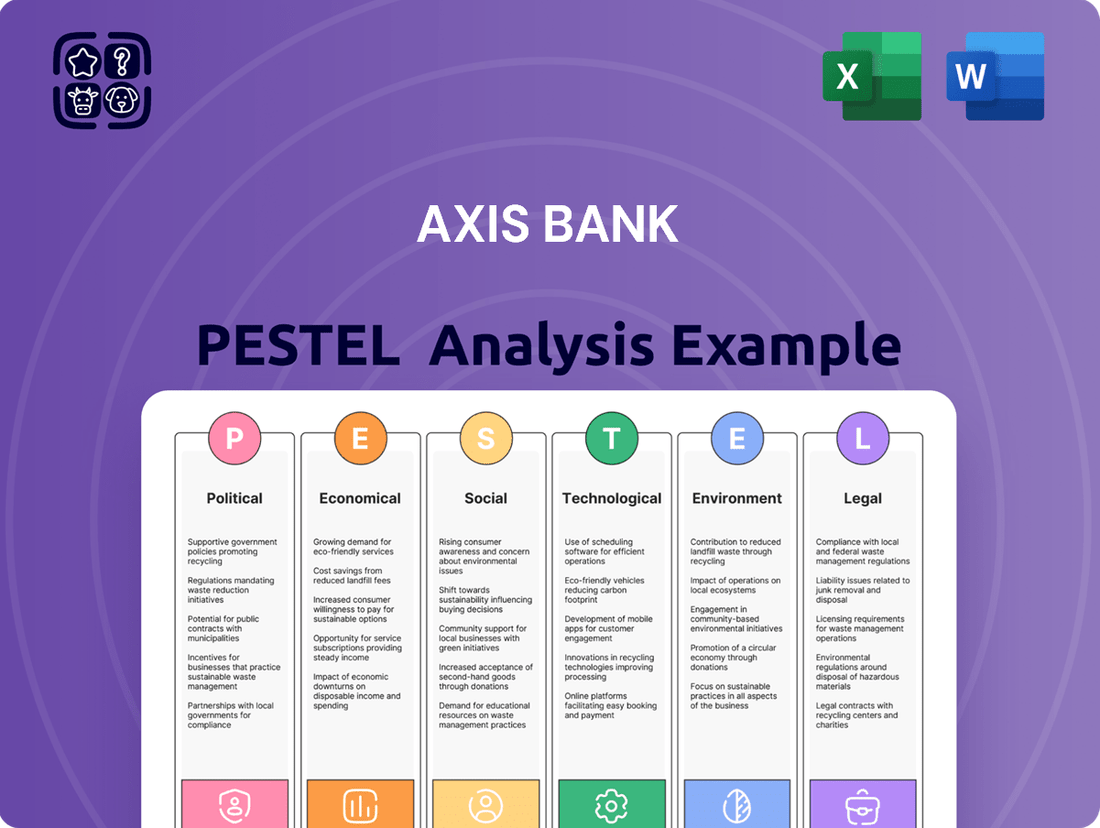

Axis Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Bank Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Axis Bank's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Download the full report to gain a strategic advantage and make informed decisions.

Political factors

Government policies, especially those from the Reserve Bank of India (RBI), significantly shape Axis Bank's operational landscape. For instance, the RBI's ongoing focus on financial sector stability, evident in its prudential norms, directly affects lending practices and risk management strategies.

Recent regulatory adjustments in 2024 have tightened guidelines on asset classification and loan recovery processes. This increased scrutiny on non-performing assets (NPAs) can impact the bank's profitability by requiring higher provisioning and potentially slowing down credit growth.

Political stability in India is a cornerstone for Axis Bank's operational environment, directly influencing investor sentiment and the broader economic trajectory. A predictable political climate encourages long-term investment, which is vital for a financial institution like Axis Bank that relies on capital inflows and sustained economic activity.

As of early 2024, India's political landscape is generally perceived as stable, characterized by a strong central government and consistent policy direction. This stability provides a favorable backdrop for the banking sector, enabling institutions like Axis Bank to plan and execute strategies with greater certainty, potentially leading to improved financial performance and market confidence.

Government initiatives, such as programs promoting digital payments and financial inclusion, significantly influence Axis Bank's services and customer base. For instance, in 2024, the Indian government allocated substantial funds for financial inclusion schemes, which can boost the bank's customer base and transaction volumes.

These initiatives, like the Pradhan Mantri Jan Dhan Yojana (PMJDY), aim to bring more unbanked individuals into the formal financial system, directly benefiting banks like Axis that actively participate. While these schemes can expand customer reach, they may also introduce increased compliance costs due to evolving regulatory frameworks.

International Relations

Axis Bank, like all financial institutions, is significantly influenced by international relations and geopolitical events. These factors can inject considerable market volatility, directly impacting capital flows into and out of India, which in turn affects the liquidity and operational environment for banks. For instance, heightened global tensions in late 2024 and early 2025 could lead to increased risk aversion among foreign investors, potentially reducing foreign direct investment and portfolio inflows into India, thereby creating headwinds for credit growth and profitability.

Shifts in global trade policies and the rise of protectionist measures by major economies present both risks and opportunities. For Axis Bank, this could mean altered trade finance volumes and potential impacts on the profitability of its international banking operations. Conversely, new trade agreements or strategic alliances could open up avenues for increased cross-border lending and investment banking activities, provided they are managed with a keen understanding of evolving global economic landscapes.

- Geopolitical Instability: Escalating conflicts or trade wars in key global regions can trigger capital flight from emerging markets like India, impacting Axis Bank's funding costs and asset quality.

- Trade Policy Changes: New tariffs or trade barriers imposed by major trading partners could affect Indian export-oriented businesses, indirectly influencing their borrowing capacity and the demand for banking services from Axis Bank.

- Global Economic Outlook: A slowdown in major economies, such as the US or Europe, projected for late 2024 and into 2025, could dampen demand for Indian exports and remittances, indirectly affecting Axis Bank's retail and corporate banking segments.

Banking Reforms and Guidelines

Ongoing banking reforms, including the anticipated Banking Laws (Amendment) Act of 2024 and 2025, are significantly influencing Axis Bank's operational landscape. These legislative changes are designed to bolster governance structures, streamline operational efficiencies, and elevate audit standards, ultimately aiming to safeguard depositor interests.

Axis Bank must proactively adapt its internal procedures and compliance protocols to align with these evolving regulatory frameworks. For instance, the proposed amendments could introduce stricter capital adequacy ratios or new reporting requirements, directly impacting the bank's risk management strategies and financial planning for the 2024-2025 period.

- Enhanced Governance: Reforms may mandate more independent board oversight and stricter executive accountability.

- Operational Efficiency Drive: New guidelines could encourage digital transformation and process automation.

- Improved Audit Quality: Stricter audit requirements will necessitate robust internal control systems.

- Depositor Protection: Amendments are likely to strengthen deposit insurance schemes and resolution mechanisms.

Government policies, particularly those from the Reserve Bank of India (RBI), significantly shape Axis Bank's operations. For example, the RBI's focus on financial sector stability, evident in its 2024 prudential norms, directly impacts lending practices and risk management. Tightened guidelines on asset classification in 2024 can affect profitability through higher provisioning.

Political stability in India, a key factor for Axis Bank, encourages long-term investment and economic activity. India's generally stable political climate as of early 2024 provides a favorable backdrop for banks, enabling strategic planning with greater certainty and potentially boosting market confidence.

Government initiatives promoting financial inclusion, such as the Pradhan Mantri Jan Dhan Yojana, significantly influence Axis Bank's customer base and transaction volumes. The Indian government's allocation of funds for such schemes in 2024 can expand reach, though it may also increase compliance costs due to evolving regulatory frameworks.

Geopolitical events and global trade policy shifts can inject market volatility, impacting capital flows into India and affecting Axis Bank's liquidity and international banking operations. A slowdown in major economies projected for late 2024 and into 2025 could dampen demand for Indian exports, indirectly affecting Axis Bank's retail and corporate segments.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Axis Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and strategic advantages for Axis Bank within its operating landscape.

A PESTLE analysis of Axis Bank offers a structured approach to understanding external factors, thereby relieving the pain point of navigating complex market dynamics by providing clear insights into political, economic, social, technological, environmental, and legal influences.

Economic factors

India's economic trajectory remains a cornerstone for Axis Bank's performance. Axis Bank's own research projects a robust GDP growth rate of 7% for FY26. This positive outlook is a key determinant for loan demand and the overall health of the bank's asset portfolio.

Such strong economic expansion typically translates into increased credit appetite across diverse sectors. Businesses look to expand, and individuals often seek financing for major purchases, directly benefiting banks like Axis Bank through higher loan volumes.

Inflation, a key concern for the Reserve Bank of India (RBI), directly influences Axis Bank's operational costs and the repayment capacity of its borrowers. For instance, India's retail inflation hovered around 5.1% in early 2024, impacting consumer spending and potentially increasing loan defaults.

The RBI's monetary policy decisions, particularly the repo rate, are crucial for Axis Bank. A repo rate of 6.5% as of early 2024 dictates the bank's borrowing and lending costs, directly affecting its net interest margins and profitability.

Axis Bank's asset quality, as reflected in its Non-Performing Assets (NPAs), is a critical economic factor. The bank's Gross NPA ratio stood at 1.58% for the fiscal year 2024, demonstrating a generally healthy asset base. This metric is crucial for understanding the bank's profitability and risk management effectiveness.

Looking ahead, the Gross NPA ratio was reported at 1.28% as of March 31, 2025. This continued improvement highlights Axis Bank's ongoing efforts to manage and reduce its NPAs, a challenge that is also a significant focus for the entire Indian banking sector.

Global Economic Uncertainty

Global economic uncertainty, driven by factors such as persistently elevated interest rates and significant currency volatility, presents a tangible challenge for international trade, investment flows, and capital accessibility into economies like India. For instance, the US Federal Reserve's benchmark interest rate remained at a high 5.25%-5.50% through early 2024, impacting global borrowing costs and investment decisions.

While India's economic growth is predominantly fueled by robust domestic demand, these external economic headwinds can still introduce considerable risks. These risks can manifest as slower export growth, reduced foreign direct investment inflows, and increased costs of capital, ultimately influencing the financial performance of companies like Axis Bank. The Indian Rupee's exchange rate against major currencies, such as the US Dollar, experienced fluctuations, with the USD/INR trading in the 83-84 range during much of 2024, affecting import costs and the repatriation of profits for foreign investors.

- Elevated Interest Rates: Global central banks maintaining higher interest rates increase borrowing costs for businesses and consumers, potentially dampening investment and consumption.

- Currency Volatility: Fluctuations in exchange rates impact the cost of imports and exports, as well as the value of foreign investments.

- Trade Disruptions: Geopolitical tensions and economic slowdowns in major economies can disrupt global supply chains and reduce demand for Indian exports.

- Capital Flow Sensitivity: Emerging markets like India are susceptible to shifts in global investor sentiment, leading to volatile capital flows in response to global economic uncertainties.

Credit Growth and Financial Stability

The Indian banking sector's improving financial stability provides a fertile ground for credit growth. This is underscored by healthy Capital Adequacy Ratios (CAR) across the industry, with the overall CAR for Scheduled Commercial Banks (SCBs) standing at 15.8% as of March 2024, according to Reserve Bank of India (RBI) data. Furthermore, the Gross Non-Performing Asset (GNPA) ratio for SCBs declined to a multi-year low of 3.2% by the end of March 2024, signaling a more robust credit environment.

Axis Bank is well-positioned to capitalize on this trend. The bank's strategic emphasis on profitable and sustainable growth, coupled with its robust capital position, allows it to expand its credit offerings. As of March 31, 2024, Axis Bank reported a CAR of 16.11%, comfortably above regulatory requirements, enabling it to pursue future lending opportunities effectively.

- Healthy CAR: Indian SCBs maintained a CAR of 15.8% in March 2024.

- Declining NPAs: GNPA ratio for SCBs fell to 3.2% by March 2024.

- Axis Bank's Strength: Axis Bank's CAR was 16.11% as of March 31, 2024.

- Growth Focus: The bank's strategy supports seizing opportunities in a stable financial landscape.

India's economic growth, projected at 7% for FY26 by Axis Bank's own forecasts, is a significant driver for its business. This expansion fuels demand for credit across various sectors, benefiting the bank's loan portfolio and overall profitability. However, inflation, which stood around 5.1% in early 2024, impacts consumer spending and borrowing capacity, while the RBI's repo rate of 6.5% (early 2024) directly influences Axis Bank's lending costs and net interest margins.

Axis Bank's asset quality is a key economic indicator, with its Gross NPA ratio improving to 1.28% by March 31, 2025, down from 1.58% in FY24. This reflects a strengthening credit environment, further supported by the banking sector's overall healthy Capital Adequacy Ratio (CAR) of 15.8% as of March 2024 and a declining GNPA ratio of 3.2% by March 2024. Axis Bank's own CAR of 16.11% as of March 31, 2024, positions it well to leverage these positive trends.

| Economic Factor | Metric/Data Point | Period/Date | Implication for Axis Bank |

|---|---|---|---|

| GDP Growth Projection | 7% | FY26 | Drives loan demand and asset growth. |

| Retail Inflation | ~5.1% | Early 2024 | Affects consumer spending and loan repayment capacity. |

| Repo Rate | 6.5% | Early 2024 | Determines borrowing and lending costs, impacting margins. |

| Axis Bank Gross NPA Ratio | 1.28% | March 31, 2025 | Indicates improving asset quality and risk management. |

| Scheduled Commercial Banks GNPA Ratio | 3.2% | March 2024 | Signifies a healthier overall credit environment. |

| Axis Bank Capital Adequacy Ratio (CAR) | 16.11% | March 31, 2024 | Ensures robust capital position for growth. |

Full Version Awaits

Axis Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Axis Bank PESTLE Analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain actionable insights into the strategic landscape for Axis Bank.

Sociological factors

India's demographic shifts are a key factor for Axis Bank. The nation's median age, projected to be around 28 years in 2024, indicates a large young population entering the workforce and seeking financial services. This youthful demographic, combined with a burgeoning middle class, is expected to drive demand for retail banking products, loans, and investment solutions.

The growing middle class, characterized by increasing disposable income, directly impacts consumer banking. As more individuals gain financial independence, their needs evolve from basic savings to more sophisticated products like wealth management, insurance, and credit facilities. This trend presents a significant opportunity for Axis Bank to expand its customer base and product offerings.

The rapid digital adoption in India, with projections indicating 700 million digital banking users by 2025, fundamentally reshapes consumer behavior. This surge means a substantial majority of banking transactions are now online, compelling Axis Bank to prioritize and enhance its digital platforms to meet evolving customer expectations.

Lifestyle shifts, driven by this digital integration, demand seamless and convenient banking experiences. Axis Bank must therefore continuously innovate its digital offerings, from mobile banking apps to online account management, to remain competitive and cater to a digitally-native customer base.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) are crucial for expanding financial inclusion, aiming to bring banking services to every household. As of early 2024, PMJDY accounts have surpassed 500 million, demonstrating significant progress in reaching previously unbanked populations.

Axis Bank is strategically aligning with these national goals by expanding its physical presence in rural areas and leveraging digital channels to reach underserved segments. The bank's commitment to increasing its rural branch network and offering tailored financial products is key to tapping into these growing markets and broadening its customer base.

Urbanization and Rural Penetration

India's rapid urbanization, with a significant portion of its population now residing in cities, presents a growing customer base for Axis Bank in these metropolitan hubs. This trend fuels demand for a wider array of banking products and services, from mortgages to wealth management.

Concurrently, Axis Bank is actively pursuing a strategy of rural penetration, recognizing the vast, often unbanked, population in India's villages. This focus aims to bring essential financial services to these underserved communities, fostering financial inclusion and tapping into new markets.

By 2024, it's estimated that over 40% of India's population will be living in urban areas, a figure projected to climb. Axis Bank's efforts to reach this demographic, alongside its commitment to rural expansion, are crucial for its continued growth and market share.

- Urban Growth: Increasing urban migration drives demand for Axis Bank's retail and digital banking solutions.

- Rural Reach: Strategic initiatives target financial inclusion for the 65% of India's population still residing in rural areas as of recent estimates.

- Digital Adoption: Mobile banking and fintech solutions are key enablers for serving both urban and rural customers efficiently.

- Inclusive Banking: Axis Bank aims to bridge the financial divide by offering accessible and tailored products to diverse demographic segments.

Consumer Expectations and Behavior

Modern consumers, particularly millennials and Gen Z, increasingly demand seamless, digital-first banking solutions. Axis Bank is responding to this by enhancing its mobile banking app and online platforms, aiming for intuitive and quick transactions.

Customer expectations for personalized services and instant query resolution are also on the rise. Axis Bank's focus on AI-powered chatbots and personalized financial advice aims to address these evolving needs, a trend seen across the Indian banking sector.

- Digital Adoption: Over 70% of Axis Bank's transactions were conducted digitally in FY23, highlighting the shift in consumer behavior.

- Mobile Banking Growth: The bank reported a significant increase in mobile banking users, with over 20 million active users by the end of 2023.

- Personalization Demand: Customer surveys indicate a strong preference for tailored product offerings and proactive financial guidance.

India's evolving social fabric significantly influences Axis Bank's strategy. The nation's young demographic, with a median age around 28 in 2024, represents a vast pool of potential customers eager for financial services. This demographic trend, coupled with a growing middle class, fuels demand for retail banking, loans, and investment products, creating substantial opportunities for Axis Bank.

Digital adoption is reshaping consumer behavior, with projections of 700 million digital banking users by 2025. This necessitates Axis Bank's continuous enhancement of its digital platforms to meet the demand for seamless, convenient, and personalized banking experiences, a trend mirrored across the Indian financial sector.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), which has surpassed 500 million accounts by early 2024, underscore the drive for financial inclusion. Axis Bank's strategic expansion into rural areas and its focus on digital channels are crucial for reaching underserved populations and aligning with these national objectives.

| Sociological Factor | Description | Impact on Axis Bank | Data Point (2024/2025) |

|---|---|---|---|

| Demographics | Young population, growing middle class | Increased demand for retail banking, loans, and investments | Median age ~28 years; ~700 million digital banking users by 2025 |

| Digitalization & Lifestyle | Rapid digital adoption, demand for convenience | Focus on enhancing mobile banking and digital platforms | Over 70% of Axis Bank's transactions were digital in FY23 |

| Financial Inclusion | Government push for banking access | Expansion into rural areas and focus on underserved segments | PMJDY accounts > 500 million (early 2024) |

Technological factors

Axis Bank is at the forefront of India's banking sector's digital revolution, with substantial investments fueling its technological advancements. The bank is actively integrating platforms like Unified Payments Interface (UPI), which saw over 12 billion transactions in Q1 2024 alone, to enhance customer experience and operational efficiency.

Further embracing innovation, Axis Bank is exploring the potential of the Digital Rupee, a central bank digital currency, aiming to streamline payment systems and unlock new avenues for financial services. This focus on digital expansion is crucial for maintaining competitiveness in a rapidly evolving financial landscape.

Axis Bank is significantly increasing its investment in AI and machine learning, aiming to revolutionize customer interactions and streamline internal operations. This strategic push is designed to create more personalized banking experiences and boost efficiency across the board.

The bank is leveraging AI for advanced credit decisioning, which is crucial for managing risk and expanding its customer base, particularly among those new to credit. This technology allows for more accurate assessments, potentially leading to better loan performance.

By the end of fiscal year 2024, Axis Bank reported a substantial increase in digital transactions, with AI playing a key role in managing the backend infrastructure and personalizing customer offerings. For instance, their AI-powered chatbots handled millions of customer queries, freeing up human agents for more complex issues.

The increasing reliance on digital platforms for banking operations exposes Axis Bank to a growing landscape of cybersecurity threats and online fraud. In 2023, India reported a significant rise in cybercrimes, with financial institutions being prime targets. Axis Bank must therefore invest heavily in advanced security protocols.

To safeguard customer information and maintain its reputation, Axis Bank is implementing sophisticated measures. This includes deploying AI-driven systems capable of real-time behavior tracking to detect and prevent fraudulent activities. The bank's commitment to robust cybersecurity is crucial for building and retaining customer trust in the digital age.

Blockchain Technology and Cross-Border Payments

Axis Bank is actively integrating blockchain technology to streamline its operations, particularly focusing on cross-border payments. This strategic move aims to boost both efficiency and security for its clientele.

A notable development is Axis Bank's pioneering effort to offer 24/7 programmable USD clearing capabilities for its commercial clients. This innovation is set to significantly improve the certainty and speed of payment execution in international transactions.

- Blockchain Adoption: Axis Bank's commitment to blockchain enhances operational efficiency and security.

- 24/7 USD Clearing: A groundbreaking initiative providing continuous programmable USD clearing for commercial clients.

- Cross-Border Impact: This technology is poised to revolutionize cross-border payment execution certainty.

API Infrastructure and Fintech Collaborations

Axis Bank is actively enhancing its API infrastructure, recognizing its crucial role in fostering collaborations with fintech companies. This strategic move allows for seamless integration of diverse banking services into third-party applications, thereby spurring innovation and extending the bank's market presence.

By opening up its services through APIs, Axis Bank is positioning itself to tap into the agility and specialized offerings of fintech startups. This approach is vital for staying competitive in the rapidly evolving digital financial landscape, where partnerships are key to delivering enhanced customer experiences.

- API Integration: Axis Bank's focus on robust API infrastructure supports partnerships, enabling services like payments, account management, and loan processing to be embedded in non-banking platforms.

- Fintech Ecosystem: The bank aims to leverage the fintech ecosystem to co-create new products and services, potentially reaching a wider customer base through these collaborations.

- Digital Transformation: This technological focus is a cornerstone of Axis Bank's digital transformation strategy, driving efficiency and creating new revenue streams.

- Market Reach: By facilitating fintech collaborations, Axis Bank expands its service delivery channels beyond its traditional branches and digital platforms.

Axis Bank's technological advancements are central to its strategy, with significant investments in AI and machine learning aimed at enhancing customer experience and operational efficiency. The bank is actively exploring the Digital Rupee and integrating platforms like UPI, which processed over 12 billion transactions in Q1 2024, to streamline payment systems.

The bank's commitment to cybersecurity is paramount, with substantial investment in AI-driven systems to detect and prevent fraud, especially given the rise in cybercrimes in India. Furthermore, Axis Bank is leveraging blockchain for cross-border payments and has introduced 24/7 programmable USD clearing, improving international transaction speed and certainty.

Axis Bank's enhanced API infrastructure facilitates crucial partnerships with fintech companies, allowing for seamless integration of banking services into third-party applications. This strategy is key to co-creating new products and expanding market reach in the dynamic digital financial landscape.

| Key Technology Initiatives | Description | Impact/Benefit | Data Point (2024/2025) |

| AI & Machine Learning | Customer interaction enhancement, operational streamlining, advanced credit decisioning | Personalized banking, improved risk management | AI-powered chatbots handled millions of customer queries in FY24 |

| Digital Payments (UPI) | Integration for enhanced customer experience and efficiency | Increased transaction volume and speed | Over 12 billion UPI transactions in Q1 2024 |

| Blockchain | Streamlining cross-border payments | Increased efficiency and security | Piloting for enhanced international transaction processes |

| API Infrastructure | Fostering fintech collaborations | Extended market presence, co-creation of services | Enabling seamless integration of payments and account management |

Legal factors

Axis Bank operates under the watchful eye of the Reserve Bank of India (RBI), a situation that brings both structure and potential challenges. This regulatory environment demands strict adherence to rules governing everything from how customer accounts are managed to ensuring robust cybersecurity measures are in place. In recent times, banks like Axis have faced penalties for lapses in areas like Know Your Customer (KYC) norms, highlighting the RBI's increasing focus on accountability.

The RBI's stance is clearly moving towards holding financial institutions more directly responsible for their internal operations and compliance. This means Axis Bank, and indeed all banks in India, must invest heavily in strong internal controls and compliance systems to avoid penalties. For instance, the RBI has been proactive in issuing guidelines and conducting audits to ensure banks are meeting standards, which can impact operational efficiency and profitability if not managed proactively.

The Banking Laws (Amendment) Act, 2025, ushers in significant changes aimed at bolstering governance and improving audit standards within India's banking industry, directly affecting institutions like Axis Bank.

This legislation refines the definition of substantial interest and modifies director tenure rules specifically for cooperative banks, creating new compliance considerations for Axis Bank's operational framework.

These amendments are designed to enhance depositor protection and overall financial sector stability, influencing Axis Bank's risk management strategies and corporate governance practices.

Axis Bank, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations designed to combat financial crimes. These rules are paramount for maintaining the integrity of the financial system and preventing illicit activities.

Failure to adhere to these mandates can result in severe consequences. For instance, the Reserve Bank of India (RBI) has historically imposed substantial penalties on banks for AML/KYC lapses. In 2023 alone, the RBI levied fines totaling over ₹200 crore on various banks for compliance failures, underscoring the financial and reputational risks involved.

Data Privacy and Protection Laws

Axis Bank faces a complex legal landscape, particularly concerning data privacy. The increasing digitization of banking services means robust protection of customer information is paramount. Failure to comply with evolving regulations like India's Digital Personal Data Protection Act, 2023, can lead to significant penalties and reputational damage.

To navigate this, Axis Bank is investing in RegTech (Regulatory Technology) solutions. These technologies are vital for real-time monitoring of transactions and customer data, ensuring continuous adherence to legal frameworks. This proactive approach helps mitigate risks associated with data breaches and non-compliance.

- Data Privacy Compliance: Adherence to the Digital Personal Data Protection Act, 2023, is critical for safeguarding customer data.

- RegTech Investment: Significant allocation towards RegTech solutions enables real-time risk monitoring and compliance.

- Customer Trust: Robust data protection measures are essential for maintaining customer confidence in the digital banking environment.

Credit and Lending Norms

The Reserve Bank of India (RBI) plays a pivotal role in shaping credit and lending norms, impacting institutions like Axis Bank. Recent directives, such as those concerning the management of non-performing assets (NPAs) and the allocation of funds towards priority sector lending, necessitate continuous adaptation by banks. For instance, the RBI's asset quality review and revised NPA recognition norms, implemented in recent years, have pushed banks to strengthen their risk assessment and provisioning. Axis Bank, like its peers, must remain agile in adjusting its lending strategies and risk management frameworks to ensure ongoing compliance with these dynamic regulatory landscapes.

These evolving regulations directly influence Axis Bank's operational strategies and profitability. Adherence to priority sector lending targets, which often include segments like agriculture and small businesses, can impact the bank's overall loan portfolio composition and yield. The RBI's focus on financial stability also means that credit growth is often managed through regulatory levers, affecting the pace and nature of lending activities. As of the fiscal year ending March 2024, Axis Bank reported a Gross NPA ratio of 1.58%, demonstrating its ongoing efforts to manage asset quality within the prevailing regulatory environment.

- RBI's evolving guidelines on NPA recognition and resolution directly influence Axis Bank's asset quality management.

- Priority sector lending targets, a key RBI mandate, shape Axis Bank's loan portfolio and risk appetite.

- Axis Bank's Gross NPA ratio stood at 1.58% for FY24, reflecting its compliance with credit norms.

The Banking Laws (Amendment) Act, 2025, introduces crucial changes affecting Axis Bank's governance and audit standards. These amendments refine definitions related to substantial interest and modify director tenure rules, particularly for cooperative banks, necessitating adjustments in Axis Bank's operational framework and compliance. The legislation aims to bolster depositor protection and overall financial sector stability, directly influencing Axis Bank's risk management and corporate governance practices.

Environmental factors

Axis Bank is actively embedding Environmental, Social, and Governance (ESG) principles into its core business strategy, reflecting a growing demand from both customers and investors for sustainable financial practices. This commitment is evident in the bank's increased financing for sectors that align with environmental and social goals, directly contributing to India's broader climate action plans.

In 2023, Axis Bank announced its commitment to mobilising USD 25 billion for green and sustainable financing by 2030, underscoring its dedication to supporting India's transition to a low-carbon economy. This strategic focus not only addresses environmental concerns but also positions the bank to capitalize on the expanding market for sustainable investments.

Axis Bank's Climate Transition Action Plan is a key environmental strategy, focusing on growing its loan portfolio for sectors with positive environmental impact. This includes a significant push towards renewable energy projects and sustainable infrastructure development.

The bank is actively reducing its exposure to carbon-intensive industries, aligning with India's broader goals for a low-carbon economy. This strategic shift supports the nation's commitment to achieving its Sustainable Development Goals and mitigating climate change risks.

Strengthening climate risk assessment is another crucial element, enabling Axis Bank to better understand and manage the financial implications of climate change. This proactive approach is vital for long-term financial stability and responsible banking practices.

Axis Bank is actively channeling funds into renewable energy projects, a key component of its Environmental, Social, and Governance (ESG) strategy. This focus aligns with the global push for a sustainable economy, with the bank supporting initiatives that boost water and energy efficiency. For instance, in the fiscal year 2023-24, Axis Bank reported significant growth in its green financing portfolio, contributing to the development of crucial sustainable infrastructure.

Waste Management and Water Conservation

Axis Bank actively promotes water conservation and waste management, acknowledging India's intensifying urbanization challenges. These environmental initiatives are crucial for sustainable growth and resource preservation.

The bank's commitment is evident through strategic partnerships and dedicated funding for projects focused on these vital areas. For instance, initiatives in 2024 and early 2025 have targeted improving water efficiency in urban infrastructure and implementing advanced waste segregation and recycling programs.

- Water Scarcity Impact: India faces significant water stress, with projections indicating that over 60% of its districts could be critically dependent on groundwater by 2030, underscoring the urgency of conservation efforts.

- Urban Waste Generation: Major Indian cities generate an estimated 62 million tonnes of municipal solid waste annually, with a substantial portion remaining unmanaged, highlighting the need for robust waste management solutions.

- Green Financing Growth: In FY23, Axis Bank's green deposits saw a notable increase, reflecting growing investor interest in environmentally conscious banking products that support sustainable projects.

- Partnership Focus: Collaborations with NGOs and government bodies are central to Axis Bank's strategy, channeling funds into community-based water harvesting systems and waste-to-energy projects.

Corporate Social Responsibility (CSR) Initiatives

Axis Bank's commitment to Corporate Social Responsibility (CSR) prominently features environmental sustainability. The bank actively conducts nationwide cleanliness drives and awareness programs, fostering environmental consciousness among both its employees and the wider community. These initiatives directly support broader global environmental protection objectives.

In fiscal year 2023-24, Axis Bank reported significant CSR expenditure, with a substantial portion directed towards environmental and sustainability projects. For instance, their tree plantation drives saw over 100,000 saplings planted across various regions, contributing to carbon sequestration and biodiversity enhancement. Furthermore, their water conservation efforts in drought-prone areas benefited more than 50,000 individuals through improved water access and management systems.

- Environmental Focus: Nationwide cleanliness drives and awareness programs are central to Axis Bank's CSR strategy, promoting ecological responsibility.

- Community Impact: Initiatives aim to instill environmental consciousness, directly benefiting local communities and fostering a sense of shared responsibility.

- Employee Engagement: Programs actively involve employees, encouraging participation in environmental stewardship and aligning individual actions with corporate goals.

- Alignment with Goals: These efforts are designed to contribute to the bank's broader sustainability agenda and support global environmental protection targets.

Axis Bank is actively integrating environmental, social, and governance (ESG) principles, committing USD 25 billion to green and sustainable financing by 2030. This strategy focuses on growing its loan portfolio for sectors with positive environmental impact, such as renewable energy, and reducing exposure to carbon-intensive industries. The bank also emphasizes strengthening climate risk assessment to ensure long-term financial stability and responsible banking.

PESTLE Analysis Data Sources

Our Axis Bank PESTLE Analysis draws from a comprehensive blend of official Reserve Bank of India (RBI) reports, government policy documents, and reputable financial news outlets. We also incorporate data from international financial institutions and economic research firms to ensure a well-rounded perspective.