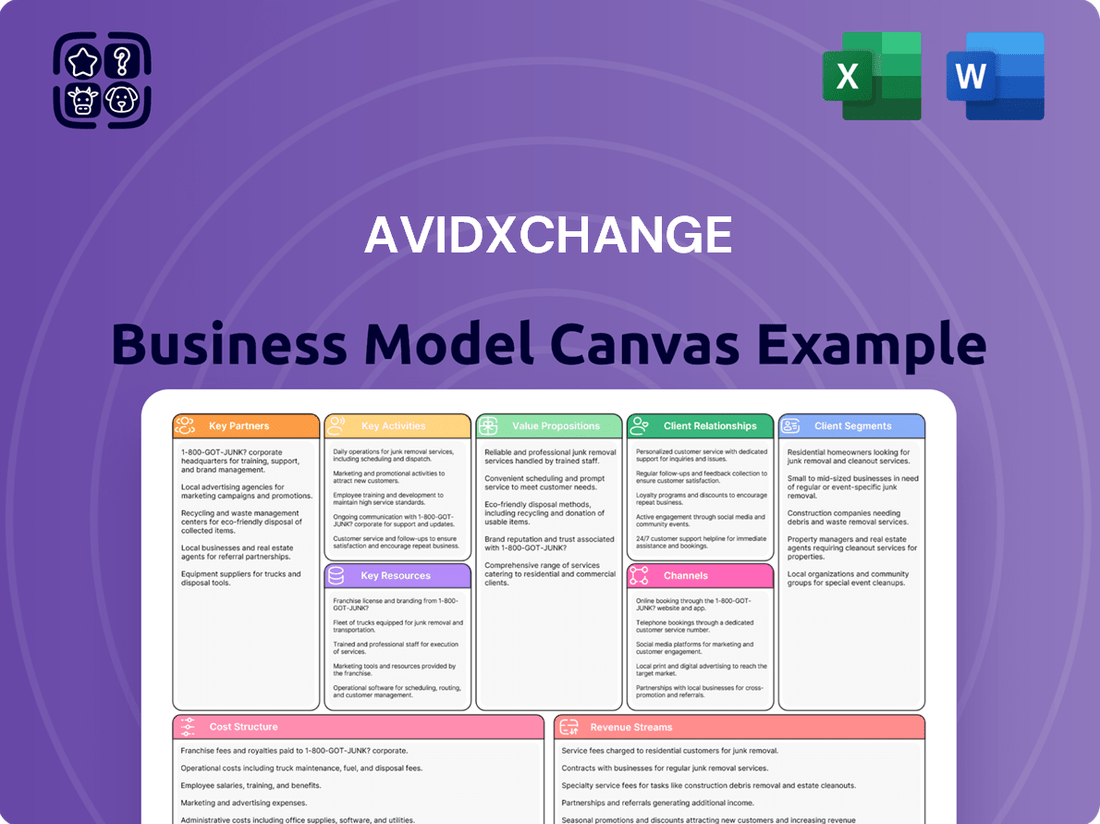

AvidXchange Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvidXchange Bundle

Unlock the full strategic blueprint behind AvidXchange's business model. This in-depth Business Model Canvas reveals how the company drives value through automating accounts payable, captures market share by serving mid-market companies, and stays ahead by focusing on integration and customer service. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a successful SaaS platform.

Dive deeper into AvidXchange’s real-world strategy with the complete Business Model Canvas. From its unique value propositions targeting operational efficiency to its cost structure and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this FinTech leader thrive—and where its future opportunities lie.

Want to see exactly how AvidXchange operates and scales its business in the complex world of financial automation? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking your own operations, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out AvidXchange’s impressive market growth and operational success. This professional, ready-to-use document is ideal for business students, financial analysts, or founders seeking to learn from proven industry strategies in the B2B SaaS space.

Transform your research into actionable insight with the full Business Model Canvas for AvidXchange. Whether you're validating a similar business idea, conducting a competitive analysis, or understanding key partnerships, this comprehensive template gives you all the strategic components in one place.

Partnerships

AvidXchange cultivates essential alliances with leading Enterprise Resource Planning (ERP) and accounting software providers. These include prominent names such as NetSuite, Microsoft Dynamics, and Sage Intacct. This strategic collaboration allows for deep integrations, ensuring a smooth and uninterrupted flow of financial data for their mutual clients.

These integrations are fundamental to embedding AvidXchange's accounts payable (AP) automation capabilities directly within a client's established financial infrastructure. This approach significantly simplifies the adoption process for new users and boosts operational efficiency. For instance, AvidXchange’s integration with AppFolio and M3 demonstrates its commitment to enhancing value by connecting with core property management systems.

AvidXchange collaborates closely with financial institutions and banks to broaden its payment network and deliver comprehensive payment solutions. These partnerships often involve referral agreements or direct integrations, allowing for a wider adoption of electronic payment methods like ACH and virtual cards.

Through these alliances, banks can enhance their offerings by providing advanced accounts payable (AP) solutions to their business clientele. This strategic move not only benefits the financial institutions by adding value to their services but also grants AvidXchange access to a significantly larger customer base, fostering mutual growth in the B2B payments sector.

AvidXchange relies heavily on its channel partners and resellers to reach a broader customer base, especially in specialized industry sectors. These partners bring pre-existing connections with mid-market companies, smoothing the path for new customer acquisition.

This indirect sales strategy is vital for scaling customer growth, working hand-in-hand with AvidXchange’s direct sales teams. For instance, in 2024, a significant portion of new customer acquisitions were attributed to these reseller relationships, demonstrating their impact on market penetration.

Industry-Specific Software Providers

AvidXchange's strategy heavily relies on integrating with specialized software used by its target middle-market clients. By partnering with providers of industry-specific platforms, AvidXchange can offer more seamless and tailored accounts payable (AP) automation solutions.

These collaborations are crucial for deepening market penetration in sectors like real estate, construction, and healthcare, where unique workflows demand specialized software integrations. For instance, a partnership with MIP Fund Accounting by Community Brands demonstrates AvidXchange's commitment to serving niche markets such as nonprofits and government entities, providing them with integrated AP and payment capabilities.

- Industry-Specific Software Integration: Partnerships enable AvidXchange to connect directly with accounting and ERP systems prevalent in sectors like construction and real estate, enhancing data flow and user experience.

- Market Access and Credibility: Collaborating with established software providers grants AvidXchange access to their existing customer bases and lends credibility within specialized verticals.

- Enhanced Solution Value: By embedding AP automation into existing industry software, AvidXchange provides a more comprehensive and efficient solution for businesses, reducing manual processes and potential errors.

Technology and Innovation Partners

AvidXchange actively collaborates with technology and innovation partners to embed advanced functionalities like AI into its platform. This allows for enhanced automation and more robust fraud detection, crucial for maintaining trust and efficiency in financial processes. For instance, their 2025 trends survey underscored the growing importance of security features, driving AvidXchange to prioritize these technological integrations.

These strategic alliances ensure AvidXchange stays ahead of the curve, meeting the dynamic needs of its clients. By investing in cutting-edge technologies, the company can deliver AP solutions that are not only smarter but also more secure, directly addressing market demands.

- AI Integration: Partners help integrate artificial intelligence for smarter invoice processing and anomaly detection.

- Enhanced Automation: Collaborations focus on automating more aspects of the accounts payable lifecycle.

- Security Advancements: Technology partners contribute to strengthening platform security, a key customer concern.

- Platform Competitiveness: These partnerships ensure AvidXchange's offerings remain state-of-the-art and meet evolving industry standards.

AvidXchange's key partnerships are foundational to its business model, enabling deep integrations with major ERP and accounting systems like NetSuite and Microsoft Dynamics. These collaborations are crucial for embedding AP automation directly into client workflows, simplifying adoption and boosting efficiency. For example, their integration with AppFolio and M3 specifically targets the property management sector.

Further strengthening its network, AvidXchange partners with financial institutions to expand its payment reach, promoting electronic payment methods like ACH and virtual cards. These alliances allow banks to offer advanced AP solutions to their business clients, simultaneously broadening AvidXchange's customer access. By 2024, these banking partnerships significantly contributed to the growth of electronic payment adoption within AvidXchange's client base.

Channel partners and resellers are vital for AvidXchange's market penetration, especially in specialized industries. These partners leverage existing relationships with mid-market companies, accelerating new customer acquisition. In 2024, a substantial portion of AvidXchange's new customer growth was directly attributed to these reseller relationships, highlighting their effectiveness in expanding market reach.

AvidXchange also prioritizes partnerships with providers of industry-specific software, such as MIP Fund Accounting by Community Brands for non-profits. These integrations tailor AP automation solutions for niche markets like construction, real estate, and healthcare, enhancing the value proposition for specialized client needs. These focused integrations allow AvidXchange to effectively serve diverse market segments with customized AP and payment capabilities.

What is included in the product

AvidXchange's Business Model Canvas focuses on automating accounts payable and payment processes for mid-market companies, highlighting its digital platform as a key value proposition to streamline operations and reduce costs for its customers.

This model details AvidXchange's strategy of targeting specific customer segments with a recurring revenue model driven by transaction fees and software subscriptions, emphasizing efficiency and vendor relationships.

AvidXchange's Business Model Canvas acts as a pain point reliver by offering a clear, one-page snapshot of their automated invoice and payment solutions, simplifying complex financial processes for mid-market companies.

The AvidXchange Business Model Canvas effectively relieves pain points by providing a structured, shareable format that highlights how they streamline accounts payable, saving businesses time and reducing manual errors.

Activities

AvidXchange's core activities heavily involve continuous research and development to refine its cloud-based Accounts Payable (AP) automation platform. This dedication to innovation ensures the platform remains at the forefront of financial technology.

Key development efforts focus on introducing new features and enhancing existing ones, such as AI-powered invoice data extraction and automated approval routing. These advancements aim to significantly reduce manual effort and errors in the AP process.

The company actively integrates cutting-edge technologies to streamline invoice processing, approval workflows, and payment execution for its clients. For instance, in 2023, AvidXchange continued to invest in AI and machine learning capabilities to improve data accuracy and processing speeds.

By consistently innovating its product suite, AvidXchange reinforces its market leadership. This commitment to R&D is crucial for meeting evolving client needs and staying competitive in the rapidly advancing fintech landscape.

AvidXchange's core activities revolve around maintaining and operating its robust cloud-based platform. This ensures the stability, security, and scalability necessary to handle the vast volume of transactions for its extensive customer base. By mid-2024, the company was serving over 8,500 buyer customers and facilitating payments for approximately 1.3 million suppliers, highlighting the critical need for seamless operations.

Ongoing maintenance, system upgrades, and stringent cybersecurity protocols are paramount. These efforts protect sensitive financial data and guarantee uninterrupted service, which is fundamental for trust and retention in the fintech industry. In 2024, a significant portion of AvidXchange's operational focus was on enhancing these foundational elements to support continued growth and reliability.

AvidXchange's key activities revolve around managing its expansive AvidPay Network. This network is crucial for facilitating secure electronic payments, including ACH, virtual cards, and checks, connecting businesses with their suppliers.

The company handles intricate payment routing, reconciliation, and robust fraud prevention measures to ensure transactions are both efficient and touchless. This operational excellence underpins the reliability of their service.

Success in this area is directly measured by the increasing volume of transactions processed and the total payment volume flowing through the network. For instance, in 2024, AvidXchange processed a significant number of payments, reflecting the growing adoption of their automated payment solutions.

Customer Acquisition and Onboarding

AvidXchange drives customer acquisition through targeted sales and marketing, focusing on middle-market businesses. This includes direct sales teams and collaborations with strategic partners to broaden reach. In 2024, the company continued to invest in these channels to expand its network of buyers.

Once a business becomes a customer, AvidXchange prioritizes a streamlined onboarding process. This involves integrating the new client's existing financial systems with the AvidXchange platform, ensuring a smooth transition to AP automation. Successful onboarding is vital for customer retention and maximizing the value derived from the service.

- Direct Sales Efforts: AvidXchange employs a direct sales force to engage potential clients, highlighting the benefits of AP automation.

- Strategic Partnerships: Collaborations with accounting firms and other software providers expand AvidXchange's market access and customer acquisition.

- Efficient Onboarding: A dedicated onboarding team ensures rapid integration and user adoption, minimizing disruption for new clients.

- Buyer Network Growth: The acquisition and successful onboarding of new businesses directly contribute to the expansion of AvidXchange's buyer customer base.

Customer Support and Relationship Management

AvidXchange prioritizes robust customer support and proactive relationship management to foster loyalty and expansion. This involves offering dedicated technical assistance, comprehensive onboarding and training programs, and consistent account management to ensure clients fully leverage the platform's capabilities.

These efforts directly translate into high customer satisfaction, a critical driver for retention in the competitive fintech space. For instance, in 2024, companies with strong customer support often see retention rates exceeding 90%, a significant factor for recurring revenue models like AvidXchange's.

- Technical Assistance: Providing timely and effective solutions to user inquiries and platform issues.

- Account Management: Dedicated resources to guide clients, identify opportunities, and ensure ongoing value realization.

- Training and Education: Empowering users with the knowledge to maximize platform functionality and efficiency.

- Relationship Building: Cultivating strong partnerships with both buyers and suppliers to foster a collaborative ecosystem.

AvidXchange's key activities center on platform development, ensuring its AP automation solution remains cutting-edge with features like AI data extraction. They also focus on the seamless operation and security of their cloud platform, serving over 8,500 buyers by mid-2024. Managing the AvidPay Network for efficient and secure payments, including ACH and virtual cards, is also crucial, with significant transaction volumes processed in 2024. Finally, customer acquisition through sales and partnerships, followed by effective onboarding and ongoing support, drives client retention and network growth.

| Key Activity | Description | 2024 Impact/Data |

| Platform Innovation | Developing and enhancing AP automation features, including AI integration. | Continuous improvement to maintain market leadership. |

| Platform Operations | Ensuring stability, security, and scalability of the cloud platform. | Serving over 8,500 buyer customers. |

| Network Management | Facilitating secure and efficient electronic payments through the AvidPay Network. | Processing substantial payment volumes, demonstrating network adoption. |

| Customer Acquisition & Support | Sales, marketing, onboarding, and ongoing client assistance. | Expanding buyer base and fostering high customer retention rates. |

Full Version Awaits

Business Model Canvas

The AvidXchange Business Model Canvas preview you are viewing is the actual, unedited document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. You will gain full access to this comprehensive tool, ready for immediate customization and strategic application for your business needs.

Resources

AvidXchange's proprietary technology platform is its bedrock, a sophisticated cloud-based system designed for end-to-end accounts payable automation. This platform streamlines the entire invoice processing, approval, and payment lifecycle, significantly reducing manual effort and errors for businesses. Its continuous development ensures it stays ahead, incorporating advanced AI capabilities to adapt to the dynamic needs of the middle market.

This technology is not just software; it's a competitive advantage. By automating complex AP processes, AvidXchange enables businesses to achieve greater efficiency and cost savings. For instance, in 2024, companies utilizing such platforms often report a reduction in invoice processing time by as much as 60%, a testament to the power of this digital transformation.

AvidXchange's extensive two-sided network is a cornerstone resource, linking over 8,500 buyer customers with a substantial base of more than 1.3 million supplier customers. This massive interconnectedness is crucial for enabling smooth, secure, and automated financial transactions.

The sheer scale of this network provides a significant competitive advantage, fostering an efficient ecosystem that benefits both parties involved in the payment process. It's this broad reach that allows for touchless processing, a key element in streamlining operations.

By facilitating over $250 billion in total payment volume as of early 2024, AvidXchange demonstrates the immense utility and economic activity generated through its platform. This volume underscores the network's effectiveness in driving real-world financial exchanges.

The value proposition is clear: buyers gain access to a wider supplier pool and simplified payment workflows, while suppliers benefit from faster payments and reduced administrative burdens, all powered by this extensive network.

AvidXchange's success hinges on its highly skilled workforce, comprising software engineers, financial technology specialists, sales experts, and dedicated customer support personnel. Their collective expertise in accounts payable automation and payment solutions is absolutely vital for everything from creating new products to supporting existing clients.

This deep domain knowledge allows AvidXchange to effectively develop, market, implement, and service its offerings, ensuring clients receive maximum value. The company actively cultivates a people-centric culture, striving to be recognized as a Great Place to Work, which helps attract and retain top talent in a competitive market.

Data and Intellectual Property

AvidXchange leverages the vast data generated from processing millions of financial transactions. This data is a crucial resource, feeding into product enhancement, bolstering fraud detection capabilities, and providing valuable business intelligence. In 2023, the company processed over $200 billion in payment volume, highlighting the sheer scale of data generated.

The company's intellectual property is a cornerstone of its competitive advantage. This includes robust software copyrights protecting its core technology, trademarks safeguarding its brand, and valuable trade secrets embedded within its sophisticated automation algorithms and payment processing methodologies. This IP portfolio actively shields its innovations.

- Data Insights: Millions of processed transactions offer insights for product development and fraud prevention.

- Intellectual Property: Software copyrights, trademarks, and trade secrets protect automation and payment processes.

- Competitive Edge: IP safeguards innovations, maintaining a distinct market position.

- Transaction Volume: Processing over $200 billion in payments in 2023 underscores the data's breadth.

Financial Capital and Funding

Access to financial capital is critical for AvidXchange to fund its operations, invest in research and development, pursue strategic acquisitions, and expand into new markets. A robust financial foundation allows the company to execute its growth strategy effectively.

AvidXchange has demonstrated its ability to secure substantial funding. For instance, in 2021, the company announced a significant funding round led by various investors, bolstering its capital reserves to fuel further innovation and market penetration.

The company also leverages credit facilities to manage its liquidity and support its ongoing business needs. These financial instruments provide flexibility in managing working capital and funding day-to-day activities.

Strengthening its financial position further, in October 2022, AvidXchange was acquired by TPG, a leading private equity firm, in partnership with Corpay. This transaction underscores the confidence in AvidXchange's business model and provides enhanced financial backing for its future endeavors.

- Financial Strength: AvidXchange maintains a strong balance sheet, enabling strategic investments.

- Funding Rounds: The company has successfully secured significant capital through various funding rounds.

- Credit Facilities: Access to credit lines supports ongoing operations and liquidity management.

- Strategic Acquisition: The TPG and Corpay partnership in 2022 enhanced its financial capacity and strategic outlook.

AvidXchange's proprietary technology platform is its bedrock, a sophisticated cloud-based system designed for end-to-end accounts payable automation. This platform streamlines the entire invoice processing, approval, and payment lifecycle, significantly reducing manual effort and errors for businesses. Its continuous development ensures it stays ahead, incorporating advanced AI capabilities to adapt to the dynamic needs of the middle market.

This technology is not just software; it's a competitive advantage. By automating complex AP processes, AvidXchange enables businesses to achieve greater efficiency and cost savings. For instance, in 2024, companies utilizing such platforms often report a reduction in invoice processing time by as much as 60%, a testament to the power of this digital transformation.

AvidXchange's extensive two-sided network is a cornerstone resource, linking over 8,500 buyer customers with a substantial base of more than 1.3 million supplier customers. This massive interconnectedness is crucial for enabling smooth, secure, and automated financial transactions.

The sheer scale of this network provides a significant competitive advantage, fostering an efficient ecosystem that benefits both parties involved in the payment process. It's this broad reach that allows for touchless processing, a key element in streamlining operations.

By facilitating over $250 billion in total payment volume as of early 2024, AvidXchange demonstrates the immense utility and economic activity generated through its platform. This volume underscores the network's effectiveness in driving real-world financial exchanges.

The value proposition is clear: buyers gain access to a wider supplier pool and simplified payment workflows, while suppliers benefit from faster payments and reduced administrative burdens, all powered by this extensive network.

AvidXchange's success hinges on its highly skilled workforce, comprising software engineers, financial technology specialists, sales experts, and dedicated customer support personnel. Their collective expertise in accounts payable automation and payment solutions is absolutely vital for everything from creating new products to supporting existing clients.

This deep domain knowledge allows AvidXchange to effectively develop, market, implement, and service its offerings, ensuring clients receive maximum value. The company actively cultivates a people-centric culture, striving to be recognized as a Great Place to Work, which helps attract and retain top talent in a competitive market.

AvidXchange leverages the vast data generated from processing millions of financial transactions. This data is a crucial resource, feeding into product enhancement, bolstering fraud detection capabilities, and providing valuable business intelligence. In 2023, the company processed over $200 billion in payment volume, highlighting the sheer scale of data generated.

The company's intellectual property is a cornerstone of its competitive advantage. This includes robust software copyrights protecting its core technology, trademarks safeguarding its brand, and valuable trade secrets embedded within its sophisticated automation algorithms and payment processing methodologies. This IP portfolio actively shields its innovations.

- Data Insights: Millions of processed transactions offer insights for product development and fraud prevention.

- Intellectual Property: Software copyrights, trademarks, and trade secrets protect automation and payment processes.

- Competitive Edge: IP safeguards innovations, maintaining a distinct market position.

- Transaction Volume: Processing over $200 billion in payments in 2023 underscores the data's breadth.

Access to financial capital is critical for AvidXchange to fund its operations, invest in research and development, pursue strategic acquisitions, and expand into new markets. A robust financial foundation allows the company to execute its growth strategy effectively.

AvidXchange has demonstrated its ability to secure substantial funding. For instance, in 2021, the company announced a significant funding round led by various investors, bolstering its capital reserves to fuel further innovation and market penetration.

The company also leverages credit facilities to manage its liquidity and support its ongoing business needs. These financial instruments provide flexibility in managing working capital and funding day-to-day activities.

Strengthening its financial position further, in October 2022, AvidXchange was acquired by TPG, a leading private equity firm, in partnership with Corpay. This transaction underscores the confidence in AvidXchange's business model and provides enhanced financial backing for its future endeavors.

- Financial Strength: AvidXchange maintains a strong balance sheet, enabling strategic investments.

- Funding Rounds: The company has successfully secured significant capital through various funding rounds.

- Credit Facilities: Access to credit lines supports ongoing operations and liquidity management.

- Strategic Acquisition: The TPG and Corpay partnership in 2022 enhanced its financial capacity and strategic outlook.

AvidXchange's core resources are its advanced technology platform, its expansive two-sided network connecting buyers and suppliers, and its skilled workforce. The platform's automation capabilities drive efficiency, while the network facilitates billions in payment volume, creating a powerful ecosystem. The expertise of its employees is crucial for innovation and client support.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Technology Platform | Cloud-based AP automation system | Streamlines invoice processing, approval, and payment |

| Two-Sided Network | Connects buyers and suppliers | Over 8,500 buyer customers, 1.3M+ supplier customers |

| Total Payment Volume | Facilitated financial transactions | Over $250 billion in early 2024; $200 billion processed in 2023 |

| Skilled Workforce | Experts in fintech, AP automation, sales, support | Drives product development and client satisfaction |

| Intellectual Property | Software copyrights, trademarks, trade secrets | Protects core technology and algorithms |

| Financial Capital | Funding for operations and growth | Enhanced by TPG/Corpay acquisition in Oct 2022 |

Value Propositions

AvidXchange drastically cuts expenses tied to manual accounts payable, eliminating costs for paper, printing, postage, and manual labor. This automation streamlines the entire invoice-to-pay cycle, allowing clients to save money and redirect their resources toward more impactful business activities.

Customers frequently experience significant reductions in both time and expenditure. For instance, in 2024, businesses utilizing AvidXchange reported an average reduction of 40% in invoice processing costs, directly attributable to the elimination of manual tasks and physical materials.

AvidXchange's cloud-based platform significantly boosts efficiency by automating the entire accounts payable (AP) lifecycle. This means businesses can move invoices from capture and approval all the way to payment much faster.

The automation inherent in the system dramatically cuts down on manual errors, which are common in traditional AP processes. This acceleration in payment cycles directly improves cash flow management and operational smoothness.

By reducing the time spent on repetitive, manual tasks, finance teams are freed up. They can then dedicate their expertise to more strategic initiatives, such as financial analysis and business forecasting, thereby increasing overall productivity.

For instance, in 2024, businesses utilizing AvidXchange reported an average reduction of 50% in invoice processing time. This operational improvement allows companies to handle a higher volume of transactions without a proportional increase in staffing.

AvidXchange offers businesses unparalleled real-time visibility into their financial operations, providing a clear picture of cash flow and expenditures. This enhanced control is crucial for effective financial management. For example, in 2024, companies using automated AP solutions like AvidXchange reported an average reduction of 70% in manual data entry, freeing up valuable resources for strategic analysis.

The platform's robust reporting and analytics capabilities enable deeper insights, fostering better cash flow management and strengthening audit trails. This granular visibility allows for improved oversight of spending and ensures adherence to compliance requirements. A 2024 study indicated that businesses with automated invoice processing experienced a 45% decrease in late payment penalties.

Customizable approval workflows are a cornerstone of AvidXchange's value proposition, ensuring proper oversight and security at every stage of the payment process. This feature significantly reduces the risk of fraud and errors, bolstering financial integrity. In 2024, a significant percentage of businesses reported enhanced internal controls after implementing automated approval processes, leading to fewer audit exceptions.

Secure and Reliable Payments

Secure and Reliable Payments is a cornerstone of AvidXchange's value proposition, offering businesses a robust alternative to traditional paper checks. By facilitating electronic payment methods like ACH and virtual cards, the platform significantly minimizes the inherent risks of fraud and errors associated with paper-based transactions. This shift to digital payments not only enhances efficiency but also bolsters the security posture of financial operations.

AvidXchange prioritizes data protection through stringent security measures, including advanced encryption protocols and granular user access controls. These safeguards are crucial for maintaining compliance with financial regulations and protecting sensitive customer and transaction data. This commitment to security builds essential trust, giving businesses confidence and peace of mind when managing their financial workflows.

The reliability of AvidXchange’s payment processing is underscored by its track record and continuous investment in technology. For instance, in 2023, AvidXchange processed over $240 billion in payment volume, demonstrating its capacity to handle large-scale financial transactions securely and efficiently. This operational scale highlights the platform's dependability for businesses of all sizes.

- Reduced Fraud Risk: Electronic payments like ACH and virtual cards eliminate vulnerabilities associated with paper checks, such as theft and counterfeiting.

- Enhanced Data Security: AvidXchange employs encryption and strict access controls to safeguard sensitive financial information, ensuring compliance and preventing breaches.

- Increased Transaction Reliability: The platform's robust infrastructure ensures timely and accurate payment processing, minimizing disruptions and errors in financial operations.

- Peace of Mind for Businesses: By providing a secure and dependable payment system, AvidXchange allows businesses to focus on core operations without worrying about payment-related risks.

Seamless Integration with Existing Systems

AvidXchange offers a significant advantage by seamlessly integrating with over 220 popular accounting systems and ERPs. This vast compatibility minimizes disruption for new clients, allowing them to adopt powerful AP automation without overhauling their existing financial infrastructure. This approach simplifies the implementation process considerably.

The ease of integration directly translates to less downtime and a faster path to realizing the benefits of automated accounts payable. Clients can continue using their familiar systems, ensuring a smooth transition and maintaining the integrity of their financial records. This focus on leveraging existing investments makes AvidXchange an attractive solution for businesses of all sizes.

- Extensive Compatibility: Integrates with over 220 accounting systems and ERPs.

- Minimized Disruption: Clients retain their existing infrastructure.

- Simplified Implementation: Reduces the complexity and time for adoption.

- Data Integrity: Ensures consistent and accurate financial records across systems.

AvidXchange provides significant cost savings by automating manual accounts payable processes, eliminating expenses related to paper, printing, and labor. This efficiency allows businesses to reallocate resources to more strategic activities, as evidenced by a 2024 report where clients saw a 40% reduction in invoice processing costs.

The platform accelerates the invoice-to-pay cycle, improving cash flow and reducing manual errors. In 2024, users experienced a 50% decrease in invoice processing time, enabling better financial management and operational fluidity.

Businesses gain real-time visibility into financial operations and enhanced control over cash flow and expenditures. A 2024 study showed a 70% reduction in manual data entry, freeing up teams for critical analysis and leading to a 45% decrease in late payment penalties.

AvidXchange offers secure payment solutions, reducing fraud risk associated with paper checks through electronic methods like ACH and virtual cards. The platform's robust security measures, including encryption and access controls, ensure data protection and compliance.

| Value Proposition | Key Benefit | Supporting Fact (2024 Data unless specified) |

| Cost Reduction | Eliminates manual AP expenses | 40% average reduction in invoice processing costs |

| Efficiency Gains | Automates invoice-to-pay cycle | 50% reduction in invoice processing time |

| Enhanced Visibility & Control | Real-time financial insights | 70% reduction in manual data entry; 45% decrease in late payment penalties |

| Security & Reliability | Reduces fraud, secures data | Processed over $240 billion in payment volume (2023) |

| Seamless Integration | Connects with 220+ systems | Minimizes disruption, faster adoption |

Customer Relationships

AvidXchange’s automated self-service portals provide significant value by allowing both buyers and suppliers to independently manage invoices and track payment statuses. This direct access fosters transparency and reduces the burden on customer support for routine inquiries, streamlining operations for all parties involved.

In 2024, AvidXchange continued to enhance these self-service capabilities, aiming to further empower users. By enabling independent access to reporting and payment tracking, the company facilitates greater control and convenience, which is crucial in today's fast-paced business environment.

These digital tools are designed to boost efficiency across the AvidXchange network. By minimizing the need for manual intervention or direct contact for common tasks, both buyers and suppliers can save valuable time and resources, leading to a more fluid transaction process.

For its middle-market buyer customers, AvidXchange offers dedicated account management. This ensures smooth implementation, continuous improvement, and lasting client happiness. This hands-on approach is key to building robust relationships and tackling the unique challenges of complex accounts payable processes.

This personalized service fosters strong customer loyalty and drives overall customer success. By having a dedicated point of contact, clients feel supported and valued throughout their engagement with AvidXchange.

AvidXchange cultivates a robust community through events like user conferences and educational webinars. These platforms empower customers to exchange valuable insights and learn from one another's experiences with the software.

The company actively encourages feedback, which not only strengthens client relationships but also informs product development. For instance, in 2024, AvidXchange reported a significant increase in user-generated content within their online community forums, highlighting active engagement.

This focus on community building creates a supportive ecosystem where clients can share best practices, leading to more efficient adoption and utilization of AvidXchange's solutions.

Educational Content and Resources

AvidXchange significantly invests in providing comprehensive educational content to its clientele. This includes a robust library of webinars, in-depth case studies, and insightful thought leadership pieces designed to illuminate the advantages of Accounts Payable automation for finance leaders. By demystifying industry trends and best practices, they cultivate a more informed customer base.

This approach strategically positions AvidXchange not just as a vendor, but as a trusted advisor, bolstering customer understanding and reinforcing the inherent value proposition of their automated solutions. For instance, their 2025 Trends Survey offers current data and actionable insights into the evolving AP landscape.

- Educational Offerings: Webinars, case studies, and thought leadership content are central to AvidXchange's customer relationship strategy.

- Value Proposition: This content educates finance leaders on AP automation benefits and industry navigation, fostering trust.

- Trusted Advisor Role: By enhancing customer knowledge, AvidXchange solidifies its position as a knowledgeable partner.

- Data-Driven Insights: Resources like the 2025 Trends Survey provide empirical data to support their claims and guide customers.

Feedback and Continuous Improvement

AvidXchange places significant emphasis on gathering customer feedback to fuel its ongoing commitment to improvement and product innovation. This is crucial for staying ahead in the competitive fintech landscape.

By actively listening to the needs and challenges faced by its clients, AvidXchange can strategically prioritize platform enhancements and the development of new functionalities that directly align with market demands. For example, in 2024, customer feedback directly influenced the roadmap for new integrations with mid-market ERP systems, a key area of focus based on user input.

This iterative process ensures that the AvidXchange platform consistently remains relevant and delivers exceptional value to its diverse user base. Their approach to customer relationships is built on a foundation of understanding and responsiveness.

- Customer Feedback Channels: AvidXchange utilizes multiple channels, including direct surveys, account manager interactions, and user group sessions, to collect comprehensive feedback.

- Data-Driven Prioritization: Feedback is systematically analyzed and categorized, allowing for data-driven decisions on which improvements and features to prioritize for development.

- Impact on Product Development: Client insights directly shape the evolution of AvidXchange's solutions, ensuring they meet current and future business needs.

- 2024 Focus Areas: Key enhancements in 2024, such as expanded mobile capabilities and improved reporting dashboards, were largely driven by direct customer requests and observed usage patterns.

AvidXchange builds strong customer relationships through a combination of self-service portals, dedicated account management for mid-market clients, and active community engagement. These elements foster transparency, efficiency, and loyalty.

The company actively seeks and incorporates customer feedback to drive product development, ensuring its solutions remain relevant and valuable. For example, in 2024, enhancements to reporting dashboards were a direct result of client input.

Educational content and data-driven insights, such as the 2025 Trends Survey, position AvidXchange as a trusted advisor, further solidifying these relationships by empowering their clients.

Channels

AvidXchange relies heavily on its direct sales force to connect with middle-market businesses. This team is responsible for showcasing how AvidXchange's accounts payable (AP) automation and payment solutions can solve specific client pain points and drive efficiency.

Through personalized consultations, the direct sales team educates prospects on the benefits of AP automation, such as reducing manual processing and improving payment accuracy. This hands-on approach is vital for closing deals in a market often navigating complex financial workflows.

The direct sales channel is a primary driver for acquiring new buyer customers. In 2024, AvidXchange continued to invest in expanding its sales team to reach a broader segment of the middle market, aiming to onboard a significant number of new clients.

AvidXchange's strategic partnerships with Enterprise Resource Planning (ERP) providers like Sage Intacct and financial institutions act as critical indirect sales channels. These collaborations allow AvidXchange to tap into a vast network of businesses already utilizing these platforms, effectively extending its market reach. For instance, integrations with ERP systems streamline the procure-to-pay process, making AvidXchange a natural extension for their clients.

These partnerships are instrumental in driving customer acquisition by leveraging the trust and existing relationships these institutions have with their client base. By referring their customers or embedding AvidXchange’s solutions, partners provide a warm introduction, significantly reducing customer acquisition costs and accelerating sales cycles. This strategy is particularly effective in reaching the underserved middle market, where many businesses rely on these established financial and operational software providers.

In 2024, the continued deepening of these relationships is expected to be a primary growth driver. AvidXchange's focus on seamless integration with major ERP systems, such as NetSuite and SAP, coupled with alliances with community banks and credit unions, reinforces its go-to-market strategy. These alliances are not just about referrals; they often involve co-marketing efforts and joint solution development, further solidifying AvidXchange's position within the financial automation ecosystem.

AvidXchange leverages a comprehensive digital marketing approach to reach its target audience. This includes highly focused campaigns on professional networking sites like LinkedIn, where they share valuable industry insights and promote their solutions. Content syndication and informative webinars are also key components, designed to attract and educate potential clients about the benefits of automated invoice and payment solutions.

Their corporate website acts as a central hub for brand visibility and lead generation, providing in-depth information about their services and success stories. The investor relations portal ensures transparency and accessibility for stakeholders, further solidifying their online credibility. This multi-faceted online presence is crucial for attracting new business and fostering relationships within the financial operations sector.

Industry Events and Trade Shows

Industry events and trade shows are a crucial touchpoint for AvidXchange, allowing direct engagement with potential clients and partners. These gatherings provide a valuable stage to demonstrate their payment automation solutions and foster connections within the financial technology sector. For instance, participation in events like the AFP Annual Conference or Money 20/20 offers significant visibility.

AvidXchange leverages these platforms for thought leadership, sharing insights on automating accounts payable and payment processes. This direct interaction helps build brand recognition and establish credibility within key verticals. In 2024, AvidXchange continued its active presence at these industry gatherings.

- Showcasing Solutions: Demonstrating the efficiency and benefits of AvidXchange's payment automation technology.

- Networking Opportunities: Connecting with potential customers, partners, and industry influencers.

- Brand Building: Enhancing market presence and recognition in the fintech and AP automation space.

- Thought Leadership: Presenting insights and expertise on financial process automation.

Referral Programs

AvidXchange leverages referral programs as a key component of its customer acquisition strategy. The company benefits significantly from integrated software providers and financial institutions who act as referral partners, bringing in new business. This symbiotic relationship means these partners are incentivized to recommend AvidXchange's solutions to their own client bases.

Furthermore, AvidXchange taps into the power of satisfied customers and existing partners to generate referrals. When clients experience the benefits of automated invoice-to-pay processes, they become powerful advocates. This trust-based referral system is a highly cost-effective channel for acquiring new businesses, as it relies on proven success and positive word-of-mouth.

These extensive referral networks are instrumental in driving AvidXchange's organic growth. By fostering strong relationships with partners and ensuring customer satisfaction, the company builds a sustainable pipeline of leads. For instance, in 2024, AvidXchange continued to expand its partner ecosystem, with a notable increase in referrals from accounting software integrations.

- Partner Referrals: Integrated software providers and financial institutions actively refer clients, expanding AvidXchange's reach.

- Customer Advocacy: Satisfied clients act as brand ambassadors, generating leads through trusted recommendations.

- Cost-Effective Acquisition: Referral programs offer a lower customer acquisition cost compared to traditional marketing efforts.

- Organic Growth Driver: These networks contribute directly to the company's expansion by bringing in new, pre-qualified leads.

AvidXchange's channel strategy is multifaceted, blending direct engagement with strategic alliances to maximize market penetration. Its direct sales force is crucial for educating and converting middle-market businesses by highlighting efficiency gains from AP automation. Strategic partnerships with ERP providers and financial institutions serve as powerful indirect channels, leveraging existing client trust and software integrations to drive customer acquisition. This dual approach ensures broad market reach and efficient lead generation.

Digital marketing and industry events further bolster AvidXchange's presence, attracting and engaging potential clients through targeted content and direct interaction. Referral programs, fueled by satisfied customers and integrated partners, act as a significant cost-effective acquisition driver, fostering organic growth. By 2024, AvidXchange saw continued expansion of its partner ecosystem, with a notable uptick in referrals from accounting software integrations, reinforcing the efficacy of its multi-channel strategy.

Customer Segments

AvidXchange's primary customer segment consists of middle-market businesses, typically those with annual revenues between $5 million and $1 billion. These companies often grapple with intricate accounts payable (AP) processes that are ripe for automation and efficiency gains. In 2024, the demand for AP automation solutions within this segment continued to grow as businesses sought to streamline operations and reduce manual effort.

These middle-market businesses frequently encounter challenges with paper-intensive invoice processing, manual data entry, and payment reconciliation, making them ideal candidates for AvidXchange's automated solutions. This segment represents a significant opportunity, as a considerable portion of middle-market companies still rely on outdated, manual AP systems, leaving them vulnerable to errors and delays.

AvidXchange caters to a broad spectrum of businesses, demonstrating significant reach across diverse verticals. Key sectors include real estate, construction, and homeowners associations (HOAs), where managing payables and payments presents unique challenges. The company also supports financial institutions and the media industry, tailoring its offerings to their specific operational requirements.

This broad industry focus is a core strength, as AvidXchange develops solutions that directly address the distinct accounting and payment workflows of each sector. For instance, in 2024, AvidXchange reported continued growth in its construction vertical, highlighting the demand for specialized automation in that segment. This deep vertical expertise translates into highly relevant and effective solutions that drive efficiency.

AvidXchange’s buyer customers are businesses actively using its accounts payable (AP) automation software. As of May 2025, this segment includes over 8,500 companies. These businesses leverage the platform to streamline their invoice processing, approval workflows, and payment execution.

The primary motivations for these buyer customers are clear: cost reduction and enhanced operational efficiency. They are looking to gain tighter control over their financial processes, minimizing manual effort and potential errors. Improved visibility and audit trails are also key benefits they seek from AP automation solutions.

Supplier Customers

AvidXchange's ecosystem thrives on its extensive network of supplier customers, numbering over 1.3 million. These suppliers are integral to the AvidPay Network, receiving payments electronically. Their engagement is vital for delivering the core value proposition to AvidXchange's buyer clients, who benefit from streamlined payment processes.

Suppliers experience tangible advantages, including accelerated and more reliable payment cycles, which significantly improve their cash flow management. Furthermore, the platform offers enhanced transparency into the status of their invoices, reducing administrative burdens and uncertainty.

- Network Size: Over 1.3 million supplier customers.

- Payment Method: Electronic payments via the AvidPay Network.

- Supplier Benefits: Faster, predictable payments and improved invoice visibility.

- Role in Ecosystem: Crucial for the network's value proposition to buyers.

Businesses Seeking Integration with Existing ERPs

This segment comprises businesses that prioritize a smooth connection with their current accounting software and Enterprise Resource Planning (ERP) systems. Think of companies using popular platforms like NetSuite, Microsoft Dynamics, Yardi, or MRI.

AvidXchange's strength lies in its robust integration capabilities, making it a compelling choice for organizations that are hesitant to undertake a complete overhaul of their financial infrastructure. This focus on compatibility and straightforward implementation is key for this customer group.

- Integration Focus: Businesses in this segment are actively looking for solutions that plug into their existing systems rather than demanding a full system replacement.

- Reduced Disruption: They value solutions that minimize disruption to ongoing operations and avoid the significant costs and complexities associated with migrating to a new ERP.

- Compatibility as a Driver: The ability of AvidXchange to work seamlessly with their chosen ERP is a primary purchasing driver.

- Efficiency Gains: They expect integration to unlock immediate efficiency gains by automating manual processes within their familiar accounting workflows.

AvidXchange serves distinct customer segments, primarily middle-market businesses and their suppliers. For buyers, the focus is on companies with annual revenues between $5 million and $1 billion, often struggling with manual accounts payable processes. By May 2025, AvidXchange had over 8,500 such buyer companies leveraging its platform.

Suppliers are a critical part of the AvidPay Network, numbering over 1.3 million by mid-2025. These entities benefit from faster, electronic payments, improving their cash flow and reducing administrative work. The network's strength relies on this broad supplier adoption to deliver value to the buyer segment.

| Customer Segment | Description | Key Characteristics/Needs | 2024/2025 Data Point |

| Buyer Businesses | Middle-market companies ($5M-$1B revenue) seeking AP automation. | Struggle with manual AP, seek efficiency, cost reduction, control. | 8,500+ buyer companies (May 2025) |

| Supplier Businesses | Entities receiving payments through the AvidPay Network. | Desire faster, predictable payments, improved visibility, reduced admin. | 1.3M+ supplier customers (mid-2025) |

| Vertically Focused Businesses | Companies in specific industries like construction, real estate, HOAs. | Require tailored solutions for unique AP workflows. | Continued growth reported in construction vertical (2024) |

| ERP Integrated Businesses | Companies prioritizing seamless integration with existing accounting/ERP systems. | Value compatibility, minimal disruption, and leveraging existing infrastructure. | Integrates with NetSuite, Microsoft Dynamics, Yardi, MRI |

Cost Structure

AvidXchange dedicates substantial resources to technology development and research, a core component of its business model. These investments are crucial for maintaining and advancing its cloud-based platform. Significant costs are tied to ongoing software development, research and development (R&D), and the integration of emerging technologies such as artificial intelligence.

These expenses encompass salaries for a skilled workforce including engineers and product managers, alongside the necessary IT infrastructure to support and improve the platform. For instance, R&D expenses amounted to $25.382 million in the first quarter of 2025, highlighting the company's commitment to innovation and technological advancement.

AvidXchange dedicates significant resources to its sales and marketing efforts, recognizing their crucial role in customer acquisition and market expansion. These expenses encompass the compensation for its sales teams, including salaries and commissions, as well as broader marketing initiatives.

This includes investments in digital and traditional advertising campaigns, crucial for reaching a wide audience, and participation in key industry events to foster relationships and brand visibility. The company also allocates funds for partnership development, seeking strategic alliances to broaden its reach and offerings.

For the first quarter of 2025, AvidXchange reported sales and marketing expenses totaling $22.511 million. This figure underscores the company's commitment to driving growth through robust outreach and engagement strategies.

AvidXchange's cost structure for payment processing and network operations is directly influenced by the volume of transactions managed through its AvidPay Network. These essential costs encompass transaction processing fees, bank charges, and the ongoing maintenance of its payment infrastructure. For instance, in 2024, businesses increasingly rely on digital payment solutions, driving up the need for robust and efficient processing capabilities, which directly translates to these operational expenses for AvidXchange.

The company's commitment to unit cost efficiencies is paramount in managing these expenses. By optimizing the processing of invoices and payments, AvidXchange aims to minimize the per-transaction cost. This focus is crucial as the scale of their network grows, ensuring that as more businesses adopt their platform, the cost to serve each customer remains competitive and manageable.

General and Administrative Expenses

General and administrative expenses represent the essential overhead costs that keep AvidXchange running smoothly. These aren't directly linked to creating or selling their core product but are crucial for overall business operations.

These costs encompass a range of items, including the salaries for the team managing the company's day-to-day affairs, executive leadership compensation, and the necessary fees for legal counsel and regulatory compliance. Additionally, expenses like office rent and various other operational costs fall under this category, ensuring the business infrastructure is maintained.

For the first quarter of 2025, AvidXchange reported general and administrative expenses totaling $28.948 million. This figure highlights the significant investment in the foundational elements that support the company's growth and operational integrity.

Key components of General and Administrative Expenses include:

- Salaries for administrative and executive staff

- Legal and compliance fees

- Office rent and facility costs

- Other essential operational overhead

Customer Support and Service Delivery Costs

A significant portion of AvidXchange's cost structure is dedicated to customer support and service delivery. This includes the expenses involved in maintaining a skilled support team, equipping them with the necessary software and tools, and managing the infrastructure required for efficient customer interaction. For instance, companies in the SaaS space often allocate substantial budgets to customer success managers and technical support specialists to ensure clients can effectively utilize their platforms.

These costs also extend to the crucial processes of customer onboarding and training. AvidXchange invests in ensuring new clients are properly integrated into their system, providing comprehensive training to maximize adoption and minimize early-stage issues. Ongoing technical assistance is also a key component, addressing client inquiries and resolving any technical challenges that may arise. These investments are vital for fostering high customer satisfaction, which directly impacts retention rates.

Specifically, for the fiscal year 2023, AvidXchange reported selling, general, and administrative (SG&A) expenses of $379.8 million. A substantial part of this SG&A is attributable to customer support, sales, and marketing efforts aimed at retaining and expanding the customer base. The company's commitment to customer success is a direct driver of these operational expenditures.

- Customer Support Personnel: Salaries and benefits for support staff, including account managers and technical specialists.

- Onboarding & Training: Costs associated with developing materials and delivering training to new and existing customers.

- Technology & Tools: Investment in CRM systems, help desk software, and other tools to manage customer interactions.

- Customer Retention Initiatives: Programs and services designed to ensure ongoing customer satisfaction and loyalty.

AvidXchange's cost structure is heavily weighted towards technology and talent. Significant investments are made in research and development, as well as maintaining and enhancing their cloud-based platform. Sales and marketing are also major expense categories, critical for customer acquisition and market penetration.

Operational costs are tied to transaction volumes, with a focus on unit cost efficiency. General and administrative expenses cover essential overhead, including executive compensation and compliance, while customer support and onboarding represent substantial investments in client retention and satisfaction.

The company's financial performance in 2024 and early 2025 reflects these cost drivers, with notable expenditures in R&D, sales, marketing, and general administration. These figures underscore AvidXchange's commitment to innovation and growth in the financial technology sector.

| Expense Category | Q1 2025 (Millions USD) | FY 2023 (Millions USD) |

|---|---|---|

| Research & Development | 25.382 | N/A |

| Sales & Marketing | 22.511 | N/A |

| General & Administrative | 28.948 | N/A |

| Total SG&A (approximate) | N/A | 379.8 |

Revenue Streams

AvidXchange's primary revenue driver stems from recurring software subscription fees. These fees are levied on buyer customers for continuous access to their cloud-based accounts payable automation platform. The pricing structure often adapts to the specific needs of each client, factoring in elements like the breadth of features employed, the number of active users, and the volume of transactions processed through the system.

This subscription model ensures a predictable revenue stream for AvidXchange. In the first quarter of 2025, the company reported significant growth in its software revenue, reaching $30.9 million. This figure underscores the value proposition of their AP automation solution and its adoption by businesses seeking efficiency in their financial operations.

A substantial revenue driver for AvidXchange is the payment transaction fees generated from processing payments via its AvidPay Network. These fees are structured in various ways, including per-transaction charges, volume-based rates, and interchange fees specifically for virtual card payments.

In the first quarter of 2025, AvidXchange reported a robust $75.9 million in payment revenue, underscoring the significance of these transaction-based income streams to its overall financial performance.

AvidXchange generates interest income from the funds it holds on behalf of customers as payments clear. This revenue stream, often referred to as 'float,' adds to their overall payment processing earnings.

In the first quarter of 2025, AvidXchange reported $11.0 million in interest income. This figure represents a decline when compared to the interest income earned in the first quarter of 2024, indicating a shift in market conditions or operational strategies affecting float utilization.

Value-Added Services and Features

AvidXchange generates additional revenue through value-added services that go beyond basic invoice and payment automation. These offerings cater to specific customer needs, unlocking further monetization potential. For instance, their Payment Accelerator service allows suppliers to receive early payments for a fee, creating a win-win scenario for both AvidXchange and its clients' supply chains.

These specialized features, like enhanced reporting capabilities and industry-specific solutions tailored to sectors such as real estate or healthcare, provide clients with deeper insights and greater operational efficiency. Such premium services represent a significant avenue for AvidXchange to differentiate its offerings and capture additional revenue streams.

- Early Payment Options: Services like Payment Accelerator allow suppliers to receive funds faster for a fee, improving cash flow.

- Enhanced Reporting: Clients can access more detailed analytics and customized reports for better business intelligence.

- Industry-Specific Solutions: Tailored features for sectors like real estate and healthcare address unique operational challenges.

- Additional Monetization: These services create revenue opportunities beyond core invoice and payment processing.

Professional Services and Implementation Fees

While AvidXchange’s core revenue comes from transaction fees and subscription services, professional services also contribute. These services, which include implementation, customization, and training, are particularly valuable for clients with more intricate needs or larger-scale deployments. This segment, though smaller, is showing robust growth, underscoring its importance in client onboarding and satisfaction.

In the first quarter of 2025, AvidXchange reported $1.1 million in revenue from these professional services. This represents a notable increase, highlighting the company's ability to offer specialized support that complements its automated invoice payment solutions.

- Professional Services Revenue: Generated $1.1 million in Q1 2025.

- Service Offerings: Includes implementation, customization, and training.

- Client Focus: Supports larger or more complex client deployments.

- Growth Indicator: Significant increase in services revenue signifies growing demand.

AvidXchange's revenue streams are diversified, centering on its accounts payable automation platform. The company primarily generates income through recurring software subscription fees, charged to buyer customers for accessing its cloud-based services. Additionally, significant revenue is derived from payment transaction fees, including those from virtual card payments processed via its AvidPay Network.

Interest income from funds held during payment processing, often called float, also contributes to revenue, though it saw a dip in Q1 2025 compared to the previous year. Value-added services, such as early payment options for suppliers and enhanced reporting, along with professional services like implementation and training, further bolster AvidXchange's income.

| Revenue Stream | Q1 2025 Revenue | Q1 2024 Revenue | Significance |

|---|---|---|---|

| Software Subscriptions | $30.9 million | N/A (Growth reported) | Core recurring revenue |

| Payment Transactions | $75.9 million | N/A (Growth reported) | Primary transaction-based income |

| Interest Income (Float) | $11.0 million | Higher in Q1 2024 | Income from held funds |

| Professional Services | $1.1 million | N/A (Growth reported) | Implementation & support |

Business Model Canvas Data Sources

The AvidXchange Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and market intelligence gathered from industry analysis. These diverse data sources ensure each component of the canvas is grounded in operational reality and market understanding.