Axis Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Bank Bundle

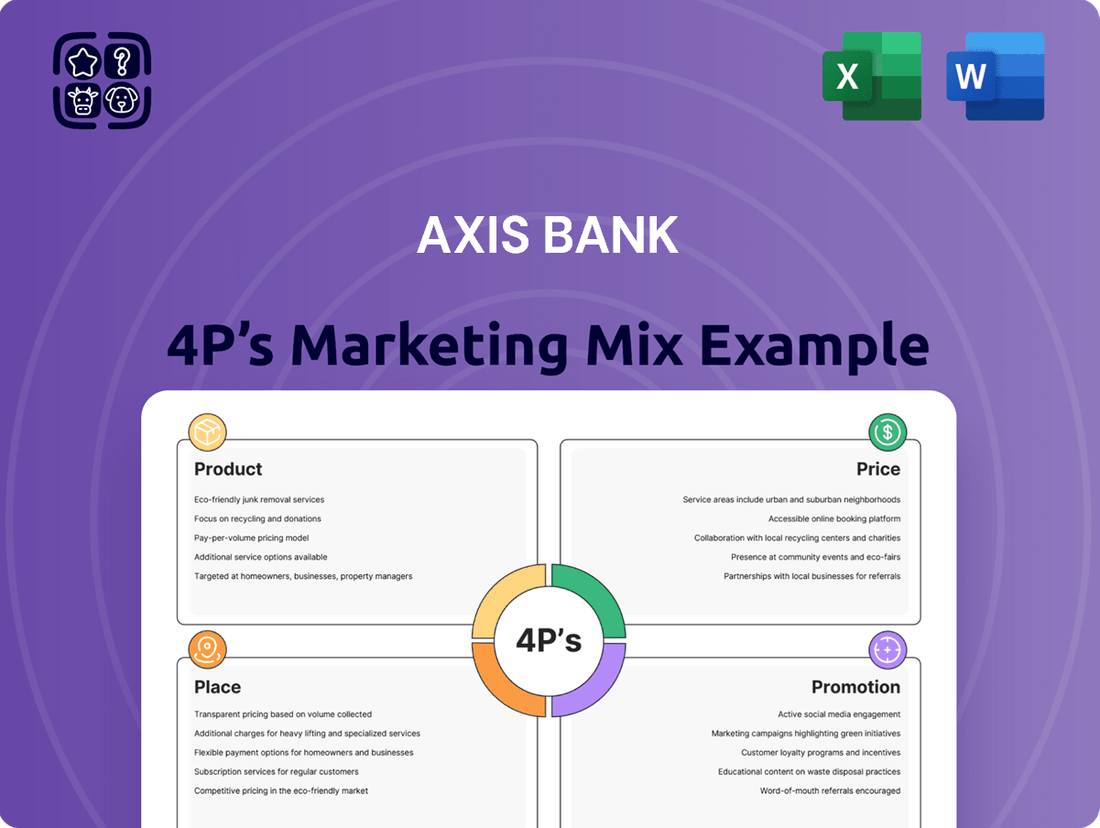

Axis Bank's marketing strategy is a masterclass in how to leverage the 4Ps for customer acquisition and retention. From its diverse product portfolio to its competitive pricing, expansive distribution network, and impactful promotional campaigns, the bank has carved a significant niche in the Indian financial landscape.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Axis Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights to understand and replicate success.

Product

Axis Bank's product strategy is built around a diverse financial portfolio, ensuring it meets the needs of a broad customer base. This includes everything from basic savings and current accounts to a wide array of loans, credit cards, and investment options for individual customers.

For businesses, Axis Bank offers tailored solutions, including working capital finance, trade finance, and treasury services, supporting everything from small enterprises to large corporations. This comprehensive approach ensures that clients can find all their financial needs met under one roof.

By Q1 FY2025, Axis Bank reported a robust net profit of ₹7,726 crore, reflecting the success of its diversified product offerings and strong customer engagement across all segments.

Axis Bank's commitment to a digital-first approach is evident in its product strategy, focusing on innovative solutions that streamline banking. The introduction of UPI-ATM, allowing cardless cash withdrawals and deposits, exemplifies this, with UPI transactions in India reaching over 12 billion in the first half of 2024 alone.

Furthermore, services like 'Bharat Connect for Business' cater to B2B collections, reflecting a targeted digital offering for commercial clients. This digital push is designed to boost customer satisfaction and operational efficiency, as seen in the rapid onboarding for online accounts and the seamless integration of instant digital payments.

Axis Bank's Product strategy in lending is comprehensive, offering everything from personal loans up to ₹40 lakhs with competitive rates to mortgages and business financing. This diverse portfolio ensures they cater to a broad customer base, from individuals seeking personal credit to businesses requiring capital. Their focus on swift processing and reduced paperwork streamlines the borrowing experience.

The bank's commitment extends to financial inclusion through specialized agricultural and rural lending initiatives. This demonstrates a strategic approach to serving underserved markets, further broadening their product reach. By offering tailored solutions for various segments, Axis Bank solidifies its position as a full-service financial provider.

Wealth Management and Investment Offerings

Axis Bank's wealth management and investment offerings, primarily through its Burgundy Private segment, are designed to cater to affluent clients with personalized strategies. This focus extends to expanding its reach into Tier 2 cities, acknowledging the growing wealth base in these areas. As of early 2024, Burgundy Private has been actively increasing its presence, aiming to capture a larger share of this demographic.

The product suite is comprehensive, encompassing a wide array of investment avenues. This includes traditional options like mutual funds and bonds, alongside more sophisticated products such as alternate investment funds and insurance solutions. This diverse offering allows clients to build a well-rounded portfolio tailored to their specific risk appetite and financial goals. For instance, Burgundy Private has seen significant inflows into its curated alternative investment fund offerings in the last fiscal year.

Leveraging advanced technology and deep market expertise, Axis Bank provides personalized investment advice. This approach ensures that clients receive strategies aligned with their unique financial circumstances and aspirations. The bank's commitment to digital integration further enhances the client experience, offering seamless access to information and advisory services, which is crucial for the modern affluent investor.

- Targeted Expansion: Burgundy Private is actively expanding into Tier 2 cities, recognizing the significant wealth creation occurring in these regions.

- Diverse Product Portfolio: Offerings include mutual funds, bonds, alternate investment funds, and insurance, providing a holistic investment solution.

- Personalized Strategies: The bank utilizes its expertise and technology to create bespoke investment plans for affluent clients.

- Technology Integration: Digital platforms are employed to enhance client experience and provide seamless access to wealth management services.

Integrated Corporate and Treasury Services

Axis Bank's Integrated Corporate and Treasury Services cater to large and mid-corporates by offering a comprehensive suite of financial solutions. This product, under the 'Product' element of the 4Ps, bundles essential banking needs into a single offering.

The bank's commitment to providing a holistic banking experience is evident in its diverse service portfolio. These services include:

- Corporate Accounts and Loans: Facilitating day-to-day transactions and providing crucial funding for business growth.

- Capital Market Services: Assisting companies in raising capital through equity and debt markets.

- Trade and Forex: Supporting international trade transactions and managing foreign exchange exposures.

- Treasury Operations: Engaging in foreign exchange and derivatives trading to manage financial risks and optimize liquidity.

In the fiscal year 2023-24, Axis Bank reported significant growth in its corporate loan book, which stood at approximately INR 3.65 trillion, demonstrating strong client engagement with these integrated services.

Axis Bank's product strategy is a cornerstone of its market presence, encompassing a wide spectrum of financial solutions for individuals, businesses, and affluent clients. This diversified product suite, ranging from digital payment innovations like UPI-ATM to specialized wealth management services through Burgundy Private, aims to cater to every financial need.

The bank's product offerings are continuously enhanced by a digital-first approach, exemplified by streamlined online account opening and cardless cash withdrawals, aligning with India's rapidly growing digital payment ecosystem. By Q1 FY2025, Axis Bank's net profit reached ₹7,726 crore, underscoring the success and broad appeal of its comprehensive product portfolio.

| Product Category | Key Offerings | Target Segment | FY24 Performance Indicator |

|---|---|---|---|

| Retail Banking | Savings Accounts, Loans, Credit Cards, Investments | Individuals | Strong growth in retail deposits |

| Corporate Banking | Working Capital, Trade Finance, Treasury Services | SMEs to Large Corporations | Corporate loan book ~INR 3.65 trillion |

| Wealth Management | Mutual Funds, Alternate Investments, Insurance | Affluent Clients (Burgundy Private) | Expansion into Tier 2 cities |

| Digital Banking | UPI-ATM, Digital Account Opening | All Segments | Supports over 12 billion UPI transactions (H1 2024) |

What is included in the product

This analysis offers a comprehensive breakdown of Axis Bank's marketing strategies across Product, Price, Place, and Promotion, detailing their approach to product innovation, competitive pricing, distribution channels, and communication efforts.

It provides a deep dive into Axis Bank's marketing positioning, grounded in actual brand practices and competitive context, making it ideal for professionals needing to understand their market strategy.

Simplifies Axis Bank's marketing strategy by clearly outlining how Product, Price, Place, and Promotion address customer pain points, providing a quick understanding of their customer-centric approach.

Place

Axis Bank's extensive branch network is a cornerstone of its physical presence, aiming to reach a broad customer base. As of the second quarter of fiscal year 2025, the bank boasts 5,577 branches, demonstrating a significant physical footprint across India.

This expansive network is further bolstered by a strategic focus on expanding into semi-urban and rural areas, making banking services more accessible. The bank has outlined plans to add between 400 to 500 new branches each year, underscoring its commitment to physical accessibility and customer convenience.

Axis Bank's 'Bharat Banking' strategy is key to its expansion in rural and semi-urban areas, offering customized financial products. This approach focuses on an asset-led liability model, driving growth by establishing a strong presence in underserved regions.

The bank is strategically increasing its branch network in these locations, aiming to make banking services more accessible. As of the fiscal year ending March 31, 2024, Axis Bank reported a significant increase in its rural and semi-urban customer base, reflecting the success of this outreach.

Axis Bank prioritizes robust digital channels, making banking accessible through its 'Open by Axis Bank' mobile app, internet banking, and WhatsApp services. This allows customers to easily manage accounts and conduct transactions anytime, anywhere.

The bank is committed to a seamless 'phygital' experience, blending physical and digital interactions. As of early 2024, Axis Bank reported over 20 million active mobile banking users, with digital channels handling a significant portion of its retail transactions, demonstrating strong customer adoption.

International Presence

Axis Bank's international footprint extends beyond India, with key offices in Singapore, Dubai (DIFC), and GIFT City. This strategic presence is complemented by representative offices in the UAE, including Abu Dhabi, Dubai, and Sharjah, as well as in Dhaka, Bangladesh. These locations are crucial for facilitating global banking services.

These international operations are designed to cater to the specific needs of global Indian businesses and Non-Resident Indians (NRIs). By establishing these touchpoints, Axis Bank aims to offer integrated and efficient cross-border financial solutions, ensuring a seamless banking experience for its international clientele.

- Global Network: Offices in Singapore, Dubai (DIFC), GIFT City.

- Representative Offices: UAE (Abu Dhabi, Dubai, Sharjah), Bangladesh (Dhaka).

- Target Clientele: Global Indian businesses and NRIs.

- Service Offering: Seamless, borderless banking solutions.

Omnichannel Customer Access

Axis Bank's omnichannel customer access strategy ensures seamless interaction across various touchpoints. This approach integrates its extensive network of over 4,900 branches and 15,000 ATMs with advanced digital channels, including its mobile banking app and internet banking services. This allows customers to manage their finances, apply for loans, and access customer support through their preferred channel, fostering convenience and engagement.

The bank's digital transformation efforts have significantly boosted its online and mobile presence. As of Q3 FY24, Axis Bank reported approximately 21.7 million mobile banking users and over 10.8 million internet banking users, highlighting the growing preference for digital channels. This multi-pronged approach caters to diverse customer needs, offering a consistent and responsive banking experience.

- Digital Dominance: Over 21.7 million mobile banking users as of Q3 FY24.

- Branch Network: A physical presence of more than 4,900 branches nationwide.

- ATM Accessibility: A widespread network of over 15,000 ATMs for easy cash access.

- Integrated Service: Seamless transition between physical and digital platforms for a unified customer journey.

Axis Bank's place strategy centers on a robust, multi-channel approach, blending an extensive physical network with strong digital offerings. The bank's commitment to accessibility is evident in its expanding branch presence, particularly in semi-urban and rural areas through its 'Bharat Banking' initiative.

This physical expansion is complemented by a significant digital push, offering customers convenient access through mobile banking, internet banking, and WhatsApp. This 'phygital' strategy ensures customers can engage with Axis Bank through their preferred channel, whether in person or online.

The bank also maintains a strategic international presence to serve global Indian businesses and NRIs, further broadening its reach and accessibility across different geographies.

| Channel | Key Data Point | Metric/Status |

|---|---|---|

| Branches | Total Branches (Q2 FY25) | 5,577 |

| Branch Expansion | Annual New Branches Planned | 400-500 |

| Digital - Mobile | Active Mobile Banking Users (Early 2024) | Over 20 million |

| Digital - Internet | Active Internet Banking Users (Q3 FY24) | Over 10.8 million |

| International Presence | Key International Offices | Singapore, Dubai (DIFC), GIFT City |

Preview the Actual Deliverable

Axis Bank 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished Axis Bank 4P's Marketing Mix analysis you’ll own. You'll receive this comprehensive document instantly after purchase, ready for immediate application. Gain clear insights into Axis Bank's strategies for Product, Price, Place, and Promotion without any surprises.

Promotion

Axis Bank's promotional strategy, centered on the 'Dil Se Open' philosophy, prioritizes building genuine relationships with customers by emphasizing a human-centric and empathetic approach to banking. This philosophy moves beyond mere transactional interactions to foster deeper connections.

The recent campaign, 'har raah dil se open,' introduced in December 2024, specifically honors the commitment of Axis Bank's extensive workforce of over 100,000 bankers. This initiative underscores the bank's core values of warmth, empathy, and openness.

The Targeted Campaign Films, a key component of Axis Bank's promotion strategy, directly address diverse customer needs. The 'har raah dil se open' initiative launched five films, each tailored to specific segments like salaried individuals, senior citizens, entrepreneurs, high-net-worth clients, and customers in rural India. This approach ensures resonant messaging.

These films highlight the dedication of Axis Bank employees in supporting a wide array of financial requirements and ambitions. By showcasing this commitment across the bank's broad network, Axis Bank aims to build trust and foster deeper customer relationships, aligning with its customer-centric approach.

Axis Bank leverages a fully integrated marketing communications strategy, utilizing television, digital, social media, print, and out-of-home advertising to reach its broad customer base. This ensures consistent messaging about its value propositions and competitive advantages.

In 2024, Axis Bank's digital advertising spend saw a significant increase, reflecting a strategic shift towards online channels to engage with a younger demographic. This investment aims to enhance brand recall and drive customer acquisition through targeted campaigns.

Emphasis on Human Connection in Digital Age

Axis Bank's promotional strategy in the digital age emphasizes the enduring importance of human connection. While rapidly adopting new technologies, their campaigns spotlight how dedicated employees are the true differentiator, ensuring exceptional customer experiences. This focus on personal service sets them apart in a crowded banking sector.

Their marketing clearly communicates that technology is a tool to enhance, not replace, the human element. This approach resonates with customers who value trust and personalized support. In 2024, Axis Bank continued to invest in training its staff to provide this high-touch service, even as digital channels expanded.

- Employee-Centric Campaigns: Promotions often feature real Axis Bank employees, showcasing their commitment and expertise.

- Bridging Digital and Human: Campaigns illustrate how digital tools empower employees to offer more personalized advice and support.

- Customer Testimonials: Highlighting positive interactions with bank staff reinforces the message of human connection.

- Service Differentiation: This focus on people provides a tangible advantage against competitors solely emphasizing digital convenience.

Brand Repositioning and Digital Focus

Axis Bank's promotional efforts are increasingly focused on its digital transformation, aiming to reposition the brand as a digital-first entity. This is exemplified by initiatives like the 'Open by Axis Bank' mobile app, designed to offer a seamless and enjoyable digital banking experience.

These campaigns highlight the convenience of digital banking, with the goal of liberating customers from traditional banking friction. This strategic shift directly addresses the growing customer demand for accessible and efficient digital financial services.

- Digital Adoption: Axis Bank reported a significant increase in digital transactions, with over 90% of savings account transactions conducted digitally by the end of FY24.

- Mobile App Engagement: The 'Open by Axis Bank' app saw a 35% year-on-year growth in active users in early 2025, reflecting strong customer adoption.

- Brand Perception: A Q1 2025 survey indicated a 15% improvement in customer perception of Axis Bank as an innovative and digitally advanced bank.

- Customer Convenience: Promotions emphasize time savings, with digital channels allowing customers to complete tasks up to 50% faster compared to branch visits.

Axis Bank's promotional strategy masterfully blends its 'Dil Se Open' ethos with a robust digital push. By highlighting employee dedication through campaigns like 'har raah dil se open' (launched December 2024), they reinforce human connection, a key differentiator. This is complemented by a significant increase in digital advertising spend in 2024, targeting younger demographics and promoting seamless experiences via their 'Open by Axis Bank' app.

The bank's integrated marketing approach spans traditional and digital channels, ensuring consistent messaging. Their campaigns emphasize technology as an enabler for personalized service, a strategy supported by staff training to deliver high-touch experiences. This focus on bridging digital convenience with human empathy is central to their promotional efforts, aiming to build trust and deepen customer relationships.

Axis Bank's promotional focus on digital transformation is evident in the 'Open by Axis Bank' app's success, with a 35% year-on-year growth in active users by early 2025. This digital shift aims to enhance customer convenience, as demonstrated by over 90% of savings account transactions being digital by the end of FY24. A Q1 2025 survey also showed a 15% improvement in the perception of Axis Bank as innovative and digitally advanced.

| Promotional Focus | Key Initiatives/Campaigns | Data/Evidence (2024-2025) |

|---|---|---|

| Human Connection & Empathy | 'Dil Se Open' philosophy, 'har raah dil se open' campaign (Dec 2024) | Campaigns feature real employees, highlighting commitment and expertise. |

| Digital Transformation & Convenience | 'Open by Axis Bank' mobile app, increased digital advertising spend (2024) | 35% YoY growth in app active users (early 2025); >90% savings account transactions digital (FY24 end). |

| Integrated Marketing Communications | TV, digital, social media, print, OOH advertising | 15% improvement in perception as innovative/digital (Q1 2025 survey). |

Price

Axis Bank strategically prices its loan products, offering competitive interest rates on personal loans starting from 9.99% as of August 2025. This competitive pricing is a key element of their marketing mix, aiming to attract a broad customer base.

These attractive rates are directly linked to the bank's Marginal Cost of Funds based Lending Rate (MCLR). This dynamic pricing model ensures that Axis Bank's offerings remain appealing in the ever-changing financial landscape.

The specific interest rate a customer receives can vary. Factors such as the loan amount requested, the individual's financial profile, and their existing relationship with Axis Bank all play a role in determining the final rate.

Axis Bank has updated its ATM transaction fees, with new charges taking effect from July 1, 2025. This adjustment sees an increase in fees for financial transactions that exceed the complimentary limit at both Axis Bank and other banks' ATMs. The new fee is set at ₹23 per transaction, a rise from the previous ₹21.

These revised charges apply to a broad range of account types, including savings accounts, Non-Resident Indian (NRI) accounts, and Trust Accounts. This move by Axis Bank is in line with the Reserve Bank of India's (RBI) guidelines concerning ATM usage fees.

Axis Bank's credit card fee adjustments, effective December 20, 2024, reflect a strategic move to optimize revenue streams. New redemption fees for EDGE Rewards and Miles, alongside an increased monthly interest rate of 3.75%, directly impact customer loyalty programs and borrowing costs.

Further revenue enhancement comes from introduced or revised charges for services like auto debit reversals, cash payments at branches, and specific transaction categories including wallet loads, fuel, utility, gaming, rental, and educational payments.

Account Maintenance Charges

Axis Bank implements account maintenance charges as part of its pricing strategy. These fees are designed to incentivize customers to maintain minimum average balances in their savings accounts. For instance, effective April 1, 2024, specific charges apply for non-maintenance of these balances, with the exact amounts varying based on the account type and the shortfall.

Furthermore, Axis Bank levies charges on accounts closed within a specific early period after opening. This policy, which typically applies to closures between 14 days and one year of account inception, aims to offset administrative costs associated with account setup and early termination.

- Minimum Average Balance Charges: Fees are applied if the stipulated minimum average balance is not maintained, encouraging consistent account activity.

- Early Closure Fees: A penalty is imposed for closing an account within the first year, specifically between 14 days and 12 months of opening.

- Revenue Generation: These charges contribute to the bank's non-interest income, supporting operational costs and profitability.

- Customer Behavior Influence: The fee structure guides customer banking habits towards maintaining active and sufficiently funded accounts.

Transparent Fee Structures and Policies

Axis Bank is committed to transparent fee structures, offering clear breakdowns of charges for all its banking products and services. This transparency builds trust and helps customers make informed decisions about their finances.

The bank ensures customers are well-informed about any potential changes to interest rates, transaction fees, or other service charges through proactive communication channels. For instance, as of early 2024, Axis Bank maintained competitive savings account interest rates, with tiered structures clearly outlined on their website, ranging up to 3.50% for balances above ₹50 Lakh.

- Clear Fee Disclosures: All fees, from ATM withdrawals to account maintenance, are readily accessible on the Axis Bank website and mobile app.

- Competitive Interest Rates: In the first quarter of 2024, Axis Bank's retail lending rates remained competitive, reflecting market conditions and the bank's strategic pricing.

- Value-Based Pricing: Pricing strategies are designed to align with the perceived value of services, ensuring fairness for customers while considering operational costs and market dynamics.

- Proactive Communication: Customers receive timely notifications regarding any adjustments to fees or interest rates, fostering a sense of reliability.

Axis Bank's pricing strategy is multifaceted, balancing competitive product rates with revenue generation through various fees. For instance, personal loan interest rates began at a competitive 9.99% in August 2025, directly influenced by their MCLR. Simultaneously, ATM transaction fees were adjusted to ₹23 per transaction from July 1, 2025, impacting both Axis Bank and other bank ATM usage.

Credit card fees also saw adjustments by December 20, 2024, including new redemption fees and a 3.75% monthly interest rate. Account maintenance charges, introduced from April 1, 2024, incentivize maintaining minimum average balances, with penalties for shortfalls. Early closure fees, typically between 14 days and 12 months, cover administrative costs.

| Service/Product | Pricing Detail | Effective Date |

|---|---|---|

| Personal Loans | Starting interest rate from 9.99% | August 2025 |

| ATM Transactions (Exceeding Limit) | ₹23 per transaction | July 1, 2025 |

| Credit Card Interest Rate | 3.75% monthly | December 20, 2024 |

| Savings Account Maintenance | Charges for non-maintenance of minimum average balance | April 1, 2024 |

| Account Closure | Fees for closure between 14 days and 12 months | Ongoing |

4P's Marketing Mix Analysis Data Sources

Our Axis Bank 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence. This ensures a data-driven understanding of Axis Bank's product offerings, pricing strategies, distribution networks, and promotional activities.