AvidXchange Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvidXchange Bundle

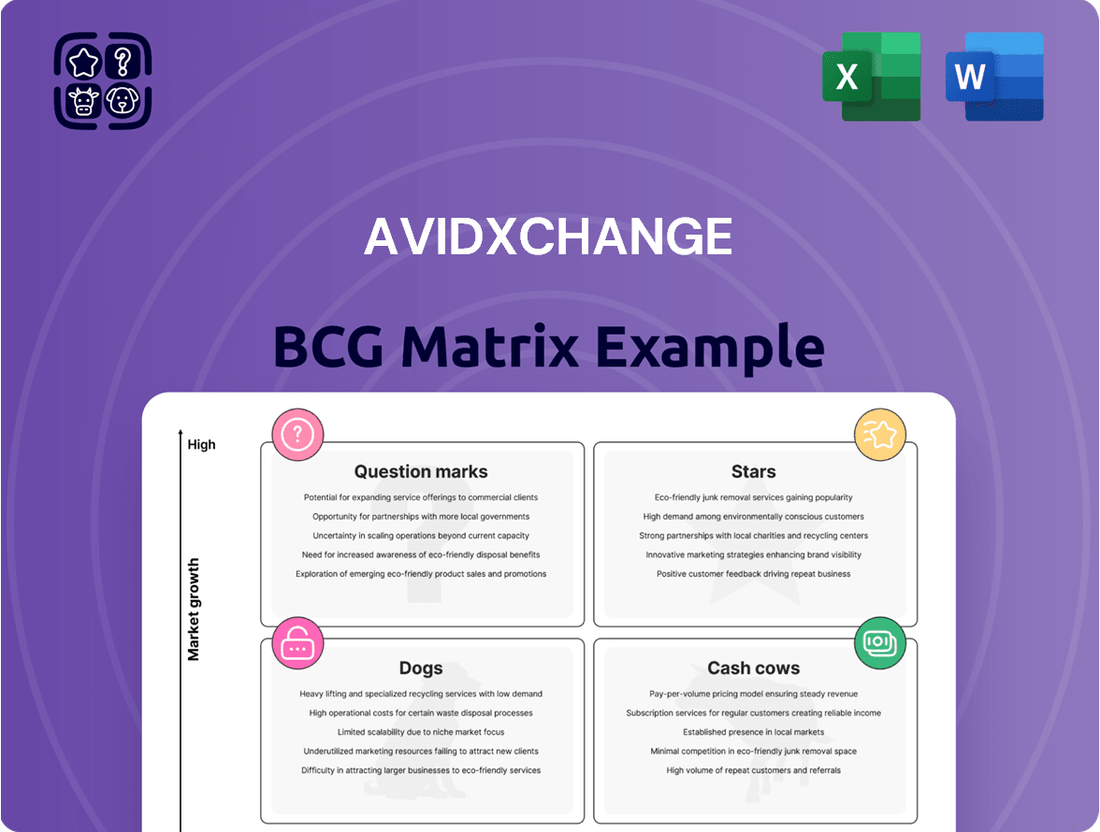

Curious about AvidXchange's strategic product positioning? This glimpse into their BCG Matrix highlights potential Stars and Cash Cows, but what about the crucial details of their Dogs and Question Marks? Understanding these dynamics is key to unlocking their full market potential.

The full BCG Matrix report provides a comprehensive, quadrant-by-quadrant analysis of AvidXchange's product portfolio, offering data-backed insights into market share and growth rates. Don't just guess where their opportunities and challenges lie; know them definitively.

Purchase the complete AvidXchange BCG Matrix to gain actionable strategies for resource allocation, investment decisions, and product lifecycle management. Equip yourself with the clarity needed to navigate the evolving landscape of financial technology.

This is your opportunity to move beyond surface-level understanding and dive deep into the strategic framework that guides AvidXchange's success. Get the full report and transform your strategic planning.

Stars

AvidXchange's Payment Accelerator program is a shining example of a 'Star' in the BCG Matrix. This offering has seen remarkable growth, effectively doubling each year.

Projections indicate it's on track to become a substantial $100 million business, highlighting its strong market traction and potential. By giving suppliers access to early payments, the program addresses a clear need in the B2B payment landscape.

This rapid expansion underscores AvidXchange's leadership in a rapidly evolving and lucrative segment of their operations. The program's success is a testament to its ability to provide a valuable service that suppliers actively seek.

AvidXchange's AI-driven platform enhancements solidify its position as a Star in the BCG matrix. The integration of advanced AI and machine learning into their core offering facilitates intelligent data extraction and automates complex financial processes. This focus on AI is critical, as a significant 76% of finance departments in 2024 acknowledged the substantial value AI brings to their operations.

By continuously investing in AI agents and sophisticated automation capabilities, AvidXchange directly addresses a rapidly growing market demand. These technological advancements not only streamline operations but also significantly improve decision-making for buyers, which in turn boosts platform adoption and reinforces AvidXchange's leadership in the accounts payable automation space.

AvidXchange's cloud-based AP automation suite, serving over 8,500 middle-market businesses, holds a significant position in a dynamic market. With 76% of finance departments viewing cloud solutions as critical or favorable, the market is ripe for expansion. This trend suggests a strong future for AvidXchange's scalable platform.

Strategic ERP Integrations

AvidXchange's strategic ERP integrations are a significant strength, positioning them favorably within the AP automation market. Their vast network, boasting over 240 ERP integrations, allows for highly efficient workflow automation across a wide range of customers.

This deep integration capability serves as a powerful magnet for acquiring new, high-quality buyer logos and solidifying relationships with existing clients. This, in turn, directly contributes to market share expansion in the rapidly growing AP automation sector. For instance, by early 2024, AvidXchange reported continued strong adoption of its integrated solutions, driving customer acquisition.

- Over 240 ERP Integrations: A key competitive advantage enabling seamless automation.

- Attracts High-Quality Buyers: Deep integration drives new customer acquisition.

- Strengthens Existing Relationships: Enhances customer retention and loyalty.

- Fuels Market Share Expansion: Directly contributes to growth in the AP automation market.

- Momentum Beyond 2025: These partnerships are expected to sustain growth trajectories.

AvidPay Network Expansion

The AvidPay Network is a prime example of a strong growth asset within the AvidXchange portfolio, boasting a network effect that fuels its expansion. By connecting over 1.35 million supplier customers, the network’s value escalates significantly with each new participant, creating a formidable competitive advantage.

This robust B2B payment ecosystem facilitates seamless electronic transactions, positioning AvidXchange favorably within the digital payments market. Its substantial reach and increasing adoption point to a high market share in the B2B payment processing sector.

- Network Size: Over 1.35 million supplier customers.

- Growth Driver: Network effect, where value increases exponentially with more users.

- Competitive Advantage: Strong barrier to entry due to established network size and efficiency.

- Market Position: High market share in the B2B digital payments arena.

AvidXchange's Payment Accelerator program demonstrates strong growth and market leadership, effectively doubling annually and projected to reach $100 million. This offering provides suppliers with early payment access, addressing a critical need in B2B payments and highlighting AvidXchange's ability to capture a lucrative market segment.

What is included in the product

AvidXchange's BCG Matrix offers a strategic view of its product portfolio, highlighting which offerings are market leaders and which require careful consideration for future investment or divestment.

Clear visualization of AvidXchange's portfolio, identifying growth opportunities and areas for investment.

Cash Cows

AvidXchange's core accounts payable automation platform is a prime example of a Cash Cow. This established product consistently delivers significant revenue and robust positive cash flow, a testament to its market maturity and customer loyalty.

The platform boasts strong gross margins, reflecting its efficiency and established value proposition. This mature offering benefits from a vast and deeply integrated customer base, minimizing the need for extensive marketing spend to retain its market leadership.

In 2024, AvidXchange reported that its core AP automation solutions continued to be a primary driver of its financial performance. The company highlighted the sticky nature of its middle-market clients, who depend on the platform for essential daily financial operations.

Standard invoice processing and approval workflows are the bedrock of AvidXchange's offering, representing a mature market segment where they hold significant share. These core functionalities are essential for nearly all businesses seeking AP automation, making them a consistent revenue generator for AvidXchange. Their widespread adoption means these features require minimal ongoing development investment, acting as true cash cows.

AvidXchange's strategy to deepen engagement with its existing buyer customer base is a clear indicator of its Cash Cow segment. By focusing on increasing invoice and payment transaction volumes, the company is leveraging its established relationships to drive growth within a mature market. This approach capitalizes on the predictable revenue streams generated by over 8,500 buyer customers.

The company's commitment to increasing electronic payment penetration among this base further solidifies its Cash Cow status. This initiative not only enhances efficiency for both AvidXchange and its clients but also creates opportunities for cross-selling additional solutions. For instance, in 2024, AvidXchange reported a significant increase in the adoption of its payment solutions, with over 75% of eligible payments being processed electronically, demonstrating the success of this strategy.

Transaction Yield Optimization

AvidXchange's transaction yield optimization is a key indicator of its financial health, demonstrating a strong ability to generate revenue from its payment processing services. Even with economic headwinds, the company has managed to maintain and even slightly grow this yield. This resilience speaks volumes about the core profitability of its offerings.

The focus on expanding transaction yield shows AvidXchange is effectively monetizing its transaction volume. This consistent contribution to gross margin signifies a mature service where pricing power is well-established. It’s a testament to their efficient operational model and the value proposition they offer to customers.

- Transaction Yield Stability: AvidXchange's ability to maintain its transaction yield, a critical metric for payment processors, underscores the robust nature of its core business. This stability is particularly noteworthy given the macroeconomic uncertainties experienced through 2024, suggesting a resilient revenue stream.

- Gross Margin Contribution: The consistent contribution of yield expansion to gross margin highlights the efficiency with which AvidXchange converts transaction volume into profit. This focus ensures that as volume grows, profitability scales effectively.

- Optimized Pricing Power: Maintaining or increasing transaction yield in a competitive landscape points to optimized pricing strategies and strong customer retention. It indicates that customers perceive significant value in AvidXchange's services, allowing for favorable pricing arrangements.

Established Customer Support and Services

AvidXchange's established customer support and professional services are a significant Cash Cow, underpinning the company's reliable revenue streams. This segment benefits from a deeply entrenched client base that relies on consistent, high-quality assistance, fostering exceptional customer loyalty.

The company's commitment to its well-established clients translates into very high retention rates. For instance, AvidXchange reported an impressive 98.6% net transactions retained in 2024, a testament to the value provided by its support and services.

This strong customer retention directly fuels recurring revenue, which is crucial for a Cash Cow. The operational costs associated with maintaining these services, while significant, are relatively stable and predictable compared to the revenue they generate, ensuring a consistent and dependable cash flow for AvidXchange.

- High Customer Loyalty: Driven by effective support and professional services.

- Exceptional Retention Rates: Demonstrated by 98.6% net transactions retained in 2024.

- Recurring Revenue Generation: A direct result of sustained client relationships.

- Stable Operational Costs: Contributing to predictable and reliable cash flow.

AvidXchange's core AP automation platform functions as a Cash Cow, consistently generating substantial revenue and positive cash flow due to its market maturity and loyal customer base. In 2024, these essential AP solutions remained a primary financial driver, with over 75% of eligible payments processed electronically, showcasing the platform's deep integration and minimal need for extensive marketing.

The company's focus on increasing electronic payment penetration among its 8,500+ buyer customers directly leverages this Cash Cow status. This strategy not only enhances operational efficiency but also drives predictable revenue streams through transaction volume, solidifying its position as a stable, high-margin offering.

AvidXchange's strong customer retention, evidenced by a 98.6% net transaction retention rate in 2024, further highlights the Cash Cow nature of its established services. This loyalty, fueled by reliable support and professional services, ensures recurring revenue with relatively stable operational costs, guaranteeing consistent cash flow.

What You’re Viewing Is Included

AvidXchange BCG Matrix

The AvidXchange BCG Matrix preview you are currently viewing is the precise, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis, meticulously crafted by industry experts, is designed to provide actionable insights into AvidXchange's product portfolio, enabling strategic decision-making and clear visualization of market positions.

Dogs

Legacy on-premise integrations, particularly those that are highly customized and not designed for scale, might be categorized as Dogs in the AvidXchange BCG Matrix. These systems demand continuous maintenance and support, yet their customer base is likely diminishing or highly specialized. This translates to low growth prospects and the potential for tying up valuable resources without delivering substantial returns.

The market trend strongly favors cloud-based solutions, a shift that significantly reduces the demand for older, on-premise integration models. For instance, by the end of 2024, it’s estimated that over 90% of new enterprise software deployments will be cloud-based, further marginalizing the growth potential for these legacy systems.

Highly manual or niche payment processes represent a segment of AvidXchange's operations that could be considered Dogs in a BCG Matrix analysis. These are payment types that require significant human intervention or cater to very specific industries, meaning they haven't achieved broad market adoption within AvidXchange's network. For instance, the processing of certain paper checks for specialized industries or complex international wire transfers that lack standardization can fall into this category.

These niche processes often consume disproportionate resources for compliance, specialized handling, and customer support. Despite these investments, they contribute minimally to overall transaction volume or revenue yield. This low volume and limited growth potential, coupled with the high cost of maintenance, positions them as Dogs. For example, if a particular niche payment type only accounts for less than 0.5% of AvidXchange's total processed transactions in 2024, it would clearly indicate low market share.

AvidXchange's journey, like many in the tech sector, likely includes pilot programs or experimental features that didn't gain the expected traction. While specific details aren't publicly disclosed, such initiatives, if they failed to achieve desired market penetration or scalability, would be classified as Dogs in a BCG matrix. These would represent past investments that didn't yield significant market share or demonstrate strong growth potential.

These "Dogs" often consume resources without delivering the anticipated returns. For instance, if a new feature aimed at a niche market segment in 2023 or early 2024 did not show uptake, it might be considered a Dog. The lack of significant adoption means it's unlikely to contribute to future revenue growth, making it a candidate for strategic review and potential discontinuation.

Non-Core Cyclical Revenue Streams (e.g., Political Ads)

Revenue streams like political advertising are classified as Dogs because they are tied to highly cyclical and unpredictable markets. These revenues saw a substantial drop in non-election years, making them difficult to forecast. This points to low and unstable growth, with AvidXchange holding minimal strategic market share in this particular segment of its core business.

The advertising market, especially political advertising, is notoriously volatile. For instance, while political ad spending in the US reached an estimated $9.7 billion in the 2020 election cycle, it significantly decreased in off-election years. This instability directly impacts revenue predictability and growth potential for businesses reliant on such streams.

- Low Growth: Political ad revenue is highly dependent on election cycles, leading to inconsistent and often low growth outside of these periods.

- High Cyclicality: The revenue is directly tied to election schedules, making it inherently cyclical and prone to sharp declines in non-election years.

- Unpredictable Forecasting: The erratic nature of political spending makes accurate revenue forecasting extremely challenging.

- Low Market Share: In the broader context of AvidXchange's core business, this segment represents a small and strategically less important market share.

Underperforming Vertical-Specific Modules

Certain industry-specific modules within AvidXchange's offerings have struggled to gain traction, potentially fitting into the Dogs quadrant of the BCG matrix. These specialized solutions, despite upfront investment, haven't seen substantial adoption or revenue growth within their intended verticals.

The core issue is a lack of market resonance. If these modules don't appeal to a significant portion of the middle-market segment AvidXchange targets, they will likely yield low revenue compared to their ongoing development and maintenance expenses. For instance, a module designed for a niche construction sub-sector might have high support costs but generate minimal sales if that sub-sector isn't large enough or actively seeking such a solution.

This underperformance can drain resources that could otherwise be allocated to more promising areas of the business. In 2024, the company's focus on expanding its platform capabilities means that underperforming modules represent a direct drag on innovation and market expansion efforts.

- Low Market Penetration: Specific vertical modules exhibit minimal adoption rates within their target industries.

- High Maintenance Costs: Development and ongoing support for these underperforming modules outweigh the revenue they generate.

- Resource Drain: These modules consume capital and attention that could be better invested in growth-oriented products or services.

- Strategic Re-evaluation Needed: AvidXchange may need to consider divesting, overhauling, or discontinuing these modules to optimize resource allocation.

Legacy on-premise integration solutions at AvidXchange, especially those that are highly customized and not built for scalability, can be considered Dogs. These systems require ongoing investment in maintenance and support, but their user base is shrinking or highly specialized, indicating low growth and limited return on investment.

The market's strong preference for cloud-based solutions by 2024, with over 90% of new enterprise software deployments being cloud-native, further diminishes the growth prospects for these older integration models.

AvidXchange's niche payment processes, such as handling certain paper checks for specific industries or complex, non-standard international wires, also fall into the Dog category. These processes demand considerable resources for compliance and specialized handling but contribute minimally to overall transaction volume and revenue.

For example, if a particular niche payment type accounts for less than 0.5% of AvidXchange's total processed transactions in 2024, it highlights low market share and limited growth potential. These "Dogs" consume resources without delivering proportional returns, and AvidXchange may need to reassess their strategic value.

Question Marks

AvidXchange's forthcoming Spend Management platform, slated for a second-half 2025 launch, targets a burgeoning market. This segment focuses on holistic expense control, extending beyond traditional accounts payable functions, indicating substantial future potential. The company's current footprint in this specific area is still developing, positioning it as a newcomer with considerable room for expansion.

The strategic outlay for this new platform requires significant capital to establish a solid market presence. This investment is critical for building brand recognition and capturing a meaningful share in a competitive landscape. Consequently, the platform embodies the characteristics of a Question Mark within the BCG matrix: high market growth potential coupled with a currently low market share, necessitating strategic investment to drive future success.

AvidXchange's early-stage AI-driven automation capabilities are currently positioned as question marks on the BCG matrix. These innovative features, while showing promise for high growth in the dynamic fintech sector, have yet to achieve significant market penetration. Their development is ongoing, and their future success hinges on demonstrating clear return on investment and securing widespread customer adoption as they are rolled out.

Expanding into more comprehensive cross-border payment solutions, especially in untapped international markets, positions AvidXchange's cross-border offerings as a Question Mark in the BCG Matrix. The global B2B payments market is enormous, projected to reach $1.5 trillion by 2027, a testament to its high growth potential.

AvidXchange’s current strength lies predominantly in North America. Venturing into new international territories means starting with a minimal market share, necessitating significant investment in infrastructure, localization, and marketing to gain traction against established global players.

Targeting Larger Enterprise Market Segments

AvidXchange's move to target larger enterprise market segments, beyond its traditional middle-market focus, would be classified as a Question Mark within the BCG Matrix. This segment presents significant growth opportunities, but it also demands a distinct approach. For instance, while AvidXchange has a strong foothold in the middle market, capturing a larger share of the enterprise space requires adapting sales cycles and product capabilities to meet the complex needs of these larger organizations.

This strategic pivot is characterized by high market growth potential, as larger enterprises often have more substantial transaction volumes and a greater need for sophisticated accounts payable automation. However, AvidXchange currently possesses a relatively low market share in this segment when compared to deeply entrenched enterprise solution providers who have long-standing relationships and tailored offerings. For example, in 2024, the enterprise spend on AP automation software was projected to reach over $3 billion globally, a substantial market AvidXchange is only beginning to penetrate.

To succeed, AvidXchange would need to invest in enhanced features, potentially including more robust integration capabilities with diverse ERP systems common in enterprises and advanced analytics. The sales and marketing strategies would also need refinement, focusing on consultative selling and demonstrating clear ROI for very large organizations.

Key considerations for this Question Mark segment include:

- High Market Growth Potential: The enterprise sector's demand for AP automation continues to rise, driven by digital transformation initiatives.

- Low Current Market Share: AvidXchange faces established competitors with significant market penetration in this segment.

- Increased Investment Requirements: Targeting enterprises necessitates R&D for advanced features and a scaled sales force adept at enterprise-level deals.

- Competitive Landscape: Major players like SAP Ariba, Coupa, and Oracle offer comprehensive suites that pose significant competition.

New Strategic Partnerships in Untapped Verticals

AvidXchange's strategic move into new industry verticals, such as specialized segments within healthcare or manufacturing where their current market penetration is minimal, places these initiatives firmly in the Question Mark category of the BCG matrix. These ventures represent potential high-growth opportunities but come with inherent risks and require significant upfront investment.

The company's focus on these untapped areas is a deliberate strategy to diversify revenue streams and capture emerging market share. For example, by targeting niche healthcare providers or specific manufacturing sub-sectors, AvidXchange aims to replicate its success in accounts payable automation in new environments. The inherent uncertainty of market adoption and competitive response in these new verticals necessitates careful resource allocation and risk management.

To illustrate the potential, consider that the global healthcare automation market alone was projected to reach over $50 billion by 2024, with significant growth driven by efficiency needs in revenue cycle management and supply chain operations. Similarly, the manufacturing sector's adoption of digital transformation tools, including AP automation, is accelerating. In 2023, manufacturing companies reported an average of 15% of their invoices processed manually, highlighting a clear opportunity for improvement and adoption of automated solutions like those offered by AvidXchange.

- Untapped Verticals: Targeting specific niches within healthcare and manufacturing beyond current core segments.

- Growth Potential: Aims to unlock new revenue streams and capture emerging market share.

- Investment Required: These initiatives necessitate initial capital outlay for market entry and development.

- Unproven Market Share: Success is dependent on market adoption and competitive positioning in these new areas.

AvidXchange's new Spend Management platform, launching in the latter half of 2025, represents a significant growth opportunity. While the market for holistic expense control is expanding rapidly, AvidXchange's current presence in this specific area is still nascent. This positions the platform as a Question Mark, requiring substantial investment to build market share and brand awareness against established competitors.

The company's early-stage AI-driven automation features are also classified as Question Marks. Despite their potential to drive growth in the competitive fintech sector, these capabilities have yet to gain widespread market adoption. Their success hinges on demonstrating tangible ROI and securing broad customer acceptance as they are further developed and rolled out.

Expanding into new international markets for cross-border payments presents another Question Mark opportunity for AvidXchange. The global B2B payments market is substantial, projected to reach $1.5 trillion by 2027, indicating high growth potential. However, AvidXchange’s current limited footprint outside North America means it enters these new territories with a low market share, demanding significant investment in localization and infrastructure to compete effectively.

BCG Matrix Data Sources

Our AvidXchange BCG Matrix leverages a blend of internal financial data and external market research. This includes competitor analysis, industry growth rates, and customer adoption trends to accurately position our offerings.