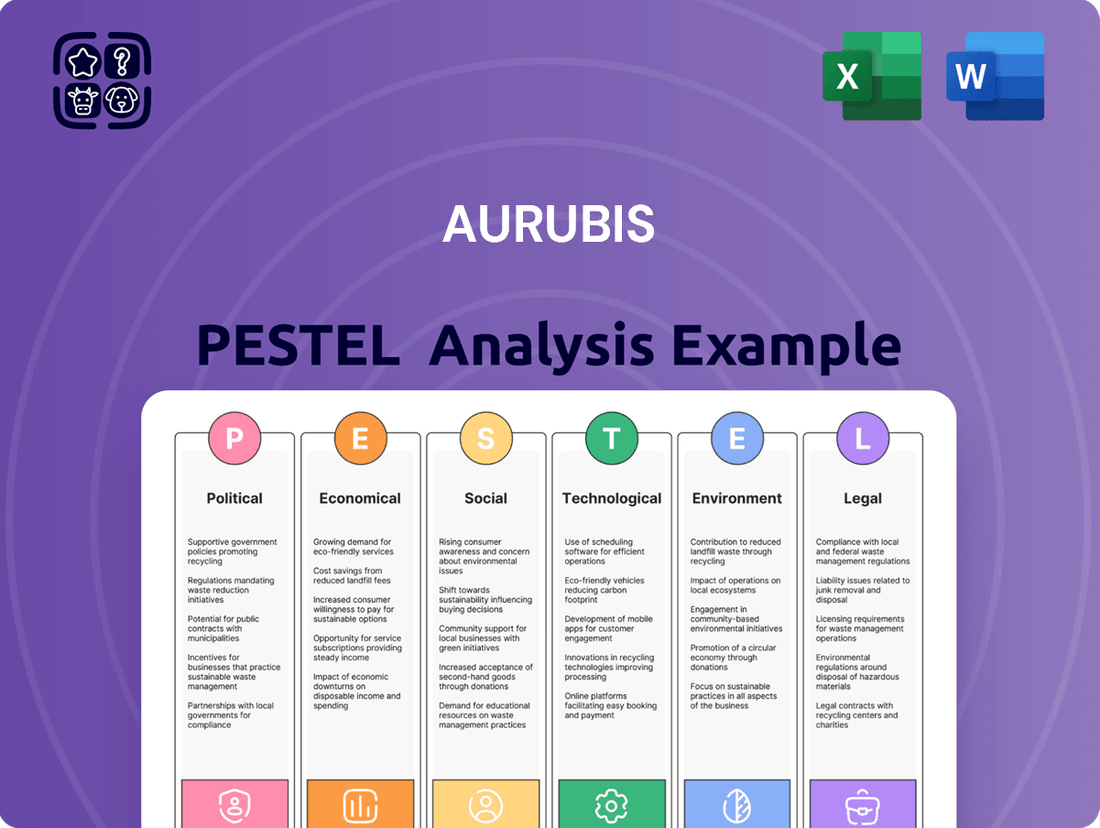

Aurubis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

Aurubis operates within a dynamic global landscape, heavily influenced by political stability, economic fluctuations, and evolving technological advancements. Our PESTLE analysis delves into these critical external factors, revealing how they shape Aurubis's strategic direction and market position. Understand the opportunities and threats to gain a competitive advantage.

Unlock the full potential of your market strategy with our comprehensive PESTLE analysis of Aurubis. We've meticulously researched the political, economic, social, technological, legal, and environmental forces impacting this leading copper producer. Download the complete report now to arm yourself with actionable intelligence and make informed decisions.

Political factors

Geopolitical stability in regions like South America, where Aurubis sources copper concentrate, is crucial for uninterrupted supply. For instance, political unrest in Peru, a significant copper producer, could disrupt shipments and increase costs. Similarly, trade policies, such as the European Union's carbon border adjustment mechanism, could impact the competitiveness of Aurubis's products in international markets.

Trade agreements and tariffs directly influence the cost and availability of key inputs like copper scrap, a vital material for Aurubis's recycling operations. In 2024, ongoing trade tensions between major economies could lead to increased tariffs on imported metals, potentially raising Aurubis's procurement expenses and affecting its pricing strategies.

Government policies and incentives are increasingly shaping the landscape for companies like Aurubis, a major player in copper recycling. For instance, the European Union's Circular Economy Action Plan, with significant funding allocated through initiatives like the Green Deal, directly supports the development of recycling infrastructure and mandates for recycled content in various products. This creates a favorable environment for Aurubis's core business, encouraging greater material recovery and demand for recycled copper.

Government industrial policies, particularly those focused on critical raw materials like copper and strategic industries such as renewable energy, directly influence Aurubis's operational landscape. For instance, the European Union's Critical Raw Materials Act, proposed in 2023 and aiming for adoption in 2024, seeks to bolster domestic sourcing and processing, potentially creating favorable conditions for Aurubis's recycling and refining activities.

Subsidies and incentives play a crucial role. In 2024, many governments continue to offer tax credits and grants for investments in green technologies and circular economy initiatives, which can reduce the capital expenditure for Aurubis's expansion projects in areas like advanced recycling. Germany, a key market for Aurubis, has historically provided R&D grants for metallurgy and resource efficiency, supporting innovation in the sector.

Regulatory environment and enforcement

Aurubis operates within a complex regulatory framework that significantly influences its operational costs and strategic planning. Stricter environmental regulations, such as those concerning emissions and waste management, are increasingly common across its operating regions. For instance, the European Union’s continued push for a circular economy and tighter controls on industrial pollutants directly impacts smelting and refining processes. This can lead to increased investment in pollution control technologies and potentially higher compliance costs.

The enforcement of these regulations also plays a crucial role. Regions with robust environmental protection agencies and rigorous enforcement mechanisms, like Germany and Belgium where Aurubis has major facilities, can impose substantial penalties for non-compliance. This necessitates continuous monitoring and adaptation to evolving legal standards. In 2023, Aurubis reported significant investments in environmental protection measures, underscoring the substantial financial commitment required to meet these standards.

Furthermore, political pressure to enhance the environmental and social governance (ESG) performance of heavy industries is a growing trend. This can translate into demands for greater transparency, reduced carbon footprints, and improved labor practices. Aurubis, as a major copper and precious metals producer, is subject to scrutiny regarding its supply chains and the environmental impact of its mining and processing activities. Potential changes in political administrations or shifts in public opinion can lead to policy adjustments that affect Aurubis’s investment decisions and overall business model.

- Increased Compliance Costs: Evolving environmental regulations, particularly in the EU, necessitate ongoing investment in advanced pollution control and waste management technologies, impacting operational expenditures.

- Enforcement Scrutiny: Regions with strong regulatory enforcement, like Germany, pose a risk of significant financial penalties for non-compliance, requiring diligent adherence to environmental standards.

- ESG Pressure: Political and public demand for improved ESG performance puts pressure on companies like Aurubis to enhance supply chain transparency and reduce their environmental footprint.

International relations and sanctions

Aurubis, as a global player, is significantly impacted by shifting international relations and the imposition of economic sanctions. For instance, tensions in Eastern Europe could disrupt supply chains for critical raw materials like copper concentrate, impacting Aurubis's production in 2024 and 2025. The company must actively manage geopolitical risks to maintain access to key markets and ensure compliance with evolving trade regulations.

Navigating these complex geopolitical landscapes is crucial for Aurubis's business continuity. The company's ability to adapt to sanctions regimes, such as those affecting Russia, directly influences its sourcing strategies and market presence. In 2024, Aurubis reported that its Russian smelter operations were not directly impacted by sanctions, but the broader geopolitical climate necessitates constant vigilance and strategic adjustments to raw material sourcing.

- Geopolitical Risk Management: Aurubis invests in robust geopolitical risk assessment frameworks to anticipate and mitigate disruptions stemming from international conflicts and sanctions.

- Supply Chain Diversification: The company actively diversifies its raw material sources to reduce reliance on any single region, particularly in light of potential sanctions impacting specific countries.

- Compliance and Ethics: Aurubis ensures strict adherence to all international sanctions and trade laws, maintaining ethical sourcing practices across its global operations.

Government support for the circular economy, like the EU's 2024 Green Deal initiatives, directly benefits Aurubis by promoting recycled material use and infrastructure development. The EU's Critical Raw Materials Act, anticipated in 2024, aims to boost domestic sourcing and processing, potentially favoring Aurubis's recycling and refining operations. Furthermore, subsidies for green technologies in 2024, including R&D grants in Germany, can lower capital costs for Aurubis's expansion projects.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Aurubis, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of Aurubis's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Global commodity prices significantly impact Aurubis, especially copper, a primary revenue driver. For instance, LME copper prices averaged around $8,500 per tonne in early 2024, a level that directly affects Aurubis's top-line performance and how it values its substantial copper inventories.

The volatility of scrap metal prices, crucial for Aurubis's recycling segment, also shapes its procurement and profitability. Fluctuations in these input costs, often tied to broader industrial demand and supply chain disruptions, directly influence operational margins and require agile sourcing strategies to maintain competitive cost structures.

Global economic growth is a significant driver for Aurubis, as a robust economy typically translates to higher demand for its copper and other specialty metals. For instance, the automotive sector, a major consumer of copper, saw global vehicle production rebound in 2023, with projections for continued, albeit moderate, growth through 2024 and 2025, directly benefiting companies like Aurubis.

Industrial demand, particularly from construction and electronics, also plays a crucial role. The global construction market is expected to grow, supported by infrastructure spending in various regions. Similarly, the expanding electronics industry, fueled by advancements in technology and consumer demand for devices, requires substantial amounts of high-quality metals, bolstering Aurubis's sales volumes.

Conversely, economic slowdowns or recessions in key markets can directly impact Aurubis's sales and investment plans. A projected slowdown in global GDP growth for 2024, though still positive, could temper demand. Major markets like Europe and Asia are closely watched, as any contraction there would likely lead to reduced orders and a more cautious outlook for future capital expenditures.

Inflationary pressures, especially elevated energy and raw material costs, directly affect Aurubis's operating expenses, impacting smelting, refining, and logistics. For instance, the average industrial electricity price in Germany, a key market for Aurubis, saw significant increases in 2023 and early 2024 compared to pre-energy crisis levels.

Aurubis actively manages these cost increases through various strategies, including long-term supply contracts for raw materials and energy, and by optimizing its production processes to improve energy efficiency. The company's focus on vertical integration and efficient resource utilization helps mitigate the impact of volatile commodity markets on its profitability and ability to offer competitive pricing.

Currency exchange rates

Currency exchange rate fluctuations significantly impact Aurubis's global operations. For instance, a stronger US Dollar relative to the Euro can increase the cost of imported raw materials, while simultaneously boosting the value of dollar-denominated export revenues. This dynamic affects Aurubis's profitability and competitiveness in international markets.

Aurubis actively manages its exposure to foreign exchange risks. The company employs hedging strategies, such as forward contracts and options, to lock in exchange rates for future transactions. This proactive approach aims to stabilize earnings and protect against adverse currency movements.

- Euro-Dollar Volatility: The EUR/USD exchange rate is a key concern, as Aurubis's primary listing and a significant portion of its operations are Euro-denominated, while many raw material purchases and sales occur in US Dollars.

- Hedging Strategies: Aurubis utilizes financial instruments to mitigate foreign exchange risk, aiming to reduce the impact of currency fluctuations on its reported earnings.

- Impact on Revenue and Costs: A weaker Euro can make Aurubis's exports more attractive but increases the cost of dollar-priced inputs, and vice versa.

Interest rates and access to capital

Fluctuations in interest rates directly impact Aurubis's financial flexibility. Higher rates increase the cost of borrowing for essential capital expenditures, like upgrading smelters or investing in new technologies, and also affect the cost of managing working capital. For instance, if Aurubis needs to finance a significant expansion project, a rise in interest rates from, say, 3% to 5% could substantially increase the annual debt servicing cost, impacting profitability.

Access to affordable capital is paramount for Aurubis's strategic growth. The company relies on access to credit markets for funding major projects, such as its planned €300 million investment in its Bulgarian copper smelter to enhance sustainability and efficiency, announced in late 2023. If financing becomes more expensive or difficult to obtain due to rising interest rates or tighter lending conditions, such crucial investments could be delayed or scaled back, potentially hindering long-term competitiveness.

- Interest Rate Impact: Rising interest rates increase Aurubis's borrowing costs for capital expenditures and working capital.

- Access to Capital: The availability of affordable financing is critical for expansion, technological upgrades, and acquisitions.

- Financing for Growth: In 2024, the European Central Bank's monetary policy decisions, including potential rate adjustments, will significantly influence Aurubis's cost of capital.

- Strategic Investments: Higher borrowing costs could affect the feasibility and timing of major projects, such as those aimed at improving environmental performance.

Global economic growth remains a key determinant for Aurubis, with demand for copper and other metals closely tied to industrial output and consumer spending. Projections for global GDP growth in 2024, while varied across regions, generally indicate a moderate expansion, which should support Aurubis's sales volumes, particularly from sectors like automotive and construction.

Inflationary pressures continue to influence operating costs, with energy and raw material prices remaining a significant factor. Aurubis's ability to manage these costs through efficient processes and strategic sourcing will be critical for maintaining profitability throughout 2024 and into 2025.

Currency fluctuations, especially the EUR/USD exchange rate, will continue to impact Aurubis's financial results. The company's hedging strategies are designed to mitigate the adverse effects of these movements on its revenue and cost base.

Interest rates play a crucial role in Aurubis's financing costs and investment decisions. The current interest rate environment, influenced by central bank policies, affects the affordability of capital for expansion projects and operational needs.

| Economic Factor | 2024 Projection/Status | Impact on Aurubis | Key Data Point |

|---|---|---|---|

| Global GDP Growth | Moderate expansion expected | Supports demand for metals | IMF projects 3.2% global growth for 2024 |

| Inflation (Energy/Raw Materials) | Persistently elevated | Increases operating costs | Industrial electricity prices in Germany remain significantly higher than pre-2022 levels |

| EUR/USD Exchange Rate | Volatile | Affects revenue and import costs | EUR/USD traded around 1.08 in early 2024 |

| Interest Rates | Higher than recent past | Increases borrowing costs | ECB maintained key interest rates in early 2024, impacting financing for projects like the Bulgarian smelter upgrade |

Full Version Awaits

Aurubis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aurubis PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Aurubis's strategy and operations.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for strategic planning and risk assessment.

Sociological factors

Demographic shifts, including an aging workforce in key regions, present a challenge for Aurubis in securing the necessary technical and engineering talent. For instance, in Germany, the number of skilled tradespeople has been declining, impacting specialized industries like copper production. Aurubis actively addresses this by investing in robust apprenticeship programs and partnerships with technical universities to cultivate future talent, aiming to bridge potential skill gaps in its highly specialized operational and innovation needs.

Societal pressure for ethical conduct is intensifying, directly impacting companies like Aurubis. Stakeholders, including customers and investors, increasingly scrutinize supply chains for responsible sourcing and transparent operations. Aurubis's reputation hinges on its ability to meet these evolving expectations, influencing its relationships with various groups.

Aurubis demonstrates a commitment to social initiatives and community engagement. The company actively participates in programs aimed at fostering local development and ensuring fair labor practices throughout its global operations. This focus on social responsibility is crucial for maintaining a positive corporate image and attracting ethically-minded investors.

Public perception significantly shapes Aurubis's brand image, especially concerning heavy industries' environmental footprint. Growing awareness of resource consumption and emissions means companies like Aurubis face scrutiny regarding their sustainability practices. A positive brand image, built on transparent communication and tangible environmental improvements, is crucial for maintaining social license to operate and attracting ethically-minded investors and customers.

In 2024, Aurubis reported a 15% increase in customer inquiries specifically related to the sustainability of their copper sourcing and production processes. This highlights a growing demand for transparency and responsible manufacturing. To address this, Aurubis has invested €50 million in upgrading its recycling facilities, aiming to boost the circular economy aspect of its operations, which directly impacts public perception and brand loyalty.

Consumer demand for sustainable products

Societal shifts are increasingly favoring products derived from recycled and sustainably sourced materials, presenting a significant opportunity for Aurubis. This growing consumer consciousness directly impacts purchasing behavior, pushing manufacturers to prioritize suppliers with strong circular economy credentials. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products, a trend that directly benefits Aurubis's extensive recycling operations.

This demand translates into a competitive advantage for Aurubis, as its established expertise in copper and other metal recycling aligns perfectly with market expectations. Manufacturers are actively seeking partners who can demonstrate a commitment to sustainability throughout their supply chains. Aurubis's ability to process complex recycling streams and produce high-quality secondary metals positions it favorably in this evolving landscape.

- Growing Consumer Preference: Over 60% of consumers in 2024 indicated a willingness to pay a premium for sustainable goods.

- Manufacturer Demand: Businesses are actively seeking supply chain partners with verifiable circular economy practices.

- Aurubis's Advantage: The company's advanced recycling capabilities directly address this increasing market requirement.

Health and safety standards

Societal expectations and regulatory demands for robust health and safety standards significantly influence Aurubis's operational framework. The company must continually adapt its protocols and invest in advanced safety equipment and comprehensive employee training to meet these evolving expectations, particularly in its high-risk industrial environments.

Aurubis's commitment to a safe working environment is paramount, aiming to minimize occupational hazards across its global operations. This focus is reflected in their safety performance metrics and ongoing initiatives to enhance workplace well-being.

- Safety Investment: In 2023, Aurubis reported a strong focus on safety, with initiatives aimed at reducing incident rates. While specific financial figures for safety equipment investment are not always itemized separately, the company's overall expenditure on operational improvements reflects a commitment to safety infrastructure.

- Employee Training: Aurubis provides extensive safety training programs for its employees, covering hazard recognition, emergency procedures, and the proper use of personal protective equipment. This training is crucial given the nature of metallurgical operations.

- Regulatory Compliance: Aurubis operates under stringent health and safety regulations across various jurisdictions, including EU directives and national legislation, ensuring adherence to established safety benchmarks.

Societal pressure for ethical and sustainable practices is a significant driver for Aurubis. Consumers and investors alike are increasingly scrutinizing supply chains, demanding transparency and responsible sourcing. Aurubis's 2024 sustainability report highlighted a 15% rise in customer inquiries concerning ethical copper sourcing, underscoring this trend. The company's investment of €50 million in recycling facility upgrades in 2024 directly addresses this demand for circular economy practices, aiming to enhance its brand image and attract ethically-minded stakeholders.

Technological factors

Innovations in metal recycling, like advanced sorting and hydrometallurgy, significantly boost Aurubis's ability to process intricate scrap. These technologies allow for more precise separation of materials, leading to higher yields of valuable metals. For instance, advancements in pyrometallurgy are enabling the recovery of metals from previously uneconomical waste streams.

New smelting technologies are also a key factor, focusing on reducing energy demands and increasing metal recovery. Aurubis's commitment to these advancements is crucial for maintaining a competitive edge in resource efficiency. In 2023, the company reported a substantial increase in its recycling volumes, demonstrating the practical application of these technological improvements.

Aurubis is heavily investing in automation and digitalization to streamline its production processes. For instance, the company is implementing advanced robotics in its smelters, particularly for handling hazardous materials, which significantly boosts worker safety and reduces reliance on manual labor. This move is projected to cut operational costs by an estimated 8-12% across key facilities by the end of 2025.

The integration of digital twins allows Aurubis to simulate and optimize complex metallurgical processes in real-time, leading to improved resource efficiency and yield. Furthermore, the company is leveraging data analytics and artificial intelligence for predictive maintenance on its machinery, aiming to reduce unplanned downtime by up to 15% in 2024, thereby ensuring consistent output and quality control.

Material science innovation is a significant technological driver for Aurubis. Advancements in creating new metal alloys and composite materials can unlock entirely new markets or reshape demand for traditional copper products. For instance, the development of high-strength, lightweight copper alloys could boost demand in the aerospace and automotive sectors, areas where weight reduction is paramount.

Aurubis actively invests in research and development to stay at the forefront of these material science advancements. Their focus is on developing specialized metal products with enhanced properties tailored for specific industrial applications, such as improved conductivity for electronics or increased corrosion resistance for infrastructure projects. This strategic R&D is crucial for maintaining a competitive edge in a rapidly evolving technological landscape.

Energy efficiency technologies

Aurubis is actively investing in energy efficiency technologies to curb its substantial energy usage. For instance, the company is implementing waste heat recovery systems and upgrading its furnaces to more efficient models. These advancements are projected to significantly reduce operational costs by lowering energy consumption.

The integration of renewable energy sources is also a key focus for Aurubis. This strategic move aims to decrease the company's carbon footprint, aligning with global sustainability goals. By embracing these technological shifts, Aurubis is positioning itself for more environmentally responsible and cost-effective operations in the coming years.

- Waste Heat Recovery: Aurubis's investments in waste heat recovery systems are designed to capture and reuse heat generated during production processes, thereby reducing the need for primary energy input.

- Furnace Efficiency: Upgrades to furnace technology are crucial for lowering energy intensity, as furnaces represent a significant portion of the company's energy expenditure.

- Renewable Energy Integration: The company is exploring and implementing renewable energy solutions to power its operations, aiming to reduce reliance on fossil fuels and lower greenhouse gas emissions.

Process optimization and control systems

Aurubis leverages advanced process control systems and real-time monitoring to fine-tune its smelting and refining operations. This technological integration allows for significant waste reduction and ensures a higher degree of product consistency across its copper and other metal outputs. For instance, in 2023, Aurubis reported a 15% reduction in energy consumption per ton of copper produced at its Hamburg site, directly attributable to upgraded control systems.

Simulation software plays a crucial role in optimizing production workflows, enabling Aurubis to identify bottlenecks and test process improvements virtually before implementation. These continuous improvement initiatives, driven by technological insights, are key to enhancing overall plant performance and resource utilization. The company's ongoing investment in digital transformation, with a notable €50 million allocated in 2024 for digitalization projects, underscores its commitment to this area.

- Optimized Production: Advanced control systems enhance efficiency and reduce material loss in copper smelting.

- Waste Minimization: Real-time monitoring and simulation help cut down on energy and resource waste.

- Product Consistency: Technology ensures uniform quality in Aurubis's metal products.

- Continuous Improvement: Ongoing investment in digital solutions drives better plant performance and resource management.

Technological advancements in metal processing are a key driver for Aurubis, enhancing its capacity to handle complex scrap materials through innovations like advanced sorting and hydrometallurgy. These upgrades improve material separation and increase valuable metal yields, with pyrometallurgy now enabling the recovery of metals from previously uneconomical waste streams.

Aurubis is also focusing on new smelting technologies that reduce energy consumption and boost metal recovery rates. The company's investment in automation and digitalization, including robotics for hazardous material handling, is projected to cut operational costs by 8-12% by the end of 2025. Furthermore, digital twins and AI-driven predictive maintenance are being implemented to reduce unplanned downtime by up to 15% in 2024.

Material science innovation is another critical area, with Aurubis investing in R&D for specialized metal products and alloys tailored for sectors like aerospace and automotive. Energy efficiency technologies, such as waste heat recovery and furnace upgrades, are also being deployed to lower energy consumption, complemented by the integration of renewable energy sources to reduce the company's carbon footprint.

| Technological Area | Impact on Aurubis | Key Data/Projection |

| Metal Processing Innovations | Enhanced scrap handling, increased metal yield | Improved recovery from waste streams via pyrometallurgy |

| Automation & Digitalization | Streamlined operations, improved safety, cost reduction | Projected 8-12% operational cost reduction by end-2025; up to 15% reduction in unplanned downtime (2024) |

| Energy Efficiency & Renewables | Reduced energy consumption, lower carbon footprint | Implementation of waste heat recovery and furnace upgrades; integration of renewable energy sources |

Legal factors

Aurubis faces significant operational constraints due to stringent environmental regulations. Laws governing emissions, wastewater, and hazardous waste management directly affect its smelting and recycling activities, influencing compliance costs and the ability to operate. For instance, in 2023, the European Union continued to enforce directives like the Industrial Emissions Directive, requiring substantial investments in pollution control technologies for facilities like Aurubis's Hamburg plant.

Obtaining and maintaining complex environmental permits is crucial for Aurubis's business continuity. These permits are essential for its smelting and recycling operations, ensuring adherence to standards for everything from air quality to land remediation. Failure to comply can lead to hefty fines and operational shutdowns, as seen with past environmental incidents at similar industrial sites across Europe.

Health and safety legislation significantly shapes Aurubis's operational framework. National and international laws mandate strict workplace standards, employee training, and robust risk management protocols across its mining and processing facilities. Failure to comply can result in substantial fines and legal liabilities, particularly in hazardous industrial environments.

Competition and antitrust laws are crucial for Aurubis, as they prevent practices like price-fixing and market manipulation within the global metals sector. These regulations directly impact Aurubis's market strategies, pricing decisions, and any future mergers or acquisitions, ensuring a level playing field.

Large entities like Aurubis face significant legal scrutiny to avoid monopolistic behavior. For instance, in 2023, the European Commission continued its investigations into potential anti-competitive practices across various industries, setting a precedent for vigilance in concentrated markets like copper and precious metals.

Product liability and quality standards

Aurubis must adhere to stringent legal mandates concerning the quality, safety, and performance of its metal products. These regulations directly influence manufacturing processes and the rigorousness of quality control systems implemented across its operations. For instance, in 2023, the European Union continued to enforce directives like the General Product Safety Regulation, impacting how Aurubis ensures its copper and other metal products meet consumer safety expectations.

Failure to comply with these evolving legal standards can expose Aurubis to significant product liability claims. Such liabilities could stem from product defects, contamination, or non-conformance with specific industry benchmarks, potentially leading to costly recalls, legal battles, and reputational damage. The company's commitment to quality assurance is therefore directly tied to mitigating these legal risks.

- Product Safety Regulations: Aurubis must ensure its metal products, particularly those used in critical applications like electrical wiring or plumbing, meet all relevant safety certifications and standards.

- Quality Management Systems: Compliance with ISO 9001 and other quality management standards is crucial for demonstrating product consistency and minimizing liability risks.

- Environmental Compliance: Legal requirements related to the environmental impact of metal production and product lifecycle also influence quality standards and liability.

- Consumer Protection Laws: Legislation protecting consumers from faulty or misrepresented goods directly impacts Aurubis's product warranties and claims processes.

International trade laws and sanctions compliance

Aurubis navigates a complex web of international trade laws, including customs duties, import/export licensing, and evolving sanctions. For instance, as of early 2024, geopolitical tensions continue to influence trade flows, particularly concerning critical raw materials and metals. Compliance with these regulations is paramount to avoid significant financial penalties and protect the company's reputation.

Failure to adhere to trade restrictions can lead to substantial fines and disruptions. Aurubis's global operations, sourcing materials from and selling to numerous countries, necessitate rigorous monitoring of these legal frameworks. For example, the company must ensure its supply chains are free from entities or materials subject to sanctions imposed by major economic blocs.

- Global Trade Complexity: Aurubis must comply with diverse customs regulations and import/export controls across its international operations.

- Sanctions Compliance: Adherence to evolving sanctions regimes is critical to avoid penalties and maintain market access.

- Reputational Risk: Non-compliance with international trade laws can severely damage Aurubis's brand and stakeholder trust.

- Supply Chain Integrity: Ensuring all sourced materials and sales channels meet legal trade requirements is a constant operational challenge.

Aurubis operates under a strict legal framework governing environmental protection, health and safety, and product quality. Compliance with regulations like the EU's Industrial Emissions Directive and product safety laws impacts operational costs and product marketability. For example, in 2023, ongoing enforcement of environmental standards necessitated continued investment in pollution control technologies across Aurubis's facilities.

Antitrust and competition laws are vital, preventing market manipulation and ensuring fair competition, which influences Aurubis's pricing and strategic decisions. The company must also navigate complex international trade laws, including customs duties and sanctions, with non-compliance risking substantial fines and supply chain disruptions, as seen with evolving geopolitical trade impacts in early 2024.

| Legal Factor | Impact on Aurubis | Example/Data (2023-2024) |

|---|---|---|

| Environmental Regulations | Increased compliance costs, operational limitations | Continued enforcement of EU Industrial Emissions Directive |

| Health & Safety Laws | Mandatory workplace standards, risk management protocols | Requirement for robust safety training and equipment |

| Competition Law | Influences pricing, M&A strategies | Ongoing vigilance against anti-competitive practices in metals markets |

| Trade Laws & Sanctions | Supply chain integrity, risk of fines | Impact of geopolitical tensions on raw material trade flows |

Environmental factors

Global and regional climate policies, such as carbon pricing and emissions trading schemes, are increasingly influencing Aurubis's strategic direction. These regulations are pushing the company to actively reduce its greenhouse gas footprint, aligning with national decarbonization targets. For instance, the EU's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, directly impacting industrial sectors like metals production.

Transitioning to lower-carbon production methods and energy sources necessitates significant investment. Aurubis's commitment to sustainability involves substantial capital expenditure in areas like energy efficiency upgrades and the adoption of renewable energy. In 2023, the company continued to invest in projects aimed at reducing its environmental impact, with a focus on lowering Scope 1 and Scope 2 emissions.

Aurubis is well-positioned to benefit from increasing concerns over resource scarcity and the growing adoption of circular economy principles. Government mandates are pushing industries towards greater use of recycled materials, a core area of Aurubis's business. For example, the European Union's Circular Economy Action Plan aims to boost the use of recycled materials in products, directly supporting Aurubis's recycling capabilities.

The demand for recycled copper and other metals is on the rise as manufacturers seek to reduce their environmental footprint and comply with sustainability regulations. Aurubis's expertise in recycling complex metal-containing waste streams makes it a vital partner for businesses transitioning to more sustainable material sourcing. This trend is expected to continue, with projections indicating significant growth in the recycled metals market through 2025 and beyond.

Stricter environmental regulations significantly influence Aurubis's operational expenses and necessitate substantial investments in pollution control technologies. For instance, the European Union's Industrial Emissions Directive sets stringent limits on pollutants, requiring continuous upgrades to wastewater treatment and air emission control systems at Aurubis's smelters and refineries.

Aurubis actively works to minimize its environmental footprint by implementing advanced waste management strategies. This includes maximizing the recycling of process residues and by-products, aiming for a circular economy approach. In 2023, the company reported a significant portion of its production residues being recycled, contributing to resource efficiency and reduced landfill reliance.

The company's commitment to reducing pollutant emissions is evident in its ongoing investments in modernizing facilities. Aurubis has focused on lowering sulfur dioxide emissions from its smelting operations and improving water quality management across its sites, aligning with evolving environmental standards and public expectations for corporate responsibility.

Water usage and management

Aurubis faces increasing scrutiny regarding its water usage, especially given the global pressure on freshwater resources and tightening discharge regulations. These environmental factors directly impact its copper refining operations, which are inherently water-intensive. For instance, in 2023, Aurubis reported a total water withdrawal of 15.3 million cubic meters across its global sites, highlighting the scale of its water footprint. Stricter environmental standards necessitate significant investment in advanced wastewater treatment technologies and process optimization to minimize both consumption and pollutant discharge.

The company is actively pursuing strategies to mitigate these risks and enhance its water stewardship. Aurubis is investing in closed-loop systems to recycle and reuse water within its production processes, thereby reducing its reliance on external freshwater sources. Furthermore, a strong emphasis is placed on responsible wastewater management, ensuring that any discharged water meets or exceeds regulatory requirements. These initiatives are crucial for maintaining operational continuity and social license to operate, particularly in regions facing water stress.

- Water Withdrawal: Aurubis's global water withdrawal was 15.3 million cubic meters in 2023, indicating a substantial reliance on water resources.

- Regulatory Impact: Stricter discharge regulations necessitate ongoing investment in advanced wastewater treatment to comply with environmental standards.

- Optimization Efforts: The company is implementing closed-loop systems and water recycling technologies to reduce overall water consumption and improve efficiency.

- Sustainability Goals: Responsible water management is a key component of Aurubis's broader sustainability strategy, aiming to minimize its environmental impact.

Biodiversity and land use impacts

Aurubis's industrial activities, including its smelters and processing plants, necessitate significant land use, impacting local ecosystems. Careful management of these sites, along with waste disposal areas, is crucial to mitigate environmental damage. For instance, in 2023, Aurubis reported on its land management practices across its various European sites, emphasizing rehabilitation efforts where possible.

The company is committed to reducing its ecological footprint. This includes initiatives aimed at minimizing habitat disruption and, where feasible, actively participating in biodiversity protection. Aurubis's sustainability reports often detail projects focused on restoring or enhancing local biodiversity around its operational areas, reflecting a growing awareness of these environmental factors.

- Land Use Management: Aurubis operates facilities requiring substantial land, necessitating careful planning to minimize ecological impact.

- Waste Disposal Sites: Responsible management of waste disposal areas is key to preventing land and soil contamination.

- Biodiversity Initiatives: The company aims to reduce its footprint and, where possible, contribute to local biodiversity conservation efforts.

- Ecological Footprint Reduction: Aurubis is actively working to minimize the environmental impact of its operations on surrounding ecosystems.

Aurubis's operations are significantly shaped by environmental regulations, particularly those concerning emissions and resource use, driving investments in cleaner technologies. The company's 2023 sustainability report highlighted ongoing efforts to reduce greenhouse gas emissions, aligning with directives like the EU's Fit for 55 package. This focus on decarbonization requires substantial capital expenditure in areas such as energy efficiency and renewable energy integration.

The increasing demand for recycled materials, supported by policies promoting a circular economy, presents a key opportunity for Aurubis. The European Union's Circular Economy Action Plan, for instance, encourages greater use of recycled content, directly benefiting Aurubis's recycling capabilities. This trend is expected to continue, with market growth projected through 2025.

Aurubis faces strict environmental standards that impact operational costs and require continuous investment in pollution control. For example, the European Union's Industrial Emissions Directive mandates stringent limits on pollutants, necessitating upgrades to wastewater and air emission control systems. The company's 2023 water withdrawal was 15.3 million cubic meters, underscoring the need for advanced water management and recycling systems to meet evolving regulations.

Managing land use and waste disposal sites is critical for minimizing ecological impact. Aurubis actively works to reduce its environmental footprint, including initiatives for biodiversity protection around its operational areas. The company is committed to responsible land management and waste disposal practices, as detailed in its 2023 site reports.

| Environmental Factor | Impact on Aurubis | Key Data/Initiatives (2023/2024 Focus) |

| Climate Policies & Emissions | Drives investment in decarbonization and cleaner production methods. | Alignment with EU's Fit for 55; focus on Scope 1 & 2 emission reduction. |

| Circular Economy & Recycling | Boosts demand for recycled materials, leveraging Aurubis's expertise. | Supported by EU Circular Economy Action Plan; growth projected through 2025. |

| Pollution Control & Water Use | Requires significant investment in advanced treatment technologies. | Compliance with Industrial Emissions Directive; 15.3 million m³ water withdrawal (2023); investment in closed-loop systems. |

| Land Use & Biodiversity | Necessitates responsible site management and ecological impact mitigation. | Focus on land management, waste disposal, and biodiversity protection initiatives. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aurubis is grounded in data from leading industry associations, market research firms, and official government publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the copper and metals industry.