AvidXchange PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvidXchange Bundle

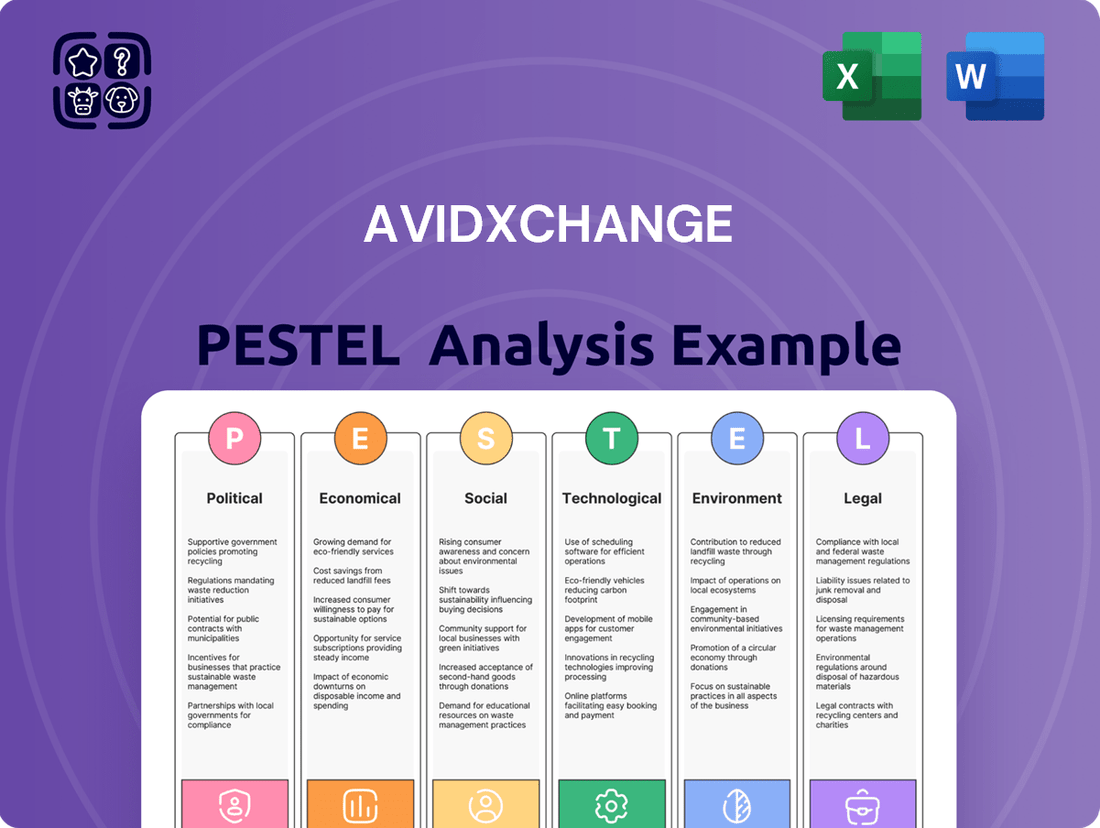

Unlock AvidXchange's strategic landscape with our comprehensive PESTLE analysis. We dissect the political, economic, social, technological, legal, and environmental factors that are actively shaping its operational environment. Understand the critical external forces impacting AvidXchange's growth and competitive positioning. Get actionable intelligence to refine your own market strategies and anticipate future challenges. Download the full, expertly crafted PESTLE analysis now for immediate strategic advantage.

Political factors

Government regulations significantly shape the digital payments landscape AvidXchange operates within. For instance, in 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance for payment processors, impacting how AvidXchange verifies user identities and monitors transactions.

Policy shifts can create new avenues for growth. The increasing focus on data privacy, as seen with evolving state-level regulations mirroring aspects of GDPR in the US during 2024 and early 2025, could drive demand for secure and compliant payment platforms like AvidXchange.

Conversely, stricter compliance can necessitate substantial investment. Updates to Payment Card Industry Data Security Standard (PCI DSS) requirements, with new versions expected in 2025, demand ongoing platform security enhancements and audits, directly affecting operational costs for AvidXchange.

Navigating these evolving legislative frameworks is crucial. Failure to adapt to new directives, such as those concerning real-time payment reporting or cross-border transaction transparency expected to gain traction through 2025, could lead to significant fines and reputational damage for AvidXchange.

The increasing complexity of data privacy laws, including GDPR and CCPA, directly impacts AvidXchange's operations. As of early 2024, enforcement actions and evolving interpretations of these regulations necessitate continuous adaptation in how financial data is managed. This includes robust security measures and transparent data handling practices, crucial for client confidence and avoiding penalties, which can range into millions of dollars for non-compliance.

Government initiatives aimed at boosting digital transformation are a significant tailwind for companies like AvidXchange. For instance, the U.S. government’s proposed initiatives, such as potential tax credits for technology investments in 2024 and 2025, encourage businesses, particularly small and medium-sized enterprises (SMEs), to adopt digital solutions. These programs directly translate into increased demand for AvidXchange’s accounts payable automation services as businesses seek efficiency and resilience.

Such incentives, whether through direct subsidies, grants, or favorable tax policies, effectively lower the financial hurdle for potential clients. This acceleration in adoption allows automation providers like AvidXchange to penetrate the market more rapidly. The overall sentiment is that this creates a highly conducive environment for businesses to upgrade their financial processes, driving growth for tech-forward companies.

Political Stability and Economic Policy

Political stability is crucial for AvidXchange, especially as its middle-market clients often operate with tighter margins and can be more sensitive to economic shifts driven by political decisions. A stable environment fosters business confidence, encouraging these companies to invest in technology solutions like AvidXchange's, which streamline their financial operations. For instance, in 2024, continued political stability in the US, a primary market for AvidXchange, supported moderate business investment growth.

Government economic policies directly impact the liquidity and spending power of AvidXchange's customer base. Policies like infrastructure spending can boost the construction sector, a key segment for AvidXchange, increasing their need for efficient payment solutions. Conversely, austerity measures might reduce business spending. The 2025 US budget proposal, for example, includes significant allocations for infrastructure, potentially benefiting AvidXchange's clients.

- US Political Stability: The United States, a key market for AvidXchange, has maintained a generally stable political landscape, which historically supports business investment and confidence, crucial for mid-market companies adopting new financial technologies.

- Government Spending Impact: Government initiatives like infrastructure spending in 2024 and projected for 2025, particularly in sectors like construction, can directly increase the transaction volume and need for efficient payment processing among AvidXchange's clientele.

- Regulatory Environment: Evolving financial regulations, influenced by political decisions, can create both opportunities and challenges for fintech companies like AvidXchange, requiring adaptability in compliance and service offerings.

Anti-Money Laundering (AML) and Sanctions Policies

AvidXchange operates under a stringent regulatory environment, particularly concerning anti-money laundering (AML) and international sanctions. These government policies necessitate the integration of robust compliance features into their payment processing platforms. For instance, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) regularly updates its sanctions lists, requiring continuous monitoring of transactions and customer data to prevent illicit financial flows. Failure to comply can result in significant penalties, impacting the company's operational continuity and reputation.

Adherence to AML and sanctions regulations is paramount for maintaining AvidXchange's credibility and fostering trust among its clients and within the broader financial sector. This involves rigorous processes for customer due diligence, transaction monitoring, and suspicious activity reporting. In 2024, the global focus on financial crime prevention has intensified, with regulatory bodies increasing scrutiny on fintech companies like AvidXchange to ensure they are not facilitating illegal activities. This translates to substantial investments in compliance technology and personnel.

- Regulatory Compliance: AvidXchange must integrate sophisticated AML and sanctions screening tools into its payment solutions, aligning with mandates from bodies like OFAC.

- Risk Management: The company's risk management frameworks are directly shaped by these policies, influencing customer onboarding procedures and ongoing transaction surveillance.

- Reputational Integrity: Strict adherence to these regulations is vital for preserving AvidXchange's reputation and its standing as a trusted partner in financial transactions.

- Operational Impact: Compliance requirements directly affect the design and functionality of AvidXchange's payment processing systems, demanding continuous adaptation to evolving legal landscapes.

Political stability in key markets like the US, a core region for AvidXchange, underpins business confidence and investment in technology solutions. Government spending on infrastructure, projected to continue into 2025, can boost sectors like construction, increasing transaction volumes for AvidXchange clients. However, the complex and evolving regulatory landscape, driven by political decisions, requires constant adaptation to ensure compliance with mandates like AML and data privacy, impacting operational costs and strategic planning.

What is included in the product

This PESTLE analysis provides an in-depth examination of the external macro-environmental factors influencing AvidXchange, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights for strategic decision-making, identifying opportunities and threats to navigate the evolving landscape of the accounts payable automation industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how AvidXchange's focus on regulatory compliance (Political) and technological advancements (Technological) addresses customer pain points in AP automation.

Economic factors

High inflation in 2024 and early 2025 can significantly increase operating expenses for AvidXchange and its clientele, potentially impacting profitability and leading to reduced investment in new software solutions. For instance, persistent inflation could drive up costs for cloud hosting, marketing, and employee compensation, directly affecting AvidXchange's bottom line.

Rising interest rates, a common response to inflation, could also present challenges. As the Federal Reserve maintained a hawkish stance through much of 2024, businesses facing higher borrowing costs might delay or scale back investments in technology upgrades, including financial automation platforms like those offered by AvidXchange. This could slow the adoption rate of new solutions.

However, the inherent value proposition of automation remains strong, especially during economic headwinds. The cost savings and efficiency gains from automating accounts payable and payments, estimated by some industry reports to be as high as 50-70% for certain processes, make AvidXchange's offerings an appealing investment even when budgets are tight. This efficiency can offset rising operational costs for clients.

Economic growth is a crucial driver for AvidXchange, as the financial health of middle-market businesses directly influences their ability to invest in solutions like Accounts Payable (AP) automation. A strong economy, characterized by rising GDP and consumer confidence, typically translates to increased business spending on efficiency and digital transformation. For instance, in 2024, projections for US GDP growth were around 2.5%, signaling a favorable environment for businesses to upgrade their operational tools.

When businesses are financially stable, they are more likely to allocate capital towards modernizing their AP processes, which AvidXchange specializes in. This investment is often viewed as a way to improve cash flow and reduce operational costs. As of early 2025, many middle-market companies were reporting improved profit margins, encouraging them to pursue technology adoption to maintain that momentum.

Conversely, an economic slowdown or recessionary period can significantly dampen demand for AvidXchange's services. During downturns, businesses tend to implement budget freezes or cuts, prioritizing essential operational expenses over new technology investments. This could lead to delayed adoption of AP automation, as companies focus on immediate cost-saving measures rather than long-term efficiency gains.

Businesses are significantly boosting their investments in digital transformation, with a notable focus on financial operations, directly impacting companies like AvidXchange. This economic trend underscores a widespread drive for enhanced operational efficiency, reliance on data for strategic decisions, and the growing necessity of supporting remote work environments.

The global digital transformation market was projected to reach $7.1 trillion by 2024, illustrating the substantial economic commitment. Companies are increasingly prioritizing the automation of manual tasks, recognizing it as a critical strategy for long-term cost reduction and strengthening financial oversight.

By 2025, it's estimated that over 80% of enterprises will have adopted digital-first strategies, a testament to the perceived economic benefits of digital integration. This widespread adoption fuels demand for solutions that streamline financial processes, offering a direct economic advantage through reduced errors and faster transaction cycles.

Competitive Landscape and Pricing Pressure

The accounts payable (AP) automation and broader FinTech sectors are quite crowded, with many companies vying for market share. This intense competition directly translates into pricing pressure for players like AvidXchange. For instance, the AP automation market, which was estimated to reach $4.8 billion in 2023, is projected to grow to $11.5 billion by 2030, indicating significant investment and numerous entrants. This means AvidXchange must constantly innovate and offer compelling value to maintain its revenue streams and market position.

Economic conditions play a crucial role in how this competitive landscape impacts AvidXchange. During economic downturns, businesses often become more cost-conscious, scrutinizing every expense and seeking the most competitive pricing. This can intensify pricing pressure as clients look for savings. Conversely, during periods of economic growth, businesses might be more willing to invest in solutions that offer efficiency and long-term value, potentially easing some pricing pressures but increasing the demand for differentiation.

To navigate this environment, AvidXchange needs to focus on continuous innovation and clearly differentiating its offerings. This could involve developing unique features, expanding service capabilities, or building stronger customer relationships. For example, as of Q1 2024, AvidXchange reported a 22% year-over-year increase in total revenue, reaching $163.1 million, demonstrating their ability to grow even amidst competition. However, maintaining this growth requires a strategic approach to pricing and a commitment to delivering superior value.

- Intense Competition: The AP automation and FinTech markets feature a large number of providers, leading to significant pricing pressure.

- Economic Sensitivity: Economic cycles directly influence client price sensitivity, impacting revenue models and market share strategies for companies like AvidXchange.

- Need for Differentiation: Continuous innovation and clear value propositions are essential for AvidXchange to stand out and retain customers in a competitive market.

- Revenue Growth Amidst Competition: AvidXchange achieved 22% year-over-year revenue growth in Q1 2024, underscoring the importance of strategic execution in a competitive landscape.

Access to Capital for SMBs

The availability and cost of capital for middle-market businesses are critical determinants of their capacity and inclination to adopt new software solutions, such as those offered by AvidXchange. For instance, in early 2024, the Federal Reserve maintained interest rates, making borrowing more expensive for many SMBs. This environment can indeed slow down technology investments.

Conversely, periods of more accessible credit and lower borrowing expenses can spur greater investment in operational upgrades. A report from the Small Business Administration in late 2023 highlighted that while loan approvals were steady, the average interest rate for small business loans remained elevated compared to previous years. This directly affects the sales cycle and market penetration potential for AvidXchange.

- Interest Rate Environment: Higher interest rates increase the cost of borrowing, potentially delaying SMB software adoption.

- Credit Market Conditions: Tighter lending standards can limit the ability of SMBs to secure the financing needed for new technology investments.

- Investor Confidence: The willingness of venture capital and private equity firms to fund SMB growth impacts their ability to spend on solutions like AvidXchange.

- Economic Outlook: A positive economic outlook generally encourages SMBs to invest in tools that improve efficiency and scalability.

The economic landscape in 2024 and early 2025 presents a dual-edged sword for AvidXchange. While persistent inflation and higher interest rates, exemplified by the Federal Reserve's hawkish stance, can increase operating costs and dampen business investment in new technologies, the core value proposition of automation remains compelling. The drive for digital transformation, with the global market projected to hit $7.1 trillion by 2024, continues to fuel demand for solutions that enhance efficiency and reduce manual tasks, offering a critical pathway for businesses to offset rising expenses and improve financial oversight.

| Economic Factor | Impact on AvidXchange | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Inflation | Increases operating costs for AvidXchange and clients; may reduce investment in new solutions. | US CPI inflation averaged around 3.4% in early 2024, with projections for continued elevated levels. |

| Interest Rates | Higher borrowing costs can deter businesses from investing in technology upgrades. | Federal Reserve Funds Rate remained above 5% through early 2025, impacting SMB borrowing costs. |

| Digital Transformation Investment | Strong demand for automation solutions to improve efficiency and cut costs. | Global digital transformation market projected to reach $7.1 trillion in 2024. Over 80% of enterprises expected to adopt digital-first strategies by 2025. |

| Economic Growth | Favorable for middle-market businesses to invest in AP automation. | US GDP growth projected around 2.5% in 2024, indicating a supportive environment for business spending. |

| Competition & Pricing | Intense market competition leads to pricing pressure; need for differentiation. | AP Automation market estimated to grow from $4.8 billion (2023) to $11.5 billion by 2030. AvidXchange reported 22% YoY revenue growth in Q1 2024. |

Preview the Actual Deliverable

AvidXchange PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for AvidXchange delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understand the external forces shaping the accounts payable automation market and how AvidXchange navigates them.

Sociological factors

The digital literacy of employees within middle-market companies significantly shapes how easily they can adopt and use AvidXchange's cloud-based solutions. A workforce comfortable with technology will find it much simpler to embrace automation, which in turn leads to a smoother rollout and greater satisfaction with the platform. For instance, a 2024 survey indicated that 78% of middle-market businesses reported an increase in their employees' digital skills over the past two years, a trend that bodes well for solutions like AvidXchange.

This growing digital fluency also directly affects the investment needed for training. When employees are already digitally proficient, the learning curve for new software is shorter, potentially reducing the overall cost of implementation and increasing the perceived value of the automated solutions. Businesses with a higher baseline of digital literacy are likely to see quicker returns on investment as their teams can more rapidly leverage the full capabilities of platforms designed to streamline financial processes.

The ongoing embrace of remote and hybrid work models by businesses has dramatically amplified the demand for financial management tools that are cloud-based and readily accessible from anywhere. This societal shift directly benefits AvidXchange, as its platform is designed for seamless AP automation regardless of employee location. Indeed, a 2024 survey indicated that 70% of companies plan to offer hybrid work options indefinitely, highlighting the persistent need for such digital solutions.

Companies are actively seeking financial automation software that allows their accounts payable departments to operate efficiently and securely without requiring physical presence or paper-based workflows. This desire for location-agnostic functionality is a powerful driver for digital transformation in finance departments. Market analysis from early 2025 projects continued growth in the adoption of cloud-based AP automation solutions, with an estimated 25% year-over-year increase in demand.

Businesses are increasingly prioritizing operational efficiency and cost reduction, a trend that directly fuels the demand for automation solutions like those offered by AvidXchange. This cultural shift means companies are actively seeking ways to streamline processes and minimize manual tasks, especially in financial operations. For instance, a 2024 survey indicated that 65% of CFOs identified process automation as a top priority for improving financial operations.

AvidXchange thrives in this environment because its accounts payable (AP) automation solutions directly address the business culture's focus on streamlined workflows and reduced manual effort. The drive for improved financial visibility, a key benefit of AP automation, resonates strongly with decision-makers aiming for better control and data-driven insights. In 2025, projections suggest the AP automation market will continue its strong growth, with an estimated compound annual growth rate (CAGR) of 12.5% through 2030, reflecting this cultural embrace.

Perception of Data Security and Trust

Societal concerns about data breaches and cyber fraud significantly influence how businesses view cloud-based financial solutions like those offered by AvidXchange. A 2024 survey indicated that 70% of CFOs cite data security as their primary concern when adopting new financial technology. This heightened awareness means AvidXchange must consistently demonstrate its commitment to safeguarding sensitive financial information.

Building and maintaining trust is paramount for AvidXchange. Clients need assurance that their financial data is protected against cyber threats and fraud. In 2025, reports suggest that companies experiencing a significant data breach can face an average financial loss exceeding $4 million, underscoring the critical need for robust security protocols.

The perception of data security directly impacts AvidXchange's ability to attract and retain clients, especially for businesses digitizing their accounts payable and receivable processes. Overcoming hesitations requires clear communication about security measures and compliance certifications. For instance, the increasing adoption of AI in fraud detection by financial institutions in 2024 highlights the evolving landscape of security and the need for continuous innovation.

- Client Hesitation: 70% of CFOs in 2024 identified data security as their top concern regarding new financial technology.

- Financial Impact of Breaches: In 2025, data breaches cost companies an average of over $4 million.

- Trust Building: AvidXchange's success hinges on demonstrating unwavering commitment to data protection and compliance.

- Technological Advancements: The rise of AI in fraud detection in 2024 signifies the dynamic nature of cybersecurity in financial services.

Generational Shifts in Business Leadership

Generational shifts are significantly reshaping business leadership, with younger, digitally fluent generations increasingly taking the helm. This trend directly benefits companies like AvidXchange. As these emerging leaders ascend, they bring a natural inclination towards adopting advanced technologies to streamline operations. A 2024 survey indicated that 75% of Gen Z and Millennial business leaders prioritize cloud-based solutions for financial management, compared to 40% of Baby Boomer leaders.

This demographic shift fuels demand for automation and modern platforms, directly aligning with AvidXchange's offerings in accounts payable and payment automation. Companies are actively seeking ways to modernize their financial processes, and younger leadership is often the catalyst for these investments. For instance, by the end of 2025, it's projected that over 60% of middle-market companies will have implemented AI-driven financial tools, a stark increase from just 35% in 2022.

- Increased Adoption of Automation: Younger leaders are more likely to champion automation in financial processes.

- Preference for Cloud-Based Solutions: Digital natives favor cloud platforms for efficiency and accessibility.

- Investment in Modern Technology: This demographic prioritizes tech investments to modernize financial operations.

- Impact on Market Growth: The trend supports the growth trajectory of financial technology providers like AvidXchange.

The increasing comfort of employees with digital tools directly benefits AvidXchange, as a more tech-savvy workforce adopts automation solutions more readily. By 2024, 78% of middle-market firms reported improved employee digital skills, smoothing AvidXchange's integration. This digital fluency also cuts down training costs, accelerating the return on investment for businesses adopting AP automation. The widespread adoption of remote work, with 70% of companies planning indefinite hybrid models in 2024, further amplifies the need for cloud-based financial management tools like AvidXchange.

Societal concerns about data security are paramount, with 70% of CFOs in 2024 citing it as their top worry when adopting new financial tech. AvidXchange must demonstrate robust data protection, especially as data breaches cost companies over $4 million on average in 2025. Younger generations entering leadership roles, with 75% of Gen Z and Millennial leaders prioritizing cloud solutions in 2024, are driving demand for financial automation. By 2025, over 60% of middle-market companies are expected to use AI-driven financial tools, up from 35% in 2022, highlighting this generational influence.

| Sociological Factor | Impact on AvidXchange | Supporting Data (2024-2025) |

|---|---|---|

| Digital Literacy | Facilitates easier adoption of AP automation solutions. | 78% of middle-market businesses reported increased employee digital skills (2024). |

| Remote/Hybrid Work Trends | Increases demand for accessible, cloud-based financial tools. | 70% of companies plan to offer indefinite hybrid work options (2024). |

| Data Security Concerns | Requires AvidXchange to showcase strong cybersecurity measures. | 70% of CFOs cited data security as their top concern for new financial tech (2024). |

| Generational Shift in Leadership | Drives demand for modern, automated financial processes. | 75% of Gen Z/Millennial leaders prioritize cloud solutions (2024). |

Technological factors

AvidXchange can leverage AI and machine learning to make its invoice processing platform smarter. Imagine AI automatically understanding complex invoices, pulling out the right data faster than a human ever could. This means fewer errors and quicker payments for businesses.

These technologies are crucial for advanced fraud detection. Machine learning algorithms can spot unusual patterns in transactions that might indicate fraud, protecting AvidXchange clients. For instance, in 2024, the global AI market was valued at over $200 billion, highlighting the rapid adoption and investment in these capabilities.

Predictive analytics, powered by AI, can offer clients valuable insights. This could include forecasting cash flow needs or identifying potential payment bottlenecks before they become problems. Gartner predicted that by 2025, AI-driven process automation would reduce operational costs for many businesses by 30%.

The ongoing advancements in cloud computing, particularly in areas like enhanced scalability, robust security, and improved reliability, directly bolster AvidXchange's cloud-native platform. These technological leaps enable AvidXchange to deliver more sophisticated services, manage escalating transaction volumes, and maintain critical high uptime for its financial clients.

For instance, by mid-2024, major cloud providers reported significant investments in infrastructure, with AWS alone committing over $150 billion to data center expansion in the US through 2028. This continuous improvement in cloud technology empowers AvidXchange to offer more resilient and feature-rich solutions, supporting faster deployment cycles and seamless software updates essential in the fast-paced financial technology sector.

Cybersecurity threats are a growing concern for financial technology companies like AvidXchange, with the sophistication of attacks constantly increasing. This means AvidXchange must continually invest in cutting-edge security to safeguard the sensitive financial data it handles. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk involved.

Offering strong security features, such as advanced encryption, multi-factor authentication, and proactive threat detection, is absolutely crucial for AvidXchange. These capabilities not only build and maintain client trust but also ensure compliance with various data protection regulations in an environment where breaches are increasingly common. A recent report indicated that the average cost of a data breach in the financial sector reached $5.90 million in 2023.

Integration Capabilities with ERP Systems

AvidXchange's success hinges on its ability to seamlessly integrate with a wide array of Enterprise Resource Planning (ERP) and accounting systems prevalent in the middle market. This technological capability directly impacts market penetration and customer adoption, as businesses prioritize solutions that enhance, rather than disrupt, their existing IT ecosystems. For instance, in 2024, approximately 75% of mid-sized businesses reported that integration with their core financial systems was a primary consideration when selecting new software, highlighting the importance of this factor for AvidXchange.

The depth and breadth of these integrations are crucial. Businesses are looking for platforms that can connect effortlessly with systems like SAP, Oracle NetSuite, Microsoft Dynamics, and QuickBooks, among others. This ensures that accounts payable (AP) processes are streamlined and data flows accurately across the organization. A strong integration strategy allows AvidXchange to capture a larger share of the market by catering to diverse technological infrastructures.

- Broad ERP Compatibility: AvidXchange supports integration with over 200 ERP and accounting systems, a significant differentiator in the market.

- API-Driven Integrations: Utilizing robust APIs allows for more flexible and efficient data exchange, reducing implementation time.

- Data Synchronization: Successful integration ensures real-time data synchronization, improving accuracy and reducing manual reconciliation efforts for finance teams.

- Scalability: The integration framework is designed to scale with the growing needs of middle-market businesses, supporting increased transaction volumes.

Mobile Technology and Accessibility

The widespread adoption of mobile technology directly impacts how AvidXchange develops its services. With more professionals managing business on the go, there's a growing need for mobile-optimized platforms. This means creating interfaces and features that work seamlessly on smartphones and tablets, ensuring users can access critical financial functions anytime, anywhere.

By offering secure and user-friendly mobile access, AvidXchange empowers financial professionals with greater flexibility. This accessibility is crucial for tasks like approving invoices or monitoring payment statuses, streamlining workflows and supporting increasingly common hybrid or remote work arrangements. In 2024, it's estimated that over 70% of business professionals regularly use mobile devices for work-related tasks, highlighting this trend.

- Mobile-First Design: AvidXchange's strategy increasingly prioritizes mobile-friendly interfaces to cater to on-the-go financial management needs.

- Enhanced Accessibility: Secure mobile access allows for real-time approvals and monitoring, improving operational efficiency for users.

- Flexible Work Support: The platform's mobile capabilities align with the growing demand for flexible and remote work environments in finance.

- Market Trends: Over 70% of professionals utilized mobile devices for work in 2024, underscoring the importance of mobile functionality.

Technological advancements are fundamentally reshaping invoice processing. AvidXchange can leverage AI and machine learning to create a smarter, more automated platform, significantly reducing manual effort and errors. These technologies are also vital for enhancing fraud detection, as AI can identify suspicious patterns that human oversight might miss. By 2025, AI-driven automation was projected to cut operational costs by up to 30% for many companies, a benefit AvidXchange can pass on to its clients.

Legal factors

AvidXchange operates within the heavily regulated financial services sector, necessitating strict adherence to a complex web of rules. This includes compliance with regulations like the Bank Secrecy Act (BSA) and various state money transmission laws, which are crucial for maintaining operational legitimacy and client trust. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize robust anti-money laundering (AML) programs, a key area for payment processors.

Failure to comply with these evolving financial regulations, such as those related to data privacy and consumer protection, can lead to significant penalties and reputational damage. Staying updated with regulatory changes, like potential updates to Payment Services Directives (PSDs) in various jurisdictions or new cybersecurity standards being implemented by bodies like the National Institute of Standards and Technology (NIST), is paramount. Regular internal audits and external reviews are therefore essential components of AvidXchange's operational strategy to mitigate these legal risks.

AvidXchange must navigate a complex web of data protection laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside evolving state-specific privacy rules. Handling sensitive financial information means strict adherence is paramount, as penalties for non-compliance can be severe. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk.

Failure to comply can result in substantial fines, with GDPR penalties alone reaching up to 4% of global annual turnover or €20 million. This legal landscape demands AvidXchange implement and maintain robust data security measures, clear consent management strategies, and transparent practices for handling customer data. In 2024, the increasing scrutiny on data privacy worldwide means proactive compliance is not just a legal requirement but a business imperative to maintain trust and avoid significant financial and reputational damage.

AvidXchange, operating within the financial technology sector, faces significant legal scrutiny under Anti-Money Laundering (AML) and Know Your Customer (KYC) mandates. These regulations are designed to combat financial crime by requiring thorough client identification and ongoing transaction monitoring. Failing to adhere to these laws can result in substantial penalties, impacting a company's operational license and reputation.

As of early 2024, regulatory bodies globally continue to enhance AML/KYC frameworks. For instance, the Financial Crimes Enforcement Network (FinCEN) in the United States frequently updates its guidance. AvidXchange must ensure its onboarding processes verify customer identities rigorously, often requiring multiple forms of identification and data points to meet these evolving legal standards.

The cost of non-compliance is substantial, with fines levied against financial institutions for AML/KYC violations reaching hundreds of millions of dollars in recent years. AvidXchange's investment in robust compliance technology and personnel is therefore not merely a cost center but a critical business imperative to safeguard against such financial and reputational damage.

Contract Law and Service Level Agreements

The legal bedrock of AvidXchange’s operations hinges on robust contract law and meticulously crafted Service Level Agreements (SLAs). These agreements are the blueprints for its client relationships, clearly delineating service boundaries, accountability, and performance benchmarks. For instance, in 2024, AvidXchange's focus on digital invoice processing means SLAs likely detail uptime guarantees for its platform, data security protocols, and turnaround times for payments, crucial for maintaining client trust and operational efficiency.

These legally binding documents are paramount in managing expectations and proactively preventing disputes. They outline performance standards, such as processing accuracy rates and response times for customer support, which directly impact client satisfaction and retention. Failure to meet these agreed-upon standards can lead to defined penalties, underscoring the importance of compliant and clear contractual language.

The enforceability of these contracts ensures that AvidXchange can operate with confidence, knowing its obligations and rights are clearly established. This legal framework also dictates how any disagreements are resolved, often through arbitration or mediation clauses, aiming for efficient and fair settlements. By adhering to these legal stipulations, AvidXchange safeguards its business interests and fosters long-term, stable client partnerships.

The evolving regulatory landscape, particularly concerning data privacy and financial transactions, directly influences the structure and content of AvidXchange's contracts and SLAs. Staying compliant with regulations like GDPR or CCPA, which impact how client data is handled, is critical. For example, as of early 2025, updates to data breach notification laws in various jurisdictions require specific contractual clauses detailing immediate reporting procedures, adding another layer of legal complexity that must be expertly managed.

Intellectual Property Rights

AvidXchange's competitive edge heavily relies on protecting its proprietary software, unique algorithms, and technological advancements. This protection is achieved through robust intellectual property rights, including patents, copyrights, and trade secrets.

Legal actions to deter infringement and actively enforce these IP rights are paramount. This safeguards AvidXchange's distinctive solutions and helps maintain its leading position in the accounts payable automation market.

- Patents: AvidXchange likely holds patents for its core AP automation technologies, preventing competitors from using similar innovations. As of early 2024, the company continues to invest in R&D, with patent filings being a key indicator of its innovation pipeline.

- Copyrights: Copyrights protect the literal expression of AvidXchange's software code and user interfaces, ensuring that unauthorized copying is illegal.

- Trade Secrets: Confidential business information, such as customer lists and specific operational processes, are protected as trade secrets, providing a competitive advantage.

- Enforcement: AvidXchange actively monitors the market for potential IP infringement and is prepared to take legal action to protect its intellectual assets.

AvidXchange must navigate a complex landscape of financial regulations, including Anti-Money Laundering (AML) and Know Your Customer (KYC) mandates, to combat financial crime. As of early 2024, global regulatory bodies like FinCEN continue to enhance these frameworks, requiring rigorous identity verification and transaction monitoring. Failure to comply can result in substantial penalties, with fines for AML/KYC violations in the financial sector reaching hundreds of millions of dollars in recent years, making robust compliance a critical business imperative.

Environmental factors

The increasing focus on environmental, social, and governance (ESG) factors is fueling a significant shift towards paperless operations across industries. Businesses are actively seeking ways to reduce their carbon footprint and minimize waste, making digital solutions for processes like accounts payable highly attractive.

AvidXchange's core offering directly addresses this demand. By automating the invoice and payment process, the company enables businesses to virtually eliminate paper, thereby cutting down on resource consumption and disposal. This digital transformation not only supports sustainability goals but also streamlines operations.

For instance, a typical business might process thousands of invoices annually, each potentially involving paper, printing, and postage. Transitioning to an electronic system like AvidXchange's can reduce paper usage by an estimated 80-90% for these transactions. This translates to substantial environmental benefits and cost savings for clients.

The trend is accelerating, with many companies setting ambitious targets for waste reduction and digital transformation. In 2024, for example, a significant percentage of businesses reported prioritizing digital solutions to meet their ESG commitments, directly benefiting providers like AvidXchange.

Companies are increasingly prioritizing Corporate Social Responsibility (CSR), seeking partners that align with their sustainability goals. AvidXchange can enhance its CSR profile and appeal to environmentally conscious clients by highlighting its role in enabling paperless processes and operational efficiency.

This focus on sustainability can contribute to a more positive brand image and create market differentiation for AvidXchange. For instance, a move towards digital invoice processing can significantly reduce paper consumption; in 2023, AvidXchange processed billions of dollars in invoices, implying a substantial reduction in physical paperwork compared to traditional methods.

As a cloud-based software provider, AvidXchange's environmental impact is significantly tied to the energy demands of the data centers that power its platform. The global data center industry consumed an estimated 200-300 terawatt-hours (TWh) of electricity in 2023, a figure projected to rise as digital services expand.

There's increasing pressure from regulators and stakeholders for companies to address the substantial energy footprint of data centers. This necessitates AvidXchange to actively evaluate and advocate for data infrastructure solutions that prioritize energy efficiency and are powered by renewable energy sources.

This focus on energy consumption is a critical operational consideration for AvidXchange, directly influencing its sustainability efforts and its ability to meet evolving environmental standards and corporate responsibility goals.

Regulatory Pressure for Green Practices

While not a direct mandate on AvidXchange, evolving environmental regulations globally are shaping client priorities. Many businesses are now actively seeking solutions that align with their sustainability goals, and AvidXchange's paperless accounts payable automation directly supports this by reducing paper consumption and associated waste. This trend is accelerating, with a growing number of companies, particularly larger enterprises, setting ambitious ESG (Environmental, Social, and Governance) targets for their supply chains. For instance, by 2024, many publicly traded companies are enhancing their environmental reporting, which indirectly boosts demand for vendors like AvidXchange that facilitate greener operations.

The increasing emphasis on environmental impact reporting means clients are looking for partners who can contribute to their positive environmental footprint. AvidXchange's digital invoicing and payment platform offers a tangible way for businesses to reduce their reliance on paper, a key factor in corporate sustainability initiatives. This can be a significant differentiator in the market. The global green building market, for example, which is projected to reach over $3.1 trillion by 2027, indicates a broader business commitment to environmental responsibility that extends to operational efficiency.

- Reduced Paper Usage: AvidXchange's digital solutions directly decrease paper consumption, a key environmental benefit for clients.

- ESG Alignment: Companies are increasingly prioritizing vendors that help them meet their Environmental, Social, and Governance (ESG) objectives.

- Marketing Advantage: Highlighting the environmental benefits of AvidXchange's services can serve as a strong marketing differentiator.

- Client Demand for Sustainability: Businesses are actively seeking to reduce their carbon footprint, making paperless solutions more attractive.

Remote Work and Reduced Commuting

AvidXchange's cloud-based platform supports remote work, which can lead to significant environmental advantages for its clients. By enabling employees to work from home, the need for daily commuting is reduced, directly cutting down on vehicle emissions and the associated carbon footprint. This trend is gaining momentum, with many companies actively encouraging or adopting hybrid and fully remote models.

The environmental impact of reduced commuting is substantial. For instance, a study by the U.S. Department of Transportation in 2023 indicated that a typical commuter might drive over 10,000 miles annually. Shifting a portion of this to remote work can translate to thousands of fewer vehicle miles traveled per employee. This aligns with broader societal goals for sustainability and corporate environmental responsibility.

AvidXchange's role in facilitating this shift is indirect but impactful. By providing a robust platform for managing accounts payable remotely, the company empowers its clients to embrace flexible work arrangements. This contributes to a more sustainable business ecosystem, where operational efficiency is coupled with environmental consciousness.

- Reduced Carbon Emissions: Less commuting means fewer cars on the road, directly lowering greenhouse gas output.

- Lower Energy Consumption: Decreased office building usage can lead to reduced energy demands for heating, cooling, and lighting.

- Improved Air Quality: Fewer vehicles contribute to better local air quality in urban and suburban areas.

- Support for Sustainable Practices: Facilitating remote work aligns businesses with growing environmental, social, and governance (ESG) expectations.

The growing emphasis on Environmental, Social, and Governance (ESG) criteria is a significant driver for businesses to adopt paperless solutions like AvidXchange's. This shift directly supports clients' sustainability objectives by reducing their paper consumption and waste. Many companies are now actively seeking partners that align with their environmental goals, making AvidXchange's digital accounts payable automation a compelling offering.

AvidXchange's platform facilitates a reduction in paper usage, a key environmental benefit that resonates with clients aiming to lower their carbon footprint. For example, transitioning to digital invoices can cut paper use by up to 90% per transaction. This aligns with corporate responsibility initiatives, as evidenced by the increasing number of companies setting ambitious ESG targets and enhancing their environmental reporting by 2024.

The company's cloud-based infrastructure, while essential, also presents environmental considerations related to data center energy consumption. As the global data center industry consumed an estimated 200-300 TWh of electricity in 2023, AvidXchange must prioritize energy-efficient solutions and renewable energy sources to mitigate its environmental impact.

The ability of AvidXchange's platform to support remote work offers further environmental advantages by reducing employee commuting. Less travel translates directly to lower vehicle emissions and improved air quality, aligning with broader sustainability goals and corporate ESG expectations. This trend is significant, with potential to reduce thousands of vehicle miles traveled per employee annually.

PESTLE Analysis Data Sources

Our AvidXchange PESTLE Analysis is meticulously constructed using a blend of public government data, reputable financial market reports, and leading industry analysis. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the accounts payable automation sector.