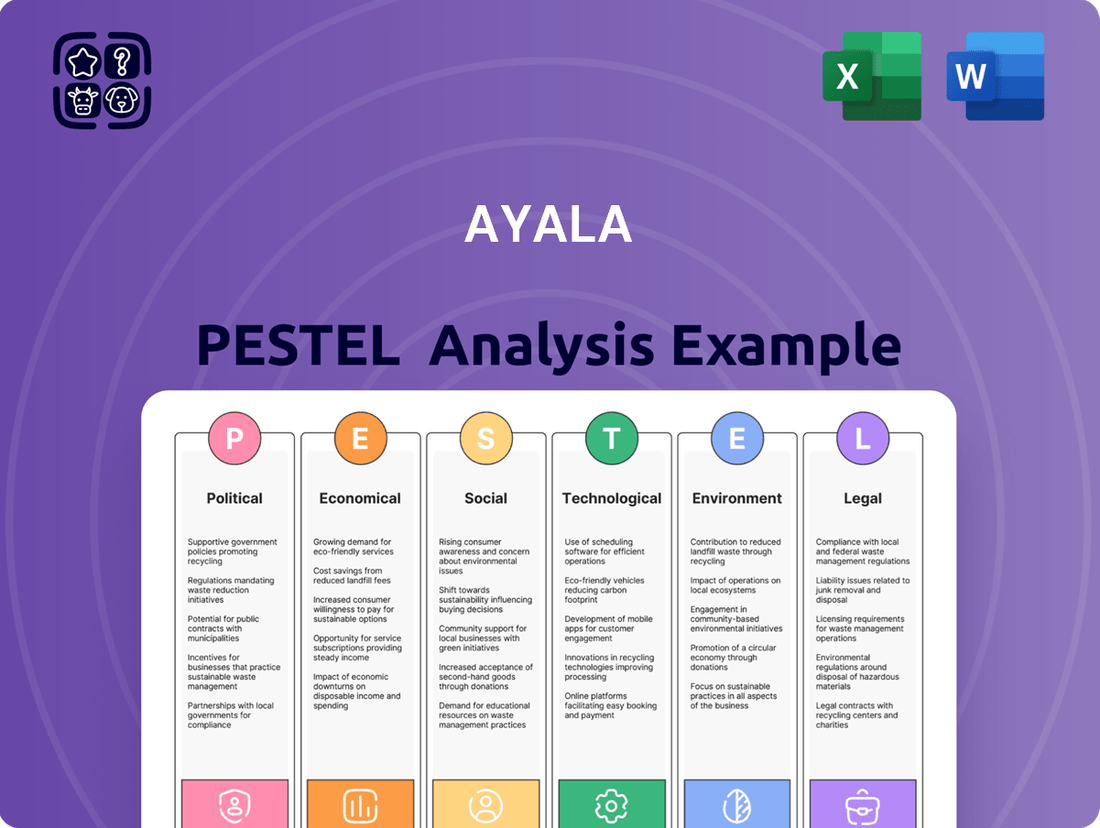

Ayala PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Ayala's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version to gain actionable intelligence and elevate your business planning.

Political factors

Ayala Corporation's operations in the Philippines are significantly influenced by government stability and policy consistency. The nation's economic momentum, evidenced by a projected 5.6% GDP growth in 2024 driven by public investments, underscores the importance of a predictable policy environment.

This stability is vital for Ayala's diverse portfolio, spanning real estate, telecommunications, and power sectors, where long-term planning and capital allocation depend on predictable regulatory frameworks.

Despite global geopolitical uncertainties, Ayala's constructive outlook for 2025 suggests a level of confidence in the Philippines' political landscape and its capacity to maintain policy continuity, which is essential for fostering continued economic development and supporting major corporate investments.

Ayala Corporation operates within a dynamic regulatory landscape in the Philippines, particularly affecting its core businesses in real estate, financial services, telecommunications, and power. These sector-specific rules are crucial for maintaining operational licenses and integrity.

The Philippine government's commitment to enhancing economic competitiveness is evident through ongoing reforms and incentives. For instance, the tax reform bill enacted in 2024 aims to boost foreign investment by lowering corporate income tax rates, a move that could positively impact Ayala's subsidiaries and their ability to attract capital.

Ayala's strategic direction is closely aligned with the Philippine government's focus on fostering resilient and inclusive economic expansion. This includes significant support for digital transformation, a key area given the Philippines was identified as the fastest-growing internet economy in Southeast Asia in 2024, with e-commerce sales projected to reach $20 billion by 2025.

Public-private partnerships are also crucial, as demonstrated by the memorandum of understanding between the Climate Change Commission and Ayala Group. This collaboration aims to accelerate the achievement of national climate goals, reflecting a growing emphasis on sustainability in government policy and corporate strategy.

Trade Policies and International Relations

Ayala Corporation, while deeply rooted in the Philippines, navigates a global landscape where trade policies and international relations significantly impact its operations and future growth. The company's extensive supply chains and burgeoning international ventures are directly susceptible to shifts in global trade agreements and geopolitical stability.

For 2025, Ayala's strategic planning actively incorporates the ongoing global geopolitical and macroeconomic uncertainties. These factors are crucial in shaping the company's outlook, influencing everything from raw material costs to market access.

Favorable international relations and robust trade agreements are vital for Ayala's strategic objectives. These conditions enable smoother global expansion, secure access to necessary materials, and facilitate the acquisition of advanced technologies, directly bolstering its competitive edge.

- Trade Policy Impact: Changes in tariffs or trade barriers, such as those potentially affecting electronics or construction materials, could alter sourcing costs for Ayala's diverse businesses.

- Geopolitical Risk: Regional conflicts or trade disputes, for instance, in Southeast Asia or between major economic blocs, pose risks to supply chain continuity and market demand for Ayala's products and services.

- International Expansion: Ayala's ability to pursue overseas investments, particularly in sectors like infrastructure and telecommunications, hinges on stable diplomatic ties and predictable trade environments.

- Global Sourcing: The availability and cost of advanced technologies and specialized components, critical for Ayala's innovation in areas like renewable energy and digital services, depend heavily on open international trade channels.

Anti-Corruption Efforts and Governance Emphasis

The Philippine government's heightened focus on anti-corruption measures and robust corporate governance significantly shapes the operational landscape for major conglomerates like Ayala. This emphasis fosters a more transparent and accountable business environment, crucial for sustainable growth.

Ayala Corporation's consistent inclusion in the FTSE4Good Index Series, a testament to its strong ESG performance, highlights its commitment to these principles. For instance, in 2024, the index continued to recognize Ayala for its comprehensive policies and practices related to anti-bribery and corruption, and its overall corporate governance framework.

Strong governance is not merely a compliance issue; it's a strategic imperative. It directly influences investor sentiment, with global funds increasingly prioritizing companies demonstrating high standards of ethical conduct and transparent operations. This can translate into lower cost of capital and enhanced access to funding, vital for Ayala's diverse business units.

The ongoing efforts to improve governance and combat corruption in the Philippines are expected to continue, creating a more predictable and favorable investment climate. Ayala's proactive approach in aligning with these national priorities positions it well to capitalize on these evolving conditions.

Ayala Corporation's strategic positioning is closely tied to the Philippine government's policy direction and regulatory environment. The nation's economic growth, projected at 5.6% for 2024, is supported by public investments, emphasizing the need for policy consistency to benefit Ayala's diverse business interests.

The government's commitment to economic competitiveness, including tax reforms enacted in 2024 to lower corporate income tax, aims to attract foreign investment and positively impact Ayala's subsidiaries. Furthermore, the strong government support for digital transformation, evidenced by the Philippines being the fastest-growing internet economy in Southeast Asia in 2024, aligns with Ayala's strategic focus on technology and connectivity.

Ayala's operations are also influenced by the government's focus on anti-corruption measures and robust corporate governance, which foster a more transparent business environment. Ayala's consistent recognition in ESG indices for its strong governance practices, including anti-bribery policies, demonstrates its alignment with these national priorities and enhances investor confidence.

What is included in the product

This Ayala PESTLE analysis provides a comprehensive examination of the macro-environmental factors influencing the conglomerate's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for Ayala.

The Ayala PESTLE Analysis offers a structured framework that simplifies complex external factors, acting as a pain point reliever by providing clarity and focus for strategic decision-making.

Economic factors

The Philippine economy is showing robust growth, with a GDP expansion of 5.6% in 2024, positioning it as the second-fastest growing in Southeast Asia. This performance is fueled by strong domestic consumption and ongoing government infrastructure spending, creating a positive backdrop for Ayala Corporation's various ventures.

Ayala Corporation's leadership maintains a positive outlook for 2025, expecting the nation's economic expansion to continue even amidst global economic uncertainties. This sustained growth trajectory is a key factor supporting the company's strategic planning and investment decisions.

Low and stable inflation, projected to average around 3.5% for 2024 and potentially moderating further in 2025, alongside sustained remittances, are anticipated to underpin consumption-driven growth in the Philippines. This environment is generally favorable for businesses like Ayala, as it supports consumer spending, a key economic driver.

Interest rate fluctuations directly affect Ayala's financial services segment, particularly Bank of the Philippine Islands (BPI). For instance, a monetary policy easing cycle, such as potential rate cuts by the Bangko Sentral ng Pilipinas (BSP) in late 2024 or early 2025, could boost BPI's loan origination and improve its net interest margins, positively impacting profitability.

Ayala's diverse portfolio is significantly bolstered by a growing and increasingly affluent consumer base. The middle class, now representing a substantial 40% of the population, is a key driver of consumption. This is further supported by a healthy economic environment, evidenced by a projected 7% growth in GNI per capita for 2024.

Consumer spending demonstrated strong momentum, rising by 4.8% in 2024, and forecasts indicate this trend is set to continue. This robust consumer demand directly translates into positive outcomes for Ayala's core businesses, particularly in real estate development, telecommunications services, and retail operations, as consumers have more disposable income to spend.

Foreign Exchange Rates and Remittances

Remittances from Overseas Filipino Workers (OFWs) remain a significant pillar of the Philippine economy, bolstering consumer spending power. In 2023, these remittances reached a record high of $33.5 billion, providing a stable economic base for many households and influencing demand for goods and services, which indirectly benefits Ayala's diverse portfolio.

However, volatility in foreign exchange rates presents a challenge for Ayala Corporation. For instance, a weakening Philippine Peso against the US Dollar can increase the cost of foreign-denominated debt for subsidiaries like Globe Telecom, impacting their financing expenses. Similarly, ACEN Corporation, with its international projects, may face foreign exchange losses on its earnings when translated back into local currency.

The strengthening of the US Dollar, a trend observed in the broader global economic landscape, can also trigger capital outflows from emerging markets, including the Philippines. This can affect investment sentiment and potentially impact the cost of capital for Ayala and its businesses.

- Remittance Growth: OFW remittances hit $33.5 billion in 2023, a testament to their economic importance.

- Forex Impact on Globe: Higher financing costs due to a weaker Peso can affect Globe's profitability.

- ACEN's Forex Exposure: ACEN's international operations are susceptible to forex losses impacting reported earnings.

- Capital Flow Sensitivity: A strong USD can lead to capital flight from emerging markets, potentially affecting investment in the Philippines.

Investment Climate and Capital Availability

Ayala Corporation is making a substantial investment, earmarking P230 billion for capital expenditures in 2025. This significant allocation underscores their strategic focus on growth within key sectors such as renewable energy, real estate, and digital services, signaling a robust outlook for future expansion.

The company benefits from a strong financial position, characterized by ample liquidity and diverse access to capital. This includes funding from domestic and international banking institutions, multilateral organizations, and robust engagement with capital markets, ensuring a stable foundation for its ambitious projects.

Furthermore, the broader investment climate is being positively influenced by government initiatives. Strategic reforms and fiscal incentives, such as the tax reform bill passed in 2024, are designed to enhance the attractiveness of the Philippines for foreign direct investment, thereby improving overall capital availability.

- Capital Expenditure: Ayala Corp. plans P230 billion in CAPEX for 2025.

- Sector Focus: Investments are directed towards renewable energy, real estate, and digital services.

- Financial Strength: The company boasts strong liquidity and broad capital access.

- Government Support: Reforms and tax incentives, like the 2024 tax bill, aim to boost foreign investment.

The Philippine economy is set for continued growth, with GDP expected to expand by 5.6% in 2024, making it a leading economy in Southeast Asia. This expansion is largely driven by robust domestic consumption and ongoing government infrastructure projects, creating a favorable environment for Ayala Corporation's diverse business interests.

Ayala Corporation anticipates sustained economic growth in 2025, even with global economic uncertainties. This positive outlook is supported by factors like low and stable inflation, projected to be around 3.5% for 2024, and strong OFW remittances, which bolster consumer spending. These economic conditions are beneficial for Ayala's various sectors, including real estate, telecommunications, and retail.

Monetary policy, particularly interest rates, significantly impacts Ayala's financial services arm, BPI. Potential interest rate cuts by the Bangko Sentral ng Pilipinas in late 2024 or early 2025 could boost BPI's lending activities and profitability. Furthermore, a growing middle class, now representing 40% of the population, fuels consumer spending, which is crucial for Ayala's businesses.

| Economic Indicator | 2024 Projection/Data | 2025 Outlook | Impact on Ayala |

|---|---|---|---|

| GDP Growth | 5.6% | Positive outlook | Supports overall business growth |

| Inflation Rate | ~3.5% | Moderating | Supports consumer spending |

| OFW Remittances | $33.5 billion (2023) | Continued strength | Boosts consumer demand |

| Interest Rates | Potential easing | Potential easing | Benefits BPI's lending and margins |

Preview Before You Purchase

Ayala PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ayala PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the conglomerate.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed breakdown of the external forces shaping Ayala's strategic landscape, offering actionable insights for business planning.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is meticulously researched and presented, ensuring you receive a valuable and ready-to-apply strategic tool.

Sociological factors

The Philippines is experiencing significant demographic shifts, with a burgeoning and increasingly affluent consumer base. The middle class now constitutes approximately 40% of the population, presenting a robust market for Ayala's diverse range of products and services, from telecommunications to consumer goods.

Continued urbanization is a powerful driver for Ayala's real estate development arm, Ayala Land. As more Filipinos move to cities, the demand for housing, commercial spaces, and integrated communities, all core to Ayala Land's strategy, continues to grow, reaching an estimated 65% urban population by 2025.

These evolving demographic trends directly inform Ayala Corporation's strategic expansion plans. The company is well-positioned to leverage the increasing purchasing power and changing lifestyle preferences of a growing, urbanized population across its various business segments.

Ayala Corporation's diverse portfolio is strategically positioned to adapt to shifting consumer desires and evolving lifestyles. The company's ability to offer a wide range of products and services across sectors like real estate, telecommunications, banking, and infrastructure allows it to meet these changing demands effectively.

The Philippines' digital landscape is transforming rapidly, with e-commerce and digital payments experiencing significant growth. As Southeast Asia's fastest-growing internet economy in 2024, this digital shift directly benefits Ayala's telecommunications arm, Globe, and its fintech subsidiary, Mynt, which operates GCash, by driving increased adoption and usage of their digital services.

Ayala's diverse business segments, including real estate, construction, financial services, and healthcare, depend heavily on a readily available and skilled workforce. The Philippines' labor market, with its significant youth demographic, offers a large pool of potential employees, though the demand for specialized skills in sectors like technology and advanced manufacturing continues to grow.

The company's focus on a 'People-First Culture' and inclusivity is a strategic response to evolving workforce expectations and a key component of its sustainability efforts. This approach aims to attract and retain talent, which is critical as Ayala expands its reach, for instance, with AC Health's ongoing initiatives to broaden healthcare access across the nation.

Income Distribution and Social Equity

Ayala Corporation's commitment to social equity is evident in its efforts to address income disparities in the Philippines. By providing access to crucial services such as healthcare and education, the company aims to uplift communities and foster broader economic participation. This focus on bridging structural divides is central to Ayala's mission of enabling people to thrive.

The company's diverse portfolio, ranging from high-end property developments to affordable digital solutions, demonstrates its engagement with a wide spectrum of income levels. This broad reach allows Ayala to impact various societal segments, contributing to a more inclusive economic landscape. For instance, in 2024, Ayala Land continued its expansion in affordable housing segments, aiming to reach more low-to-middle income families.

Ayala's strategic investments in sectors vital to everyday life underscore its role in promoting social equity. By improving access to these services, the company not only drives business growth but also contributes to the overall well-being and upward mobility of Filipinos. This approach aligns with national development goals focused on reducing poverty and enhancing quality of life.

- Bridging Gaps Ayala actively works to reduce economic disparities through its business operations.

- Service Accessibility Expansion of healthcare and education services aims to benefit a wider population.

- Diverse Market Reach Engagement across premium and accessible market segments highlights societal inclusivity.

- Socio-Economic Impact Investments are strategically made to foster upward mobility and improve living standards.

Health and Education Trends

Ayala Corporation's strategic focus on health and education directly addresses evolving societal needs and demographic shifts. The company's significant investments in these sectors, particularly through AC Health, underscore a commitment to improving access to quality services.

AC Health is actively expanding its footprint, aiming to become a USD2-billion healthcare enterprise by 2035. This ambitious target involves substantial growth in its retail pharmacy network, clinic services, and hospital operations, reflecting a response to increasing demand for comprehensive healthcare solutions.

- AC Health's Net Loss Narrowed: The company has demonstrated progress in its financial performance, narrowing its net loss, indicating improved operational efficiency and market traction.

- USD2 Billion Enterprise Target by 2035: This aggressive growth objective highlights Ayala's long-term vision for its healthcare arm, signaling significant capital allocation and strategic development.

- Expansion in Retail Pharmacies, Clinics, and Hospitals: The planned expansion across these key healthcare verticals demonstrates a multi-faceted approach to capturing market share and serving diverse patient needs.

- Response to Growing Demand for Quality Services: These investments are a direct reaction to the increasing consumer expectation and societal imperative for accessible and high-quality healthcare and educational offerings.

Ayala's commitment to social equity is evident in its efforts to bridge economic disparities by providing access to essential services like healthcare and education, fostering broader economic participation. The company's diverse portfolio, from high-end properties to accessible digital solutions, engages various income levels, contributing to a more inclusive economy. In 2024, Ayala Land continued its expansion in affordable housing, targeting more low-to-middle income families to enhance upward mobility and living standards.

| Sociological Factor | Ayala's Response/Strategy | Key Data/Initiative (2024/2025 Focus) |

|---|---|---|

| Demographic Shifts & Urbanization | Leveraging a growing, affluent, and urbanizing population for diverse product and service offerings. | Middle class ~40% of population; Urban population projected at 65% by 2025. |

| Evolving Consumer Lifestyles | Adapting product and service portfolios to meet changing consumer desires and preferences. | Expansion across real estate, telco, banking, and infrastructure to cater to diverse needs. |

| Digital Adoption | Benefiting from rapid growth in e-commerce and digital payments. | Globe and GCash (Mynt) are key beneficiaries of Southeast Asia's fastest-growing internet economy in 2024. |

| Workforce Dynamics | Utilizing a large youth demographic while addressing demand for specialized skills. | Focus on 'People-First Culture' and inclusivity to attract and retain talent, supporting AC Health's expansion. |

| Social Equity and Inclusion | Addressing income disparities and promoting upward mobility through service access. | Ayala Land's affordable housing expansion; AC Health's goal to become a USD2 billion enterprise by 2035. |

Technological factors

The Philippines is experiencing a digital boom, recognized as Southeast Asia's fastest-growing internet economy in 2024. This surge is fueled by expanding e-commerce and digital payment sectors, creating a fertile ground for tech-driven businesses.

Ayala's strategic investments in digital infrastructure are paying off handsomely. Globe Telecom, its telecommunications unit, and Mynt, the operator of GCash, are key players in this digital wave. In 2024, Globe Telecom reported a significant increase in equity earnings, largely driven by its mobile data business and growing subscriber base, while GCash continued its impressive user growth, solidifying its position as a leading digital wallet.

This widespread digital transformation necessitates that all businesses, including Ayala's diverse portfolio, must embrace and integrate digital solutions to remain competitive and relevant. The pervasive shift impacts operational efficiency, customer engagement, and market reach across all industries.

Ayala Land, a major player in the Philippines' property sector, is actively integrating smart city technologies and sustainable building methods into its large-scale community developments. This technological adoption is crucial for boosting operational efficiency, cutting expenses, and elevating the overall customer journey in property development and management.

The company's strategic investment in digital transformation is a significant driver for resilient economic expansion, directly impacting the planning and construction of future communities. For instance, in 2023, Ayala Land reported a 33% increase in net income to PHP 36.3 billion, showcasing the financial benefits of its forward-looking strategies, which increasingly rely on technological advancements.

Ayala's banking arm, Bank of the Philippine Islands (BPI), is at the forefront of financial innovation, particularly through its stake in Mynt, the operator of GCash. This strategic engagement highlights a commitment to leveraging technology for broader financial inclusion and service delivery.

Mynt's significant growth trajectory, evidenced by an 86% surge in equity earnings for Q1 2025, underscores the increasing consumer reliance on digital financial platforms. This rapid adoption is a direct result of user base expansion and improved profitability within the fintech sector.

The burgeoning digital financial landscape necessitates ongoing investment in technological advancements and robust cybersecurity protocols. Ayala, through its fintech initiatives, must continuously adapt to evolving user needs and maintain the integrity of its digital services.

Automation and AI in Operations

The increasing integration of automation and artificial intelligence (AI) across industries offers significant potential for Ayala Corporation to boost efficiency and innovation within its diverse portfolio. Ayala's strategic appointment of Emmanuel P. Maceda to its Board of Directors, a move made in 2024, underscores a commitment to leveraging expertise in emerging technologies like AI, signaling a proactive approach to technological advancement.

These advancements are poised to streamline operations, from customer service in banking and telecommunications to logistics in infrastructure and real estate. For instance, AI-powered analytics can optimize resource allocation and predictive maintenance in infrastructure projects, while automation in customer interactions can enhance the user experience in Ayala Land's property management and Globe Telecom's digital services.

- Enhanced Efficiency: AI and automation can reduce manual labor, minimize errors, and speed up processes across Ayala's business units, potentially leading to cost savings.

- Improved Decision-Making: AI-driven data analysis provides deeper insights, enabling more informed strategic and operational decisions.

- New Service Offerings: Automation and AI can facilitate the development of innovative digital products and services, creating new revenue streams.

Renewable Energy Technology Advancements

Ayala's energy subsidiary, ACEN, is making significant strides in renewable energy, aiming for a substantial 20-gigawatt renewable capacity by 2030. This aggressive expansion is underpinned by rapid advancements in solar, wind, and battery storage technologies.

These technological leaps are not just beneficial for ACEN but are also critical for the Philippines to meet its own renewable energy targets. For instance, the cost of solar photovoltaic (PV) power has seen a dramatic decline, making it increasingly competitive with traditional energy sources.

ACEN's commitment to adopting these cutting-edge technologies is essential for its sustained growth and long-term viability. The company's strategy involves continuous investment in innovation to enhance efficiency and reliability across its renewable energy portfolio.

- ACEN's 2030 renewable capacity target: 20 gigawatts.

- Key technologies driving growth: Solar, wind, and battery storage.

- Impact of technological advancements: Reduced costs and increased competitiveness of renewables.

- Strategic importance: Vital for ACEN's growth and the Philippines' energy transition.

The Philippines' digital surge, with its internet economy growing fastest in Southeast Asia in 2024, directly benefits Ayala's tech investments like Globe Telecom and GCash. Globe's mobile data growth and GCash's user expansion in 2024 highlight this trend.

Ayala Land's integration of smart city tech and sustainable building methods, as seen in its 2023 net income rise of 33% to PHP 36.3 billion, demonstrates technology's impact on operational efficiency and customer experience.

Ayala's energy arm, ACEN, is leveraging advancements in solar, wind, and battery storage to achieve its 20 gigawatt renewable capacity target by 2030, a move crucial for both the company and the nation's energy transition.

The increasing adoption of AI and automation across Ayala's diverse portfolio, supported by strategic appointments in 2024, promises to boost efficiency, improve decision-making, and unlock new service offerings.

| Ayala Subsidiary | Key Technology Focus | 2024/2025 Data/Impact |

|---|---|---|

| Globe Telecom | Mobile Data Expansion | Significant increase in equity earnings driven by mobile data business. |

| Mynt (GCash) | Digital Payments & Fintech | 86% surge in equity earnings for Q1 2025; continued impressive user growth. |

| Ayala Land | Smart City & Sustainable Tech | 33% increase in net income to PHP 36.3 billion in 2023; enhanced operational efficiency. |

| ACEN | Renewable Energy Tech (Solar, Wind, Battery) | Aiming for 20 GW renewable capacity by 2030; reduced costs and increased competitiveness of renewables. |

Legal factors

Ayala Corporation navigates a complex web of laws and regulations across its diverse business units. In financial services, for example, the Bangko Sentral ng Pilipinas (BSP) sets stringent capital adequacy ratios and consumer protection rules, impacting how its banking arm, Bank of the Philippine Islands (BPI), operates.

Telecommunications, under the Department of Information and Communications Technology (DICT), faces regulations concerning spectrum allocation and data privacy, which are critical for Globe Telecom's service delivery.

The real estate sector, particularly for Ayala Land, is governed by land use planning laws and building codes, influencing development approvals and project timelines.

Compliance with these varied legal frameworks is not just a matter of avoiding penalties but is fundamental to maintaining operational licenses and fostering investor confidence, especially as the company seeks to expand its footprint in 2024 and beyond.

Ayala Corporation, as a major employer in the Philippines, must strictly comply with national labor laws and employment regulations. These cover critical areas such as minimum wage requirements, mandated working hours, occupational safety standards, and the provision of statutory employee benefits like social security and health insurance contributions.

The company's focus on a 'People-First Culture' is reinforced by its Human Rights Policy Statement, endorsed in 2025. This policy underscores Ayala's commitment to respecting and upholding human rights throughout its operations and its entire supply chain, ensuring fair treatment and safe working conditions for all employees.

Ayala Corporation operates under a stringent framework of environmental protection laws, particularly impacting its significant real estate development and power generation ventures. These regulations govern everything from land use and waste management to emissions control, necessitating careful planning and execution across its diverse business units.

The company's proactive stance on environmental stewardship is underscored by its ambitious goal of achieving net-zero greenhouse gas emissions by 2050. Ayala's ongoing efforts in greenhouse gas accounting and third-party validation, as detailed in its sustainability reports, showcase a commitment to transparently meeting and exceeding environmental benchmarks.

Compliance with these environmental mandates is not an afterthought but is deeply embedded within Ayala's core sustainability strategy and its comprehensive risk management framework. This integration ensures that environmental considerations are factored into every stage of project development and operational decision-making, mitigating potential legal and reputational risks.

Data Privacy and Cybersecurity Laws

Ayala Corporation's extensive operations in financial services and telecommunications necessitate strict adherence to data privacy and cybersecurity laws. The company manages a substantial volume of sensitive customer information, making compliance a critical operational imperative. For instance, the Data Privacy Act of 2012 (Republic Act No. 10173) in the Philippines mandates robust data protection measures.

The increasing reliance on digital platforms and e-commerce, particularly evident with the projected growth in the Philippine digital economy, amplifies the importance of cybersecurity. In 2023, the Bangko Sentral ng Pilipinas (BSP) continued to emphasize cybersecurity resilience for financial institutions, with cyber fraud incidents costing the Philippine banking sector billions of pesos annually. Ayala's commitment to safeguarding digital transactions and customer data is therefore paramount to maintaining trust and operational continuity.

- Data Privacy Act of 2012: Governs the processing of personal information in the Philippines, impacting how Ayala handles customer data.

- Cybersecurity Regulations: Mandates by bodies like the Bangko Sentral ng Pilipinas (BSP) to protect financial systems and data from cyber threats.

- E-commerce Growth: The rapid expansion of online transactions necessitates enhanced digital security protocols for companies like Ayala.

Corporate Governance Codes and Compliance

Ayala Corporation places significant emphasis on corporate governance, with its Board of Directors actively monitoring sustainability initiatives through a dedicated Sustainability Committee. This commitment is reflected in its consistent inclusion in the FTSE4Good Index Series, a recognition stemming from strong performance in crucial areas like corporate governance, health and safety, and anti-corruption measures. For example, in 2023, Ayala’s ESG score from FTSE Russell was 4.3 out of 5, demonstrating its robust framework.

Adherence to stringent governance codes is paramount for Ayala, fostering transparency, accountability, and upholding ethical business practices across its operations. This focus is crucial for investor confidence and long-term value creation. The company’s 2024 Integrated Report highlights a 98% compliance rate with the Philippine Corporate Governance Code.

Key aspects of Ayala's corporate governance include:

- Board Oversight: A dedicated Sustainability Committee ensures ESG factors are integrated into strategic decision-making.

- Index Recognition: Consistent inclusion in the FTSE4Good Index Series validates its commitment to good governance.

- Compliance Framework: Adherence to codes like the Philippine Corporate Governance Code ensures transparency and ethical conduct.

- Stakeholder Engagement: Robust governance facilitates trust and engagement with investors, employees, and the wider community.

Ayala Corporation's legal landscape is shaped by a robust regulatory environment, particularly concerning data privacy and cybersecurity. The Data Privacy Act of 2012 (Republic Act No. 10173) is a cornerstone, dictating how the company handles sensitive customer information across its diverse business units. This is amplified by the growing digital economy, where cybersecurity resilience is paramount, with the Bangko Sentral ng Pilipinas (BSP) continuing to emphasize strong protective measures for financial institutions. In 2023, cyber fraud incidents cost the Philippine banking sector billions of pesos annually, underscoring the critical need for Ayala to safeguard digital transactions and customer data to maintain trust and operational continuity.

Environmental factors

The Philippines, where Ayala operates extensively, faces significant threats from climate change and extreme weather. For instance, in 2023, the country experienced numerous typhoons and prolonged dry spells, impacting infrastructure and agricultural output, which can indirectly affect consumer spending and demand for Ayala's diverse services.

Ayala is actively addressing these risks by integrating climate considerations into its business strategy. The company regularly updates its risk register, as stated in its 2024 sustainability reports, to better anticipate and mitigate the financial and operational impacts of events like rising sea levels and increased storm intensity on its real estate developments and energy infrastructure.

Ayala Corporation is significantly prioritizing sustainability, embedding eco-conscious strategies throughout its diverse business units. This commitment is clearly demonstrated in its 2024 Integrated Report, which details the company's efforts to weave its core values into operations for positive economic, environmental, and social impact.

The company’s robust Environmental, Social, and Governance (ESG) framework has proven highly attractive to investors, evidenced by securing $6.2 billion in sustainable financing by the close of 2024.

The Philippines has committed to ambitious renewable energy goals, aiming for 35% of its power generation from renewables by 2030 and 50% by 2040. This national push creates a favorable environment for companies like Ayala's energy subsidiary, ACEN.

ACEN is actively contributing to these targets, with plans to expand its renewable energy capacity significantly. The company is targeting a substantial 20-gigawatt renewable capacity by the year 2030, demonstrating a direct alignment with the country's energy transition objectives and attracting considerable investment into green energy initiatives.

Resource Scarcity and Waste Management

Ayala Corporation actively monitors its environmental impact, with its 2024 Integrated Report detailing key performance indicators for emissions, energy, water, waste, and materials across its diverse business units. This focus underscores a commitment to sustainable resource management.

The company's strategic approach integrates efforts to reduce resource consumption and enhance waste management practices. These initiatives are fundamental to Ayala's broader climate action goals and its pursuit of operational efficiency.

These forward-thinking practices directly contribute to more sustainable operations and a demonstrably reduced environmental footprint, aligning with global sustainability trends and investor expectations for environmental stewardship.

Key environmental performance metrics tracked by Ayala include:

- Emissions: Monitoring and reduction targets for greenhouse gas (GHG) emissions.

- Energy Consumption: Efficiency improvements and a growing reliance on renewable energy sources.

- Water Usage: Strategies for conservation and responsible water management in its operations.

- Waste Management: Programs focused on waste reduction, recycling, and responsible disposal.

Biodiversity and Land Use Regulations

Ayala Land is making significant strides in environmental stewardship, particularly through its commitment to biodiversity and responsible land use. As of early 2025, the company is actively engaged in nurturing private forest carbon projects that span over 700 hectares. This initiative is a clear demonstration of their dedication to carbon sequestration and the preservation of natural ecosystems within their development areas.

These efforts directly address the growing importance of biodiversity conservation and sustainable land management practices in the real estate sector. By proactively investing in these projects, Ayala Land not only contributes to carbon removal but also reinforces its commitment to integrating ecological considerations into its core business operations. This approach is vital for maintaining its social license to operate and ensuring long-term resilience.

Adherence to evolving land use regulations and a proactive stance on environmental stewardship are paramount for Ayala Land’s continued success. These factors are increasingly becoming critical determinants of a company's sustainability profile and its ability to secure stakeholder trust. The company's engagement in over 700 hectares of forest carbon projects, as of early 2025, underscores this commitment.

- Biodiversity Focus: Ayala Land's 700+ hectare private forest carbon projects actively support biodiversity conservation.

- Land Use Responsibility: The company integrates responsible land use principles into its real estate developments.

- Sustainability Driver: Adherence to land use regulations and environmental stewardship are crucial for long-term sustainability.

- Social License: Proactive environmental engagement strengthens Ayala Land's social license to operate.

Ayala Corporation is deeply invested in environmental sustainability, as highlighted in its 2024 Integrated Report. The company is actively managing its environmental footprint through key performance indicators like emissions reduction and increased energy efficiency, aiming for a more sustainable operational model.

The Philippines' commitment to renewable energy, targeting 35% by 2030, directly benefits Ayala's energy arm, ACEN, which plans to reach 20 gigawatts of renewable capacity by 2030, aligning with national green energy goals.

Ayala Land's proactive environmental stewardship is evident in its over 700 hectares of private forest carbon projects as of early 2025, bolstering biodiversity and responsible land use, which are critical for its long-term sustainability and social license.

Ayala's ESG framework is attractive to investors, securing $6.2 billion in sustainable financing by the end of 2024, demonstrating a strong market recognition of its environmental commitments.

| Environmental Focus Area | Key Initiatives/Targets | Data Point (as of 2024/early 2025) |

|---|---|---|

| Renewable Energy | ACEN's renewable capacity expansion | Target: 20 GW by 2030 |

| Forest Carbon Projects | Ayala Land's biodiversity and carbon sequestration efforts | Area: Over 700 hectares |

| Sustainable Financing | Investor attractiveness of ESG framework | Secured: $6.2 billion by end of 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ayala is grounded in a comprehensive review of data from reputable sources including government reports, financial institutions, and respected industry publications. We meticulously gather information on political stability, economic indicators, technological advancements, social trends, environmental regulations, and legal frameworks.