Axis Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Bank Bundle

Explore how Axis Bank's diverse product portfolio aligns with the BCG Matrix, identifying potential Stars, Cash Cows, Dogs, and Question Marks. Understand the strategic implications of each quadrant for the bank's growth and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize Axis Bank's market position and future investments.

Stars

Axis Bank is a dominant force in digital payments, holding a significant 32% market share in the UPI Payer PSP segment as of Q4FY25. This strong position is bolstered by its substantial 19% terminal market share in the merchant acquiring business, indicating robust adoption by businesses.

The digital payments and merchant acquiring sector presents a high-growth avenue for Axis Bank, fueled by India's burgeoning digital economy. Initiatives like the 'neo for merchants' platform and UPIATM are designed to capture this growth, supported by the bank's highly-rated mobile app, 'Open by Axis Bank', which boasts a large and active user base.

Axis Bank's Burgundy Private wealth management is a shining star, boasting a remarkable 33% year-on-year surge in Assets Under Management (AUM), reaching close to ₹2.07 trillion. This impressive growth is fueled by a strategic push into 15 new Tier 2 cities, expanding its footprint to 42 locations nationwide.

This expansion directly targets the burgeoning affluent population outside of major metropolitan areas, a demographic increasingly focused on wealth creation. Burgundy Private's aggressive outreach into these emerging geographies positions it for sustained high growth, solidifying its status as a key star product within the Axis Bank portfolio.

Axis Bank's Small Business Banking (SBB) and Mid-Corporate (MC) segments are demonstrating strong momentum. In Q4FY25, SBB loans saw a healthy 17% year-on-year increase, while the Mid-Corporate book grew by 10% year-on-year.

These combined segments, including SME lending, now represent a substantial 22.71% of Axis Bank's total loan portfolio. This marks a significant expansion, up by approximately 740 basis points over the past four years, underscoring the bank's strategic focus and success in this area.

Axis Bank is effectively capturing market share in this high-growth segment by deploying its specialized knowledge and digital advancements to cater to the needs of Indian businesses, from micro, small, and medium enterprises (MSMEs) to larger corporations.

Digital Transformation Initiatives

Axis Bank is a leader in India's digital banking transformation, aiming to be the top digital-first bank. Its strategy involves significant investment in advanced technologies like AI for customer service and blockchain for trade finance. These efforts are key to improving customer experience and operational efficiency, which will help capture more market share.

- Digital Focus: Axis Bank's strategic goal is to become India's leading digital-first bank.

- Technology Investment: The bank is investing in AI-powered virtual relationship managers and blockchain for trade finance.

- Market Position: These initiatives are designed to enhance customer experience and operational efficiency, driving future market share.

- Growth Potential: Axis Bank's commitment to technology positions it for high growth in a rapidly evolving digital market.

Subsidiary Performance (Axis Securities, Axis AMC)

Axis Securities and Axis Asset Management Company (AMC) are shining stars within Axis Bank's portfolio. In FY25, Axis Securities saw its Profit After Tax (PAT) surge by an impressive 39% year-on-year.

Axis AMC also demonstrated robust growth, with its PAT climbing 21% year-on-year during the same period. These strong performances from key domestic subsidiaries underscore their significant contribution to the bank's overall profitability.

- Axis Securities PAT Growth (FY25): 39% year-on-year

- Axis AMC PAT Growth (FY25): 21% year-on-year

- Total Domestic Subsidiaries PAT Growth (FY25): 11% year-on-year

- Return on Investments for Subsidiaries: Approximately 46%

Axis Bank's digital payments and merchant acquiring businesses are clear stars, driven by India's digital surge. The bank holds a substantial 32% market share in the UPI Payer PSP segment as of Q4FY25, complemented by a 19% terminal market share in merchant acquiring.

The Burgundy Private wealth management segment is another star performer, achieving a 33% year-on-year increase in Assets Under Management (AUM), reaching nearly ₹2.07 trillion. This growth is propelled by strategic expansion into 15 new Tier 2 cities.

Axis Securities and Axis Asset Management Company (AMC) are also stars, with FY25 PAT growth of 39% and 21% respectively. These subsidiaries are crucial contributors to the bank's overall financial strength.

| Business Segment | Key Metric | FY25 Performance | Market Position |

|---|---|---|---|

| Digital Payments (UPI PSP) | Market Share | 32% (Q4FY25) | Leading |

| Merchant Acquiring | Terminal Market Share | 19% (Q4FY25) | Strong |

| Burgundy Private Wealth Management | AUM Growth | 33% YoY | High Growth |

| Axis Securities | PAT Growth | 39% YoY | Strong Contributor |

| Axis AMC | PAT Growth | 21% YoY | Strong Contributor |

What is included in the product

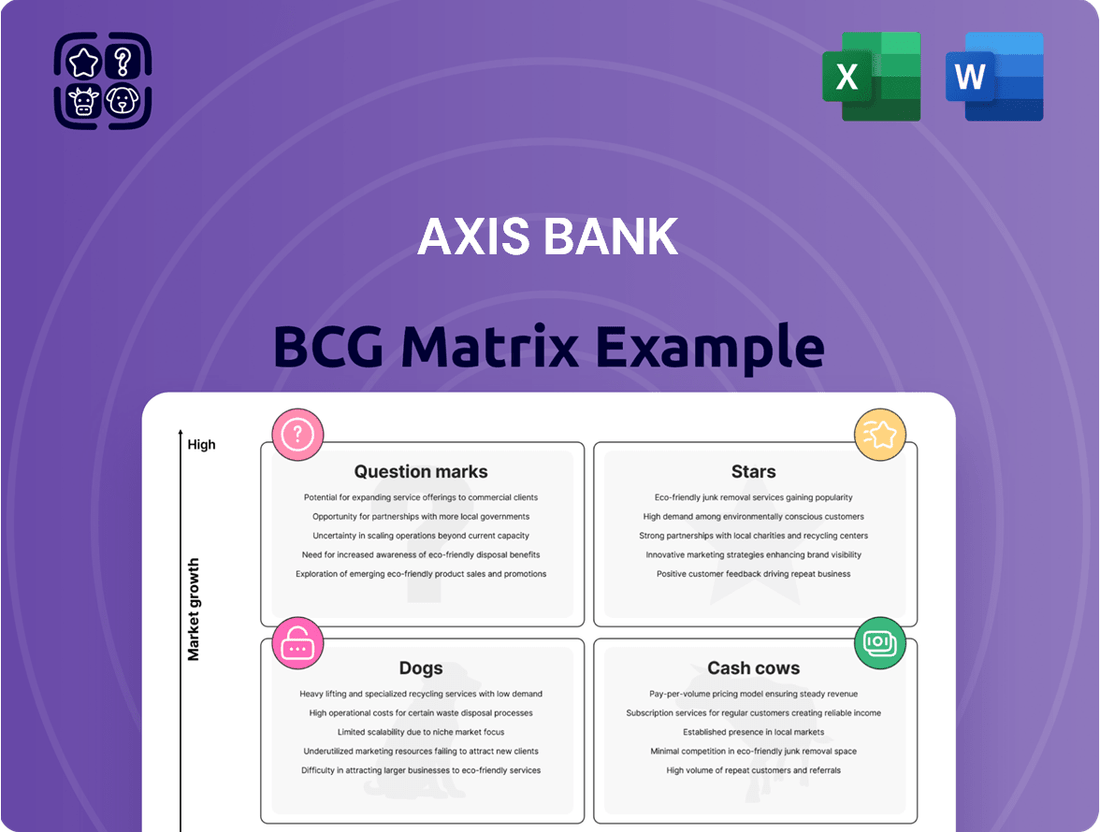

Axis Bank's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

A clear Axis Bank BCG Matrix overview helps prioritize resources, alleviating the pain of inefficient allocation.

Cash Cows

Axis Bank's retail deposits, particularly its Current Account and Savings Account (CASA) base, represent a significant Cash Cow. In FY25, month-end balance total deposits saw a 10% year-on-year increase, reaching ₹12.05 lakh crore, while quarterly average balance total deposits grew 9% year-on-year to ₹11.78 lakh crore.

The CASA ratio, a crucial metric for low-cost funding, remained robust at 41% on a month-end balance basis and 38% on a quarterly average balance basis as of March 31, 2025. This consistent and cost-effective funding source underpins the bank's profitability, allowing for stable net interest margins even in a competitive, mature banking landscape.

Axis Bank's core corporate banking services are a powerhouse, consistently generating significant cash flow by catering to large Indian corporations. This segment thrives on deep domain expertise and robust transaction banking, which naturally boosts current account balances.

The bank's established client relationships and substantial market share in this mature segment ensure steady, reliable cash generation. For instance, in FY24, Axis Bank's corporate loan book saw robust growth, reflecting the continued demand for its services.

Axis Bank's established credit card business is a clear cash cow. Despite a competitive landscape, the bank commands a significant 14% market share, making it the fourth-largest credit card issuer in India as of April 2025. This strong position is partly due to the strategic acquisition of Citibank's consumer banking operations in 2023, which significantly expanded its credit card customer base and offerings.

The financial performance of this segment underscores its cash cow status. In May 2025, Axis Bank saw its credit card spending reach an impressive ₹22,455 crore. This high volume translates into robust fee income and consistent interest revenue, demonstrating the segment's ability to generate substantial profits from a mature yet steadily growing market.

Treasury Operations

Axis Bank's treasury operations, a vital component of its financial strategy, include foreign exchange, derivatives trading, and equity and mutual fund management. These activities consistently contribute a substantial portion to the bank's gross income, underscoring their importance as a stable revenue generator. For instance, in the fiscal year ending March 31, 2024, Axis Bank reported a net profit of ₹44,022 crore, with treasury income playing a significant role in this performance.

While not characterized by rapid expansion, these treasury functions leverage Axis Bank's substantial balance sheet and established market position. This allows them to generate consistent and predictable income streams, effectively acting as a reliable cash cow. The efficient management of these diverse treasury activities ensures a steady flow of profits, bolstering the bank's overall financial health.

- Foreign Exchange: Facilitating currency transactions for clients and proprietary trading.

- Derivatives Trading: Managing risk and generating income through various derivative instruments.

- Equity and Mutual Funds: Investment and trading activities in capital markets.

- Contribution to Gross Income: Treasury operations consistently form a significant part of Axis Bank's overall revenue.

Branch Banking Network

Axis Bank's extensive branch banking network, boasting over 4,900 branches and more than 15,000 ATMs as of early 2024, solidifies its position as a significant player in India's financial landscape. This vast physical footprint is a key differentiator, enabling broad customer reach and substantial deposit mobilization, especially in underserved regions.

This established network acts as a reliable generator of consistent business, underpinning Axis Bank's operations and customer engagement. Even as digital transformation accelerates, the enduring strength of this physical infrastructure continues to provide a stable revenue stream, characteristic of a cash cow within the BCG matrix.

- Extensive Reach: Over 4,900 branches and 15,000+ ATMs nationwide.

- Deposit Mobilization: Crucial for attracting and retaining customer deposits.

- Customer Acquisition: Facilitates access and service, particularly in semi-urban and rural areas.

- Stable Revenue: Generates consistent business and supports overall bank operations.

Axis Bank's retail deposits, particularly its Current Account and Savings Account (CASA) base, represent a significant Cash Cow. In FY25, month-end balance total deposits saw a 10% year-on-year increase, reaching ₹12.05 lakh crore, while quarterly average balance total deposits grew 9% year-on-year to ₹11.78 lakh crore. The CASA ratio, a crucial metric for low-cost funding, remained robust at 41% on a month-end balance basis and 38% on a quarterly average balance basis as of March 31, 2025. This consistent and cost-effective funding source underpins the bank's profitability, allowing for stable net interest margins even in a competitive, mature banking landscape.

Axis Bank's established credit card business is a clear cash cow. Despite a competitive landscape, the bank commands a significant 14% market share, making it the fourth-largest credit card issuer in India as of April 2025. In May 2025, Axis Bank saw its credit card spending reach an impressive ₹22,455 crore. This high volume translates into robust fee income and consistent interest revenue, demonstrating the segment's ability to generate substantial profits from a mature yet steadily growing market.

Axis Bank's treasury operations, including foreign exchange and derivatives trading, consistently contribute a substantial portion to its gross income. For instance, in the fiscal year ending March 31, 2024, Axis Bank reported a net profit of ₹44,022 crore, with treasury income playing a significant role. These functions leverage the bank's substantial balance sheet and market position to generate consistent and predictable income streams.

The bank's extensive branch banking network, boasting over 4,900 branches and more than 15,000 ATMs as of early 2024, acts as a reliable generator of consistent business. This vast physical footprint enables broad customer reach and substantial deposit mobilization, providing a stable revenue stream characteristic of a cash cow.

| Segment | Description | FY24/FY25 Data Points | BCG Status |

|---|---|---|---|

| Retail Deposits (CASA) | Low-cost funding source | ₹12.05 lakh crore (month-end deposits FY25), 41% CASA ratio (Mar 2025) | Cash Cow |

| Credit Cards | High transaction volume, fee income | 14% market share (Apr 2025), ₹22,455 crore spending (May 2025) | Cash Cow |

| Treasury Operations | Forex, derivatives, investments | Contributed significantly to ₹44,022 crore net profit (FY24) | Cash Cow |

| Branch Banking Network | Customer reach and deposit mobilization | 4,900+ branches, 15,000+ ATMs (early 2024) | Cash Cow |

Preview = Final Product

Axis Bank BCG Matrix

The Axis Bank BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, contains no watermarks or demo content, ensuring you get a professional, ready-to-use report for immediate application in your business planning.

Dogs

Axis Bank's gross non-performing assets (NPAs) saw an uptick, reaching 1.57% by June 2025, a rise from 1.28% in March 2025, with net NPAs climbing to 0.45%. This shift is largely due to a technical adjustment in how certain cash credit, overdrafts, and settled accounts are classified, rather than a fundamental weakening of loan quality.

While Axis Bank clarifies this does not signal a true deterioration in its loan book, these 'technically' impacted NPAs still demand management attention and can tie up capital. Such assets can be considered temporary 'dogs' within the BCG framework, requiring focused strategies for resolution to free up resources and protect profitability.

While Axis Bank's overall loan book showed growth, certain traditional loan segments, especially those with a history of higher defaults, are showing signs of becoming 'dogs' within the BCG matrix. These are areas that require careful management to avoid becoming a drag on the bank's performance.

The bank's Gross Non-Performing Assets (GNPA) saw an uptick, partly due to technical reclassifications. This suggests that specific products like cash credit and overdraft facilities might be experiencing underlying stress, indicating potential issues within these legacy segments.

For instance, in the fiscal year ending March 31, 2024, Axis Bank reported a GNPA ratio of 1.58%. While this is a relatively low figure, the increase from the previous year, coupled with the mention of specific product types, points to the need for proactive strategies in these areas.

To prevent these underperforming segments from persistently impacting profitability and diverting valuable resources, Axis Bank must implement robust monitoring systems and efficient recovery processes. This proactive approach is key to revitalizing these loan categories or mitigating their negative effects.

Certain legacy IT systems within Axis Bank, despite the bank's strong digital push, can be categorized as 'dogs' in a BCG matrix framework. These systems, while functional, are likely characterized by low market share in terms of their contribution to new revenue streams or customer acquisition, coupled with low growth prospects for their underlying technology. For instance, older core banking modules or payment processing infrastructure that haven't been fully integrated with newer, agile platforms might fall into this category.

These legacy systems often represent a drain on resources, requiring continuous maintenance and support without offering a significant competitive edge. In 2024, banks globally, including Axis Bank, are increasingly scrutinizing such IT assets. The cost of maintaining these older systems can be substantial, diverting capital that could otherwise be invested in developing cutting-edge digital services or enhancing customer experience through AI and cloud-based solutions. Their low efficiency and limited scalability make them prime candidates for strategic review, potentially leading to phased modernization or complete divestment.

Low-Margin, Highly Commoditized Basic Banking Products

Basic banking products like savings accounts and standard checking accounts, which are highly commoditized and face intense competition, can be considered 'dogs' within Axis Bank's portfolio. These offerings, while essential for a universal bank's customer base, often yield very thin margins and contribute little to overall profitability or significant market share expansion. For instance, in 2024, the average net interest margin for Indian banks hovered around 3.1%, a figure often pressured by the low-yield nature of these basic deposit accounts.

Axis Bank's strategic emphasis on businesses with high Risk-Adjusted Return on Capital (RAROC) signals a deliberate move to de-emphasize investments in these low-differentiation, low-margin products. The bank's reported focus on retail lending and corporate banking segments, which typically offer better risk-adjusted returns, indicates a strategic allocation of capital away from areas where competitive pressures limit profitability. In the fiscal year 2024, Axis Bank's net interest income grew, but a significant portion of this growth was driven by its more specialized and higher-margin lending portfolios rather than its basic deposit-gathering activities.

- Low Margins: Products like basic savings accounts often operate with net interest margins that are pressured by intense market competition and regulatory caps on certain types of deposits.

- High Commoditization: The undifferentiated nature of these products means that customer acquisition and retention rely heavily on factors other than product features, such as branch network or brand, limiting pricing power.

- Minimal Growth Contribution: While these products are necessary for customer acquisition, they typically do not drive significant growth in market share or overall revenue for the bank.

- Strategic Shift: Axis Bank's focus on high RAROC businesses suggests a strategic intent to allocate resources towards more profitable and differentiated offerings, moving away from reliance on commoditized banking services.

International Operations with Limited Scale

Axis Bank's international operations with limited scale can be viewed through the lens of the BCG Matrix as potential 'dogs'. While the bank maintains a presence in key financial hubs like DIFC (Dubai) and Singapore, along with representative offices in Abu Dhabi, Sharjah, and Dhaka, the cancellation of Axis Bank UK Limited's banking license in October 2024 and its subsequent liquidation highlights the challenges of maintaining and scaling international ventures.

These smaller-scale international operations, especially those in intensely competitive global markets, may struggle to achieve significant market share or profitability. The high costs associated with maintaining these branches and offices, coupled with potentially low returns, could classify them as 'dogs' if they do not demonstrably contribute to Axis Bank's overall strategic objectives or financial performance.

For instance, the UK operation's closure in 2024, after a period of operation, suggests that not all international expansions yield the desired growth. The bank's focus might need to shift towards optimizing existing international footprints or divesting from those that consistently underperform and drain resources without clear strategic benefits.

- International Presence: Branches in DIFC (Dubai), Singapore; Representative offices in Abu Dhabi, Sharjah, Dhaka.

- Challenging Ventures: Axis Bank UK Limited's license cancellation (Oct 2024) and liquidation.

- 'Dog' Classification Criteria: Limited scale, high operational costs, low market share in competitive markets, minimal contribution to overall growth/profitability.

- Strategic Review: Need for optimization or divestment of underperforming international operations.

Certain loan segments within Axis Bank, particularly those with a history of higher defaults or facing intense competition, can be identified as 'dogs' in the BCG matrix. For example, the bank's gross non-performing assets (NPAs) saw an uptick to 1.57% by June 2025, a rise from 1.28% in March 2025, with net NPAs at 0.45%. While a technical adjustment in classification was cited, these 'technically' impacted NPAs still require focused resolution strategies to free up capital and prevent them from becoming a drag on performance.

These underperforming areas, such as certain traditional loan segments or legacy IT systems, demand robust monitoring and efficient recovery processes. For instance, in FY24, Axis Bank reported a GNPA ratio of 1.58%, and while low, the increase highlights the need for proactive management in specific product types like cash credit and overdrafts.

The bank's strategic shift towards high Risk-Adjusted Return on Capital (RAROC) businesses also implies a de-emphasis on low-margin, commoditized products like basic savings accounts, which contribute minimally to growth and face significant competitive pressures.

Axis Bank's international operations, particularly those with limited scale and high operational costs, may also be categorized as 'dogs'. The cancellation of Axis Bank UK Limited's banking license in October 2024 and its subsequent liquidation exemplify the challenges faced by such ventures in achieving profitability and market share in competitive global markets.

| Segment/Product | BCG Category | Key Characteristics | 2024/2025 Data Point | Strategic Implication |

| Certain Loan Segments (e.g., Cash Credit, Overdrafts) | Dogs | Higher default history, technical NPA increases, require focused resolution | GNPA ratio 1.57% (June 2025), up from 1.28% (March 2025) | Proactive monitoring, efficient recovery processes |

| Legacy IT Systems | Dogs | Low contribution to new revenue, high maintenance costs, limited scalability | Global trend of scrutinizing IT assets for cost optimization | Modernization or divestment |

| Basic Banking Products (e.g., Savings Accounts) | Dogs | Low margins, high commoditization, minimal growth contribution | Net Interest Margins pressured by competition, ~3.1% for Indian banks (2024) | De-emphasize, focus on high RAROC businesses |

| Underperforming International Operations | Dogs | Limited scale, high operational costs, low market share | Axis Bank UK Limited license cancellation (Oct 2024) and liquidation | Optimize footprint or divest |

Question Marks

Axis Bank's UPIATM and Bharat Connect for Business are prime examples of emerging digital solutions. UPIATM allows for cardless cash transactions, a significant convenience in India's rapidly digitizing financial landscape. Bharat Connect, on the other hand, aims to simplify bill payments for businesses through the Bharat Bill Payment System (BBPS). These initiatives align with the growing demand for seamless digital financial services.

In 2023, India saw a substantial surge in digital payments, with UPI transactions alone reaching over 110 billion. This robust growth indicates a strong market appetite for digital financial tools. While UPIATM and Bharat Connect for Business are relatively new, their potential to capture a significant share of this expanding market is considerable. Their success hinges on driving widespread adoption and demonstrating clear value propositions to both individual consumers and businesses.

The current market penetration and revenue generation for these specific digital solutions are still in their nascent stages, reflecting their 'question mark' status in the BCG matrix. Significant investment in marketing, infrastructure, and user education will be crucial to accelerate their growth. If these investments translate into strong customer uptake and sustained transaction volumes, they have the potential to evolve into 'stars' within Axis Bank's digital product portfolio.

Axis Bank's 'Bharat Banking' initiative, targeting rural and semi-urban areas, is positioned as a strategic growth driver. The bank aims to double its rural customer base by leveraging micro-lending and agri-tech collaborations, tapping into the significant growth potential fueled by financial inclusion efforts and regional economic development.

This segment represents a classic question mark in the BCG matrix due to its high growth potential but also the substantial investment required for infrastructure, technology, and tailored local strategies. For instance, in 2024, the Indian government's continued push for financial inclusion, with initiatives like the Pradhan Mantri Jan Dhan Yojana, has expanded the addressable market in these regions. Axis Bank's success here hinges on its ability to deploy capital effectively to build market share against established players and local cooperative banks.

Axis Bank, like many evolving financial institutions, is likely investigating new niche lending products. These could target rapidly growing sectors or customer groups currently overlooked by mainstream banking. For instance, specialized financing for the burgeoning electric vehicle ecosystem or tailored credit lines for women entrepreneurs represent potential avenues.

These emerging segments, while offering significant future growth potential, typically begin with a small market presence. Axis Bank would need to invest heavily in developing robust risk assessment models, targeted marketing campaigns, and innovative product features to gain traction. The success of these ventures depends on their ability to carve out a distinct market position and offer compelling value propositions to stand out from potential competitors.

Leveraging AI/ML for Hyper-Personalized Services

Axis Bank is strategically aiming to be India's premier digital-first bank, with hyper-personalized services powered by AI and machine learning as a core component of its growth. While the bank has already implemented AI for customer interactions through its chatbot 'Astra', the broader application of AI/ML for truly hyper-personalized offerings across its entire service spectrum is still in its nascent stages. This ambitious initiative necessitates substantial financial commitments towards advanced data analytics, robust AI infrastructure, and specialized talent acquisition. The ultimate success of this strategy in capturing a dominant market share remains to be seen, placing it in the 'question mark' category with significant, yet unproven, future growth potential.

The bank's commitment to AI/ML for personalization is a key differentiator, aiming to move beyond generic offerings to tailor financial products and services to individual customer needs and behaviors. For instance, by analyzing transaction data and customer preferences, Axis Bank can proactively suggest relevant investment products or loan offers. This focus on individual customer journeys is crucial for a digital-first strategy, as it directly addresses the evolving expectations of tech-savvy consumers who value bespoke experiences.

- Investment in AI/ML: Axis Bank is channeling significant resources into building its AI and data analytics capabilities to drive hyper-personalization.

- Chatbot 'Astra': The existing AI-powered chatbot, 'Astra', serves as a foundational step in leveraging AI for customer engagement.

- Market Potential: The success of hyper-personalization in translating into a leading market position is a key factor in its 'question mark' classification.

- Data-Driven Strategy: The bank's blueprint relies heavily on leveraging vast amounts of customer data to create unique and tailored financial solutions.

Expansion into Specific International Markets

Axis Bank's strategic expansion into specific international markets, beyond its existing footprint and excluding the UK exit, can be viewed as potential question marks within a BCG matrix framework. These initiatives, such as deepening presence in Southeast Asia or exploring opportunities in the Middle East, require substantial capital outlay and navigate complex regulatory landscapes and fierce competition.

The success of these ventures hinges on Axis Bank's ability to quickly capture market share, offering the potential for significant returns. However, the inherent uncertainty in these growth markets necessitates thorough due diligence and a committed, long-term strategic approach.

- Potential Markets: Focus areas could include high-growth economies in Southeast Asia, such as Vietnam or Indonesia, and emerging markets in the Middle East.

- Investment & Competition: Entry requires significant investment in infrastructure, technology, and talent, facing established global and local banking players.

- Risk & Reward: High potential returns are linked to rapid market penetration, but risks include regulatory changes, economic volatility, and competitive pressures.

- Strategic Imperative: Successful execution could diversify revenue streams and enhance Axis Bank's global standing, but requires careful risk management and adaptability.

Axis Bank's new digital initiatives, like UPIATM and Bharat Connect for Business, represent ventures with high growth potential but uncertain market acceptance. These are classic question marks, requiring significant investment to gain traction. For example, in 2024, the continued expansion of India's digital payment infrastructure, with UPI transactions projected to exceed 150 billion, provides a fertile ground for such innovations.

The bank's strategic push into rural and semi-urban areas through its Bharat Banking initiative also falls into the question mark category. While the potential market is vast, driven by government financial inclusion drives, the execution challenges and investment needed to build infrastructure and tailored services are substantial. By the end of 2023, over 500 million accounts were opened under the Pradhan Mantri Jan Dhan Yojana, highlighting the scale of the opportunity and the competition.

Emerging niche lending products, such as those for the electric vehicle sector or women entrepreneurs, are also question marks. These segments offer high future growth but require substantial upfront investment in specialized risk models and marketing to establish a market presence. As of early 2024, the Indian EV market is experiencing rapid growth, with sales increasing by over 150% year-on-year, underscoring the potential for targeted financial solutions.

Axis Bank's ambitious goal to become a digital-first bank powered by AI and machine learning for hyper-personalization is a significant question mark. While AI adoption is growing, with banks increasingly using AI for customer service and analytics, achieving true hyper-personalization across all services requires massive investment in data infrastructure and talent. The bank's chatbot, 'Astra', is a step, but the broader vision demands substantial development.

Expansion into new international markets, beyond existing operations, presents another set of question marks. These ventures require considerable capital and face complex regulatory environments and established competition, with potential for high returns if market share is captured quickly. For instance, Southeast Asian economies are projected to see continued strong GDP growth in 2024, presenting attractive, albeit challenging, opportunities.

| Initiative | Market Growth Potential | Market Share | Investment Required | BCG Category |

|---|---|---|---|---|

| UPIATM & Bharat Connect | High | Low (Nascent) | High | Question Mark |

| Bharat Banking (Rural/Semi-Urban) | High | Low | High | Question Mark |

| Niche Lending Products (e.g., EV, Women Entrepreneurs) | High | Low | High | Question Mark |

| AI/ML for Hyper-Personalization | High | Low | Very High | Question Mark |

| International Market Expansion (New Geographies) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Axis Bank BCG Matrix leverages comprehensive data from Axis Bank's annual reports, investor presentations, and publicly available financial statements. This is augmented by industry-specific market research reports and competitor analysis to provide a robust strategic overview.