AvidXchange Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvidXchange Bundle

AvidXchange operates in a dynamic market where understanding competitive forces is paramount. Our initial analysis reveals moderate threats from new entrants and substitutes, but the true power lies in the complex interplay of buyer and supplier negotiations. The intensity of rivalry within the accounts payable automation space significantly shapes AvidXchange's strategic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AvidXchange’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

AvidXchange’s reliance on crucial technology providers, like those offering cloud infrastructure services, presents a potential area of supplier power. If these providers have limited alternatives or are indispensable to AvidXchange's core operations, they could leverage this position to influence terms and pricing. The increasing adoption of cloud-based solutions in accounts payable (AP) automation underscores the critical need for dependable cloud infrastructure, making these suppliers key stakeholders.

AvidXchange's reliance on payment network partners and financial institutions for its virtual card and ACH payment solutions highlights a significant area of supplier power. These partners, such as Visa and Mastercard, are essential for facilitating transactions. Their ability to dictate terms, including transaction fees, directly impacts AvidXchange's operational costs and profitability. In 2023, the virtual card payment sector continued to grow, with transaction volumes increasing, but this growth also means greater leverage for the underlying networks.

The bargaining power of suppliers in the Accounts Payable (AP) automation space, particularly for AI and machine learning components, is on the rise. As advanced features like intelligent invoice capture and sophisticated fraud detection become essential, specialized AI providers gain leverage.

The increasing integration of AI into AP automation means companies like AvidXchange are more reliant on these specialized technology suppliers. This reliance grew significantly in 2024, with a notable increase in AI investment across fintech sectors, pushing demand for these niche services.

Supplier Power 4

While ERP system developers aren't direct suppliers in the traditional sense, their power is significant for AvidXchange. Seamless integration with popular platforms like QuickBooks, NetSuite, and Sage is crucial for AvidXchange's platform functionality and attractiveness to customers. The depth and ease of these integrations act as a key competitive differentiator in the market.

This reliance on ERP compatibility means that changes in ERP systems or their integration requirements can impact AvidXchange's operational efficiency and product development roadmap. For instance, if a major ERP vendor like Oracle NetSuite were to significantly alter its API in 2024, it could necessitate substantial development resources for AvidXchange to maintain compatibility, potentially increasing their costs.

- Criticality of Integration: AvidXchange's platform success hinges on its ability to integrate smoothly with a wide array of ERP systems.

- Competitive Differentiator: The quality and depth of these integrations can set AvidXchange apart from competitors.

- Vendor Dependence: Changes in ERP vendor strategies or technical specifications can directly influence AvidXchange's operational costs and development priorities.

- Market Influence: Developers of widely adopted ERP solutions hold considerable sway due to the essential nature of their systems for AvidXchange's client base.

Supplier Power 5

Talent in specialized areas like software development, cybersecurity, and AI is a significant supplier for fintech companies, including AvidXchange. The intense demand for these skills in the rapidly evolving financial technology landscape means that suppliers of this talent can exert considerable bargaining power. This is particularly true as companies like AvidXchange rely heavily on these experts to drive innovation and maintain their complex platforms.

The need for highly skilled professionals to develop and enhance software, ensure robust cybersecurity, and leverage artificial intelligence in financial processes directly translates into increased labor costs for companies in the sector. For instance, in 2024, the demand for AI and machine learning specialists often saw salaries rise significantly, impacting operational expenses for firms needing these capabilities. This dynamic empowers specialized talent as a potent supplier, capable of commanding higher compensation and favorable terms.

- High Demand for Specialized Skills: The fintech industry's reliance on software developers, cybersecurity experts, and AI specialists creates a competitive talent market.

- Innovation and Platform Maintenance: Skilled professionals are crucial for developing new features and ensuring the stability and security of platforms like AvidXchange's.

- Impact on Labor Costs: The scarcity and high demand for these skills contribute to rising salary expectations and overall labor costs for companies.

- Supplier Power Leverage: Specialized talent can leverage this demand to negotiate better compensation and working conditions, increasing their bargaining power.

AvidXchange faces supplier power from critical technology infrastructure providers, especially cloud services, whose specialized nature limits alternatives. Payment network partners like Visa and Mastercard also hold sway, dictating transaction fees that directly impact AvidXchange's costs. The increasing reliance on AI specialists for advanced AP automation features further elevates supplier leverage, particularly as demand for these skills surged in 2024.

| Supplier Category | Key Players/Examples | Impact on AvidXchange | 2024 Trend Impact |

|---|---|---|---|

| Cloud Infrastructure | AWS, Microsoft Azure | High dependency for platform operations; pricing power | Continued growth in cloud adoption increases supplier leverage |

| Payment Networks | Visa, Mastercard | Control transaction fees, impacting revenue streams | Increased transaction volumes in 2023/2024 enhance network influence |

| Specialized AI/ML Talent | Niche AI development firms | Essential for advanced AP features; high demand for talent | Significant salary increases for AI specialists in 2024 |

| ERP System Developers | Oracle NetSuite, Sage | Integration compatibility is vital; potential for API changes | API changes by major vendors can necessitate costly updates |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like AvidXchange, while also analyzing buyer and supplier power within the accounts payable automation sector.

A dynamic model that allows for scenario planning by adjusting competitive intensity, supplier power, and buyer bargaining power to anticipate market shifts.

Customers Bargaining Power

Middle market businesses, AvidXchange's core clientele, wield increasing power due to the growing availability of accounts payable (AP) automation solutions. This competitive landscape allows them to readily compare features, pricing structures, and the ease of integration with existing systems. The market for AP automation is seeing a notable uptick in providers, directly benefiting buyers with more choices and leverage in negotiations. For instance, as of early 2024, reports indicate a 15% year-over-year growth in the AP automation software market, fueling further competition.

Finance leaders are increasingly focused on the clear return on investment (ROI) for AI and cloud adoption, a trend that significantly bolsters customer power. This means companies like AvidXchange must clearly articulate and prove the financial benefits, such as cost savings and efficiency improvements, to win and keep business. For instance, a 2024 survey by IDC indicated that 60% of organizations cited ROI as a primary driver for cloud migration, highlighting this customer demand.

The expectation for demonstrable value creation places considerable leverage in the hands of AvidXchange's clients. They can demand more competitive pricing or seek alternative solutions if the promised benefits of automation and digital transformation aren't readily apparent. This pressure encourages AvidXchange to continuously innovate and refine its offerings to showcase tangible improvements in financial operations.

Customers in the accounts payable automation space wield significant bargaining power, largely driven by their heightened focus on cybersecurity and fraud prevention. As businesses grapple with increasingly sophisticated cyber threats, they naturally demand that their AP automation providers offer top-tier security measures, making this a non-negotiable feature. This strong buyer preference for security allows them to dictate terms and exert pressure on providers to invest heavily in protective technologies, potentially impacting pricing and service level agreements.

Customer Power 4

The bargaining power of customers for AvidXchange is a significant factor. While switching providers might require some integration effort, the existence of multiple alternatives compels AvidXchange to focus on superior user experience and robust customer support to maintain loyalty. This continuous need for improvement is a direct response to the ever-present threat of customer churn in a competitive market.

AvidXchange's clients, particularly those in mid-market and enterprise segments, often have the resources to evaluate and adopt alternative solutions. The potential for customers to switch providers, even with some integration effort, means AvidXchange must continuously enhance its user experience and support to ensure client satisfaction and retention.

The availability of several competing platforms in the accounts payable (AP) and payment automation space makes customer retention a key challenge for AvidXchange. For instance, in 2023, the AP automation market was valued at approximately $5.0 billion and is projected to grow, indicating a robust competitive landscape where customer loyalty is earned, not guaranteed.

- Customer Switching Costs: While integration requires effort, the availability of alternatives means AvidXchange must continually invest in user experience and support to minimize churn.

- Market Competition: The presence of multiple AP automation solutions intensifies the challenge of retaining customers, as clients can readily explore other options.

- Client Resourcefulness: Mid-market and enterprise clients often possess the capabilities to assess and implement competing technologies, increasing their bargaining power.

- Value Proposition Focus: To counter customer power, AvidXchange must consistently deliver a compelling value proposition, emphasizing efficiency gains and cost savings.

Customer Power 5

The bargaining power of customers for AvidXchange, particularly large enterprises or groups of middle market businesses, is significant when they seek bundled solutions or industry-specific customizations. These larger clients can leverage their volume and potential to switch providers to negotiate more favorable terms. For instance, a large enterprise might demand integration with their existing ERP system that goes beyond standard offerings, giving them leverage.

AvidXchange actively mitigates this by forging strategic partnerships with major ERP providers and industry-specific platforms. These collaborations allow AvidXchange to offer more tailored and integrated solutions, thereby reducing the incentive for customers to seek alternatives. By embedding their services within these widely adopted systems, AvidXchange increases switching costs and customer stickiness.

- Customer Concentration: AvidXchange's customer base includes a mix of small, medium, and large businesses. While smaller clients have little individual bargaining power, larger enterprises or industry groups can exert more influence.

- Switching Costs: The cost and complexity of integrating an accounts payable automation solution into existing financial systems create switching costs that can limit customer bargaining power, especially after initial implementation.

- Partnership Strategy: AvidXchange's partnerships with ERP systems like NetSuite and Sage Intacct are crucial. These integrations make it more difficult for customers to leave without disrupting their core financial operations.

- Product Differentiation: AvidXchange's focus on industry-specific solutions, such as those for construction or real estate, can differentiate its offering and reduce the perceived substitutability of competitors, thereby diminishing customer bargaining power.

Customers in the accounts payable automation market wield considerable bargaining power due to the increasing availability of comparable solutions and a strong emphasis on demonstrable ROI. As of early 2024, the AP automation market saw a 15% year-over-year growth, indicating a competitive landscape where buyers have more choices. This heightened competition allows clients to readily compare features and pricing, pushing providers like AvidXchange to clearly articulate financial benefits to secure and retain business, with 60% of organizations in 2024 citing ROI as a key driver for technology adoption.

The bargaining power of AvidXchange's customers is amplified by their focus on cybersecurity and the ease of switching providers if dissatisfied with user experience or support. With the AP automation market valued at approximately $5.0 billion in 2023 and projected to grow, customer retention is paramount. AvidXchange counteracts this by enhancing user experience and support, and through strategic partnerships with ERP systems, which increase switching costs and customer stickiness.

| Factor | Impact on AvidXchange | Mitigation Strategy |

|---|---|---|

| Increased Market Competition | Heightened customer bargaining power due to more choices. | Focus on product differentiation and superior customer support. |

| Emphasis on ROI | Customers demand clear financial benefits and efficiency gains. | Continuously showcase tangible improvements and cost savings. |

| Cybersecurity Demands | Customers prioritize robust security, influencing provider selection. | Invest heavily in protective technologies and security certifications. |

| Lower Switching Costs | Ease of switching can lead to customer churn if value is not perceived. | Deepen ERP integrations and enhance user experience to increase stickiness. |

Preview Before You Purchase

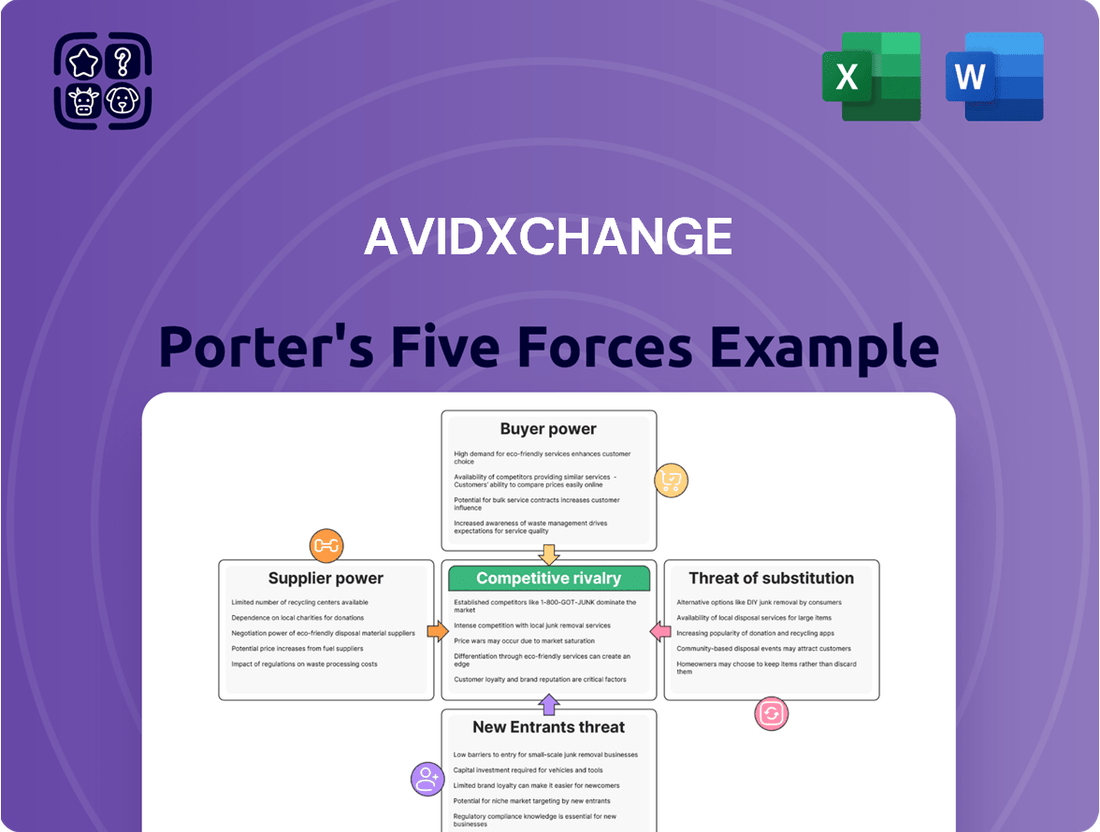

AvidXchange Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of AvidXchange, as previewed, is the exact document you will receive immediately after purchase, offering a detailed examination of the competitive landscape. You're looking at the actual, professionally written analysis that delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the accounts payable automation market. Once you complete your purchase, you’ll get instant access to this exact file, providing you with actionable insights into AvidXchange's strategic positioning. This is the complete, ready-to-use analysis file; what you're previewing is what you get, fully formatted and ready for your business needs.

Rivalry Among Competitors

The accounts payable (AP) automation market is a crowded space, with established giants like Tipalti, BILL, Stampli, and Oracle NetSuite all vying for attention. These companies offer robust solutions, often targeting the same middle-market businesses, which naturally fuels fierce competition for customer acquisition and market share.

Competitive rivalry in the accounts payable automation space, particularly for companies like AvidXchange, is intensifying. Differentiation is increasingly centered on advanced capabilities, such as AI-powered invoice processing and fraud detection. For instance, a significant portion of finance leaders in a 2024 survey indicated that AI-driven automation for tasks like data extraction and validation is a top priority for their departments.

The user experience and seamless integration with existing ERP systems also serve as crucial battlegrounds. Companies are investing heavily in intuitive interfaces and specialized integrations for various industries to reduce implementation friction and enhance adoption rates. This focus on ease of use and connectivity directly impacts customer retention and new client acquisition, making it a key area of competition.

Innovation in AI-driven efficiency, such as predictive analytics for cash flow management and automated exception handling, is another prominent trend. As of early 2025, early adopters of these advanced AI features are reporting substantial reductions in processing times, with some seeing up to a 30% decrease in manual touchpoints for invoice handling.

Competitive rivalry in the accounts payable automation space is intense, with companies like AvidXchange constantly needing to prove their value. Businesses are feeling the economic pinch, making pricing strategies and the clear demonstration of cost savings and efficiency paramount. For instance, in 2024, many companies are scrutinizing every dollar spent, demanding a tangible return on investment for new software solutions.

To stand out, platforms must articulate a compelling value proposition that justifies the expenditure on their services. This means highlighting how their automation not only saves time but also reduces errors, improves vendor relationships, and offers greater visibility into spending. The ability to showcase these benefits directly impacts a company's ability to retain existing clients and attract new ones in a crowded market.

Competitive Rivalry 4

Strategic partnerships with Enterprise Resource Planning (ERP) systems and specialized industry platforms are crucial for expanding reach and embedding solutions within customer workflows. This intensifies rivalry as companies compete for exclusive or preferred integration status, potentially creating significant customer lock-in and competitive advantages.

AvidXchange's focus on integrations with popular ERPs like NetSuite and Sage Intacct highlights this competitive dynamic. Companies that secure deeper or more exclusive integrations can differentiate themselves and build stronger customer relationships.

- Intensified Competition for Integrations: Fintech providers are actively seeking and solidifying partnerships with major ERP vendors and industry-specific software providers. This creates a race to secure preferred or exclusive integration rights.

- Customer Lock-in and Switching Costs: Deeply integrated solutions make it harder for customers to switch providers, as this often involves re-integrating with their core financial systems, thereby increasing switching costs.

- Market Reach Expansion: Partnerships act as a significant channel for customer acquisition. Companies with broader and deeper integration networks gain access to a larger potential customer base.

- Differentiation and Value Proposition: The quality and exclusivity of these integrations become a key differentiator, allowing companies to offer a more seamless and value-added experience compared to competitors.

Competitive Rivalry 5

The competitive rivalry in the accounts payable automation space, where AvidXchange operates, is intense and heavily influenced by rapid technological progress. Companies must invest significantly in research and development, especially in areas like artificial intelligence and cloud computing, to stay ahead. Those that don't keep pace with these innovations, such as advancements in machine learning for invoice processing or enhanced cybersecurity for cloud platforms, risk becoming obsolete.

This constant technological churn means that established players and emerging fintech startups are locked in a perpetual race. For instance, in 2024, the demand for AI-driven fraud detection within payment systems is a key differentiator. Companies like AvidXchange are expected to continually enhance their platforms to offer more sophisticated automation and data analytics, directly impacting their competitive standing. Failure to do so can lead to a loss of market share to more agile competitors.

- Technological Pace: The rapid evolution of AI and cloud technologies necessitates ongoing R&D investment for companies like AvidXchange to maintain relevance in the accounts payable automation market.

- Adaptation Imperative: Businesses failing to integrate emerging technologies risk falling behind competitors who are quicker to adopt and leverage these advancements.

- R&D Focus: Key areas for innovation include AI for invoice data extraction and validation, and cloud infrastructure for scalability and accessibility.

- Competitive Pressure: Continuous feature enhancements and platform upgrades are crucial to counter threats from both established rivals and nimble new entrants in the fintech sector.

The accounts payable automation market is highly competitive, with numerous players, including established technology firms and agile fintech startups, vying for market share. Differentiation often hinges on advanced features like AI-powered invoice processing and robust fraud detection capabilities. For example, a 2024 industry survey revealed that over 60% of finance leaders prioritize AI-driven automation for critical tasks such as data extraction and validation.

Seamless integration with existing Enterprise Resource Planning (ERP) systems and a superior user experience are also key battlegrounds, influencing customer acquisition and retention. Companies are investing heavily in intuitive interfaces and industry-specific integrations to minimize implementation friction. As of early 2025, early adopters of advanced AI features in AP automation report significant efficiency gains, with some experiencing up to a 30% reduction in manual invoice handling touchpoints.

Pricing strategies and a clear demonstration of return on investment are paramount, especially as businesses scrutinize expenditures. In 2024, tangible cost savings and efficiency improvements are essential for justifying software investments. Strategic partnerships with ERP vendors further intensify rivalry, as companies compete for preferred integration status, which can create customer lock-in and significant competitive advantages.

| Key Competitor | Primary Focus | 2024 Market Positioning Highlight |

|---|---|---|

| Tipalti | Global AP automation, supplier payments | Strong emphasis on compliance and global payment capabilities. |

| BILL (formerly Bill.com) | Small to medium business AP/AR automation | Focus on ease of use and integration for SMBs. |

| Stampli | AI-powered AP automation | Leveraging AI for enhanced efficiency and fraud prevention. |

| Oracle NetSuite | Integrated ERP and business management | Offering AP automation as part of a comprehensive suite. |

SSubstitutes Threaten

Manual accounts payable (AP) processes are a persistent threat of substitution for AvidXchange. Despite the clear inefficiencies, many businesses, particularly smaller ones or those hesitant about adopting new technology, continue to rely on manual AP workflows. Indeed, as of 2024, a substantial portion of AP departments still operate with partially or fully manual systems, representing a significant segment of the market that could potentially bypass automated solutions.

Generic accounting software and broad Enterprise Resource Planning (ERP) systems can act as substitutes for specialized accounts payable (AP) automation. While these can handle basic AP functions, they often fall short on the advanced automation and payment network advantages offered by dedicated platforms. For instance, while many ERPs integrate with AP solutions, their built-in AP capabilities might be less robust.

The threat of substitutes is moderately high because many businesses already utilize accounting software or ERPs, making integration a more feasible option than adopting a completely new, specialized system. The cost and complexity of switching to a new platform can be a deterrent. However, the tangible benefits of enhanced efficiency and reduced errors from specialized AP automation can outweigh these initial hurdles for some organizations.

While AvidXchange offers specialized solutions, the threat of substitutes exists, particularly from in-house developed systems or custom integrations. Larger enterprises, especially those with unique workflows or stringent data security requirements, might opt to build their own accounts payable automation solutions. This approach, though demanding in terms of resources and time, allows for complete control and customization, potentially negating the need for third-party software. For instance, a Fortune 500 company might dedicate significant IT resources to create a proprietary system that integrates seamlessly with their existing ERP and financial reporting tools, thereby bypassing the need for an external provider like AvidXchange.

4

Outsourced accounting and Business Process Outsourcing (BPO) firms present a significant threat of substitutes for AvidXchange. These services can take over accounts payable (AP) functions, allowing companies to avoid investing in specialized automation software like AvidXchange's platform. This means businesses have a viable alternative that doesn't require capital expenditure on technology, potentially limiting the perceived necessity of AvidXchange's offerings.

The appeal of these substitutes lies in their ability to deliver a complete service solution. Clients essentially offload the entire AP process, including data entry, invoice processing, and payments, to a third party. This can be particularly attractive to small and medium-sized businesses that may lack the internal resources or expertise to implement and manage complex AP automation software effectively. In 2024, the BPO market continued its robust growth, with the global market size estimated to reach over $400 billion, indicating a substantial availability of such substitute services.

Key aspects of the threat include:

- Cost-Effectiveness: Outsourcing can sometimes offer a more predictable and potentially lower cost structure compared to purchasing and maintaining software licenses and infrastructure.

- Flexibility and Scalability: BPO providers can often scale services up or down more readily than a company can adjust its internal software capabilities.

- Reduced IT Burden: Companies can avoid the complexities of software integration, updates, and maintenance by opting for an outsourced service.

- Focus on Core Competencies: Outsourcing AP allows businesses to concentrate on their primary operations rather than administrative tasks.

5

While specialized AP automation software is the primary offering, basic digital tools can act as substitutes. Individuals or smaller businesses might use a combination of email, spreadsheets, and online banking to manage payables. This patchwork approach, though less efficient and prone to errors, represents a lower-cost alternative for very small operations that cannot justify dedicated AP automation. For instance, a small business owner might manually enter invoice data into a spreadsheet and then process payments through their online bank, a process that, while time-consuming, avoids the direct software cost.

The threat of substitutes for AvidXchange's core Accounts Payable (AP) automation services is present, though often less sophisticated. These substitutes typically involve manual processes or the use of generic digital tools that can partially replicate AP functions. For example, businesses might still rely on a combination of:

- Email and document storage: For receiving and filing invoices.

- Spreadsheets: To track invoice details, payment status, and vendor information.

- Online banking platforms: For initiating and managing payments.

While these manual or semi-manual methods can perform some basic AP tasks, they come with significant drawbacks. The lack of integrated workflows, automated data capture, and robust reporting leads to lower efficiency, increased risk of errors, and potential compliance issues. For example, manual data entry into spreadsheets can easily lead to transposition errors, and reconciliation becomes a much more arduous task. In 2024, the continued reliance on these less-automated methods by a segment of the market, particularly very small businesses or those with exceptionally simple AP needs, still constitutes a viable substitute, albeit one that offers considerably less value and scalability compared to dedicated AP automation solutions like AvidXchange.

The threat of substitutes for AvidXchange's specialized AP automation is moderate. While many businesses still use manual processes or basic digital tools like spreadsheets and email for AP, these are significantly less efficient and more error-prone. For instance, in 2024, a notable portion of small businesses continued to rely on these methods, highlighting a market segment that could potentially adopt more automated solutions. Generic accounting software and ERP systems also serve as substitutes, offering broader functionality but often lacking the deep AP automation capabilities of dedicated platforms.

Outsourced accounting and Business Process Outsourcing (BPO) firms represent a more significant substitute threat. These services offer a complete AP solution, allowing companies to bypass the need for AP automation software altogether. The global BPO market's continued growth, potentially exceeding $400 billion in 2024, underscores the availability and appeal of these comprehensive service alternatives, especially for businesses lacking internal resources or expertise.

Larger enterprises may also develop in-house, custom-built AP solutions, providing complete control and integration with existing systems. This presents a formidable substitute for companies with unique requirements or strong IT capabilities, allowing them to avoid third-party software dependencies.

While these substitutes exist, the clear benefits of specialized AP automation, such as enhanced efficiency, reduced errors, and access to payment networks, continue to drive adoption for businesses seeking to optimize their AP processes.

Entrants Threaten

The threat of new entrants in the accounts payable (AP) and payment automation space, particularly for companies like AvidXchange, remains moderate. Building a robust, secure, and scalable cloud-based platform alongside an extensive payment network requires substantial capital investment. For instance, developing the necessary IT infrastructure and ensuring compliance with financial regulations can easily run into millions of dollars. Companies like AvidXchange have invested heavily in these areas, creating a significant upfront hurdle for potential competitors looking to replicate their established operational capabilities and reach.

The threat of new entrants in the accounts payable automation space is generally considered moderate. Establishing trust and building an extensive network of both buyer and supplier customers is a time-consuming and resource-intensive endeavor. AvidXchange's established presence, boasting over 8,500 buyer customers and a network of 1.35 million supplier customers as of 2024, represents a significant barrier to entry for newcomers. This scale creates a network effect, making it more attractive for new buyers to join an existing platform with a large supplier base.

The threat of new entrants for AvidXchange is moderate, primarily due to the significant technical hurdles involved. New companies need to develop deep integrations with a vast array of existing Enterprise Resource Planning (ERP) and accounting systems, a process that demands substantial development resources and expertise.

Achieving seamless interoperability across these diverse platforms is a complex challenge, requiring considerable investment in software development and testing. For instance, a new entrant would need to map and connect with hundreds, if not thousands, of unique system configurations, a task that can take years and millions of dollars to perfect.

This technical barrier is further amplified by the need for robust security protocols and data privacy compliance, adding another layer of complexity and cost. Without these critical elements, any new solution would struggle to gain trust and adoption in the market, especially given the sensitive financial data involved.

4

The threat of new entrants for AvidXchange is moderate. Entering the fintech space, especially in payment processing and accounts payable automation, demands significant upfront investment in technology, compliance, and building trust. For instance, the Financial Crimes Enforcement Network (FinCEN) requires stringent anti-money laundering (AML) and know-your-customer (KYC) compliance, which can be costly and complex for startups. Furthermore, maintaining robust cybersecurity measures to protect sensitive financial data is a continuous and substantial expense, acting as a barrier to entry.

New players must also navigate a landscape shaped by existing players and evolving customer expectations. The need for specialized expertise in areas like payment security and regulatory compliance, such as those mandated by the Payment Card Industry Data Security Standard (PCI DSS), requires considerable resources and skilled personnel. This complexity, coupled with the established brand recognition and customer base of companies like AvidXchange, makes it challenging for newcomers to gain immediate traction. For example, as of early 2024, the global cybersecurity market is projected to reach over $200 billion, highlighting the scale of investment needed in this area alone.

- High Investment Costs: Significant capital is required for technology infrastructure, regulatory compliance, and cybersecurity.

- Regulatory Hurdles: Navigating complex financial regulations (e.g., AML, KYC) demands specialized knowledge and ongoing adaptation.

- Cybersecurity Demands: Protecting sensitive financial data necessitates substantial and continuous investment in advanced security measures.

- Brand Trust and Reputation: Building credibility in the financial sector takes time and a proven track record, which is difficult for new entrants to replicate quickly.

5

The threat of new entrants in the accounts payable automation space, particularly for serving the middle market, is moderate. Established players like AvidXchange benefit significantly from strong brand recognition and deep-rooted customer relationships built over years of service. Newcomers face a steep climb in replicating this trust and loyalty.

Middle-market businesses often prioritize reliability and proven solutions when adopting new financial technology. This preference for established vendors, who understand their unique needs and regulatory environments, creates a substantial barrier for emerging companies. AvidXchange’s specialization in this segment gives it a crucial edge.

While the technology itself might be replicable, the specialized knowledge of the middle-market segment is a harder asset for new entrants to acquire. This includes understanding specific workflows, compliance requirements, and integration needs common to businesses in this size bracket. For instance, AvidXchange reported a significant increase in customer acquisition in the first quarter of 2024, highlighting the ongoing demand for its specialized expertise.

The capital investment required to develop a robust and secure platform, coupled with the marketing and sales efforts needed to build brand awareness and secure initial customers, also presents a challenge.

- Brand Recognition: AvidXchange has cultivated a strong brand image within the middle-market financial operations sector.

- Established Customer Relationships: Long-standing partnerships provide a stable revenue base and crucial testimonials.

- Specialized Knowledge: Deep understanding of middle-market business processes and pain points is a key differentiator.

- Preference for Proven Solutions: Middle-market firms often favor vendors with a track record of success, reducing the appeal of unproven newcomers.

The threat of new entrants in AvidXchange's market remains moderate, primarily due to the substantial capital investment needed for technology development, regulatory compliance, and building a secure payment network. For example, the global cybersecurity market's growth, projected to exceed $200 billion by early 2024, illustrates the scale of investment required for security alone. New entrants also face significant hurdles in establishing brand trust and acquiring a substantial customer base, especially in the middle market where reliability and proven solutions are highly valued.

AvidXchange's established network, boasting over 8,500 buyer customers and 1.35 million supplier customers as of 2024, creates a powerful network effect that deters new entrants. Furthermore, the technical complexity of integrating with diverse ERP and accounting systems, alongside stringent regulatory requirements like AML and KYC, demands specialized expertise and significant upfront resources, making it difficult for newcomers to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

| Capital Investment | Developing secure, scalable platforms and extensive payment networks requires millions in IT infrastructure and compliance. | High |

| Regulatory Compliance | Meeting AML, KYC, and PCI DSS standards necessitates specialized knowledge and ongoing adaptation. | High |

| Network Effects | AvidXchange's large customer and supplier base (8,500+ buyers, 1.35M+ suppliers in 2024) creates a strong ecosystem advantage. | High |

| Technical Expertise | Complex ERP/accounting system integrations and robust cybersecurity demand significant development resources. | High |

| Brand Trust & Reputation | Building credibility and customer loyalty in the financial sector is a long-term process for new entrants. | Medium |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AvidXchange is built upon a foundation of robust data, including company annual reports, S&P Capital IQ filings, and industry-specific research from IBISWorld. This combination ensures a comprehensive understanding of the competitive landscape.