AvidXchange SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvidXchange Bundle

AvidXchange, a leader in accounts payable automation, boasts significant strengths in its robust technology platform and extensive customer base, offering a compelling solution for businesses seeking efficiency. However, like any growing company, it navigates potential weaknesses such as reliance on integrations and the competitive fintech landscape.

Discover the complete picture behind AvidXchange’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

AvidXchange's strength lies in its extensive network, connecting a vast number of buyers and suppliers. This creates a powerful network effect, where each new participant increases the platform's value for everyone else. As of Q1 2024, AvidXchange reported serving over 8,000 mid-market businesses, demonstrating the scale of its ecosystem. This broad reach simplifies and accelerates the accounts payable process for all users by providing more potential transaction partners.

The sheer size of this established network acts as a significant barrier to entry for potential competitors looking to break into the market. This robust ecosystem, built over years of operation, solidifies AvidXchange's dominant market position and makes it difficult for newer entrants to replicate its value proposition. The company's focus on specific verticals also contributes to the strength of these targeted networks.

AvidXchange's strength lies in its dedicated focus on the middle market. This specialization means their solutions are crafted to precisely fit the distinct challenges faced by these businesses, unlike more generalized offerings.

This concentrated approach allows AvidXchange to cultivate a profound understanding of their middle-market clients' specific needs. This deep insight translates into the development of highly relevant software features and the provision of expert, specialized customer support that truly resonates.

This targeted expertise cultivates more robust client relationships and, consequently, higher retention rates within this vital segment. In 2023, AvidXchange reported serving over 8,000 mid-market customers, highlighting the scale of their success in this niche.

AvidXchange boasts a comprehensive, cloud-based platform designed to fully automate the accounts payable and payment processes. This integrated solution covers everything from capturing invoices to making the final payment, offering a seamless experience for businesses.

The end-to-end automation significantly cuts down on manual errors and boosts operational efficiency, giving clients clear, real-time insights into their financial activities. This streamlined approach is crucial for businesses looking to optimize their back-office functions.

Its cloud-native design ensures the platform can easily scale with growing businesses and remains accessible from anywhere, at any time. Clients benefit from continuous updates and a flexible, modern system that adapts to evolving needs, a key advantage in today's fast-paced financial landscape.

Strong Cost Reduction and Efficiency Gains

AvidXchange's core strength is its ability to drive significant cost reductions and efficiency improvements for businesses. By automating the entire invoice and payment process, companies can move away from cumbersome, paper-intensive manual operations. This automation directly translates into lower labor costs associated with data entry, processing, and manual reconciliation. For instance, businesses can see a reduction in processing costs per invoice, with some estimates showing savings of up to 60% compared to manual methods.

The efficiency gains extend to eliminating costly errors and preventing late payment penalties, which can significantly impact a company's bottom line. In 2023, businesses continued to face rising operational expenses, making solutions that offer tangible savings highly attractive. AvidXchange's platform directly addresses this need by streamlining workflows and providing greater visibility into payment cycles, thereby reducing the risk of missed deadlines and associated fees.

Key benefits include:

- Reduced labor costs: Automating manual tasks frees up employees for more strategic activities.

- Minimized errors: Digital processing reduces data entry mistakes and payment discrepancies.

- Elimination of late fees: Improved payment visibility ensures timely transactions.

- Lower paper and printing costs: Transitioning to a digital workflow significantly cuts these expenses.

Secure and Touchless Transactions

AvidXchange's platform emphasizes secure and touchless transactions, a critical advantage for businesses handling sensitive financial information. This automation significantly minimizes the potential for human error and fraud, while digital payments bolster security and offer enhanced traceability. Such a commitment to security and automation fosters client trust and directly addresses the escalating need for robust and efficient financial operations, especially in today's evolving remote and hybrid work settings.

The focus on secure, touchless processing aligns with market trends, as evidenced by the increasing adoption of digital payment solutions across industries. For instance, a significant portion of businesses are actively seeking to digitize their accounts payable processes to improve efficiency and reduce risk. AvidXchange's capabilities directly cater to this demand, offering a solution that not only streamlines operations but also fortifies financial data against potential threats.

- Enhanced Security: Digital transactions reduce the physical handling of checks and sensitive data, mitigating risks associated with mail fraud and data breaches.

- Reduced Fraud: Automation in invoice processing and payment execution limits opportunities for fraudulent activities by minimizing manual intervention.

- Operational Efficiency: Touchless workflows accelerate payment cycles and reduce the administrative burden associated with traditional paper-based processes.

- Improved Traceability: Digital records provide a clear audit trail for all transactions, enhancing compliance and financial oversight.

AvidXchange's extensive buyer and supplier network is a core strength, creating a valuable ecosystem. As of Q1 2024, the company served over 8,000 mid-market businesses, demonstrating significant reach and a strong network effect that deters competitors.

The company's specialization in the middle market allows for tailored solutions and deep customer understanding. This focus fosters strong client relationships and high retention, with over 8,000 mid-market customers served in 2023.

AvidXchange offers a comprehensive, cloud-based platform for end-to-end accounts payable and payment automation. This streamlined approach boosts efficiency, reduces errors, and provides real-time financial insights, supported by its scalable, accessible cloud-native design.

A key benefit is the significant cost reduction and efficiency gains achieved through automation, moving businesses away from manual processes. This translates to lower labor costs, minimized errors, and elimination of late fees, with potential savings up to 60% compared to manual methods.

The platform emphasizes secure, touchless transactions, reducing fraud and human error. This commitment to security and digital payments builds client trust and aligns with market demands for robust financial operations.

What is included in the product

This analysis maps AvidXchange’s market strengths in automated payment solutions for the middle market, alongside operational gaps and competitive risks that could impact its growth.

Simplifies complex accounts payable processes, reducing manual effort and errors.

Weaknesses

AvidXchange's focus on the middle market, while a strategic advantage, also creates a significant dependency. This concentration means that any economic headwinds specifically hitting this segment, such as reduced spending or tighter credit conditions, could have a more pronounced impact on AvidXchange's financial performance than if they had a broader customer base.

For instance, a slowdown in middle-market business expansion or investment could directly curtail the adoption of AvidXchange's services. This reliance makes them particularly sensitive to the overall health and growth trajectory of this specific economic tier.

While AvidXchange reported total revenue of $635.9 million for the fiscal year 2023, a substantial portion of this is attributable to their core middle-market clientele. This concentration risk is a key consideration for investors and strategists looking at their future growth potential and resilience.

The accounts payable automation market is incredibly crowded, with many established companies and new fintech startups all trying to capture a piece of the market. This tough competition often means companies have to lower their prices, spend more on marketing, and always be coming up with new features to stand out. For instance, in 2023, the AP automation market was valued at approximately $3.2 billion and is projected to grow, meaning more players are entering.

This intense rivalry puts pressure on AvidXchange to consistently invest in research and development as well as sales efforts. Without this, it will be difficult to keep up with well-funded competitors who can pour more resources into innovation and market reach. Staying ahead requires a constant effort to improve offerings and effectively communicate their value.

Integrating AvidXchange’s platform with the myriad of existing enterprise resource planning (ERP) systems utilized by middle-market businesses presents a significant hurdle. This process is often complex and demands substantial resources from both AvidXchange and its clients. For instance, a custom integration project could require an average of 40-60 hours of development time, increasing initial setup costs.

The unique nature of each ERP system means that integration challenges are not one-size-fits-all. This can translate into extended implementation timelines, potentially delaying the value realization for new customers. Reports in early 2024 indicated that average implementation periods for complex financial software integrations can stretch to 3-6 months.

Such integration complexities can act as a deterrent for some prospective clients who may prioritize a more straightforward, plug-and-play solution. If not managed with exceptional efficiency and clear communication, these difficulties can lead to client dissatisfaction, impacting customer retention rates.

Potential for Customer Acquisition Costs

Acquiring new middle-market customers for AvidXchange can be a significant undertaking, often involving substantial investments in sales and marketing. This is particularly true in the B2B software space, where financial automation solutions require a dedicated approach to reach potential clients. For instance, in 2024, the average customer acquisition cost (CAC) for SaaS companies in the financial technology sector has been observed to be in the range of $2,000 to $4,000, highlighting the expense involved.

The sales cycle for business-to-business software, especially in financial automation, tends to be lengthy. This extended period is due to the need to engage with multiple decision-makers within an organization and conduct thorough due diligence to ensure the solution meets complex requirements. Such protracted sales processes contribute to the overall cost of bringing a new customer onto the platform.

High customer acquisition costs can directly affect profitability. Unless these initial expenses are effectively counterbalanced by a strong customer lifetime value (CLTV) and the implementation of efficient scaling strategies, the financial impact can be substantial. For example, if a company's CAC is 30% higher than its average annual revenue per user (ARPU), it can strain financial resources and hinder growth. AvidXchange needs to ensure its CLTV significantly exceeds its CAC to maintain healthy margins.

- Significant Investment: Acquiring middle-market customers requires considerable outlay in sales and marketing.

- Extended Sales Cycles: B2B financial automation sales involve multiple stakeholders and detailed due diligence, prolonging the process.

- Profitability Impact: High CAC can erode profits if not offset by strong CLTV and efficient scaling.

- Industry Benchmarks: For 2024, SaaS CAC in fintech can range from $2,000 to $4,000, indicating the expense level.

Data Security and Compliance Risks

AvidXchange, operating in financial technology, inherently manages highly sensitive customer financial data, positioning it as a significant target for cyber threats. A data breach or non-compliance with stringent data privacy laws, such as GDPR or CCPA, could irreparably harm its reputation and result in substantial financial penalties, potentially impacting customer retention. For instance, reports indicate that the average cost of a data breach in the financial services sector reached $5.90 million in 2023, a figure AvidXchange must actively mitigate.

The company faces ongoing challenges in maintaining a robust cybersecurity posture and adapting to ever-changing data protection regulations. This necessitates continuous investment in advanced security measures and compliance protocols, representing a considerable and recurring operational expense. Failure to stay ahead of these evolving risks could lead to operational disruptions and loss of client confidence, directly affecting revenue streams and market position.

- Cybersecurity Threats: AvidXchange's role as a financial data processor makes it a target for sophisticated cyberattacks.

- Regulatory Compliance: Adherence to evolving data privacy regulations (e.g., GDPR, CCPA) is critical and resource-intensive.

- Reputational Risk: A security incident could severely damage customer trust and brand image.

- Financial Penalties: Non-compliance can result in significant fines, impacting profitability.

AvidXchange's reliance on the middle market, while strategic, creates concentrated risk. Economic downturns affecting this segment can disproportionately impact revenue, as seen in their $635.9 million revenue for fiscal year 2023, largely derived from this core customer base.

The accounts payable automation market is highly competitive, with numerous established players and new fintech entrants. This intense rivalry, within a market valued at approximately $3.2 billion in 2023, necessitates continuous investment in innovation and marketing to maintain market share and attract new clients.

Integrating AvidXchange's platform with diverse ERP systems presents a significant challenge, often requiring substantial resources and leading to extended implementation timelines, potentially delaying customer value realization. Reports in early 2024 noted that custom financial software integrations can take 3-6 months to complete.

High customer acquisition costs, estimated between $2,000-$4,000 for SaaS fintech in 2024, coupled with lengthy B2B sales cycles, can strain profitability if not offset by strong customer lifetime value. This financial pressure requires careful management to ensure sustainable growth.

Operating in financial technology exposes AvidXchange to substantial cybersecurity risks and the need for ongoing compliance with data privacy regulations. The average cost of a data breach in financial services was $5.90 million in 2023, highlighting the critical need for robust security measures to protect its reputation and financial standing.

What You See Is What You Get

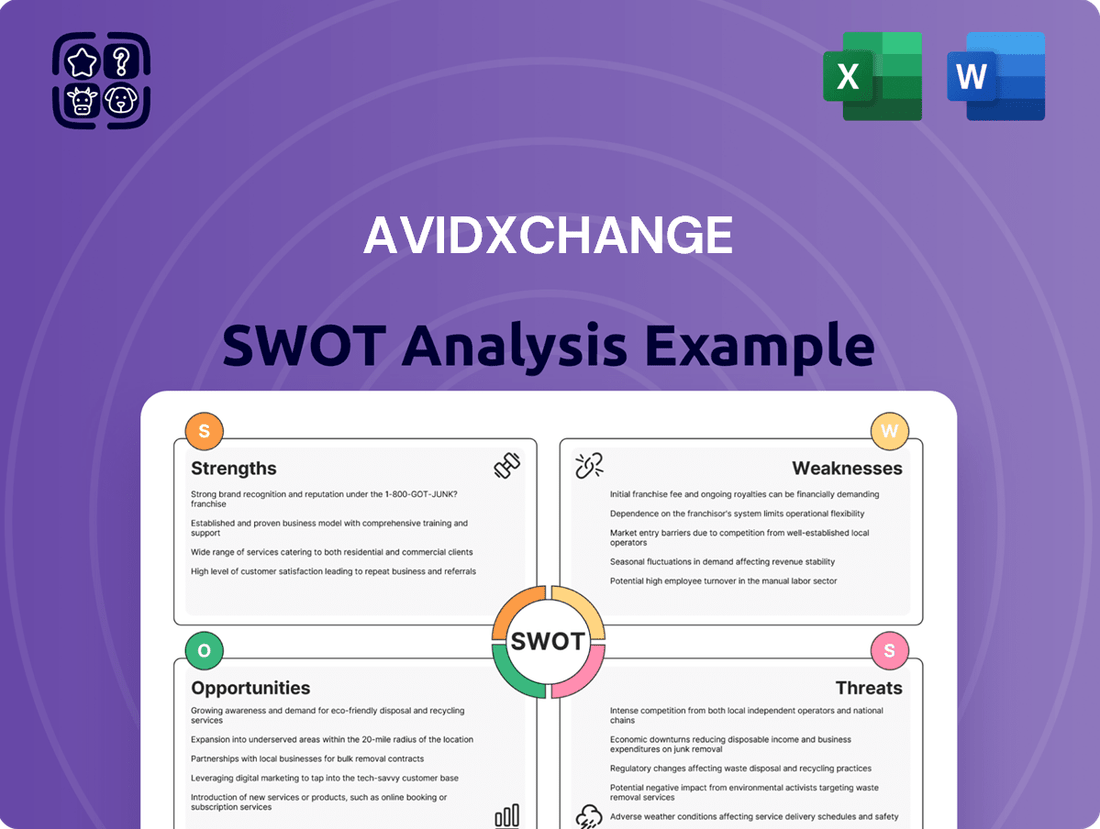

AvidXchange SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you're getting the exact analysis you expect, without any hidden surprises. You're viewing a live preview of the actual SWOT analysis file, providing a clear snapshot of the professional quality and comprehensive insights you'll gain. The complete version becomes available after checkout, unlocking the full potential of this strategic tool for your business.

Opportunities

The market for accounts payable automation is booming, with businesses actively looking to cut down on manual work, boost efficiency, and gain better financial oversight. This strong, ongoing trend is a major advantage for AvidXchange, as more companies are realizing the strategic value of automating their AP processes.

By 2025, the global AP automation market is projected to reach $5.1 billion, showing a compound annual growth rate of 12.5% from 2020. This expansion is fueled by the need for streamlined operations and improved data accuracy.

The ongoing digital transformation across industries means that the pool of potential customers for AP automation solutions is constantly expanding. Companies are increasingly adopting cloud-based solutions and digital payment methods, further widening the addressable market for AvidXchange.

AvidXchange has a significant opportunity to grow by extending its automated payment solutions into new areas. Currently strong in the middle market, the company could adapt its platform to cater to the more complex accounts payable (AP) requirements of larger enterprises. This move could tap into a much larger customer base.

Furthermore, AvidXchange can target specific industry verticals that have distinct AP workflows, such as healthcare or manufacturing. By tailoring its offerings, the company can address unique pain points, making its solutions even more valuable. This focused approach can drive deeper market penetration.

The company's existing technology infrastructure and established partner network provide a solid foundation for this expansion. Adapting its current capabilities to serve new customer segments and industries is a logical next step. This leverages existing investments and accelerates market entry.

Expanding into these adjacent markets would substantially increase AvidXchange's total addressable market. For instance, the enterprise AP automation market is projected to grow considerably in the coming years, offering substantial revenue potential. This strategic diversification is key to sustained growth.

AvidXchange can significantly expand its market presence by forming strategic alliances with complementary technology providers, financial institutions, and industry-specific software vendors. These partnerships can broaden its product ecosystem and customer reach, allowing for a more integrated offering in the accounts payable automation space.

Targeted acquisitions present another key opportunity for AvidXchange. By acquiring smaller competitors or companies possessing cutting-edge technologies, such as AI-driven analytics, AvidXchange can rapidly gain market share, absorb valuable talent, and enhance its existing product suite. For instance, the company's acquisition of Fast-Ray in 2021 bolstered its invoice data capture capabilities, demonstrating the effectiveness of this strategy.

Inorganic growth through acquisitions and partnerships allows AvidXchange to accelerate market penetration and expedite product development cycles. This strategic approach is crucial for staying ahead in the competitive fintech landscape, where innovation and comprehensive solutions are paramount for sustained growth and customer acquisition.

Leveraging AI and Advanced Analytics

Integrating AI and machine learning into AvidXchange's platform is a prime opportunity to enhance its core offerings. This technology can significantly improve invoice processing automation and bolster fraud detection capabilities. For instance, by leveraging AI, AvidXchange could reduce manual data entry errors, which industry reports suggest can be as high as 15% in traditional AP processes. Furthermore, AI-driven analytics can provide clients with more sophisticated insights into their spending patterns and optimize payment cycles.

These advancements directly translate to a stronger value proposition for AvidXchange's clients. By offering more intelligent solutions, the company can solidify its competitive position in the accounts payable automation market. The potential for AI to streamline operations and uncover financial efficiencies is substantial, aligning with the growing demand for data-driven decision-making in finance departments. As of early 2024, the global AI in fintech market is projected to reach over $25 billion by 2027, indicating a strong tailwind for companies embracing these technologies.

- Enhanced Automation: AI can further automate invoice capture and data extraction, reducing manual effort and potential errors.

- Improved Fraud Detection: Machine learning algorithms can identify anomalous transactions and patterns indicative of fraud more effectively.

- Optimized Payments: AI can analyze payment terms and cash flow to recommend optimal payment timing, potentially unlocking early payment discounts or improving working capital.

- Deeper Financial Insights: Advanced analytics powered by AI can provide clients with more granular data and predictive insights into their financial operations.

International Market Expansion

AvidXchange has a significant opportunity to expand its reach into international markets, addressing the universal need for streamlined accounts payable and payment processes. The company's robust cloud-based platform provides a scalable foundation for adapting its solutions to diverse global regulatory landscapes and operational demands. This strategic move could tap into substantial new revenue streams and solidify AvidXchange's position as a global leader in financial automation.

The global market for accounts payable automation is substantial and growing. For instance, the global accounts payable automation market size was valued at USD 1.8 billion in 2023 and is projected to reach USD 5.1 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030. This presents a clear runway for AvidXchange to leverage its existing technology and expertise in new geographies.

- Global Demand: Businesses worldwide face similar challenges with manual AP processes, creating a broad market for automation solutions.

- Scalable Technology: AvidXchange's cloud platform is well-suited for adaptation to different international compliance and operational requirements.

- Revenue Growth: Entry into new international markets offers a significant avenue for long-term revenue diversification and expansion.

- Competitive Advantage: Early international expansion can establish a strong foothold before competitors, securing market share.

AvidXchange can expand its service offerings by integrating advanced AI and machine learning capabilities. This will enhance invoice processing, improve fraud detection, and provide deeper financial insights for clients. The global AI in fintech market is projected to exceed $25 billion by 2027, indicating a strong tailwind for this strategy.

Expanding into enterprise markets and specific industry verticals presents a significant growth opportunity. By tailoring solutions for larger businesses and sectors like healthcare or manufacturing, AvidXchange can broaden its customer base and increase market penetration. The enterprise AP automation market is expected to see considerable growth, offering substantial revenue potential.

Strategic partnerships and acquisitions are key to accelerating market share and enhancing product development. Collaborating with complementary technology providers and acquiring companies with innovative tech, such as AI analytics, can strengthen AvidXchange's competitive position. The company's acquisition of Fast-Ray in 2021 demonstrated the effectiveness of this inorganic growth strategy.

International expansion offers a vast, untapped market for accounts payable automation. AvidXchange's scalable cloud platform is well-suited to adapt to global regulatory and operational demands, opening new revenue streams. The global accounts payable automation market was valued at USD 1.8 billion in 2023 and is projected to reach USD 5.1 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030.

| Opportunity | Description | Market Data/Fact |

| AI & Machine Learning Integration | Enhance automation, fraud detection, and financial insights. | Global AI in fintech market projected to exceed $25 billion by 2027. |

| Market Expansion (Enterprise & Verticals) | Tailor solutions for larger businesses and specific industries. | Enterprise AP automation market shows considerable growth potential. |

| Strategic Partnerships & Acquisitions | Accelerate market share and product development. | AvidXchange acquired Fast-Ray in 2021 to boost data capture capabilities. |

| International Market Entry | Tap into global demand for AP automation solutions. | Global AP automation market projected to reach $5.1 billion by 2030 (CAGR 16.2% from 2024-2030). |

Threats

The financial technology landscape is evolving rapidly, with numerous fintech startups consistently entering the market, alongside established technology behemoths that could potentially expand into the accounts payable (AP) automation sector. These emerging players often leverage cutting-edge technologies and novel business strategies that could disrupt AvidXchange's current standing. For instance, the global fintech market size was valued at approximately $11.3 trillion in 2023 and is projected to grow significantly, indicating the intense competitive environment.

To counter this, AvidXchange must prioritize continuous innovation and the clear differentiation of its service portfolio. This proactive approach is essential for staying ahead of aggressive competitors and ensuring its continued relevance in a fast-paced market. Failure to adapt could lead to a erosion of market share as newer, more agile solutions gain traction.

A substantial economic slowdown or recession presents a significant threat, as middle-market businesses, AvidXchange's core customer base, may reduce spending on software and essential operational costs. This could directly curtail AvidXchange's sales momentum, customer acquisition, and the ability to retain existing clients.

The company's reliance on the middle market makes it particularly vulnerable to economic downturns, impacting its revenue streams and growth trajectory. For example, during periods of economic contraction, businesses often scrutinize discretionary spending, which could include accounts payable automation solutions if perceived as non-essential in the short term.

The fintech and payment sectors face a constantly shifting regulatory environment, encompassing data privacy like GDPR and CCPA, anti-money laundering (AML) standards, and payment network rules. For example, the Consumer Financial Protection Bureau (CFPB) actively enforces various consumer protection laws affecting payment providers, and failure to comply can lead to significant penalties. AvidXchange must navigate these complexities to avoid substantial fines and legal entanglements.

Adapting to new regulations, such as those related to open banking or evolving cybersecurity mandates, presents a considerable operational challenge. The cost of implementing and maintaining compliance programs can be substantial, impacting profitability. For instance, increased cybersecurity investments, often driven by regulatory pressure, added millions to operational budgets for many financial institutions in 2024.

Cybersecurity Breaches and Data Privacy Concerns

AvidXchange, by its nature of processing sensitive financial information, is a prime target for sophisticated cyberattacks. Threats like ransomware, phishing, and outright data breaches are ever-present and growing in intensity. A significant security incident in 2024 or 2025 could result in substantial financial penalties and irreparable damage to client trust. The company must invest heavily in robust cybersecurity measures to mitigate these risks.

The financial services sector, in general, saw a significant increase in cyberattacks in recent years, with the average cost of a data breach reaching millions of dollars. For instance, IBM's 2023 Cost of a Data Breach Report indicated an average cost of $4.45 million globally. This highlights the critical need for AvidXchange to stay ahead of evolving cyber threats to protect its operations and its clients' data.

- Ransomware Attacks: Disrupting operations and demanding payment for data recovery.

- Data Breaches: Unauthorized access and exfiltration of sensitive client financial data.

- Phishing Scams: Deceiving employees to gain access to systems or sensitive information.

- Regulatory Fines: Penalties for non-compliance with data protection regulations like GDPR or CCPA.

Technological Obsolescence and Disruption

The swift evolution of technology presents a significant threat to AvidXchange. The company must consistently pour resources into research and development to keep its platform competitive and up-to-date. For instance, the market for financial technology, or fintech, saw substantial investment in 2024, with global fintech funding reaching billions, highlighting the need for continuous innovation to capture market share.

Failing to embrace new technological advancements, such as integrating blockchain for more efficient payment processing or adapting to evolving enterprise software preferences, could render AvidXchange's offerings obsolete. This risk necessitates proactive strategic planning and substantial ongoing investment in R&D to maintain relevance in a rapidly changing landscape.

- Technological obsolescence requires continuous R&D investment.

- Emerging trends like blockchain integration are critical.

- Shifts in enterprise software demand platform adaptability.

- Failure to innovate risks losing market position to more agile competitors.

Intense competition from both fintech startups and large tech firms poses a significant risk, especially as the global fintech market continues its rapid expansion. Economic downturns also threaten AvidXchange, as its middle-market customer base may cut spending on essential operational tools. Furthermore, evolving regulations and the ever-present danger of sophisticated cyberattacks require constant vigilance and investment, with data breaches costing millions.

| Threat Category | Specific Risk | Potential Impact | Example Data/Context (2024-2025) |

|---|---|---|---|

| Competition | New entrants and tech giants | Market share erosion, pricing pressure | Global fintech market valued at ~$11.3T in 2023; significant VC funding in 2024 for new solutions. |

| Economic Factors | Recessionary pressures on middle market | Reduced customer spending, slower sales growth | Businesses often scrutinize discretionary spending during economic contractions. |

| Regulatory & Compliance | Data privacy (GDPR, CCPA), AML, payment network rules | Fines, legal penalties, increased operational costs | CFPB enforcement actions; increased cybersecurity investments by financial institutions in 2024. |

| Cybersecurity | Ransomware, data breaches, phishing | Financial losses, reputational damage, loss of client trust | Average data breach cost ~$4.45M globally (IBM 2023); sector saw increased cyberattacks. |

| Technological Obsolescence | Failure to adopt new tech (e.g., blockchain) | Loss of competitive edge, platform irrelevance | Billions invested in fintech R&D in 2024; need for continuous innovation. |

SWOT Analysis Data Sources

This AvidXchange SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's operational landscape and competitive positioning.