Axis Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Bank Bundle

Axis Bank navigates a dynamic banking landscape, facing intense rivalry from established players and nimble fintechs. Understanding the bargaining power of its customers and the looming threat of new entrants is crucial for its sustained success.

The complete report reveals the real forces shaping Axis Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Axis Bank's access to capital and funding sources is a critical factor influencing supplier bargaining power. The bank primarily sources funds through retail deposits, wholesale deposits, and interbank borrowings.

While individual retail depositors have minimal bargaining power due to the fragmented nature of the deposit base, larger institutional depositors or interbank lenders may exert more influence. However, Axis Bank's diversified funding strategy, which includes a vast network of branches and digital channels for retail deposits, generally mitigates the concentrated bargaining power of any single funding source.

In 2024, Indian banks, including Axis Bank, continued to benefit from a generally stable deposit growth environment, although competition for deposits intensified. For instance, the Reserve Bank of India's repo rate, a key benchmark for lending and deposit rates, remained a significant factor influencing the cost of funds for all banks throughout the year.

Technology providers are increasingly vital for Axis Bank, especially in areas like core banking, cybersecurity, and digital platforms. Their influence hinges on how unique and essential their services are, how easily Axis Bank can switch to another provider, and the degree of tailored solutions needed. For instance, specialized AI-driven fraud detection systems might offer significant leverage to their creators.

The availability of specialized talent in crucial areas like digital banking, data analytics, and risk management significantly impacts Axis Bank's operational efficiency and innovation. A scarcity of these highly skilled professionals can empower them, leading to increased bargaining power and potentially higher salary expectations and recruitment expenses for the bank.

Axis Bank's strategic investments in employee empowerment and continuous training programs are designed to foster loyalty and retain its valuable workforce, mitigating the risks associated with talent shortages and their associated cost implications.

Regulatory Bodies (RBI)

While not a traditional supplier, the Reserve Bank of India (RBI) wields considerable influence over Axis Bank, acting as a critical 'supplier' of operating licenses, regulatory frameworks, and monetary policy directives. The RBI's stringent oversight, including potential adjustments to capital adequacy norms and liquidity requirements, directly shapes Axis Bank's operational capacity and risk appetite.

The RBI's power is evident in its ability to impose penalties or mandate specific actions, impacting profitability and strategic flexibility. For instance, increased risk weights on certain lending categories or a heightened focus on compliance can necessitate higher capital allocation and more rigorous internal controls, thereby increasing operational costs for Axis Bank.

The RBI's monetary policy decisions, such as changes in the repo rate or cash reserve ratio, directly influence Axis Bank's cost of funds and lending margins. These policy shifts, often implemented to manage inflation or economic growth, demonstrate the RBI's significant bargaining power, as Axis Bank must adapt its business model accordingly.

- RBI as a Regulator: The RBI dictates licensing, operational guidelines, and capital requirements for all banks in India, including Axis Bank.

- Monetary Policy Influence: Changes in repo rates and other monetary tools directly affect Axis Bank's interest income and borrowing costs.

- Compliance Burden: Stringent compliance requirements and potential penalties for non-adherence represent a significant cost and risk factor for Axis Bank.

- Risk Weight Adjustments: The RBI's ability to alter risk weights on different asset classes can impact Axis Bank's capital adequacy ratios and lending strategies.

Payment Network Providers

Payment network providers, including card networks like Visa and Mastercard, and the Unified Payments Interface (UPI) infrastructure, are critical for Axis Bank's transaction processing capabilities. Their bargaining power is significant due to the essential and widespread nature of their services in facilitating digital payments.

The widespread adoption of these networks means Axis Bank relies heavily on them to conduct a vast number of transactions. For instance, in FY23, UPI processed over 83 billion transactions, highlighting its indispensability. This reliance gives these providers leverage in negotiations over fees and terms.

However, the landscape is evolving. India's strong push for interoperability and the development of indigenous payment systems are gradually working to reduce the bargaining power of these external providers. As domestic alternatives gain traction and regulatory frameworks evolve, Axis Bank may find more flexibility in its dealings with payment network providers.

- Critical Infrastructure: Card networks and UPI are fundamental to Axis Bank's digital transaction ecosystem.

- High Transaction Volume: UPI alone facilitated over 83 billion transactions in FY23, underscoring the scale of reliance.

- Evolving Power Dynamics: India's focus on interoperability and domestic solutions aims to mitigate the bargaining power of established payment networks.

Axis Bank's suppliers, particularly technology providers and talent, hold moderate bargaining power. While specialized tech services are crucial, the bank's diversified approach and ongoing investments in in-house capabilities help manage this. The Reserve Bank of India (RBI) as a regulator and monetary authority exerts significant influence, shaping operational costs and strategies.

In 2024, the competitive landscape for digital banking solutions intensified, potentially offering Axis Bank more options and thus reducing supplier leverage. For instance, the increasing availability of cloud-based banking solutions and fintech partnerships provided alternative avenues for technological advancement.

Talent acquisition and retention remained a key focus. With a growing demand for skilled professionals in areas like AI and cybersecurity, suppliers of specialized talent could command higher compensation, impacting Axis Bank's recruitment expenses. The bank's proactive strategies in employee development aim to counter this.

| Supplier Category | Bargaining Power Level | Key Factors Influencing Power | 2024 Context/Data |

|---|---|---|---|

| Technology Providers | Moderate | Uniqueness of service, switching costs, customization needs | Increased availability of cloud solutions, rise of specialized fintechs |

| Talent (Skilled Professionals) | Moderate to High | Scarcity of specialized skills (AI, Data Analytics), demand in the sector | High demand for digital banking talent, leading to competitive salaries |

| Funding Sources (Large Institutions) | Low to Moderate | Concentration of deposits, interbank lending market conditions | Stable deposit growth, but increased competition for wholesale funding |

| RBI (Regulator/Monetary Authority) | High | Regulatory mandates, monetary policy tools, penalty powers | Continued focus on prudential norms and digital banking oversight |

What is included in the product

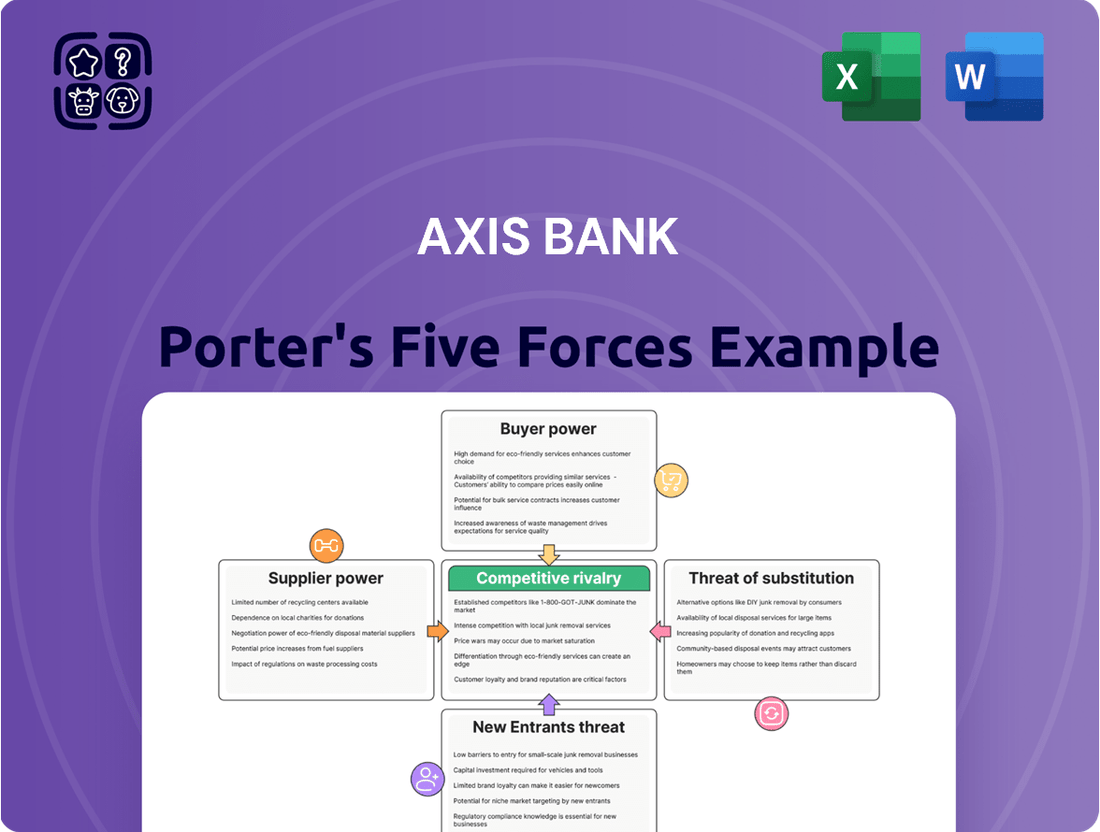

This analysis of Axis Bank's competitive landscape reveals the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes.

Instantly identify and prioritize competitive threats with a visual breakdown of each force, making strategic adjustments for Axis Bank straightforward.

Customers Bargaining Power

Axis Bank's diverse customer base, encompassing retail clients, small and medium-sized enterprises (SMEs), and large corporations, significantly dilutes the bargaining power of individual customers. The sheer volume of retail customers, for instance, means that any single customer's ability to dictate terms or demand concessions is minimal.

Customers in India benefit from a vast selection of banking choices, including public sector, private sector, and foreign banks. This competitive landscape means customers can readily compare and switch between institutions offering superior rates, enhanced services, or more advanced digital platforms. For instance, as of early 2024, India boasts over 12 public sector banks, more than 20 private sector banks, and several foreign banks operating within the country, giving consumers significant leverage.

The increasing prevalence of digital banking and user-friendly mobile applications has significantly lowered the barriers for customers to compare financial products and switch between banks. This ease of switching directly empowers customers, as they can readily move to institutions offering better rates, services, or digital experiences. In 2023, India's digital payment transaction volume crossed 14.8 trillion Indian Rupees, highlighting the widespread adoption and comfort with digital financial platforms.

Axis Bank's strategic focus on enhancing its digital offerings, including robust mobile banking and seamless online account management, is a direct response to this shift. By investing in superior digital solutions, Axis Bank aims to not only attract new customers but, more importantly, to foster loyalty and reduce churn in a highly competitive landscape where switching costs are minimal.

Interest Rate Sensitivity

Customers, especially large corporations and high-net-worth individuals, exhibit significant sensitivity to interest rate changes on both loans and deposits. This sensitivity directly translates into their bargaining power.

Their capacity to shift substantial funds or secure financing from alternative sources empowers them to negotiate more favorable terms. This is particularly true when interest rates are volatile, as they can easily move their business to a competitor offering better rates.

In 2024, for instance, with interest rates fluctuating, Axis Bank, like other financial institutions, faced pressure to maintain competitive deposit and lending rates to retain these key customer segments. For example, a slight increase in a competitor's deposit rate could lead to significant outflows from a bank if its own rates are not aligned.

- High Sensitivity: Large corporate and HNI clients are acutely aware of interest rate differentials.

- Mobility of Funds: These customers can quickly move substantial capital, impacting a bank's liquidity and profitability.

- Competitive Pressure: Banks must offer competitive rates to prevent customer attrition in a dynamic rate environment.

- Impact on Margins: Customer bargaining power on rates directly affects a bank's net interest margin.

Information Transparency and Financial Literacy

Customers today are far more informed than ever before. With the internet at their fingertips, they can easily research financial products, compare fees, and understand the value proposition of different banks. This surge in financial literacy means customers are less likely to accept opaque pricing or subpar services. For instance, in 2024, a significant portion of retail banking customers in India actively used online comparison tools before choosing financial products, putting pressure on institutions like Axis Bank to be transparent.

This increased transparency directly impacts the bargaining power of customers. They can readily identify better deals and are more willing to switch providers if they feel they are not getting competitive pricing or added benefits. Axis Bank, therefore, must continuously innovate and offer compelling value-added services, such as personalized financial advice or loyalty programs, to not only attract but also retain its customer base in this highly competitive landscape.

- Informed Decisions: Customers leverage online resources to compare interest rates, fees, and service quality across various financial institutions.

- Demand for Transparency: A growing expectation exists for clear, upfront pricing and easily understandable terms and conditions from banks.

- Competitive Pressure: Banks like Axis Bank face pressure to offer superior value and customer experience to prevent customer attrition.

- Switching Behavior: Increased financial awareness can lead to a higher propensity for customers to switch banks for better offerings.

The bargaining power of Axis Bank's customers is shaped by several key factors. A vast and competitive banking landscape in India, featuring numerous public, private, and foreign banks, allows customers to easily compare offerings and switch providers, thereby increasing their leverage.

Digitalization has further amplified this power by reducing switching costs and increasing price transparency. Customers can readily access information and compare financial products, pushing banks like Axis to offer competitive rates and superior digital experiences to retain business. For instance, India's digital payment volume exceeding 14.8 trillion Indian Rupees in 2023 underscores customer comfort and adoption of digital financial platforms, which facilitates easier switching.

Large corporate clients and high-net-worth individuals wield significant influence due to their sensitivity to interest rate differentials and their ability to move substantial funds. This necessitates competitive pricing from Axis Bank to prevent customer attrition, directly impacting the bank's net interest margins.

| Factor | Impact on Customer Bargaining Power | Axis Bank's Response/Consideration |

|---|---|---|

| Market Competition | High; numerous banking alternatives available. | Focus on differentiated services and competitive pricing. |

| Digitalization & Switching Costs | High; easy comparison and low costs to switch banks. | Investment in superior digital platforms and customer experience. |

| Customer Financial Literacy | High; informed customers demand transparency and value. | Emphasis on clear pricing, value-added services, and loyalty programs. |

| Customer Segment (Large Corporates/HNIs) | Very High; sensitive to rates, mobile funds. | Strategic rate management and relationship building to retain key clients. |

Preview Before You Purchase

Axis Bank Porter's Five Forces Analysis

This preview shows the exact Axis Bank Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the bank. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector, all presented in a comprehensive and professionally formatted document.

Rivalry Among Competitors

Axis Bank operates in a fiercely competitive Indian banking landscape. Major public sector banks like State Bank of India (SBI) and leading private sector players such as HDFC Bank and ICICI Bank are dominant forces, directly challenging Axis Bank across retail, corporate, and digital banking services.

This intense rivalry means banks are constantly innovating and offering competitive pricing to attract and retain customers. For instance, as of early 2024, the Indian banking sector boasts over 12 public sector banks and more than 20 private sector banks, all vying for market share.

Major banks like Axis Bank are heavily invested in aggressive growth, especially in retail and SME lending, aiming to capture a larger slice of the market. This pursuit of expanding loan books and deposits intensifies the rivalry among established players.

In 2024, the Indian banking sector witnessed significant competition, with banks actively vying for market share. For instance, Axis Bank reported a 14.2% year-on-year growth in its retail loan book as of March 31, 2024, highlighting the aggressive expansion efforts across the industry.

Axis Bank, like its peers, faces intense competition driven by a digital transformation race. Banks are pouring significant capital into developing innovative digital products and enhancing their online platforms to capture the growing segment of tech-savvy customers. This pursuit of digital superiority means constant pressure to offer more seamless and convenient banking experiences, directly impacting customer acquisition and retention.

Pricing Pressure and Margin Compression

The banking sector, particularly in India where Axis Bank operates, is characterized by fierce competition. This intense rivalry directly translates into pricing pressure, especially on loan interest rates and deposit yields. For instance, in early 2024, the Reserve Bank of India's repo rate stood at 6.50%, influencing lending and deposit rates across the industry, creating a dynamic environment where banks must constantly adjust their pricing to remain competitive.

This constant pressure on pricing inevitably leads to margin compression, specifically impacting Net Interest Margins (NIMs). Banks like Axis Bank face the challenge of maintaining profitability when the spread between their lending rates and borrowing costs narrows. In the fiscal year 2023-24, Axis Bank reported a Net Interest Margin of 3.96%, a figure that underscores the ongoing effort to balance competitive pricing with profitability.

- Intense competition forces banks to offer more attractive interest rates on deposits and loans.

- NIM compression is a direct consequence, squeezing profitability from core lending activities.

- Operational efficiency becomes paramount to offset reduced margins.

- Diversification of income through fee-based services is crucial for sustained profitability.

Asset Quality and Regulatory Scrutiny

Axis Bank, like its peers, navigates intense competition stemming from regulatory scrutiny over asset quality. While the overall asset quality in the Indian banking sector has shown improvement, regulators maintain a sharp focus, particularly on segments like unsecured retail loans and instances of potential fraud. This heightened oversight necessitates robust risk management frameworks and continuous compliance efforts, adding a significant competitive dimension.

The Reserve Bank of India's (RBI) proactive stance, exemplified by its increased monitoring of unsecured lending and the implementation of stricter provisioning norms, directly impacts how banks like Axis manage their loan portfolios. For instance, in early 2024, the RBI raised the risk weight on unsecured personal loans to 125% from 100%, a move designed to curb excessive growth in this segment and push banks towards more prudent lending. This regulatory pressure means that maintaining superior asset quality is not just a strategic advantage but a fundamental requirement to avoid penalties and maintain market confidence.

- Regulatory Focus: Regulators are closely monitoring the growth and risk profiles of unsecured retail loans.

- Risk Weight Increases: In early 2024, the RBI increased the risk weight on unsecured personal loans, impacting capital requirements for banks.

- Fraud Prevention: Banks face intensified scrutiny regarding measures to prevent and detect fraudulent activities within their operations.

- Operational Challenges: Adhering to evolving regulatory requirements and maintaining high asset quality presents ongoing operational hurdles and competitive pressures.

Competitive rivalry within the Indian banking sector is intense, with Axis Bank facing significant pressure from both public and private sector peers. This competition drives innovation and aggressive pricing strategies, as seen in the rapid growth of retail loan books across the industry. As of March 31, 2024, Axis Bank's retail loan book expanded by 14.2% year-on-year, reflecting the broader trend of market share pursuit.

The digital transformation race further intensifies this rivalry, compelling banks to invest heavily in online platforms and digital products to attract tech-savvy customers. This constant push for superior digital experiences directly impacts customer acquisition and retention efforts.

Pricing pressure is a direct consequence of this rivalry, impacting Net Interest Margins (NIMs). For example, the Reserve Bank of India's repo rate stood at 6.50% in early 2024, influencing lending and deposit rates. Axis Bank reported a NIM of 3.96% for FY 2023-24, highlighting the challenge of balancing competitive rates with profitability.

| Key Competitors | Market Position | Key Competitive Actions |

|---|---|---|

| State Bank of India (SBI) | Largest Public Sector Bank | Aggressive retail expansion, digital offerings |

| HDFC Bank | Leading Private Sector Bank | Strong digital presence, diverse product portfolio |

| ICICI Bank | Major Private Sector Bank | Focus on retail and SME lending, digital innovation |

SSubstitutes Threaten

Non-Banking Financial Companies (NBFCs) present a notable threat of substitutes to Axis Bank. These entities offer a broad spectrum of financial services, encompassing loans, wealth management, and insurance, often characterized by more adaptable terms and quicker processing times compared to conventional banks. For instance, in 2023, the NBFC sector saw significant growth, with total assets rising, indicating their increasing appeal to customers seeking alternatives to traditional banking.

Fintech companies and digital payment platforms, particularly those leveraging UPI in India, present a significant threat of substitutes for Axis Bank. These platforms offer streamlined alternatives for payments, lending, and investment services, often with lower transaction fees and greater user convenience, directly competing with traditional banking offerings. For instance, UPI transactions in India reached a staggering 13.42 billion in Q4 2023, indicating a massive shift in consumer preference towards digital payment solutions.

Government-backed financial inclusion initiatives, like India's Pradhan Mantri Jan Dhan Yojana (PMJDY), offer basic banking services to underserved populations. As of January 2024, PMJDY had over 51 crore accounts opened, demonstrating a significant reach. This expansion of accessible, often low-cost, banking through public digital infrastructure can serve as a substitute for some of Axis Bank's traditional retail banking products, particularly for basic savings and transaction needs.

Direct Capital Markets

For large corporations, direct access to capital markets presents a significant substitute for traditional bank financing. Companies can issue corporate bonds or commercial papers, tapping directly into a pool of investors rather than relying solely on bank loans. This disintermediation allows them to potentially secure funding at more competitive rates and with greater flexibility.

In 2024, the global bond market continued to be a robust source of capital for corporations. For instance, investment-grade corporate bond issuance remained strong, reflecting investor appetite for yield and corporate issuers' desire to diversify funding sources away from banks. This trend highlights the ongoing viability of capital markets as a direct alternative to bank lending for large, creditworthy entities.

The availability of these direct financing channels exerts pressure on banks like Axis Bank. It forces them to remain competitive in their lending terms and services to retain corporate clients. The ease with which large firms can bypass traditional banking structures for capital raises underscores the threat of substitutes in this segment of the financial services industry.

- Direct Access to Capital Markets: Corporations can issue bonds and commercial papers, bypassing traditional bank loans.

- Investor Funding Pool: This allows companies to raise capital directly from a broad base of investors.

- Competitive Pressure on Banks: The availability of substitutes compels banks to offer more attractive lending terms and services.

Peer-to-Peer (P2P) Lending and Crowdfunding

Emerging alternative financing platforms like peer-to-peer (P2P) lending and crowdfunding present a growing threat of substitution for traditional banking services, including those offered by Axis Bank. These platforms connect borrowers directly with lenders or a crowd of investors, disintermediating traditional financial institutions.

While still a niche market, the growth trajectory of these alternatives is notable. For instance, the global P2P lending market was valued at approximately USD 113.8 billion in 2023 and is projected to grow significantly. Similarly, crowdfunding platforms have facilitated billions in funding for various ventures.

- P2P Lending Growth: The P2P lending market is expanding, offering alternative funding avenues.

- Crowdfunding Impact: Crowdfunding provides direct access to capital for individuals and businesses.

- Disintermediation: These platforms bypass traditional banking intermediaries, potentially reducing reliance on banks like Axis.

- Future Substitution: Continued growth could pose a more substantial future substitution threat to traditional banking models.

The threat of substitutes for Axis Bank is multifaceted, stemming from non-banking financial companies (NBFCs) and fintech platforms that offer flexible, faster financial solutions, evidenced by the NBFC sector's growth and the massive adoption of UPI, with 13.42 billion transactions in Q4 2023. Government initiatives like PMJDY, with over 51 crore accounts by January 2024, also provide basic banking alternatives, particularly for underserved populations. Furthermore, large corporations increasingly access capital markets directly through bond issuance, a trend supported by strong global bond market activity in 2024, pressuring banks to remain competitive.

| Substitute Type | Key Characteristics | 2023/2024 Data Point | Impact on Axis Bank |

|---|---|---|---|

| NBFCs | Flexible terms, quick processing | Significant sector growth | Competition for loans, wealth management |

| Fintech/Digital Payments | Streamlined services, lower fees, convenience | 13.42 billion UPI transactions (Q4 2023) | Direct competition for payments, lending |

| Govt. Initiatives (e.g., PMJDY) | Basic banking, financial inclusion | Over 51 crore accounts (Jan 2024) | Substitution for basic retail banking needs |

| Capital Markets | Direct corporate funding | Strong global bond issuance in 2024 | Reduced reliance on bank loans for large corporations |

Entrants Threaten

The Indian banking sector is characterized by substantial regulatory hurdles, primarily overseen by the Reserve Bank of India (RBI). These include rigorous licensing processes, stringent capital adequacy ratios, and extensive compliance mandates, all of which significantly elevate the cost and complexity of market entry for new entities.

Establishing a new bank, like Axis Bank, demands immense capital. Think about setting up branches, investing in cutting-edge technology for digital banking, and meeting stringent regulatory requirements. These upfront costs can easily run into billions of dollars, making it incredibly difficult for newcomers to even get started.

For instance, in 2023, the Reserve Bank of India (RBI) requires new banks to have a minimum paid-up voting equity capital of ₹500 crore. This substantial financial hurdle effectively deters many potential entrants, safeguarding the market for existing players like Axis Bank.

Established brand loyalty and trust present a significant barrier for new entrants. For instance, in 2024, Axis Bank, like many established players, benefits from decades of customer relationships and a reputation for reliability. New banks would need to overcome this ingrained trust, a challenge amplified by the fact that customer acquisition costs in the banking sector remain high, often exceeding 15% of the initial deposit value, making it a costly endeavor to chip away at existing customer bases.

Technological Investment and Digital Infrastructure

New entrants face substantial barriers in building the necessary digital banking infrastructure. Significant technological investment is required to establish robust, secure, and scalable platforms capable of handling complex financial transactions and meeting stringent regulatory compliance. This is particularly challenging given the accelerating pace of digital transformation within the banking industry, where continuous upgrades and innovation are paramount.

The cost of developing and maintaining cutting-edge digital capabilities can be prohibitive for emerging players. For instance, the global fintech market size was valued at over USD 2.5 trillion in 2023 and is projected to grow significantly, highlighting the scale of investment needed to compete. New entrants must also contend with the expertise required to navigate cybersecurity threats and ensure data privacy, adding another layer of complexity and cost.

- High Capital Outlay: Establishing a secure and efficient digital banking platform demands massive upfront investment in hardware, software, and specialized talent.

- Rapid Technological Evolution: The need to constantly adapt to new technologies, such as AI-driven analytics and blockchain, creates an ongoing cost and expertise challenge.

- Cybersecurity Demands: Protecting customer data and financial assets against sophisticated cyberattacks requires continuous and substantial investment in security infrastructure and personnel.

Competition from Existing Players

Any new entrant into the banking sector, particularly in India where Axis Bank operates, would encounter formidable competition from established players. These incumbents, including major public sector banks and other private sector banks, have cultivated deep market knowledge and extensive customer relationships over many years. For instance, as of March 31, 2024, the Indian banking sector comprised over 140 scheduled commercial banks, each vying for market share.

These existing banks boast significant financial resources, allowing them to invest heavily in technology, marketing, and talent acquisition. This financial muscle enables them to offer competitive interest rates, a wide array of products, and robust digital banking services, creating high barriers to entry. Gaining a foothold and achieving profitability against such entrenched entities would be a considerable challenge for newcomers.

- Established Market Presence: Existing banks have built strong brand recognition and trust over decades.

- Extensive Customer Bases: Incumbents possess large, loyal customer segments that are difficult to attract.

- Deep Financial Resources: Major players have the capital to absorb initial losses and invest in growth.

- Regulatory Experience: Existing banks are well-versed in navigating the complex regulatory landscape of the Indian financial sector.

The threat of new entrants for Axis Bank is significantly mitigated by high regulatory barriers and substantial capital requirements. The Reserve Bank of India's stringent licensing, capital adequacy, and compliance mandates create a costly and complex entry process. For example, in 2023, the minimum paid-up voting equity capital requirement for new banks was ₹500 crore, a considerable financial hurdle.

Furthermore, established brand loyalty and the high cost of customer acquisition pose significant challenges for newcomers. In 2024, Axis Bank benefits from decades of customer trust, making it difficult for new entities to attract and retain customers, as acquisition costs can exceed 15% of initial deposit value.

The need for extensive investment in digital banking infrastructure, including secure platforms and continuous technological upgrades, presents another major barrier. The global fintech market, valued at over USD 2.5 trillion in 2023, underscores the scale of investment required to compete effectively, alongside the expertise needed for cybersecurity and data privacy.

Finally, intense competition from over 140 scheduled commercial banks in India as of March 31, 2024, with their deep financial resources and established market presence, makes it challenging for new entrants to gain market share and achieve profitability against incumbents like Axis Bank.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Axis Bank is built upon a foundation of verified data, drawing from the bank's annual reports, investor presentations, and regulatory filings. We supplement this with insights from reputable financial news outlets, industry analysis reports, and macroeconomic data to provide a comprehensive view of the competitive landscape.