Ayala Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

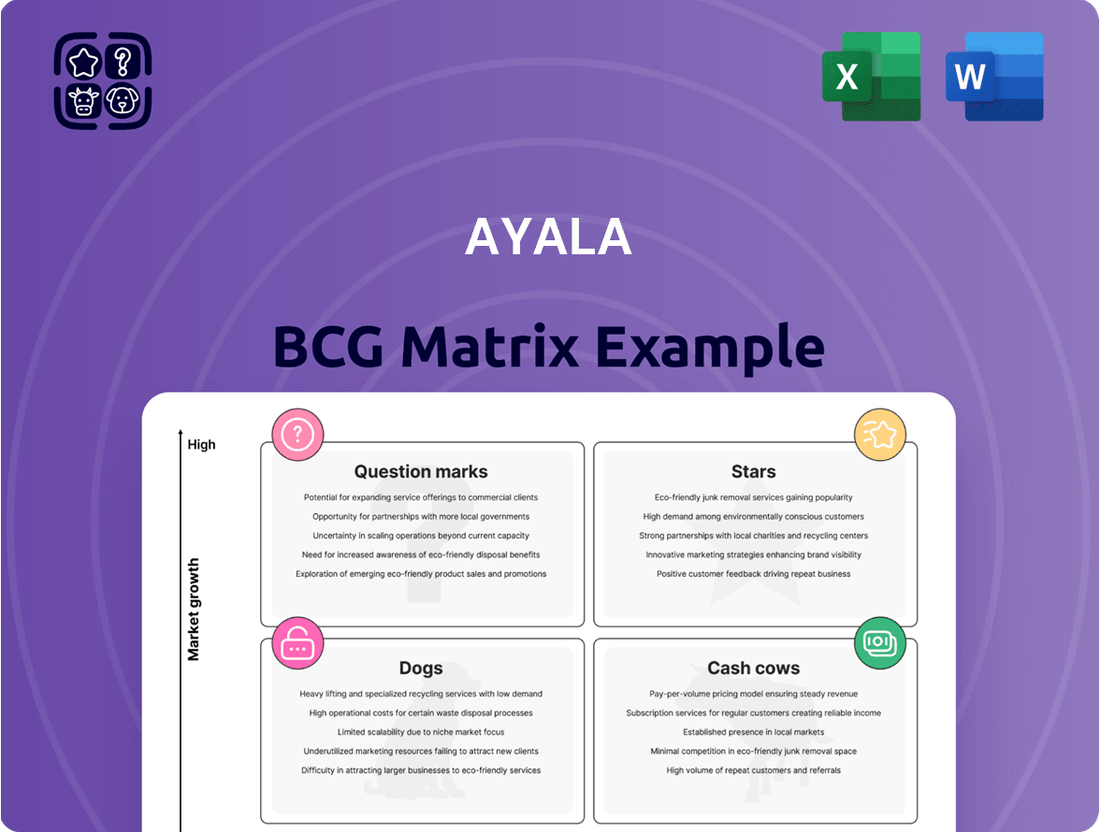

Uncover the strategic positioning of this company's product portfolio with our insightful preview of the BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and get a glimpse into their market share and growth potential. Purchase the full BCG Matrix for a comprehensive analysis, actionable insights, and a clear roadmap to optimize your investments and drive future success.

Stars

ACEN, Ayala Corporation's renewable energy subsidiary, is positioned as a strong contender in the BCG matrix. In 2024, ACEN saw its net income surge by 27%, reaching PHP 9.36 billion, fueled by a 25% increase in renewable energy generation. This expansion was bolstered by new capacity in both the Philippines and Australia, highlighting its growing market presence.

Ayala Land Inc. (ALI) is a prime example of a Star in the BCG Matrix. In 2024, ALI achieved record revenues of P180.7 billion, a significant 21% increase from the previous year, and its net income rose by 15% to P28.2 billion. This robust financial performance underscores its strong market position and growth trajectory.

The company's success is largely driven by its property development segment, with notable strength in residential sales and estate lot bookings. Furthermore, its leasing and hospitality businesses are contributing significantly to its overall financial health, demonstrating diversified revenue streams within a high-growth sector.

ALI's strategic vision is to consistently outperform the Philippine economy's growth over the next five years. This ambition is supported by a focused strategy on developing premium properties, further solidifying its Star status by capitalizing on current market demand and future opportunities.

Bank of the Philippine Islands (BPI) is a strong contender in the Philippine banking sector, likely positioned as a Star or Cash Cow in a BCG matrix. Its record-high net profit of P62 billion in 2024, a 20% year-on-year increase, underscores its robust market share and profitability. This growth was fueled by a significant 22.3% rise in net interest income and a 25.3% jump in non-interest income, demonstrating BPI's ability to capitalize on its strong market position and diverse revenue streams.

BPI's strategic focus on capital efficiency and digital innovation further solidifies its favorable market standing. The bank's digital initiatives are proving successful, attracting 1 million new customers in 2025, which indicates continued expansion and engagement in a growing market. This forward-looking approach suggests BPI is well-equipped to maintain its growth trajectory and market leadership.

Globe Telecom

Globe Telecom, a key player in the telecommunications sector, demonstrates strong performance within the BCG matrix framework. In 2024, the company reported record consolidated gross service revenues of P165 billion, marking a 2% year-over-year increase. This growth was largely fueled by its robust mobile and corporate data segments.

The company's strategic focus on expanding its subscriber base is evident. Globe added 3.9 million mobile subscribers in 2024, bringing its total to 60.9 million. This expansion highlights its market penetration and the increasing demand for its services.

Looking ahead, Globe is targeting positive free cash flow by 2025. The company anticipates acquiring approximately 11 million new mobile customers over the next five years. This ambitious growth plan is underpinned by continuous efforts to enhance network accessibility and improve the overall mobile customer experience.

- Record Revenue: Globe Telecom achieved P165 billion in consolidated gross service revenues in 2024, up 2% from the prior year.

- Subscriber Growth: The company expanded its mobile customer base by 3.9 million in 2024, reaching a total of 60.9 million subscribers.

- Future Outlook: Globe aims for positive free cash flow by 2025 and projects acquiring 11 million new mobile customers in the next five years.

Mynt (GCash)

Mynt, the company behind GCash, is a prime example of a star in the BCG matrix. Its valuation soared to $5 billion, more than doubling in 2024 thanks to significant investments from Ayala Corporation and Mitsubishi UFJ Financial Group. This rapid growth reflects its strong market position and the increasing demand for its services.

GCash's lending products have experienced remarkable expansion. In 2024, the number of unique borrowers doubled, and the volume of loans disbursed increased by a substantial 85%. These figures highlight GCash's success in penetrating the market and effectively meeting the financial needs of its users.

- Unicorn Status: Mynt's valuation reached $5 billion, a significant increase in 2024.

- Investment Growth: Ayala Corporation and Mitsubishi UFJ Financial Group's investments fueled this valuation surge.

- Lending Expansion: GCash's lending arm saw a doubling of unique borrowers and an 85% rise in disbursed loans in 2024.

- Market Impact: The platform is driving financial inclusion in the Philippines through its mobile-first approach.

Stars in the BCG matrix represent business units or products with high market share in a high-growth industry. These entities generate significant revenue but also require substantial investment to maintain their growth. Companies like ACEN, Ayala Land, BPI, Globe Telecom, and Mynt (GCash) exemplify Stars within Ayala Corporation's portfolio, demonstrating strong financial performance and market leadership.

ACEN's substantial net income growth of 27% in 2024, reaching PHP 9.36 billion, alongside a 25% increase in renewable energy generation, positions it as a Star. Ayala Land's record revenues of P180.7 billion and a 15% net income increase to P28.2 billion in 2024 further solidify its Star status. BPI's record net profit of P62 billion in 2024, a 20% rise, and Globe Telecom's P165 billion gross service revenues in 2024 showcase their strong market positions.

Mynt, the operator of GCash, achieved a valuation of $5 billion in 2024, doubling its worth, with its lending products seeing a doubling of unique borrowers and an 85% increase in disbursed loans. These companies are crucial for Ayala Corporation's future growth, requiring continued investment to capitalize on their high-growth market potential.

| Business Unit | 2024 Revenue (PHP billions) | 2024 Net Income (PHP billions) | Key Growth Driver | Market Position |

| ACEN | Not Specified | 9.36 (up 27%) | Renewable energy generation (up 25%) | High Growth, High Share |

| Ayala Land Inc. | 180.7 (up 21%) | 28.2 (up 15%) | Property development, sales, leasing | High Growth, High Share |

| BPI | Not Specified | 62 (up 20%) | Net interest income, non-interest income | High Growth, High Share |

| Globe Telecom | 165 (up 2%) | Not Specified | Mobile and corporate data | High Growth, High Share |

| Mynt (GCash) | Not Specified | Not Specified | Digital lending, fintech services | High Growth, High Share |

What is included in the product

The Ayala BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Ayala BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Ayala Land's mature leasing and hospitality assets, like its established shopping centers and office buildings, function as significant cash cows within its portfolio. These properties consistently generate substantial and stable cash flow, a testament to their strong market presence and demand. For instance, in 2023, Ayala Land reported a consolidated revenue of PHP 147.9 billion, with its leasing and hotel segments contributing significantly to this top line, underscoring their reliable income generation capabilities.

Because these assets are situated in mature markets, they typically demand lower promotional and placement investments compared to newer ventures. This allows Ayala Land to effectively 'milk' these established operations for consistent profits. The financial strength derived from these cash cows provides the company with the necessary capital to strategically reinvest into higher-growth areas of its business, fueling future expansion and innovation.

BPI's traditional banking operations, encompassing deposits, lending, and established fee-based services, are its undisputed cash cows. These core segments hold a substantial market share within the mature Philippine financial landscape, consistently delivering robust profits and strong cash flows. While growth in these areas may be moderate, BPI can further enhance efficiency and profitability through ongoing optimization.

Globe Telecom's legacy mobile and broadband services function as its cash cows within the Ayala BCG Matrix. These established offerings, catering to basic connectivity and data needs, boast high market penetration and consistent demand, ensuring a stable revenue stream for the company.

In 2024, Globe's mobile business continued to be a significant contributor, with its postpaid and prepaid segments demonstrating resilience. The company reported strong subscriber growth in its mobile services, underscoring the ongoing demand for its core offerings. This steady cash generation allows Globe to fund investments in new growth areas.

Similarly, Globe's broadband services have maintained a robust subscriber base, driven by increased reliance on home internet for work and entertainment. The company's focus on network reliability and customer retention in these mature segments solidifies their position as dependable cash generators, providing a solid foundation for future expansion.

Ayala Land's Commercial and Industrial Lots

Ayala Land's commercial and industrial lots function as a classic Cash Cow within the BCG framework. These sales, particularly in mature developments, offer substantial profit margins and maintain a steady demand, underpinning consistent revenue streams.

While not exhibiting explosive growth, this segment is a significant contributor to Ayala Land's overall property development income and robust cash flow generation. The increasing demand for land parcels outside the bustling Metro Manila area further solidifies this segment's ability to consistently produce cash.

- High-Margin Sales: The sale of commercial and industrial lots, especially in established Ayala Land estates, generates high profit margins due to premium locations and developed infrastructure.

- Consistent Demand: These properties cater to businesses seeking strategic locations, ensuring a reliable and ongoing demand that fuels steady sales volumes.

- Cash Flow Generation: The segment is a vital source of consistent cash flow for Ayala Land, supporting other ventures and overall financial stability.

- Geographic Diversification: Demand for these lots extends beyond Metro Manila, indicating a broadening market and sustained cash-generating potential across different regions.

ACEN's Operational Renewable Energy Plants

ACEN's established operational renewable energy plants, especially those with long-term power purchase agreements (PPAs), are its cash cows. These facilities generate consistent, predictable income, bolstering ACEN's financial stability.

While ACEN actively pursues growth and new projects, classifying it as a Star, its existing, fully operational renewable assets are the bedrock of its current profitability. These mature assets are key contributors to its bottom line.

- Stable Revenue Streams: ACEN's operational solar and wind farms, often backed by PPAs, provide a reliable income flow. For instance, in the first half of 2024, ACEN reported a significant increase in its attributable net income, largely driven by its operational assets.

- Profit Contribution: These cash cows generate substantial profits that fund ACEN's aggressive expansion into new markets and technologies, ensuring continued growth.

- Mature Market Performance: The performance of these plants in established renewable energy markets underscores their cash-generating capabilities, allowing ACEN to reinvest strategically.

Cash cows represent established, high-performing assets within a company's portfolio that generate consistent profits with minimal investment. For Ayala Land, these include mature shopping malls and office buildings, which consistently bring in stable cash flow. In 2023, Ayala Land's leasing and hotel segments were significant contributors to its PHP 147.9 billion revenue, highlighting their reliable income generation.

These mature assets require less capital for promotion and development, allowing for efficient profit extraction. The substantial cash generated from these cash cows is then strategically deployed to fuel growth in emerging business areas, supporting overall corporate expansion.

BPI's core banking services, such as deposits and lending, are its primary cash cows. These segments, holding a strong market share in the Philippines, reliably produce robust profits and cash flows, even with moderate growth. BPI continues to optimize these operations for enhanced efficiency and profitability.

Globe Telecom's legacy mobile and broadband services are its cash cows, benefiting from high market penetration and consistent demand. In 2024, Globe's mobile segment showed resilience, with subscriber growth contributing to steady revenue. These dependable cash generators enable Globe to invest in new growth ventures.

Ayala Land's commercial and industrial lots, particularly in mature developments, are significant cash cows. These sales yield high profit margins and benefit from steady demand, ensuring consistent revenue. The increasing demand for land outside Metro Manila further strengthens this segment's cash-generating potential.

| Company | Cash Cow Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Ayala Land | Mature Malls & Offices | Stable cash flow, low investment needs | Significant contributor to PHP 147.9B revenue (2023) |

| BPI | Traditional Banking | High market share, consistent profits | Reliable profit and cash flow generation |

| Globe Telecom | Legacy Mobile & Broadband | High penetration, consistent demand | Resilient revenue, funds new growth areas |

| Ayala Land | Commercial/Industrial Lots | High margins, steady demand | Consistent revenue, supports expansion |

| ACEN | Operational Renewable Plants | Long-term PPAs, predictable income | Significant net income increase (H1 2024) |

What You’re Viewing Is Included

Ayala BCG Matrix

The preview you are viewing is the exact, unwatermarked Ayala BCG Matrix document you will receive upon purchase. This comprehensive analysis tool is fully formatted and ready for immediate strategic application, offering clear insights into your business portfolio. You can confidently proceed with your purchase, knowing you're acquiring a professional-grade report designed for effective business planning and decision-making.

Dogs

AC Industrials, representing certain segments within Ayala Corporation's portfolio, likely falls into the 'Dogs' category of the BCG Matrix. This is evidenced by the fact that these non-core businesses, including AC Industrials, reported losses in 2024.

The electronics manufacturing arm, Integrated Micro-Electronics Inc. (IMI), is actively pursuing strategic initiatives. These include streamlining its global operations and divesting from assets like its Czech Republic unit by mid-2025, signaling a move away from segments with low market share and growth potential.

Ayala Corporation is actively pursuing a $1 billion divestment strategy, targeting the sale of roughly $350 to $400 million in smaller, non-core assets.

These divested assets, including Ayala's remaining stake in Manila Water Company and Light Rail Manila Corporation (LRMC), are likely categorized as 'dogs' within the BCG matrix. This classification stems from their potentially limited growth prospects or a strategic misalignment with Ayala's core business objectives.

The divestment aims to strengthen and refocus resources on Ayala's primary, high-growth business segments, thereby optimizing the company's overall portfolio.

Ayala Corporation's strategic review in 2024 identified several smaller businesses for rationalization, a move that aligns with the 'dog' quadrant of the BCG Matrix. These ventures likely exhibited low market share and low growth potential, contributing to the company's overall performance. The company's leadership indicated that 2025 could mark an inflection point for these smaller entities following extensive rationalization efforts undertaken in the preceding year.

Legacy or Outdated Technology Services within Globe

Within Globe's diverse service offerings, certain legacy or outdated technology services can be categorized as 'dogs' in the BCG matrix. These are services experiencing declining subscriber numbers and market relevance, likely due to being surpassed by more advanced solutions or intense competition. For instance, traditional fixed-line voice services, while still existing, have seen a significant drop in usage as mobile and internet-based communication gain prominence.

These 'dog' services typically generate minimal cash flow and offer little to no growth potential. Globe's strategic emphasis on expanding its data-centric products and digital services, such as its 5G network expansion and digital lifestyle apps, implicitly signals a gradual phasing out or reduction in investment for these older, less efficient offerings. This strategic shift aims to reallocate resources towards areas with higher growth and profitability.

- Declining Usage: Traditional landline services have seen a steady decline, with subscriber numbers falling as mobile penetration increases. In 2024, the Philippines' fixed-line teledensity remained relatively low compared to mobile, reflecting this trend.

- Low Market Share: While specific figures for individual legacy services are not always broken out, the overall market share for services like legacy fixed-line voice has been shrinking against newer communication methods.

- Minimal Cash Generation: The revenue generated from these outdated services is often insufficient to cover their operational costs, leading to low or negative cash flow contribution.

- Limited Growth Potential: With the advent of broadband, VoIP, and mobile data, there is virtually no room for growth in the subscriber base or revenue for these legacy services.

Certain Underperforming Retail or Niche Property Developments by Ayala Land

Within Ayala Land's extensive property holdings, certain retail or niche developments may be experiencing underperformance. These could be identified by factors such as declining foot traffic, prolonged vacancy periods, or sluggish sales velocity, particularly in markets facing increased competition or economic headwinds.

For instance, if a particular Ayala Land mall or specialized commercial space in a less-trafficked district shows consistently low occupancy rates, perhaps dipping below 80% by mid-2024, it would be categorized as a potential ‘dog’ in the BCG matrix. Such segments would warrant a strategic review to minimize further capital infusion and potentially explore divestment if their market share and growth prospects remain dim.

- Low Occupancy Rates: Developments with occupancy rates consistently below industry benchmarks, say below 85% in 2024, signal potential underperformance.

- Stagnant Sales Growth: Retail segments exhibiting minimal or negative year-on-year sales growth, potentially less than 2% in 2024, indicate market challenges.

- High Vacancy Periods: Properties experiencing extended periods of vacancy, with average lease terms significantly shorter than the portfolio average, point to demand issues.

- Declining Foot Traffic: A noticeable and sustained drop in customer visits, perhaps a 5% or more decrease in footfall compared to the previous year, highlights market disinterest.

Dogs in the BCG Matrix represent business units or products with low market share and low growth potential. These entities typically generate insufficient revenue to cover their costs and often require significant cash to maintain operations. Ayala Corporation's strategic rationalization efforts in 2024, which included identifying smaller businesses for divestment, directly aligns with managing 'dog' assets. For example, AC Industrials, reporting losses in 2024, and certain legacy services within Globe, exemplify this category. The company's divestment of non-core assets, totaling approximately $350 to $400 million in 2024-2025, aims to free up capital and focus on more promising ventures.

Question Marks

AC Health, Ayala's healthcare arm, is positioned as a question mark in the BCG matrix, representing a high-growth but cash-intensive venture. The company is aggressively expanding its network, with a goal to serve 24 million Filipinos by 2030 and reach 1,000 Generika Drugstore locations by 2025.

Despite a 10% revenue increase in 2024, AC Health is currently operating at a loss and requires significant capital infusion to fuel its ambitious expansion plans, including its hospital and clinic network and a new cancer center.

AC Mobility, Ayala Corporation's electric vehicle and dealership arm, represents a classic question mark in the BCG matrix. While Ayala plans substantial investments in EV charging infrastructure and dealership expansion, with a projected 125% increase in funding for 2025 over 2024, the segment is currently a cash drain with a nascent market share. This strategic focus on a high-growth, emerging market necessitates significant capital outlay to build scale and capture future market potential.

AC Logistics, an emerging venture for Ayala Corporation, is currently positioned as a question mark in the BCG matrix. The company reported losses in 2024, reflecting the significant investment required for market entry and expansion.

Ayala Corporation's collaboration with A.P. Møller Capital underscores a strategic intent to capture market share in what is perceived as a high-growth logistics sector. This partnership aims to bolster AC Logistics' local operations and accelerate its development.

As a relatively new business, AC Logistics is likely a cash consumer, investing heavily in infrastructure and operational scaling. This investment profile, coupled with the sector's growth potential, places it in the question mark category, indicating uncertain but potentially high future returns.

Ayala Education (iPeople)

Ayala Education's joint venture, iPeople, is strategically positioned within the education sector, emphasizing digital transformation and innovative learning methods. This focus aligns with the growing demand for accessible, high-quality education, particularly through collaborations such as those with DepEd and Khan Academy.

Given its commitment to expanding reach and market share, iPeople is likely in a growth phase, necessitating continued investment. The company's strategic use of AI and data analytics aims to navigate the evolving educational landscape effectively, seeking to enhance learning outcomes and operational efficiency.

- Digital Transformation Focus: iPeople is actively integrating digital tools and innovative learning approaches to modernize education delivery.

- Growth Phase: The company is in a stage of expansion, requiring significant investment to build market presence and secure a larger share.

- Strategic Partnerships: Collaborations with entities like DepEd and Khan Academy are key to broadening access and enhancing educational quality.

- AI and Data Utilization: iPeople plans to leverage artificial intelligence and data analytics to adapt to and lead in the dynamic education market.

New Digital Ventures and Fintech Innovations (beyond GCash)

Ayala Corporation is actively expanding its footprint in financial technology, exploring avenues beyond its highly successful GCash platform. These new digital ventures are positioned in rapidly expanding markets, aiming to tap into emerging consumer needs and business solutions.

While these innovative fintech initiatives are in their nascent stages, they represent a strategic move into high-potential sectors. For instance, the digital payments landscape in the Philippines, where GCash operates, saw a significant surge in transaction values, reaching billions of pesos in 2023, indicating the market's appetite for such services. New ventures in areas like digital lending, insurtech, or blockchain-based solutions are likely targeting similar growth trajectories.

These ventures, though currently holding a small market share, are poised for substantial growth. They require considerable investment in technology development, customer acquisition, and marketing to achieve widespread adoption. The inherent uncertainty of capturing significant market share in competitive digital spaces means these are classic ‘question mark’ plays in the BCG matrix, demanding careful resource allocation and strategic execution.

- Focus on emerging fintech segments: Ayala is likely investing in areas like digital lending, insurtech, and potentially blockchain applications.

- High-growth market potential: These new ventures are targeting rapidly expanding digital economies, mirroring the success seen in adjacent fintech sectors.

- Low current market share: Despite the market's growth, these new initiatives are in their early stages and have yet to establish a dominant presence.

- Significant investment required: Capturing market share in competitive digital spaces necessitates substantial capital for technology, marketing, and user acquisition.

Question marks in the Ayala BCG matrix represent business units with low market share in high-growth industries. These ventures require significant investment to develop and capture market potential, with uncertain outcomes. Ayala's strategic allocation of capital to these areas reflects a long-term vision for growth and diversification. The success of these question marks hinges on effective execution and market adoption.

| Business Unit | Industry Growth | Market Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| AC Health | High | Low | High | Question Mark |

| AC Mobility | High | Low | High | Question Mark |

| AC Logistics | High | Low | High | Question Mark |

| iPeople (Ayala Education) | High | Low | High | Question Mark |

| New Fintech Ventures | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.