Axis Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Bank Bundle

Unlock the strategic blueprint behind Axis Bank's success with our comprehensive Business Model Canvas. This detailed document reveals how they effectively serve diverse customer segments, forge key partnerships, and generate revenue streams in the dynamic banking sector. Gain actionable insights into their value proposition and cost structure.

Partnerships

Axis Bank actively partners with fintech firms to bolster its digital services. These collaborations are key to integrating advanced solutions in areas such as payments and lending, significantly improving customer journeys and operational efficiency. For instance, in 2024, Axis Bank continued its focus on leveraging fintech for seamless customer onboarding and enhanced digital payment experiences.

Axis Bank's strategic alliances with global payment behemoths like Visa, Mastercard, and India's own RuPay form the backbone of its credit and debit card offerings. These partnerships are not just about branding; they are fundamental to ensuring that every transaction, whether online or at a physical point of sale, is processed securely and efficiently. This allows Axis Bank to provide its customers with seamless payment experiences, both within India and across international borders.

In 2024, these alliances are particularly vital as digital payments continue to surge. For instance, the increasing adoption of RuPay in India, which saw a significant increase in transaction volume in the fiscal year ending March 2024, directly benefits Axis Bank by expanding its domestic reach. Similarly, the continued global acceptance of Visa and Mastercard ensures that Axis Bank cardholders can transact with confidence wherever they travel, reinforcing the bank's commitment to providing a comprehensive and globally recognized payment ecosystem.

Axis Bank actively partners with government and public sector entities to facilitate direct benefit transfers, a crucial component of India's welfare programs. For instance, in the fiscal year 2023-24, Axis Bank processed a significant volume of DBT payments, contributing to the efficient disbursement of subsidies and social security benefits to millions of citizens.

These collaborations extend to public sector lending and infrastructure financing, where Axis Bank plays a role in funding national development projects. The bank's involvement in such initiatives underscores its commitment to supporting economic growth and providing essential financial services to government undertakings, often involving substantial financial commitments and adherence to stringent regulatory frameworks.

Insurance and Mutual Fund Companies

Axis Bank strategically partners with leading insurance providers and prominent mutual fund companies. These collaborations are fundamental to its bancassurance and wealth management strategies, allowing the bank to offer a comprehensive suite of financial products. This expands its value proposition beyond core banking services.

Through these alliances, Axis Bank effectively cross-sells a diverse range of products, including life insurance, general insurance, and various mutual fund schemes, to its extensive customer base. This integrated approach provides customers with holistic financial solutions, catering to their protection and investment needs.

These partnerships are a significant driver of fee-based income for Axis Bank. For example, in the fiscal year 2023-24, Axis Bank reported a substantial increase in its retail advances and a healthy growth in fee income, partly attributable to its successful bancassurance and wealth management operations.

- Bancassurance Growth: Partnerships enable Axis Bank to distribute insurance products, contributing to its non-interest income.

- Wealth Management Expansion: Collaborations with mutual fund houses allow the bank to offer a wider investment portfolio, enhancing wealth management services.

- Fee Income Generation: These strategic alliances are crucial for generating recurring fee-based revenue streams, diversifying income sources.

Technology and Infrastructure Providers

Axis Bank actively partners with major technology and infrastructure providers to ensure its banking operations are both robust and secure. These collaborations are crucial for accessing cutting-edge software, hardware, and advanced cybersecurity measures. For instance, in 2024, Axis Bank continued its focus on cloud adoption, leveraging partnerships with hyperscale cloud providers to enhance scalability and data management capabilities for its digital banking services.

These strategic alliances are fundamental to maintaining the integrity and performance of Axis Bank's core banking systems and its expanding digital platforms. By integrating the latest technological advancements, the bank aims to deliver seamless customer experiences and maintain a competitive edge in the rapidly evolving financial landscape. This commitment to technological infrastructure underpins the bank's stability and its capacity for future innovation.

Key aspects of these partnerships include:

- Access to Advanced Cybersecurity Solutions: Ensuring protection against evolving digital threats through collaborations with leading cybersecurity firms.

- Cloud Infrastructure Services: Partnering with major cloud providers for scalable, secure, and efficient data storage and processing.

- Core Banking System Upgrades: Working with technology vendors to implement and maintain state-of-the-art core banking software.

- Digital Platform Development: Collaborating with IT infrastructure providers to build and enhance the bank's digital channels and mobile applications.

Axis Bank's key partnerships are crucial for its operational efficiency and market reach. Collaborations with fintech firms enhance digital services, while alliances with global payment networks like Visa and Mastercard ensure seamless transactions for cardholders. Strategic tie-ups with insurance providers and mutual fund houses bolster bancassurance and wealth management offerings, driving fee-based income.

In 2024, Axis Bank continued to leverage these partnerships to expand its digital footprint and product suite. For instance, its focus on fintech integration led to improved customer onboarding, and its bancassurance business saw healthy growth, contributing to the bank's overall revenue diversification. The bank's commitment to technological advancement also saw it deepen ties with cloud providers for enhanced data management and security.

| Partnership Type | Key Collaborators | Impact Area | 2023-24 Data/Observation |

|---|---|---|---|

| Fintech Integration | Various Fintech Companies | Digital Services, Payments, Lending | Continued focus on seamless customer onboarding and enhanced digital payments. |

| Payment Networks | Visa, Mastercard, RuPay | Card Services, Transaction Processing | RuPay transaction volume saw significant increase; global acceptance ensures international reach. |

| Bancassurance & Wealth Management | Insurance Providers, Mutual Fund Houses | Product Distribution, Fee Income | Substantial increase in fee income partly attributed to these operations. |

| Technology & Infrastructure | Hyperscale Cloud Providers, Cybersecurity Firms | Digital Banking, Security, Scalability | Ongoing cloud adoption for enhanced scalability and data management. |

What is included in the product

Axis Bank's Business Model Canvas focuses on serving diverse customer segments, from retail to corporate, through extensive branch networks, digital channels, and strategic partnerships to deliver a wide range of financial products and services.

Key revenue streams are driven by net interest income, fees from banking services, and treasury operations, supported by robust cost management and a focus on customer acquisition and retention.

Axis Bank's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategic approach, simplifying complex banking operations for better understanding and faster decision-making.

This canvas streamlines the identification of key value propositions and customer segments, effectively addressing the pain point of information overload for stakeholders.

Activities

Axis Bank's key retail banking activities revolve around managing a broad spectrum of customer accounts, including savings, current, and fixed deposits. These operations are fundamental to its customer acquisition and retention strategies.

The bank also actively provides a diverse range of retail loans, such as home, personal, and auto loans, which are crucial for revenue generation through interest income. This necessitates robust customer service, efficient transaction processing, and meticulous risk assessment for each individual borrower.

In 2023, Axis Bank reported a significant growth in its retail loan book, which stood at approximately ₹2.5 trillion, highlighting the importance of these operations to its overall financial performance and market presence.

Axis Bank's corporate and commercial banking activities are central to its operations, focusing on providing a comprehensive suite of financial services to a wide range of businesses, from large corporations to small and medium enterprises (SMEs). This involves offering crucial financial products like working capital finance, term loans, trade finance, and project finance, all designed to support business growth and operational needs.

A core component of this segment is the meticulous credit analysis and robust relationship management required to structure complex financial solutions. These tailored offerings are essential for meeting the diverse and often unique requirements of businesses operating across various economic sectors, thereby fueling the bank's overall expansion.

In 2024, Axis Bank continued to demonstrate strength in its corporate banking segment. For instance, the bank reported robust growth in its advances to large corporations and SMEs, reflecting its commitment to supporting the backbone of the economy. The bank's focus on sectors like manufacturing and infrastructure has been particularly noteworthy, contributing to its sustained market presence.

Treasury and Investment Banking are crucial for Axis Bank's operations. Key activities include managing the bank's liquidity, making strategic investments in government securities, and handling foreign exchange operations. These functions are vital for maintaining financial stability and optimizing returns.

Investment banking services cater to corporate clients, offering expertise in mergers and acquisitions advisory, equity capital markets, and debt capital markets. This segment helps businesses raise capital and navigate complex financial transactions.

In the fiscal year 2024, Axis Bank reported robust performance in its treasury and investment banking segments. The bank's treasury operations contributed significantly to its non-interest income, demonstrating effective asset-liability management and profitable deployment of funds.

Digital Banking and Innovation

Axis Bank's key activities in digital banking and innovation focus on creating and refining its digital offerings. This includes the ongoing development, maintenance, and enhancement of their online banking platforms, mobile applications, and a wide array of online payment solutions. The bank is committed to staying at the forefront by integrating cutting-edge technologies to improve user experience and security.

Continuous innovation is paramount, with a strong emphasis on incorporating new technologies such as artificial intelligence (AI) and blockchain to elevate their digital services. By actively driving the adoption of these digital tools, Axis Bank aims to broaden its customer reach and significantly boost operational efficiency across its services.

- Platform Development: Continuously building and improving the core digital banking infrastructure and mobile app features.

- Innovation Integration: Researching and implementing new technologies like AI for personalized services and blockchain for secure transactions.

- User Experience Enhancement: Focusing on intuitive design and seamless navigation across all digital touchpoints.

- Digital Adoption Drive: Implementing strategies to encourage customer usage of digital channels, aiming for increased transaction volumes and reduced reliance on physical branches.

Risk Management and Compliance

Axis Bank actively implements comprehensive risk management frameworks to identify, assess, and mitigate various risks. This includes rigorous processes for credit risk, market risk, operational risk, and the increasingly vital area of cyber risk.

Adherence to regulatory mandates is a cornerstone of Axis Bank's operations. This involves strict compliance with Reserve Bank of India guidelines, robust anti-money laundering (AML) protocols, and all relevant banking and financial sector standards.

In 2023, Axis Bank reported a Gross Non-Performing Asset (GNPA) ratio of 1.34%, demonstrating a commitment to managing credit risk effectively. Their focus on operational efficiency and cybersecurity is crucial for maintaining stability and customer trust.

- Credit Risk Mitigation: Ongoing monitoring of loan portfolios and proactive measures to address potential defaults.

- Market Risk Management: Strategies to hedge against fluctuations in interest rates and foreign exchange.

- Operational Resilience: Systems and processes to prevent disruptions and manage internal failures.

- Cybersecurity: Advanced measures to protect customer data and banking systems from digital threats.

Axis Bank's key activities in digital banking and innovation are centered on enhancing its digital platforms and mobile applications, alongside developing advanced payment solutions. The bank prioritizes integrating emerging technologies like AI and blockchain to improve customer experience and operational efficiency, aiming for wider customer reach and increased transaction volumes through digital channels.

| Key Activity | Focus Area | 2024 Data/Trend |

|---|---|---|

| Platform Development | Core digital infrastructure, mobile app features | Ongoing enhancements to user interface and functionality. |

| Innovation Integration | AI for personalization, blockchain for security | Increased investment in AI-driven customer insights and secure transaction protocols. |

| User Experience Enhancement | Intuitive design, seamless navigation | Focus on reducing customer effort and increasing digital engagement. |

| Digital Adoption Drive | Promoting digital channel usage | Targeting higher percentage of transactions via digital platforms, aiming for significant growth in mobile banking users. |

Preview Before You Purchase

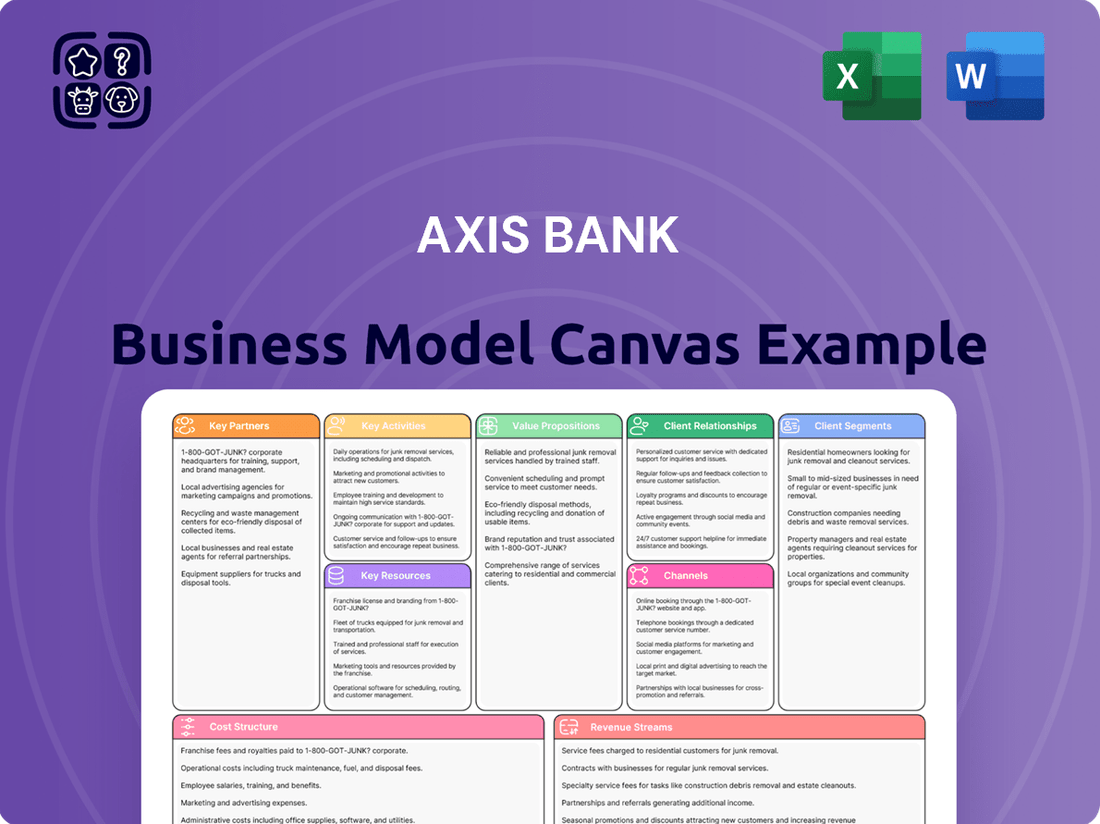

Business Model Canvas

The Axis Bank Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot from the complete, ready-to-use file. You'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately apply its insights to your strategic planning.

Resources

Axis Bank's financial capital, comprising shareholder equity, diverse customer deposits, and strategic borrowings, forms the bedrock of its operations. This substantial capital base, exemplified by a reported Net Interest Income of INR 40,137 crore for the fiscal year ending March 31, 2024, directly fuels its lending capabilities and investment portfolios.

The bank's commitment to maintaining strong capital adequacy ratios, consistently above regulatory requirements, is a testament to its financial prudence. As of March 31, 2024, Axis Bank's Capital Adequacy Ratio (CRAR) stood at a healthy 15.16%, reinforcing its stability and capacity for growth.

This robust financial foundation not only empowers Axis Bank to undertake significant business activities but also cultivates trust among its vast depositor base and the broader investor community, crucial elements for sustained expansion and market leadership.

Axis Bank's human capital is a cornerstone of its operations, encompassing a diverse team of skilled banking professionals, technology innovators, astute risk managers, and dedicated customer service staff. This collective expertise fuels the bank's ability to drive innovation, maintain seamless operations, and cultivate robust customer loyalty.

In 2024, Axis Bank continued its focus on talent development, recognizing that its employees' skills are paramount to staying ahead in the dynamic financial landscape. The bank invested significantly in training programs designed to enhance technical proficiency and customer engagement capabilities, ensuring its workforce remains equipped with the latest industry knowledge.

Axis Bank's technology infrastructure is built on advanced IT systems, including secure data centers and robust core banking software. This foundation enables seamless transaction processing and the delivery of a wide array of digital banking services to its customers.

The bank's digital platforms, such as its mobile app and internet banking, are powered by this sophisticated technology. In 2023, Axis Bank reported significant growth in its digital transactions, reflecting the effectiveness of its technology investments in meeting evolving customer needs.

Crucially, strong cybersecurity frameworks are integrated throughout the infrastructure to protect sensitive customer data and ensure operational resilience. This commitment to security is paramount in the digital age, safeguarding against threats and maintaining customer trust.

Brand Reputation and Trust

Axis Bank's brand reputation and the deep trust it has cultivated are cornerstones of its business model. This established name acts as a powerful magnet, drawing in new customers while fostering loyalty among its existing client base. In the financial sector, where security and reliability are paramount, this trust directly translates into customer retention and a positive market perception.

The bank's commitment to customer service and ethical practices has solidified its standing. For instance, in the fiscal year 2023-24, Axis Bank reported a significant increase in its retail customer base, a testament to the trust it has earned. This strong brand equity also smooths the path for strategic alliances and partnerships, as potential collaborators are more inclined to engage with a reputable institution.

- Customer Acquisition: A strong brand reduces customer acquisition costs by making the bank a preferred choice.

- Customer Retention: Trust fosters loyalty, leading to lower attrition rates and higher lifetime customer value.

- Partnership Facilitation: A reputable brand attracts and secures favorable terms with partners and intermediaries.

- Market Perception: Positive brand image influences investor confidence and regulatory relationships.

Extensive Branch and ATM Network

Axis Bank leverages its extensive physical footprint, comprising numerous branches and ATMs, as a core component of its customer engagement strategy. This widespread network ensures accessibility across both urban centers and more remote rural locations, providing a tangible point of contact for a diverse customer base.

While digital banking adoption continues to surge, Axis Bank recognizes the enduring significance of its physical presence. The branch and ATM network remains crucial for specific transaction types, fostering personal relationships with customers, and crucially, serving segments of the population who may be less inclined or able to utilize digital channels. This dual approach caters to a broader spectrum of customer needs and preferences.

As of the fiscal year ending March 31, 2024, Axis Bank operated a significant network, underscoring its commitment to physical accessibility. For instance, the bank maintained a substantial number of branches and ATMs across India, facilitating convenient banking for millions. This vast reach is a key differentiator, ensuring that customers can access services regardless of their location or technological proficiency.

- Branch Network: Axis Bank maintained a robust network of branches, providing essential banking services and personalized customer support.

- ATM Accessibility: A widespread ATM network ensured 24/7 cash withdrawal and deposit facilities, enhancing customer convenience.

- Geographic Reach: The physical network extended across diverse geographies, catering to both urban and rural populations.

- Customer Segmentation: The physical infrastructure played a vital role in serving customers who prefer in-person interactions or have limited access to digital platforms.

Axis Bank's key resources are its robust financial capital, its skilled human capital, its advanced technology infrastructure, its strong brand reputation, and its extensive physical network of branches and ATMs. These elements collectively enable the bank to deliver a comprehensive range of financial services, foster customer loyalty, and maintain a competitive edge in the market.

The bank's financial strength, supported by a Net Interest Income of INR 40,137 crore for FY24 and a CRAR of 15.16% as of March 31, 2024, underpins its lending and investment activities. Its human capital is continuously developed through training, while its technology infrastructure ensures seamless digital services, evidenced by growth in digital transactions in 2023. The brand's trust, reflected in increased retail customers in FY23-24, facilitates acquisition and retention, and the physical network ensures broad accessibility.

| Key Resource | Description | FY24 Data/Impact |

|---|---|---|

| Financial Capital | Shareholder equity, deposits, borrowings | Net Interest Income: INR 40,137 crore; CRAR: 15.16% (as of Mar 31, 2024) |

| Human Capital | Skilled banking professionals, tech innovators, risk managers | Continued investment in talent development and training programs |

| Technology Infrastructure | Advanced IT systems, secure data centers, core banking software | Enabled significant growth in digital transactions (2023); robust cybersecurity |

| Brand Reputation & Trust | Established name, customer loyalty, ethical practices | Increased retail customer base (FY23-24); positive market perception |

| Physical Network | Branches and ATMs | Widespread network ensuring accessibility across diverse geographies |

Value Propositions

Axis Bank's value proposition centers on providing a truly comprehensive financial ecosystem. They offer everything from basic savings and current accounts to a wide spectrum of loan products, including personal, home, and business loans. For 2024, Axis Bank reported a robust retail loan book growth, showcasing their commitment to meeting diverse borrowing needs.

Beyond lending, Axis Bank provides a full suite of investment avenues, including mutual funds, stocks, and insurance products, alongside a robust credit card portfolio. This integrated approach ensures customers can manage all their financial requirements, from everyday transactions to long-term wealth creation, through a single, trusted provider.

Axis Bank offers state-of-the-art digital platforms, including a mobile app and online services, allowing customers to conduct transactions, pay bills, and manage accounts seamlessly from any location. This commitment to digital convenience, evident in their intuitive user interfaces and ongoing tech upgrades, directly addresses the modern consumer's need for speed and accessibility.

In 2024, Axis Bank's digital initiatives have seen significant traction, with a substantial portion of their customer base actively utilizing these channels for daily banking needs. For instance, a notable percentage of savings account transactions and customer service queries are now handled digitally, reflecting a strong adoption rate of their innovative solutions.

Axis Bank crafts bespoke financial solutions for distinct client groups, including retail customers, large corporations, and SMEs. This strategic segmentation enables the delivery of specialized loan products, wealth management, and corporate banking services precisely aligned with each segment's unique needs.

For instance, in 2024, Axis Bank continued to enhance its offerings for SMEs, a vital segment contributing significantly to India's economic growth. By providing tailored working capital loans and digital banking platforms, the bank aimed to support these businesses in navigating evolving market dynamics and expanding their operations.

The bank's retail segment benefits from personalized wealth management strategies and diverse investment products, catering to varying risk appetites and financial goals. Simultaneously, its corporate banking arm focuses on complex financial structuring, trade finance, and advisory services for large enterprises, fostering long-term partnerships and facilitating substantial growth.

Reliable and Secure Banking

Axis Bank prioritizes robust security measures and strict regulatory compliance, ensuring the safety of customer funds and sensitive data. This dedication to reliability and security fosters deep trust and confidence among its diverse clientele.

Customers gain assurance that their financial assets are well-protected, which is crucial for building and maintaining long-term banking relationships. For instance, Axis Bank's digital platforms often feature multi-factor authentication and advanced fraud detection systems, reflecting this commitment.

- Enhanced Digital Security: Implementation of advanced encryption and secure authentication protocols across all digital channels.

- Regulatory Adherence: Strict compliance with banking regulations and data protection laws to safeguard customer information.

- Fraud Prevention: Continuous monitoring and sophisticated systems to detect and prevent fraudulent activities, protecting customer assets.

- Customer Data Protection: Robust policies and technologies in place to ensure the privacy and security of personal and financial data.

Customer-Centric Service

Axis Bank prioritizes customer-centric service by offering responsive support across various channels, including digital platforms and physical branches. This focus aims to ensure a positive and helpful experience for every client.

Personalized advisory services are a cornerstone, with dedicated relationship managers providing tailored financial guidance. This approach helps customers navigate their financial goals effectively.

Efficient grievance redressal mechanisms are in place to address customer concerns promptly. For instance, in Q4 FY24, Axis Bank reported a significant improvement in customer service metrics, with a notable reduction in complaint resolution times.

- Responsive Support: Offering multi-channel assistance for immediate customer needs.

- Personalized Advice: Tailored financial guidance through dedicated relationship managers.

- Efficient Redressal: Streamlined processes for addressing customer grievances.

- Enhanced Satisfaction: Commitment to service excellence fostering customer loyalty.

Axis Bank offers a comprehensive financial ecosystem, providing everything from savings accounts and diverse loan products to investment avenues and insurance. This integrated approach allows customers to manage all their financial needs through a single, trusted provider, supported by robust retail loan growth in 2024.

Customer Relationships

Axis Bank excels in personalized relationship management, particularly for its high-net-worth, corporate, and SME clients. Dedicated relationship managers offer tailored advice and proactive solutions, serving as a single point of contact for intricate financial requirements.

This focused approach cultivates deep trust and fosters enduring client loyalty. For instance, in FY24, Axis Bank reported a significant increase in its retail franchise, with customer growth reflecting the success of these relationship-centric strategies.

Axis Bank's self-service digital platforms, including its mobile app and internet banking, empower customers to manage accounts and conduct transactions independently. This offers significant convenience and efficiency, allowing users to bank on their own schedule.

In 2024, Axis Bank reported a substantial increase in digital transactions, with over 90% of savings account transactions occurring through digital channels. This highlights the widespread adoption and reliance on these self-service options.

Axis Bank leverages AI-powered chatbots and interactive voice response (IVR) systems to provide instant support for common banking needs. This automation handles a significant portion of routine queries, improving response times and allowing human agents to focus on more intricate customer issues. In 2024, banks globally saw customer satisfaction rise with the implementation of such automated solutions, with many reporting a reduction in average query resolution time by up to 30%.

Branch-Based Interaction and Advisory

Axis Bank leverages its extensive branch network to offer personalized, face-to-face customer relationships. This traditional channel is crucial for complex transactions and advisory services, catering to a significant segment of their customer base. In 2024, Axis Bank continued to operate a substantial number of branches across India, ensuring accessibility for customers seeking direct interaction and guidance.

- Branch Network Reach: Axis Bank maintained a widespread physical presence, with thousands of branches across India as of early 2024, facilitating direct customer engagement.

- Key Service Touchpoints: Branches are vital for new account openings, processing loan applications, and offering in-depth wealth management advice, fostering deeper customer connections.

- Customer Preference: This interaction model serves customers who value traditional banking methods and require personal assistance for their financial needs.

Community Engagement and Financial Literacy

Axis Bank actively fosters customer relationships through robust community engagement and financial literacy initiatives. These programs are designed to educate customers on a wide array of financial products, emphasizing responsible money management and advancing financial inclusion across diverse segments of society.

By conducting workshops and outreach, the bank aims to demystify complex financial concepts, making them accessible to everyone. This commitment not only builds significant goodwill but also deepens the bank's connection with its extensive customer base, fostering trust and loyalty.

- Financial Literacy Programs: Axis Bank conducted over 1,500 financial literacy sessions in 2023, reaching more than 250,000 individuals.

- Community Outreach: The bank's initiatives in rural and semi-urban areas saw a 15% increase in participation in 2023 compared to the previous year.

- Digital Inclusion: Efforts to promote digital banking literacy resulted in a 20% rise in new mobile banking users among first-time digital adopters in the last fiscal year.

- Customer Education: Feedback from workshops indicated that 85% of participants felt more confident in managing their finances after attending.

Axis Bank strategically nurtures customer relationships through a multi-channel approach, blending personalized human interaction with efficient digital self-service. This ensures varied customer needs are met effectively, fostering loyalty and satisfaction.

The bank's commitment to relationship management is evident in its dedicated teams for high-value clients, while digital platforms cater to the broader customer base seeking convenience. This dual focus is a cornerstone of their customer engagement strategy.

In 2024, Axis Bank's customer-centric initiatives continued to drive growth, with digital channels handling a significant majority of transactions, demonstrating a successful adaptation to evolving customer preferences.

| Relationship Channel | Key Features | Customer Segment Focus | FY24 Data/Impact |

|---|---|---|---|

| Personalized Relationship Management | Dedicated RM, Tailored advice, Proactive solutions | HNI, Corporate, SME | Increased customer acquisition in these segments |

| Digital Self-Service | Mobile App, Internet Banking | Retail, Mass Affluent | Over 90% of savings account transactions via digital channels |

| AI/Automation Support | Chatbots, IVR | All segments (for routine queries) | Reduced query resolution time, improved customer satisfaction |

| Branch Network | Face-to-face interaction, Advisory services | All segments (especially those preferring traditional banking) | Maintained extensive branch presence for accessibility |

Channels

Axis Bank's branch network is a cornerstone of its customer engagement strategy, offering a physical presence for a wide range of banking services. As of March 31, 2024, Axis Bank operated 4,994 branches across India, demonstrating its extensive reach. These branches are vital for fostering direct customer relationships, providing personalized advice, and handling intricate financial transactions such as account opening and loan processing.

The physical branches are particularly important for customers who value face-to-face interaction and seek assistance with more complex banking needs. They act as key touchpoints for building trust and ensuring customer satisfaction, especially for services that require detailed explanation or personal guidance. This traditional banking channel complements digital offerings, catering to a diverse customer base with varying preferences.

Axis Bank leverages its extensive network of Automated Teller Machines (ATMs) as a crucial customer-facing channel. These machines facilitate essential self-service transactions such as cash withdrawals, deposits, and balance inquiries, offering customers unparalleled convenience. As of March 31, 2024, Axis Bank operated over 15,000 ATMs, underscoring its commitment to widespread accessibility.

The 24/7 availability of ATMs significantly reduces the reliance on physical branches for routine banking needs, thereby improving operational efficiency for the bank and enhancing customer experience. This constant accessibility is a key driver in meeting the daily transactional demands of a diverse customer base.

Axis Bank's Internet Banking Portal acts as a vital digital storefront, allowing customers to conduct a wide array of banking transactions securely from their computers. This includes managing accounts, facilitating fund transfers, settling bills, and even applying for new banking products, all offering unparalleled convenience and control.

This robust online platform is central to Axis Bank's strategy for customer engagement and operational efficiency. In 2024, the bank reported a significant increase in digital transactions, with a substantial portion of these occurring through its internet banking portal, underscoring its importance as a primary customer touchpoint.

Mobile Banking Application

Axis Bank's mobile banking application serves as a crucial, feature-rich channel, enabling customers to manage accounts, make instant payments, apply for loans, and track investments anytime, anywhere. This digital-first approach caters to the growing demand for convenient, on-the-go banking services.

The app's user-friendly interface and accessibility are key to its role as a primary driver of digital customer engagement for Axis Bank. It reflects the bank's commitment to leveraging technology for enhanced customer experience.

- Digital Transactions: In FY24, Axis Bank reported a significant increase in mobile banking transactions, highlighting the app's central role in customer interactions.

- Customer Adoption: The bank has seen a steady rise in the number of active users on its mobile platform, indicating strong customer preference for digital channels.

- Service Expansion: New features are regularly integrated, such as personalized offers and enhanced security protocols, to maintain the app's competitive edge and utility.

Contact Centers and Customer Support

Axis Bank leverages dedicated contact centers and robust customer support lines, offering assistance through phone, email, and live chat. These channels are crucial for addressing customer queries, handling grievances, and processing service requests efficiently. In 2024, Axis Bank reported a significant increase in digital customer interactions, with its contact centers playing a pivotal role in resolving complex issues that couldn't be handled through self-service platforms.

These support mechanisms are fundamental to the bank's customer-centric approach, ensuring timely help and issue resolution across all touchpoints. They act as a vital support backbone, reinforcing the effectiveness of other service delivery channels by providing a human touch and expert assistance when needed.

- Customer Reach: Axis Bank's contact centers aim to provide accessible support to its vast customer base across India.

- Service Resolution: Focus on quick and effective resolution of customer queries and complaints, enhancing satisfaction.

- Digital Integration: Seamlessly integrate with digital channels to offer a unified customer experience.

- Support for Other Channels: Act as a critical escalation point and support system for online and mobile banking services.

Axis Bank utilizes a multi-channel approach to reach its diverse customer base. This includes its extensive physical branch network, over 15,000 ATMs as of March 31, 2024, and robust digital platforms like Internet Banking and a mobile application. Additionally, dedicated contact centers provide crucial human support. These channels collectively ensure accessibility, convenience, and personalized service for millions of customers.

| Channel | Key Features | Customer Interaction Type | Data Point (as of March 31, 2024) |

|---|---|---|---|

| Branch Network | Full-service banking, personalized advice, complex transactions | Face-to-face, relationship building | 4,994 branches |

| ATMs | Cash withdrawal, deposits, balance inquiry, self-service | Self-service, transactional | Over 15,000 ATMs |

| Internet Banking | Account management, fund transfers, bill payments, product applications | Digital, self-service, transactional | Significant increase in digital transactions |

| Mobile Banking | Account management, payments, loan applications, investments | Digital, mobile-first, on-the-go | High volume of mobile transactions |

| Contact Centers | Query resolution, grievance handling, service requests | Assisted, problem-solving, human interaction | Key role in resolving complex issues |

Customer Segments

Axis Bank's retail customer segment is broad, encompassing individuals from salaried professionals and self-employed individuals to senior citizens and students. This diverse group relies on the bank for essential banking services.

These customers typically seek savings and current accounts for daily transactions, alongside personal, home, and auto loans to finance major life events. Credit cards and basic investment products are also key offerings catering to their financial management and growth needs.

In 2024, Axis Bank continued to serve this vital segment, with retail deposits forming a significant portion of its funding base. For instance, by the end of the fiscal year 2023-24, Axis Bank reported a substantial growth in its retail loan book, reflecting strong demand for its lending products.

Small and Medium Enterprises (SMEs) form a significant customer base for Axis Bank, encompassing businesses of varying sizes and across diverse sectors. These enterprises typically seek a range of financial solutions to manage their day-to-day operations and fuel their growth. In 2023, SMEs accounted for a substantial portion of India's GDP, highlighting their economic importance and the demand for banking services.

Axis Bank caters to these needs by providing essential financial products such as working capital finance, crucial for managing cash flow, and term loans for capital expenditure and expansion. Trade finance solutions are also offered to facilitate international and domestic commerce, alongside specialized business current accounts and efficient payment solutions to streamline transactions.

The bank's strategy involves offering customized packages designed to support the unique requirements of SMEs, from their initial setup to their ambitious expansion plans. As of the first quarter of 2024, Axis Bank reported a robust growth in its SME loan book, reflecting the increasing reliance of these businesses on the bank for their financial infrastructure.

Axis Bank serves large domestic and multinational corporations, public sector undertakings, and financial institutions within its customer segments. These clients have intricate financial requirements, including corporate finance, project finance, treasury operations, investment banking, trade finance, and sophisticated cash management solutions.

In 2023, Axis Bank's corporate loan book saw significant growth, reflecting its commitment to this segment. The bank actively provides specialized advisory services and manages large-scale financial transactions for these high-value clients, aiming to be a strategic partner in their growth and operational efficiency.

Non-Resident Indians (NRIs)

Non-Resident Indians (NRIs) represent a crucial customer base for Axis Bank, comprising Indian citizens living abroad who possess distinct financial requirements. These needs often revolve around specialized NRI accounts, efficient remittance services to transfer funds back to India, and tailored investment avenues within the Indian market. Axis Bank addresses these by offering a suite of products designed to simplify their financial dealings and investment strategies in their home country.

This segment is a significant contributor to Axis Bank's financial health, particularly in terms of bolstering its deposit base and driving foreign exchange inflows. For instance, in the financial year 2023-24, Axis Bank reported substantial growth in its NRI deposits, reflecting the segment's increasing engagement with the bank's offerings.

- NRI Account Offerings: Savings, current, and fixed deposit accounts specifically designed for NRIs, offering competitive interest rates and convenient banking.

- Remittance Services: Facilitating seamless and cost-effective money transfers from overseas to India through various channels.

- Investment Opportunities: Providing access to Indian equity markets, mutual funds, and real estate, along with expert advisory services.

- Wealth Management: Tailored wealth management solutions to help NRIs grow and manage their assets in India.

Wealth Management and High Net Worth Individuals (HNIs)

Axis Bank's Wealth Management and High Net Worth Individuals (HNIs) segment targets affluent clients seeking comprehensive financial solutions. This includes personalized portfolio management, expert investment advice, and meticulous estate planning. As of early 2024, India's HNI population was estimated to be over 700,000 individuals, representing a significant growth opportunity.

The bank provides exclusive banking privileges and dedicated relationship managers who understand the complex needs of these clients. These managers offer bespoke solutions designed for sophisticated financial goals and substantial asset growth. In 2023, the assets under management for wealth management services in India saw robust growth, indicating strong demand.

- Target Audience: Affluent individuals and families with substantial investable assets.

- Services Offered: Portfolio management, investment advisory, estate planning, succession planning, and exclusive banking services.

- Value Proposition: Bespoke solutions, dedicated relationship managers, and access to exclusive financial products and privileges.

- Market Context: Growing HNI population in India, with increasing demand for sophisticated wealth management services.

Axis Bank's customer segments are diverse, ranging from individual retail customers and SMEs to large corporations and Non-Resident Indians (NRIs). Each segment has unique financial needs that the bank aims to fulfill through specialized products and services.

The bank's strategy involves catering to the everyday banking needs of retail customers, providing growth capital and operational finance to SMEs, and offering complex financial solutions to large corporates. For NRIs, the focus is on facilitating remittances and investment opportunities in India.

In 2024, Axis Bank's retail loan book demonstrated strong growth, reflecting continued demand from individuals. Similarly, the SME segment saw increased engagement, with the bank reporting robust growth in its SME loan book in Q1 2024, underscoring their reliance on Axis Bank for financial infrastructure.

| Customer Segment | Key Needs | Axis Bank Offerings | 2023-24 Data Highlight |

|---|---|---|---|

| Retail Individuals | Daily banking, loans, credit cards | Savings/Current Accounts, Personal/Home Loans, Credit Cards | Significant growth in retail loan book |

| SMEs | Working capital, expansion finance | Working Capital Loans, Term Loans, Trade Finance | Robust growth in SME loan book (Q1 2024) |

| Large Corporates | Corporate finance, treasury, investment banking | Project Finance, Treasury Operations, Advisory Services | Significant growth in corporate loan book |

| NRIs | Remittances, India investments | NRI Accounts, Remittance Services, Investment Opportunities | Substantial growth in NRI deposits |

| Wealth Management/HNIs | Portfolio management, wealth growth | Personalized Portfolio Management, Investment Advisory | Growing HNI population in India |

Cost Structure

Employee salaries and benefits represent a substantial cost for Axis Bank, reflecting its extensive network of branches and diverse operational departments. This expense category encompasses base salaries, performance-based bonuses, health insurance, retirement contributions, and other essential benefits for its thousands of employees. For instance, in the fiscal year ending March 31, 2024, Axis Bank reported employee expenses amounting to approximately ₹16,500 crore, highlighting its significant investment in human capital.

Axis Bank's technology and infrastructure expenses are substantial, covering the upkeep and enhancement of its IT systems. This includes significant outlays for software licenses, robust cybersecurity measures to protect customer data, and the operation of data centers and networking infrastructure. In 2024, banks globally, including Axis Bank, continued to invest heavily in digital platform development and cloud services to meet evolving customer expectations and operational efficiency demands.

Axis Bank dedicates significant resources to maintaining its vast network of branches and ATMs. These costs encompass rent, upkeep, utilities, and security for its physical locations, which remain crucial for customer accessibility, particularly for those preferring traditional banking methods. In fiscal year 2024, Axis Bank operated over 4,900 branches and more than 15,000 ATMs across India, underscoring the substantial operational expenditure associated with this physical infrastructure.

Marketing and Advertising Costs

Axis Bank invests significantly in marketing and advertising to build its brand and attract customers. These expenditures cover a wide range of activities, from digital campaigns and social media engagement to traditional advertising and promotional events. In the fiscal year 2023-24, banks, including Axis Bank, have seen increased marketing budgets to counter competition and highlight digital offerings and customer-centric products.

Key areas of spending include:

- Brand Building: Maintaining and enhancing brand perception through consistent messaging and corporate social responsibility initiatives.

- Advertising Campaigns: Running targeted advertisements across television, print, digital, and outdoor media to reach diverse customer segments.

- Customer Acquisition: Costs associated with onboarding new customers, including referral programs and introductory offers.

- Digital Marketing: Investing in SEO, SEM, content marketing, and social media advertising to drive online engagement and lead generation.

Regulatory and Compliance Costs

Axis Bank, like all financial institutions, faces significant regulatory and compliance costs. These expenses are crucial for adhering to the Reserve Bank of India's (RBI) directives and other statutory obligations. For instance, in FY23, Indian banks collectively spent billions on compliance, a figure expected to rise as regulations evolve.

These costs encompass investments in sophisticated compliance software, regular audits, legal counsel, and dedicated personnel to manage these complex requirements. Training staff on evolving regulations is also a substantial ongoing expense, ensuring the bank operates within legal frameworks.

- Compliance Technology: Investments in software for anti-money laundering (AML) and know your customer (KYC) processes.

- Audit and Legal Fees: Costs associated with internal and external audits, plus legal consultations.

- Personnel Costs: Salaries and training for compliance officers and legal teams.

- Reporting and Data Management: Expenses for generating and submitting regulatory reports accurately and on time.

Axis Bank's cost structure is heavily influenced by its operational scale and the nature of financial services. Key expenses include employee compensation, technology investments, maintaining its physical branch network, marketing efforts, and significant outlays for regulatory compliance. These elements collectively form the backbone of its cost base, directly impacting profitability and operational efficiency.

Revenue Streams

Net interest income is the backbone of Axis Bank's revenue generation, stemming directly from its core banking operations. This income is the spread between what the bank earns on its assets, like loans and securities, and what it pays out on its liabilities, such as customer deposits and borrowed funds.

For the financial year 2024, Axis Bank reported a robust net interest income of ₹41,059 crore, a significant increase from ₹30,760 crore in FY23. This growth highlights the bank's expanding lending portfolio and its ability to manage interest rate differentials effectively.

Axis Bank generates significant revenue from fees and commissions, diversifying its income beyond traditional interest. This includes earnings from loan processing, transaction fees, ATM usage, and credit card services. For instance, in the fiscal year ending March 31, 2024, Axis Bank reported a substantial increase in its non-interest income, which is heavily influenced by these fee-based activities.

Further bolstering this revenue stream are commissions from wealth management services, bancassurance partnerships, and trade finance operations. These diverse fee-based incomes contribute to the bank's overall financial stability and resilience. In FY24, the bank's focus on expanding its fee income segments played a crucial role in its robust financial performance.

Axis Bank's treasury income is generated from its active participation in financial markets. This includes profits from trading government securities, managing foreign exchange transactions, and other investment activities. For instance, in the fiscal year ending March 31, 2024, Axis Bank reported a net profit of ₹12,595 crore, with treasury operations contributing to this overall performance through strategic market engagement.

Digital Banking Service Fees

Axis Bank generates revenue from digital banking service fees through various channels. These include charges for premium digital services, online transaction fees, and value-added services available on their digital platforms. As more customers embrace digital banking, these fees are becoming a significant contributor to the bank's overall income.

In the fiscal year 2023-24, Axis Bank reported a substantial increase in its retail digital transactions, indicating a growing reliance on these services. While specific figures for digital service fees are often bundled within broader fee income, the trend clearly shows their increasing importance. For instance, charges for specific digital payment solutions and enhanced online banking features directly translate into revenue.

- Premium Digital Services: Fees for advanced features and personalized digital banking experiences.

- Online Transaction Charges: Nominal fees for certain types of digital payments or fund transfers.

- Value-Added Digital Services: Revenue from specialized online tools, analytics, or advisory services offered digitally.

- Digital Payment Solutions: Charges associated with using proprietary or integrated digital payment gateways and platforms.

Investment Banking and Advisory Fees

Axis Bank generates substantial revenue through its investment banking and advisory services. This includes earning income from advising on mergers and acquisitions, underwriting new equity and debt offerings for corporations, and providing other strategic financial guidance to its large corporate clients.

These fees are often project-based, meaning they are tied to the successful completion of specific transactions. For major deals, these fees can represent a significant portion of the bank's overall income. For instance, in the fiscal year 2024, the Indian investment banking sector saw robust activity, with Axis Bank actively participating in numerous landmark deals, contributing to its fee-based income.

- Mergers and Acquisitions (M&A) Advisory: Fees earned from guiding companies through the process of buying, selling, or merging with other entities.

- Underwriting Services: Income from guaranteeing the sale of new securities (stocks and bonds) issued by corporations to investors.

- Corporate Advisory: Revenue generated from providing strategic financial advice, restructuring services, and capital raising assistance to businesses.

- Project Finance Advisory: Fees for structuring and advising on financing for large infrastructure and industrial projects.

Axis Bank's revenue streams are diverse, encompassing net interest income, fees and commissions, treasury operations, digital banking services, and investment banking. The bank's ability to leverage these varied income sources contributes to its overall financial strength and market position.

Net interest income, derived from lending and deposit activities, remains a primary driver. For FY24, this stood at ₹41,059 crore. Fee and commission income, generated from services like loan processing and wealth management, further diversifies revenue. Treasury operations and investment banking also add significant profit, particularly during periods of active market participation.

| Revenue Stream | FY24 (₹ Crore) | FY23 (₹ Crore) |

|---|---|---|

| Net Interest Income | 41,059 | 30,760 |

| Fee and Commission Income | (Significant increase reported) | (Previous year data available) |

| Treasury Operations | (Contributed to net profit) | (Previous year data available) |

Business Model Canvas Data Sources

The Axis Bank Business Model Canvas is meticulously crafted using a blend of internal financial statements, customer transaction data, and regulatory filings. This ensures a robust understanding of operational performance and financial health.