone of Ayala's telecommunications, is heavily invested in the robust operation and strategic expansion of its mobile and broadband infrastructure. This includes the ongoing deployment of new cell sites across the Philippines, a critical activity for enhancing coverage and capacity. In 2024, Globe continued its aggressive network build-out, aiming to increase its 5G presence and improve overall service quality for its millions of subscribers.

A significant aspect of this key activity is Globe's commitment to sustainability, evidenced by its transition towards renewable energy sources for its network operations. This strategic move not only reduces environmental impact but also contributes to operational efficiency. Furthermore, Globe is continuously enhancing its digital services, with GCash, its mobile wallet, playing a pivotal role in expanding its digital ecosystem and offering a wider range of financial services to Filipinos.

Renewable Energy Generation & Infrastructure Development

ACEN Corporation, Ayala's renewable energy subsidiary, is at the forefront of developing and operating solar, wind, and geothermal power plants. Their strategic focus includes expanding existing capacity and initiating new projects to bolster their renewable portfolio.

ACEN is committed to achieving net-zero greenhouse gas emissions, actively investing in cleaner energy sources and retiring carbon-intensive assets. This drive towards sustainability underpins their infrastructure development activities.

- Capacity Expansion: ACEN aims to reach 5,000 MW of attributable capacity by 2025, with a significant portion from new renewable projects.

- Net-Zero Commitment: The company is working towards a net-zero target, phasing out coal-fired power plants and increasing renewable energy generation.

- Project Development: Key activities involve securing land, obtaining permits, and managing the construction of new solar farms and wind projects across various regions.

- Infrastructure Investment: Significant capital is allocated to building and upgrading the necessary infrastructure to support the integration of renewable energy into the grid.

Strategic Investments & Portfolio Management

Ayala Corporation actively pursues strategic investments and portfolio management, consistently seeking out and nurturing new avenues for growth. In 2024, the company continued its focus on diversifying beyond its traditional real estate and utilities sectors, with significant attention paid to emerging industries like healthcare, logistics, industrial technologies, and education. This proactive approach aims to build a resilient and future-ready business portfolio.

The company's strategy involves not only identifying promising new ventures but also strategically scaling up existing businesses that demonstrate strong potential. Simultaneously, Ayala Corporation engages in the rationalization of initiatives that may no longer align with its long-term objectives or offer optimal returns. This dynamic management ensures that capital is allocated efficiently, enhancing overall portfolio performance and shareholder value.

- Investment Focus: Ayala Corporation's strategic investments in 2024 were geared towards high-growth sectors, including healthcare, logistics, industrial technologies, and education, reflecting a deliberate diversification strategy.

- Portfolio Optimization: The company actively manages its portfolio by scaling up promising new businesses while rationalizing underperforming or non-core initiatives to maximize efficiency and returns.

- Financial Performance Impact: This strategic approach aims to bolster Ayala Corporation's financial resilience and drive sustainable long-term growth, as evidenced by its ongoing commitment to innovation and market adaptation.

Ayala's key activities are multifaceted, encompassing property development, financial services through BPI, telecommunications via Globe, and renewable energy through ACEN. These core operations are supported by strategic investments and portfolio management aimed at diversification and growth.

In 2024, Ayala Land continued to develop integrated communities, while BPI focused on expanding digital financial services, reporting a net income of PHP 49.4 billion in 2023. Globe Telecom invested heavily in network infrastructure, including 5G deployment, and ACEN pursued its 5,000 MW capacity target by 2025, emphasizing renewable energy development and net-zero commitments.

| Key Activity | Description | 2023/2024 Data/Focus |

| Property Development | Crafting integrated communities | Ongoing development of master-planned estates. |

| Financial Services (BPI) | Banking, loans, investment management | PHP 49.4 billion net income (2023); focus on digital expansion. |

| Telecommunications (Globe) | Mobile and broadband infrastructure | Network build-out, 5G expansion, GCash digital ecosystem. |

| Renewable Energy (ACEN) | Developing solar, wind, geothermal plants | Targeting 5,000 MW capacity by 2025; net-zero commitment. |

| Strategic Investments | Portfolio management and diversification | Focus on healthcare, logistics, industrial tech, education. |

Preview Before You Purchase

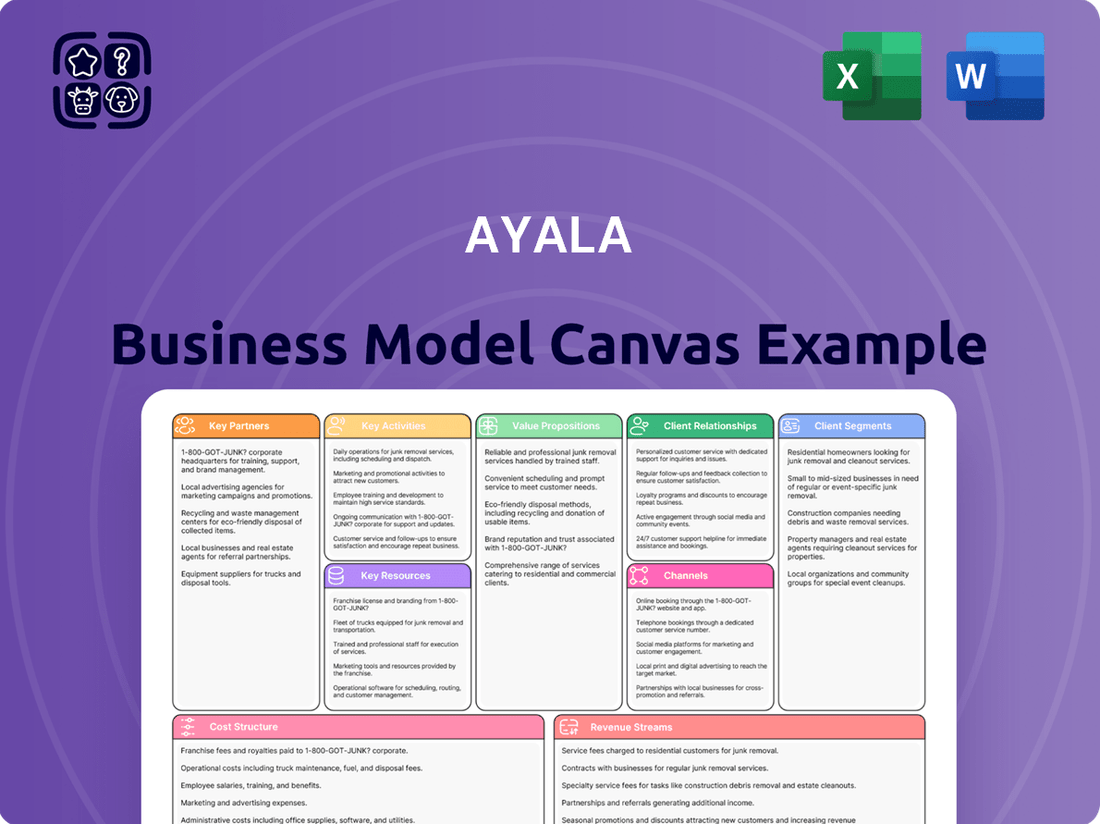

Business Model Canvas

The Ayala Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you get a direct look at the professional structure and content that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this identical, ready-to-use Business Model Canvas.

Resources

Ayala Land's extensive land bank, a cornerstone of its business model, provides the raw material for its diverse property developments. This strategic asset allows the company to consistently launch new residential, commercial, and industrial projects, fueling its growth across the Philippines.

As of the first quarter of 2024, Ayala Land reported a substantial land bank, enabling a robust pipeline of projects. This vast real estate portfolio is crucial for their integrated community developments, ensuring sustained expansion and new revenue streams.

Ayala Corporation's robust financial capital is a cornerstone of its business model, allowing for significant capital expenditures and strategic investments across its diverse business segments. As of the first quarter of 2024, Ayala reported consolidated revenues of PHP 142.7 billion, demonstrating its substantial operational scale and financial strength.

This financial capacity is further bolstered by access to substantial credit lines from both domestic and international banking institutions, alongside a proven ability to tap into capital markets. For instance, in 2023, the company successfully issued PHP 10 billion in retail bonds, highlighting its favorable standing with investors and lenders.

Globe Telecom's robust telecommunications infrastructure, a key resource for Ayala, is built upon an extensive network of cell sites, fiber optic cables, and data centers. This foundational element directly supports its service offerings and is crucial for meeting increasing digital demands.

Significant ongoing investments are being channeled into enhancing this infrastructure. For instance, Globe has been actively expanding its 5G network coverage and upgrading its fiber-to-the-home (FTTH) capabilities, demonstrating a commitment to future-proofing its operations.

In 2024, Globe continued to prioritize network expansion and modernization. The company reported substantial capital expenditures allocated towards improving network quality and capacity, ensuring reliability and supporting the surge in data consumption driven by digital services and remote work trends.

Diversified Human Capital & Specialized Expertise

Ayala's strength lies in its extensive and varied workforce, boasting specialized knowledge across critical industries. This diverse talent pool fuels innovation and ensures high operational standards throughout the conglomerate.

The group's human capital is a cornerstone of its business model, enabling it to navigate and excel in complex markets. This expertise spans sectors vital to economic growth and development.

- Real Estate: Ayala Land's development projects benefit from seasoned architects, urban planners, and property managers.

- Finance: Bank of the Philippine Islands (BPI) employs skilled financial analysts, risk managers, and customer service professionals.

- Technology: Globe Telecom relies on IT specialists, network engineers, and cybersecurity experts to drive digital transformation.

- Healthcare: AC Health leverages medical professionals, hospital administrators, and public health experts to improve healthcare access.

- Energy: ACEN (formerly AC Energy) utilizes renewable energy engineers, project developers, and environmental scientists for sustainable power solutions.

Established Brand Reputation & Market Leadership

Ayala Corporation's established brand reputation is a cornerstone of its business model, built on a history stretching back to 1834. This legacy translates into deep-seated trust among consumers and partners across its diverse portfolio, which includes real estate, banking, telecommunications, and infrastructure.

Market leadership in key segments further solidifies this advantage. For instance, in 2024, Ayala Land continued to be a dominant force in Philippine real estate development, consistently launching successful projects and maintaining a strong market share. Similarly, Bank of the Philippine Islands (BPI), a major Ayala subsidiary, remains one of the country's largest and most respected financial institutions, reflecting sustained customer loyalty and a robust market position.

- Brand Equity: Ayala's brand is synonymous with quality, reliability, and long-term value in the Philippines.

- Market Dominance: Leadership in sectors like real estate and banking provides significant competitive moats and customer acquisition advantages.

- Customer Trust: The long-standing reputation fosters high levels of customer trust, reducing acquisition costs and increasing retention rates.

- Diversified Strength: The strength of the Ayala brand underpins its success across various industries, creating cross-sectoral benefits.

Ayala Land's expansive land bank is a critical resource, providing the foundation for its diverse property developments and ensuring a sustained pipeline of projects. This strategic asset fuels consistent growth across residential, commercial, and industrial sectors, as evidenced by its robust project launches in early 2024.

Ayala Corporation's substantial financial capital, demonstrated by PHP 142.7 billion in consolidated revenues in Q1 2024, enables significant investments and strategic initiatives. This financial strength is further augmented by strong access to credit and successful capital market engagements, such as its PHP 10 billion retail bond issuance in 2023.

Globe Telecom's advanced telecommunications infrastructure, including extensive cell sites and fiber optic networks, is a vital resource supporting its digital services. Continuous investment in 5G expansion and FTTH upgrades in 2024 underscores Globe's commitment to network enhancement and meeting escalating data demands.

The conglomerate's human capital, characterized by specialized expertise across its various industries, is a key driver of innovation and operational excellence. This skilled workforce is instrumental in navigating complex markets and achieving success in vital economic sectors.

Ayala's strong brand reputation, built over decades, fosters deep trust among consumers and partners. This equity, combined with market leadership in sectors like real estate and banking, provides significant competitive advantages and customer loyalty, as seen in its sustained market dominance throughout 2024.

Value Propositions

Ayala Land's value proposition centers on crafting master-planned communities that seamlessly blend residential, commercial, and recreational elements. This integration fosters unparalleled convenience and enhances the overall quality of life for those living and working within these vibrant, holistic environments.

These developments are designed with sustainability at their core, aiming to create environments that are not only appealing but also responsible. This commitment is reflected in their ongoing efforts to incorporate green building practices and preserve natural spaces within their projects, contributing to a better urban future.

For instance, Ayala Land's commitment to sustainable urban living is evident in projects like Vermosa in Cavite, which emphasizes a balanced lifestyle with sports facilities and ample green spaces. In 2023, Ayala Land reported a net income of P24.1 billion, underscoring the market's positive reception to its integrated and sustainable development approach.

Ayala, through its subsidiary BPI, offers a broad spectrum of financial products and services designed for both individuals and businesses. Their focus is on making these solutions easily accessible, incorporating innovative features, and prioritizing digital convenience. This commitment is evident in their robust banking services and the continuous expansion of digital platforms, such as GCash, which saw a significant surge in user activity, processing billions of transactions in 2023.

Globe Telecom, a key player in the Philippines, offers dependable and cutting-edge digital connectivity. This includes robust mobile services, high-speed broadband, and integrated fintech solutions, facilitating smooth communication and digital commerce for millions. Their commitment to network enhancement is evident in ongoing investments.

In 2024, Globe continued its aggressive network modernization, aiming to boost data speeds and expand coverage. This focus on infrastructure underpins their value proposition of reliable digital access, crucial for both personal and business needs in an increasingly connected world.

Sustainable Energy & Infrastructure Development

Ayala actively drives national progress by investing in renewable energy sources and essential infrastructure, providing environmentally friendly power and fostering economic expansion. This dedication is a key part of their strategy to reach net-zero emissions.

Their commitment is evident in projects like ACEN Corporation's significant renewable energy portfolio. As of the first quarter of 2024, ACEN had over 4,400 megawatts of attributable capacity from renewable energy sources, with a substantial portion of this being solar and wind power.

- Renewable Energy Focus: Ayala, through ACEN, is a major player in the Philippines' transition to cleaner energy, with a growing installed capacity of renewable energy assets.

- Infrastructure Investment: Beyond energy, Ayala invests in critical infrastructure, including water and telecommunications, which are vital for economic development and sustainability.

- Net-Zero Commitment: The company has set ambitious targets for reducing its carbon footprint and achieving net-zero emissions, aligning its business strategy with global climate goals.

Holistic Healthcare & Educational Services

Ayala’s commitment to holistic well-being is evident in its significant investments in healthcare and education. These sectors are designed to deliver high-quality, accessible services, fostering community development and improving overall quality of life.

The company actively expands its healthcare footprint through its hospital and clinic networks, aiming to reach more individuals with essential medical care. This expansion is crucial for addressing healthcare gaps and ensuring greater accessibility.

In education, Ayala supports institutions that provide valuable learning opportunities, contributing to the intellectual and professional growth of students. This dual focus on health and education underscores Ayala's dedication to social progress.

- Healthcare Expansion: Ayala Corporation, through its subsidiary AC Health, is actively growing its hospital and clinic network. As of 2024, AC Health operates multiple hospitals and a growing number of primary care clinics across the Philippines, aiming for broader patient reach.

- Educational Initiatives: Ayala supports various educational programs and institutions, focusing on improving learning outcomes and accessibility. This includes partnerships and direct investments in schools and universities.

- Community Impact: The combined healthcare and educational services are designed to uplift communities by providing essential services and opportunities for development, contributing to a healthier and more educated populace.

- Strategic Growth: Ayala’s ventures in these sectors reflect a long-term strategy to build sustainable businesses that also deliver significant social returns, aligning with national development goals.

Ayala Land's value proposition is built on creating master-planned communities that integrate residential, commercial, and recreational spaces, enhancing convenience and quality of life. Their commitment to sustainability is woven into these developments, emphasizing green practices and preserving natural areas. This approach is exemplified by projects like Vermosa, which promotes a balanced lifestyle, and was reflected in their P24.1 billion net income in 2023.

Customer Relationships

Ayala prioritizes personalized client management, especially for its high-value customers in real estate and financial services. This means offering bespoke solutions and dedicated support, a strategy that resonates strongly in their premium residential and corporate banking divisions.

In 2024, Ayala Land's premium developments, such as those in Bonifacio Global City, saw continued strong demand, underscoring the success of this tailored approach. Similarly, Bank of the Philippine Islands (BPI), a key Ayala subsidiary, reported a significant increase in its high-net-worth client base, benefiting from personalized wealth management services.

Ayala actively leverages technology to foster strong customer relationships through its digital engagement and self-service platforms. This is particularly evident in its financial services and telecommunications arms.

For instance, Bank of the Philippine Islands (BPI) offers comprehensive digital banking services, allowing customers to manage accounts, make payments, and apply for loans online. As of the first quarter of 2024, BPI reported a significant increase in digital transactions, with over 60% of its total transactions conducted through digital channels, highlighting customer preference for convenience.

Similarly, Globe Telecom and its mobile wallet GCash are at the forefront of digital interaction. GCash, a leading e-wallet in the Philippines, boasts over 50 million registered users as of early 2024, facilitating seamless transactions and customer support. Globe's continuous investment in network infrastructure further supports these digital services, ensuring accessibility for a vast customer base.

Ayala Land actively cultivates community through resident events and shared amenities, fostering a strong sense of belonging within its integrated townships. These programs are designed to enhance resident loyalty and create vibrant living environments.

Corporate & Institutional Partnerships

Ayala cultivates deep-rooted connections with a broad array of corporate clients, government bodies, and institutional investors across its varied sectors. These partnerships are the bedrock of its sustained growth, fostering trust and shared objectives.

These relationships are strategically managed to ensure long-term collaboration and mutual benefit, driving value creation for all stakeholders involved. For instance, Ayala Land's significant partnerships with local government units are crucial for urban development projects, ensuring regulatory alignment and community buy-in.

Ayala's commitment to these partnerships is evident in its consistent engagement and the successful execution of large-scale projects. In 2024, Ayala Corporation reported a consolidated net income of PHP 34.4 billion, underscoring the financial strength derived from these strategic alliances.

- Corporate Clients: Ayala's diverse businesses serve numerous corporate clients, providing essential services and solutions that contribute to their operational efficiency and growth.

- Government Entities: Collaborations with government agencies are vital for infrastructure development, public-private partnerships, and navigating regulatory landscapes.

- Institutional Partners: Ayala attracts and retains institutional investors and financial institutions through a track record of stability and strong corporate governance, facilitating access to capital for expansion.

- Mutual Value Creation: The emphasis is on building enduring relationships that generate tangible benefits and shared success, reinforcing Ayala's position as a trusted partner.

Customer Service & Support Networks

Ayala Corporation prioritizes robust customer relationships through comprehensive service and support networks. These include dedicated call centers, a widespread network of physical branches, and accessible online support channels designed to efficiently address customer inquiries and offer timely assistance across its diverse business units.

- Extensive Reach: Ayala's commitment to customer service is evident in its multi-channel approach, ensuring accessibility for a broad customer base.

- Customer Engagement: For instance, in 2024, Globe Telecom, a key Ayala subsidiary, reported serving over 100 million mobile subscribers, underscoring the scale of customer interactions managed daily.

- Digital Integration: The group actively invests in digital platforms to enhance customer support, reflecting a growing trend in the Philippine market for seamless online service experiences.

- Service Excellence: This focus on customer support aims to foster loyalty and satisfaction, a critical component for sustained growth in competitive sectors like telecommunications, banking, and real estate.

Ayala fosters deep connections through personalized service for high-value clients and community building in real estate. Its digital platforms, like GCash and BPI's online services, are key to engaging millions of users. Strategic partnerships with corporations and government entities are crucial for large-scale projects and sustained growth.

| Customer Segment | Key Relationship Strategy | 2024 Data/Example |

|---|---|---|

| High-Value Individuals | Personalized service, bespoke solutions | BPI's high-net-worth client base growth |

| Real Estate Residents | Community events, shared amenities | Ayala Land township resident engagement |

| Digital Users | Self-service platforms, digital engagement | GCash: 50M+ users; BPI: 60%+ digital transactions |

| Corporate & Government | Long-term collaboration, strategic partnerships | Ayala Land's LGU partnerships for urban development |

Channels

Ayala Land's integrated estates and mixed-use developments are the core channels for its diverse real estate offerings. These vibrant communities bundle residential, commercial, and retail components, acting as direct conduits to customers. For instance, in 2024, Ayala Land continued to expand its presence in key growth areas, leveraging these integrated projects to capture market demand.

Bank of the Philippine Islands (BPI) leverages its vast branch network and ATMs as key physical touchpoints. As of the first quarter of 2024, BPI operated 1,142 branches and 2,442 ATMs across the Philippines, facilitating direct customer interactions and service delivery.

This extensive physical infrastructure is vital for reaching a broad customer base, especially in areas where digital access may be limited. These touchpoints are essential for traditional banking services and building customer trust.

Ayala actively utilizes digital platforms and mobile applications to enhance customer interactions and streamline transactions. Their portfolio, which includes telecommunications giant Globe, financial services provider Ayala Finance, and real estate developer Ayala Land, all benefit from these digital touchpoints.

For instance, GCash, a leading mobile wallet and financial services app operated by Mynt (a subsidiary of Globe), processed over 2.8 billion transactions in 2023, demonstrating the significant role of mobile applications in their ecosystem. This digital reach allows for efficient service delivery and customer engagement across their diverse business segments.

Direct Sales Forces & Broker Networks

Ayala leverages dedicated direct sales forces to market its high-value real estate properties, ensuring personalized engagement with potential buyers. This approach is crucial for navigating the complexities of significant property transactions.

Complementing its direct sales, Ayala also utilizes a broad network of real estate brokers. In 2024, the Philippine real estate market saw continued activity, with brokers playing a vital role in connecting sellers with a wider pool of interested parties, especially for luxury and commercial segments.

- Direct Sales: Focused on high-net-worth individuals and corporate clients for premium real estate and specialized financial products.

- Broker Networks: Extensive reach across various market segments, facilitating transactions for a broader customer base in 2024.

- Synergy: Combining direct outreach with broker partnerships maximizes market penetration and sales efficiency for Ayala's diverse portfolio.

Strategic Partnerships & Distribution Agreements

Ayala actively cultivates strategic partnerships to significantly expand its distribution networks and accelerate market penetration, particularly within its burgeoning healthcare and logistics sectors. These alliances are crucial for tapping into new customer bases and enhancing service delivery.

In 2024, Ayala's commitment to strategic alliances was evident in its continued expansion of AC Health's reach, aiming to serve a wider population through partnerships with clinics and pharmacies. For instance, its collaboration with Generika Drugstore, a leading retail pharmacy chain in the Philippines, provides a robust distribution channel for its pharmaceutical products.

- Expanded Distribution: Partnerships with established players in new markets, like the aforementioned Generika Drugstore collaboration, allow Ayala to leverage existing infrastructure for faster product and service rollout.

- Market Penetration: By aligning with entities that already possess strong customer relationships, Ayala can more effectively reach diverse consumer segments, overcoming initial market entry barriers.

- Synergistic Growth: These collaborations often create a win-win scenario, where Ayala gains access to new customers and distribution channels, while its partners benefit from new offerings or enhanced capabilities.

Ayala's channels are a blend of direct engagement and broad network utilization. Integrated developments serve as primary conduits for real estate, while BPI's extensive branch and ATM network offers crucial physical touchpoints for banking. Digital platforms, notably GCash, are increasingly vital for transaction processing and customer interaction across the group.

These varied channels are supported by dedicated sales teams for high-value offerings and extensive broker networks to maximize market reach. Strategic partnerships, such as AC Health's collaborations with pharmacies, further expand distribution, especially in newer sectors.

| Channel Type | Key Entities/Examples | 2024/Recent Data Point |

|---|---|---|

| Integrated Developments | Ayala Land Estates | Continued expansion in key growth areas |

| Physical Touchpoints | BPI Branches & ATMs | 1,142 branches, 2,442 ATMs (Q1 2024) |

| Digital Platforms | GCash (Mynt/Globe) | Over 2.8 billion transactions (2023) |

| Direct Sales | Ayala Land Premium Properties | Personalized engagement for high-net-worth clients |

| Broker Networks | Real Estate Brokers | Facilitating transactions across market segments |

| Strategic Partnerships | AC Health / Generika Drugstore | Expanding reach in healthcare and pharmaceuticals |

Customer Segments

Ayala Land effectively serves a broad customer base for residential properties, encompassing those looking for their first home to affluent buyers seeking high-end residences. Their portfolio spans various price points, demonstrating a commitment to accessibility and luxury across different market segments.

The company's strategy involves distinct brands tailored to specific income levels, ensuring a targeted approach to meet diverse buyer needs. This segmentation allows Ayala Land to capture market share from first-time homebuyers needing affordable options to sophisticated investors interested in premium developments.

For instance, in 2024, Ayala Land continued to see strong demand in its mid-market and premium segments, with projects like those in Nuvali and Arca South attracting significant interest. Their ability to cater to a wide range of financial capacities, from entry-level housing to luxury estates, underscores their comprehensive market penetration.

Ayala's corporate and business clients span from burgeoning small and medium enterprises (SMEs) to established large corporations. For these businesses, Ayala offers a comprehensive suite of solutions, including essential financial services and strategic commercial real estate opportunities.

These offerings are designed to support business growth and operational efficiency. For instance, in 2024, Ayala Land’s office leasing segment continued to be a significant revenue driver, catering to the diverse space needs of businesses across various industries.

Beyond real estate, Ayala's telecommunications arm, Globe Telecom, provides critical connectivity solutions for businesses. In the first quarter of 2024, Globe reported a substantial increase in its enterprise business, highlighting the strong demand for digital services among corporate clients.

BPI and GCash cater to millions of Filipinos seeking convenient banking and payment solutions. BPI, for instance, reported over 10 million active customers in 2023, highlighting its extensive reach for everyday transactions and financial services.

This segment is drawn to digital innovation, valuing easy access to funds and seamless online transactions. GCash, a leading digital wallet, processed over PHP 3 trillion in transactions in 2023, demonstrating the immense demand for accessible digital finance.

Financial inclusion is a key driver, with these platforms empowering unbanked and underbanked populations with essential financial tools. Their focus on user-friendly interfaces and expanding service offerings directly addresses the needs of a broad customer base.

Telecommunications Subscribers (Consumer & Enterprise)

Globe Telecom's customer base is extensive, catering to both individual consumers and businesses. For consumers, this encompasses millions of prepaid and postpaid mobile users who rely on voice, data, and messaging services. On the enterprise side, Globe provides critical communication infrastructure and data solutions to a wide array of businesses, from small and medium enterprises to large corporations, ensuring their operational continuity and growth.

As of the first quarter of 2024, Globe reported a mobile subscriber base of over 100 million, demonstrating significant reach within the consumer market. Their enterprise segment also shows robust growth, with a substantial number of corporate accounts leveraging their broadband and specialized digital solutions. For instance, in 2023, Globe’s enterprise revenue grew by 11%, highlighting the increasing demand for advanced connectivity and digital services from businesses.

- Consumer Mobile Subscribers: Over 100 million individuals relying on prepaid and postpaid services.

- Enterprise Clients: A broad spectrum of businesses requiring robust communication and data solutions.

- Service Offerings: Voice, data, broadband, and specialized digital services tailored for both segments.

- Market Penetration: Demonstrates significant reach and a strong presence in both consumer and business telecommunications markets.

Healthcare & Education Seekers

Ayala's healthcare and education segments are designed for individuals and families prioritizing high-quality medical and learning experiences. This includes those actively seeking advanced hospital care, accessible clinics, and reliable pharmacy services. The focus is on dependable, specialized medical attention and comprehensive educational pathways.

In 2024, the demand for enhanced healthcare accessibility and quality education continues to drive growth. For instance, AyalaLand Medical REIT, which includes hospitals like Cardinal Santos Medical Center and Asian Hospital, saw significant patient volumes, reflecting the segment's appeal. Similarly, AC Education, encompassing institutions like National Teachers College and University of Nueva Caceres, reported increased enrollment figures, indicating a strong preference for established educational providers.

- Quality Medical Services: Targeting individuals and families who value advanced treatments and patient-centric care from renowned institutions.

- Educational Advancement: Catering to students and parents seeking reputable academic programs and lifelong learning opportunities.

- Accessibility and Convenience: Providing a network of healthcare facilities and educational centers that are strategically located and easy to access.

- Specialized Care Needs: Addressing specific medical requirements and educational specializations that meet evolving market demands.

Ayala Land’s customer segments are diverse, ranging from individual homebuyers across various income brackets to corporate clients seeking commercial spaces. They also serve the broader Filipino population through their telecommunications and financial services arms, BPI and GCash, and cater to those prioritizing quality healthcare and education.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Residential Property Buyers | First-time homeowners to affluent buyers; diverse price points. | Continued strong demand in mid-market and premium segments (e.g., Nuvali, Arca South). |

| Corporate & Business Clients | SMEs to large corporations needing financial services and commercial real estate. | Office leasing a significant revenue driver; Globe's enterprise business saw substantial demand. |

| Individual Consumers (Financial Services) | Millions seeking convenient banking and digital payment solutions. | BPI: Over 10 million active customers (2023); GCash processed over PHP 3 trillion in transactions (2023). |

| Individual Consumers (Telecommunications) | Prepaid and postpaid mobile users relying on voice, data, and messaging. | Globe: Over 100 million mobile subscribers (Q1 2024); enterprise revenue grew 11% (2023). |

| Healthcare & Education Seekers | Individuals and families prioritizing quality medical and learning experiences. | Increased patient volumes in AyalaLand Medical REIT hospitals; rising enrollment in AC Education institutions. |

Cost Structure

Ayala Land's cost structure heavily relies on property development and construction. This includes the substantial expenses associated with acquiring land, preparing it for development, and the actual building of residential, commercial, and mixed-use projects. For instance, in 2023, the company reported capital expenditures of PHP 118.7 billion, a significant portion of which directly funds these development activities.

Ayala Corporation's cost structure is significantly shaped by operating expenses across its varied portfolio. In 2024, these include substantial personnel costs, administrative overhead, and marketing investments for its banking arm, BPI, its telecommunications giant, Globe, and its energy ventures like ACEN.

Beyond these established sectors, newer growth areas such as integrated property development and healthcare also contribute to operational outlays. For instance, Globe's ongoing network upgrades and BPI's digital transformation initiatives represent considerable expenditures aimed at future revenue generation.

Capital expenditures are a significant cost for Ayala Corporation, especially in areas like network expansion for Globe Telecom and new developments by Ayala Land. For instance, Globe Telecom's capital expenditures in 2023 reached PHP 63.5 billion, primarily for network upgrades and 5G expansion.

ACEN, Ayala's renewable energy arm, also incurs substantial capital costs for its solar and wind farm projects. In 2023, ACEN invested PHP 19.1 billion in new renewable energy capacity, reflecting the ongoing push towards sustainable energy infrastructure.

These large upfront investments in infrastructure and expansion are fundamental to maintaining and growing market share and ensuring long-term competitive positioning across Ayala's diverse business segments.

Financing & Interest Expenses

Ayala Corporation's cost structure is significantly impacted by financing and interest expenses, particularly due to its substantial debt used for funding major projects and acquisitions. In 2023, Ayala Corporation reported consolidated interest expenses of PHP 28.6 billion, reflecting the cost of servicing its various debt instruments. Effective management of this debt is crucial for maintaining profitability and financial health.

- Debt Servicing Costs: Interest payments on loans and bonds are a direct outflow, impacting net income.

- Financing Strategy: The company's approach to raising capital, whether through debt or equity, directly influences these expenses.

- Interest Rate Sensitivity: Fluctuations in interest rates can increase or decrease the cost of borrowing.

- 2023 Performance: Ayala’s consolidated net income for 2023 was PHP 30.5 billion, with financing costs being a key deduction.

Technology & Digital Infrastructure Investment

Ayala's commitment to staying competitive necessitates significant and continuous investment in its technology and digital infrastructure. This includes substantial outlays for upgrading hardware, developing proprietary software, and maintaining robust digital platforms across its diverse business segments like banking and telecommunications. For instance, in 2023, Ayala Corporation reported capital expenditures of PHP 105.5 billion, a significant portion of which was allocated to digital transformation and infrastructure enhancements across its subsidiaries.

These investments are crucial for driving innovation and ensuring a superior customer experience in an increasingly digital-first market. By staying at the forefront of technological advancements, Ayala aims to streamline operations, offer cutting-edge digital services, and maintain a strong competitive edge. The company's strategic focus on digital services is reflected in its subsidiaries' performance, with Globe Telecom, for example, consistently investing billions in network expansion and modernization to meet growing data demands.

- Ongoing Technology Upgrades: Ayala consistently allocates capital to maintain and enhance its IT infrastructure, ensuring operational efficiency and security across all business units.

- Software Development & Licensing: Significant costs are incurred for developing in-house software solutions and licensing essential digital tools to support banking, telecommunications, and other digital services.

- Digital Platform Enhancement: Investments are made to improve user interfaces, expand functionalities, and ensure the scalability of digital platforms to cater to a growing customer base and evolving market needs.

- Cybersecurity Measures: A substantial portion of the technology budget is dedicated to robust cybersecurity protocols and systems to protect sensitive customer data and maintain trust in its digital offerings.

Ayala Corporation's cost structure is characterized by significant capital expenditures for infrastructure development and expansion across its diverse business segments. These investments are crucial for maintaining market leadership and long-term growth. For example, Ayala Land's substantial capital outlays for property development and Globe Telecom's network upgrades represent major cost drivers.

Operating expenses, including personnel, administration, and marketing, form another core component of Ayala's cost structure. These costs are spread across its banking, telecommunications, energy, and property businesses, supporting day-to-day operations and strategic initiatives like digital transformation.

Financing costs, particularly interest expenses on debt, are also a considerable factor, reflecting the capital-intensive nature of its operations and growth strategies. In 2023, Ayala Corporation reported consolidated interest expenses of PHP 28.6 billion.

Investments in technology and digital infrastructure are essential for competitiveness, driving innovation and enhancing customer experience across all subsidiaries. This includes substantial spending on hardware, software, and cybersecurity measures.

| Cost Category | 2023 Data (PHP Billion) | Key Drivers |

|---|---|---|

| Capital Expenditures (Total) | 105.5 | Property Development (Ayala Land), Network Upgrades (Globe), Renewable Energy Projects (ACEN) |

| Operating Expenses | N/A (Consolidated) | Personnel, Administration, Marketing across all segments |

| Financing Costs (Interest Expense) | 28.6 | Debt servicing for project funding and acquisitions |

| Technology & Digital Infrastructure | Significant portion of CapEx | Hardware, Software, Digital Platforms, Cybersecurity |

Revenue Streams

Ayala Land, a key subsidiary, generates significant revenue through the sale of residential properties, commercial lots, and office spaces. This is a core component of their business, directly translating property development into cash flow.

Beyond outright sales, Ayala also secures recurring income streams from leasing its extensive portfolio of shopping centers, office buildings, and hotels. This provides a stable and predictable revenue base, complementing their development-driven sales.

In 2023, Ayala Land reported a substantial increase in its net income, reaching PHP 37.4 billion, up 32% from the previous year, underscoring the strength of its sales and leasing operations.

The Bank of the Philippine Islands (BPI) derives substantial revenue from net interest income, which is the difference between the interest earned on its assets, like loans and investments, and the interest paid on its liabilities, such as deposits. In 2023, BPI reported a net interest income of PHP 118.8 billion, a notable increase from the previous year, reflecting a healthy lending portfolio and effective management of its funding costs.

Beyond interest income, BPI also generates significant revenue through financial service fees. These fees encompass a wide array of banking services, including transaction fees for digital and branch operations, wealth management services for high-net-worth individuals, and interchange fees from credit and debit card usage. In 2023, BPI's fee and commission income reached PHP 42.6 billion, demonstrating the success of its diversified fee-based offerings.

Globe Telecom's primary revenue streams stem from its telecommunications services, encompassing both mobile and broadband subscriptions. These core offerings are complemented by significant income from data services and specialized corporate data solutions, catering to a wide range of consumer and business needs.

A notable and increasingly important revenue contributor is Globe's fintech subsidiary, Mynt, which operates the popular GCash platform. Mynt generates revenue through a variety of channels, including transaction fees from its extensive user base and interest income from its lending services, demonstrating a successful diversification strategy.

In 2023, Globe reported a consolidated service revenue of PHP 157.4 billion, with mobile services accounting for a substantial portion. The company also highlighted the growing contribution of its digital solutions, including those from GCash, which processed over PHP 4 trillion in total transaction value in 2023, underscoring the financial sector's impact on overall revenue.

Energy Generation & Supply

ACEN Corporation, a key player in the energy sector, primarily generates revenue through the sale of electricity. This income stems from its expanding portfolio of renewable energy assets, including solar, wind, and geothermal power plants. The company benefits from both long-term power purchase agreements (PPAs) and revenues earned from participating in the spot electricity market, offering a diversified approach to revenue generation.

In 2024, ACEN's commitment to renewable energy continued to drive its financial performance. The company reported significant progress in its operational capacity, with a substantial portion of its revenue linked to the stable, contracted sales from its renewable energy projects. This strategy provides a predictable income stream, while participation in the spot market allows ACEN to capitalize on favorable market conditions.

- Contracted Sales: Revenue secured through long-term Power Purchase Agreements with various off-takers, providing stable and predictable cash flows.

- Spot Market Revenues: Income generated from selling electricity directly into the wholesale electricity market, influenced by real-time supply and demand dynamics.

- Renewable Energy Focus: Increasing contribution from solar, wind, and geothermal power generation, aligning with global sustainability trends and offering growth opportunities.

- Diversified Portfolio: Revenue streams are supported by a geographically and technologically diverse set of power generation assets.

Healthcare & Education Service Fees

Ayala's healthcare and education segments are increasingly contributing to its revenue mix. AC Health, its healthcare arm, generates income from a variety of sources, including hospital and clinic services, pharmaceutical sales through its Generika Drugstore chain, and other medical-related offerings.

In 2024, AC Health continued to expand its reach, with Generika Drugstores alone operating over 900 outlets across the Philippines, each contributing to the overall service fee revenue. This segment is crucial for capturing a growing demand for accessible healthcare solutions.

- Hospital and Clinic Services: Revenue from patient care, diagnostics, and specialized medical treatments.

- Pharmacy Sales: Income derived from the sale of prescription and over-the-counter medications, as well as health and wellness products.

- Education Tuition and Fees: Earnings from tuition, miscellaneous fees, and other services provided by Ayala's educational institutions.

Ayala's diverse business units contribute to a robust revenue model, anchored by property development and leasing from Ayala Land. BPI provides stability through net interest income and financial service fees, while Globe Telecom's revenue is driven by its telecommunications services and the burgeoning fintech sector via GCash.

ACEN Corporation generates income from electricity sales, primarily through contracted renewable energy projects and spot market participation. AC Health, in turn, earns from hospital services, pharmacy sales, and the education sector benefits from tuition and fees.

| Business Unit | Primary Revenue Streams | 2023/2024 Data Highlights |

|---|---|---|

| Ayala Land | Property Sales, Leasing | PHP 37.4 billion net income (2023) |

| BPI | Net Interest Income, Financial Service Fees | PHP 118.8 billion net interest income (2023); PHP 42.6 billion fee and commission income (2023) |

| Globe Telecom | Telco Services, Data Services, Fintech (GCash) | PHP 157.4 billion consolidated service revenue (2023); GCash processed over PHP 4 trillion in transaction value (2023) |

| ACEN Corporation | Electricity Sales (Contracted & Spot) | Growth in operational capacity and contracted sales (2024) |

| AC Health | Hospital/Clinic Services, Pharmacy Sales | Over 900 Generika Drugstore outlets (2024) |

Business Model Canvas Data Sources

The Ayala Business Model Canvas is informed by a blend of internal financial reports, extensive market research, and strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of the business's current state and future direction.